Summary

Table of Content

Sprinkler Irrigation System Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sprinkler Irrigation System Market Size

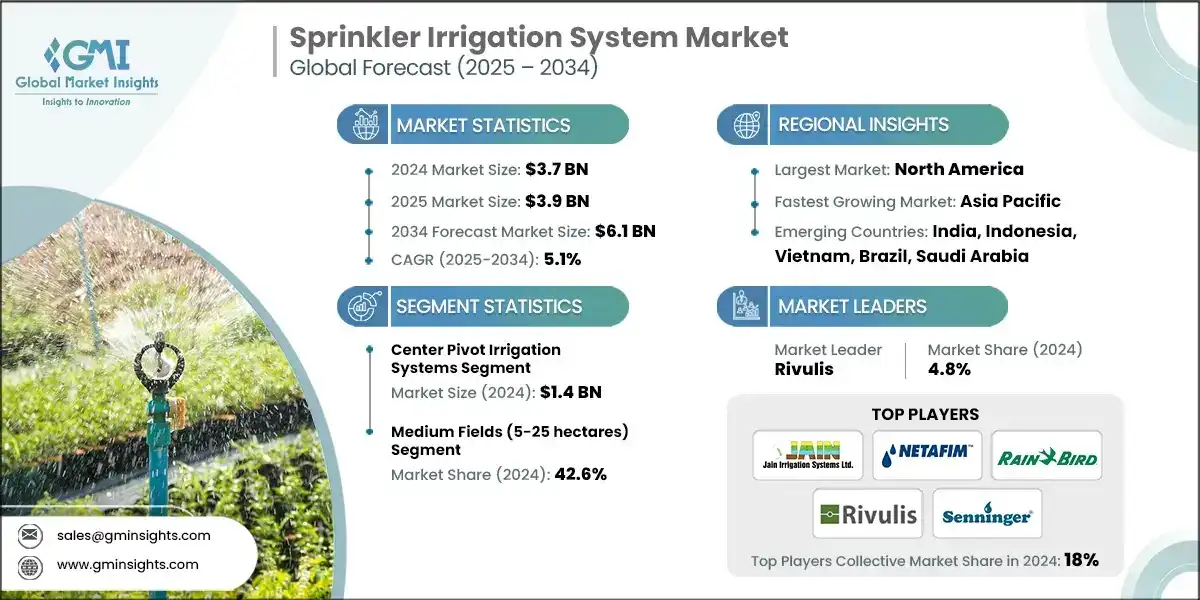

The global sprinkler irrigation system market was estimated at USD 3.7 billion in 2024. The market is expected to grow from USD 3.9 billion in 2025 to USD 6.1 billion in 2034, at a CAGR of 5.1%, according to Global Market Insights Inc.

To get key market trends

- The market has grown 27% since 2019, driven by increasing water scarcity and the need for efficient irrigation methods that minimize waste.

- Governments are actively promoting micro-irrigation through subsidies and infrastructure development, such as India’s construction of over 37,000 farm ponds and online application systems for irrigation support.

- Technological innovations like Champion Irrigation’s automatic solenoid valve enhance system reliability and ease of use, enabling more farmers to adopt.

- Climate change-induced heatwaves have also pushed farmers toward precision irrigation and manufacturers are developing newer technologies for easier adoption of these systems.

- For example, in August 2025, Netafim launched a Mega-PULSAR system for orchard cooling. These real-world initiatives reflect a shift toward sustainable, scalable irrigation solutions.

- As per the scientific study conducted by researchers and reported (2024) on ScienceDirect, Sprinkler irrigation systems demonstrated a WUE improvement of up to 35% compared to traditional surface irrigation methods in semi-arid regions, significantly reducing water losses due to runoff and evaporation.

- In trials conducted on maize crops, sprinkler systems increased yield by 18–22%, attributed to uniform water distribution and better soil moisture retention.

- Moreover, the study found that low-pressure sprinkler systems consumed 20–25% less energy than conventional high-pressure systems, making them more viable for small and medium-scale farmers.

- Automation and modular design in modern sprinkler systems reduced labor requirements by 30–40%, especially in large-scale operations.

- Farmers cited climate variability and government incentives as key motivators for switching to sprinkler systems, with adoption rates rising sharply in regions facing erratic rainfall patterns.

