Summary

Table of Content

Synthetic Biology Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Synthetic Biology Market Size

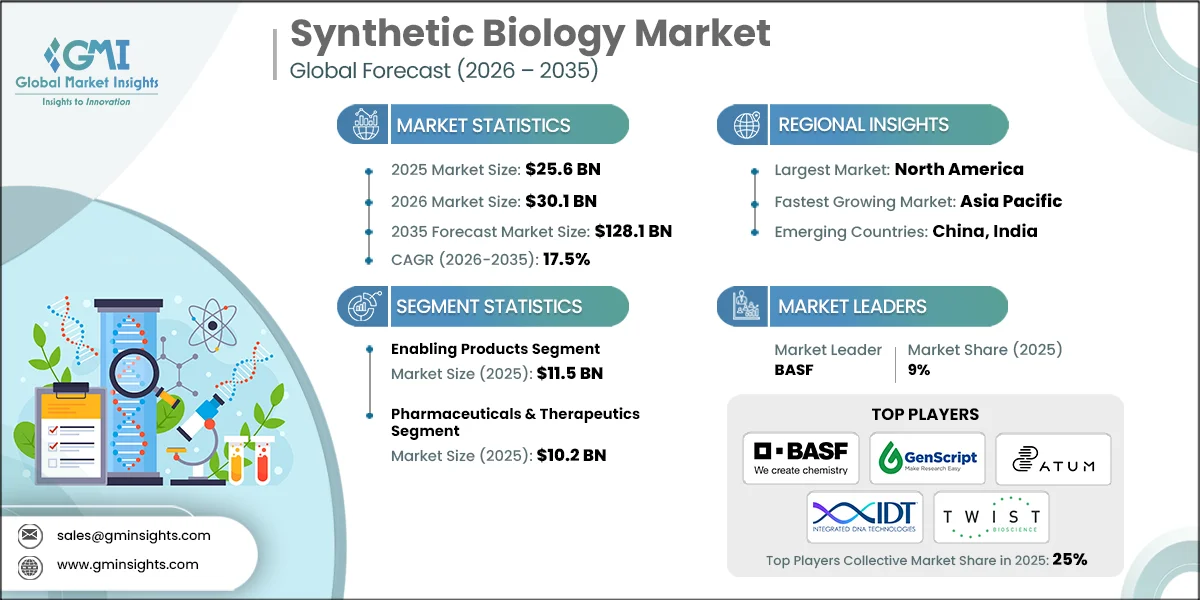

The global synthetic biology market size was valued at USD 25.6 billion in 2025. The market is set to expand from USD 30.1 billion in 2026 to USD 128.1 billion by 2035, advancing at 17.5% CAGR from 2026 to 2035 according to latest report published by Global Market Insights Inc.

To get key market trends

- Synthetic biology is a field that plays a transformative role by coupling engineering principles with biological systems so that novel biological components, devices, and systems can be designed and constructed. These contemporary practices of synthetic biology have undergone an evolutionary transition from more basic genetic engineering manipulations to the development of advanced platforms that allow programmed manipulation of cellular functions with an unprecedented level of accuracy.

- This change has been fueled by exponential advances in DNA synthesis and sequencing technologies, computational biology tools, and an ever-increasing understanding of biological design principles. The marketplace covers enabling products that include oligonucleotides, enzymes, and chassis organisms; core products such as synthetic genes, cells, and DNA libraries; as well as enabled products including pharmaceuticals, industrial chemicals, biofuels, and biomaterials.

Synthetic Biology Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 25.6 Billion |

| Market Size in 2026 | USD 30.1 Billion |

| Forecast Period 2026 - 2035 CAGR | 17.5% |

| Market Size in 2035 | USD 128.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing adoption of CRISPR and genome editing technologies for precise genetic modifications | Accelerates development of targeted therapies and genetically engineered products. |

| Growing integration of artificial intelligence and bioinformatics tools | Enhances research efficiency, reduces time-to-market, and improves product accuracy. |

| Rising demand for sustainable and eco-friendly bioproducts across industries | Drives innovation towards greener solutions, expanding market applications. |

| Pitfalls & Challenges | Impact |

| Rising prevalence of chronic diseases and personalized medicine approaches | May slow regulatory approval processes and increase R&D complexity. |

| Opportunities: | Impact |

| Innovative solutions in healthcare, agriculture, and sustainable biomanufacturing to address global challenges. | Opens new markets for biotech advancements to solve pressing global issues. |

| Market Leaders (2025) | |

| Market Leaders |

9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Synthetic Biology Market Trends

- Changing Interest in CRISPR and Genome Editing Technologies: The application of CRISPR-Cas9 and other next-generation genome-editing technologies has created waves toward the adoption of synthetic biology in all spectra of use-from therapeutic applications to agro-industrial ones. The most transverse event in the field was the FDA clearance in 2023 as the first CRISPR-based therapy for sickle-cell disease. Clinical trials showed marvellous efficacy rates with 83% of patients suffering from B-cell acute lymphoblastic leukaemia who received CRISPR-engineered CAR-T cells achieving remission.

