Summary

Table of Content

Roller Shutter Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Roller Shutter Market Size

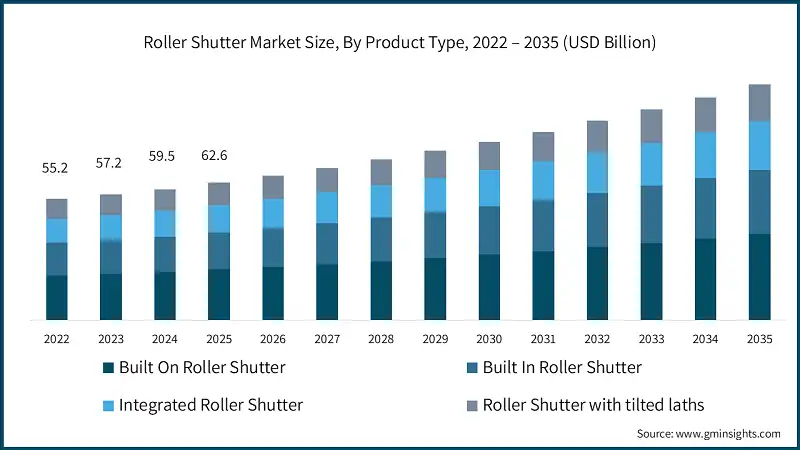

The global roller shutter market was estimated at USD 62.6 billion in 2025. The market is expected to grow from USD 65.9 billion in 2026 to USD 107.4 billion in 2035, at a CAGR of 5.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

A significant portion of the efficiency gain and supply chain eco consciousness, which are heavily emphasized, has led to a surge in the demand for high-speed roller shutter systems. This is attributed to the increase in mergers and acquisitions among industry leaders. The combining of the forces of the key players in the business resulted in more innovations, broader product portfolios, and stronger market presence.

Meanwhile, the use of manual door operation methods or basic sectional gates has not only become less environmentally friendly but also less economically viable. Presently, the insulated roller shutter systems signify a more sustainable future as they have been equipped with energy, saving motor technology and materials with high thermal resistance, thus limiting the environmental impact by reducing energy loss.

This green way is consistent with the adoption of sustainable practices in logistics and manufacturing, which is also a factor contributing to the growth of the market. The utilization of automation in warehousing and logistics hubs has become a trend in North America, with demand increasing at a fast pace. Moreover, the rise of industrial and e-commerce infrastructure spending in Europe and some parts of the Asia and Pacific region has paved the way for the commercial viability of such equipment. Both consumers and professionals have chosen efficient, mechanized solutions for high, throughput distribution, thus they are no longer using the old, time, consuming shuttle methods.

Roller Shutter Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 62.6 Billion |

| Market Size in 2026 | USD 65.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.6% |

| Market Size in 2035 | USD 107.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| High security & crime prevention needs | The rising concern for property safety in urban areas drives the demand for reinforced aluminum and steel shutters. This is a primary factor for both retail storefronts and residential complexes. |

| Smart home & building automation | The shift toward smart cities necessitates roller shutters that integrate with IoT ecosystems. This allows users to control security remotely via smartphones, boosting sales of motorized systems. |

| Energy efficiency & thermal insulation | Global energy regulations (like the EU Green Deal) push property owners toward insulated shutters. These systems can reduce building heat loss by up to 25-30%, supporting sustainability goals. |

| Pitfalls & Challenges | Impact |

| High installation costs & maintenance | Premium automated systems require professional installation and periodic motor service. This high upfront cost can deter budget-conscious homeowners and small businesses. |

| Complexity of retrofitting older structures | Integrating modern motorized shutters into existing legacy buildings often requires structural modifications, leading to higher labor costs and potential aesthetic misalignments. |

| Opportunities: | Impact |

| IoT & predictive maintenance sensors | Utilizing AI-enabled sensors to monitor motor health and slat alignment reduces unplanned repairs. This enables manufacturers to offer "Maintenance-as-a-Service" (MaaS) contracts. |

| Hurricane & extreme weather protection | The increase in volatile weather patterns creates a massive need for storm-rated, impact-resistant shutters in coastal regions, particularly in North America and East Asia. |

| Market Leaders (2025) | |

| Market Leaders |

9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

E-retailers and third, party logistics (3PL) providers are most of the time demanding faster methods that are less disruptive for accessing facilities. Because of this, roller shutters are becoming a major choice due to their already, known benefits, for example, the optimization of floor space and reduction of the risk of workplace injuries caused by manual lifting and straining. As a matter of fact, the market is basically driven by an increased awareness of the long, term benefits of a fully integrated building envelope, which leads to a broader acceptance of these powerful devices.

