Summary

Table of Content

U.S. Wound Care Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Wound Care Market Size

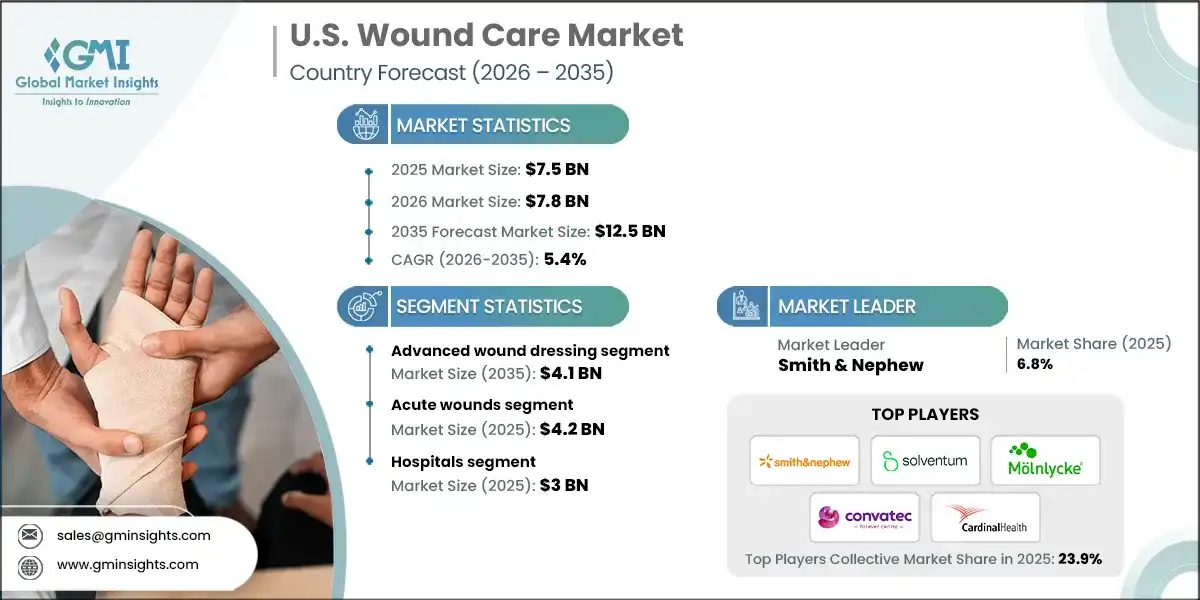

The U.S. wound care market was valued at USD 7.5 billion in 2025 and is projected to grow from USD 7.8 billion in 2026 to USD 12.5 billion by 2035, expanding at a CAGR of 5.4%, according to Global Market Insights Inc.

To get key market trends

The steady growth of the U.S. wound care market is driven by factors such as the rising prevalence of diabetes in the U.S., growing technological advancements in wound care products, an increasing number of surgical procedures, and a surge in government initiatives aimed at improving access to wound care. Major top five companies in the industry includes Smith & Nephew, Solventum, Molnlycke Health Care, Convatec Group, and Cardinal Health.

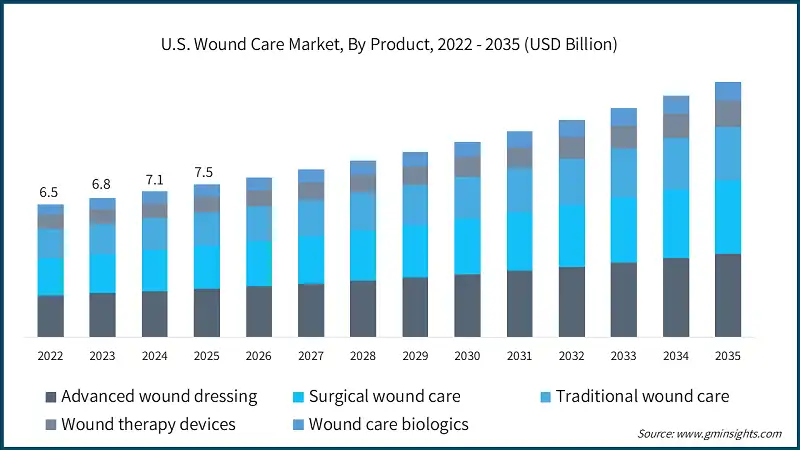

The U.S. wound care market has experienced significant growth, increasing from USD 6.5 billion in 2022 to USD 7.1 billion in 2024, primarily due to the rising prevalence of diabetes in the country. For example, according to the Centers for Disease Control and Prevention (CDC), in 2021, approximately 38.4 million people of all ages in the U.S., representing 11.6% of the total population, were living with diabetes. Among adults aged 18 years and older, 38.1 million individuals had diabetes, accounting for 14.7% of all U.S. adults. This highlights the growing demand for effective wound care solutions, particularly advanced therapies and products designed to manage chronic wounds such as diabetic foot ulcers, pressure ulcers, and surgical wounds.