- Bringing AI within the Domain of Bioinformatics Tools: This merging of artificial intelligence with synthetic biology is essentially changing the research and development workflow regarding designing biological systems with computer precision. Machine learning has shown to have the capacity to optimize protein yields, whereby ML-enabled strain development achieved 1.8 times improvements over standard methods. The release of AlphaFold 3 in 2024 extended predictive capability to include protein-DNA, protein-RNA, and protein-ligand interactions in addition to protein structures, thereby opening up a new level of understanding for the development of synthetic biological systems.

- The Rise of Sustainable and Eco-Friendly Bioproducts in Demand: The environment altogether tension for synthetic biology to serve as an alternative to petroleum products and current resource consumption. Analyses show that 60% of tangible inputs into the global economy can potentially be biologically produced, which signifies a huge step transformation in synthetic biology. Chemicals and materials manufactured biomanufacturing are relatively high-on environmental benefits, where life cycle assessments show up to 96% reduction in greenhouse gas emissions for cellular agriculture products compared with conventional beef production.

Synthetic Biology Market Analysis

Learn more about the key segments shaping this market

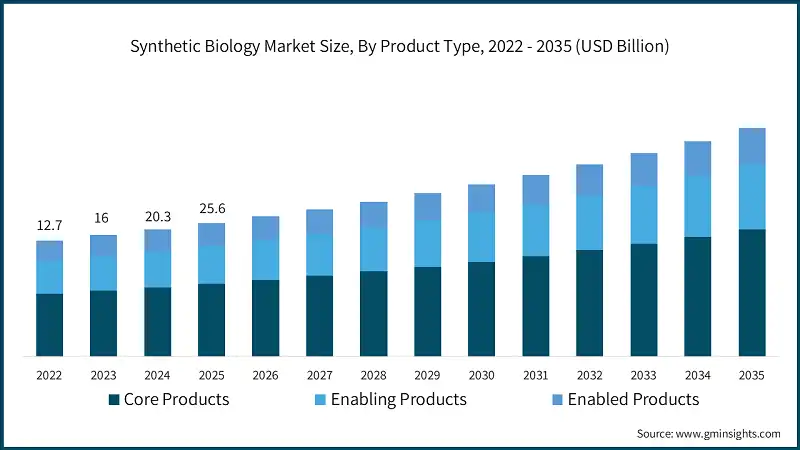

Based on product type, the synthetic biology market is segmented as core products, enabling products and enabled products. Enabling products dominated the market with an approximate market size of USD 11.5 billion in 2025 and is expected to grow with a CAGR of 16.5% till 2035.

- Enabling products are the largest and most extensive category, which includes all the essential tools, technologies, and reagents that need to be incorporated in any synthetic biology research and development initiative. Items contained in this category include oligonucleotides, enzymes (polymerases, ligases, restriction enzymes), cloning kits or kits, chassis organisms (bacterial, yeast, mammalian cell lines), and software platforms involved in synthetic biology design and simulation.

- This segment is the largest contributor to the sector because the products are frequently in demand due to the requirement to have base tools and reagents during both development and production phases of each synthetic biology project.

- The oligonucleotide synthesis market from enabling products is experiencing solid growth, fueled by ever-increasing applications into therapeutics, diagnostics, and research. Integrated DNA Technologies, Twist Bioscience, and GenScript are some of the companies that have increased much of their production capability as a strategy to tackle ever-growing demands. Twist has developed silicon-based DNA synthesis platform, allowing many oligonucleotides to be produced in parallel at a very low cost and at higher above the conventional column base synthesis. The company reported that in 2023, they shipped more than 300 million oligonucleotides, an indicator of demand scale for these enabling products.

