Summary

Table of Content

Small Drones Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Small Drones Market Size

The global small drones market size was valued at USD 5.86 billion in 2024 and is estimated to grow at 12.5% CAGR from 2025 to 2034. The increasing advancements in battery energy density, sensor miniaturization, and onboard processing drive the small drones industry.

To get key market trends

The trade tariffs by the Trump administration on the steel, aluminum, and Chinese-made components has led to increase in the production cost of small drones. This is due to the reliance of shipbuilders on these materials and components for hull construction and advanced electronics. The global tariff war had led to disruption of the supply chain, shifting the focus of manufacturers on alternative suppliers. The higher costs have in turn led to slowing down the innovations and delayed ships deployment. On the positive side, the tariffs have encouraged countries to boost their domestic production of critical technologies to reduce reliance on foreign suppliers in the long run. The market growth has also slowed down due to the increased costs initially, particularly for the budget constrained defense programs. Overall, the tariffs have led to increased domestic manufacturing and their immediate impact on the small drones increased prices and supply chain adjustments.

Small Drones Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.86 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.5% |

| Market Size in 2034 | USD 18.78 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The small drones market is poised for big change due to the rapid growth of modernization initiatives within the defense industry and increased military budgets worldwide. Japan has large maritime trading history providing port infrastructure that has established vessel traffic management systems (VTMS) where they are with advanced functionalities. Japan also implements stringent maritime safety regulations that require the use of current VTMS solutions which can provide broad picture situational awareness and establish traffic monitoring regimes. Japanese companies are forging advances in technology among marine traffic management companies as their racing to develop and implement next generation technologies to further increase safety and efficiency within the maritime domain.

With artificial intelligence and machine learning, the use of small drones is rapidly accelerating. With autonomous small drones, real-time decision-making, obstacle detection, and adaptive mission plan deployment can occur without any human intervention. Advanced sensor fusion and data analytics (as examples) lead to more reliable unmanned vehicle systems that are less error prone. If we can continually innovate in this area, it will not only get cheaper it will make small drones even smarter and efficient.

Economic sustainability and savings from operations is driving the uptake of Small Drones. Conventional manned drone vehicles and systems all require crew related expenses such as training, salaries and on-board facilities. Unmanned systems help eliminate those costs and reduce fuel consumption.

Small Drones Market Trends

- The market for small drones is seeing unmatched penetration into wide-ranging applications, transforming the military as well as commercial spheres. Within the military space, such systems are getting deeply entrenched within ISR operations, and latest happenings demonstrate the increased scope they have in operation. For example, in September 2023, the Indian Army proposed plans to deploy mini drones with their main battle tanks to allow real-time enemy detection and tracking of movements using vertical take-offs from tank turrets. In like fashion, in February of 2023, Lockheed Martin Skunk Works and BAE Systems tested the value of their Indago and Stalker small uncrewed aerial systems on an Amphibious Combat Vehicle platform, boosting US Marine Corps battlefield management capability.

- The commercial marketplace is undergoing similar revolutionary uses, most notably in delivery and logistics services. Amazon's expansion of its drone delivery services to Italy and the United Kingdom in October 2023 is a demonstration of the increased confidence in commercial drone uses. These systems are also increasingly proving useful in agriculture, remote sensing, search and rescue, civil infrastructure inspection, and security surveillance. The diversity of small drones is also exemplified through their application in resource exploration, especially in oil-based economies where they are applied to automate inspection of distant oil and gas fields and deep-sea rigs. The systems are also proving to be highly useful in scientific studies, gathering important information regarding wildlife, air pollution, and geographical surveys that would prove hard to collect through traditional methods.

