Summary

Table of Content

Slow Speed Shredding Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Slow Speed Shredding Machine Market Size

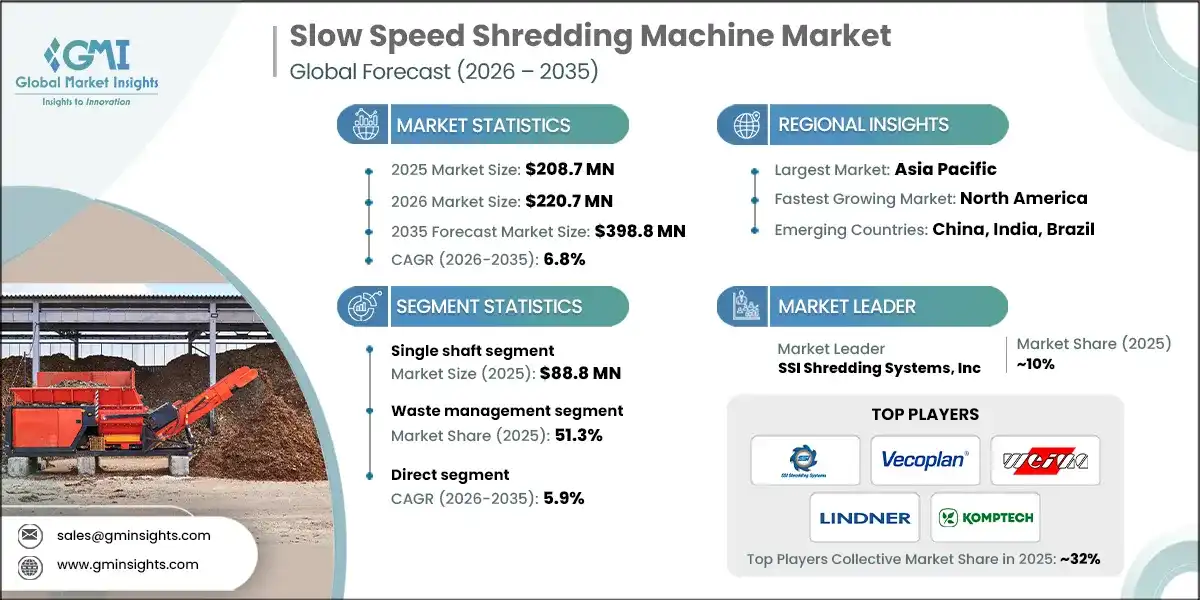

The slow speed shredding machine market was estimated at USD 208.7 million in 2025. The market is expected to grow from USD 220.7 million in 2026 to USD 398.8 million in 2035, at a CAGR of 6.8% according to latest report published by Global Market Insights Inc.

To get key market trends

- With the global waste volume growing at an alarming rate and government regulations being introduced to eliminate waste from landfills, many companies are investing in slow-speed shredders as a means of reducing their waste output. The purpose of the shredder is to reduce the size of the waste into manageable sizes so that it can be reused and/or recycled into various products, such as refuse-derived fuel. Therefore, by decreasing the volume of waste being brought into landfills, the shredder will reduce haulage costs for municipalities, help improve the sorting and recovering of materials downstream, and provide feedstock for alternative fuel products.

- The majority of slow-speed and mobile shredders currently in use are deployed in the MRW/MRF and transfer facility applications. In addition, both markets are primarily dominated by consumer and waste streams. As industry continues to focus on providing customers with new and innovative solutions for waste management, there has been an increase in the number of municipalities and integrated waste management companies investing in shredders. The increased focus on sustainable management practices will continue until 2025.

- Corporate responsibility and sustainability have significantly increased as a result of the environmental, social, and governance (ESG) commitments and policies put forth by many corporations. Due to this, many corporations are pursuing, or will soon pursue, the adoption of circular economic frameworks, such as that proposed by the European Union. In order for companies to be successful in transitioning to a circular economy, it is critical to develop new and innovative waste management equipment that prioritizes the recovery of materials rather than disposing of them in landfills. Slow-speed, high-torque shredders are among the most important tools for this type of transition because they can effectively separate heterogeneous inputs, such as plastics and metals and wood products, at production.

