Summary

Table of Content

Weaving Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Weaving Machine Market Size

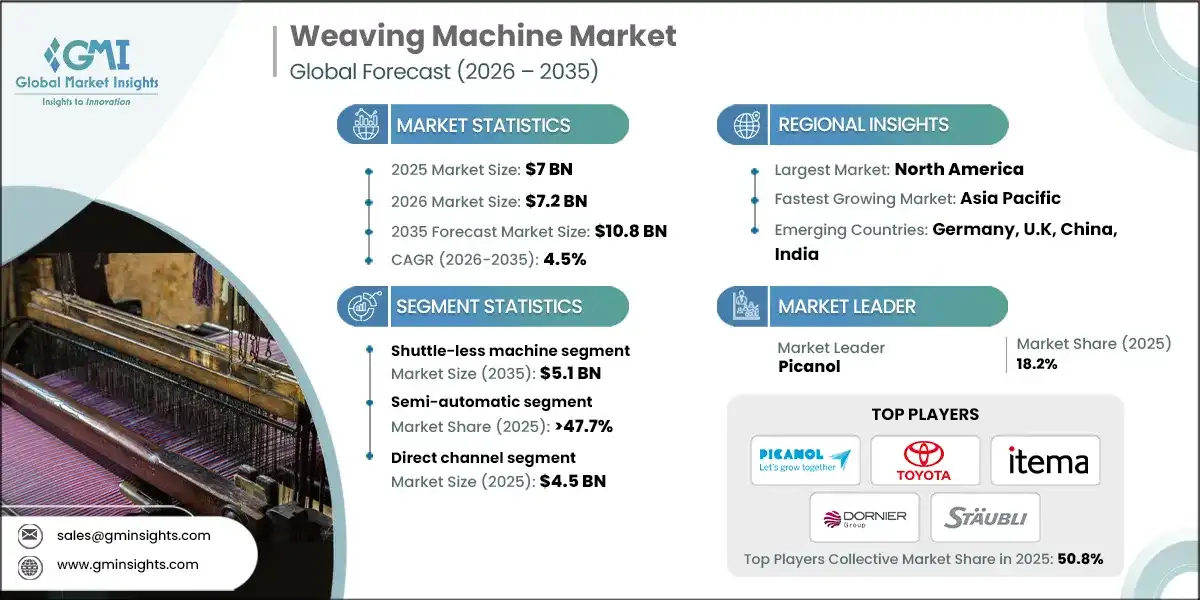

The weaving machine market was valued at USD 7 billion in 2025. The market is expected to grow from USD 7.2 billion in 2026 to USD 10.8 billion in 2035, at a CAGR of 4.5%, according to latest report published by Global Market Insights Inc.

To get key market trends

The demand for high-quality long-lasting fabrics has increased in the automotive, athletic, and fashion industry sectors and is driving the rapid growth of the weaving machine industry. This demand is fuelled by the use of AI-IoT technologies that are being developed today and that automate/simplify weaving machine production processes through digitized technology.

Also, government programs that promote automation in the manufacturing industry are helping the market grow. The Bureau of Labor Statistics states that in the past five years, the use of automation in manufacturing has grown by 15%. Manufacturers have greatly reduced labour costs while improving their productivity as a result of the above government programs and encouragement to use advanced weaving manufacturing technology to compete.

Automated systems allow a manufacturing facility to maximize production by removing the errors associated with human interaction and the dependence on human labor. An example is Toyota Industries Corporation. They have developed and implemented systems for their weaving operations that create better quality product while minimizing the cost of producing the product. These innovations support the global push for sustainable practices in the manufacture of textiles.

Moreover, the increasing emphasis on the environment has led to greater use of energy- efficient looms. As many governments are encouraging companies to produce using environmentally sustainable or “green” techniques, the market will continue to expand due to these initiatives.

In Europe, for example, the EU's regulations regarding reduction of global warming gases have prompted a shift in investment towards more sustainable manufacturing processes among textiles producers. Consumer demand for high- quality fabrics throughout most industries will continue to empower the weaving machinery sector, thus creating significant value for manufacturers and investors alike.