- Enzymatic reagents represent another important enabling product, with innovation in polymerase engineering resulting in improved fidelity, processivity, and thermostability for various applications. High-fidelity polymerases are essential for accurate DNA synthesis and amplification, while specialized enzymes enable novel molecular biology techniques. The enzyme market benefits by volume from the expanding applications of synthetic biology and by value from the increasing prices of more sophisticated engineered enzymes that can command premium prices.

Learn more about the key segments shaping this market

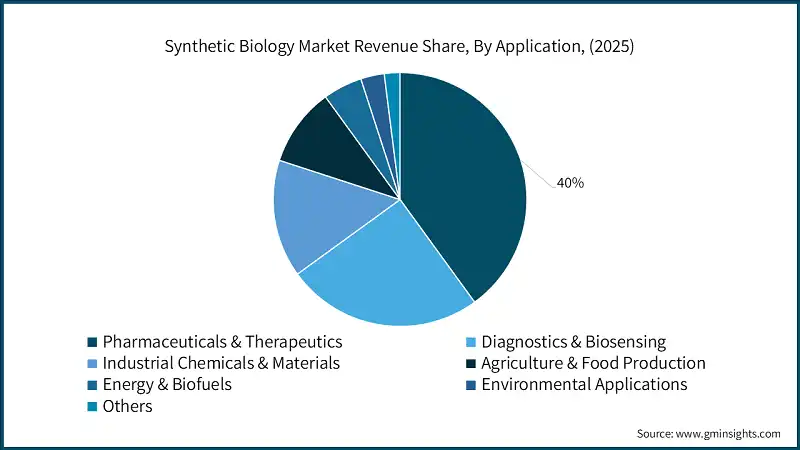

Based on application, the synthetic biology market is segmented as pharmaceuticals & therapeutics, diagnostics & biosensing, industrial chemicals & materials, agriculture & food production, energy & biofuels, environmental applications, and others. Pharmaceuticals & therapeutics held the largest market size of USD 10.2 billion in 2025 and is expected to grow at a CAGR of 14.5% during 2026 to 2035.

- Pharmaceuticals and therapeutics represent the largest and the most commercially advanced application arena for synthetic biology. Within this segment are included therapies, cell therapies, gene therapies, mRNA vaccines and therapeutics, engineered biologics, and biosynthetic small molecule drugs. The segment achieved both clinical and commercial validation with multiple products from synthetic biology receiving approval and generating revenues.

- The mRNA platform enables rapid development of vaccines and therapeutics via the encoding of desired antigens or therapeutic proteins in synthetic mRNA molecules, which are then delivered to patient cells using lipid nanoparticles. The validation of this platform by the COVID-19 vaccines developed by Moderna and BioNTech/Pfizer offers a unique opportunity for synthetic biology to metamorphose. The platform keeps on expanding beyond vaccines against infectious diseases to cancer immunotherapy, rare genetic diseases, and protein replacement therapies. Moderna has over 40 programs in clinical development, and BioNTech, CureVac, and others continue to advance their mRNA pipelines. The mRNA therapeutics market is expected to surpass USD 50 billion by 2030, thus providing true market insight into the disruptive nature of the synthetic biology platform.

- Six CAR-T therapies have obtained FDA approval for hematological malignancies, Kymriah, Yescarta, Tecartus, Breyanzi, Abecma, and Carvykti. These therapies have displayed impressive responses in refractory cancer patients, with some enjoying durable remissions. Clinical trials have reported 83% remission rates in B-cell acute lymphoblastic leukemia patients treated with CRISPR-engineered CAR-T cells. The CAR-T market crossed USD 3 billion in 2023, with the lofty prospects of sustained growth due to improved manufacturing processes and reducing costs as well as further applications for solid tumors.

Looking for region specific data?

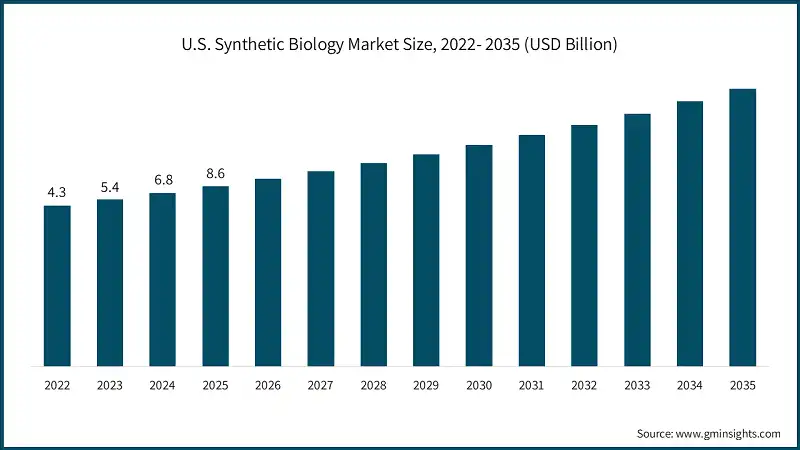

The U.S. synthetic biology market valued at USD 8.6 billion in 2025 and estimated to grow to almost USD 43.1 billion by 2035. North America holds around 41% of the market share in 2025.

