Summary

Table of Content

Specialty Chemicals Recycling Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Specialty Chemicals Recycling Market Size

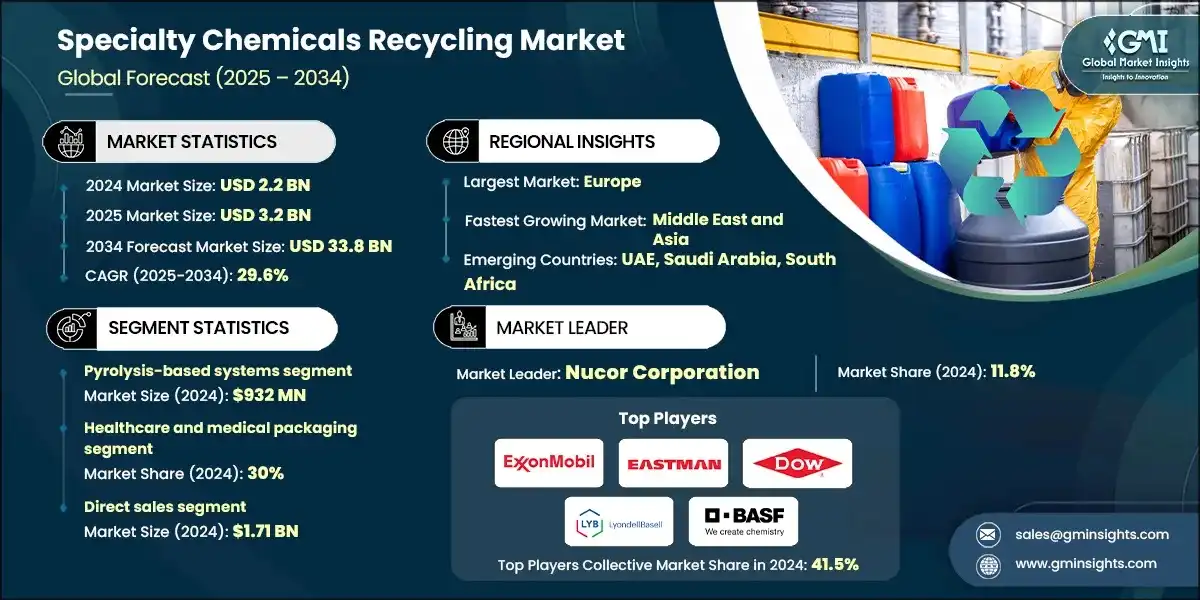

The global specialty chemicals recycling market was valued at USD 2.2 billion in 2024. The market is expected to grow from USD 3.2 billion in 2025 to USD 33.8 billion in 2034, at a CAGR of 29.6%, according to the latest report published by Global Market Insights Inc.

To get key market trends

- The global specialty chemicals recycling market aims at recovering and recycling such high-value chemical materials as solvents, catalysts, pigments, and other specialty chemical by-products. Instead of disposing as waste, recycling helps in transforming into usable feedstocks, or intermediate chemicals. This helps the companies in reducing raw material consumption and operational costs, and contributes in environmental sustainability by lowering waste and promoting circular economy principles.

- Recent advances in technology are changing the process of recycling specialty chemicals. Techniques such as advanced distillation, membrane separation, chemical depolymerization, and purification processes help companies to recover materials with greater efficiency and purity.

- Digital tools and automation process, monitoring software, and optimization software helps in streamlining operations or processes thus reduce energy consumption, and ensure consistent product quality. These advancements are making recycling a more attractive and economic proposition for many specialty chemicals.

- Specialty chemical recycling caters to a range of industries such as coatings, adhesives, electronics, or pharmaceuticals and water treatment, allowing recovery of the chemicals to process without any loss in quality. These kinds of recycling practices are adopted by highly industrialized countries with strict laws, while emerging countries are beginning to investigate such processes to reduce costs and environmental effects. Regulatory pressures, cost savings, and sustainability awareness continue to jolt the growth engine for all types of specialty chemicals recycling on a global platform.

