Summary

Table of Content

U.S. AI-Driven Retinal Screening Device Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. AI-Driven Retinal Screening Device Market Size

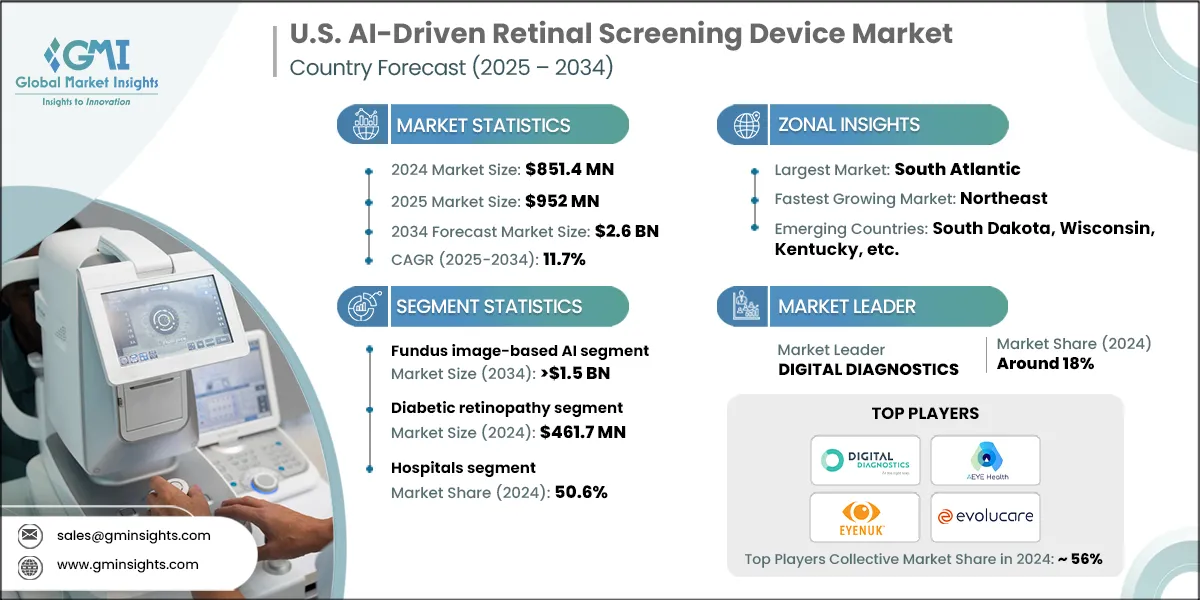

The U.S. AI-driven retinal screening device market was estimated at USD 851.4 million in 2024. The market is expected to grow from USD 952 million in 2025 to USD 2.6 billion in 2034, at a CAGR of 11.7% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The market is driven by increasing prevalence of diabetic retinopathy and age-related eye diseases, advancements in deep learning and image recognition technologies, and a rise in awareness and demand for early diagnosis in ophthalmology coupled with a growing geriatric population, among other factors.

A supportive regulatory environment for AI in healthcare, high diabetic prevalence in the country, and a shortage of ophthalmologists in rural and underserved areas are among the key factors propelling the market growth. AEYE Health, DIGITAL DIAGNOSTICS, EYENUK, and evolucare are among the leading players operating in the U.S. AI-driven retinal screening device market. These players mainly focus on product innovation, technological advancement, implementation of autonomous AI screening for diabetic retinopathy, ease of integration, and scalability, as well as affordability, to improve their industry position.

U.S. AI-Driven Retinal Screening Device Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 851.4 Million |

| Market Size in 2025 | USD 952 Million |

| Forecast Period 2025 - 2034 CAGR | 11.7% |

| Market Size in 2034 | USD 2.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of diabetic retinopathy and age-related eye diseases | This is driving widespread adoption of AI screening tools in primary care, helping detect conditions early and reducing the burden on ophthalmologists. |

| Rise in awareness and demand for early diagnosis in ophthalmology | Patients and providers are prioritizing preventive care, leading to increased deployment of AI tools for routine retinal screening across diverse healthcare settings. |

| Supportive regulatory environment for AI in healthcare | FDA clearances and evolving guidelines are accelerating market entry and boosting confidence among providers to adopt AI-based diagnostic solutions. |

| Advancements in deep learning and image recognition technologies | Improved algorithm accuracy and speed are enhancing diagnostic reliability, making AI tools more viable for real-world clinical use. |

