Summary

Table of Content

Synthetic and Bio Emulsion Polymers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Synthetic and Bio Emulsion Polymers Market Size

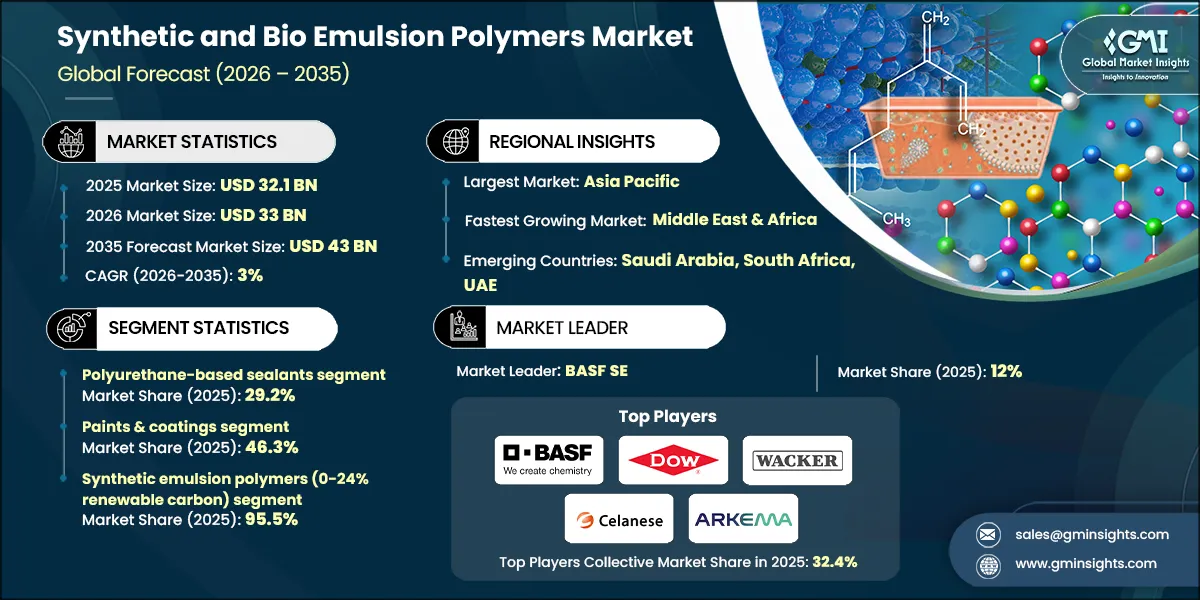

The global synthetic and bio emulsion polymers market was valued at USD 32.1 billion in 2025. The market is expected to grow from USD 33 billion in 2026 to USD 43 billion in 2035, at a CAGR of 3% according to latest report published by Global Market Insights Inc.

To get key market trends

- Synthetic and Bio Emulsion Polymers transitioned over years from being a specific product category into an essential enabler of modern-day maritime operations. Their role has expanded beyond simple sealing functionality into support structures support for advanced vessel integrity, corrosion resistance, and life cycle performance. Sustainability is coming to redefine industrial priorities. Synthetic and Bio Emulsion Polymers are set in this new paradigm as one of the key components toward diminishing the environmental footprint in shipbuilding, maintaining, and retrofitting activities. This change indicates the shift of an entire industry toward materials that combine durability with eco-friendly formulations.

- The market is buoyed increasingly by technological advancements and frameworks of sustainability. Hybrid polymer formulations, low volatile organic content systems, and similar formulations attract attention as they become the norm for shipbuilding and operation in compliance with strict environmental regulation. Not only do they provide better performance in extreme marine conditions, but they also boast compliance with world decarbonization goals.

- The regional strengths and the priorities of any of the marine regions define the growth patterns of the market. Asia Pacific is a significant driving force in shipbuilding activities, coupled with the ever-growing commercial fleets that consequently create a highly demanding end-use market for high-performance sealing solutions. The stringent regulations and sustainability requirements in Europe favor the adoption of environment-friendly products, while North America boosts market momentum through its recreational boating segment and technological innovations.

