Summary

Table of Content

Smart Water Meter Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Water Meter Market Size

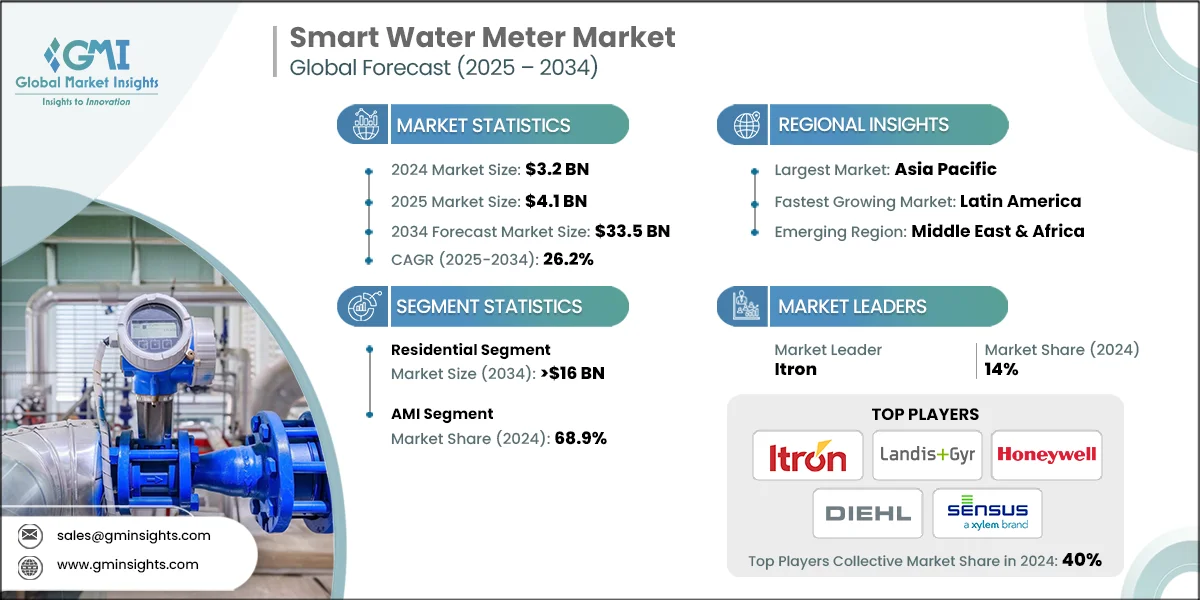

The global smart water meter market size was valued at USD 3.2 billion in 2024. The market is expected to grow from USD 4.1 billion in 2025 to USD 33.5 billion in 2034, at a CAGR of 26.2%, according to Global Market Insights Inc.

To get key market trends

- The smart water meter market is experiencing significant growth driven by technological advancements, increasing emphasis on water conservation, regulatory pressures, and the need for efficient water management systems. As cities and utilities seek to optimize water distribution and reduce wastage, the adoption of smart water meters has gained momentum worldwide.

- One of the primary drivers of this growth is the rising demand for real-time data and improved accuracy in water usage monitoring. Traditional water meters often require manual readings, which can be labor-intensive and prone to errors. Smart water meters, equipped with IoT technology, enable remote monitoring, real-time data collection, and automated billing, thereby enhancing operational efficiency and customer service.

- Government initiatives and regulatory frameworks are also propelling market expansion. Many regions implement policies to promote water conservation and reduce leakages, which facilitate smart meters through early leak detection and consumption analytics. For instance, China invested a record USD 187.8 billion in the construction of water conservancy facilities in 2024.

- Similarly, The U.S. government announced USD 140 million investment for water conservation and efficiency projects as part of the President's Investing in America agenda to enhance the resilience of the West to drought and climate change. Moreover, the Infrastructure Investment and Jobs Act delivers more than USD 50 billion to EPA to improve our nation's drinking water, wastewater, and stormwater.

- Countries facing water scarcity issues are increasingly adopting smart metering solutions as part of their sustainability strategies. Additionally, incentives and subsidies offered by governments further stimulate adoption, especially in developing regions where water management infrastructure is still evolving.

