Summary

Table of Content

Smart Mattress Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Mattress Market Size

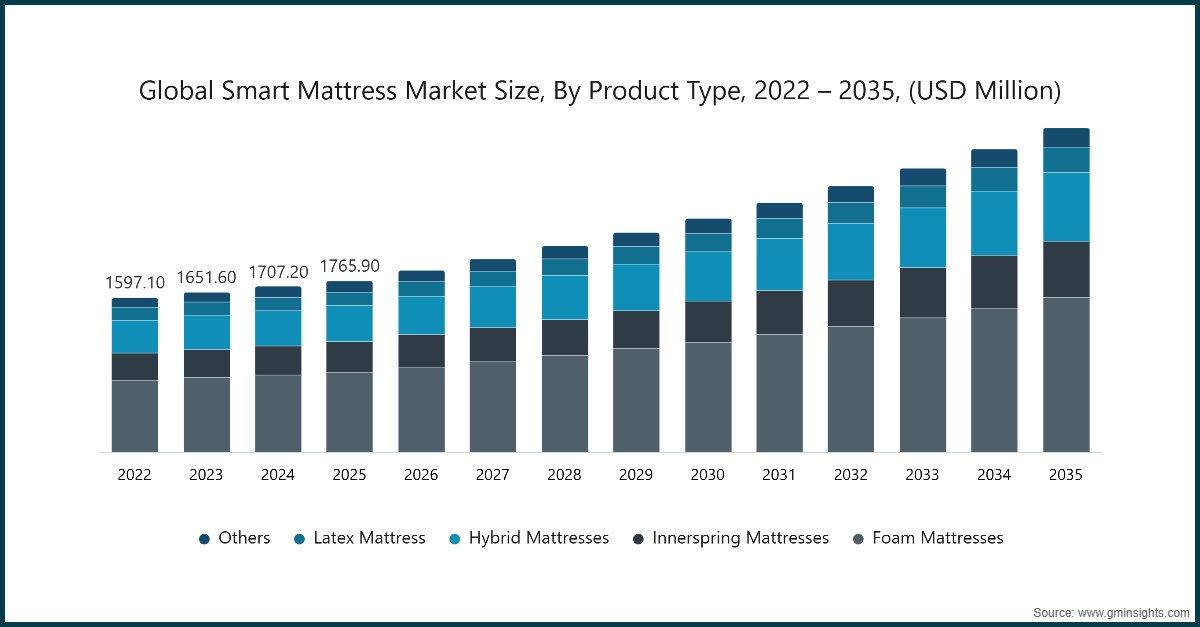

The smart mattress market was estimated at USD 1.76 billion in 2025. The market is expected to grow from USD 1.87 billion in 2026 to USD 3.34 billion in 2035, at a CAGR of 6.6% according to latest report published by Global Market Insights Inc.

To get key market trends

The demand for advanced sleep optimization systems is primarily driven by sustainability within the realm of personal health and the requirement to adhere to digital health standards, aided by the rising number of mergers and acquisitions between market leaders. Mergers between the market leaders such as Sleep Number, Tempur Sealy, and Eight Sleep contribute towards the market experiencing rising innovations, product expansion, and enhanced market presence. The traditional methods necessary for enhanced sleep foam support or the basic orthopedic designs, are now outdated among the modern consumers. The modern smart mattresses create a more optimized environment since they can effectively improve sleep on both the physical and digital aspects, thereby contributing towards enhanced health elements. This integration within the sleep tech domain falls within the overall preference within the consumer space towards data-aided health optimization and hence the contribution within the rising demand within the market.

Increasing demand for smart home integration and the luxury lifestyle development in North America, coupled with growing healthcare and wellness budgets in Europe and pockets of the Asia-Pacific, are the main factors driving the commercial viability for this equipment. In addition, both homeowners and hospitality professionals are increasingly inclined toward automated and responsive sleep solutions that move beyond traditional, unresponsive methods-from manual position adjustments to fixed-firmness mattresses. Generally, IoT sleep systems are recognized as a more effective and lifestyle-aligned alternative because their ability to convert biometric data into actionable insights or real-time comfort adjustments has been speaking volumes.

One of the most defining factors in the market for integrated sleep platforms is the use of biometric sensors and AI-driven thermal regulation units that have gained prominent traction due to proven benefits, among which are the minimization of sleep health hazards and chronic fatigue. The fact that their market is highly dependent on the awareness of the long-term benefits from high-efficiency sleep tracking, which in its turn results in wider acceptance of these potent devices, is beyond any doubt.

