Summary

Table of Content

Smart Glass Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Glass Market Size

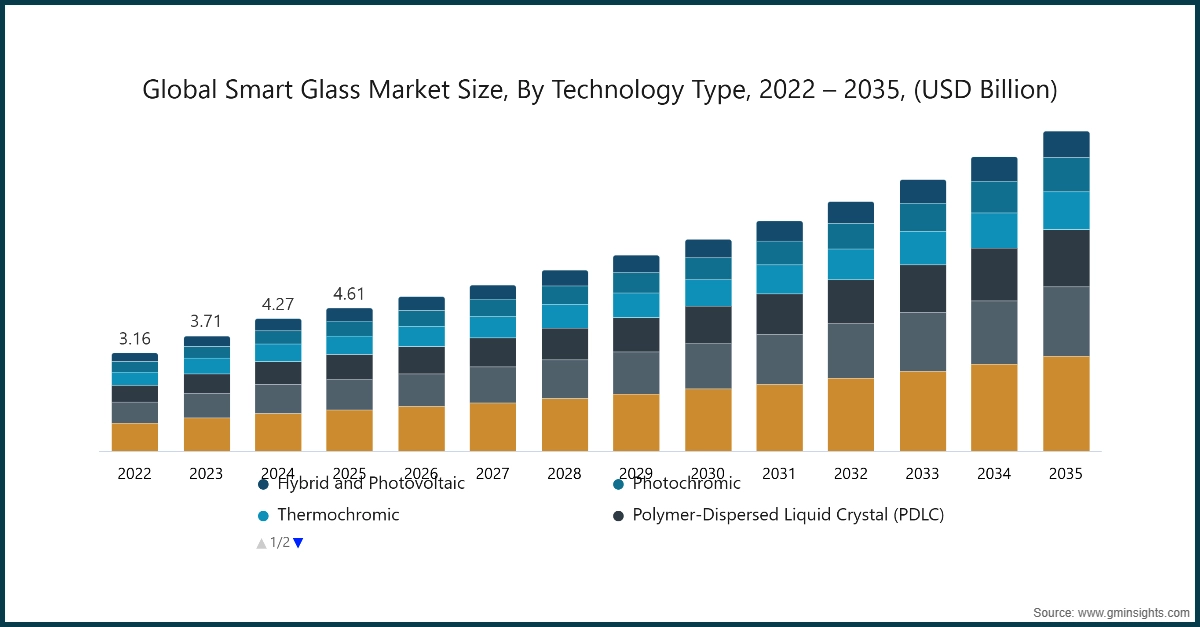

The global smart glass market was estimated at USD 4.6 billion in 2025. The market is expected to grow from USD 5 billion in 2026 to USD 10.3 billion in 2035, at a CAGR of 8.4% according to latest report published by Global Market Insights Inc.

To get key market trends

The rising awareness among people about environment sustainability is fueling the adoption of smart glass because of partnerships being established between key companies in the industry. Conventional light management systems, including manually adjusted blind systems or permanent tint coating, are less effective in managing a structure's energy consumption footprint. Smart glass is more environment-friendly because this technology responds dynamically to achieve adjustments in transparency and tint to ensure that there is minimal solar heat gain in a structure, making artificial lighting systems obsolete. This environment-friendly technology is driving the aggressive growth in the market because of its contribution to net zero architecture, which has become a preferred choice for people globally.

A growing demand for energy-efficient infrastructure and urban development in North America, together with an increasing governmental mandate for green building construction in Europe and other regions of Asia-Pacific, provides, therefore, the underlying commercial viability of this technology.

Consumers and architects alike want mechanized, automated solutions for climate control, as opposed to the older, static methods like heavy drapery or external shading systems. Smart glass is widely regarded as a cleaner, more sophisticated, and environmentally responsible alternative to many of its peers working on modern facades, turning from transparent to opaque or tinted depending on environmental triggers.