- Technological innovations are expanding the capabilities and affordability of smart water meters. Integration of advanced sensors, machine learning algorithms, and data analytics allows utilities to predict consumption patterns, detect anomalies, and optimize maintenance schedules. The decreasing costs of sensors and wireless communication modules make these systems more accessible for a broader range of applications, from residential households to large industrial complexes.

- The market is also witnessing a shift towards integrated smart water management systems, combining smart meters with other infrastructure components such as leak detection sensors and pressure management tools. This integrated approach enhances overall system efficiency and sustainability. Moreover, global economy underscored the importance of remote monitoring solutions, accelerating investments in smart water infrastructure to ensure reliable water supply.

- Geographically, North America and Europe lead the market due to mature infrastructure, technological adoption, and stringent regulations. However, rapid urbanization and water scarcity issues in Asia-Pacific and the Middle East are driving substantial growth in these regions, presenting lucrative opportunities for market players.

Smart Water Meter Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 26.2% |

| Market Size in 2034 | USD 33.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Water Conservation | Growing awareness about water scarcity and conservation encourages adoption of smart water meters that monitor usage in real-time, promoting efficient water management. |

| Government Regulations and Incentives | Governments are implementing policies and providing incentives to promote smart water meter deployment as part of water sustainability initiatives. |

| Technological Advancements and Connectivity | Developments in IoT, wireless communication, and data analytics make smart water meters more accurate, affordable, and easier to integrate into existing water infrastructure. |

| Pitfalls & Challenges | Impact |

| High Installation and Maintenance Costs | The initial investment for smart meter deployment, including hardware, infrastructure, and ongoing maintenance, can be substantial, potentially hindering widespread adoption. |

| Opportunities: | Impact |

| Integration with Smart Grid and Renewable Energy Systems | Smart meters can facilitate better integration of renewable energy sources and support the development of smart grids, enhancing grid stability and efficiency. |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

Collective market share in 2024 is 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Latin America |

| Emerging Region | Middle East & Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Smart Water Meter Market Trends

- Widespread adoption of IoT (Internet of Things) technologies is transforming water metering systems. Smart water meters equipped with sensors and connectivity capabilities allow for real-time data collection, remote monitoring, and automated billing. This trend enhances operational efficiency for water utilities, reduces manual meter reading costs, and minimizes human errors.

- The integration of data analytics and AI (Artificial Intelligence) is becoming prominent. Utilities leverage advanced analytics to detect leakages, identify consumption patterns, and predict future demand. AI-driven insights enable proactive maintenance and efficient water distribution, leading to significant reductions in water wastage and operational costs.

- The increasing regulatory pressures and governmental initiatives are fueling the market. Many governments worldwide are setting ambitious water conservation targets and mandating the installation of smart meters to promote transparency and efficient water usage. For instance, the U.K.'s AMP8 program mandates the installation of 10 million smart meters by 2030, while Spain’s approximately USD 3 billion PERTE initiative is accelerating smart water infrastructure deployment.

- Another notable trend is the rising focus on sustainability and environmental concerns. Smart water meters contribute to sustainable water management by providing detailed consumption data, promoting responsible usage among consumers, and supporting the development of smart city infrastructure.

- Governments aiming to become more sustainable are investing heavily in smart water infrastructure, including meters, to achieve their environmental goals. The U.S. Bipartisan Infrastructure Law (BIL) has allocated over USD 50 billion to water infrastructure, with a focus on sustainability and equitable access, making it the largest federal investment in water systems to date.

- Furthermore, technological innovations such as the use of advanced materials, improved battery life, and enhanced communication protocols (like NB-IoT and 5G) are making smart water meters more reliable, energy-efficient, and easier to deploy across diverse geographic regions. These innovations facilitate installation in remote or hard-to-reach areas, expanding smart water meter market reach.

- Additionally, the market is witnessing a shift towards hybrid solutions combining traditional metering with digital features, providing a transitional pathway for regions with limited technological infrastructure. This hybrid approach allows utility providers to gradually upgrade their infrastructure while maintaining operational continuity.

