Summary

Table of Content

Steam Trap Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Steam Trap Market Size

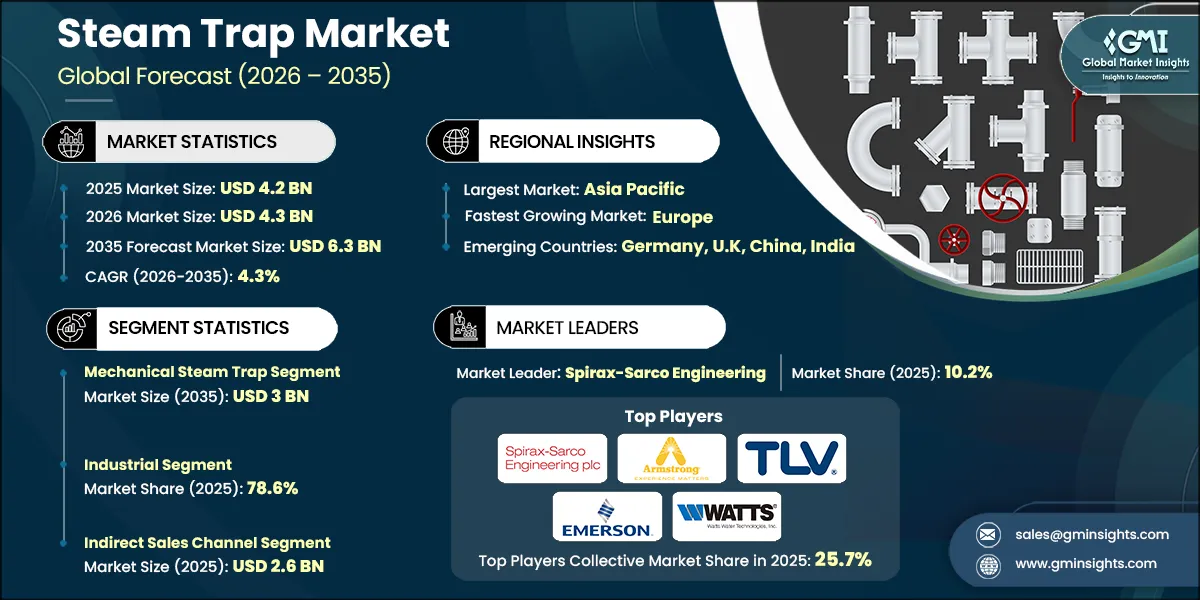

The steam trap market was valued at USD 4.2 billion in 2025. The market is expected to grow from USD 4.3 billion in 2026 to USD 6.3 billion in 2035, at a CAGR of 4.3%, according to latest report published by Global Market Insights Inc.

To get key market trends

The steam trap market size is expected to witness significant growth owing to increasing implementation of energy efficient and automation of steam footprint of industries. Steam traps such as the ones designed for automated systems will enable companies to optimize their steam processes by being able to effectively remove the condensate from the steam while ensuring that the steam remains in the steam distribution system.

This enables companies to drastically reduce the amount of energy wasted from steam condensing out of the steam distribution system. Leading companies like Spirax Sarco and Armstrong International have developed "smart" versions of their steam traps that have real time monitoring and predictive maintenance capabilities, allowing companies to run their steam operations in a more efficient manner while minimizing unplanned downtime of their steam systems.

Steam Trap Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.2 Billion |

| Market Size in 2026 | USD 4.3 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.3% |

| Market Size in 2035 | USD 6.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increased industrial automation and process efficiency demands | Growing automation across manufacturing encourages adoption of advanced steam traps that reduce steam loss, improve process control, and support predictive maintenance. This push toward efficiency accelerates demand for modern trap technologies integrated with IoT and smart monitoring systems |

| Rising adoption of energy-efficient solutions in manufacturing | Surging focus on energy conservation drives industries to replace older traps with high-efficiency models that minimize waste and operational costs. This shift strengthens market growth as companies prioritize sustainability and compliance with global energy-efficiency standards. |

| Government regulations on energy conservation and emissions reduction | Tightening regulatory pressures push industries to upgrade steam systems to prevent energy losses and meet emissions-reduction goals. These policies act as a strong catalyst for adopting advanced steam traps designed to cut steam waste and improve overall system efficiency. |

