Summary

Table of Content

U.S. Circular Economy Materials in Construction Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Circular Economy Materials in Construction Market Size

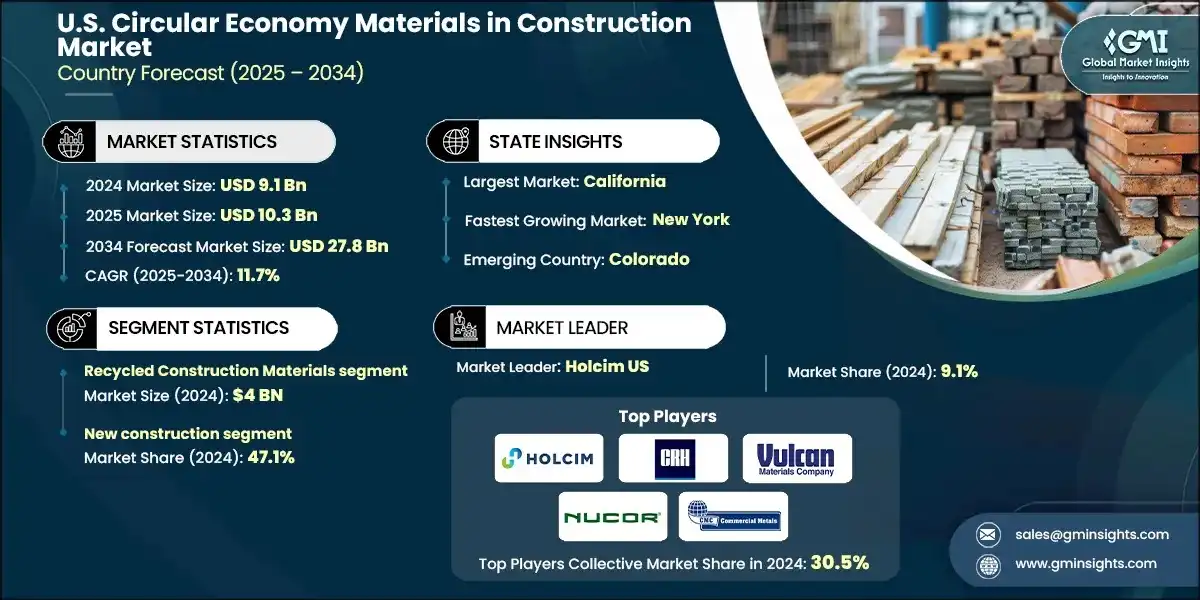

The U.S. circular economy materials in construction market was valued at USD 9.1 billion in 2024. The market is expected to grow from USD 10.3 billion in 2025 to USD 27.8 billion in 2034, at a CAGR of 11.7%, according to the latest report published by Global Market Insights Inc.

To get key market trends

- The U.S. has established itself as a global leader in the circular economy construction materials market, with about 21% of the total global market value in 2024. The U.S. market has experienced over 56% growth from 2020. The Environmental Protection Agency (EPA) has also publicly shared that the U.S. recycling rate for construction and demolition waste increased drastically in 2023, demonstrating momentum.

- U.S. market segments show recycled construction materials as the highest consumed category with a nearly 48% market share. The recycled materials category includes recycled concrete aggregate (RCA), reclaimed steel, reclaimed timber, and the use of recycled plastics whether for structural or non-structural purposes. Then, bio-based materials—e.g., hempcrete, laminated timber, mycelium, and cellulose insulation—subsequently captures approximately 31% of the market, spurred by carbon storage benefits and reliance on regional agricultural supply chains. Finally, waste-to-material technologies. Rounds out the market with about 13%. These three segments are rapidly becoming established practice as unique alternatives to conventional building materials.