- Government programs have played a pivotal role in accelerating the adoption of sprinkler irrigation systems. For instance, the Indian Ministry of Agriculture and Farmers Welfare, under the “Per Drop More Crop” component of the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), promotes micro-irrigation technologies including sprinklers.

- As per the report released by Department of Agriculture & Farmers Welfare, Government of India, the net irrigated area during 2022-23 was 79312 thousand hectares, 22.85% of which was accounted by canal source of irrigation, 2.82% by tanks, 49.34% by tube wells, 13.46% by other wells and remaining 11.53% is irrigated by other source of irrigation such as sprinkler irrigation systems.

- Government of India has provided financial assistance under the Pradhan Mantri Krishi Sinchayee Yojana, i.e., Per Drop More Crop (PMKSY-PDMC) which serves as a significant market driver. The scheme offers a subsidy of 55% for small and marginal farmers and 45% for other farmers for the installation of drip and sprinkler systems.

Sprinkler Irrigation System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.7 Billion |

| Market Size in 2025 | USD 3.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.1% |

| Market Size in 2034 | USD 6.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Government-led irrigation initiatives | Public subsidies and infrastructure programs have accelerated global adoption, especially in developing economies with water-stressed agriculture. |

| Climate adaptation and water efficiency | Rising climate volatility has made sprinkler systems essential for maintaining crop yields while reducing water consumption by up to 40%. |

| Technological integration and automation | Smart irrigation technologies have expanded market reach by enabling precision farming and reducing labor dependency across large-scale operations. |

| Pitfalls & Challenges | Impact |

| Infrastructure and water source limitations | Inadequate water access and poor rural infrastructure restrict the scalability of sprinkler systems, especially in developing regions with fragmented supply chains. |

| Environmental and maintenance challenges | Improper system management and lack of technical support led to inefficiencies and environmental degradation, reducing long-term adoption and trust among farmers. |

| Opportunities: | Impact |

| Integration with renewable energy systems | Capitalizing on this opportunity would enable sustainable irrigation expansion in energy-poor regions, reduce long-term costs for farmers, and align the market with global decarbonization goals. |

| Expansion into non-agricultural segments | Diversifying into non-agricultural applications can stabilize revenue streams, reduce seasonal dependency, and open premium markets with higher margins. |

| Market Leaders (2024) | |

| Market Leaders |

4.8% market share |

| Top Players |

The collective market share in 2024 is 18% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Indonesia, Vietnam, Brazil, Saudi Arabia |

| Future Outlook |

|

What are the growth opportunities in this market?

Sprinkler Irrigation System Market Trends

- The integration of Internet of Things (IoT) technologies into sprinkler systems is revolutionizing irrigation management. Smart controllers, soil moisture sensors, and weather-based automation enables farmers to optimize water usage in real time. For example, Rain Bird’s ESP-TM2 controller allows remote scheduling and monitoring via mobile apps, reducing water waste and improving crop health. This trend is driven by the need for precision agriculture and is expanding rapidly in regions with digital infrastructure, offering manufacturers opportunities to differentiate through innovation and data-driven services.

- To mitigate rising logistics costs and supply chain disruptions, companies are increasingly localizing production. Rivulis’ establishment of a manufacturing facility in Tijuana, Mexico, is a strategic move to serve North American markets more efficiently. This trend reflects a broader shift toward regional manufacturing hubs that reduce lead times, improve responsiveness to local demand, and support government-backed “Make in Country” initiatives. Economically, this enhances cost competitiveness and resilience, especially in price-sensitive markets.

- Climate volatility and declining freshwater availability are compelling governments and farmers to adopt water-efficient irrigation systems. Sprinkler systems, particularly low-pressure and pulsed variants, are gaining traction as they reduce water consumption by up to 40% compared to traditional methods. Netafim’s Mega-PULSAR™ system, designed to cool orchard canopies during heatwaves, exemplifies how climate-responsive technologies are becoming mainstream. This external pressure is not only reshaping product design but also influencing policy and funding priorities globally.

- There is a growing consumer and institutional demand for sustainably produced agricultural goods, which is influencing farmers to adopt water-efficient technologies like sprinkler systems. Certifications such as GLOBALG.A.P. and sustainability-linked financing from institutions like the IFC are encouraging growers to demonstrate responsible water use. For example, large agribusinesses in Latin America are integrating sprinkler systems to meet export standards and ESG compliance, thereby aligning irrigation practices with market expectations.