Apart from that, continuous refinements in responsive materials-including SmartGrid-and frame design will further enhance user safety and ease of operation. This interplay of smart home readiness with an industry-wide focus on preventive health management, coupled with a demand for high-tech convenience, is supporting the market's positive financial performance.

The market is backed by fundamental elements such as progress in sensor-embedded fabric and adaptive foam technologies, which drive the transformation of basic furniture into highly durable, health-specific machinery. The development experienced within the industry is highly focused on nano sensors and phase-change cooling materials that improve efficiency and comfort when handling wider ranges of body temperature and sleep posture. The companies are very active not only in improving user experience with mobile-enabled performance monitoring to offer enhanced health tracking but also in the introduction of automated self-adjusting firmness systems for better ergonomics in high-pressure situations. The biggest factor leading the smart mattress market pertains to rapid urbanization and high-end residential projects, along with professional and homeowner desire for scientifically optimized, recovery-focused sleep.

This efficiency has been very attractive to both hospitality providers looking for premium guest experiences and healthcare firms that require patient monitoring, which is both consistent and non-invasive. The choice of this technology impacts directly on the makeup of the market: the Biometric Tracking and Thermal Regulation segments consistently record the highest revenue share and thus account for most of the total market revenue over the last years. The major share of this segment is directly related to machines' strong performance, long life, and high scalability; thus, they are a perfect match for the modern professional's requirement of versatility and data-driven recovery.

Besides, technology is getting increasingly important, and digital pressure mapping means more personalized and accurate sleep. These mutually reinforcing trends reveal not only the market's vivacity but also its capacity to satisfy the needs of wellness management worldwide.

Further, market players in the smart mattress industry focus on the construction of internal sensor arrays and cooling layers that imply state-of-the-art technology, for example, the development of durable smart fibers, advanced multi-zone pneumatic design, advanced AI-driven sleep coaching systems offering much faster physical recoveries.

Smart Mattress Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.76 Billion |

| Market Size in 2026 | USD 1.87 Billion |

| Forecast Period 2026-2035 CAGR | 6.6% |

| Market Size in 2035 | USD 3.34 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Awareness of Sleep Hygiene & Wellness | Increasing clinical evidence linking sleep to mental health and longevity drives consumers to invest in high-end, data-tracking mattresses. This fuels demand for systems that monitor heart rate, respiratory patterns, and sleep stages. |

| Integration with Smart Home Ecosystems | Consumers now expect mattresses to "talk" to smart thermostats, lighting, and alarms. This connectivity drives the adoption of IoT-enabled beds that can pre-cool or pre-warm based on the users schedule. |

| Growth in the Luxury Hospitality & Healthcare Sector | Growth in the Luxury Hospitality & Healthcare Sector |

| Pitfalls & Challenges | Impact |

| High Price Point and Long Replacement Cycles | Advanced biometric and thermal systems significantly increase the retail price. Unlike software, a mattress is a 7–10 year investment, making frequent upgrades difficult for the average consumer. |

| Concerns over Data Privacy & Security | The collection of sensitive health and biometric data via built-in sensors raises significant privacy concerns, necessitating robust cybersecurity measures and transparent data policies. |

| Opportunities: | Impact |

| AI-Driven Personalized Sleep Coaching | Developing AI engines that not only track sleep but provide active coaching—such as adjusting mattress firmness in real-time to stop snoring—creates a high-value competitive edge. |

| Subscription-Based "Wellness-as-a-Service" | As the hardware base grows, manufacturers can offer premium monthly insights, telehealth integration, and cloud-based analytics as a high-margin, recurring revenue stream. |

| Market Leaders (2025) | |

| Market Leader |

Market share 8% |

| Top Players |

Collective market share 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Smart Mattress Market Trends

The industry surrounding the smart mattress is witnessing dynamic shifts because of the growing number of new product offerings and innovative technology adoption by the leaders in this industry. The major players in this industry are launching innovative sleeping systems with novel features such as AI-enabled biometric sensing, live heat management, and connectivity. Such innovative offerings in the industry are being designed for consumers who are constantly growing and demanding efficient and easy-to-use solutions for sleeping optimization and health restoration. The industry’s adaptation to such trends is a testimonial to their dedication towards innovative ideas, thereby providing innovative tools to their customers to optimize physical restoration and 'sleep debt' and make way for a more efficient wellness cycle.