| Pitfalls & Challenges | Impact |

| High initial installation and maintenance costs | The significant upfront cost of advanced or smart steam traps limits adoption, especially in cost-sensitive sectors. Ongoing maintenance expenses further challenge small and mid-sized operators, slowing modernization across older facilities. |

| Limited awareness and expertise in steam trap maintenance | Lack of skilled personnel and poor maintenance practices reduce trap efficiency and lead to energy losses, discouraging wider adoption of advanced systems. This capability gap hampers market growth as industries struggle to maintain optimal steam-system performance |

| Opportunities: | Impact |

| Expansion of smart & IoT‑enabled steam trap solutions | The rise of IoT and automation enables real‑time monitoring, predictive diagnostics, and reduced downtime, making smart traps highly attractive for modern factories. This creates strong market expansion potential as industries shift toward digitally optimized steam networks. |

| Rising demand driven by industrial growth & energy‑efficiency regulations | Rapid industrial growth—especially in oil & gas, chemicals, and manufacturing—combined with strict energy‑efficiency mandates, boosts demand for reliable steam traps. These regulatory tailwinds create sustained opportunities for high‑performance, energy‑saving steam management technologies. |

| Market Leaders (2025) | |

| Market Leaders |

10.2% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Europe |

| Emerging countries | Germany, U.K, China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Energy conservation by governments and legislative policies will continue to drive the growth of the steam trap market. The U.S. Department of Energy states that improving a steam system's efficiency could result in a decrease of between 10 to 15% in energy consumption. Therefore, advanced steam traps will be key to enabling companies to maintain their energy costs while working towards established global sustainability goals through a reduction of carbon emissions in light of increased environmental regulations.

Chemical, food processing, and pharmaceutical industries will lead the way in adopting advanced technology associated with steam traps. In food processing, advanced steam traps can ensure that food products receive uniform heat for the best quality. Likewise, in the pharmaceutical industry, advanced steam traps can help to ensure that products remain within the temperature specifications required for strict regulatory compliance and product safety.

The shift toward smart manufacturing is encouraging the continued development of intelligent steam traps that can optimize energy efficiency, improve safe operation and help ensure that sustainability factors are considered and are thus the backbone of every modern-day industrial facility. By employing "smart steam traps", companies will optimize and increase their capacity for operating efficiently while at the same time be positioned as forerunners in manufacturing with energy efficient and sustainable practices.

Steam Trap Market Trends

Changing innovation and technology transformation are important for the growth of the steam trap industry.

- The demand for steam traps is increasing due to improvements in technology, including the use of smart IoT-enabled devices, as well as the emphasis on designing more energy-efficient steam traps. The introduction of smart steam traps that are equipped with sensors and connected to the internet allow users to monitor their steam traps in real-time, which gives them the ability to perform predictive maintenance to minimize downtime. For example, Spirax Sarco's launch of the STAPS wireless steam trap monitoring system, the ability to better utilize steam and improve efficiency in their operations.

- Energy efficiency continues to be a key area of focus for steam trap manufacturers as they produce models that meet the high standards established by environmental regulations. According to the U.S. Department of Energy, approximately 37% of all energy consumed in a manufacturing company is used in its industrial steam systems. Companies, such as Armstrong International, have responded to this issue by providing energy-efficient steam traps, which in turn can reduce the environmental impact of steam operation and support companies' sustainability goals.

- Government initiatives play a significant role in impacting how the steam trap market will develop in the future. For instance, two major pieces of legislation in the U.S. and Europe are the European Union's (EU) Green Deal and the U.S. Inflation Reduction Act; both of these pieces of legislation support industries to invest in energy-efficient technologies such as advanced steam traps. These legislative initiatives are designed to increase the adoption of sustainable technologies by reducing greenhouse gas emissions and supporting the development of sustainable industrial practices

- Further there also continue to be significant obstacles to adoption due to high installation and maintenance costs. Advanced steam traps with IoT capabilities have high initial costs to install, as they need a significant amount of money spent on integrating the existing systems and establishing the monitoring infrastructure for the traps. For example, retrofitting the older steam piping network in many larger buildings presents a significant challenge, both logistically and financially.

