Summary

Table of Content

U.S. Clinical Nutrition Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Clinical Nutrition Market Size

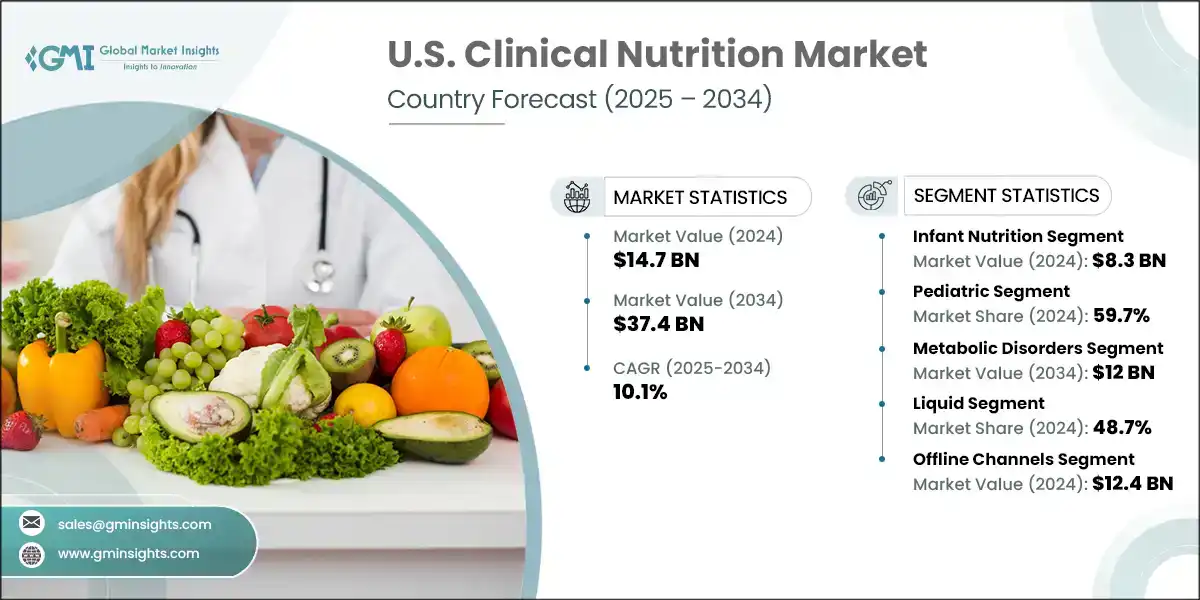

The U.S. clinical nutrition market was estimated at USD 14.7 billion in 2024. The market is expected to grow from USD 15.8 billion in 2025 to USD 37.4 billion in 2034, growing at a CAGR of 10.1%. The market is rapidly evolving due to several factors such as increasing chronic disease cases, rising aging population and a strong shift towards home healthcare services.

To get key market trends

These factors prompted the need for specialized nutritional support to enhance treatment outcome and improve patient recovery. Growing ageing population that are more susceptible to nutritional deficits due to reduced appetite, physiological changes and ongoing health issues, surge the demand for tailored nutritional interventions. As clinical nutrition has proven to be a valuable tool in improving health outcomes, particularly when traditional dietary intake falls short of nutritional needs. This has led to the mounting shift towards tailored nutritional solutions, which offer targeted support based on individual health profiles significantly boosting market growth.

Clinical nutrition is a specialized area that focuses on the managing nutritional support for a patient suffering from chronic illness. The key players in the industry include Abbott (Abbott Nutrition), Nestle Health Science, Danone and Fresenius Kabi. These companies emphasize developing, disease-specific nutritional products, personalized nutrition plans, and offering home care solutions. To maintain their position in the competitive industry, the companies are continuously striving to broaden their product offering, expand research and development capabilities, and maintain strong distribution networks.