Small Drones Market Analysis

Learn more about the key segments shaping this market

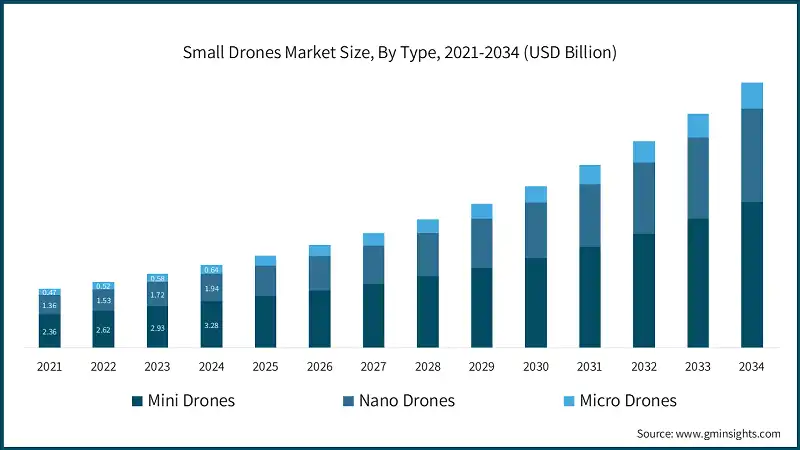

Based on type, the market is divided into mini drones, nano drones, micro drones.

- The mini drones market was valued at USD 3.28 billion in 2024. This strong market position is based largely on the segment's mass adoption in both military and civilian applications. Mini drones have played a critical role in numerous military operations, and defence forces around the globe are adopting these systems for tactical reconnaissance, surveillance, and intelligence purposes. The use of mini drones for supporting different payload configurations while retaining operating efficiency has positioned them strongly in defence applications. In the business market, such systems are heavily used for aerial photography, surveying, mapping, and inspection of infrastructure, adding to their market dominance.

- The nano drones market is projected to grow at a CAGR of 13.1% by 2034. This strong market position is based largely on the segment's mass adoption in both military and civilian applications. Mini drones have played a critical role in numerous military operations, and defence forces around the globe are adopting these systems for tactical reconnaissance, surveillance, and intelligence purposes. The use of mini drones for supporting different payload configurations while retaining operating efficiency has positioned them strongly in defence applications. In the business market, such systems are heavily used for aerial photography, surveying, mapping, and inspection of infrastructure, adding to their market dominance.

Learn more about the key segments shaping this market

Based on platform, the small drones market is divided into fixed-wing, rotary, hybrid.

- The fixed-wing market is projected to grow at a CAGR of 12.6% by 2034. The fixed-wing segment is witnessing strong growth in the market, driven by its superior capabilities in intelligence, surveillance, and reconnaissance (ISR) applications. Despite having limited payload capacity, these drones are superior at long-endurance and long-range flights and are best suited for both high and low-altitude operations. The segment is also seeing major technology upgrades, especially in remote operating capabilities and sensor integration. The rising need for line-of-sight controls and beyond visual line of sight operations is also driving the growth in fixed-wing drones, particularly in military applications where range and endurance are paramount needs.

- The rotary wing market was valued at USD 7.98 billion in 2034. This strong market position is largely attributed to the segment's extensive use in both military and commercial domains. Mini drones have now become a key component in numerous military operations, with defence forces across the globe adopting these systems for tactical intelligence, surveillance, and reconnaissance needs. The flexibility of mini drones in accommodating various payload configurations without compromising operational efficiency has made them highly desirable for defence purposes. They are used in the commercial industry intensively for aerial photography, surveying, mapping, and infrastructure inspection, which has led to their market dominance.

Based on mode of operation, the small drones market is divided into remotely piloted, partially autonomous, fully autonomous.

- The remotely piloted market is projected to grow at a CAGR of 12.3% by 2034. These systems are widely adopted in security patrol, search and rescue, and event monitoring, where direct operator intervention is critical to mission success. Certification and training requirements for remote pilots ensure compliance with aviation regulations, driving demand for standardized control stations and secure communication datalinks. Although RPAS platforms typically have lower autonomy, they benefit from mature support infrastructure and proven reliability across both civilian and defence applications.

