Summary

Table of Content

Very Small Aperture Terminal (VSAT) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Very Small Aperture Terminal Market Size

VSAT Market size exceeded USD 10 billion in 2019 and is estimated to grow at over 8% CAGR between 2020 and 2026. Increasing requirement of data management and high frequency trading is expected to drive the industry growth.

Significant investment in research and development has allowed market players to provide innovative solutions to their customer to enhance their communication systems. This is among the major strategic initiatives practiced by industry participates. For instance, various innovative companies including Cobham and General Dynamics have recently introduced corrosion resistant VSAT which will increase the overall lifespan of a product, reducing it operational cost.

To get key market trends

The VSAT industry will experience a moderate dip in 2020 and then witness accelerated growth rate due to coronavirus (COVID-19) pandemic. Sudden outbreak of virus in early 2020 and imposition of nationwide lockdowns in many countries has created market disruption. Gradual establishment of new ways of remote operations will subsequently increase the market demand post 2020.

Very Small Aperture Terminal Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 10 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 8.21% |

| Market Size in 2026 | 18 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Very Small Aperture Terminal Market Analysis

The North America P, L, S segment is projected to observe a growth rate of around 8% through 2026 owing to increasing number of fixed network and cellular communications. For instance, in April 2020, The Federal Communication Commission (FCC) announced the rise of 20% to 35% on fixed networks and 10% to 20% in cellular network post pandemic as compared to previous situations. The rise is backed up by increasing number of operational cell phones within the region.

Learn more about the key segments shaping this market

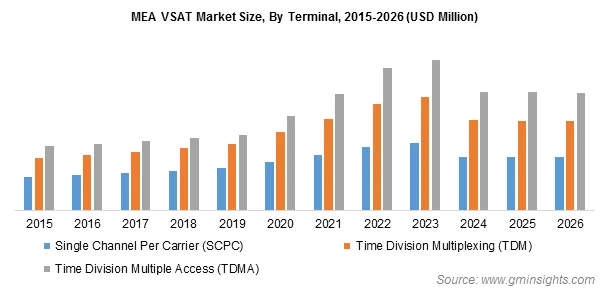

The MEA VSAT Time Division Multiple Access (TDMA) will register growth rate of more than 3% during 2020-2026. Government stabilization and investments done by major industry players towards establishment of comprehensive communication network for general purpose will serve as the primary market driving factors. A range of applications such as voice communication and data transfer supported by TDMA allows the segment to gain maximum market share.

Learn more about the key segments shaping this market

The Latin America VSAT market size from data transfer application segment will cross USD 250 million by 2026 led by the increasing initiatives taken by regional government to digitize economies. These initiatives have resulted in long term collaboration between market players, establishing healthy business environment.

Similar efforts have been taken by various government and private players across the globe to cater the rising demand of data transfer at much faster rates, providing market opportunities at global level.

Looking for region specific data?

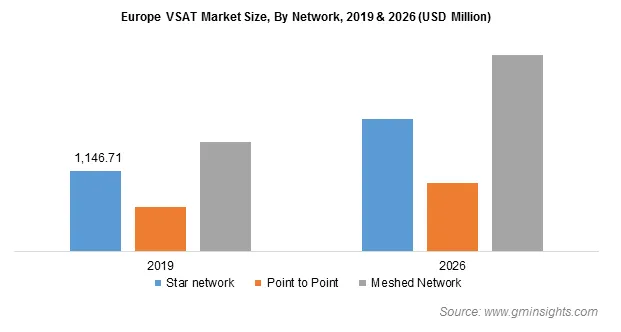

The European point to point VSAT market revenue is likely to surpass USD 950 million by 2026, growing at more than 7% CAGR between 2020 and 2026. Presence of major industry players within the region and innovative solutions provided by range of service providers is assisting market competitiveness.

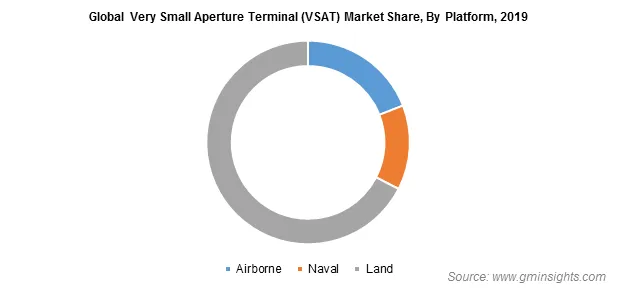

The land-based VSAT market valuation was over USD 7 billion in 2019 and is poised to expand at a CAGR of around 8% during the forecast timeframe. The rising demand for telecommunication, live broadcasting services, and private networks by corporates will generate high market share. Major industry players operating in the market are providing open architecture customizable VSAT solutions, increasing their scope of application and making them more user friendly.