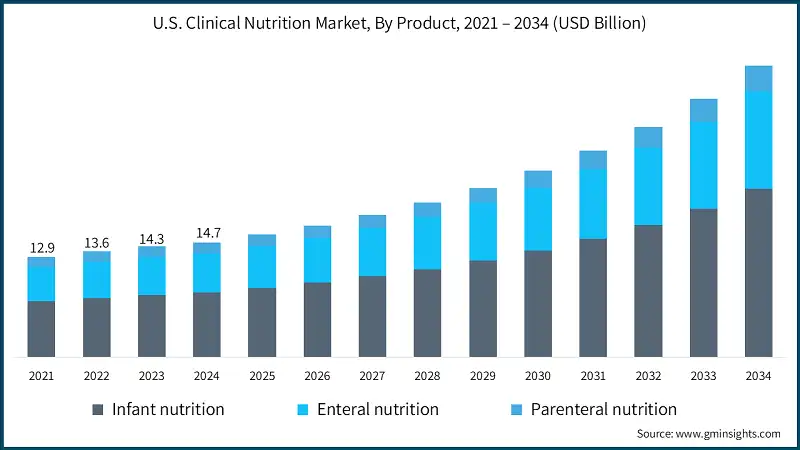

The market substantially increased from USD 12.9 billion in 2021 to USD 14.3 billion in 2023. The rapid evolution in the market was attributed to the growing prevalence of chronic disease condition and increased awareness for personalized nutrition. The COVID-19 pandemic emphasized the significance of immune health, accelerating awareness in nutritional support. In addition, government initiatives promoting nutrition security and innovations in disease-specific and home-based care products contributed to the sustainable market growth. Additionally, incidence of premature births and infant nutrition needs further stimulated the market expansion.

Furthermore, integration of digital health platforms and expanding e-commerce for clinical nutrition delivery is improving access and convenience, making it easier for patients to obtain and manage their nutritional therapies.

The U.S. clinical nutrition market is categorized into clinical nutrition products that are designed to meet specific dietary needs when regular food intake is inadequate, inappropriate due to chronic disease conditions. The clinical nutrition product encompasses infant nutrition, enteral nutrition and parenteral nutrition. It plays a critical role in supporting patient recovery, improving clinical outcomes.

U.S. Clinical Nutrition Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 14.7 Billion |

| Forecast Period 2025 – 2034 CAGR | 10.1% |

| Market Size in 2034 | USD 37.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of chronic diseases | Increasing cases of diabetes, cancer, gastrointestinal disorders, and neurological conditions are fueling demand for disease-specific nutrition |

| High incidence of malnutrition | Pediatric and adult malnutrition, particularly in developing regions, is a major factor boosting market growth |

| Advancements in nutritional science | Innovations in formulations are improving efficacy and patient compliance |

| Shift toward home healthcare | Increased adoption of clinical nutrition in outpatient and home care settings is enhancing market penetration |

| Pitfalls & Challenges | Impact |

| High cost of advanced formulations | Premium products may be unaffordable for many patients and healthcare systems |

| Limited reimbursement policies | Inconsistent insurance coverage for clinical nutrition products hinders adoption |

| Opportunities: | Impact |

| Personalized nutrition solutions | Genomics and metabolomics are enabling tailored nutrition plans based on individual health profiles |

| Plant-based and allergen-free products | Rising demand for clean-label, sustainable, and inclusive nutrition options |

| Technological integration | Digital health tools for tracking intake and compliance are enhancing patient outcomes |

| Market Leaders (2024) | |

| Market Leaders |

|

| Top Players |

|

| Competitive Edge |

|

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Clinical Nutrition Market Trends

- Growing shift towards personalized and disease-specific nutrition to address the need for nutritional support fuels the market demand.

- Rising chronic diseases incidences such as diabetes, cancer, and gastrointestinal (GI) disorders are increasingly spurring the demand to tailored nutritional therapies to support patient recovery and improve clinical outcomes. As reported in studies, clinical nutritional therapy is a cornerstone for diabetes management. For example, A type 2 diabetic patient is highly recommended the Medical Nutrition Therapy (MNT), a personalized meal plan including whole grains, lean proteins, non-carb vegetables, and healthy fats. Such dietary approach helps to maintain the blood-glucose levels, supporting weight management, and decreasing the risk of complications such as cardiovascular disease.

- Additionally, the integration of digital health technologies enabled platforms to track dietary intake, monitor health outcome, and provide virtual consultations improving accessibility to nutritional care and enhanced patient adherence to treatment plans. This shift is further supported by growing consumer awareness of preventive health and well-being, leading to increased adoption of clinical nutrition for out-patients and in-patients. These factors collectively reflected a broader evolution in healthcare embracing nutrition as fundamental to treatment.

- As innovation continues and awareness grows, the market is poised for sustained and significant expansion in the coming years.

U.S. Clinical Nutrition Market Analysis

Learn more about the key segments shaping this market

The market was valued at USD 12.9 billion in 2021. The market size reached USD 14.3 billion in 2023, from USD 13.6 billion in 2022.

Based on the product, the market is segmented into infant nutrition, enteral nutrition, and parenteral nutrition. The infant nutrition segment accounted for the largest revenue of USD 8.3 billion in 2024 due to the increasing demand for specialized nutritional support in newborns and infants. The segment is expected to exceed USD 21.6 billion by 2034, growing at a CAGR of 10.3% during the forecast period.

