Summary

Table of Content

Scissor Lift Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Scissor Lift Market Size

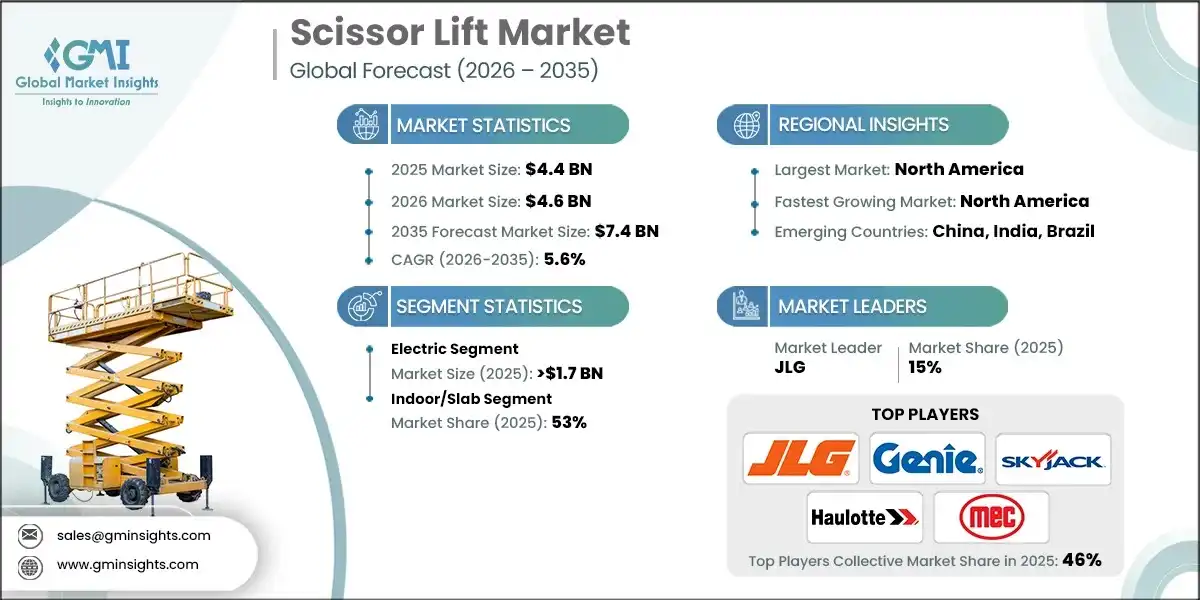

The scissor lift market was estimated at USD 4.4 billion in 2025. The market is expected to grow from USD 4.6 billion in 2026 to USD 7.4 billion in 2035, at a CAGR of 5.6% according to latest report published by Global Market Insights Inc.

To get key market trends

The growth of the scissor lift industry is reflective of the growing importance of scissor lifts to the industries that use them. Companies in the construction industry, manufacturing, maintenance, etc., are using scissor lifts to provide safe and effective work environments for both employees and equipment. Because of their ease of use, versatility, and ability to operate in confined spaces, scissor lifts provide an effective solution for a variety of indoor and outdoor work applications. The focus of the scissor lift market has evolved from being driven primarily by the need for utilitarian solutions to a market that is now focused on providing operator comfort, increased safety features, and addressing environmental concerns.

As a result, manufacturers are producing electric and hybrid scissor lifts to meet their sustainability goals and respond to increased regulations concerning workplace noise and air quality. As a result of this demand, electric and hybrid scissor lifts are also being built with more compact designs and more sophisticated control systems for operators. Additionally, rental services are also driving the growth of the scissor lift market, as companies look for affordable options that don't require long-term commitments to ownership.

By providing durable, low-maintenance, and reliable equipment suitable for repeated use, suppliers have responded to this demand by providing models that will last through multiple uses. Ultimately, the scissor lift market is at a crossroads where the demand for safer workplaces is driving the advancement of technology in the industry, while at the same time, continuing to focus on the practical solutions provided by scissor lifts for many industries. Therefore, as businesses continue to focus on maximizing productivity, adhering to regulatory compliance, and enhancing the safety of their employees, scissor lifts will continue to be an integral part of their inventory of equipment.