- Public-sector infrastructure spending from the Infrastructure Investment and Jobs Act (IIJA), and from Buy Clean initiatives, are creating a necessary demand for circular materials for schools, bridges, and public buildings. Deconstruction mandates in Seattle and San Francisco are creating new secondary markets for salvaged materials, and federal entities, like the General Services Administration (GSA), are integrating material circularity into their project criteria. Cities and campus-scale projects across the U.S. are even beginning to require Environmental Product Declarations (EPDs), and design for disassembly (DfD) considerations in new buildings.

- Future growth will be influenced by regulatory advances and by economic feasibility. As highlighted by the U.S. Department of Energy, the cost of CO2-mineralized concrete has decreased 40% since 2020, allowing it to compete with the price of traditional cement.

U.S. Circular Economy Materials in Construction Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 9.1 Billion |

| Market Size in 2025 | USD 10.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 11.7% |

| Market Size in 2034 | USD 27.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for sustainable infrastructure and housing | Boosts government- and private-led initiatives promoting circular materials |

| Rising emphasis on construction waste diversion (EPA) | Increases circular operations, recovering high volumes of reusable materials from C&D debris |

| Heightened ESG targets by developers and GCs | Drives adoption of materials carrying EPDs and certifications like Cradle-to-Cradle |

| Pitfalls & Challenges | Impact |

| Fragmented building codes and local-level regulations | Causes inconsistencies in adoption and slows momentum across regions |

| High cost of third-party material certifications | Acts as a barrier to entry for smaller suppliers and slows down spec process |

| Opportunities: | Impact |

| Integration of circularity within federal infrastructure projects (e.g., GSA, Army Corps) | Stimulates nationwide demand for compliant circular and low-embodied carbon products |

| Adoption of digital tools (e.g., material passports, BIM-integrated circularity scoring) | Enhances traceability and long-term reuse potential in large-scale construction projects |

| Market Leaders (2024) | |

| Market Leaders |

9.1% market share |

| Top Players |

Collective market share in 2024 is 30.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | California |

| Fastest Growing Market | New York |

| Emerging Country | |

| Future Outlook |

|

What are the growth opportunities in this market?

Circular Economy Materials in Construction Market Trends

- Rise of Certified Low-Carbon Construction Materials: The notable agenda item for 2024 is expanding adoption of certified low-carbon materials with EPDs, Cradle-to-Cradle (C2C) and Declare labels. The use of certified materials is increasingly required in public infrastructure and even private green building projects for eligibility. The U.S. Green Building Council tracked EPD product submissions, which has grown over 30% since 2021, as manufacturers are and will be required to adopt EPDs. This demand is increasingly triggered by expanding "Buy Clean" policies on both the state and federal levels. Manufacturers themselves are now focused on transparency, recyclability and life-cycle assessment, placing certified suppliers in an advantageous position. Expect this to become a more pressing issue in the coming year as carbon caps are introduced into building codes across the nation.

- Growth of Digital Material Passports and Transparency Tools: Digital material passports are rapidly expanding with the aim of improving traceability, reuse and management of materials over their entire life-cycle. Large-scale projects are adopting platforms like Madaster and GIGA Origin to log material components and their potential for reuse. Over 1.2 billion square feet of material is already digitally tracked and recorded globally. In the U.S. this trend is increasingly paired with building information modeling (BIM) enabling an efficient approach to material salvage and smart disassembly strategies. As more regulatory frameworks are enacted demanding more transparency, digital tools will become necessary to enable circular construction models.

- Increasing Preference for Materials Storing Carbon and Bio-Based Materials: Material categories identified as “bio-based” (particularly hempcrete, cross-laminated timber, mycelium panels, and plant-based insulation) are rapidly increasing in popularity. According to USDA’s BioPreferred program, the U.S. bio-based building materials category has been increasing more than 19% annually since 2020. Bio-based materials are appealing due to their potential carbon-sequestration benefits, low embodied energy, and alignment with net-zero construction goals, and are increasingly incentivized by federal incentives, local nonprofit organizations, updates to local building codes, and participation in voluntary carbon markets. As built-environment developers search for options that consume less energy relative to conventional materials that tend to be more energy-intensive in their manufacturing, bio-based products are proving to be viable and safe alternatives that can be deployed at scale for residential, commercial, and public infrastructure projects.