Synthetic and Bio Emulsion Polymers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 32.1 Billion |

| Market Size in 2026 | USD 33 Billion |

| Forecast Period 2026 - 2035 CAGR | 3% |

| Market Size in 2035 | USD 43 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for eco-friendly and sustainable products | The demand for innovation towards sustainability |

| Rising applications in paints, coatings, and adhesives industries | These segments continue to post volume growth even as synthetic polymers lead industrial coatings and adhesives |

| Advancements in polymerization technologies | Enhance operational and economic efficiencies for synthetic polymers and enable scale for bio-based alternatives |

| Pitfalls & Challenges | Impact |

| Fluctuating raw material prices | Loss in margins for synthetic polymers; constraints in feedstock supply affected by bio-based polymers |

| Stringent environmental regulations | Compliance costs for synthetic polymers, while laid a very favorable push by regulations towards bio-based |

| Opportunities: | Impact |

| Expansion in emerging markets | Synthetic polymers benefit from the infrastructural growth while bio-based polymers can take advantage of increasing awareness about sustainability |

| Development of bio-based emulsion polymers | New high end, long timed segments that challenge incumbent synthetics offer great promise and assure in different ways |

| Market Leaders (2025) | |

| Market Leaders |

12% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Middle East & Africa |

| Emerging countries | Saudi Arabia, South Africa, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Synthetic and Bio Emulsion Polymers Market Trends

- Synthetic and Bio Emulsion Polymers have transcended their traditional applications in basic coatings and adhesives to became the pillar of advanced material solutions. Durability, chemical resistance, and environmental compliance offered by these polymers are critical to a myriad of applications. This evolution also highlights that the focus is increasingly on materials that are high performance and more sustainable.

- Emergence of new technologies has led to the evolution of hybrid polymer systems, new curing mechanisms, and solvent-free formulation-based systems-Flexibility, adhesion under challenging conditions, and environmental concern throughout the life cycle are the given benefits. Manufacturers have started to adopt integrated manufacturing systems to bring in resource efficiency and propose circular economy principles.

- Smart features are being built into polymer systems in the market. Self-healing and technology-based sensors for predictive maintenance and longer service life are gaining traction. These technologies are creating new value propositions for the industries, which prioritize reliability and operational efficiency in severe environments.

- Synthetic and bio-emulsion polymers are no more considered a strategic enabler in the development of a great intensity. Nowadays, they play a role not only in structural strength, fire safety, and emissions compliance, but are also ensuring compatibility with renewable energy infrastructure like offshore wind foundations. This also enhances their importance in supporting modern industrial and construction ecosystems.

Synthetic and Bio Emulsion Polymers Market Analysis

Learn more about the key segments shaping this market

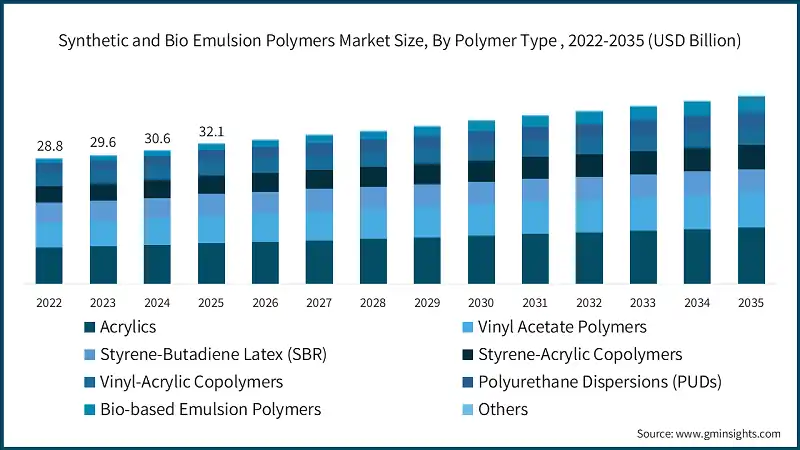

Based on polymer type, the market is segmented into acrylics, vinyl acetate polymers, styrene-butadiene latex (SBR), styrene-acrylic copolymers, vinyl-acrylic copolymers, polyurethane dispersions (PUDs), bio-based emulsion polymers, Others. Polyurethane-based sealants dominated the market with an approximate market share of 29.2% in 2025 and is expected to grow with a CAGR of 3.2% by 2035.