Scissor Lift Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.4 Billion |

| Market Size in 2026 | USD 4.6 Billion |

| Forecast Period 2026-2035 CAGR | 5.6% |

| Market Size in 2035 | USD 7.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Safe Working Platforms | Industries are prioritizing worker safety and efficiency, leading to increased adoption of scissor lifts as a reliable alternative to ladders and scaffolding. |

| Growth in Construction and Infrastructure Projects | Urbanization and large-scale infrastructure development worldwide are fueling demand for both indoor and rough terrain scissor lifts. |

| Shift Toward Electric and Eco-Friendly Models | Environmental regulations and sustainability goals are driving manufacturers to develop electric and hybrid lifts, boosting market acceptance. |

| Pitfalls & Challenges | Impact |

| High Initial Investment and Maintenance Costs | The upfront cost of purchasing scissor lifts and ongoing maintenance expenses can deter small businesses and contractors. |

| Operational Limitations in Extreme Conditions | Scissor lifts have restricted use in very uneven terrains or harsh weather, limiting their applicability in certain outdoor projects. |

| Opportunities: | Impact |

| Expansion of Rental Services | The growing preference for renting over owning equipment creates opportunities for rental companies and manufacturers to offer flexible solutions. |

| Integration of Smart Technologies | Adding IoT-based monitoring, telematics, and automation features can enhance safety and efficiency, opening new revenue streams for manufacturers. |

| Market Leaders (2025) | |

| Market Leaders |

15% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | North America |

| Emerging Country | China, India, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Scissor Lift Market Trends

The global scissor lift industry is experiencing dynamic shifts, driven by evolving construction practices, industrial needs, and technological advancements.

- The rental sector has a huge demand, and a large part of the reason why the rental business is thriving is because of the continued trend toward renting instead of buying scissor lifts. Rental companies continue to add technologically advanced models to their fleets to satisfy customers’ varying preferences as well as their need to be competitive in the rental market. Most rental companies have made it a point to develop new equipment not only to provide customers with a better selection of choices to choose from, but to maintain competitive advantage.

- Another large part of the growth of scissor lift rentals can be attributed to the increased focus on compact and lightweight designs. As more people turn to urban construction, indoor maintenance, and facility management, there is a need for scissor lifts that can be utilized in tight spaces and on specialty flooring, while still providing good maneuverability. By developing compact scissor lifts and making them lightweight, more customers will have the ability to utilize scissor lifts for their work while avoiding the potential danger of losing stability.

- Automation and Remote Control Capabilities: Automation and remote control capabilities are becoming more popular in the market for some scissor lifts. The incorporation of automated features and remote control systems enables users to accurately position material, enhances safety by minimizing the need for operators to be present in dangerous work environments, and increases overall productivity when executing repetitive tasks, thereby streamlining operations within complex manufacturing environments.

- Enhanced Safety Features: Manufacturers are developing advanced safety technology, such as load sensing systems, anti-tilt devices, and superior emergency lowering controls. The focus of these enhanced safety features is to help reduce accidents and improve the safety of operators, comply with worldwide occupational safety standards, and decrease users' potential liability.

- The trend towards more electrically and hybrid powered scissor lifts continues to increase as the regulations around emissions get tougher, along with the demand for quieter equipment. Electric and hybrid scissor lifts use less fuel compared to their gas-powered counterparts, which translates to lower operating costs. They don't emit harmful gases while being operated and can be used for indoor applications. Therefore, they are perfectly fit for construction companies working in urban areas and/ or for those who consider the environment.

- Most modern scissor lift products now feature telematics and can connect to the Internet of Things (IoT), allowing operators to track and monitor the performance (location, usage) of their scissor lift in real-time. Using a telematics system allows the operator to implement predictive maintenance and loss prevention as well as enhance fleet management by monitoring the efficiency of their equipment and protecting themselves from theft.