- Technology Development, Innovation in Products: There is a technological advancement in sleep technology with more advanced sleep solutions in the form of the inclusion of IoT-pressure mapping technology in addition to AI-coaching solutions for better health management. In order to make healthcare solutions for sleep more efficient and extend its useful lifespan to the mattress, there is a development in more energy-efficient cool/heating solutions, as well as a phase-change cover solution.

- Sustainable Sleep Practices: The use of proper material procurement is a practice aimed at avoiding the ecological effect of the discarded traditional foam. Major manufacturers have begun using biodegradable natural latex, organic cotton, and steel coils made from recycled materials, thus facilitating a circular economy. This is where companies are striving towards the application of environmentally responsible ESG policies and carbon neutrality initiatives as a result of the elimination of synthetic VOCs.

- Global Healthcare & Lifestyle Crises: The escalating levels of stress and the number of sleep disorders, including insomnia and sleep apnea, are causing extreme levels of recovery difficulties among various groups of people. As a result, the demand for sleep monitoring of a diagnostic nature is rising drastically. This is leading to a constant demand for bedroom remediation and fueling the reliance on smart mattresses among healthcare practitioners, athletes, and health-oriented households.

- Emphasis on Public Health and Smart Home Synergy: There is an evident focus on the management and upkeep of public health from property management firms and homeowners. Sleep cycles have thus been brought within the Smart Home context, where mattresses are linked to lighting and thermoregulators to provide a ‘perfect’ sleep phase. The never-ending quest to validate public health through data is thereby causing a yearly constant demand for a smart sleep solution within the residential and commercial sectors.

Smart Mattress Market Analysis

Learn more about the key segments shaping this market

Based on the product type, the market is divided into foam mattresses, innerspring mattresses, hybrid mattresses, latex mattresses, and others. The foam mattresses segment accounted for over 46.5% of the market share in 2025.

- Foam mattresses hold a significant portion of the market value and exhibit strong growth, indicating a continued consumer preference for the material's ability to integrate deeply embedded biometric sensors and heating/cooling coils seamlessly.

- The need for high-pressure relief combined with smart posture-adaptive technology is encouraging segment growth, particularly in the premium residential sector.

- Hybrid and Innerspring segments show a healthy growth rate, suggesting consistent demand from traditional mattress users who are transitioning to "smart" features but still prioritize the familiar support and airflow of coil-based systems.

- Latex and specialized eco-friendly units are ideal for health-conscious consumers. Wellness-focused buyers appreciate the hypoallergenic properties of latex combined with the data-driven insights of smart tracking

Learn more about the key segments shaping this market

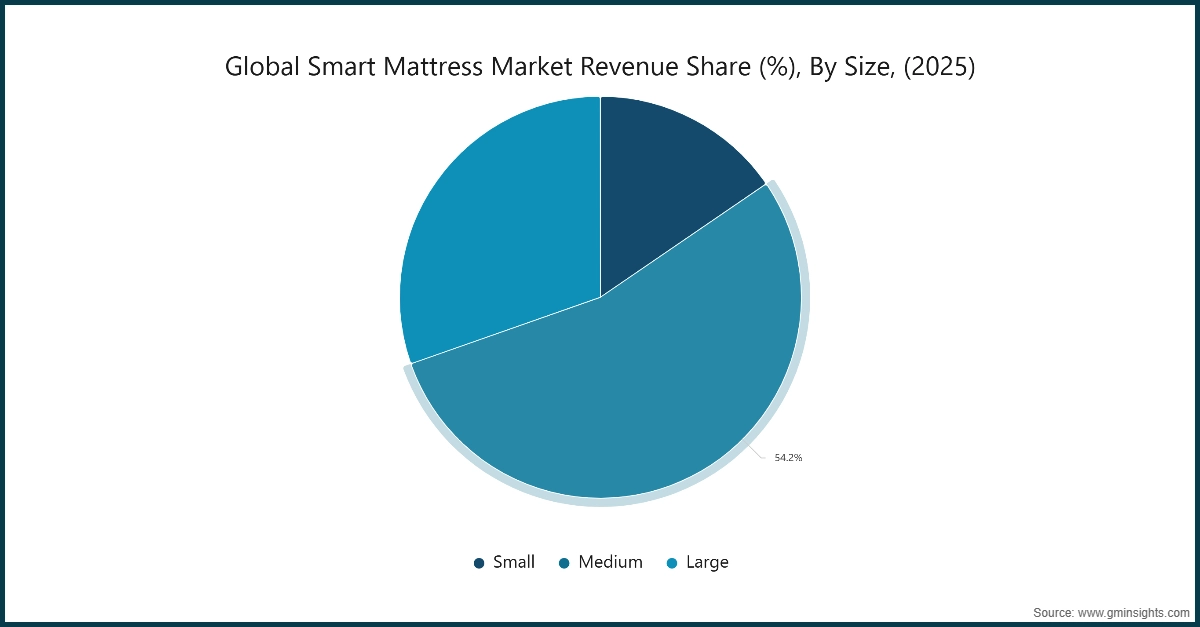

Based on the size, the smart mattress market is segmented into small, medium, and large. In 2025, the medium size (Queen/Full) held the major market share of 54.2%, reflecting the standard consumer preference for master bedroom dimensions.