- The market for slow-speed shredders is continuing to evolve as a result of technological advancements in shredding automation and increased energy efficiency. Manufacturers are now offering new patented platforms designed as slow-speed shredders that include features like electric drives, torque monitoring, device integration through the Internet of Things (IoT), telematics and advanced control. These advancements lead to greater throughput; reduced downtime; and lower operations costs for shredding.

- Manufacturers now implementing automated processes into their slow-speed and dual-shaft shredders such as, the introduction of all-electric shredders and higher-end variations with more precise control specifically designed with industrial and municipal recycling requirements in mind represents a growing trend toward automation, remote monitoring and design for energy efficiency. While improving operational efficiencies, these technologies will also help reduce greenhouse gas emissions and/or increase the carbon footprint of industrial operations worldwide.

- The rapid growth of the construction and demolition waste processing market is another strong driver for the increased use of slow-speed shredders. Urban growth and construction efforts have produced tremendous quantities of debris from projects, including wood, plastics, composite materials and other large, cumbersome materials. The best way to process such material from the construction and demolition of processed waste is to use a slow-speed shredder.

Slow Speed Shredding Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 208.7 Million |

| Market Size in 2026 | USD 220.7 Million |

| Forecast Period 2026 - 2035 CAGR | 6.8% |

| Market Size in 2035 | USD 398.8 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for waste management and recycling efficiency | Boosts adoption of slow-speed shredders for MSW and bulky waste, reducing landfill volumes and improving downstream recovery. Municipal contracts and integrated waste operators increasingly specify these machines for cost and compliance benefits. |

| Increasing adoption of sustainable and circular economy practices | EU regulations and corporate ESG goals drive investment in shredders that enable material recovery. This trend positions slow-speed machines as essential for recycling streams like plastics, metals, and wood, creating long-term demand. |

| Technological advancements in shredding automation and energy efficiency | Smart features such as IoT monitoring, torque sensors, and hybrid drives reduce downtime and operating costs. These innovations enhance machine reliability and appeal to operators seeking productivity and sustainability. |

| Pitfalls & Challenges | Impact |

| High initial investment and maintenance costs | Capital-intensive machines and specialized servicing can deter smaller operators, slowing adoption despite long-term efficiency gains. |

| Stringent environmental and safety regulations | Compliance with noise, dust, and emissions standards adds complexity and cost, requiring continuous design improvements and certification. |

| Opportunities: | Impact |

| Integration of IoT and smart monitoring for predictive maintenance | Connected shredders enable real-time diagnostics, reducing downtime and lifecycle costs—creating a strong value proposition for tech-driven operators. |

| Growing demand in emerging markets and renewable material recovery | Developing regions and renewable energy projects (e.g., biomass) present untapped potential for slow-speed shredders, expanding global market reach. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of ~10% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Slow Speed Shredding Machine Market Trends

- Manufacturers are increasingly embedding IoT sensors and AI-driven analytics into slow speed shredding machines to enable real-time monitoring, predictive maintenance, and performance optimization. This trend is driven by the need to reduce downtime and improve operational efficiency in recycling and waste management facilities. Smart shredders allow operators to track wear patterns, schedule maintenance proactively, and optimize throughput, making them a key differentiator in a competitive market.

- The growing emphasis on sustainability and circular economy principles is pushing demand for shredders that can handle diverse recyclable materials efficiently. Industries are prioritizing machines that minimize energy consumption, reduce emissions, and support material recovery processes. This trend aligns with global regulatory pressures and corporate ESG goals, positioning slow speed shredders as essential tools for eco-friendly waste processing.

- Customers are seeking shredding solutions tailored to specific material types and operational requirements. In response, manufacturers are offering modular designs that allow easy configuration and scalability. This trend enables businesses to adapt machines for different applications—such as wood, plastics, or tires—without investing in entirely new equipment, thereby reducing capital expenditure and enhancing flexibility.