Specialty Chemicals Recycling Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.2 Billion |

| Market Size in 2025 | USD 3.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 29.6% |

| Market Size in 2034 | USD 33.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising raw material costs | Rising prices of virgin chemicals make recycling a cost-effective alternative for manufacturers. By recovering and reusing specialty chemicals, companies can reduce dependency on expensive raw materials. This encourages more widespread adoption of recycling practices. |

| Technological advancements in recycling processes | Innovations such as solvent recovery systems, purification technologies, and automation are making recycling more efficient. These advancements improve product quality and reduce operational costs. Technology adoption is expanding the markets potential. |

| Growing demand from end-use industries | Industries like pharmaceuticals, coatings, electronics, and adhesives generate substantial chemical by-products. The need to manage these efficiently drives the recycling market. Increased industrial activity directly boosts demand for specialty chemical recycling. |

| Pitfalls & Challenges | Impact |

| High initial investment | Setting up recycling facilities and acquiring advanced recovery technologies require significant capital. |

| Fluctuating market demand for recycled chemicals | The demand for recycled specialty chemicals can be inconsistent, depending on industry needs and raw material prices. When virgin chemical prices drop, companies may prefer new materials over recycled ones. This uncertainty can affect profitability and investment decisions. |

| Opportunities: | Impact |

| Development of advanced recycling technologies | Innovations in chemical recovery, solvent purification, and automation offer opportunities to improve efficiency and product quality. Companies that invest in R&D can gain a competitive edge and reduce operational costs. |

| Digital platforms for chemical waste trading | Creating online marketplaces for buying, selling, or exchanging chemical by-products can optimize recycling supply chains. This increases efficiency, reduces waste, and opens new revenue streams. |

| Product innovation using recycled chemicals | Recycled specialty chemicals can be used to develop entirely new formulations or “green” products. Companies can market these as eco-friendly alternatives, gaining a competitive edge in sustainability-conscious industries. |

| Market Leaders (2024) | |

| Market Leaders |

11.8% |

| Top Players |

Collective market share of 41.5% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Middle East and Asia |

| Emerging Country | UAE, Saudi Arabia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Specialty Chemicals Recycling Market Trends

- The increase in growth of the specialty chemicals recycling industry is catered by industries realizing the economic and environmental advantages of circular production. Companies have started moving away from waste as a cost and moved toward recovering useful chemical components that may largely substitute virgin inputs. Increasingly, this awareness has, along with sustainability goals and brand commitments, triggered an incredible wave of innovation to extend the life cycle of high-value specialty compounds.

- Advancement in recycling technologies is reshaping the technological base in this market. Instead of remaining mechanical recycling only, companies have also embraced chemical and molecular recovery processes capable of treating highly contaminated materials. This is not just improving recovery yields and purity, but also providing new opportunities to tailor recycled outputs with respect to specific user needs in industry.

- Rise in collaborations and partnerships is another key driver in the market's evolution. Closed-loop ecosystems are being created by chemical manufacturers, recyclers and end-use industries, to get a constant stream supply of quality recycled materials.

- There is an increased focus in creating long-term industry strategies based on sustainable value creation. Other than just an environmental responsibility, companies are adopting differentiating and resilient traits. Integrating recycled specialty chemicals into mainstream production gives the opportunity for lesser dependence on volatile raw material markets and creates space for the increasing customer demand for greener products. This marks a transition from recycling compliance to purpose-based innovation driven by value.