Weaving Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7 Billion |

| Market Size in 2026 | USD 7.2 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.5% |

| Market Size in 2035 | USD 10.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Technological advancements in automation | Advancements in automation significantly elevate market competitiveness by improving weaving precision, lowering labor dependency, and enabling manufacturers to adopt high-speed, digitally controlled looms that boost throughput and responsiveness to demand fluctuations. |

| Rising demand for customized fabrics | The growing preference for personalized and design rich textiles drives investment in versatile weaving systems capable of rapid pattern changes, pushing manufacturers toward programmable, flexible machinery that enhances product differentiation and market agility. |

| Increased production efficiency and speed | Higher operating speeds, reduced downtime, and improved workflow integration enhance overall productivity, enabling manufacturers to optimize capacity utilization, cut operational costs, and meet shorter lead time requirements in competitive textile supply chains. |

| Pitfalls & Challenges | Impact |

| High initial investment costs | Substantial upfront expenses for advanced weaving machinery hinder adoption among small and mid size manufacturers, slowing modernization cycles and widening technology gaps that can weaken operational efficiency and competitive positioning. |

| Fluctuating raw material prices | Volatility in fiber and yarn prices creates budget uncertainty, complicating cost planning and discouraging timely equipment upgrades, ultimately affecting profitability and long term investment confidence across the textile machinery ecosystem. |

| Opportunities: | Impact |

| Sustainability policies & circular economy push | Strengthened environmental regulations and circular economy mandates accelerate demand for energy efficient, low waste weaving solutions, creating new opportunities for machinery makers that support recycling, resource optimization, and greener textile production pathways. |

| Integration of iot & predictive maintenance solutions | IoT enabled weaving systems unlock real time performance monitoring and predictive diagnostics, reducing downtime and maintenance costs while improving equipment reliability, which collectively enhances the operational value proposition for machinery adopters. |

| Market Leaders (2025) | |

| Market Leaders |

18.2% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Germany, U.K, China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Weaving Machine Market Trends

Changing innovation and technology transformation are important for the growth of the weaving machine industry.

- The market for weaving equipment is shifting heavily towards the incorporation of automating equipment as well as more efficient energy use. Manufacturers continue to implement newer forms of technology such as the use of AI & IoT into their manufacturing process to improve the efficiency of operations and provide better product utilization. Itema Group has implemented IoT-based resources in the design of their looms to enhance production efficiency.

- Governments around the world are now starting to promote energy efficiency in the manufacturing process. The U.S. Department of Energy estimates energy-efficient technologies can reduce the amount of energy used by approximately 30% over the current level of consumption in the industrial sector. The growth of sustainable manufacturing practices has been a major driver of the increasing demand for weaving equipment.

- Cost-effectiveness is also an important driver of the weaving machine market. Manufacturers are continually producing products that allow the customer to lower their costs of operation while increasing their output. For example, Picanol produced a new line of weaving machines designed to use less energy while providing high levels of output.

- The emergence of environmental concerns affects the marketplace. Companies are integrating environmentally friendly technologies into their businesses due to increased regulatory requirements and consumer demand. Technologies that reduce waste and energy consumption are now commonplace on new weaving machines.

- The trends that have developed show a shift from standard manufacturing processes to innovative, sustainable, and efficient solutions within the weaving machine industry. These advancements address both economic and environmental issues, thereby providing room for future growth and competitive opportunities.

Weaving Machine Market Analysis

Learn more about the key segments shaping this market

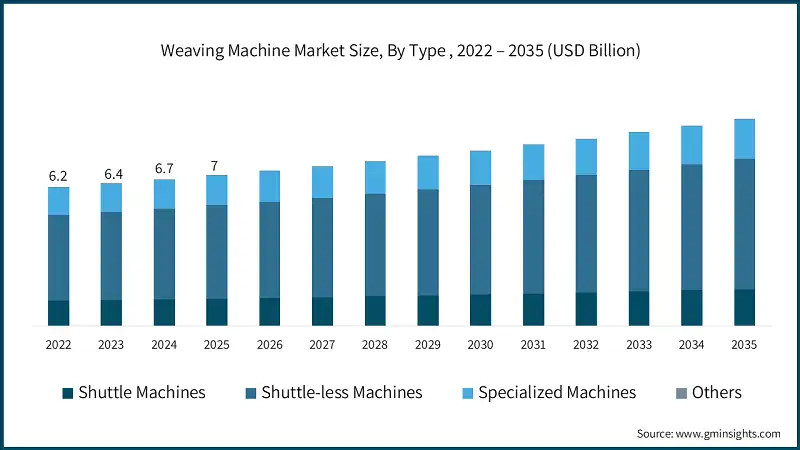

Based on type, the weaving machine industry is segmented shuttle machines, shuttle-less machines, specialized machines and others. The shuttle-less machine segment accounts for revenue of around USD 3.3 billion in 2025 and is expected to reach USD 5.1 billion by 2035.