- Acrylics dominates due to their propensities toward good adhesion with enhanced weathering and colorfastness. This makes these essential binders for the majority of paint formulations and adhesives to be subjected to marine and industrial processing. Vinyl acetate polymers surface as cost-effective and extremely flexible when moderately durable and easy formulation goals are sought. Styrene-butadiene (SBR) latex displays remarkable toughness, water resistance, has typical use in cases where high mechanical strength is required.

- Styrene-acrylic copolymers and vinyl-acrylic copolymers perform adequately in various physical parameters, offering quite good resistance to various chemicals and, at the same time, show good film properties-the latter is rather impeded in chemical resistance. Same time polyurethane dispersions (PUDs) represent superb wear and elasticity for use in high-performance coatings and adhesives.

Learn more about the key segments shaping this market

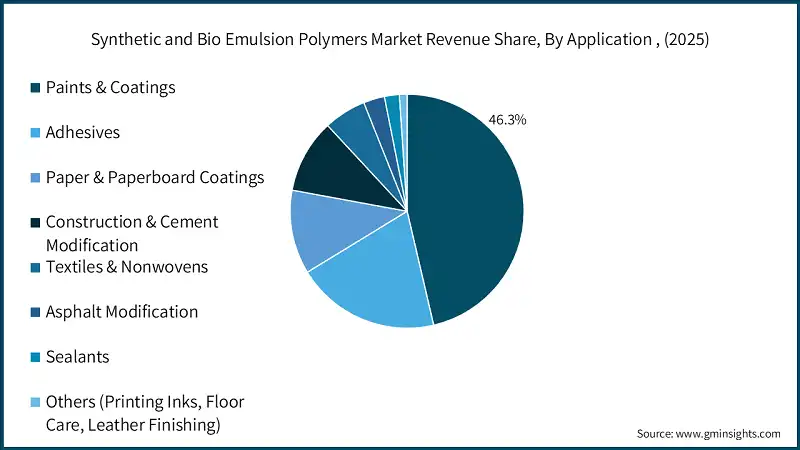

Based on application, the synthetic and bio emulsion polymers market is segmented into paints & coatings, adhesives, paper & paperboard coatings, construction & cement modification, textiles & nonwovens, asphalt modification, sealants, others (printing inks, floor care, leather finishing). Paints & coatings held the largest market share of 46.3% in 2025 and is expected to grow at a CAGR of 3.2% during 2026-2035.

- In paints and coatings, which remain the largest application segment, polymers confer essential film-forming ability, durability, and environmental stress-resistance, especially important for protective and decorative finishes. Strong bonding properties of acrylics and polyurethane dispersions are used for structural and flexible joining in adhesives, especially in demanding industrial environments.

- In construction and cement modification, these polymers enhance workability, crack resistance, and adhesion to contain high-performance concrete and mortar systems. Emulsion polymers are used in textiles and nonwovens for fabric finishing to impart very high noticeable softness properties, strength, and water repellency. In road surface applications, styrene-butadiene latex helps to modify asphalt for enhanced elasticity and weather resistance.

Based on renewable content, the synthetic and bio emulsion polymers market is segmented into synthetic emulsion polymers (0-24% renewable carbon), bio-based emulsion polymers (≥25% renewable carbon). Synthetic emulsion polymers (0-24% renewable carbon) segment dominated the market with an approximate market share of 95.5% in 2025 and is expected to grow with the CAGR of 2.4% by 2035.