Specialty Chemicals Recycling Market Analysis

Learn more about the key segments shaping this market

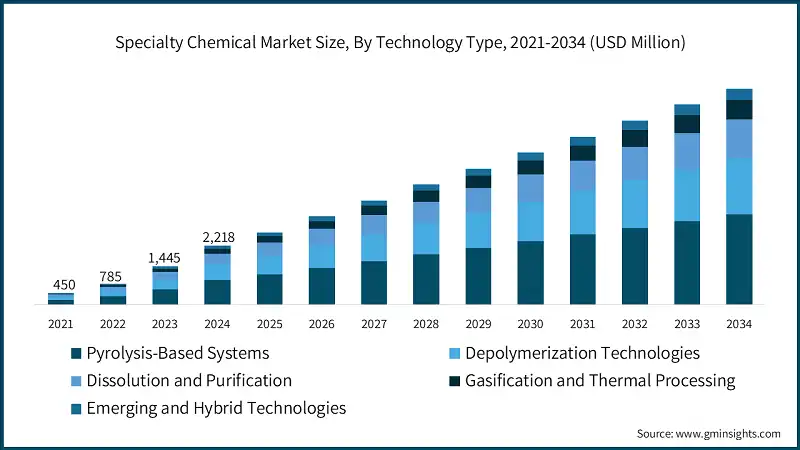

The market by technology type is segmented into pyrolysis-based systems, depolymerization technologies, dissolution and purification, gasification and thermal processing and emerging & hybrid technologies. Pyrolysis-based systems holds the largest market value of USD 932 million in 2024.

- Pyrolysis-based systems account the highest growth due to the factor that they can handle diverse, contaminated waste streams that the older recycling systems cannot handle. They also convert mixed materials into reusable chemical feedstocks, adding high value for industries that wish to achieve circular production. Followed by depolymerization technology as they enable the recovery of high-purity monomers, allowing manufacturers to produce recycled chemicals that are same in performance and quality to new materials. The increased demand for sustainable raw materials and lower reliance on fossil inputs continues to push the adoption of these two technologies across diverse industries.

- Meanwhile, dissolution, gasification, and emerging hybrid technologies are currently in development and thus increasing the diversity of recycling methods. Dissolution and purification are gaining interest in niche applications requiring preservation of material integrity, e.g. in specialty coatings and advanced packaging. Gasification helps to provide a sustainable method for converting waste into valuable intermediates by cleaner and more energy-efficient designs. Emerging and hybrid systems combine chemical and thermal processes to increase yield and flexibility and have potential for scalability in the future. Such technologies, however, may not be leading in growth but are establishing the platforms for a more integrated and efficient specialty chemicals recycling ecosystem.

Learn more about the key segments shaping this market

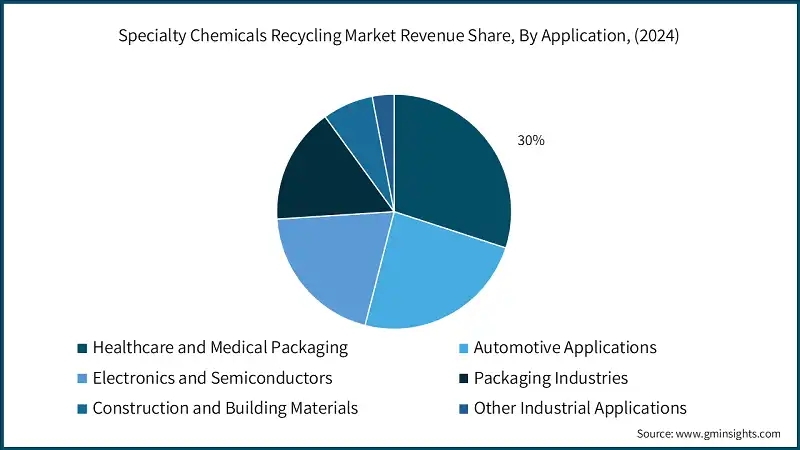

The specialty chemicals recycling market by application is segmented into healthcare and medical packaging, automotive applications, electronics and semiconductors, packaging industries, construction and building materials and other industrial applications. Healthcare and medical packaging holds the highest market share of 30% in 2024.

- Healthcare & medical packaging holds the highest market share due to increasing demand for safe, sterile, and convenient packaging solutions for medical devices, pharmaceuticals, and single-use items. Growth in this area is also attributed to an aging population, improving healthcare accessibility, and increased hygiene and regulatory standards. Automotive Applications have also seen a strong move upward with new technology in vehicles, including electronics, sensors, and safety systems, especially with the conversion to electric and autonomous vehicles, which require complex packaging solutions for components.

