Summary

Table of Content

Ship Loader and Unloader Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ship Loader and Unloader Market Size

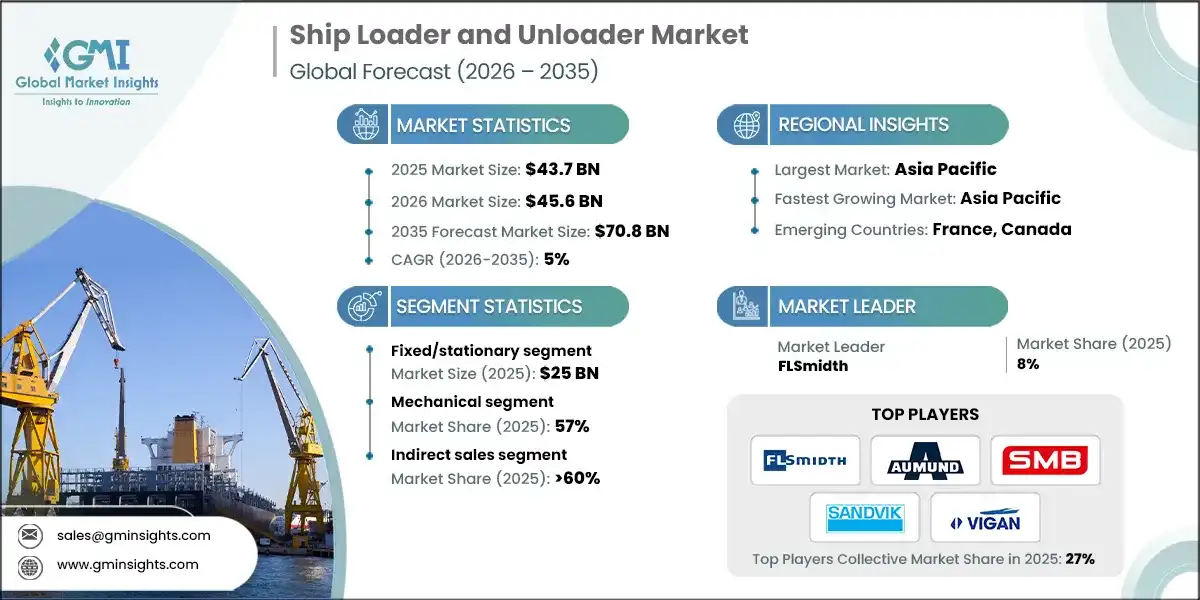

The global ship loader and unloader market is estimated at USD 43.7 billion in 2025. The market is expected to grow from USD 45.6 billion in 2026 to USD 70.8 billion in 2035, at a CAGR of 5% according to latest report published by Global Market Insights Inc.

To get key market trends

The growth of international trade, particularly in commodities like coal, iron ore, grains, and fertilizers, is a primary driver for ship loaders and unloaders. Ports are under pressure to handle larger volumes efficiently, which necessitates advanced loading and unloading systems. Increasing vessel sizes and the need for faster turnaround times have pushed operators to invest in high-capacity, automated solutions. This trend is reinforced by globalization and the expansion of emerging economies, which demand robust infrastructure for bulk material handling. Consequently, the market is witnessing strong adoption of technologically advanced equipment to optimize operational efficiency and reduce port congestion.

Moreover, the adoption of green technologies is gaining traction in the market. For example, electric and hybrid ship loaders and unloaders are being developed to reduce carbon emissions and comply with international sustainability standards. According to a report by the International Energy Agency (IEA), the maritime sector is expected to reduce its greenhouse gas emissions by 50% by 2050, driving innovation in eco-friendly port equipment. Therefore, the ship loaders and unloaders market is witnessing robust growth, driven by increasing trade volumes, larger vessel sizes, and the need for operational efficiency. The integration of advanced technologies and sustainable solutions is expected to play a pivotal role in shaping the market during the forecast period.

Port operations are undergoing a significant transformation, with ship loaders and unloaders playing a pivotal role in this evolution. Modern systems are equipped with advanced technologies such as IoT sensors, AI-driven predictive maintenance, and remote monitoring, which collectively enhance operational reliability and minimize downtime. These innovations not only improve safety standards but also significantly reduce operational costs by limiting the need for manual intervention.