- The increase in demand for high-tech textile production equipment has been one of the main drivers behind the rapid expansion of this market. Boosting textile supply productivity through the use of shuttle less loom machines is helping the manufacturers to reduce operational costs, increase production output, and minimize waste materials. Modern weaving machines are also receiving significant government support, as evidenced by the Indian Government's Production Linked Incentive (PLI) program for textiles introduced in 2021, which is designed to stimulate investment in advanced machinery in order to promote increased production and exports.

- As a result, both Toyota Industries Company and Picanol Group are leading the way in this area through their development and marketing of air-jet looms for Toyota, and innovative weaving technology for Picanol, enabling their customers to maximize the benefits of using the latest technology to improve their overall productivity.

- Further, the movement towards sustainability is also supporting the increasing adoption of shuttle less machines as those types of machine fit within the global initiatives to reduce energy use and improve the overall efficiency of resources in the textile manufacturing process.

- For example, numerous European manufacturers investing in shuttle less technology to comply with strict environmental regulations and to be able to compete on production volume at a high level. The importance of continuing to innovate is continuing to grow in the manufacturing sector.

- Thus, the shuttle less machine sector will continue to grow significantly due to continued technological advancement, government support, and the still growing industry-wide focus on being able to produce products in a cost effective and sustainable fashion.

Learn more about the key segments shaping this market

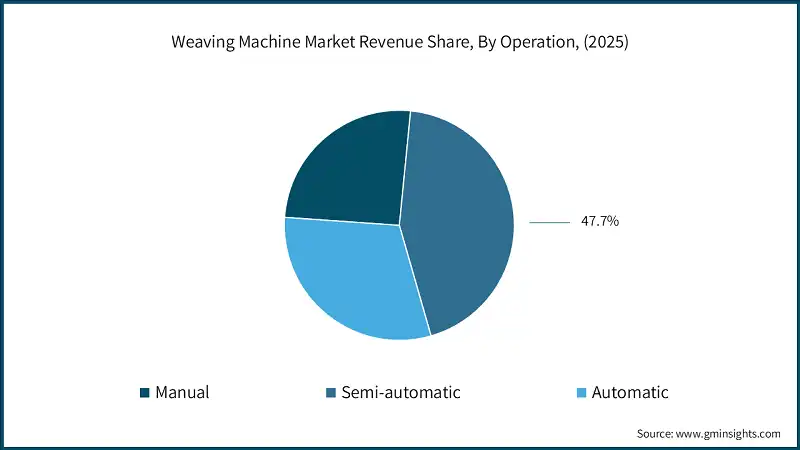

Based on operation, the weaving machine market is bifurcated into manual, semi-automatic and automation. The semi-automatic segment accounted for over 47.7% market share in 2025.

- Semi-automatic weaving machines are especially popular in developing countries with moderate labor costs, where manufacturers seek to increase efficiency through productive capacity improvements but do not require total automation. For example, India's textile sector comprises nearly two percent of the country's GDP and employs over 45 million people.

- Semi-automatic machines allow the textile industry to respond to the increasing demand for textiles with an economically viable solution. Similarly, Vietnam, a major exporter of textiles, uses semi-automatic machines extensively as a means of maintaining its competitive advantage in the global market.

- While the demand for fully automated weaving machines is increasing in developed economies like the United States and Germany, these machines typically require a substantial upfront capital investment to purchase and operate. Fully automated machines are primarily intended for large-capacity operations that require maximum production speed with minimum workforce participation. Additionally, costs typically preclude small to medium-sized businesses from purchasing fully automated machines

- The market for manual machines is mainly comprised of niche markets or craftspeople utilizing traditional methods, e.g., many areas of India and Bangladesh utilize handlooms to continue cultural arts while providing job opportunities in the rural population; however, the production output is limited in comparison to the fully automatic segment.

- The semi-automatic sector of the weaving machine industry constitutes a significant portion of the sector because of its suitability for many types of industries, which provides versatility as well as the ability to bridge the gap between industry/property/technology and handcraftsmanship; therefore, it is essential to both the global weaving machinery marketplace.

Based on distribution channel, the weaving machine market is segmented into direct and indirect. The direct channel segment generating a revenue of USD 4.5 billion in 2025.

- Direct sales eliminate the requirement for manufacturers to utilize intermediary methods when building relationships with customers. With direct sales, customers receive more personalized service and build stronger connections with manufacturers. Companies such as Toyota Industries have recognized this and have decided to utilize direct sales methods to better address their customer's needs. By establishing direct contact with customers and clearly communicating with them about the best product options, manufacturers are able to encourage trust and develop a level of customer satisfaction that will result in long-lasting relationships.