Smart glass benefits from the increasing need for less intrusive and more responsive methods of indoor environmental control by developers and residential homeowners alike, including reducing UV radiation exposure and mitigating the energy costs of excessive HVAC usage. This market is clearly influenced by the increasingly expansive awareness of the long-term cost-savings brought about by climate-adaptive glazing, which is leading to its increased adoption. Moreover, continuous enhancements will be made in thin-film coating and sensor integration set to improve response times and durability. Such a synergistic combination of regulatory support, an industry-wide focus on energy conservation, and a demand for high-tech convenience bolsters the market's strong financial trajectory.

The cornerstone supporting the market's steady growth is innovation in thin-film and electrochromic technology, turning standard panes into highly durable, application-specific functional surfaces. A distinct move toward low-voltage active systems and advanced "self-tinting" passive materials that improve heat rejection and optical clarity across varying conditions of light is observed in the industry. With all these new technologies, manufacturers also put a heavy focus on improving user experience, with features such as smartphone app integrations for remote tint control, integrated IoT sensors for real-time light management in self-contained solar-powered glass units to make retrofitting easier. Control technology is also one of the major areas of focus, where rising demand for automated Building Management System (BMS) integration is pushing the development of newer AI-driven smart windows.

The key factor contributing to the growth of the smart glass market includes the rapid increase in commercial and luxury residential construction, coupled with a growing automotive demand for high-value, obstruction-free driving environments. Unlike traditional glass, smart glass electronically changes its molecular structure just beneath its surface, serving as an effective block to heat build-up while creating a clear view and drastically reducing a building's overall carbon footprint.

This effectiveness has strongly appealed to car manufacturers wanting improved passenger comfort, as well as architectural firms demanding reliable, high-performance thermal barriers on a consistent basis. Furthermore, such demand is directly mirrored in market dynamics, where the Electrochromic & Suspended Particle Device (SPD) market segment portrays the largest market share in terms of cumulative revenues, accounting for most of the total market in recent years. In fact, such dominance in market shares is directly attributed to the high efficacy of such glass products, possessing a long-term ability to meet all of today’s professionals' demands concerning aesthetic freedom in addition to energy efficiency. Moreover, technology is bound to play a highly integral part with functions such as voice-activation-related functionality in providing a highly specialized experience.

In addition, smart glass market players have been focusing on developing switchable glazing that uses sophisticated technology, including the design of more resilient conductive coatings, liquid crystals, and improvements in lamination techniques to achieve rapid tinting.

The relevance of intelligent building envelopes will continue to be of utmost importance with the growing development of cities and establishment of new business districts. Smart glass is a critical component in such developments due to its ability to ensure a smooth operation of buildings by managing solar and privacy functions effectively. Such a requirement is especially pressing with the growing awareness of sustainable city planning practices, which advocate for reduced carbon emissions during consumption and maximized sunlight ingress. Another factor that drives property owners to invest in sophisticated glazing products is the growing property value with LEED ratings ensured by high-performance glazing products.

Innovations are expected from companies with advanced glazing solutions that promote quicker transitions between phases with greater ease. The smart glass market is expected to continue growing at a rapid pace as a result of the increasing urbanization rate of smart cities. All available indications show that growth is expected in this market.

Smart Glass Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.6 Billion |

| Market Size in 2026 | USD 5 Billion |

| Forecast Period 2026-2035 CAGR | 8.4% |

| Market Size in 2035 | USD 10.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rise in energy-efficient building demand | Increasing global energy costs and "Green Building" certifications (LEED/BREEAM) drive the adoption of electrochromic windows that reduce HVAC loads by up to 20-30%. |

| Advancements in automotive integration | Growing consumer preference for premium features in Electric Vehicles (EVs) boosts demand for SPD and PDLC sunroofs, windshields, and mirrors for heat and glare control. |

| IoT and smart home ecosystem integration | The ability to control glass tint via mobile apps, voice assistants, and AI-driven sensors aligns with the modern push for fully automated residential and commercial environments. |

| Pitfalls & Challenges | Impact |

| High initial installation and material costs | Smart glass typically costs 2x to 4x more than standard high-performance glazing, which remains a primary barrier for mass-market residential adoption. |