According to the International Association of Ports and Harbors (IAPH), ports that have adopted automation technologies have reported up to a 30% reduction in operational costs and a 25% improvement in overall efficiency. The global push for digitalization in maritime logistics aligns with the increasing adoption of smart port initiatives, where efficiency, sustainability, and competitiveness are paramount. Smart ports leverage automation and data-driven solutions to optimize cargo handling, reduce turnaround times, and lower carbon emissions.

Ship Loader and Unloader Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 43.7 Billion |

| Market Size in 2026 | USD 45.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 5% |

| Market Size in 2035 | USD 70.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Global Trade and Bulk Material Handling | Increasing trade volumes directly boost demand for high-capacity loaders and unloaders, reducing port congestion and improving turnaround times. Ports investing in advanced systems gain competitive advantages, while manufacturers benefit from higher order volumes. This trend strengthens market growth, particularly in regions with expanding commodity exports and imports. |

| Automation and Technological Advancements | Automation significantly impacts operational efficiency by reducing labor dependency and downtime. Ports adopting IoT-enabled and AI-driven systems achieve cost savings and improved safety standards. This technological shift accelerates modernization, creating long-term demand for smart equipment and positioning manufacturers with advanced solutions as market leaders. |

| Environmental Regulations and Sustainability Goals | Stricter environmental norms compel ports to adopt eco-friendly equipment, influencing purchasing decisions. Manufacturers offering energy-efficient, dust-controlled systems gain a competitive edge. Compliance-driven investments create a niche for sustainable solutions, fostering innovation and reshaping market dynamics toward green technologies. |

| Pitfalls & Challenges | Impact |

| High Capital Investment and Maintenance Costs | The financial burden of acquiring and maintaining advanced systems limits adoption, especially in developing regions. Ports with constrained budgets delay modernization, slowing overall market penetration. This restraint impacts smaller operators more severely, creating a divide between technologically advanced ports and those reliant on manual processes. |

| Space and Infrastructure Limitations at Ports | Physical constraints hinder equipment installation, particularly in older or congested ports. Retrofitting requires complex engineering and extended downtime, discouraging upgrades. This limitation restricts market growth in regions with legacy infrastructure, favoring new port developments over modernization projects. |

| Opportunities: | Impact |

| Expansion of Emerging Economies and New Port Developments | New port projects in Asia-Pacific, Africa, and Latin America create significant demand for modern equipment. Greenfield developments allow seamless integration of automated systems, driving growth for manufacturers targeting these regions. This opportunity aligns with rising trade volumes and industrialization trends. |

| Adoption of Eco-Friendly and Energy-Efficient Solutions | Sustainability initiatives open avenues for innovation in energy-efficient and low-emission equipment. Ports prioritizing green operations create strong demand for compliant solutions. Manufacturers investing in eco-friendly technologies can capture this growing segment, enhancing brand reputation and market share. |

| Market Leaders (2025) | |

| Market Leaders |

8% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | France, Canada |

| Future outlook |

|

What are the growth opportunities in this market?

Ship Loader and Unloader Market Trends

The market is evolving rapidly, shaped by technological innovation, sustainability imperatives, and global trade dynamics. Key trends include automation, digitalization, and eco-friendly designs, all aimed at improving efficiency and compliance. These developments are redefining competitive strategies and influencing investment decisions across ports worldwide.

- Automation is a dominant trend, driven by the need for operational efficiency and reduced labor dependency. Modern systems incorporate IoT sensors, AI-based predictive maintenance, and remote monitoring capabilities, enabling real-time performance optimization. Digital integration enhances safety, minimizes downtime, and lowers costs, making automated solutions a strategic priority for ports. This trend aligns with the global push toward smart port ecosystems, where data-driven decision-making ensures faster turnaround times and improved resource utilization. Manufacturers investing in advanced automation technologies are gaining a competitive edge, as ports increasingly prioritize intelligent systems to remain competitive in a highly dynamic maritime logistics environment.

- Environmental regulations and corporate sustainability goals are reshaping equipment design. Ports are adopting loaders and unloaders equipped with dust suppression systems, energy-efficient drives, and enclosed conveyors to minimize emissions and spillage. This trend reflects a broader industry shift toward green port initiatives and carbon-neutral operations. Compliance with international standards is no longer optional; it is a critical purchasing criterion. Manufacturers that innovate in eco-friendly technologies are well-positioned to capture market share, as sustainability becomes a key differentiator. The emphasis on environmental performance is expected to intensify, creating opportunities for companies offering solutions that balance productivity with ecological responsibility.