- Synthetic emulsion polymers are traditional high-performance formulations in coatings, adhesives, and construction, given their properties of good durability, chemical resistance, and versatility (0-24% renewable carbon). These are polymers made for extreme environments that require mechanical strength, weatherability, and long-term stability; hence, the industries that use them rely on them more than they do on renewable sources for their material needs.

- Bio-based emulsion polymers (≥25% renewable carbon) are gradually gaining importance as sustainability is beginning to govern material selection. These formulations combine eco-friendliness and competitive performance with a reduction in the use of petrochemical feedstock and compliance with stringent environmental regulations.

Looking for region specific data?

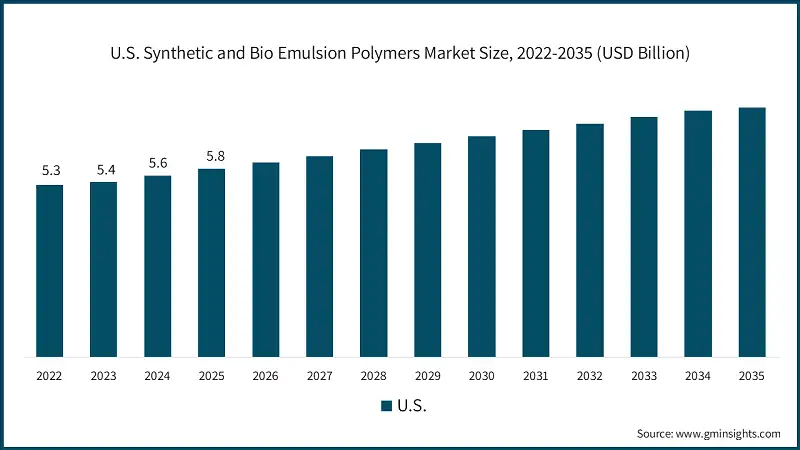

The North America synthetic and bio emulsion polymers market is growing rapidly on the global level with a market share of 21.9% in 2025.

- North America is developing into a center for Synthetic and Bio Emulsion Polymers. This is because of advanced manufacturing competences, favorable regulations, and a rapidly increasing tendency toward sustainability. The industrial ecosystem of this region encourages high-performance formulation for coatings, adhesives, and building applications, which are in accordance with stringent standards both regarding the environment and innovation-based growth.

U.S. dominates the North America market with USD 5.8 billion in 2025, showcasing strong growth potential.

- This region is led by the U.S. market focusing strongly on technology advancement as well as policy-initiated sustainability. Programs favoring the use of low-VOC system applications, renewable-content polymers, and energy-efficient solutions have greatly accelerated the pace toward greener alternatives.

Europe Synthetic and Bio Emulsion Polymers Market with revenue of USD 8.1 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Fueled by strict sustainability mandates and a developed industrial base, Europe finds itself as a prime region for the market. Eco-friendly formulations and low-emission technologies are in vogue, leading to sweeping acceptance of bio-based polymers and hybrid systems in coatings, adhesives, and construction applications.

Germany dominates the European market, showcasing strong growth potential.

- Germany leads the regional market by virtue of its high-performance manufacturing capabilities and commitment to ecologically viable solutions.

The Asia Pacific Synthetic and Bio Emulsion Polymers Market leads the market and anticipated to grow at a CAGR of 3.5% during the analysis timeframe.

- Asia Pacific is the region that is now emerging as the fastest-growing market for Synthetic and Bio Emulsion Polymers, backed by a very strong industrial base, rapid urbanization, and several infrastructure projects unfolding in the region. Its strong ship-building ecosystem, among other things, coupled with rising construction, automotive, and packaging investments-in turn-created demand for high-performance formulations of polymers.

China market is estimated to grow with a significant CAGR in the Asia Pacific region.

- China eventually emerged as the single principal regional market with high-volume manufacturing capacities and a battery of technologies backed by advanced materials. Furthermore, the country aligns both its renewable-content polymers and hybrid formulations to sustainability goals worldwide and places it as a strong innovation in coatings, adhesives, and construction solutions.

