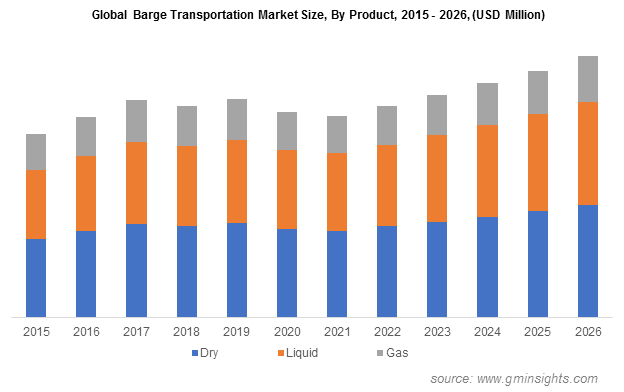

Barge Transportation Market size worth over $50 BN by 2026

Published Date: April 2020

Barge Transportation Market size is set to exceed USD 50 billion by 2026, according to a new research report by Global Market Insights Inc.

The emergence of new wireless & mobile technologies in maritime industry is driving the barge transportation industry growth. Several technology companies including Ericsson, Kongsberg Gruppen, Black Duck, and CGI are introducing new solutions in the maritime industry to enhance the fleet efficiency.

Technological advancements, such as the implementation of Big Data analytics, are providing a greater visibility of pricing trends, reducing uncertainties in businesses. The data-driven analytics improves decision-making to choose the optimal routes, fuel consumption, weather conditions, and piracy risks. The use of Big Data is reducing risks and offering growth opportunities to the market.

The positive outlook of the logistics sector, offering a convenient way of transport for heavy goods, bulk cargoes, and large volumes of commodity goods is supporting the barge transportation market demand. Barge transportation is developing and optimizing as it is used as a substitute to the rail & road transport and is more economical, efficient, and environmentally superior.

Get more details on this report - Request Free Sample PDF

The major factor challenging the market is the implementation of stringent government regulations pertaining to the maritime industry. For instance, the European Commission has set the standards, such as Directive 2004/26/EC, held for regulating emissions from the engines of inland waterway barges. This standard depicts Stage III A to cover engines ranging from 19 kW-560 kW for inland waterway vessels. However, the emergence of electric barge transportation will propel the industry growth.

Increasing offshore oil & gas exploration activities

The liquid cargo product accounted for approximately 38% of the market share in 2019. The demand for barge transportation to carry liquid cargo is increasing significantly owing to rising offshore oil & gas exploration activities. Barge transportation offers safe & efficient way to transport liquid cargo as compared to rail & road transportation modes.

Government-owned gas corporations and petroleum companies across the globe are making large investments in offshore exploration projects to explore new oil & natural gas resources.

Browse key industry insights spread across 260 pages with 298 market data tables & 20 figures & charts from the report, “Barge Transportation Market Size By Product (Dry Cargo, Liquid Cargo, Gaseous Cargo), By Barge Fleet (Open, Covered, Tank), By Application (Coal & Crude Petroleum, Agricultural Products, Coke & Refined Petroleum Products, Metal Ores, Secondary Raw Materials & Wastes, Food Products, Beverages & Tobacco, Basic Metals & Fabricated Metal Products, Chemicals, Rubber & Plastic, Nuclear Fuel), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/barge-transportation-market

Growing demand for cost-effective transportation solutions for dry cargo

The covered barge fleet held around 35% revenue share in 2019 on account of its several advantages such as protection of goods from extreme & uncertain weather conditions. It is primarily used for moving dry cargo, such as agricultural products, on account of its high cost-effectiveness.

Moreover, barge transportation service providers are focusing on building a greater number of covered barges and refitting approximately 1,000 existing covered hopper barges to serve the increasing demand for grain barges.

Increasing trade of metal ores will boost the barge transportation market revenue

Metal ore is anticipated to capture a significant industry share through 2026 due to rising local & international trade of metal ores globally. Brazil is one of the largest suppliers of metal ore in the world, responsible for substantial exports. Additionally, increasing sales of automobiles and rising investments in construction activities are proliferating the demand for metal ores. Industry participants find barge transportation a cost-efficient way to transfer such commodities.

The increasing government support for the development of regional maritime industry in Latin America

The Latin America market size crossed USD 4 billion in 2019. Brazil is witnessing rapid offshore development, resulting in an increased demand for barge transportation services. Economic stability, increased activities for the offshore production of oil, and heavy investments by energy companies in the country for the construction of self-reliant maritime sector are the major market drivers.

The increasing support of the government for the development of regional waterways infrastructure is strengthening the industry growth. The Mexico government is planning to develop a new terminal that can double the transportation of annual volume of containers through the Mexico’s busiest seaport.

Barge transportation industry players are focusing on partnerships, strategic alliances, and collaborations, along with enhancing their R&D capabilities to introduce new solutions and provide enhanced customer services. However, companies are also laying emphasis on enhancing barge transportation services to strengthen their market position and gain a competitive edge over rivals.

Key players in the market include Ingram Marine Group, Kirby Corporation, American Commercial Barge Line (ACBL), APL Logistics, SEACOR Holdings, Crowley Maritime Corporation, and Campbell Transportation Company.

Preeti Wadhwani, Prasenjit Saha