| Technical complexity and reliability issues | Challenges with switching speeds (latency), long-term durability of chemical layers, and the need for specialized electrical wiring during installation. |

| Opportunities: | Impact |

| Electrification and AI-driven tinting | Developing "Active-on-Demand" windows that use AI to predictively tint based on weather forecasts maximizes energy savings and improves occupant well-being. |

| Expansion of the healthcare and hospitality sectors | Growing demand for switchable privacy glass (PDLC) in hospitals and luxury hotels offers a hygienic, curtain-free solution for instant privacy. |

| Market Leaders (2025) | |

| Market Leader |

8% market share |

| Top Players |

The collective market share in 2025 is 28% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | Mexico, Japan, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Smart Glass Market Trends

The smart glass industry is witnessing a set of dynamic trends that have been fueled by the increase in the number of innovative product launches and technological advancements undertaken by key players across the industry. Major players have been launching the latest and most advanced versions of smart glasses that feature cutting-edge technology with new features such as adaptive tinting, better optical clarity, and sensors among others. Such technological advancements have been met with affirmative market reaction, vividly projecting the industry's focus on innovation and delivering smarter materials that improve the functionality of the building for enhanced productivity and efficiency.

- Advancement of technology and innovation: There is a trend toward more advanced glazing with a move toward wireless control systems as well as adoption of internet of things-enabled building management systems. There are innovations being developed for making electrochromic coatings and ultra-thin layers of glass for improved switching speed and reliability

- The rise in the development of green buildings and sustainable architecture: The overall health of the sustainable construction and smart cities industry in particular has played an important role in the growth scenario. The commercial architecture segment has existed as the leading segment in the industry and has accounted for a large share in the total revenue. The demand for smart glass solutions has remained consistent due to the growing need for proper energy management along with a modern facade.

- Sustainable Environmental Management: Smart glass solutions for light and temperature control in high-rise buildings can efficiently reduce the wasted energy in these buildings while also reducing the carbon emissions from them. The systems can thus be aligned with the global mission to reduce carbon emissions by different countries while also meeting the criteria for green certifications like LEED and BREEAM rating systems in sustainable building designs.

- Increasing cases of severe weather and temperature: Rising cases of severe weather and temperature are being experienced due to climate change, which is characterized by high amounts of heatwaves and varying levels of solar radiation. This consequently raises the need for adaptive thermal barriers. Thus, there is a high need for smart glass due to a constant need for high-performance glazing that is self-regulating concerning harsh sunlight.

- More focus on integrating smart infrastructure and urban forestry: The property management firms and smart city projects are increasingly turning their attention to the strategic preservation of energy-efficient spaces for optimal comfort and aesthetics. The process entails the constant upgrading of old windows to smart glass in public institutions, hospitals, and transport centers. The year-round need for maintaining intelligent infrastructure creates a consistent demand for commercial smart glass.

Smart Glass Market Analysis

Learn more about the key segments shaping this market

Based on technology type, the market is divided into electrochromic, suspended particle device (SPD), polymer-dispersed liquid crystal (PDLC), and others. The electrochromic segment held the largest share, accounting for 28.7% of the global smart glass market in 2025.

- The increasing demand for energy efficiency and automated light control in large-scale architectural projects is encouraging segment growth.

- Electrochromic segment holds the most market value and also exhibits a strong growth rate indicating a continued professional preference for materials that offer high UV blockage and integration with building management systems.

- Suspended Particle Device (SPD) segment shows a healthy growth rate (8.6%), suggesting consistent demand from the automotive and aerospace industries where rapid response times for tinting are critical for passenger comfort.

- Compact and easy to integrate, PDLC solutions are ideal for indoor privacy applications and retail displays. Interior designers and office managers appreciate the "instant privacy" functionality for glass partitions and conference rooms.

- The growing popularity of hybrid and photovoltaic smart glass underscores the market's responsiveness to the "energy-harvesting" trend, where windows not only regulate light but also generate power for the building.