- Medium-sized units represent the largest portion of the market and show the most consistent growth rate, as they are the standard for couple-based sleep tracking (dual-zone monitoring).

- Large-sized mattresses (King/California King) account for 30.4% of the market share, catering to the luxury high-end segment where users demand maximum space alongside advanced climate control and snoring-mitigation features.

- Small-sized units are primarily utilized for single-occupancy residential use or specialized medical/nursing home facilities, focusing on individual health-metric tracking.

Based on the application, the smart mattress market is segmented into Residential and Commercial. In 2025, residential segmnt held a major market share of 82.7%, generating a revenue of USD 1.46 billion.

- Residential segment represents the largest portion of the market, driven by the global "sleep economy" trend where individuals invest heavily in home-based health optimization and smart home ecosystems.

- Commercial segment, while currently smaller, is a vital area for expansion with a projected revenue of USD 541.8 million by 2035, reflecting the hospitality industry's shift toward "smart rooms" and the healthcare sector's use of smart beds for patient monitoring.

- This trend is consistent with a market that is increasingly prioritizing preventative healthcare and personalized recovery, gradually increasing the residential sector's dominance in total market value.

Looking for region specific data?

North America Smart Mattress Market

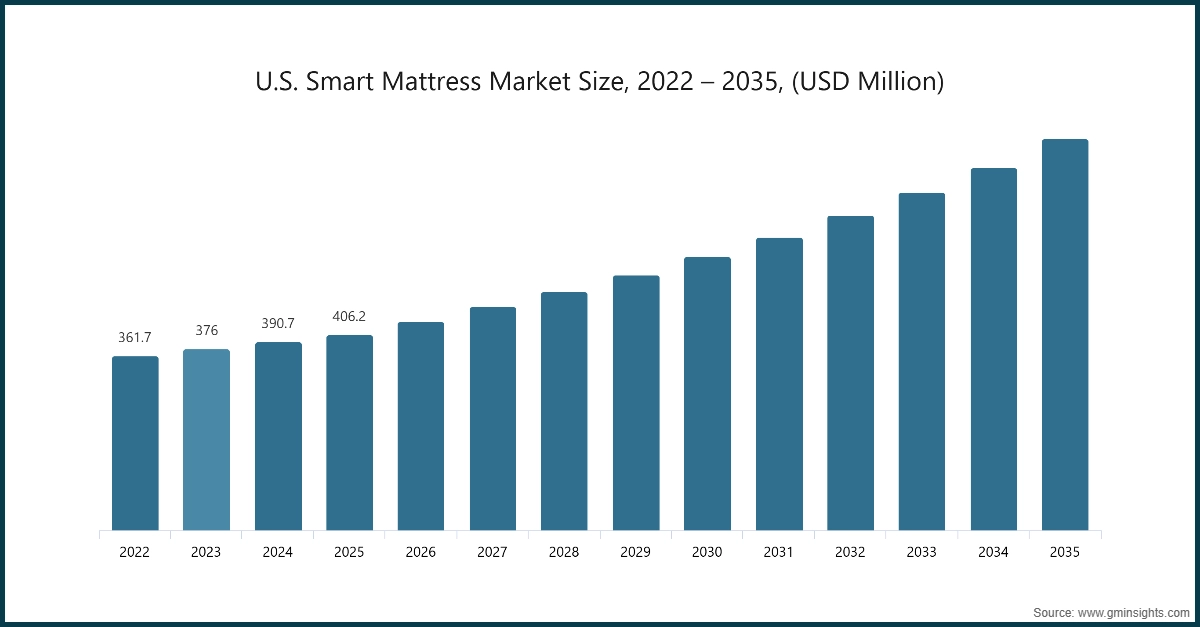

In 2025, North America is a leading regional market for smart mattresses. It has an estimated market value of USD 537.3 million in 2025, with a projected growth rate of 7.2% through 2035.