- Government support for synthetic biology in the U.S. seems more pronounced at about USD 161 million allocated by different agencies in FY 2020. This amount was earmarked to support the research on biomanufacturing and bioenergy and add to the USD 178 million allocated to it by the Department of Energy in 2022, which aims at creating sustainable substitutes for petroleum-based products. In August 2024, the National Science Foundation announced USD 75 million funding for five biofoundries to set up distributed infrastructures for researching and developing synthetic biology.

Asia Pacific is currently the fastest growing regional market on the back of aggressive government investment strategies complemented by fast growth in biomanufacturing capacity.

- China has committed to establishing synthetic biology as a national priority along with more than USD 4.17 billion of public investment in biomanufacturing alone between now and 2024. More than a billion dollars were allocated for synthetic biology research and commercialization as part of its Five-Year Plans. Between 2018 and 2022, there were 1,039 investment events related to synthetic biology in China, demonstrating a healthy involvement of the private sector besides the strong government backing.

Europe has a significant presence in the synthetic biology market due to superior academic research capabilities, emerging policy support, and established biotechnology and pharmaceutical industries.

- The policy push toward sustainable biomanufacturing by the European Union was evidenced through the setting up of the Circular Bio-Based Europe Joint Undertaking, into which USD 2.2 billion is pledged for 15 biorefineries. Launched in April 2024 with a 2024 initiation date, the SYNBEE initiative seeks to establish entrepreneurial ecosystems toward the commercialization of synthetic biology.

Latin America is perceived as small markets for synthetic biology, but fast growing, supported by increasing research capability in biotechnology for economic development.

- Brazil has the greatest presence of synthetic biology in Latin America. It possesses a strong agricultural biotechnology base as well as an emerging industrial biotechnology sector in this country. As a country, Brazil is large in agriculture, hence the market opportunities for the application of synthetic biology in crop improvement and sustainable agriculture. Argentina and Mexico also have programs for synthetic biology research and the development of biotechnology industries as a whole.

The synthetic biology market of Middle East and Africa is on the up supported by increased research capacity and increased government interest.

- Research institutions established in the UAE and Saudi Arabia are further poised for establishing links for synthetic biology with international partners. South Africa has the most developed biotechnology industry in Africa, with research capabilities in agricultural biotechnology and increasing interest in the application of synthetic biology.

Synthetic Biology Market Share

The synthetic biology industry represents a moderately fragmented competitive landscape where the five largest companies, BASF, GenScript, ATUM, Twist Bioscience, Integrated DNA Technologies own about 25% of the market share in 2025. BASF emerges as the market leader with a roughly 9% share, while the rest of the market is shared among various specialized biotech companies, academic spin-outs, and smaller flashy startups.

Such fragmentation is indicative of the variety of different platforms of technology, application areas, and value chain positions that exist in the synthetic biology ecosystem, where different companies have forged their leadership in selected segments rather than overall markets.

- BASF

- Industrial biotechnology and synthetic biology are utilized by BASF in the blue world of chemical processes and bio-based manufacture involving engineered microbes and fermentation platforms. Digital tools integrated with biotechnologies will accelerate both bioprocess development in protein engineering and enzyme discovery. Biopolymers, flavors, enzymes, and sustainable feedstocks for consumer and industrial products are some application areas. BASF partners with biotechnology firms to further enhance flexibility in raw material and bio-manufacturing capability.

- Industrial biotechnology and synthetic biology are utilized by BASF in the blue world of chemical processes and bio-based manufacture involving engineered microbes and fermentation platforms. Digital tools integrated with biotechnologies will accelerate both bioprocess development in protein engineering and enzyme discovery. Biopolymers, flavors, enzymes, and sustainable feedstocks for consumer and industrial products are some application areas. BASF partners with biotechnology firms to further enhance flexibility in raw material and bio-manufacturing capability.