- City-Level Reuse Legislation and Deconstruction Requirements: Several cities have explicitly committed to mandating selective deconstruction practices as a way of recovering usable buildings and building materials instead of relying solely on practice of demolition. For example, cities like Portland, San Antonio, and Seattle now require material audits or a salvage plans to be conducted/tested before a demolition permit is approved. According to estimations made by the EPA, over 22 cities in the U.S. now have adopted a formal deconstruction ordinance as of 2024.

Circular Economy Materials in Construction Market Analysis

Learn more about the key segments shaping this market

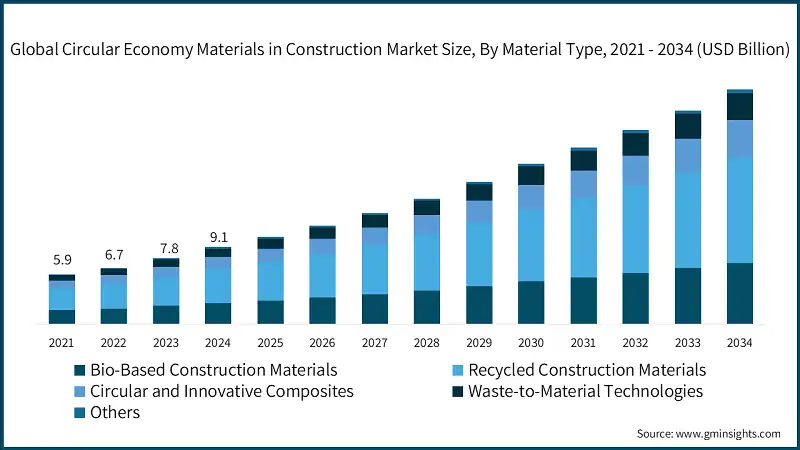

Based on material, the market is segmented into bio-based construction materials, recycled construction materials, circular and innovative composites, waste-to-material technologies, others. The recycled construction materials generated USD 4 billion in 2024.

- Recycled construction materials represent the largest market position, driven by established supply chains, regulatory compatibility, and reliable in-kind performance for use in structural applications. These products are being used in civil infrastructure and commercial real estate, in large part due to mandates (such as California's Buy Clean law) and environmental opportunities (e.g. waste diversion goals generated by the EPA).

- Products such as hempcrete, strawboard panels, and mycelium insulation are starting to generate interest from construction, design, and engineering sections, especially in low-rise and residential applications. However, limited regional supply chains, variability in building codes, and overall take-up of these products has inhibited adoption in most cases. With USDA-backed incentives introducing bio-based products and novice ESG investment in construction, there is an increase in the visibility of these products, creating a potentially fast-growing pathway for market entry.

- Waste-to-material technologies utilizing fly ash, reclaimed gypsum, and CO2 mineralized products are becoming more common in U.S. states with established and mature recycling infrastructure. The Southeast and Midwestern states of the U.S. are starting to utilize these technologies, leading to an increase in industrial-scale applications.