- The other segments tend to grow at a moderate pace. Electronics and semiconductors tend to gain from increasing demand for miniaturized and high-performance chips in computing, communication, and consumer electronics. The Packaging Industry still grows at a steady rate to meet the needs of general consumption and further online shopping. Construction and building materials have growth linked to urbanization and infrastructure development, whereas Other Industrial Applications grow at a very moderate pace, related to niche demands from industry.

Based on distribution channel, the specialty chemicals recycling market is segmented into direct sales and online. Direct sales hold the highest market value of USD 1.71 billion in 2024.

- The direct sales channel is the largest and most rapidly growing mode of distribution, which is driven by direct interaction with customers, provision of custom solutions, and efficient management of large or complex orders. Industries requiring technical guidance, customization, or bulk orders thrive on direct interaction, thus making this distribution channel indispensable for sustained growth.

- The Online channel is also growing, which is facilitated by the convenience and accessibility offered, along with the growing reliance of the customers on the digital way of purchasing. Standardized products and smaller orders, together with an e-commerce environment expanding rapidly, makes the online mode of sales a lucrative sidekick for direct selling, already taking over a bigger share of the market.

Looking for region specific data?

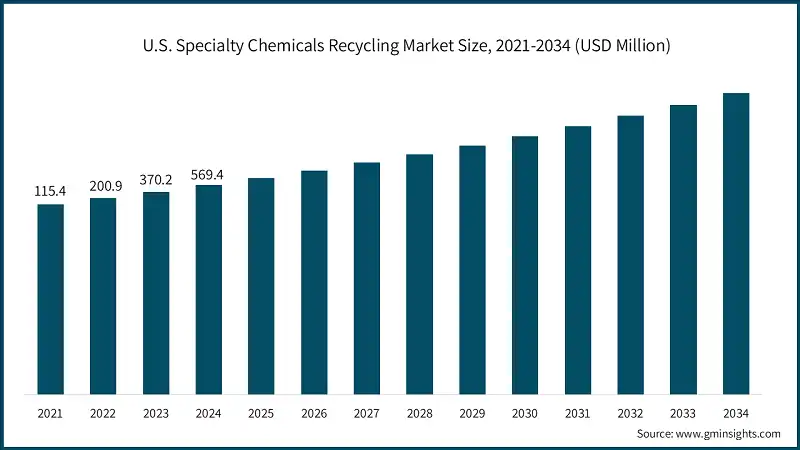

The U.S. market accounted for USD 569.4 million in 2024.

- In North America, the growth of specialty chemicals recycling market is driven by increasing demand from both the automotive and construction industries. In the U.S., demand for recycled aluminum and steel is increased due to the shift towards electric vehicles and energy-efficient infrastructure, while Canada is moving towards metal recovery from both industrial and obsolete scrap because of sustainable manufacturing and circular economy initiatives.

The market in the Germany is expected to experience significant and promising growth from 2025 to 2034.

- Europe a matured market still exploring, mainly because of Germany's advanced recycling infrastructure and stringent environmental regulations. The trend towards green building standards, renewable energy projects, and automotive electrification has brought about high demand in both ferrous and non-ferrous specialty chemicals recycling. Such countries in Europe, like France and the U.K., have also introduced policies advocating landfill waste diversion while promoting scrap metal collection, thus making Europe a significant region of sustainable metal recovery.

The specialty chemicals recycling market in China is expected to experience significant and promising growth from 2025 to 2034.

- APAC is a growing region in the specialty chemicals recycling industry and includes China, India, and Japan. Being the major manufacturing center in the world, demand in China for specialty chemicals recycling is to a large degree in automotive, electronics, and packaging sectors supported by government regulations foster resource efficiency. In India and Japan, such recycling initiatives are also expected to develop to meet the growing demand from industries and sustainability targets. Advanced technologies in sorting and processing activities are promoting efficient scaling of operations in this region.

UAE specialty chemicals recycling market is expected to experience significant and promising growth from 2025 to 2034.