- The partially autonomous market was valued at USD 7.59 billion in 2034. Partially Autonomous covers drones with sophisticated waypoint navigation, avoidance algorithms and simple on-board decision-making capabilities to lower operator workload while still supporting manual override modes. The core applications range across precision agriculture (programmed flight paths for crop mapping), infrastructure inspection (scheduled grid surveys) and last-mile delivery pilot studies. Regulators are now shaping frameworks for "human-in-the-loop" operation, enabling BVLOS flight under operator oversight and encouraging innovation in AI-enabled flight management.

Based on application, the small drones market is divided into military and law enforcement, civil and commercial.

- The military and law enforcement market are growing with a significant share of 55.4% in 2024. This dominant market position is fuelled by the widespread use of small drones in numerous commercial applications such as aerial photography, agriculture, land surveying, and route mapping services for navigation. The transport and logistics sub-segment, especially in e-commerce, has been a key driver of this dominance as businesses make use of small drones for last-mile logistics in different regions. Key e-commerce companies are aggressively investing in drone delivery capabilities to enable quicker delivery timelines without the disruptions of traffic. Moreover, the expanding use of small drones in agriculture for crop monitoring and evaluation has further consolidated the segment's market leadership position.

- The civil and commercial fully electric vessels market is projected to grow at a CAGR of 13.1% by 2034. The segment's growth is further fuelled by rising defence budgets across various nations and the growing emphasis on incorporating autonomous systems in military operations. The versatility of small drones in conducting search and rescue operations, providing tactical support, and performing reconnaissance missions has made them an indispensable tool for modern military forces. Additionally, the increasing focus on developing indigenous military drone capabilities by several countries and the rising demand for stealth operations are expected to drive the segment's growth trajectory.

Looking for region specific data?

- The U.S. small drones market was valued at USD 954.9 million in 2024. The U.S. is a key player in the global market with investments by the Department of Defence (DoD) and private firms such as Lockheed Martin. The U.S. navy’s Unmanned Campaign Framework contains and prioritizes unmanned surface and subsurface vessels for intelligence, surveillance, and reconnaissance (ISR) and strike missions. Technologies such as AI and swarm integration are gaining traction with collaboration between Defence Advanced Research Projects Agency (DARPA) and tech startups. The country leverages its advances in autonomous systems to say ahead in the market competition.

- The market in Germany is projected to grow at a CAGR of 13.4% by 2034. Germany is emerging as a key player in autonomous naval technology, with a strong emphasis on mine countermeasures (MCM) and underwater drones. German manufacturers are in the developing phase of autonomous underwater vehicle (AUVs) for NATO and European Union (EU). The strict environmental regulations by the EU are adhered to by the German Navy by prioritization of ecofriendly vessels. Germany is leveraging the EU for partnerships with European countries to be able to operate in the international waters of Baltic and North Sea. Due to its higher hand in engineering and technology, Germany can compete in the global market.

- The small drones market in UK was valued at USD 302.1 million in 2024. This expansion is fuelled by rising use of small drones for both commercial and military applications, continued technology innovation in drone function, and growing uses across industries. The nation's emphasis on building autonomous systems, artificial intelligence incorporation, and drone capability improvement continues to propel market growth.

- The market in China was valued at USD 629.9 million in 2024. China continues to be the biggest market for small drones in Asia-Pacific due to its solid manufacturing base and large-scale applications of drones across multiple industries. China is underpinned by strong investments in drone technology, major manufacturers' presence, and high adoption levels in military and commercial use. China's commitment to the development of advanced drones technologies and its well-established ecosystem of drone makers and service providers remains to enhance its leadership in the market.

- The small drones industry in India is expected to be valued at CAGR of 15.9% from 2025 to 2034. India is the Asia-Pacific region's fastest-growing market, led by growing use of small drones in military and commercial applications. India's market growth is backed by government support for domestic drone production, broadening use in agriculture and infrastructure surveillance, and rising investments in drone technology. India's emphasis on building local drone capabilities and positive regulatory reforms continues to propel market growth.