- The growing demand for infant nutrition is primarily attributed to factors such as growing awareness among parents about the crucial role of appropriate nutrition in infants for early development, along with the growing prevalence of health concerns such as lactose intolerance, allergies, and prematurity.

- Additionally, the growing advancement in infant formula formulations enriched with probiotics, docosahexaenoic acid (DHA), and other essential nutrients, has significantly gained traction in the market.

- Further, the increasing U.S. government’s initiatives towards encouraging infant health and the availability of a wide range of innovative infant nutrition products in both retail and healthcare settings further bolster the segment's growth. These factors collectively strengthen the dominance of infant nutrition reflecting a strong and steady demand in the global clinical nutrition market.

- On the other hand, enteral nutrition is expected to witness a growth rate of 9.9% driven by its efficiency in delivering vital nutrients directly to the GI tract, particularly valuable for patients with chronic conditions, cancer, or neurological disorders. In addition, increasing hospital admissions and preference for home-based enteral feeding are further accelerating market expansion.

Learn more about the key segments shaping this market

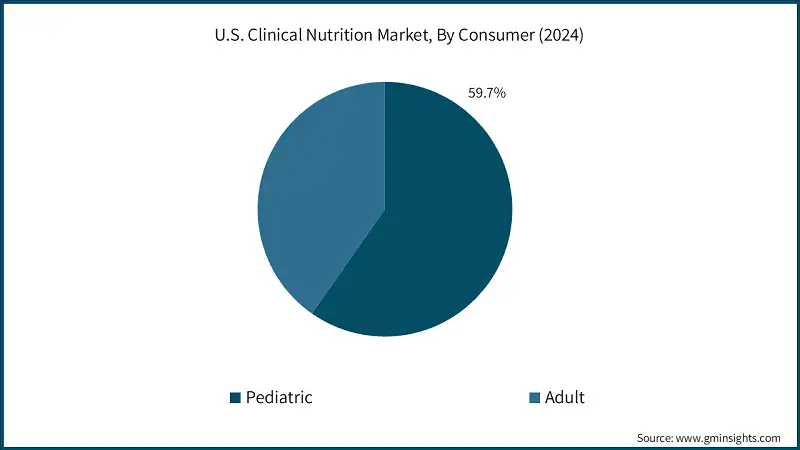

Based on the consumer, the U.S. clinical nutrition market is segmented into pediatric and adult. The pediatric segment accounted for the highest market share of 59.7% in 2024 due to the rising emphasis on child health and nutrition.

- Rising cases of premature births, congenital conditions, and pediatric malnutrition has surged the demand for specialized infant nutrition products.

- In addition, parents are becoming more aware of early nutrition’s role in their child supporting immune development, growth, and cognitive functioning fueling adoption of clinical nutrition.

- Additionally, heightened government initiatives and hospital programs intended at enhancing pediatric care further boost market growth. For instance, in September 2023, the National Nutrition Council of the Philippines initiated the Philippine Plan of Action for Nutrition (PPAN) 2023-2028. This strategy with a six-year plan aimed to lessen childhood obesity, and the burden of malnutrition. Such government initiatives bolster revolution in clinical nutrition products personalized to address the growing pediatric disease burden and boosts investment in research expanding market opportunities.

- Further, ongoing innovations in pediatric formulations such as allergen-free, plant-based, and easily digestible options continue to strengthen its market performance.

- Moreover, the adult segment is poised to grow at a significant growth rate owing to the rising chronic conditions prevalence rate in adults. Growing aging population with high exposure to chronic conditions is expected to spur uptake of nutritional support, coupled with growing shift toward home healthcare are key factors fueling demand in this segment.

Based on application, the U.S. clinical nutrition market is segmented into malnutrition, cancer nutrition, metabolic disorders, neurological diseases, gastrointestinal disorder, and other applications. The metabolic disorders segment accounted for the highest market share in 2024 and is expected to reach USD 12 billion by 2034 due to higher prevalence of metabolic conditions such as diabetes, obesity, and inherited conditions likely to surge the need for nutritional support contributing to market expansion.

- The increasing prevalence of metabolic disorders such as diabetes, obesity, and inherited metabolic conditions necessitates the need personalized dietary strategy. As standard diets often fall short, while personalized nutrition plans, based on genetics, gut microbiota and lifestyle, supporting managing the symptoms, preventing complications, and improve outcomes.

- Clinical nutrition leads as a cornerstone in providing nutritional support in maintaining blood-glucose level, supporting weight management, and providing essential nutrients in metabolically compromised individuals, making it preferable for treatment.