- Rapid industrialization and trade growth in emerging markets are fueling demand for advanced cargo handling systems. Countries in Asia-Pacific, Africa, and Latin America are investing heavily in new port infrastructure, creating opportunities for integrating state-of-the-art loaders and unloaders. Unlike older ports, these greenfield projects allow seamless adoption of automated and eco-friendly solutions. This trend is driven by rising commodity exports and imports, coupled with government initiatives to modernize logistics networks. Manufacturers targeting these regions with cost-effective, scalable technologies stand to benefit significantly. The expansion of emerging economies is expected to remain a key growth driver for the global market.

Ship Loader and Unloader Market Analysis

Learn more about the key segments shaping this market

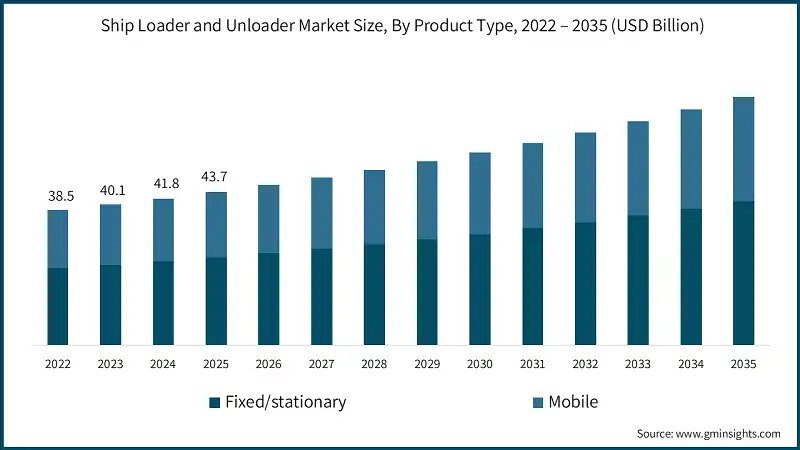

Based on product type, the market is divided into fixed/stationary and mobile. The fixed/stationary segment generated revenue of USD 25 billion in 2025.

- Fixed or stationary ship loaders and unloaders hold the largest share of the global market due to their reliability, high capacity, and suitability for large-scale port operations. These systems are preferred in major ports handling bulk commodities such as coal, iron ore, and grains, where continuous and high-volume loading is essential. Their robust design ensures long-term durability and minimal downtime, making them cost-effective over the equipment lifecycle despite higher initial investment.

- Additionally, stationary systems integrate advanced automation and dust-control technologies, aligning with environmental compliance and operational efficiency goals. Ports with established infrastructure favor these solutions for their ability to handle large vessels and optimize throughput. While mobile systems offer flexibility, fixed units dominate because of their superior performance in high-demand environments. This trend is expected to persist as global trade expands, and ports prioritize efficiency and sustainability in bulk material handling.

Learn more about the key segments shaping this market

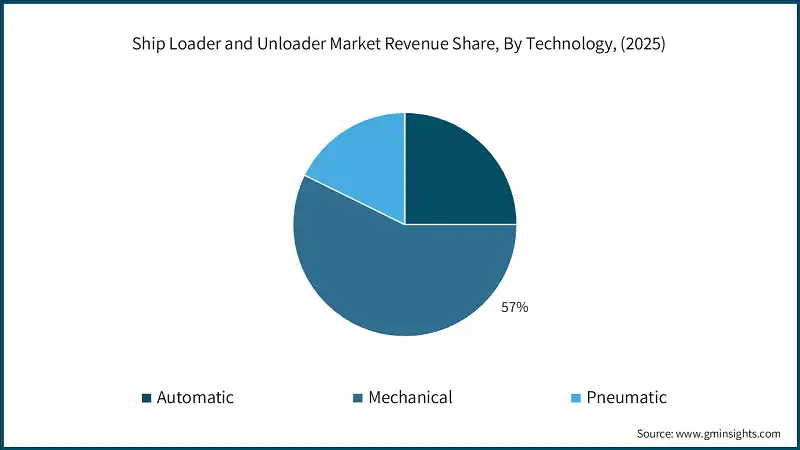

Based on end use, the ship loader and unloader market is segmented into automatic, mechanical, and pneumatic. The mechanical segment accounted for over 57% of the market share in 2025.

- Mechanical technology holds the largest share in the global ship loader and unloader industry, due to its proven reliability, cost-effectiveness, and adaptability for bulk material handling. These systems, which primarily use conveyor belts, screw conveyors, and bucket elevators, are widely deployed in ports handling commodities such as coal, minerals, and grains. Their ability to manage high-capacity operations with minimal energy consumption makes them a preferred choice for large-scale facilities.