- Rapid industrialization and urbanization in regions like Asia-Pacific and Latin America are creating significant opportunities for slow speed shredding machines. Governments in these areas are implementing stricter waste management regulations, driving investments in recycling infrastructure. This trend is expected to accelerate market penetration as local players collaborate with global manufacturers to meet rising demand.

- Environmental and workplace safety standards are influencing the design of shredding machines with advanced noise suppression and dust control features. Operators prefer machines that maintain a cleaner and quieter working environment, especially in urban recycling facilities. This trend reflects the growing importance of health and safety compliance alongside operational efficiency.

Slow Speed Shredding Machine Market Analysis

Learn more about the key segments shaping this market

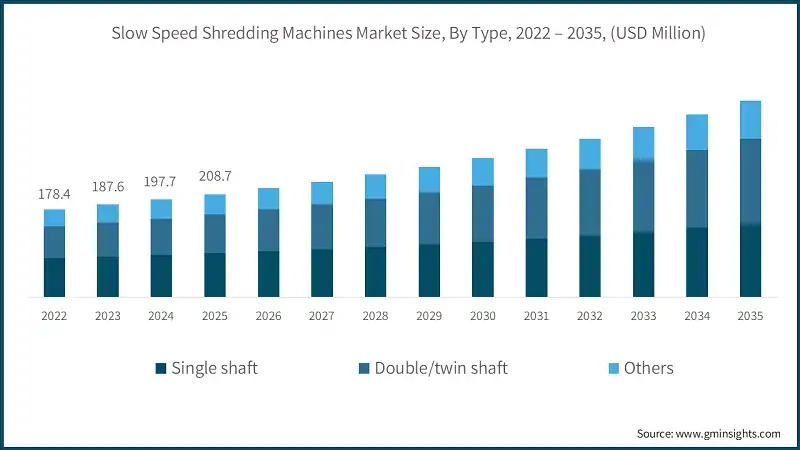

Based on type, the market is categorized into single shaft, double shaft and others. The single shaft segment accounted for revenue of around USD 88.8 million in 2025 and is anticipated to grow at a CAGR of 5.4% from 2026 to 2035.

- Single shaft shredders are gaining traction in the slow-speed shredding segment due to their simplicity and efficiency in handling a wide range of materials. Their design, featuring a single rotor and hydraulic pusher, ensures consistent feeding and uniform output size, making them ideal for applications like plastics, wood, and light metals. This streamlined mechanism reduces operational complexity and maintenance requirements, which appeals to businesses seeking cost-effective solutions.

- Moreover, single shaft shredders offer high adaptability through customizable screen sizes and automated control systems. These features allow operators to achieve precise particle sizes for downstream processes, such as recycling or energy recovery. As industries prioritize material recovery and quality, the demand for single shaft shredders is expected to rise, supported by their balance of performance, durability, and ease of integration into existing waste processing lines.

