Summary

Table of Content

U.S. Diabetes Care Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Diabetes Care Devices Market Size

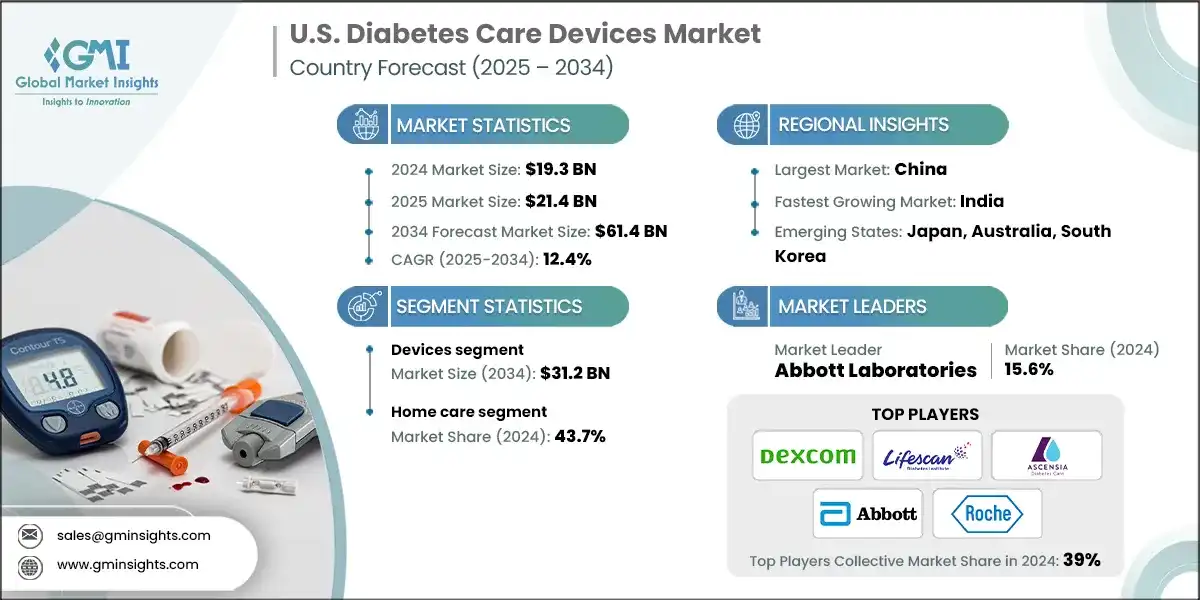

The U.S. diabetes care devices market size was valued at USD 19.3 billion in 2024. The market is projected to grow from USD 21.4 billion in 2025 to USD 61.4 billion by 2034, expanding at a CAGR of 12.4%, according to the latest report published by Global Market Insights Inc.

To get key market trends

This steady growth is stimulated by various factors such as growing prevalence of diabetes across the U.S., shift toward value-based and remote care, and favorable reimbursement policy. Diabetes care devices refer to a range of medical devices designed to help individuals with diabetes manage their condition effectively. These devices play a crucial role in monitoring blood glucose levels, administering insulin, and overall diabetes management. Major companies in the industry include F. Hoffmann-La Roche, Abbott Laboratories, Ascensia Diabetes Care Holdings, LifeScan, and Dexcom.

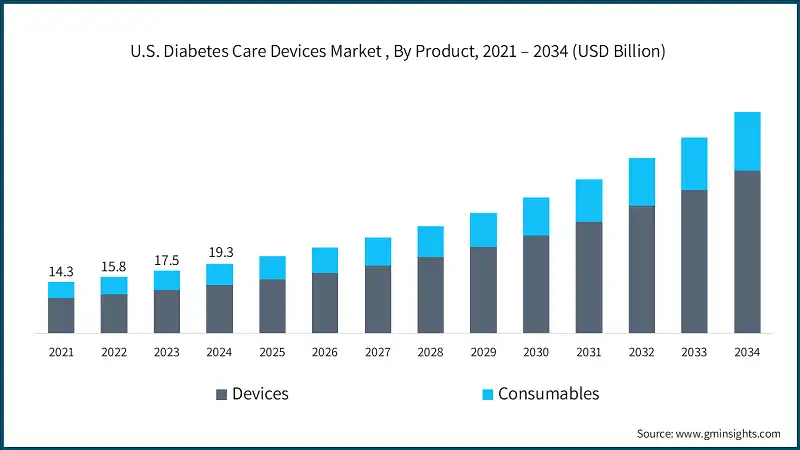

The market increased from USD 14.3 billion in 2021 to USD 17.5 billion in 2023, primarily due rising prevalence of diabetes across the U.S. which have significantly expanded the demand for effective monitoring and management solutions, as more individuals are diagnosed with diabetes the need for advanced care devices such as glucose monitors, insulin delivery system, and digital health platform continue to grow driving innovation and investment in the country.