Moreover, the ongoing upgrades in slat design and guide rail technology will help to further enhance the safety and ease of operation of the users. The interplay of infrastructure support, an industry, wide focus on smart warehouse management, and a demand for high, efficiency convenience acting as a synergy is therefore behind the market's robust financial performance. Technological innovation in equipment is one of the major factors behind the market's continuous expansion, thus, the traditional simple mechanical barriers are being gradually converted into highly intelligent, application, specific machinery. The industry is experiencing an obvious movement towards the implementation of smart drive motors and sophisticated control systems that, on the one hand, improve efficiency and, on the other hand, extend the shutter's lifespan.

The manufacturers, consequently, are very much focused on enhancing the operator’s experience through the provision of such features as IoT, enabled remote monitoring for safety purposes, modular shutter designs for excellent maneuverability on irregular facility layouts, and integrated AI and telematics for entrance management. The roller shutter market would essentially be a daily moving machinery market, thus demand and supply would be dependent on what people do with their day to day lives, e. g. the big pandemic, sized jump in e, commerce fulfillment and global trade which has, in turn, led to a professional and industrial demand for error, free and high-speed distribution spaces.

The primary operational difference between conventional manual doors and automated high-speed shutters is that the latter electrically and automatically control the flow of goods with absolute precision and efficiency, thereby eliminating handling bottlenecks, while, at the same time, an additional felicitous consequence is also being generated, and the time spent on loading and dispatching is rapidly decreasing.

Such high performance has attracted very large, scale distribution centers, which are seeking even higher throughput, as well as manufacturing/packaging firms, which require a steady and timely supply of the production line. The market composition is the direct result of the demand, as the insulated and fire, rated roller shutter segments have been consistently capturing the biggest revenue share and therefore, accounting for most of the total roller shutter market revenue in recent years. The predominance of this sector is the direct consequence of the machines' performance strength, durability, and high security, which are an ideal match for the modern professional's need for versatility and rapid deployment.

In addition, technology is gradually becoming a very significant factor, and features such as programmable logic controllers (PLCs) offer a more personalized and precise opening and closing operation. All these interrelated trends signal the market's dynamism and its ability to satisfy the requirements of a broad range of industrial and commercial sectors. Consequently, as more individuals and professional services demand quicker and less disruptive ways of maintaining security and thermal insulation, automated shutter systems are gaining popularity due to their acknowledged advantages, such as cutting down.

The demand for these products is mostly influenced by the growing recognition of energy, saving benefits of high, efficient perimeter control over the long term, which is leading to a broader acceptance of these powerful devices. The industry is witnessing a major shift in the use of reinforced aluminum and high, density polyurethane cores that increase efficiency and curtain lifespan for handling a wider range of wind pressures and environmental stresses. Manufacturers are striving hard to improve the operator's experience and as a result, they are introducing such features as IoT, enabled performance monitoring for safety enhancement, and automated self, repairing tracks for great mobility.

Roller Shutter Market Trends

The roller shutter industry is experiencing dynamic trends that are reshaping its landscape and creating new opportunities for growth. Notably, technological advancements have become a driving force, with the integration of automation and the development of lighter-weight materials. The reduced weight of modern roller shutters not only makes them more user-friendly but also opens avenues for innovation in design and installation.

Another noteworthy trend is the surge in the number of warehouses, fuelled by the exponential growth of the e-commerce industry. Additionally, the increasing trend of constructing smart homes has propelled the adoption of advanced roller shutter solutions that align with modern home automation systems.

- Technology advancement and product innovation: The machines are becoming more advanced and efficient, which is also the reason for the integration of IoT, enabled remote monitoring and wireless control systems to provide better safety and performance. Alongside the electric drive motor development for higher power and energy efficiency, companies are making the most of the efforts to produce long, lasting, high, tensile slats and strong, reinforced guide rails that will not only increase system uptime but also structural integrity.