- The maintenance aspects of advanced steam traps also present challenges. Although the need for human intervention has greatly decreased due to the implementation of advanced steam traps, there still exists the need to inspect and calibrate advanced steam traps periodically. This requires skilled people who can provide the needed inspections, calibration and other updates.

Steam Trap Market Analysis

Learn more about the key segments shaping this market

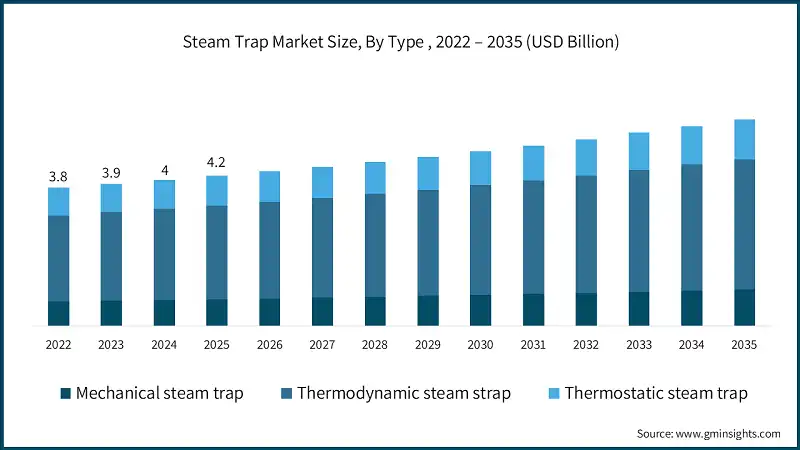

Based on type, the steam trap industry is segmented into mechanical steam trap, thermodynamic steam strap and thermostatic steam trap. The mechanical steam trap segment accounts for revenue of around USD 1.9 billion in 2025 and is expected to reach USD 3 billion by 2035.

- Mechanical steam traps dominate the market due to their reliability, cost-effectiveness, and ability to handle challenging industrial conditions. Mechanical steam traps include several different types such as thermodynamic, thermostatic, and inverted bucket and these traps all perform the same function- they discharge condensate while holding back the steam. The U.S. Department of Energy estimates that 20% of all the steam generated by facilities is wasted because of the inefficient operation of steam traps.

- Due to their durability and lower levels of maintenance required, mechanical steam traps are an excellent option for larger operations. For instance, power plants utilize mechanical steam traps for the purpose of mitigating steam loss and optimizing energy efficiency; in the area of food processing, however, they are essential in order to provide an uninterrupted source of steam for critical production steps such as sterilization and cooking.

- Companies like Spirax Sarco and Armstrong International are innovating in mechanical steam traps through the design and development of inverted bucket traps that are widely used within the power generation sector because of their strong performance and energy savings. Armstrong International for instance has become a key provider of thermostatic traps, which have become extremely popular in the food and beverage sectors.

- The U.S. Department of Energy (DOE) has implemented several programs to help businesses lower their costs and decrease their carbon footprint by optimizing the use of energy throughout their operations. The DOE's Better Plants Program provides resources and support for companies to be able to optimize their energy efficiency for various processes- including steam systems.

- While mechanical steam traps cannot provide the same precise level of control as the latest alternative options available, their basic operation, dependability and versatility across multiple industries will ensure they remain a dominant force in the market for a long time to come. These devices will meet the needs of many industrial users and provide an attractive cost-benefit to steam management systems.