Additionally, technological advancements in wound care products have significantly transformed the market, leading to improved patient outcomes and faster healing. Innovations such as negative pressure wound therapy (NPWT), bioengineered skin substitutes, and smart dressings with real-time monitoring capabilities are revolutionizing wound management. For instance, Smith & Nephew’s ACTICOAT surgical dressings are designed to prevent surgical site infections. Featuring a silver-coated polyurethane layer with an exclusive nanocrystalline structure, these dressings maximize the bactericidal action of silver by enhancing its interaction with wound fluid, thereby reducing infection risk and promoting effective healing.

Wound care includes products that are used in direct contact with the wound site to encourage the healing process and prevent further complications. Different types of wound dressings are used depending on the type of wound.

U.S. Wound Care Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7.5 Billion |

| Market Size in 2026 | USD 7.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.4% |

| Market Size in 2035 | USD 12.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of diabetes in U.S. | Drives demand for advanced wound care products, including antimicrobial dressings, NPWT, and bioengineered skin substitutes. |

| Growing technological advancements in wound care products | Innovations such as smart dressings, sensor-enabled monitoring, and bioactive materials are improving healing outcomes, reducing infection risks, and driving adoption among healthcare providers and patients. |

| Increasing number of surgical procedures | Higher surgical volumes are resulting in greater demand for post-operative wound care solutions, including advanced surgical dressings and infection prevention products. |

| Surge in government initiatives aimed at improving access to wound care | Federal programs and reimbursement policies are enhancing affordability and accessibility, encouraging hospitals and home-care providers to adopt advanced wound care solutions. |

| Pitfalls & Challenges | Impact |

| High costs associated with advanced wound care products | Limits adoption among low-income and uninsured populations, creating disparities in care and slowing overall market penetration. |

| Stringent regulatory framework | Delays in product approvals and compliance requirements increase the time-to-market for innovative solutions, impacting revenue growth and reducing competitive advantage. |

| Opportunities: | Impact |

| Rising preference for home-based wound care | The growing demand for portable NPWT devices, easy-to-use dressings, and telehealth-enabled wound monitoring is creating new revenue streams and strengthening patient engagement. |

| Market Leaders (2025) | |

| Market Leaders |

6.8% market share |

| Top Players |

|

| Competitive Edge |

|

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Wound Care Market Trends

- The rise in the surgical procedure across the country has emerged as a key catalyst driving the growth of the market. As medical interventions have become increasingly advanced and accessible, this has led to the demand for the effective wound care solutions, experiencing a parallel growth.

- For instance, as per estimates, the U.S. alone performs more than 4,297,000 elective procedures, including both surgical and non-surgical interventions, every month. Among these procedures, 46.6% are of surgical nature, requiring the utilization of operation rooms.

- The growth of elective as well as emergency procedures, including trauma cases, accidents, acute medical conditions necessitate the demand of immediate surgical interventions, thereby significantly contributing to the overall demand of advanced wound care, which is estimated to reach USD 27.5 billion by 2034 products.

- Further, wound care products play a fundamental role in surgeries, addressing not only the postoperative care but also contributing to the long term care well-being of patients by promoting the optimal healing, thus, accelerating the demand of wound care products.

U.S. Wound Care Market Analysis

Learn more about the key segments shaping this market

Based on products, the wound care market is segmented as advanced wound dressing, surgical wound care, traditional wound care, wound therapy devices, and wound care biologics. Further, advanced wound care segment is segmented into foam dressings, hydrocolloid dressings, film dressings, alginate dressings, hydrogel dressings, collagen dressings, and other advanced dressings. The advanced wound dressing segment of the market is forecasted to reach USD 4.1 billion by 2035.

- The growth of advanced wound dressings is driven by several factors, including their ability to maintain an effective moisture balance in the wound. This promotes faster tissue repair and reduces the risk of scab formation, leading to a rapid healing process.

- For example, dressings such as Coloplast Biatain Silicone maintain optimal moisture balance, which helps prevent wound drying and maceration. This improves healing conditions and minimizes pain during dressing changes.

- Additionally, advanced wound dressings that include bioactive materials or negative pressure systems significantly enhance the healing process. They create an optimal environment for wound repair, allowing the skin to heal and grow more quickly than with regular dressings.