- Increasingly urbanization, infrastructure projects, and industrial modernization become the main factor contributing to the high demand in the Middle East and Africa for specialty chemicals recycling. The UAE is into advanced recycling and sorting technologies to further improve efficiency. Meanwhile, specialty chemicals recycling are expected to meet rising demand in industries and construction markets across South Africa and Saudi Arabia. The regional initiatives on sustainability and resource conservation also play a vital role in the reliable growth in the market for MEA.

Brazil is expected to experience significant and promising growth from 2025 to 2034.

- Latin America, mainly Brazil, Mexico, and Argentina, is experiencing gradual advancement attributable to industrialization and infrastructure development. Most of the specialty chemicals recycling are being used in building and automotive industries within Brazil to save costs and reduce environmental risks. Moreover, Mexico and Argentina are improving their scrap collection and recycling programs, which support domestic manufacturing and promote sustainable use of metals across the region.

Specialty Chemicals Recycling Market Share

Specialty Chemicals Recycling markets are moderately consolidated with players like Nucor Corporation, Novelis Inc., Steel Dynamics Inc., Sims Limited, Schnitzer Steel (Radius Recycling) holding 41.5% market share and Nucor Corporation being the market leader holding the market share of 11.8% in 2024.

- In the specialty chemicals recycling industry, the leading players maintain a significant competitive edge through the continued investment in advanced processing and sorting technologies. Targeting production of high-purity specialty chemicals recycling to satisfy the most stringent quality requirements in heavy industrial sectors such as automotive, construction, and electronics, innovations in sensor-based separation, automation, and melting processes allow recyclers to improve upon recovery rates, handle increasingly diverse scrap sources, and assure materials approximated in performance to virgin metals.

- Sustainability is an underlying driver in shaping competitive strategy. Firms are optimizing processes to minimize energy consumption, carbon emissions, and environmental impact, while at the same time appealing to industries and consumers interested in circular economy practices. The efficiency and scalability of recycling not only reduce costs but enhance the environmental credibility of specialty chemicals recycling, giving recyclers leverage where compliance to regulation and conscious sourcing is demanded.

- Environmental legislation, industry standards, and traceability requirements define another boundary within which competitive advantage is maintained. Compliance with legal frameworks and international standards fosters a climate of assurance with end-users wishing to promulgate their activities into new regions and positions them as trusted suppliers of sustainable metals. These factors, comprised of transparent practices, high-quality outputs, and proactive market-based regulatory alignment, contribute highly to creating a difference between the leaders in the recycling sector and the growing competition.

Specialty Chemicals Recycling Market Companies

Major players operating in the specialty chemicals recycling industry are:

- Arkema

- BASF SE

- Chevron Phillips Chemical

- Covestro

- DSM-Firmenich

- Dow Inc.

- Eastman Chemical

- Evonik Industries

- ExxonMobil

- Indorama Ventures

- Jiangsu Eastern Shenghong

- LyondellBasell

- Mitsubishi Chemical

- PETRONAS Chemical Group

- SABIC

ExxonMobil is a global giant in the energy and chemical sectors with increasing emphasis on advanced recycling and specialty chemical innovations. ExxonMobil uses its own proprietary chemical recycling technologies to recycle plastic waste into standard-quality raw materials for the manufacture of new products. It emphasizes circular economy practices reducing plastic waste while matching performance requirements for specialty polymers and chemical intermediates. The company's strength in R&D and integrated operations provide a solid package for scalable recycling solutions aimed at global sustainability goals.

Eastman Chemical Eastman Chemical promotes itself as one of the large specialty materials companies that are strongly pushing the application of molecular recycling technologies within the recycling industry of specialty chemicals. This is a focus on breaking down complex plastics into molecular substrates that can then be reused for producing specialty polymers, films, and coatings.

Dow Inc. is among the leading companies in the field of materials science. It has incorporated recycling initiatives into its specialty chemicals and plastics operations and now coming up with mechanical and advanced recycling projects for collecting post-consumer waste and converting it into new high-performing materials through its specialty chemicals recycling segment.