| Pitfalls & Challenges | Impact |

| High initial implementation cost | Upfront investment in devices and integration limits adoption among smaller clinics and resource-constrained healthcare facilities. |

| Data privacy and security concerns | Healthcare providers remain cautious about patient data handling, slowing down AI deployment in sensitive environments. |

| Opportunities: | Impact |

| Development of portable and smartphone-based screening tools | These innovations will expand access to retinal screening in remote and underserved areas, supporting decentralized and mobile care models. |

| AI-powered predictive analytics for disease progression | Future tools will enable proactive treatment planning by forecasting disease trajectories, improving long-term patient outcomes and resource allocation. |

| Market Leaders (2024) | |

| Market Leaders |

Around 18% |

| Top Players |

Collective market share in 2024 is ~ 56% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest growing Market | Northeast |

| Emerging states | South Dakota, Wisconsin, Kentucky, etc. |

| Future outlook |

|

What are the growth opportunities in this market?

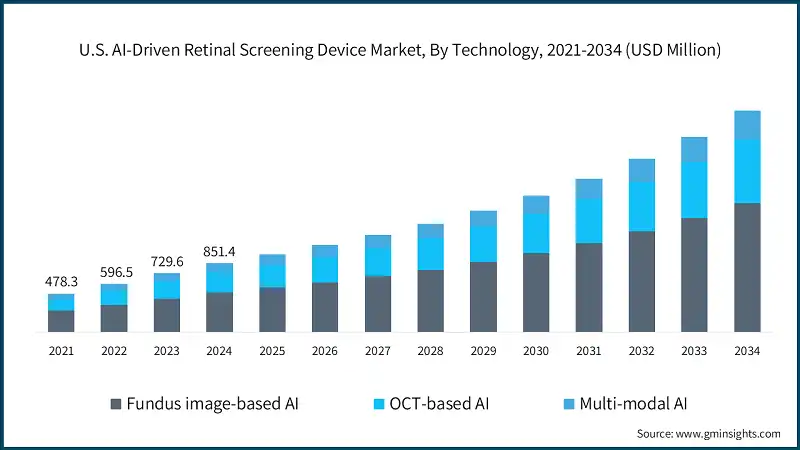

The market grew from USD 478.3 million in 2021 to USD 729.6 million in 2023, driven by rising awareness of the importance of early detection of eye diseases. Health campaigns and educational initiatives led by various organizations have played a crucial role in this trend. For instance, in 2024, Prevent Blindness launched its campaign It Started with an Eye Exam, encouraging individuals to share how regular eye checkups improved their vision and overall well-being.

This increasing emphasis on preventive eye care has accelerated the adoption of AI-enabled screening devices, which provide fast, reliable assessments for a wide range of retinal abnormalities. These systems are increasingly being integrated not only in ophthalmology clinics but also in primary care centers, pharmacies, and mobile clinics, enhancing accessibility to advanced eye diagnostics. As the focus continues to shift toward proactive and technology-driven eye care, the demand for AI-based diagnostic tools is expected to expand significantly across broader healthcare settings.

Additionally, recent advances in deep learning have significantly improved the accuracy and efficiency of image-based diagnostics. AI algorithms can now detect minute retinal changes that may often be missed by human eyes, allowing earlier and more accurate diagnoses. These technologies can continuously learn and improve, which leads to better performance over time. For instance, according to a study published in June 2025 by the Endocrine Society, researchers have developed a novel AI-powered mobile retina tracker that has the ability to screen for diabetic eye disease with an impressive 99% accuracy. As computational power and the availability of data improve, AI-enabled retinal screening devices are becoming even more complex, reliable, and scalable, making them essential tools in ophthalmology practice.

Further, the growing prevalence of diabetic retinopathy, macular degeneration, and glaucoma, particularly among the elderly population, is creating a need for advanced diagnosis tools. AI-enabled retinal screening devices can quickly, non-invasively, and reliably identify and detect such conditions, often before signs or symptoms develop. Timely detection of these diseases is crucial to prevent irreversible loss of vision. As chronic illnesses, such as diabetes, continue to rise in the U.S., healthcare providers are looking for more AI-based solutions to efficiently manage the increasing patient population and improve market growth.