For instance, according to the data from the Centers for Disease Control and Prevention (CDC) in 2021, in the U.S. alone, 38.4 million people of all ages, equivalent to 11.6% of the U.S. population, had diabetes, among them 38.1 million were adults of 18 years or older, representing 14.7% of the U.S. adult population. Thus, this substantial patient base highlights the urgent need for scalable diabetes care technology. Therefore, this increasing burden of diabetes is accelerating the growth of the diabetes care devices market across the country.

Moreover, favorable reimbursement policies are a significant catalyst for the U.S. diabetes care devices market. Government programs such as Medicare and Medicaid, along with private insurers, increasingly cover advanced devices, such as insulin pumps and continuous glucose monitoring, which is estimated to reach USD 47.1 billion by 2034, devices. This financial backing reduces out-of-pocket costs per patient and encourages hospitals and clinics to adopt and recommend this technology, as a result, more patients gain access to high-quality diabetes management tools, stimulating market growth.

For instance, according to data from the Centers for Disease Control and Prevention (CDC) in 2021, the estimated diabetes-attributable medical cost incurred by the state program totaled USD 76.6 billion per person, with an average cost of USD 8,771. Additionally, economic incentive further accelerates the adoption of advanced devices, reinforcing their role in improving outcomes and controlling healthcare expenditures.

Diabetes care devices refer to a range of medical devices designed to help individuals with diabetes manage their condition effectively. These devices play a crucial role in monitoring blood glucose levels, administering insulin, and overall diabetes management.

U.S. Diabetes Care Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 19.3 Billion |

| Market Size in 2025 | USD 21.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.4% |

| Market Size in 2034 | USD 61.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing prevalence of diabetes across U.S. | Drives demand for continuous monitoring and advanced care devices. |

| Shift toward value-based and remote care | Encourages adoption of connected, patient-centric diabetes technologies. |

| Favourable reimbursement policy | Supports wider access and affordability of diabetes care devices. |

| Pitfalls & Challenges | Impact |

| High cost of diabetes care devices | Limits adoption, especially in low-income and uninsured populations. |

| Rigorous regulatory framework | Slows product development and market entry for innovative solutions. |

| Opportunities: | Impact |

| Integration of AI and smart ecosystems | Enables predictive analytics, personalized care, and improved outcomes. |

| Market Leaders (2024) | |

| Market Leaders |

15.6% market share |

| Top Players |

Collective Market Share is 39% |

| Competitive Edge |

|

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Diabetes Care Devices Market Trends

- Remote care has become an integral part of modern healthcare in the U.S., particularly in the post-pandemic era. Diabetes devices connect to mobile applications and cloud-based platforms, providing both patients and clinicians with real-time insights, thereby enhancing the ease of access to healthcare and virtual consultations.

- Moreover, remote care devices are often an integral part of a larger digital health model, utilizing cloud-based platforms, such as electronic health records (EHRs) and artificial intelligence-driven analytics. These interconnected digital platforms enable the continuous sharing of data and predictive analytics, allowing clinicians to make informed decisions based on accurate insights. These capabilities adhere to a value-based care model and are boosting demand for innovative diabetes solutions.

- Additionally, value-based care aims to reduce long-term healthcare costs by preventing complications and addressing underlying health issues. Diabetes care devices help achieve this by early intervention and reducing hospital admissions. Therefore, as the healthcare system seeks cost-effective solutions, the market for reliable, remote-capable diabetes devices continues to grow.

- Thus, these technological advancements and shifts towards value-based remote care are positively contributing to the adoption among the patients, fostering market growth in the country.

U.S. Diabetes Care Devices Market Analysis

Learn more about the key segments shaping this market

The U.S. market was valued at USD 14.3 billion in 2021. The market size reached USD 17.5 billion in 2023, from USD 15.8 billion in 2022.

Based on the product, the market is segmented into devices and consumables. The devices segment is further bifurcated into blood glucose monitoring devices and insulin delivery devices. The blood glucose monitoring devices segment dominated the market in 2024, holding the largest share due to the widespread adoption across homecare setting, diagnostic centers, and hospitals. This segment was valued at USD 8 billion in 2024 and is projected to reach USD 31.2 billion by 2034, growing at a CAGR of 14.8%. In comparison, the insulin delivery devices segment, valued at USD 5.4 billion in 2024, is expected to grow to USD 14 billion by 2034.

- An insulin delivery device is a small, wearable, computerized device that manages diabetes by continuously delivering rapid-acting insulin under the skin through a thin tube or directly via a patch. It provides a steady background dose throughout the day. It allows users to administer extra doses for meals or to correct high blood sugar levels, offering more precise control and flexibility than multiple daily injections.