- Expansion of e-commerce and automated fulfilment services: Good health of retail and third, party logistics (3PL) industries has been one of the main reasons for the market growth. Together, e, commerce and logistics companies make a largest segment, where rapid turnover of goods requires fast access solutions. Consequently, the demand for efficient rapid, roll shutters and automated loading bay systems resulting from high-speed order fulfilment and last, mile delivery optimization is increasing. This increase is both fuelling the global supply chain expansion and the growth of urban micro, fulfilment where retailers are heavily investing in automated distribution infrastructure that requires secure, fast, acting entry points.

- Sustainable land and facility management: Energy waste and operational bottlenecks caused by thermal leakage from traditional doors are the most common problems that must be solved by proper sealing and insulation of facility openings, and their solution ultimately promotes the creation of healthier operational ecosystems and makes it easier to implement green logistics and warehouse efficiency initiatives. These measures align with ESG goals and carbon neutrality programs that are being implemented in different parts of the world, where insulated roller shutters help maintain climate control and reduce the facility's overall carbon footprint.

- Greater incidence of global supply chain disruptions: The volatility of global trade that is happening now is the main reason why local logistics focus on resilience and flexibility that has resulted in a huge surge in the implementation of modular roller shutter architectures. The situation is such that warehouses are kept in a constant state of reconfiguration and scaling, thus the demand for versatile shutter systems has increased among distribution centres, manufacturing hubs, and logistics providers who need adaptable security barriers that can be rapidly installed or changed.

- Emphasis on industry 4.0 and smart warehousing: Facility managers and industrial planners are increasingly focused on ensuring the safety and stability of throughput of the automated lines by means of proactive maintenance. In this respect, they are very active in monitoring the health of the shutters by predictive diagnostics counting cycles and analysing motor straining order to prevent costly downtimes. The incessant requirement for integrated material flow generates a consistent need for commercial, grade, smart roller shutter systems all year round.

Roller Shutter Market Analysis

Learn more about the key segments shaping this market

Based on the product type, the market is divided into built-on roller shutters, built-in roller shutters, integrated roller shutters, and roller shutters with tilted laths. The built-on roller shutter segment held the largest share, accounting for 36.9% of the global market in 2025 with a revenue of USD 23.1 billion.

- Built-on shutters dominate because they can be easily installed on existing buildings without structural changes. This makes them a professional favorite for security retrofitting in the residential and retail sectors.

- Built-on shutters hold the highest market value, the segment maintains a consistent 5.5% CAGR, indicating a steady, mature demand for external-mounted protective solutions.

- The integrated roller shutter segment shows the highest growth rate, 5.8% CAGR. This reflects a growing trend in modern architecture where shutters are designed as part of the window unit to provide a seamless aesthetic and superior thermal performance.

- Roller shutters with tilted laths cater to high-end residential and office segments where users prioritize precise control over natural light and ventilation without compromising on security.

Learn more about the key segments shaping this market

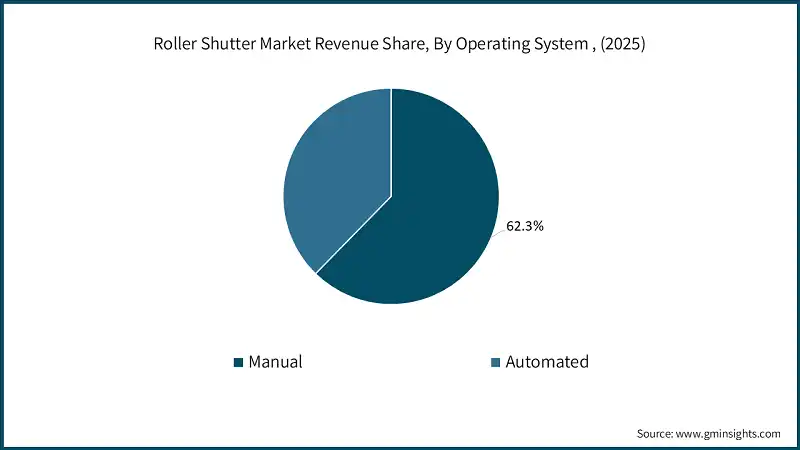

Based on the mode of operating system, the roller shutter market is segmented into manual and automated. In 2025, manual systems held the major market share of 62.3%, generating a revenue of USD 39 billion.

