Summary

Table of Content

U.S. Point-of-care CT Imaging Systems Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Point-of-care CT Imaging Systems Market Size

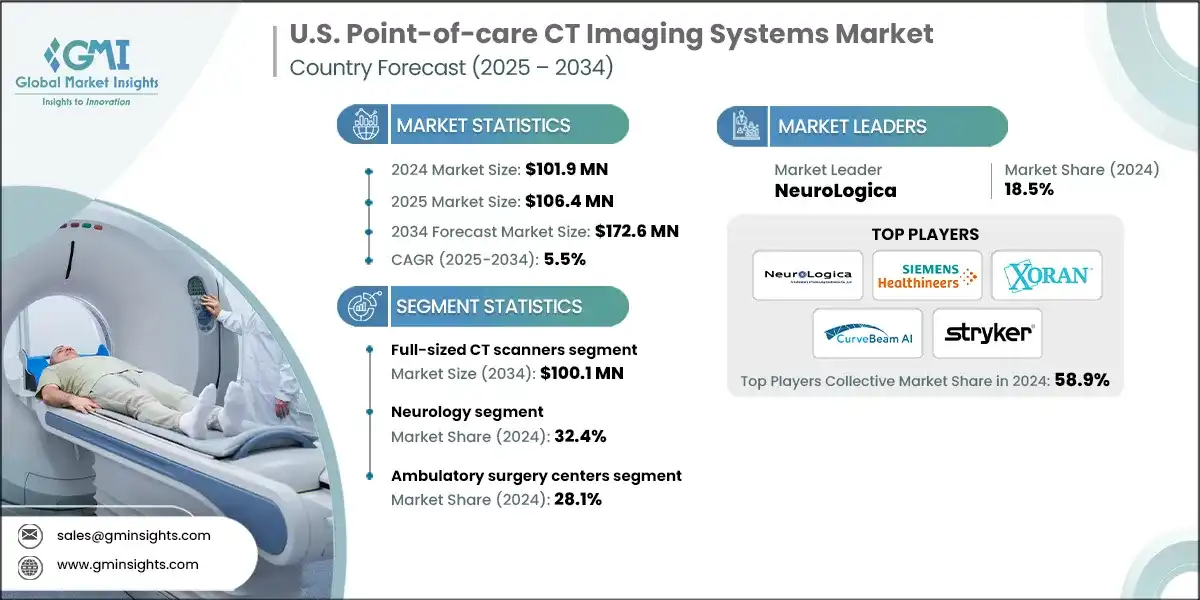

U.S. point-of-care CT imaging systems market was valued at USD 101.9 million in 2024. It is projected to grow from USD 106.4 million in 2025 to USD 172.6 million by 2034, expanding at a CAGR of 5.5%. The demand for point-of-care CT imaging in the U.S. is steadily increasing, driven by the growing number of older adults and the rising prevalence of chronic illnesses. The mobile CT systems are particularly valuable in emergency rooms and intensive care units, where rapid imaging is critical for conditions such as stroke, heart disease, and lung disorders. Designed for use near patients, these platforms accelerate diagnosis and treatment decisions. Leading companies in the U.S. market include NeuroLogica, Siemens Healthineers, Xoran Technologies, CurveBeam, and Stryker.

To get key market trends

The market grew from USD 90.2 million in 2021 to USD 97.8 million in 2023. In the U.S., the adoption of portable CT systems is gaining traction as healthcare providers increasingly focus on early diagnosis and patient-centered care. These compact, AI-enabled imaging units are being used more frequently in mobile screening programs and outpatient settings, providing fast and flexible diagnostic options. With the shift toward decentralized healthcare and telemedicine, portable CT platforms are expanding access to imaging services while reducing reliance on traditional hospital equipment.

The rising burden of chronic diseases is a key factor driving the growth of the point-of-care CT imaging systems market in the U.S. According to the CDC, as reported in 2024, approximately 129 million Americans live with at least one chronic condition. Alarmingly, 42% of the population has two or more, and 12% are managing five or more chronic illnesses. These include heart disease, cancer, diabetes, and chronic respiratory conditions, which are leading causes of death and disability nationwide. Additionally, chronic diseases place a significant strain on the healthcare system. Around 90% of the country’s annual USD 4.1 trillion healthcare spending is directed toward managing chronic and mental health conditions. This growing demand for timely and accessible diagnostics is prompting healthcare providers to adopt portable, AI-enabled CT imaging systems that deliver fast, near-patient scans in emergency, outpatient, and remote care settings.