LyondellBasell deals in chemical manufacturing with a keen focus on enhancing circular and low-carbon solutions for the specialty chemicals recycling sector. The company scales and develops chemical recycling technologies to convert waste plastics to feedstocks for high-quality polymers. Further to produce sustainable specialty chemicals with less reliance on virgin materials, its proprietary MoReTec technology and other initiatives promote the production of sustainable specialty chemicals.

BASF SE, is a chemical company, works intensely towards developing sustainable solutions among specialty chemicals in the recycling industry. ChemCycling project focus is to convert plastic waste into feedstocks for manufacturing high-performance specialty materials. BASF sees its chemical recycling as part of its wide sustainability strategy, which moves the economy toward low-carbon as well as resource-efficient.

Specialty Chemicals Recycling Industry News

- In October 2025, Northstar Recycling Co, has acquired Waste Technology Services, thus strengthening its position within the sectors of industrial waste management and the circular economy. WTS offers environmental consulting and recycling solutions to chemical, pharmaceutical, and technology industries, with an emphasis on waste reuse and reclamation. This acquisition provides Northstar with greater technical competence and enhances its service portfolio, thus creating an even stronger platform for data-driven sustainable waste and recycling management. This acquisition complements Northstar's ongoing strategy of growth through targeted acquisitions and partnerships.

- In September 2025, Technip Energies has announced the acquisition of the Advanced Materials & Catalysts business of Ecovyst Inc., which eventually strengthens its portfolio in sourcing specialty chemicals and recycling markets. This acquisition increases Technip Energies' know-how on advanced silica and zeolite-based catalysts, which substantiate growth in the sustainable fuels space, circular chemistry, and the plastics recycling industry.

The specialty chemicals recycling market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2021–2034 for the following segments:

Market, By Technology Type

- Pyrolysis-based systems

- Depolymerization technologies

- Dissolution and purification

- Gasification and thermal processing

- Emerging and hybrid technologies

Market, By Application

- Healthcare and medical packaging

- Automotive applications

- Electronics and semiconductors

- Packaging industries

- Construction and building materials

- Other industrial applications

Market, By Distribution Channel

- Direct sales

- Online

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Which application segment dominates the specialty chemicals recycling market?

The healthcare and medical packaging segment led the market with a 30% share in 2024, driven by demand for sterile and sustainable packaging solutions for medical devices, pharmaceuticals, and single-use items.

Which region leads the specialty chemicals recycling market?

The U.S. market accounted for USD 569.4 million in 2024, representing strong regional performance. Growth is driven by increasing recycling demand from automotive and construction industries, supported by sustainable manufacturing and circular economy programs.

Which technology type led the specialty chemicals recycling industry in 2024?

Pyrolysis-based systems held the largest market value of USD 932 million in 2024, as they efficiently handle contaminated waste streams and convert mixed materials into high-value chemical feedstocks.

What are the key trends shaping the specialty chemicals recycling industry?

Key trends include the shift toward chemical and molecular recovery technologies, growth of digital platforms for chemical waste trading, and the rise of closed-loop partnerships among recyclers, manufacturers, and end-use industries to promote sustainable material recovery.

What is the projected value of the specialty chemicals recycling market by 2034?

The market is expected to reach USD 33.8 billion by 2034, fueled by rising raw material costs, increasing industrial demand, and adoption of advanced recycling technologies like depolymerization and solvent recovery systems.

What is the current specialty chemicals recycling market size in 2025?

The market size is projected to reach USD 3.2 billion in 2025.

What is the market size of the specialty chemicals recycling industry in 2024?

The market size was USD 2.2 billion in 2024, with a CAGR of 29.6% expected through 2034, driven by technological advancements in recycling processes and increasing emphasis on sustainability and circular economy initiatives.

Who are the key players in the specialty chemicals recycling market?

Key players include Arkema, BASF SE, Chevron Phillips Chemical, Covestro, DSM-Firmenich, Dow Inc., Eastman Chemical, Evonik Industries, ExxonMobil, Indorama Ventures, Jiangsu Eastern Shenghong, LyondellBasell, Mitsubishi Chemical, PETRONAS Chemical Group, and SABIC.

Specialty Chemicals Recycling Market Scope

Related Reports