- A primary benefit of direct sales is that, by utilizing direct sales methods, manufacturers are able to meet their customers' after-sale service needs through customized methods. Picanol, a leading manufacturer of weaving machines, provides its customers with customized maintenance bundles and operator training programs. These services are customized based on each customer's specific needs, which allows Picanol to create a positive customer experience and foster customer loyalty.

- Further, manufacturers streamline their supply chain operations by minimizing their reliance on other third-party intermediaries. This decreases the number of costs incurred and increases the speed of product delivery to manufacturers. Furthermore, direct sales enable manufacturers to quickly respond to market needs based on feedback obtained directly from customers, without the possibility of delays caused by third-party intermediaries.

- Hence, direct sales are a key distribution channel for manufacturers that want to increase their competitiveness in the weaving machine industry and create long-term, engaging customer relationships while simultaneously providing valuable solutions to customers.

Looking for region specific data?

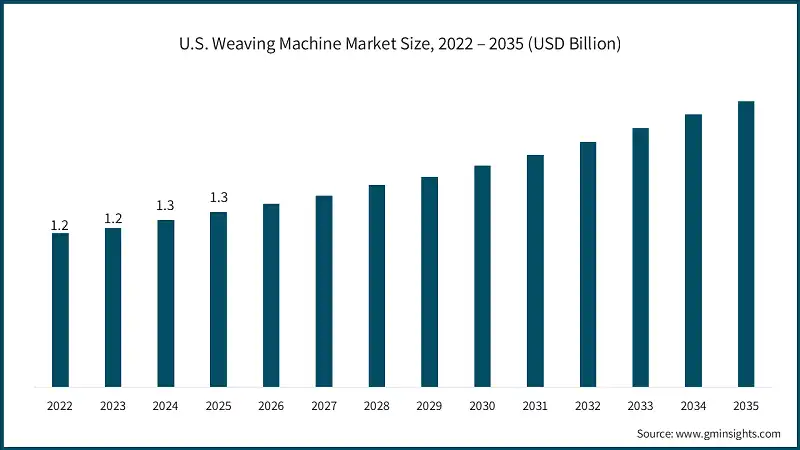

In 2025, the U.S. dominated the weaving machine market growth in North America, accounting for 65.5% of the share in the region.

- The U.S. continues to dominate North America’s weaving machine industry due to strong modernization and automation efforts across textile manufacturing facilities. Federal agencies provide substantial support to strengthen domestic manufacturing, enabling investments in advanced weaving technologies. For instance, the U.S. Department of Commerce’s EDA awarded an USD 8,00,000 grant to support textile manufacturing expansion in North Carolina, boosting equipment upgrades and production capacity.

- Additionally, nationwide manufacturing support programs offered through Manufacturing.gov and NIST’s MEP National Network play a key role in accelerating technology adoption. These programs provide funding, technical assistance, and modernization guidance for U.S. manufacturers, helping textile producers embrace automation, digital integration, and advanced production systems. .

Asia Pacific weaving machine market is expected to grow at 4.8% CAGR during the forecast period.

- Asia Pacific’s steady growth is driven by rapid industrialization, large-scale textile manufacturing, and increasing automation adoption, particularly in China and India. Governments in countries like China, India, Vietnam, and Bangladesh are offering modernization subsidies and environmental compliance incentives, which accelerate the shift toward automated weaving technologies.

Europe market is expected to grow at 4.6% CAGR during the forecast period.

- Europe’s weaving machine market benefits from strong technological leadership, sustainability-driven investments, and advanced R&D ecosystems. The region continues prioritizing eco-friendly, energy-efficient machinery to align with rising demand for sustainable textiles. Additionally, Europe’s long-standing textile heritage and growing adoption of IoT and AI-enabled production systems support machinery upgrades and sector expansion.

Middle East and Africa weaving machine market is expected to grow at 3.6% CAGR during the forecast period.

- Growth in the MEA market is propelled by expansion of textile manufacturing capacity, particularly in countries such as Egypt, Turkey, and South Africa. Rising demand for textiles, population growth, and urbanization fuel machinery investments, while governments promote industrialization through supportive trade and manufacturing policies.

Weaving Machine Market Share

The top companies in the weaving machine industry include Picanol, Toyota, Itema, Dornier and Staubli and collectively hold a share of 50.8% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Picanol develops advanced airjet and rapier weaving machines and leads the industry with high-tech, digitalized weaving solutions supported by PicConnect services. Their machines focus on high performance, sustainability readiness, and ease of use, demonstrated by innovations like the Ultimax rapier system.

- Toyota produces state-of-the-art air-jet and water-jet looms engineered for high speed, energy efficiency, and reliable fabric quality. Their technology integrates advanced shedding systems and automation features that support sustainable, digitally managed textile production.