- Moreover, insulin pumps are available in both tubed and tubeless models. Many modern pumps are integrated with a continuous glucose monitor (CGM) and utilize algorithms to autonomously administer insulin quantities based on the CGM's real-time readings of glucose levels.

- Additionally, insulin pumps offer greater flexibility, more precise dosing, and fewer daily injections. They are especially helpful for people with type 1 diabetes, children, and those with unpredictable schedules or insulin needs.

- For instance, the Omnipod by Insulet Corporation is a tubeless, wearable insulin pump designed to simplify diabetes management. Its two main models, Omnipod DASH and Omnipod 5, offer discreet and flexible insulin delivery without the need for tubing. These pumps integrate with continuous glucose monitoring (CGM) systems to automate insulin dosing based on real-time glucose levels. This closed-loop system helps users maintain better glycemic control while reducing the burden of daily injections. It is particularly useful because it provides freedom of movement and convenience, making diabetes management less intrusive and allowing for a more seamless daily living experience.

- Thus, such technological advancements in insulin delivery devices are propelling the adoption of these devices among healthcare providers and patients, positively contributing to the growth of the segment in the U.S.

Learn more about the key segments shaping this market

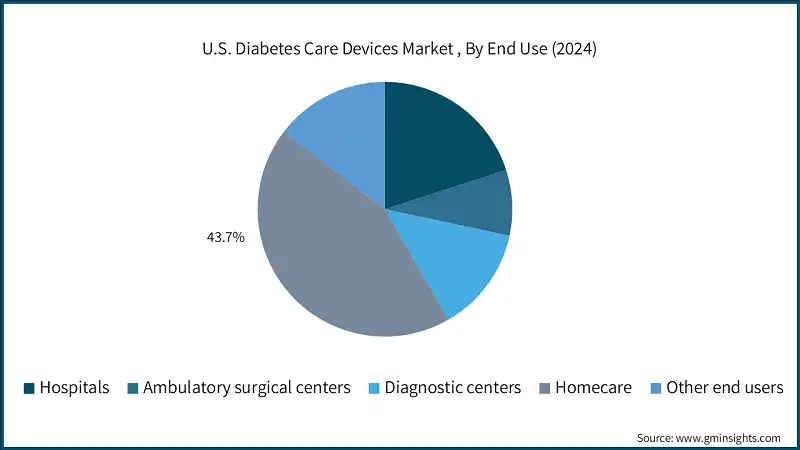

Based on end use, the U.S. diabetes care devices market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, homecare, and other end users. The homecare segment accounted for the market share of 43.7% in 2024.

- Hospitals serve as the primary site for diagnosing, treating, initiating, and monitoring diabetes. Hospitals offer timely intervention, providing access to devices and trained practitioners, which enables accurate diagnosis and treatment of diabetes. Hospitals are the most effective locations to deploy novel and high-tech methods of care for diabetes, utilizing CGMs and insulin pumps.

- Additionally, the hospital has the resources to facilitate continuous glucose monitoring and insulin delivery, primarily for serious clinical situations such as gestational or ICU patients.

- Therefore, due to their comprehensive infrastructure, skilled medical personnel, and access to advanced technologies, the hospital dominates the market.

U.S. Diabetes Care Devices Market Share

- The top 5 players in the U.S. diabetes care devices industry such as F. Hoffmann-La Roche, Abbott Laboratories, Ascensia Diabetes Care Holdings, LifeScan, and Dexcom collectively hold a 39% share of the U.S. market. These companies maintain a strong presence in the U.S. diabetes care devices market due to their extensive product offerings, well-established distribution channels, consistent innovation, and trusted brand reputation. Their ability to deliver advanced solutions and adapt to evolving consumer needs helps reinforce their market leadership.

- Emerging players entering the U.S. diabetes care devices market typically focus on strategic innovation and market adaptability to compete with established brands. They often introduce differentiated products such as wearable, connected, or AI-powered devices that offer improved user experience and personalized care. These companies build credibility by collaborating with healthcare professionals, patient advocacy groups, and tech platforms.

- Distribution strategies include partnering with retail pharmacies, leveraging e-commerce, and adopting direct-to-consumer models to reach users more efficiently. Many also target underserved segments such as youth and elderly populations, tailoring solutions to meet specific lifestyle and health needs. Strategic alliances, licensing deals, and acquisitions are common approaches to expand capabilities and market reach.

