Ballistic Protection Materials & Equipment Market worth $2.4bn by 2025

Published Date: April 2019

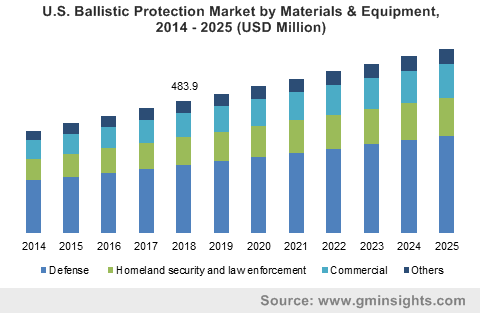

Ballistic Protection Materials & Equipment Market size will surpass USD 2.4 billion by 2025; according to a new research report by Global Market Insights Inc.

Growing terrorism in different countries across the globe is anticipated to make a subsequent positive influence on the ballistic protection materials & equipment market size by 2025. For instance, sensitive geopolitical scenarios are creating internal and external tensions across the national and international boundaries of the different countries across the world. Additionally, regional governments of developing countries are increasing their defense budget with focus on ballistic protection of the militaries and citizens. The abovementioned trends along with growing safety concerns across the globe is probable to continue and anticipated to boost the overall ballistic protection market size for materials and equipment by 2025.

Stringent regulations against VOC emission is probable to remain the crucial restrictive factor in the growth of global ballistic protection material & equipment market size in the forecast time period. Despite the stringent regulation, strong product demand from defense & law enforcement and homeland security applications is predictable to trigger the overall ballistic protection materials & equipment market size by 2025.

Get more details on this report - Request Free Sample PDF

Browse key industry insights spread across 293 pages with 391 market data tables & 23 figures & charts from the report, “Ballistic Protection Materials & Equipment Market Size By Material (Aramid, Carbon Fiber Composites, Glass Fiber & Thermoplastic, Ceramic), By Application (Defense, Homeland Security & Law Enforcement, Commercial), By Equipment (Helmet, Protective Vests & Jackets, Shields & Panels), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/ballistic-protection-market

Materials used in ballistic protection mainly include aramid, glass fiber and thermoplastic, carbon fiber composite, ceramic and wool, jute and metal among the others. Among these materials aramid contributed maximum market share and generated revenue over USD 510 million in 2018, this segment is projected to rise with highest CAGR around 5% during the forecast period. Twaron, Nomex and Kevlar are few of the popular brands of aramid which are used in the manufacturing of ballistic protection equipment globally.

Based on applications, ballistic protection materials & equipment market size has been bifurcated into homeland security & law enforcement, defense, commercial, etc. Defense held the major chunk of the total industry share in 2018, as it includes the application of almost all kinds of ballistic protection equipment including helmets, ballistic vests & jackets, ballistic panels shoes, gloves, etc. This is mainly attributed to strong rise in the safety concerns and thereby the defense budget across nations.

On the basis of equipment, ballistic protection materials and equipment market size has been segregated into protective vests and jackets, helmet, shields, and others including gloves, shoes, etc. Protective vests & jackets are produced from strongly woven aramid and other fibers and contains ballistic plate put in into for better performance. Protective vests and jacket captured the largest share of the total industry share in 2018, due to its increasing demand from defense & law enforcement as well as homeland security and law enforcement. These trends are anticipated to make noteworthy contribution to the overall ballistic protection materials & equipment market size by 2025.

At present, North America is the market leader projected to grow at CAGR around 4.5%. In terms of volume, North America held approximately 30% of the overall industry share in 2018. It is majorly credited to the strong safety standards and thereby high military expenditure in the region. On the other hand, Europe market size was valued close to USD 500 million in 2018 and is likely to project healthy gains in the forecast timeframe.

Global ballistic protection materials & equipment market is extremely competitive in nature with major prominent players contributing close to 50% of the total market share in 2018. Major players are DuPont, Teijin Limited, Texas Armoring Corporation, Honeywell International, DSM, Protective Enterprises LLC, Homeland Security Group, Armor Holdings, Protech Solutions, etc.

Ballistic protection materials and equipment market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD million from 2014 to 2025, for the following segments:

Ballistic Protection Materials And Equipment Market, Material By Application

- Aramid

- Defense

- Homeland security & law enforcement

- Commercial

- Others

- Carbon fiber composites

- Defense

- Homeland security & law enforcement

- Commercial

- Others

- Glass fiber and thermoplastic

- Defense

- Homeland security & law enforcement

- Commercial

- Others

- Ceramic

- Defense

- Homeland security & law enforcement

- Commercial

- Others

- Others

- Defense

- Homeland security & law enforcement

- Commercial

- Others

Ballistic Protection Materials & Equipment Market, By Application

- Defense

- Homeland security & law enforcement

- Commercial

- Others

Ballistic Protection Materials & Equipment Market, By Equipment

- Helmet

- Ballistic vests and jackets

- Shields & panels

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

Kiran Pulidindi, Hemant Pandey