- In conclusion, the smart water meter market is characterized by technological integration, regulatory support, sustainability initiatives, and ongoing innovation. As cities and utilities worldwide prioritize resource efficiency and environmental conservation, the demand for smart water metering solutions is expected to grow robustly, shaping the future of water management systems globally.

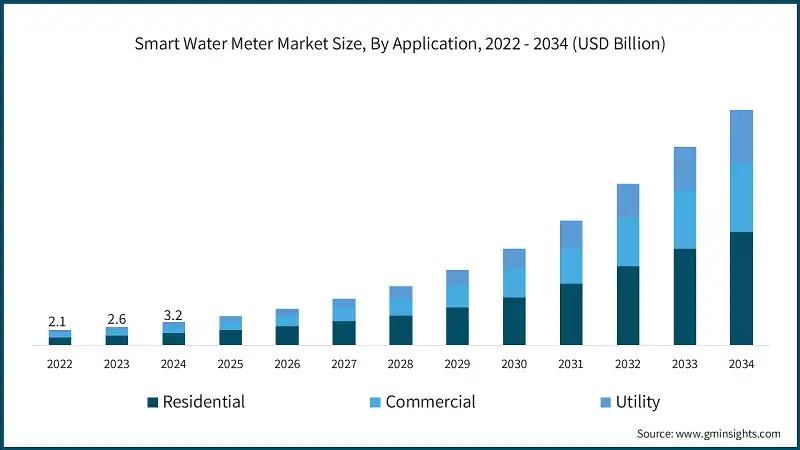

Smart Water Meter Market Analysis

Learn more about the key segments shaping this market

- Based on applications, the market is segmented into residential, commercial, and utility. The residential segment is anticipated to exceed USD 16 billion by 2034. This growth is driven by increasing adoption of smart meters in homes to improve energy management, enhance billing accuracy, and support the integration of renewable energy sources like solar panels.

- Solar energy, especially solar photovoltaic (PV) systems, is rapidly expanding and emerging as a leading component of the renewable energy industry. For instance, by 2024, the global solar PV capacity exceeded 2 terawatts, marked by substantial growth in both new installations and overall electricity production.

- The commercial segment also plays a vital role in the growth of the smart water meter market due to its substantial energy consumption and the need for efficient energy management in businesses, industries, and public facilities. Commercial establishments such as shopping malls, hotels, office buildings, hospitals, and industrial facilities are among the largest consumers of water.

- These entities often face significant challenges related to water management, including high costs, wastage, and the need for compliance with environmental regulations. The deployment of smart water meters in commercial settings offers numerous benefits.

- The growth of these segments is largely fueled by a substantial rise in electricity consumption on a broad scale. Several factors are significantly contributing to this growing demand. For instance, in 2024, the U.S. witnessed a rebound in electricity usage after a decrease in 2023, with an estimated growth rate of 2.5%. This upward trend is expected to continue, as the Energy Information Administration (EIA) projects record-breaking levels of power consumption for both 2025 and 2026.

- Utility providers are responsible for delivering safe and reliable water supplies to urban and rural populations. They face the challenge of managing aging infrastructure, reducing water losses, and ensuring equitable distribution. Smart water meters play a critical role in addressing these issues by providing granular, real-time data on water flow and consumption.

- This data helps utilities detect leaks, illegal connections, or tampering, thereby reducing non-revenue water and improving revenue collection. Moreover, smart meters enable utilities to optimize their distribution networks through better infrastructure management and maintenance planning.

- They also support water conservation efforts by empowering consumers with detailed usage information, encouraging responsible consumption. Additionally, smart meters enhance the accuracy of billing processes, reducing disputes and increasing customer satisfaction. This precision helps utilities meet regulatory compliance and achieve operational efficiency, ultimately supporting sustainable water management practices.