- For instance, a report from the National Institute of Health states that NPWT is essential in advanced wound care. It demonstrates excellent effectiveness in improving the healing process for both acute and chronic wounds by promoting tissue granulation and minimizing the risk of further infections.

- Moreover, many advanced dressings contain antimicrobial agents such as silver, iodine, or honey, which reduce the risk of infections and support a clean wound environment.

- Furthermore, non-adherent or silicone-based dressings reduce overall pain during dressing changes and minimize damage to newly formed tissues.

Based on application, the wound care market is bifurcated into chronic wounds and acute wounds. Further, the acute wounds is segmented into surgical wounds, traumatic wounds, and burns. The acute wounds segment accounted for USD 4.2 billion in 2025.

- Acute wounds, including surgical incisions, traumatic injuries, and burns, represent a significant segment of the U.S. wound care market. The rising number of surgical procedures, both elective and emergency, has fueled demand for advanced wound care solutions that ensure optimal healing and infection prevention.

- Wound care products such as foam dressings, hydrogel dressings, and film dressings are extensively used to provide immediate protection to acute wounds and reduce the risk of infection.

- Additionally, burn injuries remain a critical concern, with the American Burn Association reporting over 450,000 burn injuries annually in the U.S., driving the need for specialized burn care products.

- Increasing awareness of proper acute wound management, coupled with higher healthcare spending and improved access to advanced treatment facilities, continues to strengthen this segment.

- Furthermore, ongoing research and development initiatives and technological innovations, such as antimicrobial dressings and NPWT, are enhancing clinical outcomes and reinforcing the market’s growth.

Learn more about the key segments shaping this market

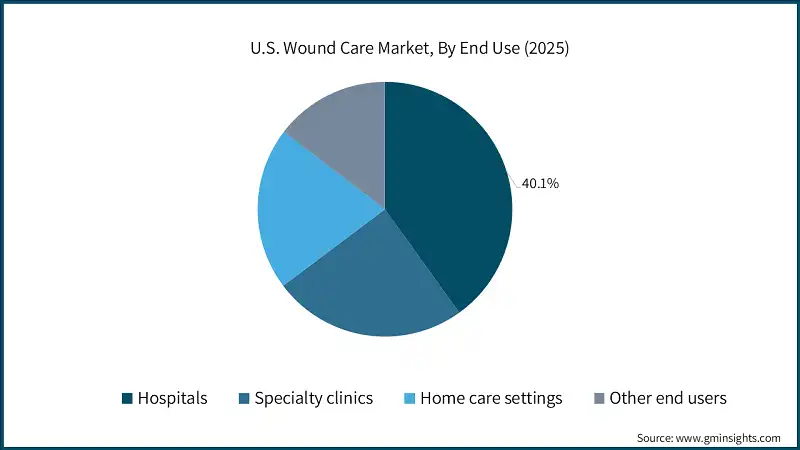

Based on end use, the U.S. wound care market is bifurcated into hospitals, specialty clinics, home care settings, and other end users. The hospitals segment accounted for USD 3 billion in 2025.

- Hospitals play a crucial role in the U.S. wound care market, as they effectively maintain adequate supplies and ensure continuous patient care, even during emergencies or periods of high patient inflow.

- Their extensive storage capacity and streamlined procurement systems position hospitals as the primary setting for advanced wound care solutions. In critical situations where time and speed are vital, products such as antimicrobial dressings, foam dressings, and NPWT systems deliver quick and effective treatment, reducing infection risks and promoting faster healing.

- Additionally, government initiatives aimed at improving wound care standards in hospitals have strengthened infrastructure and training, enhancing patient safety and clinical outcomes. Hospitals’ strategic focus on infection control and the adoption of advanced technologies continues to drive market growth and reinforce their dominance in wound care delivery.

U.S. Wound Care Market Share

- The top 5 players in the market includes Smith + Nephew, Solventum, Molnlycke Health Care, ConvaTec Group, and Cardinal Health dominate the market with a combined market share of 23.9%. They maintain this position through advanced product portfolios, strong partnerships with providers, and continuous innovation. A key strategy for their success is investing in research and development for products such as foam dressings, hydrogel dressings, advanced dressings, antimicrobial solutions, and eco-friendly biodegradable materials, aimed at improving healing, comfort, and sustainability.

- Emerging players in the U.S. wound care market are gaining traction by introducing advanced solutions, including smart dressings embedded with sensors and antimicrobial technologies. These innovations enable real-time tracking of wound status and data sharing through integrated digital platforms, ensuring better clinical decision-making and enhanced patient engagement. By focusing on user-friendly designs and ensuring interoperability with hospital systems and home-care platforms, these companies are supporting the growing trend toward decentralized and home-based wound care models.