Learn more about the key segments shaping this market

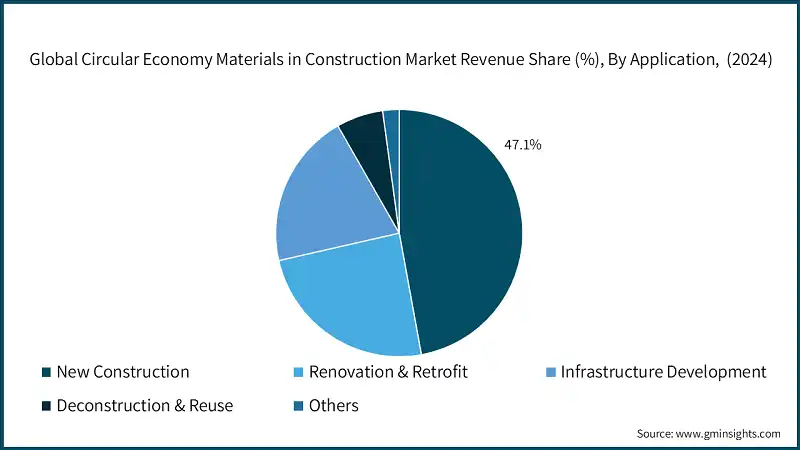

Based on applications, the market is segmented into new construction, renovation & retrofit, infrastructure development, deconstruction & reuse, and others. The new construction dominated about 47.1% of the market share in 2024.

- New construction facilitates circular material adoption because of the greater control on design early in the process, so it is often possible to use recycled or sustainable materials in construction. Specifiers and contractors increasingly support the use of prefabricated, low-carbon alternatives that satisfy LEED and EPD certifications. The commercial and multi-family housing market is expected to experience high growth in the future, ensuring demand for high-performance construction, where lifecycle performance and related performance testing, durability, and compliance with regulations and design oversight are priorities from project conception through delivery.

- Renovation and retrofit are two of the fastest growing areas of the industry as energy-efficient upgrades become increasingly desirable. Green building certifications are also afforded numerous opportunities for renovation and retrofit. Federal incentives recently established under the Inflation Reduction Act, for instance, have provided opportunities for the reuse of bio-based insulation and reclaimed wood within older residential buildings.

- Conditions of structural variability and availability for older products may restrict renovation and retrofit, as existing products may not be able to be used as designed or provide meaningful wiggle room. As a result, the initial process may require customized products or specialized installations to ensure a successful renovation or retrofit.

Based on end use sector, the market is segmented into residential construction, commercial construction, industrial construction, and infrastructure & civil engineering. The residential construction leads the market in 2024.

- Circular materials are becoming commonplace in residential projects, especially in single- and multi-family homes due to energy codes on the state level and sustainable housing programs. Products like reclaimed wood, cellulose insulation, and hempcrete are starting to show up in suburban developments. In addition, price sensitivity around construction costs and consumer preferences moving towards fewer toxins and sustainability is driving builders and developers to incorporate circular, low-waste, bio-based solutions into their upcoming new residential structures.

- Meanwhile, commercial construction continues to lead in circular adoption fueled by more stringent certification requirements for green building and corporate ESG commitments. Office uses, educational buildings, and medical facilities all require cradle-to-cradle materials, LEED-compliant structural systems, and interiors with modular applications that can be reused. In addition, private-sector green mandates and return on sustainability investment can drive the use of recyclable finishes, carbon-neutral concrete, and materials that have been digitally tracked through life-cycle assessments.

- Industrial projects persist in utilizing high-durability recycled steel, low-carbon concrete, and prefabricated systems made from reclaimed aggregates and materials from other industrial processes. Projects with warehouses and manufacturing units prioritize speed of construction and regulatory compliance versus design flexibility and therefore have even less ability to adopt bio-based materials.

Looking for region specific data?

