IR Camera Market Size worth over $10bn by 2026

Published Date: January 2020

IR Camera Market size is poised to surpass USD 10 billion by 2026, according to a new research report by Global Market Insights Inc.

Infrared camera is a non-contact electronic device that detects infrared energy and converts it into an electrical signal. The signal is then processed to produce a thermal image to perform temperature calculations. Recent innovations, specifically in detector technology, will support the incorporation of automatic functionality, built-in visual imaging, and infrared software development to deliver cost-effective thermal analysis solutions.

The IR camera market growth is attributed to growing demand from military & defense departments for surveillance purposes. The development of high-speed IR cameras with suitable sensors to measure temperature and evaluate the relative severity of heat will further drive market demand. The rising demand for IR cameras to manufacture efficient, safer, and smarter Advanced Driver Assistance Systems (ADAS) in Automotive Vehicles is propelling the market revenue.

Get more details on this report - Request Free Sample PDF

Use of IR cameras in various end-use applications will fuel the market demand

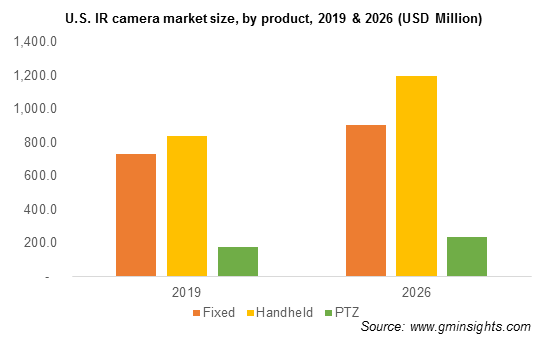

The handheld IR camera market is anticipated to grow substantially during the forecast period due to its increasing use in search & rescue operations. This camera is also used in medical, research, and maintenance applications. The camera is rugged & portable and improves the effectiveness by identifying temperature anomalies or hot spots and preventing temperature-related defects. These cost-effective cameras are durable and robust with negligible maintenance costs. Handheld cameras combine high-resolution image sensors with optomechanical resolution enhancement technology to improve the depth of focus.

Browse key industry insights spread across 300 pages with 474 market data tables and 26 figures & charts from the report, “IR Camera Market Size, By Product (Fixed, Handheld, Pan-Tilt-Zoom [PTZ]), By Technology (Cooled, Uncooled), By Wavelength (Near Infrared, Short-Wave Infrared [SWIR], Mid-Wave Infrared [MWIR], Long-Wave Infrared [LWIR]), By Application (Automotive, BFSI, Commercial, Government & Defense, Healthcare, Industrial, Residential), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/IR-infrared-camera-market-report

Cooled detectors to increase application areas of IR cameras

In 2019, the cameras integrated with cryocooler will witness high growth owing to their superior response time, frame rate, sensitivity, and spectral behavior. The cooled camera is more expensive than uncooled due to presence of a cryogenic cooling unit in the camera. It makes the camera much complex and requires significant investments from the end-use sector while deploying and integrating them with surveillance systems. However, its superior range & performance makes it a viable solution for certain applications such as coastal surveillance and homeland security.

Presence of key industry players and growing usage in medical & research applications are driving the North America IR camera market share

In 2019, North America account for over 35% industry share owing to presence of key market players, such as Raytheon Company, FLIR Systems, and Fluke Corporation coupled with ongoing technological advancements in the region.

For instance, in October 2017, FLIR Systems (U.S.) received a contract worth USD 6.8 million to provide Black Hornet PRS for the Australian Army. Moreover, the rising demand in hospitals to detect threatening diseases, such as cancer or tumors, will boost the market growth.

Defense contractors manufacture and integrate IR cameras in military helicopters & airplanes

The government & defense contractors are integrating the cameras in helicopters and airplanes to help pilots navigate during unfavorable weather conditions or night operations. In August 2018, Raytheon Company secured a contract worth more than USD 59 million from the U.S. Navy. The contract is a five-year performance-based logistics contract, according to which Raytheon will integrate IR camera into CH-53 Sea Stallion and MV-22 Ospreys helicopters. This will help pilots navigate in unfavorable weather conditions or during night operations.

Industry players are adopting collaboration strategies to remain competitive in the market

Major industry leaders operating in the IR camera market include Testo AG, SiOnyx, LLC, Seek Therma, Raytheon Company, Panasonic Corporation, Optris GmbH, Opgal Optronic Industries Ltd, OMEGA Engineering, Inc. (SPECTRIS PLC), Leonardo DRS (Leonardo SPA), InfraTec GmbH, Infrared Cameras, Inc., Honeywell International, Inc., Hanwha Techwin Co., Ltd. (Hanwha Aerospace Co., Ltd.), Hangzhou Hikvision Digital Technology Co., Ltd., Xenics, Fujifilm Holdings Corporation, Fluke Corporation, FLIR Systems, DIAS Infrared GmbH, and Axis Communications AB.

Preeti Wadhwani, Saloni Gankar