- The U.S. leads the region, showing a strong growth rate of 7.2%, driven by a mature consumer base with high disposable income and a strong early adoption of smart home ecosystems.

- Smart mattresses in this region are increasingly viewed as essential health-monitoring tools, integrating seamlessly with other IoT devices to track vital metrics like heart rate and respiratory patterns.

- The North American market meets consumer needs by offering high-tech solutions such as AI-driven automatic firmness adjustments and climate control, catering to a wellness-conscious population.

- A robust retail infrastructure, combined with a significant shift toward Direct-to-Consumer (DTC) online channels, facilitates easy access to premium sleep technologies across the continent.

Europe Smart Mattress Market

Europe market estimated at USD 345.6 million in 2025, with a projected growth rate of 5.7% through 2035. Germany leads the region with a growth rate of 6.7% and a market value of USD 108.4 million in 2025, supported by its strong emphasis on engineering excellence and premium home furnishings.

- The European market benefits from a growing focus on holistic health and sustainability, encouraging the adoption of mattresses made with eco-friendly materials and energy-efficient smart features.

- These trends make Europe a competitive landscape for innovation, particularly in "smart-meets-sustainable" technologies. Countries like France and the UK show steady growth driven by aging populations seeking better sleep ergonomics.

- The broader European market is influenced by stringent data privacy regulations (such as GDPR), which drive manufacturers to innovate in secure, on-device sleep analytics and transparent data usage.

Asia Pacific Smart Mattress Market

Asia Pacific is the largest and fastest-growing regional market. It has an estimated market value of USD 633.2 million in 2025, with a projected growth rate of 7.5% from 2026 to 2035.

- China holds the largest market share in the region, valued at USD 210.8 million in 2025, while India shows a high sub-regional growth rate of 7.7%.

- The rapid growth in Asia Pacific results from massive urbanization, a rising middle class with increasing purchasing power, and a cultural shift toward tech-integrated lifestyles in major metropolitan hubs.

- Rising awareness of the link between sleep quality and productivity significantly influences market growth, promoting local competition and the rapid entry of tech giants into the smart bedding space.

- Countries like Japan and South Korea remain vital players, demanding high-end equipment for compact urban living environments where space-saving and multifunctional smart furniture are prioritized.

Latin America Smart Mattress Market

Latin America represents a developing region of the global market, expected to reach USD 84.5 million by 2025, growing at a rate of 4.7% through 2035.

- Brazil is the primary driver in the region, projecting a growth rate of 5.1% with the largest market value of USD 40.8 million in 2025.

- Overall growth is steady, supported by the expansion of the hospitality and luxury real estate sectors, particularly in major tourist destinations and growing urban centers like Mexico City and São Paulo.

- Increasing industrialization in Mexico is boosting demand for smart sleep solutions as part of a broader trend toward modernizing home interiors.

- Market players focus on offering durable and cost-effective smart entry-level models to capture a wider consumer base, with demand often stemming from tech-savvy younger generations and premium hotel upgrades.

Smart Mattress Market Share

Sleep Number Corporation is leading the market with approximately 8% market share. Top players include Hilding Anders, Sleep Number Corporation, Somnigroup International, Eight Sleep, Emma Sleep collectively hold around 30%, indicating a moderately consolidated yet competitive landscape. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions, and collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Tempur Sealy completed its approximately USD 5 billion acquisition of Mattress Firm, the largest mattress specialty retailer in the U.S. This strategic move created a vertically integrated global bedding giant, rebranded as Somnigroup International Inc. The acquisition enhances the company’s retail footprint and omnichannel capabilities, positioning it to dominate both manufacturing and direct consumer distribution.

- The Sleep Company and Wakefit continued aggressive expansions in the Asia Pacific region. Specifically, The Sleep Company expanded its physical presence to over 30 stores while scaling its patented SmartGrid technology. This follows a broader trend of "Sleep-Tech" companies opening experience centers to serve the rapidly growing South Asian middle class.

Smart Mattress Market Companies

Major players operating in the smart mattress industry are:

- Amerisleep

- Casper Sleep Inc.

- Eight Sleep

- Emma Sleep

- Hilding Anders

- iOBED

- Kingsdown, Inc.

- Leesa Sleep

- Nolah Sleep

- Purple Innovation, LLC

- ReST (Responsive Surface Technology)

- Sleep Number Corporation

- Somnigroup International

- Tempur Sealy International, Inc.