Learn more about the key segments shaping this market

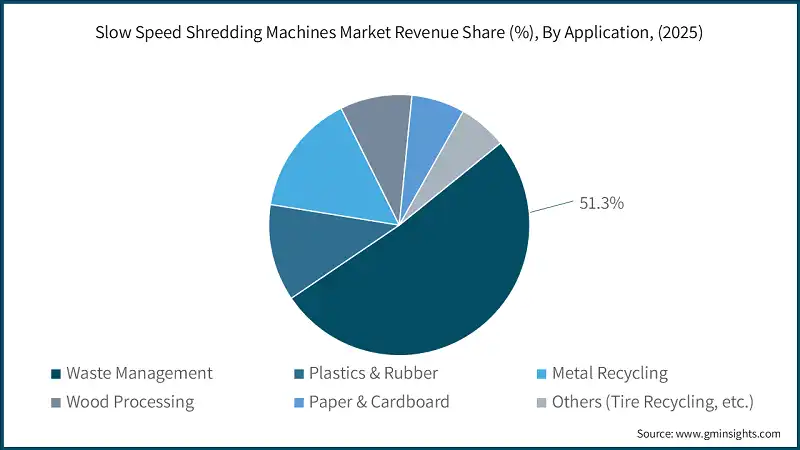

Based on application, slow speed shredding machine market consists of waste management, plastics & rubber, metal recycling, wood processing, paper & cardboard and others (tire recycling, etc.). The waste management segment emerged as leader and held 51.3% of the total market share in 2025 and is anticipated to grow at a CAGR of 6.6% from 2026 to 2035.

- The slow-speed shredding machine market is deeply intertwined with the global waste management sector, which is under increasing pressure to meet sustainability and regulatory goals. These machines play a critical role in reducing the volume of bulky waste, enabling efficient sorting and recycling. Their ability to process challenging materials like tires, e-waste, and construction debris makes them indispensable for municipal and industrial waste streams.

- As governments enforce stricter landfill diversion targets and promote circular economic initiatives, waste management companies are investing heavily in shredding technologies. Slow-speed shredders, with their low energy consumption and high torque, align perfectly with these objectives by ensuring safe, efficient, and environmentally responsible waste processing. This synergy between shredding technology and waste management practices is expected to drive long-term market growth.

Based on distribution channel, of slow speed shredding machine market consists of direct and indirect. The direct segment emerged as leader and is anticipated to grow at a CAGR of 5.9% from 2026 to 2035.

- Direct distribution channels dominate the slow-speed shredding machine market because they enable manufacturers to maintain strong relationships with end-users and provide tailored solutions. By bypassing intermediaries, companies can offer competitive pricing, faster delivery, and personalized after-sales support. This approach is particularly valuable in a market where machines require customization and ongoing technical assistance for optimal performance.

- Additionally, direct channels allow manufacturers to gather real-time feedback and insights into customer needs, fueling product innovation and service improvements. In sectors like recycling and waste management, where operational reliability is critical, buyers prefer direct engagement with OEMs to ensure quality assurance and quick resolution of technical issues. This dominance of direct distribution is likely to persist as manufacturers leverage digital platforms and service networks to strengthen customer connectivity.

Looking for region specific data?

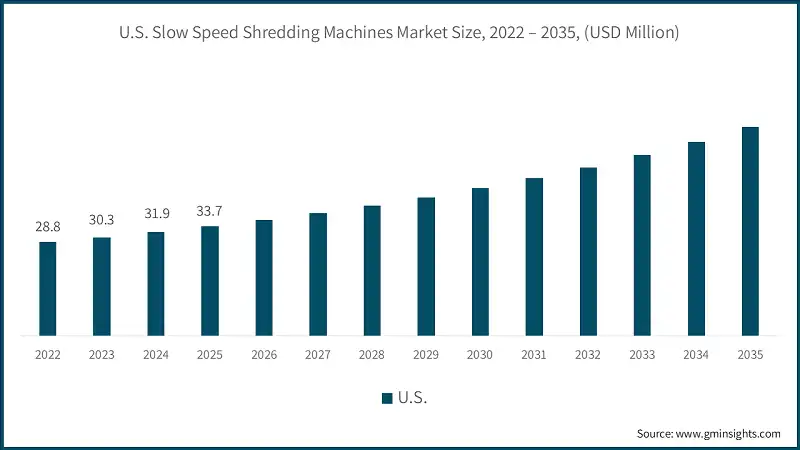

The U.S. dominates an overall North America slow speed shredding machine market and valued at USD 33.7 million in 2025 and is estimated to grow at a CAGR of 6.8% from 2026 to 2035.

- The U.S. market for slow speed shredding machines is mature and highly competitive, driven by stringent environmental regulations and advanced recycling infrastructure. Industrial sectors such as automotive, construction, and municipal waste management are major adopters, seeking machines that deliver high torque and energy efficiency.