Learn more about the key segments shaping this market

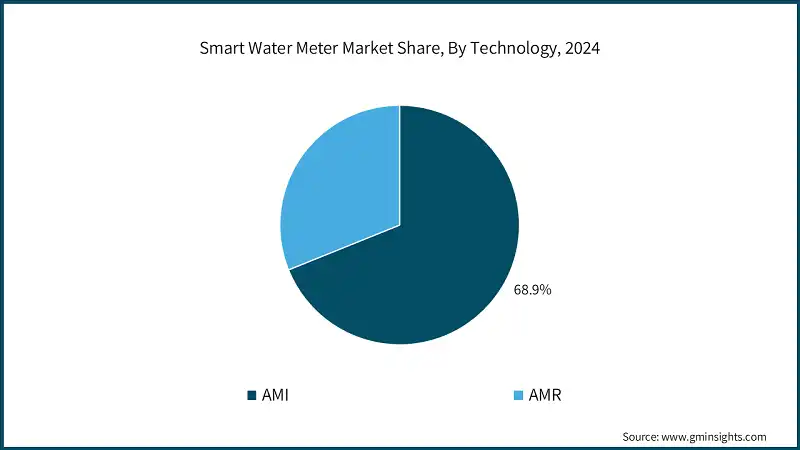

- Based on technology, the smart water meter market is segmented into AMI, and AMR. AMI segment holds the market share of 68.9% in 2024 because of its advanced capabilities compared to AMR (Automatic Meter Reading). AMI systems enable two-way communication between utilities and consumers, allowing for real-time data collection, remote management, and enhanced accuracy.

- This leads to improved efficiency, better demand management, and faster response times for issues such as leaks or outages. Additionally, the increasing adoption of smart grid technologies and the push for digital transformation in water management further favor the growth of the AMI segment, making it the dominant technology in the market.

- The automatic meter reading (AMR) segment plays a vital role in the water utility industry by enabling efficient, accurate, and cost-effective management of water consumption data. Although the AMR segment currently holds a smaller market share compared to the more advanced AMI (Advanced Metering Infrastructure), its significance remains substantial, especially in regions where technological or financial constraints limit the adoption of more sophisticated systems.

- One of the primary advantages of AMR technology is its ability to automate the collection of water usage data without the need for manual meter reading. This automation reduces the labor costs and operational challenges associated with manual readings, which can be time-consuming, labor-intensive, and prone to human error. By facilitating remote data collection, AMR systems help utilities streamline their operations, improve billing accuracy, and enhance overall efficiency.

- The rising government investment in the energy sector is significantly increasing the demand for smart water meters. For instance, in 2024 China's clean energy investment was more than USD 625 billion, almost doubling since 2015. China also achieved its 2030 wind and solar capacity target in 2024, six years ahead of schedule.

- Similarly, Australia has seen its best year for large-scale renewable energy investment since 2018, finishing the year strong in 2024 with USD 9 billion in total capital. This influx of funds often extends beyond energy generation to include smart grid and water management systems that support sustainable operations. Smart water meters are integral to these efforts, providing real-time data for efficient water use, leak detection, and demand management.

Looking for region specific data?

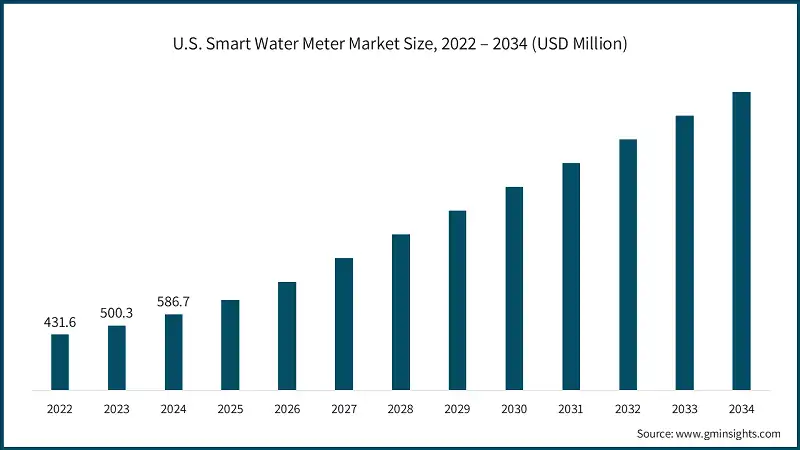

- The U.S. smart water meter market is anticipated to exceed USD 2 billion by 2034. The U.S. faces increasing water scarcity issues in various regions, driven by population growth, climate change, and aging infrastructure. Smart water meters enable utility companies to monitor water consumption in real-time, identify leaks, and detect abnormal usage patterns promptly.