- Mechanical systems also offer simpler maintenance compared to pneumatic alternatives, reducing operational downtime and lifecycle costs. Furthermore, advancements in automation and integration with dust-control features have enhanced their efficiency and compliance with environmental standards. While pneumatic systems cater to specialized applications, mechanical technology dominates because of its versatility and scalability in high-volume environments. This trend is expected to continue as ports prioritize robust, durable solutions to meet growing global trade demands.

Based on distribution channel, the ship loader and unloader market is segmented direct sales and indirect sales. In 2025, indirect sales segment held a major share, with more than 60% of market revenue.

- Indirect sales channels hold the largest share of the global market due to their ability to provide extensive reach, technical expertise, and after-sales support through established distributors and agents. These intermediaries play a critical role in connecting manufacturers with port operators, especially in regions where direct presence is limited. Indirect channels offer localized services, including installation, maintenance, and compliance assistance, which are essential for complex equipment like ship loaders and unloaders.

- Additionally, distributors often maintain strong relationships with port authorities and logistics firms, enabling faster procurement and project execution. This model reduces operational burden for manufacturers while ensuring customers receive tailored solutions and reliable support. As global trade expands and ports modernize, indirect sales are expected to remain dominant, particularly in emerging markets where regional partners facilitate market penetration and long-term service agreements.

Looking for region specific data?

Asia Pacific Ship Loader and Unloader Market

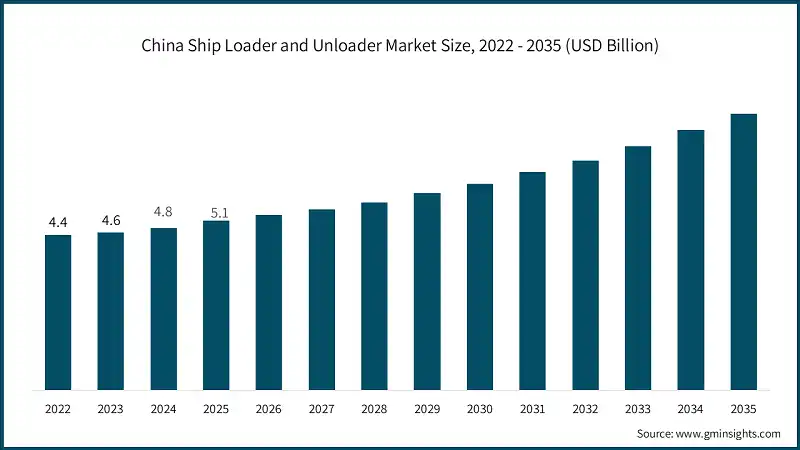

The Asia Pacific held market share of around 40% in 2025 and is anticipated to grow with a CAGR of around 5.3% from 2026 to 2035.

- China dominates the Asia-Pacific ship loader and unloader industry due to its extensive port infrastructure and leadership in global trade. The country’s rapid industrialization and high export volumes drive continuous investment in advanced cargo handling systems. Strategic initiatives to modernize ports and integrate automation technologies further strengthen their position.

- Additionally, China’s commitment to environmental compliance encourages adoption of eco-friendly equipment with dust suppression and energy-efficient features. Its role as a manufacturing hub and a key player in bulk commodity trade ensures sustained demand for high-capacity solutions. These factors collectively make China the cornerstone of growth in the APAC market.

North America Ship Loader and Unloader Market

In 2025, the U.S. dominated the North America ship loader and unloader industry, accounting for around 70% and generating around USD 5.9 billion revenue in the same year.

- The U.S. holds the largest share of the North American ship loader and unloader industry, driven by its extensive port infrastructure and high-volume trade activities. Major ports such as Houston, Los Angeles, and New Orleans handle significant bulk commodities, including grains, coal, and minerals, necessitating advanced loading and unloading systems. The country’s strong investment in automation and modernization projects further reinforces its leadership position.

- Additionally, stringent environmental regulations have accelerated the adoption of eco-friendly and dust-controlled equipment, aligning with sustainability goals. The presence of leading manufacturers and technology providers ensures continuous innovation and availability of high-capacity solutions. With growing exports of agricultural products and energy resources, demand for efficient cargo handling systems remains robust. This dominance is expected to persist as U.S. ports continue upgrading infrastructure to accommodate larger vessels and optimize operational efficiency in response to global trade expansion.