Learn more about the key segments shaping this market

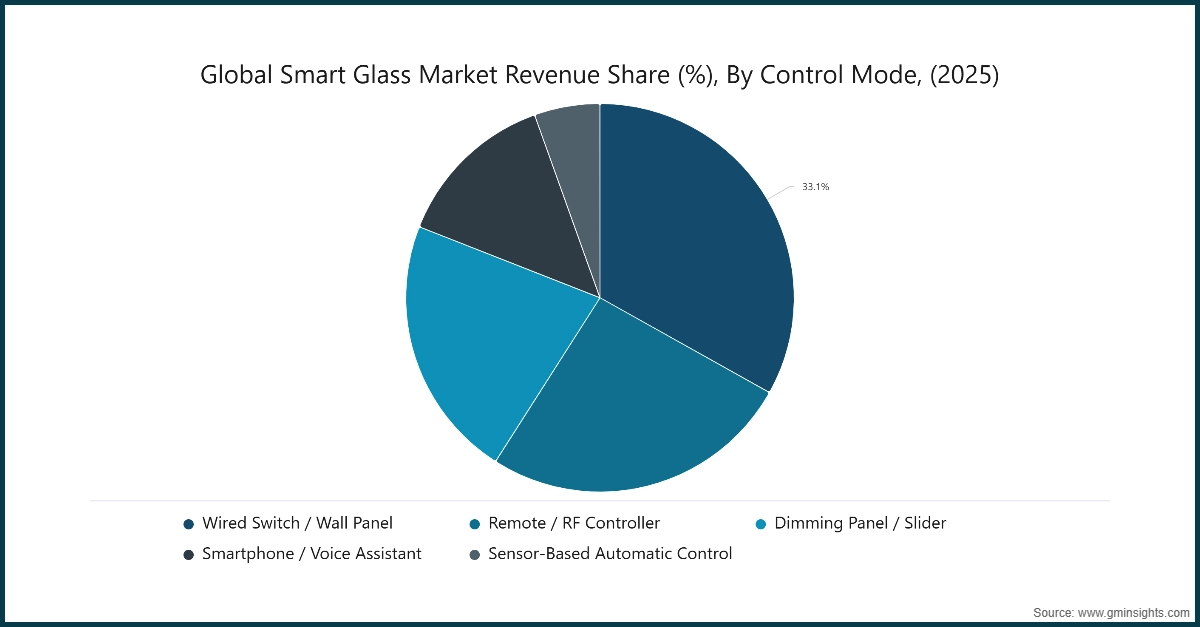

Based on the control mode, the smart glass market is segmented into wired switch wall panels, remote, RF controllers, smartphone, voice assistants, and others. In 2025, Wired Switch / Wall Panels held a major market share of 33.1%, generating a revenue of USD 1.5 billion.

- The Wired switch segment represents the largest portion of the market, as it is the standard installation method for new commercial constructions where glass control is hard-wired into the building’s electrical grid.

- Smartphone / Voice Assistant segment exhibits the highest growth rate . This reflects the industry's shift towards IoT and smart home integration, allowing users to modulate glass tint via mobile apps or voice commands like Alexa or Google Assistant.

- Remote / RF Controller segment maintains a solid growth rate, likely representing the aftermarket and retrofit market where users prefer wireless installation to avoid the cost of extensive rewiring.

- The sensor-based automatic control segment, while currently smaller, is a key area of innovation. This trend is consistent with a market moving toward "autonomous buildings" that use light and heat sensors to adjust tinting without any human intervention

Based on the end user, the smart glass market is segmented into automotive, architectural, avionics, and others. In 2025, Automotive held the major market share of 28.3%, generating a revenue of USD 1.3 billion.

- Automotive represents the largest portion of the market and shows the highest projected growth rate. This dominance is driven by the rapid adoption of smart sunroofs and side windows in premium electric vehicles (EVs) to reduce HVAC load and extend battery range.

- The Architectural segment is the second-largest contributor, fueled by the global push for "Green Buildings." Large-scale commercial developers prefer smart glass for high-rise facades to meet strict environmental and energy-saving certifications (like LEED).