- The U.S. stands as one of the most advanced global economies, accounting for approximately 26.2% of the world’s nominal GDP and around 14.8% based on purchasing power parity, as reported by the World Bank. Its significant role in international trade is evident through its substantial influence on global import and export flows. Therefore, the U.S. will be an important country, which will be considered, in the growth of U.S. smart water meter market.

- APAC countries such as China, India, and Southeast Asian nations are experiencing rapid urbanization and population growth. This surge increases demand for efficient water management solutions to support expanding urban infrastructure. Smart water meters are essential for managing water resources efficiently in densely populated cities, reducing wastage, and ensuring reliable water supply.

- Governments across APAC are increasingly implementing policies and initiatives to promote smart city development, infrastructure modernization, and water conservation. For instance, China’s focus on smart city projects and India’s push for digital governance include the adoption of smart water meters as a key component. These policies boost market growth and adoption rates significantly across the world.

- Moreover, The Middle East is one of the most water-scarce regions globally. Countries like Saudi Arabia, UAE, and Kuwait face some of the lowest per capita water availability in the world, often below 500 cubic meters per year, compared to the global average of around 1,700 cubic meters. This scarcity drives urgent demand for smart water management solutions that reduce water wastage and optimize resource use.

Smart Water Meter Market Share

- The top 5 companies in the smart water meter industry are Itron, Landis + Gyr, Honeywell International, Siemens, Diehl Stiiftung. They are contributing around 40% of the market in 2024.

- These companies are a global leader in smart water management solutions, renowned for their advanced metering infrastructure and innovative IoT-enabled devices. In 2024, Itron contributes significantly to the smart water meter market, leveraging its extensive product portfolio and technological expertise. The company is recognized for developing high-precision, reliable meters that enable utilities to monitor water consumption accurately, detect leaks, and optimize distribution networks.

- Additionally, these companies expand their reach through their wide global presence and extensive service networks, allowing them to execute large-scale projects across regions such as the Middle East, Asia Pacific, and Europe. Their capacity to tailor solutions to meet the unique needs of different grids makes them favored partners for utilities worldwide.

- Beyond their manufacturing capabilities, these companies offer extensive after-sales support, maintenance, and training services, which are essential for ensuring the long-term performance and sustainability of smart water meters. Their strong leadership and continuous technological advancements have reinforced their status as industry leaders, propelling growth and advancing innovation within the dynamic water management landscape.

Smart Water Meter Market Companies

- Xylem maintains a leading position in the smart water metering market through its Sensus and Valor Water Analytics brands. Its solutions combine smart meters, sensors, and long-range communication networks (FlexNet) to enable real-time monitoring and automated billing. Xylem’s technologies have helped utilities like Thames Water reduce consumption by 13% and Nashville save USD 181,000 monthly in meter reading costs.

- Landis + Gyr is a major player in smart metering, holding significant global market share in industrial and water metering applications. The company offers advanced metering infrastructure (AMI) and hybrid solutions for residential, commercial, and industrial sectors. It is actively expanding in regions like the UK, where regulated smart water programs are underway. Landis + Gyr strategic partnerships and innovations in communication technologies (RF, PLC, cellular) strengthen its market presence.

- Honeywell’s Connected Water platform offers end-to-end smart metering solutions, including leak detection, remote monitoring, and predictive maintenance. Its meters are deployed across residential, commercial, and industrial sectors, with integration into platforms like Connexo and Honeywell Forge for analytics and performance optimization.

Major players operating in the smart water meter industry are:

- ABB: ABB delivers smart water solutions through advanced measurement, analytics, and automation technologies. Its digital platforms support leak detection, energy optimization, and real-time monitoring. With global deployments, ABB enhances water sustainability and operational efficiency across utilities and industrial sectors.