U.S. Diabetes Care Devices Market Companies

Few of the prominent players operating in the U.S. diabetes care devices industry include:

- Abbott Laboratories

- ARKRAY

- Ascensia Diabetes Care

- B. Braun Melsungen

- Becton, Dickinson and Company

- Bionime

- DarioHealth

- Dexcom

- Dr. Reddy’s Laboratories

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Insulet

- LifeScan

- Medtronic

- Nova Biomedical

- Novo Nordisk

- Sanofi

- Sinocare

- Tandem Diabetes Care

- Ypsomed Holding

- Dexcom

Dexcom is one of the significant player in the U.S. with a market share of 15.2% in 2024.Dexcom is a prominent developer of continuous glucose monitoring (CGM) systems that help individuals with diabetes track their glucose levels in real time. The company focuses on wearable sensor-based technology that delivers convenience, precision, and seamless connectivity.

Ascensia Diabetes Care is a specialized diabetes technology company committed to enhancing the lives of people with diabetes through smart and precise monitoring tools. With a strong focus on innovation and user support, the company develops solutions that combine accuracy with digital connectivity to improve self-management.

F. Hoffmann-La Roche is a healthcare company known for its reliable contributions to diabetes care through its well-established blood glucose monitoring systems. The company focuses on delivering user-friendly and dependable solutions that support both clinical and personal diabetes management.

U.S. Diabetes Care Devices Industry News:

- In September 2023, Abbott Laboratories completed the acquisition of Bigfoot Biomedical, a company specializing in smart insulin management systems. This strategic move strengthened Abbott’s diabetes care portfolio, particularly enhancing its widely used FreeStyle Libre continuous glucose monitoring (CGM) technology.

- In May 2022, Abbott announced FDA clearance for the FreeStyle Libre 3 system, making it suitable for individuals aged four and above with diabetes. This 14-day continuous glucose monitor offered minute-by-minute glucose readings sent directly to smartphones, setting a new standard for accuracy. Despite its advanced features, the system-maintained affordability, priced at one-third of rival products. This regulatory approval expanded the FreeStyle Libre 3's user base and was anticipated to bolster Abbott's revenue.

- In March 2022, DarioHealth Corp., announced it had entered into a strategic partnership with Sanofi U.S., an innovative global healthcare company. This collaboration aimed to expedite the commercial adoption of Dario's comprehensive suite of digital therapeutics and facilitate the growth of digital health solutions on the Dario platform.

The U.S. diabetes care devices market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Devices

- Blood glucose monitoring devices

- Self-monitoring blood glucose meters

- Continuous glucose monitors

- Insulin delivery devices

- Insulin pumps

- Tubed pumps

- Tubeless pumps

- Pens

- Reusable

- Disposable

- Other insulin delivery devices

- Insulin pumps

- Blood glucose monitoring devices

- Consumables

- Testing strips

- Lancets

- Pen needles

- Standard

- Safety

- Syringes

- Insulin pumps consumables

Market, By End Use

- Hospital

- Ambulatory surgical centers

- Diagnostic centers

- Homecare

- Other end use

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. diabetes care devices industry?

Key players include Abbott Laboratories, ARKRAY, Ascensia Diabetes Care, B. Braun Melsungen, Becton, Dickinson and Company, Bionime, DarioHealth, F. Hoffmann-La Roche, Insulet, LifeScan, Medtronic, Nova Biomedical, Novo Nordisk, and Sanofi.

What are the upcoming trends in the U.S. diabetes care devices market?

Trends include remote care tech, AI-powered predictive analytics, cloud-based data sharing, and value-based care models for cost reduction.

Which region leads the diabetes care devices sector?

The U.S. leads the diabetes care devices market, with a valuation of USD 19.3 billion in 2024. The market growth is propelled by widespread adoption of innovative technologies, favorable reimbursement policies.

What was the valuation of the homecare segment in 2024?

The homecare segment accounted for 43.7% of the market share in 2024. Its growth is led by the rising preference for at-home diabetes management solutions.

What is the expected size of the U.S. diabetes care devices market in 2025?

The market size is projected to reach USD 21.4 billion in 2025.

How much revenue did the blood glucose monitoring devices segment generate in 2024?

The blood glucose monitoring devices segment generated approximately USD 8 billion in 2024 and is set to reach USD 31.2 billion by 2034.

What is the market size of the U.S. diabetes care devices in 2024?

The market size was valued at USD 19.3 billion in 2024, with a CAGR of 12.4% expected through 2034. The market growth is driven by the increasing prevalence of diabetes, a shift toward value-based and remote care.

What is the projected value of the U.S. diabetes care devices market by 2034?

The market is poised to reach USD 61.4 billion by 2034, fueled by advancements in remote care technologies, integration of AI-driven analytics, and the adoption of value-based care models.

U.S. Diabetes Care Devices Market Scope

Related Reports