Furthermore, the growing aging population in the U.S. is contributing to the demand for fast and accessible diagnostic tools. As reported in 2024, the number of Americans aged 65 and older is expected to increase from 58 million in 2022 to 82 million by 2050, a 47% rise. This group will account for nearly 23% of the total population, up from 17%. Since older adults are more likely to experience chronic illnesses and sudden health issues, the need for timely imaging solutions is becoming increasingly important. Portable CT systems are well-suited to meet this demand, offering quick diagnostics in settings such as outpatient clinics, emergency departments, and home-based care.

Point-of-care CT imaging systems are compact and portable diagnostic platforms integrated into modern clinical workflows to provide immediate, near-patient computed tomography scans. These systems are designed for use in emergency departments, ICUs, outpatient clinics, and mobile screening units, enabling prompt diagnosis of conditions such as stroke, trauma, and respiratory diseases. Equipped with advanced imaging software and increasingly powered by artificial intelligence, POC CT machines deliver high-resolution images and real-time insights, making them a critical component in decentralized and patient-focused care.

U.S. Point-of-care CT Imaging Systems Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 101.9 Million |

| Market Size in 2025 | USD 106.4 Million |

| Forecast Period 2025 - 2034 CAGR | 5.5% |

| Market Size in 2034 | USD 172.6 Million |

| Key Market Trends | |

| Drivers | Impact |

| Growing number of chronic health issues | Millions of Americans with conditions like heart disease, diabetes, and cancer are driving demand for faster imaging in emergency rooms and clinics to enable quicker diagnoses and treatments. |

| Rising aging population | The U.S. senior population, projected to grow by 47% by 2050, faces higher risks of fractures, neurological issues, and respiratory disorders, increasing the need for accessible CT imaging. |

| Increasing emphasis on early diagnosis and treatment | Healthcare systems are prioritizing early disease detection and rapid treatment, boosting the adoption of portable CT scanners in mobile units, outpatient centers, and intensive care settings. |

| Technological advancements in imaging systems | Advancements in CT systems, including improved imaging, compact designs, and AI integration, enhance their usability beyond hospitals. |

| Pitfalls & Challenges | Impact |

| High equipment costs | High costs of advanced CT systems limit adoption in smaller clinics, especially in rural areas. |

| Regulatory and reimbursement barriers | FDA approvals and varying insurance rules hinder adoption and access in certain regions. |

| Opportunities: | Impact |

| Expansion into rural and remote areas | Portable CT units enhance access to advanced imaging in underserved areas, addressing care gaps. |

| Integration with AI and telemedicine | Combining CT imaging with AI and remote care improves diagnostics and supports virtual consultations. |

| Market Leaders (2024) | |

| Market Leaders |

18.5% |

| Top Players |

Collective market share in 2024 is 58.9% |

| Competitive Edge |

|

| Regional Insights | |

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Point-of-care CT Imaging Systems Market Trends

- The U.S. point-of-care CT imaging systems industry is advancing rapidly, driven by the healthcare sector's shift toward faster, decentralized, and patient-accessible diagnostic tools. With strong infrastructure and widespread adoption of digital health technologies, providers are increasingly adopting portable CT platforms to enhance care delivery in emergencies, outpatient settings, and remote locations.

- On the product development front, manufacturers are integrating AI-driven imaging software, real-time data capabilities, and compatibility with hospital systems such as PACS and Electronic Health Records (EHR). For instance, NeuroLogica’s BodyTom is widely used in U.S. hospitals for trauma and surgical imaging, offering full-body scans at the bedside and supporting immediate clinical decisions.

- The growing emphasis on early detection and timely intervention is accelerating the use of point-of-care CT systems in emergency departments and outpatient clinics. These platforms enable rapid diagnosis of strokes, head injuries, and respiratory conditions, helping clinicians act quickly without relying on centralized radiology departments.