- Apator S.A.: Apator S.A. provides a range of smart metering technologies for water, electricity, and gas. Its water meters are known for their reliability and compatibility with remote reading systems. The company emphasizes modular design and interoperability, catering to both residential and industrial applications across various regions.

- Arad Group: Arad Group specializes in advanced water metering solutions, including ultrasonic and volumetric meters. Its products support automated data collection and remote monitoring, helping utilities improve efficiency and reduce water loss. Arad focuses on innovation, user-friendly interfaces, and integration with smart city platforms.

- Badger Meter, Inc.: Badger Meter delivers comprehensive smart water metering systems that include hardware, software, and cloud-based analytics. Its solutions enable utilities to monitor consumption, detect anomalies, and optimize water distribution. The company is known for its commitment to sustainability, precision engineering, and customer-centric technology.

- BMETERS Srl: BMETERS Srl manufactures smart water meters and remote reading systems for residential and commercial use. Its products are designed for easy installation and compatibility with various communication protocols. The company emphasizes innovation, durability, and adaptability to diverse infrastructure environments.

- Diehl Stiftung & Co. KG: Diehl Metering offers smart water metering solutions that focus on precision, connectivity, and sustainability. Its systems support automated data collection and remote monitoring, helping utilities optimize water usage and reduce losses. The company emphasizes innovation and integration with smart city infrastructure.

- Honeywell International Inc.: Honeywell provides smart water metering technologies through its Connected Utilities platform. Its solutions include advanced meters, analytics software, and remote monitoring tools. Honeywell focuses on enhancing operational efficiency, leak detection, and customer engagement through scalable and secure digital infrastructure.

- Itron Inc.: Itron is a global leader in smart metering and utility analytics. Its water metering solutions combine hardware, software, and communication networks to enable real-time data access and system optimization. Itron supports utilities in improving resource management and advancing sustainability goals.

- kamstrup: Kamstrup specializes in ultrasonic smart water meters and intelligent data solutions. Its products are designed for accuracy, durability, and remote reading capabilities. Kamstrup emphasizes digital transformation in water utilities, offering tools for consumption analysis, leak detection, and efficient distribution.

- Landis+Gyr: Landis+Gyr delivers smart metering solutions that integrate advanced communication technologies and data management platforms. Its water meters support automated readings and system diagnostics. The company focuses on interoperability, scalability, and helping utilities transition to smart infrastructure.

- Neptune Technology Group Inc.: Neptune offers smart water metering systems tailored for utility needs, including AMR and AMI technologies. Its solutions enable efficient data collection, leak detection, and customer service improvements. Neptune emphasizes reliability, ease of deployment, and long-term performance in its product design.

- Ningbo Water Meter Co., Ltd.: Ningbo Water Meter Co. manufactures a wide range of smart and mechanical water meters. Its smart solutions support remote reading and data management, catering to both domestic and international markets. The company focuses on cost-effective innovation and adaptability to diverse utility requirements.

- Schneider Electric: Schneider Electric offers smart water management solutions that integrate metering, automation, and energy optimization. Its technologies support efficient water distribution, real-time monitoring, and data-driven decision-making. The company focuses on sustainability, digital transformation, and smart infrastructure development across utility and industrial sectors.

- Siemens: Siemens provides intelligent water metering and infrastructure solutions as part of its broader smart grid and IoT portfolio. Its systems enable remote monitoring, leak detection, and consumption analytics. Siemens emphasizes innovation, interoperability, and scalable platforms for smart city and utility applications.

- Sontex SA: Sontex SA specializes in electronic water and heat meters with remote reading capabilities. Its products are designed for accuracy, reliability, and integration with various communication protocols. The company focuses on user-friendly solutions that support efficient resource management and utility modernization.

- Xylem (Sensus): Sensus, a Xylem brand, delivers smart water metering systems that combine advanced meters, communication networks, and data analytics. Its solutions help utilities improve operational efficiency, reduce water loss, and enhance customer engagement. Sensus emphasizes innovation, sustainability, and scalable infrastructure.

- ZENNER International GmbH & Co. KG: ZENNER offers a wide range of smart water meters and IoT-enabled solutions for residential and commercial use. Its systems support remote reading, consumption analysis, and leak detection. The company focuses on digital transformation, modular design, and integration with smart city platforms.