- Itema is a global weaving technology leader offering rapier, air jet, and projectile machine platforms with strong innovation capabilities. With production hubs in Italy, Switzerland, and China, they support diverse textile segments and maintain over 300,000 installed machines worldwide.

Weaving Machine Market Companies

Major players operating in the weaving machine industry are:

- Bonas

- Dornier

- Itema

- Jingwei

- Laxmi

- Lohia

- Picanol

- Qingdao Dongjia

- Rifa

- Smit

- Staubli

- Toyota

- Tsudakoma

- Van de Wiele

- Zhejiang Hengtai

Dornier manufactures high-precision rapier and air-jet weaving machines known for superior reliability across apparel, technical textiles, and composites. Their broader portfolio—including composite systems and film-stretching technologies—cements their role in advanced and high-performance textile applications.

Stäubli specializes in weaving preparation and shedding solutions such as automatic drawing-in, warp tying, Jacquard, and dobby systems that enhance mill productivity. Their automation technologies, including SAFIR and AWC 2.0, significantly improve speed, accuracy, and flexibility in modern weaving operations.

Weaving Machine Industry News

- In December 2025, Picanol unveiled its next-generation OmniPlus iConnect airjet weaving machine at ITMA ASIA + CITME 2025 in Singapore, featuring major energy-saving enhancements like EcoBoost and a redesigned air-insertion system (AirStream). The machine sets new benchmarks in speed, sustainability, and digital weaving intelligence.

- In December 2025, Dornier showcased new energy-efficient weaving technologies and advanced IoT-enabled production systems during ITMA ASIA + CITME 2025. Their latest developments emphasize networked textile production, upgraded rapier and air-jet weaving machines, and innovative solutions supporting fiber-composite manufacturing.

- In October 2025, Picanol debuted the new OmniPlus iConnect platform with AI-powered PicConnect integration and 1.5 kW energy savings per machine, solidifying its leadership in digital weaving ecosystems at ITMA Asia 2025.

- In October 2025, at ITMA ASIA Singapore 2025, Van de Wiele showcased cutting-edge carpet weaving, tufting, and velvet-weaving technologies, including the new USF Carpet Weaving Machine and HST Tufting Platform, while Bonas displayed its high-speed, energy-efficient Ji Jacquard range.

- In April 2025, At IGATEX 2025, Van de Wiele launched advanced digital weaving systems including the RCE2+ Rug & Carpet Expert with real-time predictive maintenance and the high-efficiency VSi velvet weaving machines, strengthening its dominance in carpet and luxury textile sectors.

The weaving machine market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Type

- Shuttle machines

- Shuttle-less machines

- Specialized machines

- Others

Market, By Operation

- Manual

- Semi-automatic

- Automatic

Market, By Usage

- Upholstery fabric

- Automotive textiles

- Sportswear

- Other

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What is the growth outlook for Asia Pacific from 2026 to 2035?

Asia Pacific is projected to grow at a 4.8% CAGR through 2035, fueled by rapid industrialization, large-scale textile manufacturing, and increasing automation adoption in China and India.

Who are the key players in the weaving machine market?

Key players include Picanol, Toyota, Itema, Dornier, Stäubli, Van de Wiele, Tsudakoma, Bonas, Jingwei, Laxmi, Lohia, Smit, Qingdao Dongjia, Rifa, and Zhejiang Hengtai.

What are the upcoming trends in the weaving machine market?

Key trends include deeper integration of AI-driven automation and IoT-enabled monitoring, adoption of predictive maintenance solutions, and increasing focus on sustainability policies and circular economy initiatives with energy-efficient machinery.

What was the market share of the semi-automatic operation segment in 2025?

The semi-automatic operation segment held 47.7% market share in 2025, popular in developing countries balancing efficiency improvements with moderate labor costs.

What is the current weaving machine market size in 2026?

The market size is projected to reach USD 7.2 billion in 2026.

How much revenue did the shuttle-less machine segment generate in 2025?

Shuttle-less machines generated USD 3.3 billion in 2025 and are expected to reach USD 5.1 billion by 2035, driven by high-tech textile production demands.

What is the projected value of the weaving machine market by 2035?

The weaving machine market is expected to reach USD 10.8 billion by 2035, propelled by AI-IoT integration, sustainability policies, and increasing production efficiency demands.

What is the market size of the weaving machine in 2025?

The market size was USD 7 billion in 2025, with a CAGR of 4.5% expected through 2035 driven by technological advancements in automation and rising demand for customized fabrics.

Weaving Machine Market Scope

Related Reports