- The region benefits from established distribution networks and a preference for durable, low-maintenance machines, making it a lucrative market for premium shredding solutions.

In the European slow speed shredding machine market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- Germany stands out as a leader in Europe for adopting slow speed shredding machines, supported by its strict recycling laws and commitment to sustainability.

- The country’s advanced waste management systems prioritize high-quality material recovery, driving demand for shredders with precision and reliability. German manufacturers also play a significant role in global innovation, introducing modular designs and energy-efficient technologies that set industry benchmarks.

In the Asia Pacific slow speed shredding machine market, the China held 35% share in 2025 and is anticipated to grow at a CAGR of 7.6% from 2026 to 2035.

- China represents one of the fastest-growing markets for slow speed shredding machines, fueled by rapid industrialization, urbanization, and government initiatives to improve waste management infrastructure.

- Rising volumes of industrial and municipal waste, coupled with stricter environmental regulations, are pushing demand for robust shredding solutions. Local manufacturers are expanding capabilities, while international players are entering partnerships to tap into this high-potential market.

In the Middle East and Africa slow speed shredding machine market, Saudi Arabia held 26% share in 2025 promising growth from 2026 to 2035.

- Saudi Arabia is emerging as a promising market in the Middle East, driven by Vision 2030 and its focus on sustainable development and modern waste management systems.

- Investments in recycling facilities and industrial waste processing are creating opportunities for slow speed shredding machines, particularly those designed for heavy-duty applications. The market is still developing, but growing awareness of environmental compliance and resource recovery is expected to accelerate adoption.

Slow Speed Shredding Machine Market Share

- In 2025, the prominent manufacturers in slow speed shredding machine industry are SSI Shredding Systems, Inc., Vecoplan AG, WEIMA Maschinenbau GmbH, LINDNER-RECYCLINGTECH GmbH, Komptech Group collectively held the market share of ~32%.

- SSI stands out for its engineering excellence and versatility across multiple shredding applications. Its slow-speed, high-torque shredders are known for durability and modular design, allowing customization for industrial waste, tires, and metals. SSI’s strong reputation for reliability and global service support gives it a competitive edge in heavy-duty and continuous operation environments.

- Vecoplan’s competitive strength lies in its advanced technology for recycling and material recovery. The company integrates smart automation and energy-efficient designs into its slow-speed shredders, making them ideal for plastics, wood, and biomass processing.

Slow speed shredding machine market Companies

Major players operating in the slow speed shredding machine industry include:

- Amstar Machinery Co., Ltd

- Arjes GmbH

- EDGE Innovate (NI) Ltd

- FORNNAX Technology Pvt Ltd

- GENOX Recycling Tech Co., Ltd

- Granutech-Saturn Systems

- Komptech Group

- LINDNER-RECYCLINGTECH GMBH

- SSI Shredding Systems, Inc

- Terex Corporation

- UNTHA shredding technology

- Vecoplan AG

- Vermeer Corporation

- WEIMA Maschinenbau GmbH

- ZERMA Machinery & Recycling Technology

WEIMA differentiates itself through precision engineering and user-friendly designs. Its slow-speed shredders are optimized for high performance with minimal maintenance, supported by robust German manufacturing standards. WEIMA’s emphasis on modularity and integration with downstream systems gives customers flexibility and cost efficiency, strengthening its market position.

Lindner’s edge comes from its specialization in waste-to-energy and recycling solutions. Its slow-speed shredders, such as the Urraco series, are designed for extreme durability and mobility, enabling efficient processing of bulky and contaminated materials. Lindner’s strong innovation pipeline and commitment to sustainability make it a leader in complex waste management applications.

Komptech excels in providing comprehensive solutions for organic and solid waste processing. Its slow-speed shredders, like the Crambo series, are engineered for versatility and high throughput, particularly in composting and biomass sectors. Komptech’s global presence and integrated product portfolio give it a competitive advantage in large-scale waste management projects.