Europe Ship Loader and Unloader Market

Europe market held 22% share in 2025 and is expected to grow at 5% during the forecast period.

- Germany is a key driver of growth in Europe’s ship loader and unloader industry, supported by its advanced industrial base and strong maritime infrastructure. The country’s emphasis on technological innovation and automation in port operations positions it as a leader in adopting high-capacity, efficient systems.

- Additionally, Germany’s commitment to sustainability and compliance with stringent environmental regulations fosters demand for eco-friendly equipment with dust suppression and energy-efficient features. Its strategic location and role as a major exporter of industrial goods further amplify the need for modern cargo handling solutions. These factors collectively make Germany a pivotal market within Europe’s evolving port logistics landscape.

Middle East and Africa Ship Loader and Unloader Market

Middle East and Africa ship loader and unloader industry is growing at a CAGR of 4% during the forecast period.

- Saudi Arabia plays a significant role in driving growth within the Middle East and Africa loader and unloader market, supported by its strategic position as a global energy exporter and its extensive port infrastructure. The country’s ongoing investments in modernizing maritime facilities and expanding bulk handling capabilities align with its economic diversification plans.

- Strong demand for efficient cargo handling systems in oil, petrochemical, and mineral sectors further accelerates adoption of advanced technologies. Additionally, sustainability initiatives and compliance with international standards encourage the integration of eco-friendly and automated solutions. These factors collectively position Saudi Arabia as a key growth engine in the region.

Ship Loader and Unloader Market Share

Major players in the market FLSmidth, AUMUND Group, SMB Group, Sandvik, and VIGAN Engineering collectively focus on innovation, sustainability, and global expansion to strengthen their positions. Their strategies emphasize advanced automation, IoT integration, and predictive maintenance to enhance efficiency and reduce downtime.

Sustainability remains a core priority, with investments in energy-efficient designs and dust-control technologies to meet stringent environmental regulations. Additionally, these companies leverage strong service networks and strategic partnerships to ensure localized support and long-term customer relationships. By combining technological leadership with compliance-driven solutions, they maintain competitive advantage and align with evolving port modernization trends.

FLSmidth strengthens its market position through a focus on integrated solutions and technological innovation. The company emphasizes automation, digitalization, and sustainability in its product portfolio, offering advanced ship loaders and unloaders with energy-efficient designs and dust-control systems. Strategic partnerships and acquisitions enhance their global reach, while continuous investment in R&D ensures cutting-edge solutions for bulk material handling. FLSmidth also leverages its strong service network to provide lifecycle support, reinforcing customer loyalty. By aligning with environmental regulations and smart port initiatives, the company positions itself as a leader in delivering high-capacity, eco-friendly systems tailored to evolving industry demands.

AUMUND Group focuses on specialization and engineering excellence to maintain its competitive edge. The company offers customized solutions for bulk material handling, targeting sectors such as cement, mining, and ports. Its strategy revolves around product differentiation through robust, durable designs and advanced automation features. AUMUND invests in global service centers to provide timely maintenance and technical support, ensuring operational reliability for clients. Additionally, the company prioritizes sustainability by integrating energy-efficient components and dust-reduction technologies. By combining technical expertise with strong regional presence, AUMUND secures long-term contracts and strengthens its position in markets demanding high-performance, tailored solutions.

SMB Group adopts a customer-centric approach, focusing on flexibility and innovation in ship loading and unloading systems. The company emphasizes modular designs that allow easy customization for diverse port requirements. Its strategy includes leveraging automation and digital monitoring to enhance operational efficiency and reduce downtime. SMB Group also invests in eco-friendly technologies, aligning with global sustainability trends. Strong after-sales service and technical support further reinforce its market presence. By targeting niche applications and offering scalable solutions, SMB Group positions itself as a reliable partner for ports seeking cost-effective, high-performance equipment tailored to evolving trade and environmental standards.