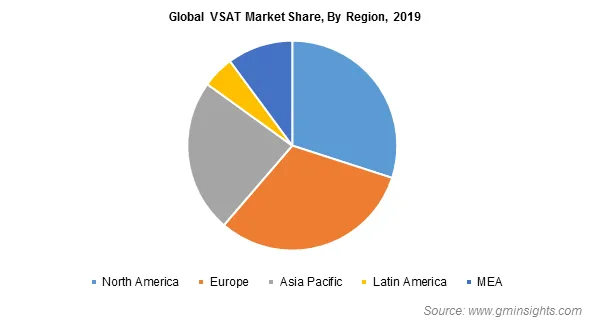

Asia Pacific VSAT market held more than 20% revenue share in 2019 and is expected to achieve more than 10% gains till 2026. Government initiatives to aid manufacturing facilities in major countries including India and China and economical, skilled labor will be the major factors attracting global industry players. Increasing marine transportation and development of new oceanic trade routes from India and China to rest of the world will positively impact the logistics of VSAT.

Very Small Aperture Terminal Market Share

Major industry players operating in VSAT market encompass

- L3Harris

- Cobham

- Hughes Network System

- KVH Industries

- Honeywell

- Thales Group

- General Dynamics

- Orbit Communication System

- Inmarsat

- Singtel

- Viasat

- Gilet Satellite networks

- X2NSat

- ST Engineering

Collaboration between global and regional companies to gain market penetration at regional level and local distribution support in operations is among the primary strategic initiatives practiced within the market. For instance, in 2019, Hughes Communications India Ltd (HCIL) announced combining of VSAT satellite operations with Bharti Airtel Services.

This market research report on very small aperture terminal (VSAT) includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2026 for the following segments:

Market, By Band

C

- Ku

- K, Ka

- P, L, S

Market, By Terminal

Single Channel Per Carrier (SCPC)

- Time Division Multiplexing (TDM)

- Time Division Multiple Access (TDMA)

Market, By Application

Video Broadcasting

- Data transfer

- Private Network

- Voice Communication

Market, By Network

Star Network

- Point to Point

- Meshed Network

Market, By Platform

Airborne

- Naval

- Land

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- New Zealand

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

- Iran

Frequently Asked Question(FAQ) :

Where will P,L,S segment depict traction?

The North America P, L, S VSAT industry size may depict 8% CAGR through 2026, driven by rising number of fixed networks and cellular communications.

How will the global VSAT market share perform through 2026?

The market size of VSAT valued at USD 10 billion in 2019, may record 8% CAGR through 2026, driven by high frequency trading and rising demand for data management.

In which region will VSAT demand depict commendable increase?

The market may exhibit massive gains in Asia Pacific, that accounted for 20% of global VSAT industry share in 2019 and may register 10% CAGR through 2026. The growth can be credited to the rising number of government initiatives and expanding manufacturing sector.

Which platform segment will help increase VSAT industry size?

The land-based VSAT market size was worth USD 7 billion in 2019 and may grow at 8% CAGR through 2026, propelled by the surging demand for live broadcasting services, private networks by corporates, and telecommunication.

How much will Europe market from point to point network architecture be by 2026?

Europe point to point VSAT segment may surpass USD 950 million by 2026, with a targeted CAGR of 7%, owing to innovative solutions given by service providers and presence of major industry players.

What factors will propel MEA VSAT TDMA market size through 2026?

The MEA VSAT Time Division Multiple Access (TDMA) industry size will depict 3% CAGR through 2026, propelled by investments by major players to establish comprehensive communication networks.

Why will data transfer applications emerge lucrative across Latin America VSAT market?

LATAM VSAT industry size from data transfer application segment may hit USD 250 million by 2026, owing to rising number of initiatives undertaken by the regional governments to digitize these economies.

Very Small Aperture Terminal Market Scope

Related Reports