Latin America Synthetic and Bio Emulsion Polymers accounted for 5.0% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Latin America is emerging as a highly promising growth region for market, where modernization in infrastructure and burgeoning construction activities, and increased investments in energy projects, are the key drivers.

Brazil leads the Latin American synthetic and bio emulsion polymers market, exhibiting remarkable growth during the analysis period.

- Brazil is already the leader in terms of regional markets, with its vigorous industrial foundation and developing maritime infrastructural base that position it as a core driver for innovation.

Middle East & Africa synthetic and bio emulsion polymers accounted for 4.5% market share in 2025 and is anticipated to show fastest growth over the forecast period.

- The market in the Middle East & Africa region is well-positioned for the anticipated exponential growth that will be augmented by developments in maritime infrastructure and modernization of ports along with various investments in offshore energy projects.

Saudi Arabia synthetic and bio emulsion polymers industry to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia incites market potential for this region and is in a healthy position to integrate green and advanced polymer technologies in the infrastructural, automotive, and marine sectors through its industrial transformation agenda.

Synthetic and Bio Emulsion Polymers Market Share

The top 5 companies in Synthetic and Bio Emulsion Polymers industry include BASF SE, The Dow Chemical Company, Wacker Chemie AG, Celanese Corporation, Arkema S.A. These are prominent companies operating in their respective regions covering approximately 32.4% of the market share in 2025. These companies hold strong positions due to their extensive experience in market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- BASF SE is a global chemical company with a wide range of products that include various chemicals, plastics, and performance materials for different industries. Their business model is based on innovation and sustainability, serving industries-from automotive, construction, and agriculture to consumer goods-with integrated manufacture and advanced material technologies.

- The Dow Chemical Company through their materials science provide the best solutions in specialty chemicals, advanced polymers, and coatings. It serves various markets like packaging, infrastructure, and transportation, using its expertise in chemical engineering to provide products that would help performance and regulatory compliance for industrial applications.

- Wacker Chemie AG is an international chemical producer specializing in silicones, polymers, and specialty chemicals. It develops products for high performance applications and sustainable material solutions across various industries like construction, electronics, and healthcare through advanced chemical processes and global production networks.

- Celanese Corporation is a technology-oriented chemical company manufacturing engineered materials and specialty polymers.The applications of its product portfolio serve automotive, industrial, and consumer markets, emphasizing innovation in polymer chemistry-and process optimization-to match evolving performance and sustainability requirements.

- Arkema S.A. engages in the global provision of specialty chemicals, contributing advanced materials, adhesives, and coatings marketed to industrial and consumer applications worldwide.

Synthetic and Bio Emulsion Polymers Market Companies

Major players operating in the synthetic and bio emulsion polymers industry include:

- BASF SE

- The Dow Chemical Company

- Wacker Chemie AG

- Celanese Corporation

- Arkema S.A.

- Trinseo PLC

- Covestro AG

- Synthomer PLC

- Dairen Chemical Corporation

- Asahi Kasei Corporation

- Mallard Creek Polymers

- Encres Dubuit

- Organik Kimya

- Shenzhen Jitian Chemical

- Indulor Chemie GmbH

Synthetic and Bio Emulsion Polymers Industry News

- In October 2024, IPS Adhesives (IPSA), a manufacturer of structural and surfacing products, acquired a wide range of adhesives based on acrylate and methyl methacrylate (MMA) technology from L & L Products. According to IPS Adhesives, the acquisition complements its specialist MMA-based products and provides a platform that enhances its ability to deliver innovative solutions that offer lightweighting and the bonding of dissimilar materials.

- In October 2022, Holcim completed the acquisition of the Polymers Sealants North America (PSNA) division of Illinois Tool Works. PSNA is a leader in coating, adhesive and sealant solutions with 2022 estimated net sales of USD 100 Billion.