- The market is witnessing increased consolidation and strategic alliances among irrigation technology providers to enhance product portfolios and global reach. Rivulis’ merger with Jain Irrigation’s international business is a prime example, creating one of the largest micro-irrigation companies globally. Such consolidation enables economies of scale, accelerates innovation, and strengthens distribution networks, positioning companies to better serve diverse markets and withstand competitive pressures.

Sprinkler Irrigation System Market Analysis

Learn more about the key segments shaping this market

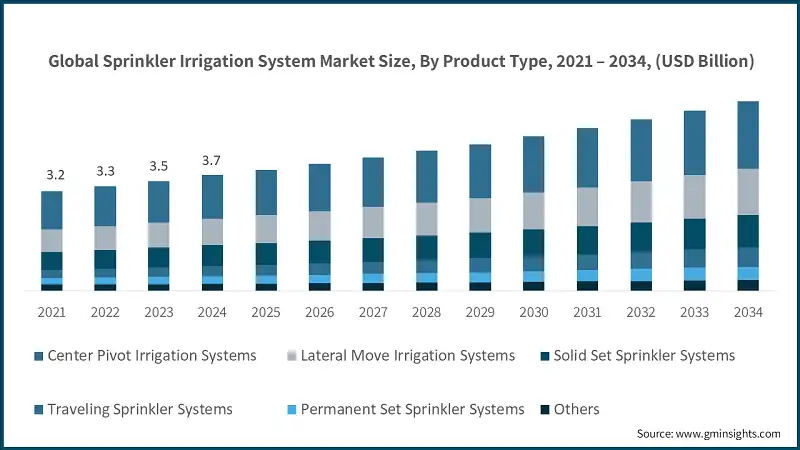

Based on product type, the market is segmented into center pivot irrigation systems, lateral move irrigation systems, solid set sprinkler systems, travelling sprinkler systems, permanent set sprinkler systems and others. In 2024, the center pivot irrigation systems segment dominated the market and generated a revenue of USD 1.4 billion and is expected to grow at CAGR of around 4.5% during the forecast period 2025 to 2034.

- Center pivot systems can irrigate large circular areas, up to 500 acres with uniform water distribution, making them ideal for commercial-scale farming.

- These systems are highly automated and require minimal manual intervention, reducing labor costs and improving operational efficiency for large farms.

- Center pivot systems are adaptable to a wide range of crops including maize, wheat, and soybeans, which are extensively cultivated in North America, Latin America, and parts of Asia.

- Modern center pivot systems are equipped with GPS, remote sensors, and variable rate irrigation (VRI), enabling precise water application based on soil and crop needs.

- Countries like the U.S. and Brazil have invested heavily in center pivot infrastructure due to favorable land topography and government-backed irrigation programs, reinforcing its market dominance.

Learn more about the key segments shaping this market

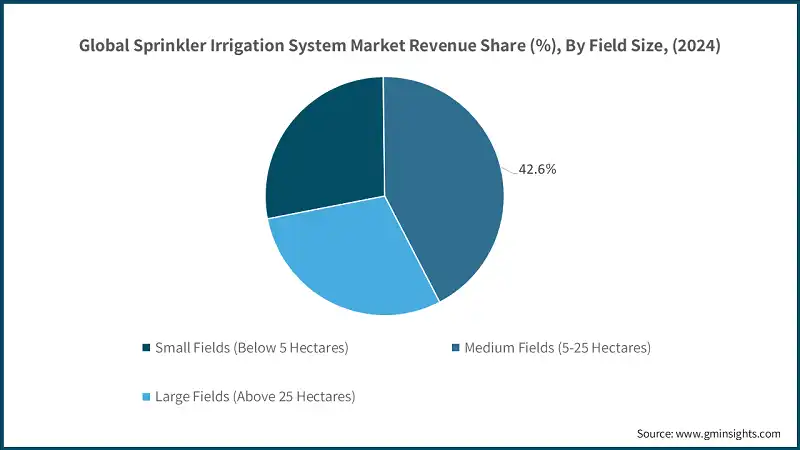

The sprinkler irrigation system market by field size is segmented into small fields (below 5 hectares), medium fields (5-25 hectares), and large fields (above 25 hectares). The medium fields (5-25 hectares) segment was the leading segment in this market in 2024 with a revenue of USD 1.6 billion and has a market share of around 42.6%.

- Medium-sized farms strike a balance between affordability and scale, making sprinkler systems economically viable without requiring large capital outlays.