- The Sleep Company

The Sleep Company and Kurlon are leading a shift toward "intelligent surfaces" with the 2025 launch of enhanced, high-performance materials. Engineered for optimal thermoregulation and pressure relief, new SmartGrid and Phase-Change Material (PCM) layers are designed to maintain a consistent sleep surface temperature of 25-26°C—up to 8°C cooler than traditional foams. Unlike standard memory foam, these advanced materials utilize open-cell structures and "drilled" air-cool designs with over 250+ ventilation channels to dissipate heat instantly. Unveiled at major 2025 industry events, these multifunctional designs allow for simultaneous spinal alignment and moisture-wicking, providing a significant advantage for both residential users and premium hospitality suites.

Smart Mattress Market News

- In August 2025, Eight Sleep secured USD 100 million in Series D funding to accelerate its pivot from consumer wellness into the medical and preventive health space. The funding supports the development of an "AI Sleep Agent" that creates "digital twins" of a user's sleep physiology, alongside new diagnostic features for conditions like sleep apnea and menopausal sleep disruptions.

- In May 2025, Eight Sleep launched the Pod 5, featuring a hydro-powered blanket for 360-degree thermal control and a new adjustable base with "Snore Response" technology that automatically elevates the sleeper's head upon detecting respiratory distress.

- In November 2025, Sleep Number announced a comprehensive business turnaround plan for 2026, focusing on fixed-cost reductions of USD 135 million. The strategy includes simplifying their smart bed lineup to attract a broader customer base and expanding distribution through new digital partnerships like HSN (Home Shopping Network).

- In 2025, Somnigroup (formerly Tempur Sealy) expanded its strategic partnership with the Calm app to integrate multi-sensory relaxation content directly into its TEMPUR-Ergo Smart Bases, creating an ecosystem that combines physical comfort with mental wellness.

- In late 2025, Emma Sleep partnered with YAAP to scale its presence in the Indian market, aiming for exponential impact in 2026. This follows Emma's successful scaling to over INR 400 crore annual revenue within the region by focusing on a digital-first, influencer-led strategy for its premium smart models.

The smart mattress market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Foam mattresses

- Innerspring mattresses

- Hybrid mattresses

- Latex mattress

- Others

Market, By Size

- Small

- Medium

- Large

Market, By Height

- Below 5 inch

- 5 inch - 10 inch

- Above 10 inch

Market, By Firmness Level

- Soft

- Medium

- Firm

Market, By Price Range

- Low

- Medium

- High

Market, By Application

- Residential

- Commercial

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the smart mattress market?

Key players include Sleep Number Corporation, Eight Sleep, Emma Sleep, Somnigroup International, Hilding Anders, Tempur Sealy International Inc., The Sleep Company, Purple Innovation LLC, Casper Sleep Inc., Amerisleep, Kingsdown Inc., Leesa Sleep, Nolah Sleep, ReST (Responsive Surface Technology), and iOBED.

Which region leads the smart mattress market?

North America market size was worth USD 537.3 million in 2025, with a projected growth rate of 7.2% expected through 2035.

What are the upcoming trends in the smart mattress market?

Key trends include AI-enabled biometric sensing, IoT-pressure mapping technology, phase-change cooling materials, subscription-based wellness services, and integration with smart home ecosystems for optimized sleep environments.

How much revenue did the residential application segment generate in 2025?

The residential segment generated USD 1.46 billion in 2025, holding 82.7% market share driven by home-based health optimization trends.

What was the market share of foam mattresses segment in 2025?

Foam mattresses held the largest share, accounting for 46.5% of the global smart mattress market in 2025, due to their ability to integrate biometric sensors and heating/cooling systems seamlessly.

What is the growth outlook for Asia Pacific smart mattress market from 2026 to 2035?

Asia Pacific market is projected to grow at 7.5% CAGR till 2035, driven by rapid urbanization, rising middle class purchasing power, and tech-integrated lifestyle adoption in metropolitan hubs.

What is the market size of the smart mattress in 2025?

The market size was USD 1.76 billion in 2025, with a CAGR of 6.6% expected through 2035 driven by rising awareness of sleep hygiene, smart home integration, and wellness-focused consumer preferences.

What is the projected value of the smart mattress market by 2035?

The smart mattress market is expected to reach USD 3.34 billion by 2035, propelled by AI-driven personalized sleep coaching, biometric tracking innovations, and expansion in luxury hospitality sectors.

What is the current smart mattress market size in 2026?

The market size is projected to reach USD 1.87 billion in 2026.

Smart Mattress Market Scope

Related Reports