- GenScript

- GenScript's activities cover Life Science Services, Industrial Synthetic Biology Products, and Cell Therapy Platforms, encompassing gene synthesis and protein engineering along with certain CRISPR tools. Its activities assist synthetic biology workflow by an array of technologies: DNA assembly, molecular engineering, and construction of microbial strains. It has a worldwide presence with facilities in the U.S., China, Singapore, Japan, and Europe sitting on its mission to assist researchers, the pharmaceutical industry, and the industrial biotech sector. GenScript's offerings support the design-up-build-test cycle for applications from therapeutics to industrial enzyme manufacture.

- GenScript's activities cover Life Science Services, Industrial Synthetic Biology Products, and Cell Therapy Platforms, encompassing gene synthesis and protein engineering along with certain CRISPR tools. Its activities assist synthetic biology workflow by an array of technologies: DNA assembly, molecular engineering, and construction of microbial strains. It has a worldwide presence with facilities in the U.S., China, Singapore, Japan, and Europe sitting on its mission to assist researchers, the pharmaceutical industry, and the industrial biotech sector. GenScript's offerings support the design-up-build-test cycle for applications from therapeutics to industrial enzyme manufacture.

- ATUM

- ATUM offers synthetic DNA, gene design, protein engineering, and cell-line development services built on their proprietary platforms GeneGPS and VectorGPS. Synthetic biology at the company is supported by transposon-based gene delivery tools with machine learning design and codon optimization algorithms. It provides service to its clients in biotechnology, pharmaceuticals, chemicals, and academia with a focus on theoretical expression optimization and engineered-protein development. R&D services are customized in California for ATUM with respect to custom constructs.

- ATUM offers synthetic DNA, gene design, protein engineering, and cell-line development services built on their proprietary platforms GeneGPS and VectorGPS. Synthetic biology at the company is supported by transposon-based gene delivery tools with machine learning design and codon optimization algorithms. It provides service to its clients in biotechnology, pharmaceuticals, chemicals, and academia with a focus on theoretical expression optimization and engineered-protein development. R&D services are customized in California for ATUM with respect to custom constructs.

- Integrated DNA Technologies

- By supplying gene fragments, oligos, vectors, and custom constructs, IDT enables very high-throughput design-build-test cycles in synthetic biology. In synthetic biology, its custom solutions program offers a tailor-made service for complex genes and applications requiring non-standard constructs and/or diverse multi-site cloning. IDT has developed a synthetic biology facility flexible to work with sponsors with diverse manufacturing workflows. These capabilities can be used across the industry for research and healthcare with regard to engineered DNA systems.

- By supplying gene fragments, oligos, vectors, and custom constructs, IDT enables very high-throughput design-build-test cycles in synthetic biology. In synthetic biology, its custom solutions program offers a tailor-made service for complex genes and applications requiring non-standard constructs and/or diverse multi-site cloning. IDT has developed a synthetic biology facility flexible to work with sponsors with diverse manufacturing workflows. These capabilities can be used across the industry for research and healthcare with regard to engineered DNA systems.

- Twist Bioscience

- Twist Bioscience manufactures high-throughput synthetic DNA leveraging its semiconductor-based platform that miniaturizes DNA-writing chemistry. It includes genes, oligo pools, variant libraries, and useful tools that support synthetic biology research, screening, and engineering. The company is focusing its synthetic DNA applications on therapeutics, agriculture, industrial chemistry, and NGS workflows. Twist is also actively engaging in partnerships and licensing technologies to expand access to long DNA and engineered-library capabilities.

- Twist Bioscience manufactures high-throughput synthetic DNA leveraging its semiconductor-based platform that miniaturizes DNA-writing chemistry. It includes genes, oligo pools, variant libraries, and useful tools that support synthetic biology research, screening, and engineering. The company is focusing its synthetic DNA applications on therapeutics, agriculture, industrial chemistry, and NGS workflows. Twist is also actively engaging in partnerships and licensing technologies to expand access to long DNA and engineered-library capabilities.