Northeast Circular Economy Materials in Construction Market Northeast region is largest among all with USD 3.1 billion market in 2024. Northeast region More municipalities in the Northeast are integrating circular materials into city redevelopment and public infrastructure projects. Cities like New York and Boston provide market incentives for the use of recycled aggregates, reclaimed wood, and alternative low-carbon cement products. State-level green building codes and performance incentives for contractors are facilitating the procurement and use of circular building inputs. Municipal government partnerships with private sector contractors are establishing framework for reuse of materials and driving clock-loop material reuse for commercial renovations and development projects, especially in transit-oriented development. Midwest region is second largest with USD 2.6 billion market value in 2024. The Midwest is applying circular economy principles to rebuild or upgrade legacy infrastructure, or to repurpose it from ongoing industry. Numerous cities like Chicago, Minneapolis, and Detroit are promoting the exclusive reuse of demolition waste or precast concrete as fly ash in road and housing projects. Many state DOTS, local cities, municipalities, and prominent regional contractors continue to specify and incorporate recycled asphalt and sustainable aggregates to minimize expenses and environmental liability. South region is growing at higher pace and contribute USD 2.4 billion in 2024. In the South, significant population growth and disaster management are driving demand for circular building materials in residential and commercial construction. Florida and Georgia are increasing state investments in hurricane-resistant rebuilds, in the wake of hurricane disasters, utilizing recycled steel, engineered timber products, and reclaimed roofing products. West region is growing at slower pace till 2034 and constitute USD 500 million in 2024. California and Washington, particularly in the Western U.S., are leading the way with policy-driven circular construction as a result of aggressive state-level sustainability mandates. Circular materials, including recycled concrete, carbon-sequestering cement, and modular salvaged steel, are becoming more prevalent in public works and private development. Green building certifications have become the standard for a number of publicly funded development projects, and for-profit enterprises are adding value to these projects. Southwest contributes equally as west and constitutes USD 500 million in 2024. In the Southwest and Mountain States, like Arizona, Utah, and Colorado, circular construction is becoming more and more important as a way to address material scarcity or climate-driven challenges to development. The communities in the Southwest or Mountain areas are experimenting with reclaimed-water systems, recycled insulation material, and earthen products as eco-conscious development. Major players operating in the circular economy materials in construction industry are: Holcim US is the most prominent player for circular construction solutions, with a market share of 9.1%. EcoPact low-carbon concrete, recycled aggregates, and waste repurposing capability plainly shows that it is the leading sustainable materials company in the country. Holcim's engagement with carbon capture, digital traceability, and circular value streams consistently demonstrates growth and innovation in nationwide infrastructure, while maintaining an emphasis on reducing overall impact on the environment, initiating material reuse, and increasing overall lifecycle efficiency, with public and commercial sectors. CRH Americas is a market player consisting of 6.8%, which is a significant part of the advancement for circular construction through recycled asphalt, recycled aggregates, and decarbonized concrete. CRH leverages a widespread network of material processing plants to make circularity a clear action within their supply chains. The group partners with municipalities to repurpose construction waste to advance urban redevelopment and highway upgrades (along with large scale LEED projects) with further scalable, eco-efficient building solutions throughout the primary regions of the U.S. Vulcan Materials is another major player, capturing 5.5% market share. The company is a key participant in recycled aggregate production and continued circular processing for American infrastructure. Vulcan's existing logistics and local quarry operations effectively make sustainable construction, at scale, possible. The company is heavily engaged in regional transportation with public works upgrades and municipalities as it pushes for material reuse and lifecycle extension efforts along the rapid developing construction corridors throughout the South and Midwest. Nucor Corp is no exception in promoting circular construction, holding a share of 6.8% and being a major participant in recycled asphalt, aggregates, and decarbonized concrete in the circular space. The nucor is engaged nationally by operating a substantial network of material processing facilities to enable circularity in their sales supply chain. Working in collaboration with municipalities, nucor aids in repurposing construction waste and provides cities with scalable, eco-efficient building solutions for urban redevelopment initiatives, road upgrades as a result of sustainability initiatives promoted by the LEED program, and projects in other sectors across the major U.S. regions. Commercial Metals Company has 5.5% of the market share and is leading the way in terms of recycled aggregate and circular processing initiatives in the growing American infrastructure-segment. Along with optimizing its logistics fleet and having quarries operate locally, it supports sustainable construction on a larger scale. Whether it is public works, regional transportation, or municipal upgrades, it continues to champion material reuse and life extension initiatives in the fast-paced construction corridors throughout the South and Midwest.Midwest Circular Economy Materials in Construction Market