Scissor Lift Market Analysis

Learn more about the key segments shaping this market

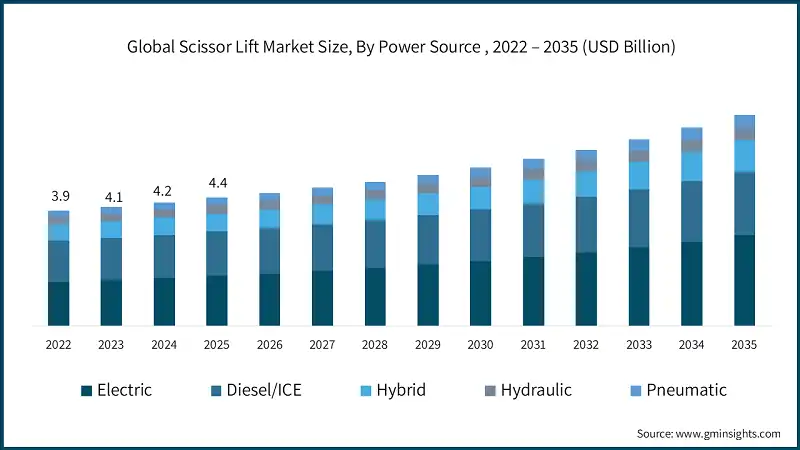

Based on power source, the market is divided into electric, diesel/ICE, hybrid, hydraulic, and pneumatic. The electric segment exceeded USD 1.7 billion in 2025.

- The electric lift segment within the scissor lift market is expected to see significant growth, largely due to tightening regulations regarding emissions from off-road vehicles and the growing focus on improving the quality of indoor air. Both factors will push the industry towards using 100% electric powered scissor lift models, which will result in increased demand for electric lift models. Diesel and internal combustion engine lifts should lose overall market share; still, those types of lifts are expected to remain in operation and to see limited value growth over time due to growing preference towards cleaner, more efficient power sources.

- Hybrid lifts are expected to experience additional growth, filling the need for applications with longer durations without charging or where limited charging is allowed; this is especially true for those applications performed in combined indoor and outdoor workspaces.

- Electric lift development has also been aided by lower cost electric batteries, improved techniques in providing safe environments for indoor operations, and thus lowered total cost of ownership (TCO) for electric lift operators. To improve the overall rental utilization rates and residual values associated with electric lifts, lift manufacturers are placing emphasis on battery management, battery charge speed, and telematics.

- During the next several years, hydraulic lifts are expected to continue to decrease in popularity as the industry transitions towards using electric drive systems for the mainstream scissor lift application. Pneumatic lifts will continue to occupy a niche position; however, they will primarily be used in environments where spark-free operations are required (e.g., clean rooms) or where a low level of safety standards prevents either the use of combustion engines or electric spark ignitions from operating.

Learn more about the key segments shaping this market

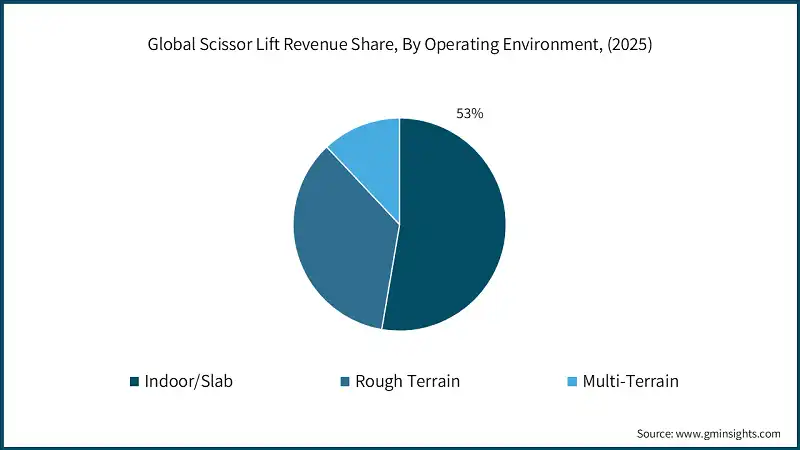

Based on operating environment, the market is segmented into indoor/slab, rough terrain, and multi-terrain. The indoor/slab segment accounted for 53% of the market share in 2025.

- The primary driver behind the global scissor lift market's dominance by the indoor or slab segment is its predominant presence in controlled indoors such as factories, warehouses, and distribution centers, among others. A common requirement for all these applications is the need for a compact, agile working platform which provides a stable base and the ability to traverse uneven surfaces without harm.

- Slab scissor lifts are ideally suited for these conditions, offering quiet electric operation and zero-emission capabilities with ease of mobility in tight areas. Moreover, these types of lifts facilitate safe worker access to perform necessary tasks for inventory management, equipment service, and installation activities, making them a key element in many industries in which most of the work is done indoors. The trend toward increased automation of operations within organized warehouses also creates a greater demand for this type of scissor lift because companies are interested in maximizing productivity and ensuring safety while working in small environments like those found in distribution centers.