- For instance, Centers for Disease Control and Prevention (CDC) reported, in 2021, approximately 38.4 million people were living with diabetes in U.S. Among which about 29.7 million were diagnosed cases. These statistics underscored the need for effective diabetes management solutions with a focus on dietary control and specialized nutrition.

- Additionally, rising healthcare spending and the growing awareness for preventive care and long-term disease management contribute to the dominance of the metabolic disorders segment emphasizing the need for clinical nutrition.

- Moreover, GI disorders are expected to grow at a significant growth rate of 10.6% in coming years. This projected growth was driven due to rising incidence of GI related conditions such as Crohn’s disease, ulcerative colitis, and irritable bowel syndrome (IBS). These rising cases are expected to surge the demand for easy digestible nutrition-based therapies supported with increasing awareness fueling this segment’s expansion.

Based on the dosage form, the U.S. clinical nutrition market is segmented into powder, liquid and solid. The liquid segment accounted for the highest market share of 48.7% in 2024 and expected to grow at a steady growth rate of 9.8% during the analysis period.

- Liquid formulation gained popularity in the market due to its ease of consumption, rapid absorption, demand for home healthcare, and its adaptability across large patient population making it a preferred choice.

- Additionally, their widespread use with versatile application in enteral and oral nutrition therapies makes them widely accepted.

- Further, innovations in liquid formulation such as ready-to-drink formulations and flavored variants have further boosted patient compliance contributing to this segment's strong market performance.

- On the other hand, solid formulation segment is poised to witness significant growth due to its convenience, longer shelf life, and ease of storage and transport. Rising consumer preference for tablets, capsules, and granules, notably among outpatients and homecare settings along with advancement in formulation technology are likely to spur the solid formulations demand in coming years.

Based on the distribution channel, the U.S. clinical nutrition market is segmented into offline channels and online channels. The offline channels segment accounted for the largest revenue of USD 12.4 billion in 2024 due to the strong presence in hospital pharmacies and healthcare institutions.

- The offline channels segment is further categorized into hospital pharmacies, retail pharmacies and other offline channels.

- Healthcare professionals often recommend and dispense clinical nutrition products through hospital pharmacies or clinics, ensuring trust and reliability in purchase.

- Additionally, patients undergo treatment favor face-to-face consultations and product access from established medical facilities.

- The offline segment benefits further from expert guidance, instant product availability, and patient ease with traditional purchasing channels, reinforcing its dominance in the market.

- On the other hand, online channels are poised to witness significant growth rising consumer preference for convenience, home delivery, and wider product availability. Increased internet penetration, telehealth adoption, and e-commerce platforms offering clinical nutrition products are driving digital sales, exclusively among tech-savvy and home care-dependent populations further expanding their growth.

U.S. Clinical Nutrition Market Share

The leading companies such as Abbott (Abbott Nutrition), Nestle Health Science, and Danone hold ~57% of the market share. These companies are determined for leadership through their extensive product portfolio, robust research and development capabilities, strategic partnership, and global distribution network. Companies are leveraging advanced clinical nutrition products with a focus on innovations in disease-specific formulations, personalized nutrition and home-based care solutions to sustain their leadership in the competitive landscape.

Mid-tier companies such as Baxter, Mead Johnson (Reckitt Benckiser), and Perrigo contribute significantly by offering value-based and niche products, particularly in pediatric and parenteral nutrition. Meanwhile, companies like B. Braun, Grifols, and Hormel Foods are expanding their presence through strategic partnerships and product diversification. Thus, the competitive landscape continues to evolve, shaped by ongoing innovation, stringent regulatory standards, and the dedicated efforts of leading companies to meet the changing needs of patients across all types of care settings.

U.S. Clinical Nutrition Market Companies

Few of the prominent players operating in the U.S. clinical nutrition industry include:

- Abbott (Abbott Nutrition)

- Aculife Healthcare

- B Braun

- BASF

- Baxter

- Danone

- Fresenius Kabi

- Grifols

- Hero Nutritionals

- Hormel Foods

- Mead Johnson (Reckitt Benckiser)

- Meiji Holdings

- Nestle Health Science

- Perrigo

- Abbott

Abbott offers a robust portfolio including pediatric and adult nutrition products such as Ensure and Pedialyte backed by extensive clinical research. The company nutrition business strength lies in pediatric and adult nutrition with strong focus on chronic disease support. Abbott’s innovation in personalized nutrition and global reach strengthen its position in the U.S. clinical nutrition market.