South Circular Economy Materials in Construction Market

West Circular Economy Materials in Construction Market

Southwest / Mountain States Circular Economy Materials in Construction Market

Circular Economy Materials in Construction Market Share

Circular Economy Materials in Construction Market Companies

Circular Economy Materials in Construction Industry News

The circular economy materials in construction market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of Kilo Tons from 2021–2034 for the following segments:

Market, By Material Type

- Bio-based construction materials

- Hemp-based materials

- Agricultural residue-based materials

- Timber & engineered wood products

- Mycelium-based materials

- Natural fiber insulation

- Recycled construction materials

- Recycled concrete aggregate (RCA)

- Recycled steel and metal components

- Recycled glass and ceramic materials

- Recycled plastic construction products

- Reclaimed timber and wood

- Circular and innovative composites

- Fiber-reinforced polymer composites

- Bio-based polymer composites

- Hybrid circular material systems

- Waste-to-material technologies

- Construction & demolition waste processing

- Industrial symbiosis feedstocks

- Advanced sorting & recovery systems

- Others

Market, By Application

- New construction

- Structural applications

- Building envelope & insulation

- Interior finishing materials

- Renovation & retrofit

- Envelope upgrades

- Interior renovation

- Energy efficiency improvements

- Infrastructure development

- Transportation & road infrastructure

- Utility & public works

- Modular civil infrastructure

- Deconstruction & reuse

- Selective deconstruction

- Component refurbishment & remanufacturing

- Material banking & reuse platforms

- Others

Market, By End Use Industry

- Residential construction

- Commercial construction

- Industrial construction

- Infrastructure & civil engineering

The above information is provided for the following regions and countries:

- Northeast

- New York

- Massachusetts

- Pennsylvania

- New Jersey

- Midwest

- Illinois

- Ohio

- Michigan

- Minnesota

- South

- Texas

- Florida

- Georgia

- North Carolina

- West

- California

- Washington

- Oregon

- Colorado

- Southwest / Mountain States

- Arizona

- Nevada

- Utah

Frequently Asked Question(FAQ) :

What is the market size of the U.S. circular economy materials in construction in 2024?

The market size exceeded USD 9.1 billion in 2024, with a CAGR of 11.7% expected from 2025 to 2034, driven by rising recycling rates for construction and demolition waste, as highlighted by the EPA.

Who are the key players in the U.S. circular economy materials in construction market?

Key players include Holcim US, CRH Americas, Vulcan Materials, Granite Construction, Eco Material Technologies, Charah Solutions, SEFA Group, Nucor Corporation, Commercial Metals Company, Trex Company, Azek Company, Strategic Materials, Urban Mining CT, CarbonCure Technologies, and SmartLam North America.

What are the upcoming trends in the U.S. circular economy materials in construction market?

Key trends include rise of certified low-carbon construction materials with EPDs, growth of digital material passports and transparency tools, increasing preference for carbon-storing bio-based materials, and city-level reuse legislation with deconstruction requirements.

Which region leads the U.S. circular economy materials in construction market?

The Northeast region leads with USD 3.1 billion in 2024, followed by the Midwest with USD 2.6 billion. California is the largest state market, New York is the fastest-growing market, and Colorado is emerging as a key state.

What is the current U.S. circular economy materials in construction market size in 2025?

The market size is projected to reach USD 10.3 billion in 2025.

How much revenue did the recycled construction materials segment generate in 2024?

Recycled construction materials generated USD 4 billion in 2024, representing the largest market position with nearly 48% market share, driven by established supply chains and regulatory compatibility.

What was the market share of the new construction application segment in 2024?

New construction dominated about 47.1% of the market share in 2024, facilitated by greater control on design early in the process and support for prefabricated, low-carbon alternatives.

What is the projected value of the U.S. circular economy materials in construction market by 2034?

The U.S. circular economy materials in construction market is expected to reach USD 27.8 billion by 2034, propelled by federal infrastructure investments, carbon reduction targets, and increased demand from both public and private sectors.

U.S. Circular Economy Materials in Construction Market Scope

Related Reports