An AI-driven retinal screening device is a medical diagnostic tool that uses artificial intelligence algorithms to analyze retinal images for signs of eye diseases. It enables fast, accurate, and often autonomous detection of conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration, improving access to early eye care.

U.S. AI-Driven Retinal Screening Device Market Trends

Integration with telehealth platforms, development of compact and portable devices, cloud-based AI deployment, and cross-specialty collaboration are among the key trends shaping the market growth.

- The market is witnessing AI-enabled retinal screening tools being integrated into telehealth services and mobile health services to allow for remote diagnosis and treatment. This opens access to eye care to people living in rural or underserved areas, offering continuity of care, especially in patients diagnosed with chronic retinal conditions like diabetic retinopathy.

- Additionally, AI-enabled retinal screening is being linked with the diagnosis of additional systemic diseases such as cardiovascular and neurological conditions. Thus, an interdisciplinary view of retinal imaging increases its value as an entry point to examining overall health.

- Further, cloud infrastructure allows for real-time image analysis and sharing data across the healthcare network. This trend facilitates scalability, lessens hardware dependence, and permits continual updates to algorithms, leading to precision and improving scope of care by increasing the number of providers in the network.

- Moreover, there is growing focus of manufacturers and developers on designing compact, portable AI-enabled retinal scanners that can be installed in primary care clinics, pharmacies, and even mobile units. The decentralization of eye screening allows for easier access and enhanced early detection.

U.S. AI-Driven Retinal Screening Device Market Analysis

Learn more about the key segments shaping this market

Increasing prevalence of diabetes, a growing geriatric population, and technological advancements in AI algorithms and image recognition technologies are among the key variables contributing to industry growth.

Based on technology, the U.S. AI-driven retinal screening device market is segmented into fundus image-based AI, OCT-based AI, and multi-modal AI. The fundus image-based AI segment accounted for a leading share of 59.5% in 2024. Growing focus on early detection of different ophthalmic disorders is anticipated to fuel the industry growth. The segment is expected to exceed USD 1.5 billion by 2034, growing at a CAGR of 12% during the forecast period.

- AI systems that utilize fundus images evaluate 2D images of the retina obtained using fundus cameras. These systems are witnessing a growing popularity as fundus cameras are affordable, portable, and convenient for use in primary care.

- AI algorithms can accurately identify diabetic retinopathy, macular degeneration, and other retinal abnormalities after training on large datasets. AI-based systems are efficient for point-of-care screening because they provide immediate results, without the need for a specialist to interpret the results.

- In addition, the potential for integration with cloud and electronic health record systems supports scalability and access across various clinical settings.

- The OCT-based AI segment was valued at USD 240.5 million in 2024. AI integrated with optical coherence tomography (OCT) makes use of high-resolution cross-sectional imaging, which allows for assessment of deeper retinal layers. OCT-based AI systems show superior sensitivity in identifying complex conditions such as glaucoma and detecting macular edema.

- Additionally, AI models that are trained on OCT scans can also detect subtle structural changes that may not be easily visible to the naked eye on fundus images. While OCT-based AI systems are more costly and generally used in specialist services, they are becoming more popular with clinicians due to the increased precision provided in diagnostics and earlier identification of disease.

- Furthermore, they are supporting ophthalmology clinics in the early identification of disease, ongoing monitoring, and providing tailored treatments.

Based on application, the U.S. AI-driven retinal screening device market is segmented into diabetic retinopathy, age-related macular degeneration, glaucoma, cataract, and other applications. The diabetic retinopathy segment accounted for a leading share and was valued at USD 461.7 million in 2024.

- The introduction of AI-integrated retinal screening is transforming the speed and accuracy of screening for diabetic retinopathy by facilitating early and autonomous diagnosis within primary care settings.

- AI systems evaluate retinal images based on the presence of microaneurysms, hemorrhages, and other indicators of disease and often do not require a specialist review of the images. With a consistently growing prevalence of diabetes in the U.S., AI tools help eliminate bottlenecks in screening, ensure individuals complete their annual eye exam, and prevent vision loss from diabetic complications. Owing to the increasing use of telehealth platforms, AI retinal screening tools play a key role in the management of diabetic eye conditions in the country.

- The age-related macular degeneration (AMD) segment was valued at USD 197.6 million in 2024. AI technologies are being implemented to detect early signs of AMD, specifically through fundus and OCT imaging for drusen and pigmentary changes. These systems can help to facilitate timely intermediary interventions, which is critical in slowing disease progression.