- Avionics and Marine segments utilize smart glass for specialized applications, such as cabin windows in luxury jets and yachts. These channels prioritize high durability and superior glare reduction to enhance the passenger experience in extreme light conditions.

- Consumer Electronics (including smart eyewear and camera filters) is a rapidly emerging segment. This indicates the market’s capacity to serve a broad spectrum of needs, from massive infrastructure projects to handheld personal devices.

North America Smart Glass Market

Looking for region specific data?

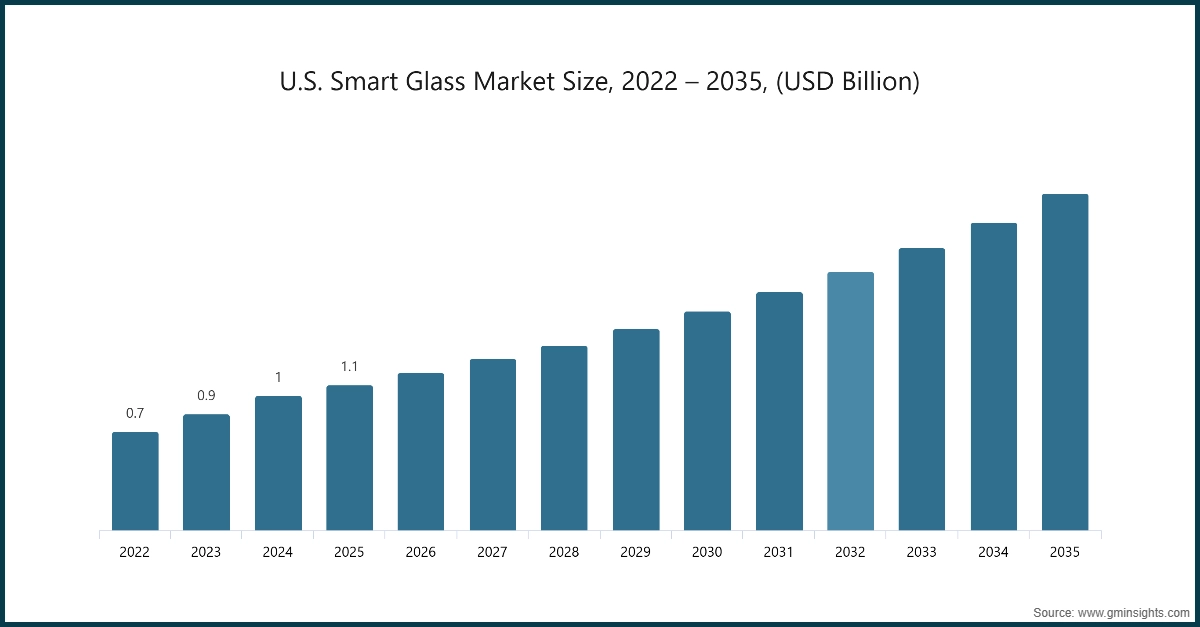

In 2025, North America is the second-largest market for smart glasses. It has an estimated market value of USD 1.1 billion in 2025 with a projected growth rate of 8.7% through 2035.

- The U.S. leads the region, showing a strong growth rate of 8.8%. This growth stems from a technologically mature market with high adoption rates in the commercial construction and premium automotive sectors.

- Smart glasses are becoming essential components for modern architectural designs and luxury vehicle manufacturers who prioritize energy efficiency and user-controlled privacy.

- The North American market meets this need by being home to leading innovators and early adopters of electrochromic and SPD technologies, supporting large-scale smart building initiatives and the transition to electric vehicles.

- The region's focus on LEED-certified green buildings and stringent energy-saving regulations further fuels demand for smart glazing solutions that reduce HVAC loads in both residential and commercial structures.

Europe Smart Glass Market

Europe is the third-largest market, estimated at USD 1.2 billion in 2025 with a projected growth rate of 7.8%. Germany leads the region with the highest sub-regional growth rate of 9.1%, driven by its world-class automotive industry and industrial sectors.