Learn more about the key segments shaping this market

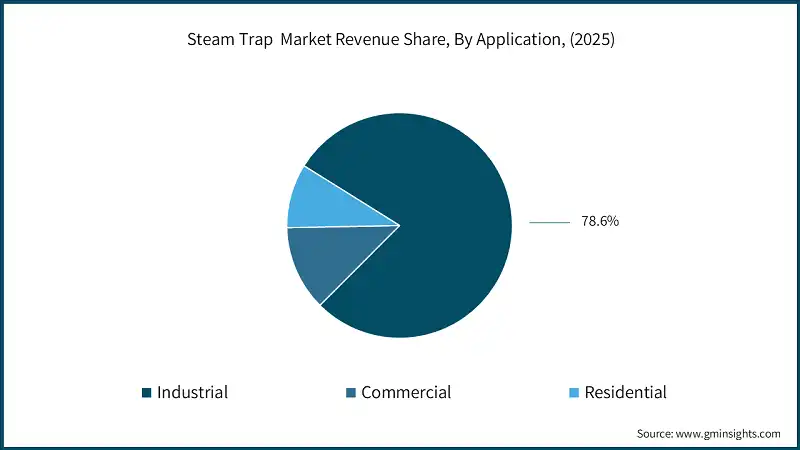

Based on the application, the steam trap market is bifurcated into industrial, commercial and industrial. The industrial segments accounted for 78.6% of the market share in 2025.

- The industrial sector is becoming a leader, partly due to the rise in demand for energy-efficient solutions and developing stringent government regulations regarding the use of energy-efficient technologies. For example, according to the U.S. Department of Energy, the use of energy-efficient steam systems could help save U.S. industry up to 20% in energy expenses by replacing older, inefficient steam traps with newer versions. Therefore, companies are now investing in the latest technologies to create advanced steam trap products.

- In addition, product-specific advancements are driving market growth. For example, Spirax Sarco recently developed the STAPS wireless steam trap monitoring System to help consumers reduce the amount of energy lost through their steam trap systems while increasing the efficiency of maintenance and repair activities.

- The demand for real-time monitoring of steam trap systems and predictive maintenance to prevent breakdowns in industrial settings supports continued growth of the steam trap market. Furthermore, government initiatives to promote sustainable practices are leading to increased acceptance of steam traps among consumers.

- In India, the Bureau of Energy Efficiency (BEE) has implemented various programs to encourage industrial users to optimize their steam system performance and efficiency, which are further propelling the region's growth of the steam trap market.

- Companies such as Armstrong International and TLV International are also aiding in the expansion of the market by providing "tailored" solutions for customers with specific needs related to steam traps. This highlights the role of steam traps as being vital for increasing energy efficiency and decreasing operational expenses in the industry.

Based on distribution channel, the market is segmented direct and indirect. The indirect sales channel segment generating a revenue of USD 2.6 billion in 2025.

- Indirect sales play a pivotal role in the steam trap market, enabling manufacturers to extend their reach without establishing a direct presence in every region. By leveraging partnerships with distributors, agents, and resellers, companies can efficiently cater to diverse industrial clients. For instance, Spirax Sarco collaborates with local distributors to provide tailored solutions for the food processing sector, ensuring compliance with stringent hygiene standards.

- Indirect selling approaches are particularly valuable to serve unique customer requirements for industries like oil & gas, as both efficiency and safety are of utmost importance to these industries. Armstrong International has formed an alliance with many regional agents in order to develop energy-efficient steam trapping systems to help decrease both energy use and operational costs at refineries.

- In addition to providing manufacturers access to expertise and support in local markets, distributor relationships enable manufacturers to access specialized market knowledge. Distributors have experience and intelligence about the needs, issues, and concerns of customers within their region, which helps them address various customer concerns.

- Thus, the distributor is able to provide a highly localized service to customers, which creates a higher level of trust and allows the distributor to deliver continuous and effective service to customers, which is crucial to supporting the industries in providing and fulfilling their complex operational needs.

- Steam trap manufacturers use indirect sales strategies not only to grow their presence in the marketplace, but also to improve their customers' experience. By offering local solutions that are tailored to customer needs, steam trap manufacturers become trusted partners for industrial applications; thus, promoting continuous growth and a stronger market position.

Looking for region specific data?