- The glaucoma segment was valued at USD 119.7 million in 2024. AI-based screening for glaucoma focuses on identifying injuries to the optic nerve and changes to intraocular pressures from OCT and fundus images. This technology helps mark participants that are in a stage where early signs of glaucoma, which are usually symptomless, are marked for further intervention.

- In the U.S., AI software systems are being implemented in outpatient and primary care settings in a planned manner to assist with early diagnosis and referral. By identifying structural changes over time, these AI systems are proving to be great resources for monitoring disease, providing timely interventions, and mitigating the irreversible loss of vision.

Learn more about the key segments shaping this market

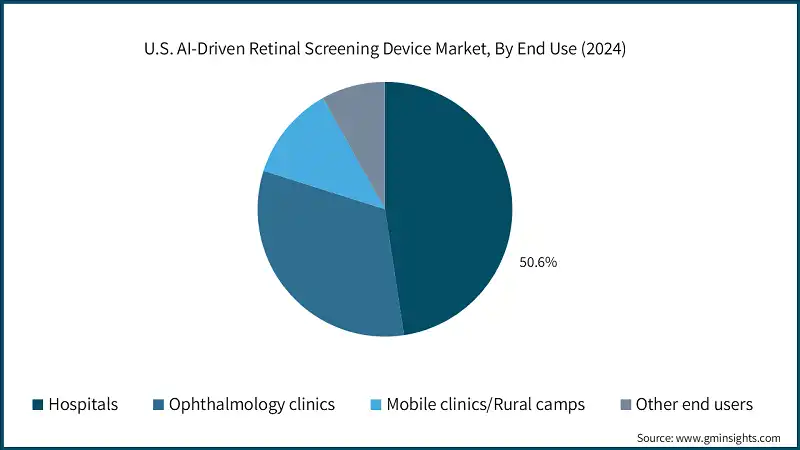

Based on end use, the U.S. AI-driven retinal screening device market is segmented into hospitals, ophthalmology clinics, mobile clinics/rural camps, and other end users. The hospitals segment accounted for the leading market share of 50.6% in 2024 as it records high patient footfall and are capable of investing in advanced resources.

- Hospitals are utilizing AI-driven retinal screening devices for improved diagnostic efficiency and to reduce specialist workload. These screening systems assist in detecting retinal diseases at the time of examination, either with routine check-ups or in diabetes management programs.

- AI tools have also been developed for streamlining workflows in emergency and outpatient departments, allowing non-specialist staff to complete retinal screenings. This allows hospitals to achieve better patient outcomes, use resources more effectively, and decrease the number of referrals for patients with retinal diseases.

- The ophthalmology clinics segment was valued at USD 280.1 million in 2024. AI tools are utilized in ophthalmology clinics to help complement the expertise of specialists, especially in the context of increased screening capacity. The AI system can facilitate triage management, determine early-stage disease, and evaluate disease progression. By improving diagnostic accuracy and analyzing images faster than healthcare professionals, these tools may enhance the clinician's ability to concentrate on more complex cases.

- Moreover, clinics may also employ the AI tool for second-opinion verification in management decisions or patient education about the disease progress, treatment options, or limitations of treatment. Clinics that incorporate AI into routine practice often find better efficiencies in clinical flow, reduced waiting times, and provide patients with a more individualized approach to care.

Looking for region specific data?

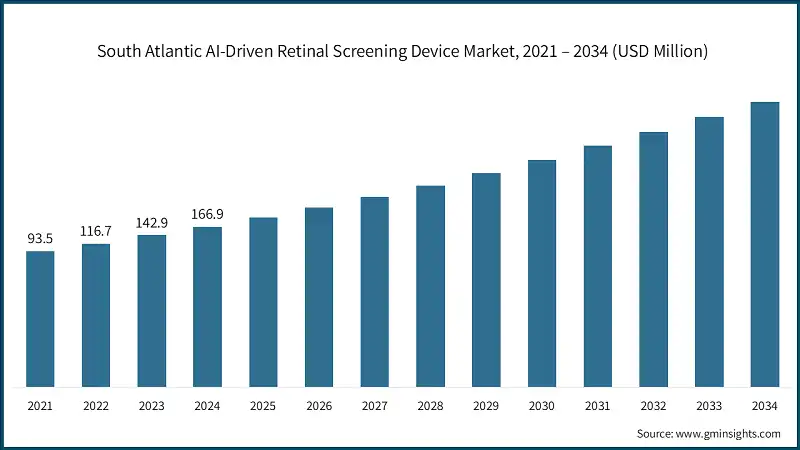

South Atlantic zone held the leading share of 19.6% in the U.S. AI-driven retinal screening device market in 2024.