- Suez: Suez provides smart water metering and digital water management solutions as part of its broader environmental services. Its technologies focus on real-time monitoring, leak detection, and consumption analytics. Suez emphasizes sustainability, operational efficiency, and integration with smart cities and utility infrastructure.

- Baylan Water Meters: Baylan Water Meters manufactures a wide range of smart and mechanical water meters for residential and industrial use. Its smart solutions support remote reading and data management. The company focuses on reliability, innovation, and adaptability to various utility requirements.

- BOVE Technology: BOVE Technology develops smart water metering systems with integrated communication capabilities. Its products are designed for accurate measurement, remote monitoring, and efficient data collection. BOVE emphasizes technological advancement, user-friendly design, and compatibility with modern utility networks.

Smart Water Meter Market News

- In March 2025, Itron, Inc. which was innovating new ways for utilities and cities to manage energy and water, announced that it was bringing its Cyble communications module to the Asia-Pacific region. The module, which was already deployed throughout EMEA, allowed mechanical water meters to become communication devices. This facilitated the transition from manual meter reading to automated meter reading and advanced metering infrastructure by enhancing the functionality of existing mechanical meters.

- In March 2024, British water utility United Utilities selected telecommunications company Arqiva to deliver over one million smart meters before 2030. The deal, valued at USD 309 million until 2030 with an option to extend for an additional five years, included sourcing, installing the smart meters and related devices. It also encompassed establishing and managing the data communications network infrastructure required for the smart metering system. This partnership aimed to enhance water management and customer service through advanced smart metering technology.

- In March 2024, Diehl Stiftung responded to the increasing demand for its HYDRUS water meters in the America market by ramping up production. The company increased its manufacturing capacity to meet the rising needs of utilities and water management providers across the United States. Alongside expanding production, Diehl was also committed to reducing its carbon footprint, supporting environmentally sustainable practices.

- In January 2024, Siemens announced the launch of its next-generation smart meters equipped with enhanced cybersecurity features and integrated AI analytics. These advanced meters aim to improve grid management by providing real-time data and predictive insights. Siemens plans to expand their smart meter portfolio by 2025, focusing on modular designs that facilitate renewable energy integration and support grid resilience.

The smart water meter market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & (‘000 Units) from 2021 to 2034, for the following segments:

Market, By Application

- Residential

- Commercial

- Utility

Market, By Technology

- AMI

- AMR

Market, By Product

- Hot water meter

- Cold water meter

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Sweden

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Egypt

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the smart water meter market?

Key players include Itron, Landis+Gyr, Honeywell International, Diehl Stiftung, Xylem (Sensus), ABB, Apator S.A., Arad Group, Badger Meter, and Kamstrup.

Which region leads the smart water meter market?

The U.S. smart water meter market size exceeded USD 2 billion by 2024, fueled by increasing water scarcity, aging infrastructure, and government investments like the Bipartisan Infrastructure Law.

How much revenue is the residential application segment expected to generate in 2034?

The residential application segment set to exceed USD 16 billion by 2034, leading the market due to widespread adoption for improved water management and billing accuracy.

What was the valuation of the AMI technology segment in 2024?

The AMI technology segment held a 68.9% market, because of its advanced capabilities compared to AMR (Automatic Meter Reading).

What are the upcoming trends in the smart water meter industry?

Key trends include widespread IoT adoption, AI-driven analytics for leak detection and demand prediction, and hybrid metering solutions to support infrastructure transitions.

What is the projected value of the smart water meter industry by 2034?

The smart water meter market is expected to reach USD 33.5 billion by 2034, dupported by IoT integration, regulatory support, and increasing demand for efficient water management.

What is the current smart water meter market size in 2025?

The global market for smart water meter is projected to reach USD 4.1 billion in 2025.

What is the market size of the smart water meter in 2024?

The market size was USD 3.2 billion in 2024, with a CAGR of 26.2% expected through 2034, driven by technological advancements, water conservation efforts, and regulatory mandates.

Smart Water Meter Market Scope

Related Reports