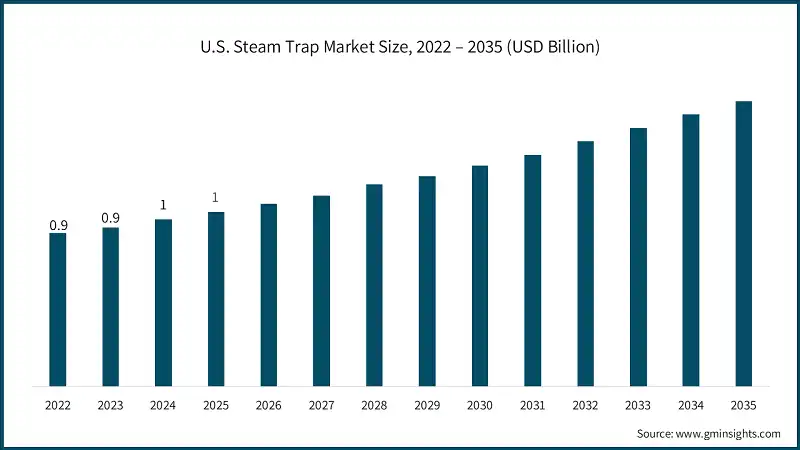

U.S. dominated the steam trap market growth in North America, accounting for 79.4% of the share 2025.

- North America’s steam trap industry growth is driven by strong industrial modernization, high adoption of automation technologies, and stringent energy-efficiency regulations. The U.S. contribution reflects the country’s robust industrial base and emphasis on optimizing steam systems for reduced energy loss.

- Regulatory pressure toward emissions reduction and energy conservation-supported by strict U.S. efficiency mandates and compliance standards—continues to accelerate upgrades to advanced steam traps. Government-aligned sustainability initiatives and increasing failure-tracking data, such as 212 failed steam traps recorded in Canada in 2023, highlight the growing need for system modernization across the region.

Asia Pacific steam trap market is expected to grow at 4.5% CAGR during the forecast period.

- The region’s growth is fueled by rapid industrialization, rising energy costs, and adoption of IoT enabled maintenance practices across sectors such as oil & gas, manufacturing, and power generation. Strong sustainability mandates—especially in India’s aggressive carbon-reduction roadmap—further push industries to deploy efficient steam management solutions.

Europe steam trap market is expected to grow at 4.4% CAGR during the forecast period.

- Europe’s growth stems from strict environmental regulations, rising carbon-reduction targets, and widespread industrial modernization. Increasing renewable energy usage—such as France reaching 25.3% renewable share of gross final energy consumption in 2022—drives adoption of efficient steam trap technologies to reduce fuel consumption and operational waste. .

Middle East and Africa steam trap market is expected to grow at 3.6% CAGR during the forecast period.

- MEA’s steam trap demand is driven by expanding oil & gas, petrochemical, and power-generation industries, which rely heavily on efficient steam systems. Governments are enforcing energy-conservation and emission-reduction measures, prompting facilities to upgrade to modern steam traps that minimize steam loss and improve thermal efficiency.

Steam Trap Market Share

The top companies in the steam trap industry include Spirax-Sarco Engineering, Armstrong International, TLV International, Emerson Electric and Watts Water Technologies and collectively hold a share of 25.7% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Spirax-Sarco provides a wide portfolio of engineered steam-system solutions, including balanced-pressure, bimetallic, inverted-bucket, sealed, and thermodynamic steam traps, helping industries improve steam efficiency and process reliability. Their steam traps are offered under the Steam Thermal Solutions segment through brands like Spirax Sarco and Gestra, serving global industrial customers.

- Armstrong International supplies a broad range of industrial steam traps designed for energy efficiency and condensate management across sectors such as oil & gas, food processing, and power generation. As one of the key global players, they support steam-system optimization through trap technologies and connected monitoring solutions.

- TLV is a leading Japanese steam-engineering company manufacturing mechanical, thermostatic, and thermodynamic steam traps used for condensate removal, steam loss prevention, and system optimization. It is consistently ranked among key global players due to its advanced steam-trap technologies and strong industrial presence.

Steam Trap Market Companies

Major players operating in the steam trap industry are:

- ARI-Armaturen

- Armstrong International

- Ayvaz

- Emerson Electric

- Forbes Marshall

- Hoffman Specialty

- Miura

- Miyawaki

- Spirax-Sarco Engineering

- Thermax

- TLV International

- Velan

- Watson-McDaniel

- Watts Water Technologies

- Yoshitake

Emerson, through its Yarway brand, delivers steam traps as part of its broader industrial automation and fluid-control portfolio, supporting energy efficiency and operational reliability in steam distribution networks. It is recognized as a major player in the global steam trap market, often included among the top suppliers.