- The South Atlantic zone, which includes states such as Florida, Georgia, and North Carolina, is witnessing strong adoption of AI retinal screening due to its large elderly population and high diabetes prevalence.

- Healthcare systems are integrating AI tools into primary care and community clinics to improve early detection and reduce the burden on specialists.

- Further, telehealth expansion and mobile screening units are also gaining traction, especially in rural and underserved areas, making AI solutions vital for preventive eye care.

The Northeast AI-driven retinal screening device market is anticipated to grow at the highest CAGR of 12.6% during the analysis timeframe.

- The Northeast region, comprising states such as New York, Massachusetts, and Pennsylvania, benefits from advanced healthcare infrastructure and strong academic-medical collaborations.

- AI retinal screening is being rapidly adopted in hospitals and research-driven clinics. The region’s emphasis on innovation, regulatory compliance, and value-based care supports the integration of autonomous AI tools into routine diagnostics.

- In addition, high urban population and tech-savvy providers further accelerate deployment in both public and private healthcare settings throughout the zone.

East North Central AI-driven retinal screening device market accounted for USD 139.3 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The East North Central zone, which includes states such as Illinois, Ohio, and Michigan, is characterized by a mix of urban and rural healthcare needs. AI retinal screening is being used to bridge gaps in specialist access, particularly in community health centers and outpatient clinics.

- The region’s focus on chronic disease management, especially diabetes, drives demand for scalable, point-of-care AI solutions.

- Moreover, the partnerships with academic institutions and insurers are helping expand coverage and adoption, thereby fuelling the industry growth.

U.S. AI-Driven Retinal Screening Device Market Share

The competitive landscape of the U.S. AI-enabled retinal screening device market is rapidly evolving as players leverage technology, partnerships, and regulatory approvals to consolidate their market position. For example, companies such as AEYE Health and Digital Diagnostics have a considerable industry presence with FDA-approved autonomous AI systems, enabling the application of the technology in primary care without the involvement of a specialist. Their commitment to accessibility and reimbursement capabilities supports their competitiveness in decentralized care.

Similarly, Eyenuk is promoting its EyeArt system significantly, especially specializing in pharmacies and clinics that support real-time screening and have Medicare approval. The company aims to improve their business presence by expanding into new settings and is also advocating for national integration.

Additionally, start-up firms and mid-sized firms are engaged in innovation, focusing on cloud-based platforms, portable devices, and interoperable devices/solutions. Larger healthcare tech organizations are planning to enter the market through acquisitions or partnerships with operating industry players.

Thus, the competitive landscape is anticipated to record growth owing to technological advancements in AI algorithms and enhancements in data privacy standards to support clinical validation impacting adoption rates.

Overall, competitive advantage remains with technological differentiation, level of ease of integration into clinical workflows, and the level of clinical utility/demand for early, accessible, and precise retinal screening devices across all clinical settings.

U.S. AI-Driven Retinal Screening Device Market Companies

A Few of the prominent players operating in the U.S. AI-driven retinal screening device industry include:

- AEYE Health

- DIGITAL DIAGNOSTICS

- evolucare

- EYENUK

- Forus Health

- iCare

- NOTAL VISION

- OPTOMED

- remidio

- Topcon Healthcare

- Visionix

- DIGITAL DIAGNOSTICS

Digital Diagnostics accounted for approximately 18% of the market share in 2024 in the U.S. AI-driven retinal screening device market. Deploys autonomous AI screening in primary care using FDA-cleared LumineticsCore. Emphasizes workflow integration, scalability, and value-based care to improve screening rates and reduce specialist dependency.

The company uses OphtAI platform for semi-automated retinal screening in teleophthalmology. Focuses on workflow efficiency, early detection, and integration into outpatient and hospital networks across the U.S.

AEYE Health targets primary care and pharmacies with FDA-cleared AI tools for autonomous diabetic retinopathy screening. The company focuses on portable devices, instant results, and partnerships to expand access and reimbursement.