- Many subsidy schemes, such as India’s PMKSY-PDMC, are structured to benefit farmers with holdings in the 5–25 hectare range, boosting adoption.

- Medium fields often support a mix of cash and food crops, which benefit from controlled irrigation, increasing demand for adaptable sprinkler systems.

- Compared to large fields, medium plots are easier to equip and maintain with modular sprinkler systems, reducing operational complexity.

- In emerging markets, medium farms are increasingly shifting from subsistence to commercial farming, driving demand for efficient irrigation technologies.

Looking for region specific data?

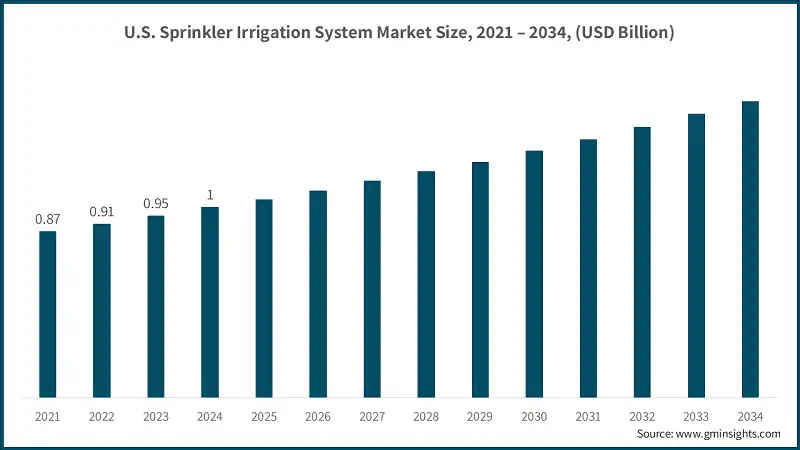

The U.S. sprinkler irrigation system market was valued at around USD 1 billion in 2024 and is anticipated to register a CAGR of 4.6% between 2025 and 2034.

- The U.S. is demonstrating strong demand in the sprinkler irrigation system industry due to its extensive agricultural land and advanced irrigation infrastructure. According to the U.S. Department of Agriculture (USDA), over 58 million acres of farmland were irrigated in 2018, with sprinkler systems accounting for more than 50% of that area, primarily through center pivot systems.

- This dominance is driven by the suitability of sprinkler systems for large-scale crop production, particularly in states like Nebraska, Texas, and Kansas, where center pivot irrigation is widely used for corn, wheat, and soybeans.

- The USDA’s Natural Resources Conservation Service (NRCS) also supports sprinkler adoption through programs like EQIP, which provide technical and financial assistance for water-efficient technologies.

- Moreover, the U.S. agricultural sector is increasingly adopting precision irrigation to address water scarcity and climate variability.

- The Environmental Protection Agency (EPA) reports that agriculture consumes approximately 80% of freshwater in the western U.S., prompting farmers to invest in systems that optimize water use.

Europe witnessed promising demand in the market with a share of around 26.1% in 2024 and is expected to grow at a robust CAGR of 5.2% during the forecast period.

- Europe is demonstrating strong demand in the sprinkler irrigation system market due to its regulatory emphasis on water efficiency and sustainable agriculture. The European Commission’s Common Agricultural Policy (CAP) encourages the adoption of precision irrigation technologies through eco-schemes and rural development programs.

- According to Eurostat, over 6.9 million hectares of irrigated land were reported across the EU in 2020, with countries like Spain, Italy, and France leading in sprinkler system usage due to their Mediterranean climates and water stress conditions. These systems are particularly favored in vineyards, orchards, and vegetable farms, where controlled irrigation is essential for quality and yield.

- Additionally, Europe’s climate adaptation strategies are driving technological upgrades in irrigation infrastructure. The European Environment Agency (EEA) highlights that climate change is intensifying drought risks across southern and eastern Europe, prompting farmers to invest in efficient systems like low-pressure sprinklers and automated controls.

Asia Pacific sprinkler irrigation system market is expected to grow at 6.9% during the forecast period.

- Asia Pacific is demonstrating strong demand in the sprinkler irrigation system industry due to its vast agricultural base and increasing government focus on water-efficient technologies.

- According to the Indian Ministry of Agriculture, over 13 million hectares have been brought under micro-irrigation through the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), with sprinkler systems playing a key role in field crop irrigation.