Synthetic Biology Market Companies

Major players operating in the synthetic biology industry are:

- Novozymes

- BASF

- GenScript

- ATUM

- Integrated DNA Technologies

- Twist Bioscience

- Biomax Informatics

- Pareto Biotechnologies

- Blue Heron

- TeselaGenSyntrox

- Thermo Fisher Scientific

- Gevo Inc

- Royal DSM

- Bristol-Myers Squibb

- Amyris

- Genomatica

- Synthetic Genomics

- Codexis

- Butamax Scarab Genomics

- Scarab Genomics

- MorphoSys

- Ginkgo Bioworks

- Evolva

- Igenbio

Synthetic Biology Industry News

- In May 2025, Mirosynth DNA molecules, a breakthrough in facilitating the building of complex synthetic DNA sequences, are released by Ribbon Bio. This further development will speed up the application in the synthetic biology market by supplying researchers with more precise and versatile genetic tools. The new technology promises to open areas within healthcare, agriculture, and biomanufacturing.

- In October 2025, Ansa Biotechnologies, the trusted partner for DNA synthesis, announces the worldwide launch of its 50 kilobase (kb) Clonal DNA product, the longest sequence-perfect synthetic DNA available commercially. The new product on offer allows scientists to design and obtain complete, error-free DNA constructs in 25 days or fewer, thus avoiding compromises that have beset gene synthesis for decades.

The synthetic biology market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Product Type

- Core products

- Synthetic nucleic acids

- Genome editing tools & reagents

- Enzymes & proteins

- Chassis organisms & cell lines

- Genetic parts & vectors

- Others

- Enabling products

- Bioinformatics & computational tools

- Automation & robotics

- Microfluidics & lab-on-chip

- Others

- Enabled products

- Therapeutic products

- Biofuels & renewable energy

- Bio-based chemicals & materials

- Food & nutrition products

- Agricultural products

- Diagnostics & biosensors

- Others

Market, By Technology

- Nucleotide Synthesis & Sequencing Technologies

- Genetic Engineering Technologies

- Bioinformatics & Computational Biology

- Microfluidics & Miniaturization

- Others

Market, By Application

- Pharmaceuticals & therapeutics

- Cell & gene therapies

- Biologics production

- Vaccine development

- Drug discovery & development

- Diagnostics & biosensing

- Medical diagnostics

- Environmental monitoring

- Food safety & quality

- Biodefense & security

- Industrial chemicals & materials

- Specialty chemicals

- Polymers & plastics

- Industrial enzymes

- Biomaterials & textiles

- Agriculture & food production

- Crop improvement

- Agricultural biologicals

- Livestock & aquaculture

- Food ingredients & additives

- Energy & biofuels

- First & second generation biofuels

- Advanced biofuels

- Hydrogen & emerging fuels

- Feedstock conversion

- Environmental applications

- Bioremediation

- Carbon capture & utilization

- Wastewater treatment

- Environmental monitoring networks

- Others

Market, By Chassis Type

- Bacterial chassis

- Yeast chassis

- Mammalian cell chassis

- Plant chassis

- Algal & photosynthetic chassis

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

How much revenue did the enabling products segment generate in 2025?

The enabling products segment generated approximately USD 11.5 billion in 2025 and is expected to grow at a CAGR of 16.5% through 2035.

What was the valuation of the pharmaceuticals & therapeutics segment in 2025?

The pharmaceuticals & therapeutics segment was valued at USD 10.2 billion in 2025 and is set to expand at a CAGR of 14.5% from 2026 to 2035.

What is the growth outlook for the U.S. synthetic biology sector?

The U.S. market, valued at USD 8.6 billion in 2025, is expected to grow to nearly USD 43.1 billion by 2035. The market is led by advancements in technology and increasing adoption across industries.

What are the upcoming trends in the synthetic biology market?

Key trends include advanced genome editing (CRISPR), AI-driven bioinformatics for precision design, and growing demand for sustainable, eco-friendly bioproducts.

Who are the key players in the synthetic biology industry?

Key players include Novozymes, BASF, GenScript, ATUM, Integrated DNA Technologies, Twist Biosciences, Biomax Informatics, Pareto Biotechnologies, Blue Heron, TeselaGenSyntrox, Thermo Fisher Scientific, and Gevo Inc.

What is the expected size of the synthetic biology industry in 2026?

The market size is projected to reach USD 30.1 billion in 2026.

What was the market size of the synthetic biology in 2025?

The market size was valued at USD 25.6 billion in 2025, with a CAGR of 17.5% expected from 2026 to 2035. The growth is driven by advancements in genome editing technologies, AI integration, and the rising demand for sustainable bioproducts.

What is the projected value of the synthetic biology market by 2035?

The market is projected to reach USD 128.1 billion by 2035, fueled by innovations in CRISPR, AI-enabled bioinformatics, and eco-friendly biomanufacturing solutions.

Synthetic Biology Market Scope

Related Reports