- The European market benefits from intense sustainability efforts and the "European Green Deal," which encourages the adoption of energy-efficient smart glass to minimize the carbon footprint of buildings.

- Major economies like France and the UK show robust growth, particularly in the heritage building restoration and high-end hospitality sectors where switchable privacy glass is in high demand.

- The larger European market gains from Industry 4.0 initiatives that integrate smart glass with automated building management systems, positioning the region as a leader in "intelligent facades."

- Countries like Italy and Spain, while growing more modestly, are increasingly utilizing smart glass in the luxury marine and tourism sectors to enhance passenger comfort and solar protection

Asia Pacific Smart Glass Market

Asia Pacific is the largest and fastest-growing regional market. It has an estimated market value of USD 1.4 billion in 2025 with a projected growth rate of 9.2% from 2026 to 2035.

- China holds the largest market share in the region, valued at USD 0.5 billion in 2025, while also maintaining the highest sub-regional growth rate of 9.7%, followed closely by India at 9.3%.

- The rapid growth in Asia Pacific results from unprecedented urbanization and massive infrastructure projects in emerging economies, requiring high volumes of advanced building materials.

- Rising awareness about energy conservation and the quest for premium aesthetics in the burgeoning middle-class housing market significantly influence growth, particularly for PDLC and photochromic solutions.

- Countries like Japan and South Korea are critical players, leveraging their advanced electronics and automotive manufacturing hubs to produce and export smart glass technologies globally.

Latin America Smart Glass Market

Latin America represents a smaller segment of the global smart glass industry expected to reach USD 0.4 billion by 2025, growing at a rate of 6.9% from 2026 to 2035.

- Brazil is the main driver in the region with the largest market value in 2025. Overall growth is modest due to varying levels of infrastructure spending and economic instability.

- However, increasing urbanization and a growing middle class are boosting demand for professional tree care and land clearing services.

- Market players are focusing on durable mid-sized equipment to take advantage of this market with demand often stemming from agricultural development and public works projects.

Smart Glass Market Share

AGC Inc. is leading with 8% market share, AGC Inc., Gentex Corporation, Corning Incorporated, View Inc., and Gauzy Ltd. collectively hold around 28%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Gentex Corporation completed the acquisition of VOXX International's automotive business, a move that integrated advanced electronic features with Gentex's core dimmable glass technologies. This strategic acquisition expanded Gentex’s footprint in the in-cabin monitoring and digital vision sectors, allowing for a more comprehensive "connected-car" suite. Steve Downing, Gentex President and CEO, emphasized that the acquisition bolsters their ability to deliver next-gen features like display-integrated dimmable sun visors and enhanced sensor-integrated mirrors.

Gauzy Ltd. unveiled its first-ever "Black SPD" (Suspended Particle Device) smart glass at CES, specifically designed to meet demand in the aeronautics and premium automotive sectors for a neutral-colored dimming solution. This was followed in July 2025 by the launch of a first-of-its-kind prefabricated smart glass stack, engineered for Tier-1 suppliers and OEM glass fabricators. This "ready-to-laminate" solution eliminates costly post-processing steps, enabling automotive manufacturers to integrate smart glass at scale with faster production timelines.

Smart Glass Market Companies

Major players operating in the smart glass industry are:

- AGC Inc.

- ChromoGenics AB

- Corning Incorporated

- EControl-Glas GmbH

- Fuyao Glass Industry Group

- Gauzy Ltd.

- Gentex Corporation

- Halio, Inc.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Pleotint, LLC

- Polytronix, Inc.

- Research Frontiers Inc.

- Saint-Gobain S.A.

- View, Inc.

Saint-Gobain S.A. continues to expand its "sustainable construction" platform, completing the acquisition of FOSROC. While FOSROC focuses on construction chemicals, the move reinforces Saint-Gobain's mission to offer holistic, energy-efficient building envelopes. The group’s SageGlass division remains a benchmark for large-scale architectural projects, focusing on AI-driven tinting that reduces building energy consumption by up to 20%.