U.S. AI-Driven Retinal Screening Device Industry News:

- In July 2025, AEYE Health, an AI-powered retinal diagnostics company, announced that it signed a strategic partnership with Ford Medical, a healthcare distributor supporting non-acute care providers. The collaboration is expected to implement AEYE's fully autonomous diabetic eye exam screening solutions to pharmacies and non-acute centers nationwide, making early detection of diabetic retinopathy easier, faster and more widely accessible for patients.

- In July 2025, Topcon Healthcare announced the acquisition of Intelligent Retinal Imaging Systems (IRIS). The company aims to enhance AI-driven clinical decision-making for diabetic retinopathy within its Healthcare from the Eye initiative. Topcon has plans to integrate IRIS technologies into its systems to improve retinal disease diagnostics.

- In February 2025, Altris AI announced the launch of an advanced glaucoma optic disc analysis module with an aim to aid in the early detection of the disease. The key parameters captured by the module include disc area, cup area, cup volume, among other metrics. This product launch is expected to improve the company's focus towards providing high-quality glaucoma care in the country.

The U.S. AI-driven retinal screening device market research report includes an in-depth coverage of the industry with estimates and forecasts in terms of revenue in (USD Million) from 2021 - 2034 for the following segments:

Market, By Technology

- Fundus image-based AI

- OCT-based AI

- Multi-modal AI

Market, By Application

- Diabetic retinopathy

- Age-related macular degeneration

- Glaucoma

- Cataract

- Other applications

Market, By End Use

- Hospitals

- Ophthalmology clinics

- Mobile clinics/Rural camps

- Other end use

The above information is provided for the following zones and states:

- East North Central

- Illinois

- Indiana

- Michigan

- Ohio

- Wisconsin

- West South Central

- Arkansas

- Louisiana

- Oklahoma

- Texas

- South Atlantic

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- Virginia

- West Virginia

- Washington, D.C.

- Northeast

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East South Central

- Alabama

- Kentucky

- Mississippi

- Tennessee

- West North Central

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

- Pacific Central

- Alaska

- California

- Hawaii

- Oregon

- Washington

- Mountain States

- Arizona

- Colorado

- Utah

- Nevada

- New Mexico

- Idaho

- Montana

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. AI-driven retinal screening device market?

Prominent players include AEYE Health, DIGITAL DIAGNOSTICS, evolucare, EYENUK, Forus Health, iCare, NOTAL VISION, OPTOMED, remidio, and Topcon Healthcare.

What are the key trends in the U.S. AI-driven retinal screening device industry?

Key trends include the integration of AI-enabled retinal screening tools with telehealth services, cloud-based AI deployment, development of portable devices, and cross-specialty collaboration for diagnosing systemic diseases like cardiovascular and neurological conditions.

What was the market share of the fundus image-based AI segment in 2024?

The fundus image-based AI segment held a leading share of 59.5% in 2024, driven by its focus on early detection of ophthalmic disorders. The segment is projected to exceed USD 1.5 billion by 2034, growing at a CAGR of 12% during the forecast period.

Which region led the U.S. AI-driven retinal screening device market in 2024?

The South Atlantic zone held the leading share of 19.6% in 2024, driven by a strong healthcare infrastructure and increasing adoption of AI-driven technologies.

Which end-use segment led the U.S. AI-driven retinal screening device market in 2024?

The hospitals segment accounted for the largest market share of 50.6% in 2024, attributed to high patient footfall and the ability to invest in advanced technologies.

What was the valuation of the diabetic retinopathy application segment in 2024?

The diabetic retinopathy segment was valued at USD 461.7 million in 2024, leading the application segment due to the high prevalence of the condition and the need for early diagnosis.

What is the projected size of the U.S. AI-driven retinal screening device market in 2025?

The market is expected to reach USD 952 million in 2025.

What is the projected value of the U.S. AI-driven retinal screening device industry by 2034?

The market is expected to reach USD 2.6 billion by 2034, fueled by integration with telehealth platforms, cloud-based AI deployment, and cross-specialty collaborations.

What was the market size of the U.S. AI-driven retinal screening device market in 2024?

The market size was USD 851.4 million in 2024, with a CAGR of 11.7% expected through 2034, driven by advancements in AI technology and increasing demand for early detection of retinal and systemic diseases.

U.S. AI-Driven Retinal Screening Device Market Scope

Related Reports