U.S. Point-of-care CT Imaging Systems Market Analysis

Learn more about the key segments shaping this market

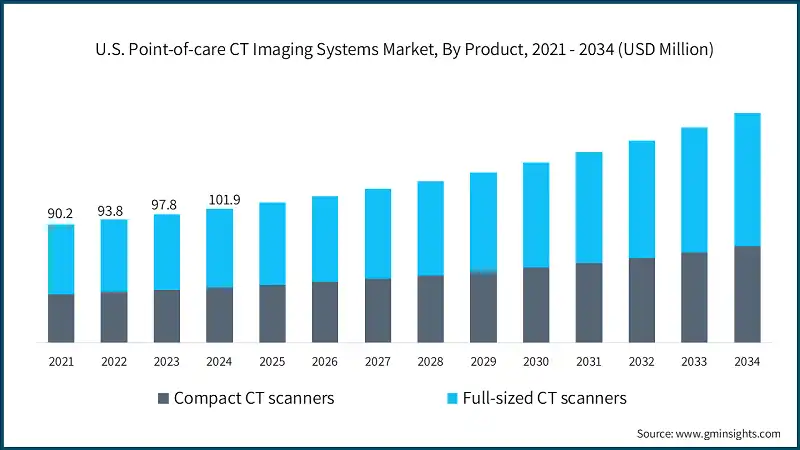

The market was valued at USD 90.2 million in 2021. The market size reached USD 97.8 million in 2023, up from USD 93.8 million in 2022.

Based on the product, the U.S. point-of-care CT imaging systems market is segmented into compact CT scanners and full-sized CT scanners. The full-sized CT scanners segment led this market in 2024, accounting for the highest market share due to their superior imaging capabilities. These systems are widely used in critical settings such as trauma centers and intensive care units, where detailed anatomical coverage and high-resolution imaging are essential for accurate diagnosis and treatment planning. This segment was valued at USD 59.8 million in 2024 and is projected to reach USD 100.1 million by 2034, growing at a CAGR of 5.4%. This growth can be attributed to the wide use of these scanners in hospitals and emergency departments, where rapid and accurate imaging is essential for timely diagnosis and treatment decisions. In comparison, the compact CT scanners segment, valued at USD 42.1 million in 2024, is expected to grow to USD 72.6 million by 2034, with a slightly higher CAGR of 5.7%, supported by its clinical viability and suitability for smaller facilities.

- Compact CT scanners are emerging as the fastest-growing segment in the U.S. point-of-care CT imaging systems market, driven by their portability, ease of use, and suitability for outpatient and specialty care environments. These systems are increasingly adopted in ENT clinics, dental practices, neuroimaging centers, and mobile health units, where space and workflow flexibility are key considerations.

- One of the main advantages of compact CT platforms is their ability to deliver high-quality imaging with low radiation doses in a small footprint. These scanners are designed for quick setup and operation, making them ideal for decentralized care settings. Their integration with PACS and EHR systems supports efficient data sharing and clinical decision-making, while intuitive interfaces and automated positioning features enhance usability for non-radiology specialists.

- For example, Xoran Technologies offers compact systems such as the xCAT IQ, widely used in neurocritical care across the U.S. Similarly, CurveBeam provides compact CT solutions tailored for orthopedic imaging, enabling weight-bearing scans that support more accurate diagnosis and treatment planning.

- As U.S. healthcare providers continue to expand services in outpatient and rural settings, compact CT scanners are gaining traction for their ability to improve access, reduce patient transfer times, and support real-time diagnostics. With growing interest in AI integration and mobile health delivery, this segment is expected to play a key role in shaping the future of point-of-care imaging across the country.

Based on the application, the U.S. point-of-care CT imaging systems market is segmented into neurology, respiratory, musculoskeletal, ENT, and other applications. The neurology segment accounted for the highest market share of 32.4% in 2024.

- The rising prevalence of neurological disorders in the U.S. is a major factor driving the demand for point-of-care CT imaging. According to a report published in JAMA Neurology, conditions such as stroke, Alzheimer's disease, and migraines represent the most significant neurological burdens in the country. The report also highlighted notable disparities in disease impact across various states, emphasizing the need for more accessible and timely diagnostic solutions.

- With the aging of the US population, stroke, traumatic brain injury, and neurodegenerative diseases are becoming more common. This trend is boosting demand for portable CT systems that provide instant, high-quality imaging at bedside. Such systems are increasingly being used in emergency departments, neurocritical care departments, and mobile stroke programs to aid in rapid clinical decision-making.