Watts manufactures thermostatic, inverted-bucket, and thermodynamic steam traps used in steam drip, heating, and process applications across industrial facilities. Their steam-trap solutions form part of broader thermal, water, and energy-management technologies supplied to global industrial and commercial users.

Steam Trap Industry News

- In July 2025 TLV launched its Large Capacity Float Steam Trap JLH15, engineered for high-volume condensate discharge and improved reliability in heavy-duty steam applications. The new design enhances heating efficiency through FLOATDYNAMIC construction and X-element air venting technology.

- In May 2025 Emerson partnered with AbbVie to deploy wireless steam trap monitoring using Plantweb Insight and WirelessHART sensors, significantly improving trap visibility and reducing energy waste. The project delivered higher product yield, lower carbon footprint, and faster failure detection.

- In March 2025 ARI Armaturen USA expanded CONA steam trap portfolio, emphasizing high-efficiency mechanical, thermostatic, and thermodynamic trap designs for industrial steam systems. The update underscored improved reliability, energy savings, and rapid support capabilities for mission-critical applications.

- In March 2025 Armstrong introduced enhanced SteamEye 24/7 monitoring technology, enabling real-time analytics, wireless detection of trap failures, and substantial energy-loss prevention. The update detailed how continuous monitoring replaces manual inspections and strengthens sustainability outcomes.

- In 2025 Spirax Sarco expanded its wireless steam trap monitoring solutions, enabling continuous trap performance visibility and reducing unplanned maintenance and energy losses. The system leverages IoT enabled analytics to support operational efficiency and sustainability goals across steam-intensive facilities.

The steam trap market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Type

- Mechanical steam trap

- Thermodynamic steam strap

- Thermostatic steam trap

Market, By Function

- Steam distribution

- Condensate recovery

Market, By Material

- Cast/ductile iron

- Carbon steel

- Stainless steel

- Alloy/specialty

Market, By Connectivity

- Conventional

- Smart/monitored traps

Market, By Application

- Residential

- Commercial

- Industrial

Market, By End Use

- Process industry

- Power generation

- HVAC & district heating

- Pharmaceuticals & healthcare

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the steam trap market?

Key players include Spirax-Sarco Engineering, Armstrong International, TLV International, Emerson Electric, Watts Water Technologies, ARI-Armaturen, Forbes Marshall, Miura, Miyawaki, Thermax, Velan, Watson-McDaniel, Hoffman Specialty, Ayvaz, and Yoshitake.

Which region leads the steam trap market?

U.S. held 79.4% share with USD 1 billion in 2025, supported by industrial modernization, high automation adoption, and stringent energy-efficiency regulations.

What is the growth outlook for Asia Pacific steam trap market from 2026 to 2035?

Asia Pacific is projected to grow at a 4.5% CAGR through 2035, fueled by rapid industrialization, rising energy costs, and adoption of IoT-enabled maintenance practices.

What are the upcoming trends in the steam trap market?

Key trends include expansion of smart and IoT-enabled steam trap solutions with real-time monitoring, integration of AI-driven analytics and predictive maintenance, and growing adoption of wireless sensor technologies for energy optimization.

What was the market share of the industrial application segment in 2025?

The industrial application segment held 78.6% market share in 2025, driven by demand for energy-efficient solutions and stringent government regulations.

How much revenue did the mechanical steam trap segment generate in 2025?

Mechanical steam traps generated USD 1.9 billion in 2025 and is expected to reach USD 3 billion by 2035, leading the market due to reliability and cost-effectiveness.

What is the current steam trap market size in 2026?

The market size is projected to reach USD 4.3 billion in 2026.

What is the market size of the steam trap in 2025?

The market size was USD 4.2 billion in 2025, with a CAGR of 4.3% expected through 2035 driven by rising adoption of energy-efficient and automated steam systems across industries.

What is the projected value of the steam trap market by 2035?

The steam trap market is expected to reach USD 6.3 billion by 2035, propelled by industrial automation, IoT-enabled monitoring solutions, and stringent government energy conservation regulations.

Steam Trap Market Scope

Related Reports