- Collaborations with hospitals and other healthcare providers are crucial for expanding distribution channels and meeting the increasing demand for effective wound care solutions, particularly in managing chronic conditions. Additionally, favorable government health initiatives and increased public awareness about effective wound care solutions are driving innovation, further strengthening the position of companies in the expanding sector.

U.S. Wound Care Market Companies

Few of the prominent players operating in the U.S. wound care industry include:

- Advancis Medical

- B. Braun Melsungen

- Baxter International

- Coloplast

- ConvaTec Group

- Ethicon

- Derma Sciences

- Medline Industries

- Medtronic

- Molnlycke Health Care

- Smith and Nephew

- Solventum

- URGO Medical

- Smith & Nephew

Smith & Nephew has a strong product portfolio, leading to greater adoption and significant market expansion. The company provides a diverse range of products related to wound care, including advanced wound care dressings. Smith+Nephew differentiates itself through its clinically proven biologic and advanced wound care portfolio, designed for chronic wounds such as diabetic foot ulcers and venous leg ulcers.

ConvaTec Group is a leading player in chronic wound management, offering innovative solutions for treating diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The company focuses on delivering cost-effective products tailored for hospitals and home care settings, ensuring accessibility and improved patient outcomes.

Molnlycke has established a strong geographical presence in the U.S., enhancing its market reach and accessibility. The company offers a comprehensive portfolio of advanced wound care products, including antimicrobial dressings, hydrogels, surgical tapes, and foam dressings.

U.S. Wound Care Industry News:

- In October 2024, Smith & Nephew announced the launch of RENASYS EDGE NPWT System, a novel system for treating chronic wounds which is designed with patient convenience in mind. The system comes with a canister that is not only discreet and operates in a non-obtrusive manner while the patients carry on with their daily activities.

- In January 2023, ConvaTec announced the launch of ConvaFoam in the U.S. This product launch helped the company to strengthen its product portfolio in advanced wound care solutions.

The U.S. wound care market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2022 - 2035 for the following segments:

Market, By Product

- Advanced wound dressing

- Foam dressings

- Hydrocolloid dressings

- Film dressings

- Alginate dressings

- Hydrogel dressings

- Collagen dressings

- Other advanced dressings

- Surgical wound care

- Sutures and staples

- Tissue adhesive and sealants

- Anti-infective dressing

- Traditional wound care

- Medical tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing agents

- Wound therapy devices

- Negative pressure wound therapy

- Oxygen and hyperbaric oxygen equipment

- Electric stimulation devices

- Pressure relief devices

- Other wound therapy devices

- Wound care biologics

- Skin substitutes

- Biological

- Allograft

- Xenograft

- Other biologicals

- Synthetic

- Biological

- Topical agents

- Skin substitutes

Market, By Application

- Chronic wounds

- Diabetic foot ulcers

- Pressure ulcers

- Venous leg ulcers

- Other chronic wounds

- Acute wounds

- Surgical wounds

- Traumatic wounds

- Burns

Market, By End Use

- Hospitals

- Specialty clinics

- Home care settings

- Other end use

Frequently Asked Question(FAQ) :

Who are the prominent players in the U.S. wound care market?

Key players include Advancis Medical, B. Braun Melsungen, Baxter International, Coloplast, ConvaTec Group, Ethicon, Derma Sciences, Medline Industries, Medtronic, Molnlycke Health Care, and Smith and Nephew.

How much revenue did the acute wounds segment generate?

The acute wounds segment accounted for USD 4.2 billion in 2025, supported by the increasing prevalence of surgical wounds, traumatic injuries, and burns.

What was the valuation of the hospital end-use segment?

The hospital segment generated USD 3 billion in 2025, dominating the market due to the high volume of surgical procedures and advanced wound care adoption in hospital settings.

What are the key trends in the U.S. wound care market?

Key trends include the rising number of surgical procedures, increasing demand for advanced wound care products, and the growing focus on emergency and elective medical interventions.

What is the estimated size of the advanced wound dressing segment?

The advanced wound dressing segment is forecasted to reach USD 4.1 billion by 2035, driven by innovations in foam, hydrocolloid, film, alginate, hydrogel, and collagen dressings.

What was the market size of the U.S. wound care market in 2025?

The market was valued at USD 7.5 billion in 2025, with a CAGR of 5.4% projected through 2035, driven by the increasing number of surgical procedures and advancements in wound care solutions.

What is the projected value of the U.S. wound care market by 2035?

The market is expected to reach USD 12.5 billion by 2035, fueled by the growing demand for advanced wound care products and the rise in emergency and elective surgical procedures.

U.S. Wound Care Market Scope

Related Reports