- Full point-of-care CT scanners are particularly useful in neurological treatment, providing high-resolution brain and spine imaging to identify bleeding, ischemia, and structural anomalies. Their compatibility with surgical navigation devices, PACS, and hospital IT infrastructure facilitates workflow efficiency and reduces response times in emergency care environments.

- At the same time, the respiratory imaging market is expected to expand at 5.9% CAGR through 2034. This is due to the high incidence of respiratory diseases such as COPD, pneumonia, and lung cancer. These diseases have put pressure on healthcare systems to deploy quicker, more accessible imaging technologies that can aid early diagnosis and treatment planning.

Learn more about the key segments shaping this market

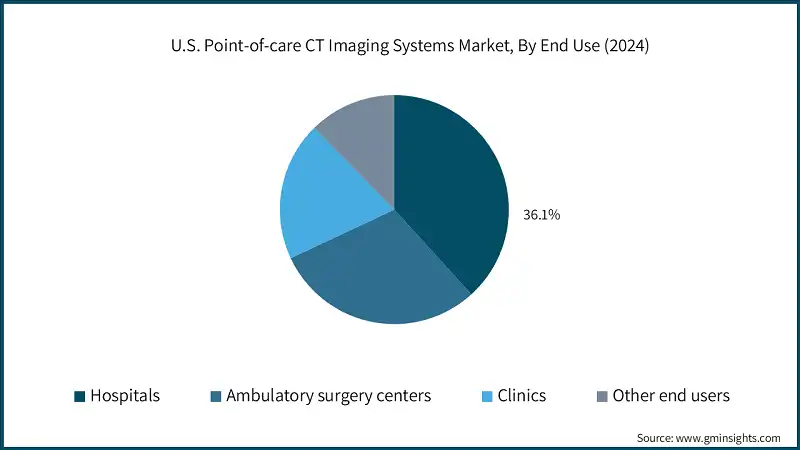

Based on end use, the U.S. point-of-care CT imaging systems market is segmented into hospitals, ambulatory surgery centers, clinics, and other end users. The ambulatory surgery centers segment held a market share of 28.1% in 2024.

- The growing number of chronic conditions such as cancer, heart disease, and diabetes is a major factor driving the adoption of point-of-care CT systems in ambulatory surgical centers (ASCs) across the U.S. According to the CDC’s National Diabetes Statistics Report, over 11.6% of Americans are living with diabetes, highlighting the need for accessible diagnostic tools in outpatient settings. ASCs are increasingly integrating compact CT systems to support early detection and care planning for these patients.

- The expansion of this segment is also supported by favorable insurance coverage, streamlined care delivery, and a rising preference for preventive health services. Patients are turning to ASCs not only for surgical procedures but also for diagnostic imaging, especially when fast results are needed without the delays of hospital-based care.

- Compact point-of-care CT scanners are well-suited for ASCs due to their small footprint, fast imaging capabilities, and ease of integration into outpatient workflows. These systems are commonly used for evaluating ENT conditions, musculoskeletal injuries, and neurological symptoms.

- In comparison, hospitals accounted for 36.1% of the U.S. market share in 2024, largely due to their access to advanced imaging infrastructure and specialized radiology staff. Hospitals continue to play a central role in diagnosing and managing complex cases, including trauma, neurological emergencies, and respiratory illnesses, making them key users of both full-sized and portable CT systems.

U.S. Point-of-care CT Imaging Systems Market Share

- The U.S. market is led by five major players, including NeuroLogica, Siemens Healthineers, Xoran Technologies, CurveBeam, and Stryker, that together account for approximately 58.9% of the total market share. These companies maintain their leadership through a combination of product innovation, AI integration, regulatory alignment, and strong partnerships with hospitals, outpatient centers, and diagnostic networks across the country.

- NeuroLogica, a subsidiary of Samsung, continues to lead with its BodyTom systems, which are widely used in trauma care, neurology, and critical care. These scanners offer full-body imaging at the point of care and are designed to integrate with surgical navigation tools and hospital IT systems, making them highly effective in emergency and neurocritical environments.

- Siemens Healthineers, Xoran Technologies, CurveBeam, and Stryker have strengthened their U.S. presence by offering compact and specialized CT solutions tailored to orthopedic, ENT, dental, and cardiovascular applications. Their systems are built to support outpatient workflows and mobile health delivery, with features such as low-dose imaging, fast scan times, and AI-powered automation.