Small Drones Market Share

The top five players AeroVironment, DJI Technology, Teledyne Technologies, Northrop Grumman, and Lockheed Martin in the small drones industry contributes over 28% of the global market share in 2024. However, the market is competitive and these companies are deploying diverse strategies to strengthen their market position and align with evolving defence needs. The market experiences regular new product releases targeting specialized uses in military, commercial, and civilian applications. Operational agility is evidenced by flexible manufacturing processes and strong supply chain networks that facilitate rapid adaptation to shifting market needs. Strategic alliances with technology companies, defence contractors, and research organizations are becoming more prevalent to drive innovation and market penetration faster. Geographic expansion strategies are being actively pursued, with companies creating regional presence through direct operations, distribution networks, and local manufacturing facilities.

To gain a competitive edge, key players are focusing on strategic partnerships with governments and tech startups to accelerate innovation in unmanned systems. The companies are significantly investing in research and development to improve their product offerings with innovative features such as enhanced flight duration, payload, and autonomous systems. New entrants and low-volume players can make inroads by concentrating on specialized market niches and creating innovative solutions for selected industry applications. Success drivers involve the creation of robust intellectual property portfolios, forging strategic alliances with larger players, and staying flexible to accommodate shifting market requirements.

AeroVironment is a leading provider of small unmanned aerial systems (sUAS) for defence and public-safety applications, offering field-proven platforms such as the RQ-11 Raven, Puma AE and Switchblade loitering munitions. The company’s systems are characterized by lightweight composite airframes, plug-and-play payload modularity and ruggedized control stations, driving their widespread adoption for tactical reconnaissance, target acquisition and beyond-line-of-sight operations.

SZ DJI Technology Co., Ltd. dominates the commercial and prosumer drone segment, commanding over 70 % share of global unit shipments with product lines including the Phantom, Mavic and Matrice series. DJI’s vertically integrated design and manufacturing model coupled with intuitive flight control software, advanced stabilization gimbals and rich payload options (LiDAR, multispectral, zoom) has established it as the default choice for aerial photography, industrial inspection, agriculture and enterprise BVLOS initiatives.

Small Drones Market Companies

Some of the prominent market participants operating in the small drones industry include:

- AeroVironment

- DJI Technology

- Teledyne Technologies

- Northrop Grumman

- Lockheed Martin

Small Drones Industry News

- In September 2024, Lithuania’s Ministry of National Defense accepted its first tranche of Parrot Anafi quadcopters valued at approximately €2.5 billion as part of a broader €36 billion (USD 40.2 billion) contract signed in July 2024 with local integrator Dettol’s to expand its UAS fleet for tactical reconnaissance and operator training, with the remaining micro- and mini-class drones scheduled for delivery through early 2025.

- In May 2024, Lockheed Martin Corporation partnered with Grupo Oesía to co-develop an advanced, secure unmanned systems command-and-control (C2) suite leveraging Oesía’s digitalengineering expertise and Lockheed Martin’s resilient communications architecture to enable seamless, real-time mission management and interoperability of UAS platforms across allied defense networks.

The small drones market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Type

- Mini drones

- Nano drones

- Micro drones

Market, By Platform

- Fixed-wing

- CTOL

- VTOL

- Rotary

- Single rotor

- Multi-rotor

- Hybrid

Market, By Mode of Operation

- Remotely piloted

- Partially autonomous

- Fully autonomous

Market, By Application

- Military and law enforcement

- Civil and commercial

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in small drones industry?

Some of the major players in the industry include AeroVironment, DJI Technology, Teledyne Technologies, Northrop Grumman, Lockheed Martin.

How big is the small drones market?

The market for small drones was valued at USD 5.86 Billion in 2024 and is expected to reach around USD 18.78 Billion by 2034, growing at 12.5% CAGR through 2034.

How much is the U.S. small drones market worth in 2024?

The U.S. market was worth over USD 954.9 million in 2024.

What is the size of mini drones segment in the small drones industry?

The mini drones segment generated over USD 3.28 billion in 2024.

Small Drones Market Scope

Related Reports