- Similarly, China’s Ministry of Water Resources has prioritized modern irrigation infrastructure under its “High-Efficiency Water-Saving Irrigation” initiative, aiming to improve irrigation coverage and reduce water waste in northern provinces. These large-scale programs reflect a regional shift toward sustainable irrigation practices, supported by public funding and policy alignment.

- Additionally, climate variability and groundwater depletion are accelerating the adoption of sprinkler systems across Asia Pacific.

- The Australian Bureau of Meteorology reports increasing drought frequency in key agricultural zones, prompting farmers to invest in precision irrigation to maintain crop yields.

- In Southeast Asia, countries like Thailand and Vietnam are integrating sprinkler systems into rice and horticulture production to improve water use efficiency and reduce labor dependency.

Sprinkler Irrigation System Market Share

- The top 5 companies in the sprinkler irrigation system industry, such as Jain Irrigation Systems Ltd., Netafim, Rain Bird Corporation, Rivulis, and Senninger, hold a market share of 18% in 2024.

- Jain Irrigation Systems Ltd. has built a diversified and vertically integrated agribusiness model, combining micro-irrigation systems, food processing, solar energy, and tissue culture. Its “Integrated System Approach” and “One-Stop-Shop for Farmers” strategy allow it to offer bundled solutions that enhance productivity and sustainability. With 19 manufacturing bases across four continents and a distribution network of over 4,000 dealers, Jain Irrigation leverages global reach and local relevance. Strong R&D capabilities and leadership in banana tissue culture further differentiate its offerings, helping it withstand competition through innovation and scale.

- Senninger, now part of Hunter Industries, has strategically unified its brand under “Hunter Agriculture” to streamline product offerings and improve customer experience. This consolidation simplifies system design and aligns with market segments more effectively. Senninger continues to focus on precision irrigation components like pressure regulators and low-pressure sprinklers, catering to agricultural, turf, and greenhouse markets. Its integration into Hunter’s broader ecosystem allows it to leverage shared R&D, distribution, and branding resources, helping it stay competitive through synergy and specialization.

- Rivulis is expanding its global footprint through infrastructure investments, notably its new factory in Tijuana, Mexico, which enhances its North American manufacturing capacity and responsiveness. This facility supports Rivulis’ mission to make micro-irrigation accessible to all growers, especially in underserved markets. The company’s strategy includes turnkey projects, climate-smart farming models, and tailored financing solutions, enabling it to scale sustainably. By combining innovation with proximity to key markets, Rivulis strengthens its competitive position in a rapidly evolving industry.

Sprinkler Irrigation System Market Companies

Major players operating in the sprinkler irrigation system industry are:

- Dripindia Irrigation Pvt. Ltd.

- Jain Irrigation Systems Ltd.

- Kisan Irrigations & Infrastructure Ltd.

- Komet Austria GmbH

- Kothari Group

- K-Rain Manufacturing

- Nelson Irrigation

- Netafim

- Novedades Agrícolas, S.A.

- Rain Bird Corporation

- Rivulis

- Senninger

- Siflon Drips & Sprinklers Pvt. Ltd.

- Sujay Irrigation

- Valmont Industries, Inc.

Netafim has transitioned from being a product-centric company to a solution-oriented provider, focusing on integrated irrigation systems tailored to specific agricultural needs. This strategic pivot, initiated under CEO Erez Meltzer, involved restructuring its global supply chain to support scalable, customized solutions rather than standalone products. By emphasizing sustainability, precision agriculture, and partnerships with local stakeholders, Netafim has positioned itself as a climate-resilient innovator. Its recent launches, like the Mega-PULSAR sprinkler system, reflect a commitment to high-tech, water-efficient solutions that address global challenges such as heatwaves and water scarcity.

Rain Bird Corporation has reinforced its market position by tailoring its product lines to regional needs, particularly in Latin America, where it invests in robust, easy-to-maintain systems and local partnerships. This geographic customization strategy allows Rain Bird to offer scalable solutions that align with local agricultural practices and climate conditions. The company also maintains a strong brand reputation through operational excellence and a focus on water conservation technologies, which are increasingly critical in drought-prone regions. Its emphasis on quality and reliability helps it retain customer loyalty despite rising competition.