Smart Glass Industry News

- In November 2025, Gentex introduced a new line of aftermarket auto-dimming mirrors at SEMA, including a slim-profile carbon fiber model developed in partnership with Ringbrothers. These mirrors utilize a proprietary darkening gel and integrated microprocessors to eliminate glare for the custom car and supercar markets.

- In August 2025, Gauzy was selected as the exclusive smart glass supplier for a Fortune 100 financial institution for its nationwide commercial offices. The multi-phase rollout includes installations across major U.S. financial hubs, utilizing PDLC technology for on-demand privacy and energy efficiency in modernized office environments.

- In July 2025, Halio highlighted the commercialization of Halio’s Smart-Tinting Glass, which now achieves its darkest tint in under three minutes 10x faster than legacy electrochromic products. The system uses a proprietary "Gradient TCO" technology to ensure uniform tinting regardless of window size.

- View Inc. has emphasized its "Smart Building" platform, integrating its electrochromic windows with cloud-based AI. This allows windows to autonomously adjust based on real-time weather data and internal occupancy, aiming to maximize mental and physical well-being by optimizing natural light.

- In 2025, Nippon Sheet Glass (NSG) continued to expand their specialized "Pilkington" range, focusing on high-performance coatings for the healthcare sector. These specialized glasses offer both solar control and antimicrobial properties, catering to the rising demand for healthier indoor environments

The smart glass market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Technology Type

- Electrochromic

- Suspended Particle Device (SPD)

- Polymer-Dispersed Liquid Crystal (PDLC)

- Thermochromic

- Photochromic

- Hybrid and Photovoltaic

Market, By Control Mode

- Wired Switch / Wall Panel

- Remote / RF Controller

- Dimming Panel / Slider

- Smartphone / Voice Assistant

- Sensor-Based Automatic Control

Market, By Application

- Facades and Curtain Walls

- Interior Partitions and Privacy Panels

- Sunroofs, Skylights and Roof Glazing

- Mirrors and Displays

Market, By End-Use

- Automotive

- Architectural

- Avionics

- Marine

- Rail

- Consumer Electronics

- Healthcare Facilities

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the smart glass market?

Key players include Saint-Gobain S.A., AGC Inc., Gentex Corporation, View Inc., Corning Incorporated, ChromoGenics AB, EControl-Glas GmbH, Fuyao Glass Industry Group, Gauzy Ltd., and Halio, Inc.

What are the upcoming trends in the smart glass industry?

Key trends include the integration of AI-driven predictive tinting, IoT-enabled smart home ecosystems, and the development of

What is the market size of the smart glasses industry in North America in 2025?

The North America smart glasses market was valued at USD 1.1 billion in 2025, driven by rising adoption of smart wearables across enterprise, healthcare, and industrial applications.

What was the valuation of the wired switch/wall panels segment in 2025?

Wired switch/wall panels captured 33.1% share in 2025, generating USD 1.5 billion in revenue. Their popularity is driven by ease of use and widespread adoption in commercial and residential buildings.

How much revenue did the electrochromic segment generate in 2025?

The electrochromic segment accounted for 28.7% of the market in 2025, making it the largest technology category. Its dominance is supported by its energy-saving capabilities and growing use in architectural and automotive applications.

What is the market size of the smart glass industry in 2026?

The market size for smart glass reached USD 5 billion in 2026, reflecting steady growth fueled by rising adoption in architectural and automotive applications.

What is the projected value of the smart glass market by 2035?

The market size for smart glass is expected to reach USD 10.3 billion by 2035, growing at a CAGR of 8.4%. This growth is driven by advancements in AI-driven tinting, increased adoption in healthcare and hospitality, and the integration of smart home ecosystems.

What is the smart glass market size in 2025?

The market size for smart glass is valued at USD 4.6 billion in 2025. Increasing demand for energy-efficient solutions and advancements in automotive and IoT integration are driving market growth.

Smart Glass Market Scope

Related Reports