- Rough terrain scissor lifts, while the second leading power source, maintain significant market presence due to their importance on outdoor and heavy-duty job sites. Outdoor job sites require equipment that can safely navigate through mud, uneven terrains, and inclement weather; rough terrain lifts are specifically built for such tasks, equipped with rugged tires and heavy-duty engines to achieve the high load capacity required to complete outdoor jobs safely. Although not as commonly used as indoor lifts, the large-scale, complex nature of outdoor projects guarantees continued demand for rough terrain lifts.

Based on distribution channel, the scissor lift market is segmented into direct sales and indirect sales. The direct sales dominate the market with highest share.

- The dominant segment in the global market is direct sales due to the preference of major construction companies, industrial operators, and rental companies to buy directly from the manufacturers or authorized dealers.

- The direct sale model provides the largest level of customization, access to after-sale service, warranties, and training programs. By working directly with suppliers, suppliers can build a better relationship with their customers, thus creating trust within the business. When companies operate a fleet of scissor lifts or require the use of specialized scissor lifts, they value the clarity and confidence of dealing directly with the supplier, which is why this model is preferred.

- Indirect sales are the fastest-growing segment of the global scissor lift market, with many small and medium enterprises and contractors looking for cost-effective and fast procurement of scissor lifts without having to enter a long-term contractual relationship. Indirect sales channels, such as e-commerce, regional distributors, and rental service providers, fulfill this need by providing a range of flexible packages at competitive prices and local availability.

- The ability to search online for scissor lift options, receive product shipments quickly, and the availability of bundled services, such as short-term rental and financing alternatives on direct purchases, are appealing to small and medium enterprise customers and buyers with limited cash flow. As both the digitalization and rental trends continue to grow, the indirect sales channel will continue to grow rapidly and expand what will become the "standard" way that scissor lifts reach end users.

Looking for region specific data?

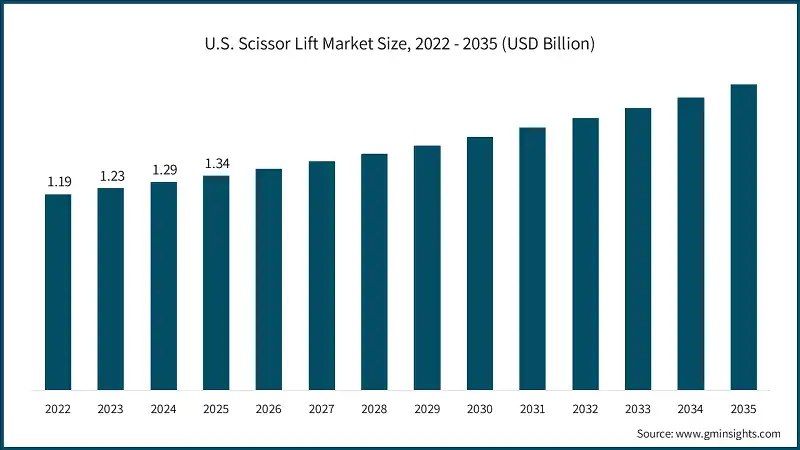

U.S. dominated the North America scissor lift market with around 82% share and generating USD 1.34 billion revenue in 2025.

- Scissor lifts are still some of the most popular and commonly used types of aerial work platforms in North America, and this trend has been largely due to the mature construction market in the US, as well as ongoing infrastructure development and a large-scale presence of modern, advanced equipment. Major rental companies and manufacturers located in North America have provided strong support and easy access to scissor lifts.

- The demand for electric slab scissor lifts in warehouses and commercial applications continues to grow because of the increased focus on safety and workplace efficiency. There will also be ongoing demand for rough-terrain scissor lift options through the continued growth of large projects within the construction industry and renewable energy sectors. Furthermore, the demand for technologically advanced and eco-friendly options within the North American market continues to strengthen its market share.

In Europe scissor lift market, Germany leads the 23% share in 2025 and is expected to grow at 5% CAGR during the forecast period.

- This market growth is driven by strict safety standards and regulations, as well as the desire to achieve sustainability goals. Equipment designed to be low emission is currently highly sought after in Europe, and as a result, electric and hybrid scissor lifts are very popular for indoor applications.