Sprinkler Irrigation System Industry News

- In August 2025, Orbia’s Netafim launched its Mega-PULSAR sprinkler technology, a precision irrigation innovation designed to protect high-value subtropical orchards such as avocado, mango, and lychee from intensifying heatwaves. The system delivers pulsed, low-volume water across orchard canopies to create localized microclimates that reduce temperature and increase humidity. Engineered for efficiency, Mega-PULSAR features wide-spacing installation, modular design, and flexible flow rates, enabling reduced water use, labor, and maintenance costs. Early field trials in 2025 demonstrated improved humidity and temperature control, positioning the solution as a scalable, climate-resilient tool for growers facing extreme weather and water scarcity challenges.

- In June 2025, the Uttar Pradesh government announced the successful construction of 37,403 farm ponds under the ‘Khet Talab Yojana’ to enhance irrigation and rainwater harvesting across the state. As part of the “Per Drop More Crop” initiative under the Rashtriya Krishi Vikas Yojana, an online application portal was launched for farmers to register for pond construction in 2025–26.

- In February 2025, Kazakhstan announced the launch of large-scale domestic production of sprinkler irrigation machines under the SU BEREKE brand, with the ADAM Group of Companies set to manufacture 1,000 units annually following the opening of a second plant in East Kazakhstan. This initiative aims to reduce reliance on imported equipment and promote water-saving technologies across 150,000 hectares of farmland each year. Supported by increased government subsidies, covering up to 85% of irrigation water costs, the move aligns with national efforts to combat water losses of up to 40% and expand the adoption of efficient irrigation systems, which currently cover only 17% of irrigated land.

- In January 2025, In January 2025, Champion Irrigation Products launched the CIP-100IV Inline Irrigation Valve with Automatic Solenoid, engineered for residential and light commercial irrigation systems. Featuring a nylon-reinforced diaphragm, double filtration, and waterproof sealing, the valve ensures high-pressure performance (15–145 PSI) and durability in varied weather conditions. Its encapsulated solenoid and manual control switch enhance reliability and ease of use, while compatibility with 1" female threaded connections supports versatile installation.

The sprinkler irrigation system market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Center pivot irrigation systems

- Lateral move irrigation systems

- Solid set sprinkler systems

- Traveling sprinkler systems

- Permanent set sprinkler systems

- Others

Market, By Component

- Sprinklers

- Pipes

- Pumps

- Control units

- Valves

- Fittings and accessories

- Others

Market, By Crop Type

- Cereals and grains

- Oilseeds and pulses

- Fruits and vegetables

- Sugar crops

- Others

Market, By Field Size

- Small fields (below 5 hectares)

- Medium fields (5-25 hectares)

- Large fields (above 25 hectares)

Market, By Mobility

- Stationary systems

- Mobile systems

Market, By End Use

- Individual farmers

- Agricultural cooperatives

- Commercial farms

- Government institutions

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the global sprinkler irrigation system market?

Key players include Jain Irrigation Systems Ltd., Netafim, Rain Bird Corporation, Rivulis, and Senninger, with the top five holding 18% market share in 2024.

What are the upcoming trends in the sprinkler irrigation system industry?

Key trends include IoT-enabled smart irrigation, regional production hubs to cut logistics costs, climate-responsive technologies such as Netafim’s Mega-PULSAR, and rising ESG-driven demand for water-efficient farming practices.

What was the valuation of the medium field size segment in 2024?

Medium fields (5–25 hectares) accounted for USD 1.6 billion in 2024 with 42.6% market share.

Which region leads the global sprinkler irrigation system market?

The U.S. market was valued at around USD 1 billion in 2024, making North America the largest regional market. Its dominance is supported by extensive irrigated farmland, USDA-backed efficiency programs, and adoption of precision irrigation technologies.

How much revenue did the center pivot irrigation systems segment generate in 2024?

Center pivot irrigation systems generated USD 1.4 billion in 2024, dominating the market due to their automation, scalability, and suitability for commercial-scale farming.

What is the current global sprinkler irrigation system market size in 2025?

The market size is projected to reach USD 3.9 billion in 2025.

What is the projected value of the global sprinkler irrigation system market by 2034?

The market size for sprinkler irrigation system is expected to reach USD 6.1 billion by 2034, supported by government-led irrigation programs, climate adaptation, and precision agriculture adoption.

What is the market size of the global sprinkler irrigation system industry in 2024?

The market size was USD 3.7 billion in 2024, with a CAGR of 5.1% expected through 2034 driven by technological integration, automation, and water efficiency needs.

Sprinkler Irrigation System Market Scope

Related Reports