Ship Loader and Unloader Market Companies

Major players operating in the ship loader and unloader industry are:

- AMECO

- AUMUND

- BEUMER

- Buhler

- Dana

- EMS-Tech

- FAM Förderanlagen Magdeburg

- FLSmidth

- Liebherr

- NEUERO

- Sandvik

- Shanghai Zhenhua Heavy Industries

- SMB

- TAKRAF

- VIGAN Engineering

Sandvik’s strategy centers on technological leadership and global expansion. The company integrates advanced automation, IoT-enabled monitoring, and predictive maintenance into its ship loader and unloader systems, ensuring superior efficiency and safety. Sandvik leverages its strong brand reputation in mining and material handling to penetrate port infrastructure markets. Sustainability is a key focus, with energy-efficient designs and dust-control features embedded in its offerings. Strategic collaborations and continuous R&D investment enable Sandvik to deliver innovative solutions that meet stringent environmental regulations. By combining cutting-edge technology with a robust service network, Sandvik secures its position as a preferred supplier for high-capacity operations.

VIGAN Engineering differentiates itself through specialization in pneumatic unloading systems, catering primarily to grain and agri-bulk sectors. Its strategy emphasizes precision, efficiency, and environmental compliance, offering equipment that minimizes dust emissions and energy consumption. VIGAN invests in innovation to enhance performance and adapt to evolving port requirements. The company also focuses on strengthening its global footprint through partnerships and localized service support, ensuring timely maintenance and technical assistance. By targeting niche markets and delivering eco-friendly, high-performance solutions, VIGAN positions itself as a leader in specialized cargo handling, capitalizing on growing demand for sustainable and efficient unloading technologies.

Ship Loader and Unloader Market News

- In November 2025, Pacific Avenue Capital Partners successfully completed the acquisition of FLSmidth Cement after meeting all regulatory and closing conditions. This strategic move enables Pacific Avenue to strengthen its portfolio in industrial solutions while allowing FLSmidth to streamline its operations and focus on core competencies. The deal reflects growing private equity interest in specialized engineering sectors and positions both entities for enhanced operational efficiency and market competitiveness.

- In May 2023, Zhenhua Heavy Industries Co., Ltd. (ZPMC) developed new high-efficiency and environment-friendly screw ship unloaders. The equipment is designed to unload bulk coal cargo with a weight of 100,000t, a rated capacity of 1,500t/h and a maximum capacity of 1,800t/h. The newly developed screw ship unloader adopts a new combination scheme of horizontal screw conveyor and belt conveyor.

- In January 2022, SAMSON introduced a mobile shiploader system designed for narrow quay applications, addressing space constraints while ensuring efficient bulk material handling. The system offers flexibility, rapid deployment, and high throughput, making it ideal for ports with limited infrastructure. This innovation reflects SAMSON’s commitment to engineering solutions that combine operational efficiency with adaptability to diverse port environments.

The ship loader and unloader market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Type

- Fixed/stationary

- Mobile

Market, By Technology

- Automatic

- Mechanical

- Pneumatic

Market, By Bulk

- Dry

- Liquid

Market, By Capacity

- Up to 5000 t/h

- 5000 t/h to 10,000 t/h

- 10,000 t/h to 20,000 t/h

- Above 20,000 t/h

Market, by Application

- Mining

- Ports and Shipping

- Construction

- Machinery

- Others (power plant industry, etc.)

Market, by Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the ship loader and unloader market?

North America remains a key market, with the U.S. contributing nearly 70% of regional revenue, amounting to USD 5.9 billion in 2025, supported by port automation and environmental compliance initiatives.

What was the valuation of the mechanical technology segment in 2025?

The mechanical segment held 57% of the global market share in 2025, generating significant revenue due to its reliability and cost-effectiveness in bulk material handling.

What is the current ship loader and unloader market size in 2026?

The market size is projected to reach USD 45.6 billion in 2026, reflecting steady growth fueled by global maritime trade expansion.

How much revenue did the fixed or stationary product segment generate in 2025?

Fixed or stationary ship loaders and unloaders generated USD 25 billion in 2025, leading the market due to their high capacity and suitability for large-scale port operations.

What are the upcoming trends in the ship loader and unloader market?

Key trends include automation and digitalization, IoT-enabled and AI-driven predictive maintenance, adoption of eco-friendly and energy-efficient equipment, and increasing investments in smart port infrastructure.

What is the projected value of the ship loader and unloader market by 2035?

The ship loader and unloader market is expected to reach USD 70.8 billion by 2035, propelled by investments in automation, high-capacity equipment, and sustainable cargo handling solutions.

What is the market size of the ship loader and unloader market in 2025?

The market size was USD 43.7 billion in 2025, with a CAGR of 5% expected through 2035, driven by rising global trade, increasing bulk material handling needs, and ongoing port infrastructure modernization.

Ship Loader and Unloader Market Scope

Related Reports