Automotive Interior Materials Market size to cross $27 Bn by 2026

Published Date: August 2020

Automotive Interior Materials Market size is likely to exceed USD 27 billion by 2026, according to a new research report by Global Market Insights Inc.

Rising vehicle production along with emergence of premium vehicle manufacturers offering superior interiors to enhance aesthetics will drive automotive interior materials industry demand. The UK alone comprises nine major premium and sports car manufacturers. High-class engineering, technical expertise in the workforce, and advanced technology have enabled manufacturers to increase their market shares.

Automotive OEMs are taking initiatives to enhance their production capability. In November 2019, Tesla announced to establish car manufacturing facility in Berlin, Germany. Automotive industry is set to experience influx and clustering of car interior component manufacturers to support the growing domestic demand. However, the ongoing COVID-19 pandemic has led to temporary closure of manufacturing facilities and it is likely to hamper the automotive interior materials market demand.

Get more details on this report - Request Free Sample PDF

Automotive fabrics have experienced tremendous innovations and increased adoption over the last few years. Relative to other solutions, such as vegan and traditional leather, fabrics are lighter and when used in large volumes, showcase considerable weight reduction. Fabrics are preferred over leather owing to their lightness and excellent performance in harsh environmental conditions. Recent innovation toward premium fabrics has helped material to penetrate the premium segment, that was considered to be dominated by leather material. Alcantara is a brand engaged in manufacturing suede microfabrics for premium vehicles. Brands, such as McLaren and Lamborghini, have incorporated this fabric in their several models.

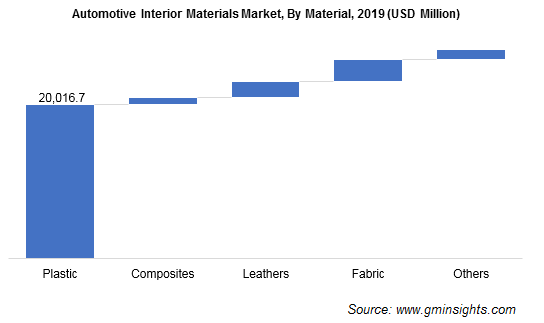

Browse key industry insights spread across 200 pages with 303 market data tables & 20 figures & charts from the report, “Automotive Interior Materials Market Size By Material (Plastic [Thermoplastics, Thermosets], Composites [Glass Fiber, Carbon Fiber, Natural Fiber], Fabrics, Leather), By Application (Consoles & Dashboards, Doors, Seats, Steering Wheels, Floor Carpet), By Vehicle (Passenger Cars, LCV, HCV), By End-users (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/automotive-interior-material-market

Improving material processing technologies to support consoles penetration

The automotive interior materials market share from consoles & dashboards application to witness around 5.5% CAGR through 2026. Advancements in material processing have made it possible to manufacture automotive consoles using multiple materials. Manufacturers are upgrading vehicles by introducing new amenities & features incorporating practicalities such as cup holders, cubbies, and design iterations. Typical interior consoles are manufactured using Acrylonitrile-Butadiene-Styrene (ABS), Polycarbonates, Polypropylene, and Styrene Maleinanhydride (SMAs). The ability of plastics to allow complex shape and design has supported the segment growth.

OEMs segment is projected to hold over 90% industry share in 2026. OEMs engage in multi-year contracts with material manufacturers, ensuring steady supply chain and product quality. However, the increasing presence of small and medium scale players is expected to drive the aftermarket segment at a considerable pace.

European regulations supporting lightweight materials to drive regional growth

Europe automotive interior materials market share is expected to grow at 5% CAGR during 2020 to 2026 propelled by increasing installation of lightweight interior materials to meet government regulations. Regulatory bodies across Europe including the federal and regional have jointly developed several standards and regulations to curb air & material emissions. Europe has drafted several policies for improvement in vehicle efficiency and adoption of electric vehicles. The presence of major auto manufacturers and large-scale material suppliers further compliments the regional growth.

Emphasis on production capacity expansion to enhance competition

Major manufacturers in the automotive interior materials market include Saudi Basic Industries Corporation (SABIC), Evonik Industries AG, UFP Technologies, Arkema, BASF SE, Stahl Holdings B.V., Hexcel Corporation, Continental AG, Toray Industries, Inc., Huntsman Corporation, Sumitomo Chemical Company, Dow Chemical Company, Covestro AG, Trinseo S.A., and Borealis AG. Key industry participants are heavily focusing on production capacity expansion to enhance their competitive edge in the industry.

Kiran Pulidindi, Akshay Prakash