- Continuous growth in the European market is also being fueled by the modernization of distribution centers, retail locations, and manufacturing facilities. As automation trends continue to accelerate in Europe, countries like Germany, France and the UK have been leading the way in terms of adopting new technologies that meet European Union regulations.

- Although most of the demand for scissor lifts continues to be for indoor slab lifts, there is also demand for these types of scissor lifts used in the construction industry, particularly within the renewable energy and infrastructure industries. Given the high rental rate in Europe, scissor lift manufacturers are putting more focus on the development of durable and easy-to-repair designs for use in the rental market.

The Asia Pacific holds significant share in the scissor lift market. China holds a share of around 44% in 2025 and is anticipated to grow with a CAGR of 5.6% from 2026 to 2035.

- APAC is the most dynamic area in terms of increasing demand for scissor lifts. APAC's demand for scissor lifts is driven by rapid urbanization and industrialization along with significant infrastructure projects being developed in China, India and Southeast Asia. Furthermore, the rapidly growing construction industry and the increasing amount of investment into smart cities presents tremendous opportunities for slab and rough-terrain scissor lifts.

- Indoor scissor lifts tend to be of much use in the areas of the manufacturing and logistics industries, while outdoor scissor lifts are most used on road, bridge and energy construction projects. Furthermore, due to the growing recognition of the importance of safety standards, combined with the transition to mechanized equipment in developing countries, this has led to an increased demand for scissor lift products. Lastly, lower competitive pricing along with availability of rental scissor lift products also supports the continued growth and strong potential markets associated with scissor lifts within the APAC region.

- As one of the leading design and manufacturing companies in the world on access platforms, JLG offers a comprehensive range of scissor lift products and continues to be an industry leader through the largest product range available, substantial innovation, and a robust international distribution system. JLG offers numerous models powered by electric and gas engine-based technologies for multiple construction and industrial purposes throughout the world.

Scissor Lift Market Share

JLG is leading with 15% market share. JLG, Genie, Skyjack, Haulotte, and MEC Aerial collectively hold around 46%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

MEC Aerial Work Platforms has established a strong reputation for producing robust and heavy-duty scissor lifts. Among the products that they manufacture are specialized models and MEC’s emphasis on continuous innovation, durability, and high-capacity models has set them apart from others in the industry. As a result of catering to niche markets, providing strong solutions for difficult construction and industrial projects, MEC has a strong position in the marketplace.

The Haulotte Group produces a complete series of essential scissor lifts that can handle some of the toughest challenges in the industry. With a strong commitment to global innovation and the continued development of the next-generation electric and rough-terrain products, as well as a comprehensive after-sales service program, The Haulotte Group continues to dominate the marketplace. They have consistently received accolades for creating some of the highest-quality performance-based products, which feature cutting-edge technology.

Scissor Lift Market Companies

Major players operating in the scissor lift industry are:

- JLG Industries, Inc. (Oshkosh Corporation)

- Terex Corporation (Genie Brand)

- Linamar Corporation (Skyjack Brand)

- Haulotte Group

- MEC Aerial Work Platforms

- Aichi Corporation (Toyota Industries)

- Manitou Group

- Zhejiang Dingli Machinery Co., Ltd.

- Hy-Brid Lifts

- AXCS Equipment

- Zoomlion Heavy Industry (Zoomlion Access)

- XCMG (Xuzhou Construction Machinery Group)

- Sinoboom Intelligent Equipment Co., Ltd.

- Almac S.p.A.

- Hangcha (Hangzhou Hangcha Aerial Platform Equipment)

- The JLG offers a wide selection of scissor lifts and is one of the leading manufacturers of access equipment in the world. With its comprehensive product range, continuous focus on developing innovative products and a large distribution network, JLG has attained significant market share within the industry. The company provides numerous electric and engine powered models that can be utilized for a variety of construction and industrial projects throughout the world.

- Genie, which is a brand of Terex Corporation, is an internationally established manufacturer of aerial work platforms, with scissor lifts being one of their most important types of equipment. Genie has developed a reputation as a manufacturer of robust, reliable and user-friendly equipment, in addition to a wide range of international availability. Continuous investment in developing new technology and safety features will help Genie remain one of the industry leaders.