These synthetic and bio emulsion polymers market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Polymer Type

- Acrylics

- Vinyl acetate polymers

- Styrene-butadiene latex (SBR)

- Styrene-acrylic copolymers

- Vinyl-acrylic copolymers

- Polyurethane dispersions (puds)

- Bio-based emulsion polymers

- Bio-based acrylics (renewable monomers)

- Bio-based styrene-butadiene

- Natural latex (rubber tree derived)

- Others

Market, By Application

- Paints & coatings

- Architectural coatings (interior & exterior)

- Industrial coatings

- Protective coatings

- Adhesives

- Pressure-sensitive adhesives (psa)

- Laminating adhesives

- Assembly adhesives

- Others

- Paper & paperboard coatings

- Paper coating (gloss, matte, silk)

- Paperboard coating (folding carton, corrugated)

- Others

- Construction & cement modification

- Cement additives & modifiers

- Waterproofing membranes

- Tile adhesives & grouts

- Exterior insulation finishing systems (eifs)

- Others

- Textiles & nonwovens

- Textile finishing & coating

- Carpet backing

- Others

- Asphalt modification

- Road construction & maintenance applications

- Roofing applications

- Others

- Sealants

- Others (printing inks, floor care, leather finishing)

Market, By Renewable Content

- Synthetic emulsion polymers (0-24% renewable carbon)

- Bio-based emulsion polymers (≥25% renewable carbon)

- Low bio-content (25-49% renewable carbon)

- Medium bio-content (50-74% renewable carbon)

- High bio-content (≥75% renewable carbon)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the key trends in the synthetic and bio emulsion polymers industry?

Key trends include increasing adoption of bio-based and hybrid polymer systems, development of low-VOC formulations, and growing use of emulsion polymers in sustainable construction, coatings, and adhesive applications.

Who are the key players in the synthetic and bio emulsion polymers market?

Major players in the synthetic and bio emulsion polymers industry include BASF SE, The Dow Chemical Company, Wacker Chemie AG, Celanese Corporation, Arkema S.A., Trinseo PLC, Covestro AG, and Synthomer PLC.

Which region leads the synthetic and bio emulsion polymers industry?

The U.S. market generated USD 5.8 billion in 2025, making it the leading country within North America. Growth is driven by advanced manufacturing capabilities, strict environmental regulations, and strong adoption of low-VOC and sustainable polymer solutions.

What was the valuation trend of the synthetic emulsion polymers segment by renewable content in 2025?

Synthetic emulsion polymers (0–24% renewable carbon) held around 95.5% market share in 2025, reflecting continued reliance on conventional formulations for durability, chemical resistance, and cost efficiency.

What was the market share of the polyurethane dispersions (PUDs) segment in 2025?

Polyurethane dispersions dominated with approximately 29.2% market share in 2025, supported by their superior elasticity, abrasion resistance, and suitability for high-performance coatings and adhesives.

How much revenue did the paints & coatings application segment generate in 2025?

Paints & coatings accounted for 46.3% market share in 2025, making it the largest application segment due to strong demand for durable, high-performance, and environmentally compliant coating solutions.

What is the projected value of the synthetic and bio emulsion polymers market by 2035?

The synthetic and bio emulsion polymers industry is expected to reach USD 43 billion by 2035, growing at a 3% CAGR, driven by advancements in polymerization technologies and increasing adoption of low-VOC and bio-based materials.

What is the market size of the synthetic and bio emulsion polymers market in 2025?

The market size exceeded USD 32.1 billion in 2025 and is expected to grow at a CAGR of 3% from 2026 to 2035, driven by rising demand for eco-friendly and sustainable polymer formulations across coatings, adhesives, and construction applications.

What is the current synthetic and bio emulsion polymers market size in 2026?

The synthetic and bio emulsion polymers industry is projected to reach USD 33 billion in 2026, supported by steady expansion in paints & coatings, adhesives, and infrastructure-related end uses.

Synthetic and Bio Emulsion Polymers Market Scope

Related Reports