Slow Speed Shredding Machine Industry News

- In May 2025, SSI’s M120?EX Dual-Shear shredder was highlighted as part of Nihon Dust’s advanced facility setup, showcasing the machine’s capability in transforming tough waste into recyclable material.

- In July 2025, at the K?2025 trade fair, WEIMA unveiled its new W5.22 single-shaft shredder, featuring higher throughput, improved maintenance access, and modular drive options (hydraulic and electromechanical), accompanied by the launch of its WE.connect digital platform.

- In January 2025, Komptech launched the Crambo?5200D, a low-speed twin-shaft shredder designed for organic waste and FOGO applications. Featuring efficient Caterpillar diesel drive, remote diagnostics via Komptech Connect, and optimized for reduced fuel consumption and maintenance, it set new benchmarks in the organic recycling sector.

- In March 2024, Terex launched TDS 815 Slow Speed Shredder, which features a compact twin shaft unit, quick-change shafts, and a CAT 4.4 140kw engine. It includes a T-Link telemetry system for real-time performance insights, enhancing efficiency and adaptability across various waste applications.

- In January 2024, Vermeer has launched the LS3600TX low-speed shredder, designed to process various materials efficiently, including contaminated waste streams. With a focus on maintenance and accessibility, it features a powerful engine, durable components, and optional enhancements, making it ideal for waste facilities, land clearing operations, and biofuel producers.

The slow speed shredding machine market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Type

- Single shaft

- Double/twin shaft

- Others

Market, By Capacity

- Below 1 ton

- Above 1 ton

Market, By Mobility

- Stationary

- Mobile

Market, By Application

- Waste management

- Plastics & rubber

- Metal recycling

- Wood processing

- Paper & cardboard

- Others (tire recycling, etc.)

Market, by Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the slow speed shredding machine market?

Key players include SSI Shredding Systems Inc., Vecoplan AG, WEIMA Maschinenbau GmbH, LINDNER-RECYCLINGTECH GmbH, Komptech Group, Amstar Machinery Co. Ltd, Arjes GmbH, EDGE Innovate (NI) Ltd, FORNNAX Technology Pvt Ltd, GENOX Recycling Tech Co. Ltd, Granutech-Saturn Systems, Terex Corporation, UNTHA shredding technology, Vermeer Corporation, and ZERMA Machinery & Recycling Technology.

What is the growth outlook for direct distribution channels from 2026 to 2035?

Direct distribution channels are projected to grow at a 5.9% CAGR till 2035, due to manufacturers' ability to provide tailored solutions, competitive pricing, and personalized after-sales support.

Which region leads the slow speed shredding machine market?

The U.S. dominates an overall North America slow speed shredding machine market with USD 33.7 million in 2025, while growing at a CAGR of 6.8% expected through 2035, driven by stringent environmental regulations and advanced recycling infrastructure.

What are the upcoming trends in the slow speed shredding machine market?

Key trends include integration of IoT sensors and AI-driven analytics for predictive maintenance, emphasis on energy-efficient and sustainable designs, and modular configurations for application-specific customization and scalability.

How much revenue did the single shaft segment generate in 2025?

Single shaft shredders generated USD 88.8 million in 2025, with anticipated growth at a 5.4% CAGR through 2035.

What was the market share of the waste management application segment in 2025?

Waste management held 51.3% market share in 2025 and is anticipated to grow at a 6.6% CAGR from 2026 to 2035.

What is the current slow speed shredding machine market size in 2026?

The market size is projected to reach USD 220.7 million in 2026.

What is the market size of the slow speed shredding machine in 2025?

The market size was USD 208.7 million in 2025, with a CAGR of 6.8% expected through 2035 driven by rising global waste volumes and stricter regulations pushing industries to reduce landfill disposal.

What is the projected value of the slow speed shredding machine market by 2035?

The slow speed shredding machine market is expected to reach USD 398.8 million by 2035, propelled by circular economy adoption, technological advancements in automation, and growing demand for sustainable waste management solutions.

Slow Speed Shredding Machine Market Scope

Related Reports