- Skyjack is one of the largest manufacturers of aerial work platforms in the world and is best known for its large variety of scissor lifts. Providing customers with simple, high-quality and easy-to-maintain products is one of Skyjack's greatest competitive advantages. Dedication to producing inexpensive, dependable equipment has been a key factor in their ability to capture significant market share around the world.

Scissor Lift Market News

- In April 2025, JLG Industries launched the ES1930M micro-sized electric scissor lift with compact dimensions and 19-foot working height for confined spaces. This will help the company in capturing the growing indoor construction and maintenance market where space constraints limit traditional equipment deployment.

- In February 2025, JLG introduced the Aviation Package for its ES2646 electric-drive scissor lift featuring LIDAR and ultrasonic detection systems for aircraft hangar operations. This will help the company in penetrating the specialized aviation maintenance sector while differentiating its product portfolio through advanced safety technology.

- In February 2025, Zoomlion announced establishment of a 55,000-square-meter MEWP manufacturing facility in Hungary to serve European markets with localized production. This will help the company in reducing logistics costs, improving delivery times, and strengthening its competitive position against established European manufacturers.

- In January 2025, Genie launched six next-generation electric slab scissor lifts featuring innovative curved linkage design and enhanced productivity capabilities. This will help the company in reducing total cost of ownership for customers while strengthening its competitive position in the electric scissor lift segment.

- In February 2024, Skyjack launched its micro scissor line including SJ3213 and SJ3219 models featuring E-Drive electric technology at the ARA Show. This will help the company in expanding its electric product portfolio while addressing customer demand for compact, zero-emission equipment in indoor applications.

The scissor lift market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Power Source

- Electric scissor lifts

- Diesel/internal combustion engine lifts

- Hybrid scissor lifts

- Hydraulic scissor lifts

- Pneumatic scissor lifts

Market, By Operating Environment

- Indoor/slab scissor lifts

- Rough terrain scissor lifts

- Multi-terrain scissor lifts

Market, By Size

- Compact/micro scissor lifts

- Standard scissor lifts

- Large scissor lifts

- Heavy-duty/high-capacity lifts

Market, By Platform Height

- Low-level access

- Mid-level access

- High-level access

- Ultra-high access

Market, By Capacity/Load Rating

- Light duty

- Standard-duty

- Heavy-duty

- Extra heavy duty

Market, By End Use Industry

- Construction & infrastructure

- Warehousing & logistics

- Manufacturing & industrial

- Facilities maintenance & property management

- Retail & commercial

- Aerospace & aviation

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Turkey

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the scissor lift market?

North America is the largest market, with the U.S. dominating with 82% share and generating USD 1.34 billion in 2025, supported by mature construction markets and strong rental infrastructure.

What are the upcoming trends in the scissor lift market?

Key trends include shift toward electric and hybrid models, integration of IoT-based telematics and automation, enhanced safety features with load sensing systems, and growing preference for compact designs for urban applications.

Who are the key players in the scissor lift market?

Key players include JLG Industries (Oshkosh Corporation), Terex Corporation (Genie Brand), Linamar Corporation (Skyjack Brand), Haulotte Group, MEC Aerial Work Platforms, Aichi Corporation (Toyota Industries), Manitou Group, Zhejiang Dingli Machinery Co., Hy-Brid Lifts, AXCS Equipment, Zoomlion Heavy Industry, XCMG, Sinoboom Intelligent Equipment Co., Almac S.p.A., and Hangcha.

What was the market share of indoor/slab scissor lifts in 2025?

Indoor/slab scissor lifts held 53% market share in 2025, dominating due to their widespread use in warehouses, factories, and distribution centers.

What is the current scissor lift market size in 2026?

The market size is projected to reach USD 4.6 billion in 2026.

How much revenue did the electric scissor lift segment generate in 2025?

Electric scissor lifts exceeded USD 1.7 billion in 2025, driven by tightening emission regulations and growing focus on indoor air quality.

What is the market size of the scissor lift in 2025?

The market size was USD 4.4 billion in 2025, with a CAGR of 5.6% expected through 2035 driven by rising focus on worker safety, operational efficiency, and growth in construction projects.

What is the projected value of the scissor lift market by 2035?

The scissor lift market is expected to reach USD 7.4 billion by 2035, propelled by expansion of rental services, shift toward electric models, and integration of smart technologies.

Scissor Lift Market Scope

Related Reports