- Nestle Health Science

Nestle Health Science specialized in disease-specific nutrition, including metabolic disorders and cancer support. Its strategic alliances with leading stakeholders such as acquisitions and collaboration along with integration of digital platforms has enhanced its offering in enhanced care. The company’s focus on to sustainability, innovation, and broad product portfolio positions it among the leaders in the evolving U.S. clinical nutrition landscape.

- Danone

Danone’s Nutricia division specializes in enteral nutrition for infants, elderly, and chronic disease patients in U.S. The company focuses on plant-based, allergen-free formulations with strong clinical backing. In addition, Danone’s investment in U.S. medical nutrition and sustainability initiatives reinforces its competitive edge in therapeutic dietary solutions.

- Fresenius Kabi

Fresenius Kabi stands out for its expertise in parenteral nutrition and infusion therapies. It offers inclusive solutions for hospital and home care settings. Its focus on safety, innovation, and global manufacturing capabilities makes it a key player in the U.S. clinical nutrition sector.

U.S. Clinical Nutrition Industry News:

- In June 2024, Nestle Health Science launched www.glp-1nutrition.com, a platform responding to consumer needs for nutritional solutions for weight loss journeys particularly those using GLP-1 therapy. This strategic move strengthens Nestle's position in the market, tapping into growing demand for weight loss and management solutions primarily focused on women's health.

- In May 2024, Baxter received the U.S. Food and Drug Administration (FDA) approval to Clinolipid (lipid injectable emulsion) used in pediatric patients, including preterm and term neonates. Clinolipid is a mixed oil lipid emulsion essential to deliver fatty acids and calories available in the U.S. It is used in parenteral nutrition when oral or enteral nutrition is inadequate or contraindicated. This approval aims to offer an expanded nutritional support to the neonates or pediatric patients with inadequate response to the oral and enteral nutrition improving the clinical outcome.

- In March 2022, Fresenius Kabi received the U.S. FDA approval for its product SMOFlipid lipid injectable emulsion (ILE) with an expanded indication for pediatric patients in the U.S. The SMOFlipid lipid injectable emulsion is a four-oil lipid emulsion used for parenteral nutrition. This approval marked a significant advancement in clinical nutrition for pediatric patients.

The U.S. clinical nutrition market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Infant nutrition

- Milk-based

- Soy-based

- Organic formula

- Other infant nutrition

- Enteral nutrition

- Standard composition

- Disease specific composition

- Elemental formulas

- Other enteral nutrition

- Parenteral nutrition

- Amino acids

- Fats

- Carbohydrates

- Vitamins and minerals

- Other parenteral nutrition

Market, By Consumer

- Pediatric

- Adult

Market, By Application

- Malnutrition

- Cancer nutrition

- Metabolic disorders

- Neurological diseases

- Gastrointestinal disorder

- Other applications

Market, By Dosage Form

- Powder

- Liquid

- Solid

Market, By Distribution Channel

- Offline channels

- Hospital pharmacies

- Retail pharmacies

- Other offline channels

- Online channels

Frequently Asked Question(FAQ) :

What is the projected value of the U.S. clinical nutrition market by 2034?

The market is expected to reach USD 37.4 billion by 2034, growing at a CAGR of 10.1% during the forecast period.

What is the projected market size of the U.S. clinical nutrition in 2025?

The market is expected to reach USD 15.8 billion in 2025.

What are the key trends in the U.S. clinical nutrition market?

Key trends include a growing shift towards personalized and disease-specific nutrition, increasing demand for tailored nutritional therapies for chronic diseases, and the rising adoption of liquid formulations due to their convenience and effectiveness.

What was the valuation of the liquid segment?

The liquid segment held a 48.7% market share in 2024 and is expected to grow at a CAGR of 9.8% during the analysis period, owing to its ease of consumption, rapid absorption, and adaptability across a wide patient demographic.

What was the market share of the pediatric segment?

The pediatric segment accounted for 59.7% of the market share in 2024, supported by an increasing focus on child health and nutrition.

Which segment accounted for the highest market share in 2024?

The metabolic disorders segment held the highest market share in 2024 and is projected to reach USD 12 billion by 2034, driven by the rising prevalence of conditions such as diabetes, obesity, and inherited metabolic disorders.

What is the market size of the U.S. clinical nutrition market in 2024?

The market size was USD 14.7 billion in 2024, driven by factors such as the increasing prevalence of chronic diseases, a growing aging population, and a shift towards home healthcare services.

Who are the key players in the U.S. clinical nutrition market?

Prominent players include Abbott (Abbott Nutrition), Aculife Healthcare, B Braun, BASF, Baxter, Danone, and Fresenius Kabi.

U.S. Clinical Nutrition Market Scope

Related Reports