- To expand their footprint, leading and emerging players are focusing on technologies that support interoperability with PACS and EMR systems, mobile deployment, and real-time diagnostics. These strategies align with the broader shift in U.S. healthcare toward decentralized care models, especially in rural and underserved communities.

U.S. Point-of-care CT Imaging Systems Market Companies

Few of the prominent players operating in the U.S. point-of-care CT imaging systems industry include:

- Carestream Dental

- CurveBeam

- Epica International

- NeuroLogica

- Siemens Healthineers

- SOREDEX

- Stryker

- Xoran Technologies

- CurveBeam

CurveBeam is known for its compact, weight-bearing cone beam CT (CBCT) systems, widely used in orthopedic and podiatry practices across the U.S. These scanners provide detailed 3D images of extremities such as knees, ankles, and feet directly at the point of care. Designed for outpatient clinics, CurveBeam’s systems are self-shielded and require minimal setup, making them ideal for small practices and mobile diagnostic units. Their focus on biomechanical imaging and low-dose protocols supports accurate diagnosis and treatment planning in musculoskeletal care.

Stryker offers mobile CT imaging solutions tailored for use in operating rooms and emergency settings. Their systems are designed to deliver high-resolution scans of complex anatomical regions and integrate with surgical navigation platforms such as Q Guidance. With battery-powered mobility and dual-mode operation, Stryker’s scanners are well-suited for deployment in trauma centers, neurocritical care units, and intraoperative environments across U.S. hospitals.

Carestream Dental specializes in CT systems for ENT and dental applications. These scanners offer high-quality imaging of sinus and cranial structures with reduced radiation exposure. Features such as automated positioning, smart scanning technology, and ergonomic design enhance diagnostic precision and patient comfort. Their systems are commonly used in outpatient specialty clinics across the U.S. and are compatible with image-guided surgical tools, supporting efficient workflows in ENT and oral health diagnostics.

U.S. Point-of-Care CT Imaging Systems Industry News

- In September 2022, CurveBeam and StraxCorp entered into a definitive merger agreement to form CurveBeam AI, a new entity focused on advancing orthopedic imaging through artificial intelligence. The merger combines CurveBeam’s expertise in weight-bearing CT imaging with StraxCorp’s AI-driven bone health analytics. CurveBeam AI expands CurveBeam’s financially viable point-of-care imaging solutions into the bone health space and also springboards AI-driven applications for weight-bearing CT (WBCT) imaging. This strategic move is expected to accelerate innovation in musculoskeletal diagnostics and broaden access to precision imaging technologies in clinical and research environments.

The U.S. point-of-care CT imaging systems market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Compact CT scanners

- Full-sized CT scanners

Market, By Application

- Neurology

- Respiratory

- Musculoskeletal

- ENT

- Other applications

Market, By End Use

- Hospitals

- Ambulatory surgery centers

- Clinics

- Other end use

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. point-of-care CT imaging systems market?

Key players include NeuroLogica, Siemens Healthineers, Xoran Technologies, CurveBeam, Stryker, Carestream Dental, Epica International, and SOREDEX.

What are the upcoming trends in the U.S. point-of-care CT imaging systems industry?

Key trends include AI-enabled portable imaging platforms, integration with telemedicine, rising adoption in ambulatory surgery centers, and expansion into rural and underserved regions.

What was the valuation of the compact CT scanners segment in 2024?

Compact CT scanners generated USD 42.1 million in 2024, supported by increasing adoption in outpatient clinics, dental, and specialty care due to their portability.

How much revenue did the full-sized CT scanners segment generate in 2024?

Full-sized CT scanners generated USD 59.8 million in 2024, leading the market due to their advanced imaging capabilities in hospitals and emergency care.

What is the current U.S. point-of-care CT imaging systems market size in 2025?

The market size is projected to reach USD 106.4 million in 2025.

What is the projected value of the U.S. point-of-care CT imaging systems market by 2034?

The U.S. point-of-care CT imaging systems industry is expected to reach USD 172.6 million by 2034, supported by AI-driven imaging innovations and the expansion of portable diagnostic platforms in decentralized healthcare.

What is the market size of the U.S. point-of-care CT imaging systems industry in 2024?

The market size was USD 101.9 million in 2024, with a CAGR of 5.5% expected through 2034 driven by the rising burden of chronic diseases and the need for rapid diagnostics.

U.S. Point-of-care CT Imaging Systems Market Scope

Related Reports