- Manual shutters remain the volume leader due to their cost-effectiveness and reliability in regions with unstable power grids or for smaller commercial storefronts where simple security is the priority.

- While manual shutters lead in share, automated systems are gaining momentum, particularly in the smart home and industrial sectors. The demand is driven by the integration of IoT sensors and smartphone controls.

- Facility managers increasingly prefer automated versions for large-scale warehouses to improve operational speed and ensure compliance with workplace safety standards by reducing manual lifting.

Based on the mode of distribution, the roller shutter market is segmented into online and offline. In 2025, offline sales held the major market share of 51.4%, reflecting the industry’s reliance on physical specialty stores and professional installers.

- The dominance of offline channels is fueled by the need for precise measurements and professional installation services. Customers often prefer a "hands-on" experience to verify material durability and security features.

- The online segment is the fastest growing 5.9% CAGR and is projected to overtake offline sales by 2034. This shift is driven by the rise of DIY-friendly shutter kits and direct-to-consumer (D2C) models by major manufacturers.

- Larger commercial projects still rely on direct relationships with distributors to secure customized, large-scale security solutions and long-term maintenance contracts.

Looking for region specific data?

Asia Pacific Roller Shutter Market

Asia Pacific is the largest and fastest-growing regional market. It has an estimated market value of USD 27.5 billion in 2025 with a projected growth rate of 5.8% from 2022 to 2035.

- China holds the largest market share, valued at USD 8.9 billion in 2025, while India is a major contributor with a value of USD 3.7 billion.

- The rapid growth is a direct result of massive urbanization and government-led infrastructure projects, including "smart city" initiatives that prioritize automated building solutions.

- A shift from manual labor to industrial automation in manufacturing plants across Southeast Asia is driving the demand for specialized, high-durability motorized shutters.

- The region’s growing middle class is increasingly investing in residential security, moving toward premium aluminum shutters for both burglary protection and noise reduction in dense urban environments.

North America Roller Shutter Market

In 2025, North America is a key regional market with an estimated value of USD 14.9 billion. and a projected growth rate of 5.5% through 2035.

- The U.S. leads the region, accounting for approximately 84.5% of the North American market in 2025. This growth is driven by a mature market with high adoption of smart home technologies and automated security systems.

- The market is heavily influenced by the expansion of e-commerce and logistics hubs, where heavy-duty motorized shutters are essential for warehouse security and operational efficiency.

- Increasingly stringent building codes in hurricane-prone coastal regions have spurred demand for high-impact, weather-resistant aluminum shutters.

- Growth is further supported by a robust residential renovation sector, where homeowners are integrating IoT-enabled shutters to improve both home security and energy insulation

Europe Roller Shutter Market

Europe is a significant market estimated at USD 12.5 billion in 2025 with a projected growth rate of 5.6%. Germany leads the region with a market value of USD 3 billion in 2025, driven by its advanced manufacturing sector and strict energy-efficiency standards.

- The European market benefits significantly from the EU Green Deal, which encourages the use of insulated roller shutters to reduce thermal loss and lower carbon footprints in buildings.

- Germany and France together represent over 45% of the regional revenue, fuelled by strong historical preferences for external shutters and a high volume of building retrofits.

- Innovation in the region is focused on "green" materials, such as recycled aluminium and eco-friendly PVC, to meet sustainability mandates.

- The integration of Industry 4.0 principles in commercial spaces promotes automated, high-speed shutters that minimize energy waste and streamline logistics.

Latin America Roller Shutter Market

Latin America represents a developing segment expected to reach USD 4.7 billion by 2025, growing at a rate of 4.6% through 2035.

- Brazil is the dominant player in the region, capturing nearly 48.3% of the market share in 2025, followed by Mexico.

- Market growth is sustained by a rising focus on commercial security in retail sectors and the modernization of professional warehousing services.

- While the market remains price-sensitive, there is a steady transition toward aluminum and synthetic materials over traditional wood, due to their lower maintenance and better durability in tropical climates.

- Economic stabilization and increased private investment in gated communities and luxury residential projects are creating new opportunities for high-end, automated shutter systems.

Roller Shutter Market Share

Alulux GmbH is leading with a 9% market share. Alulux GmbH, ASSA ABLOY AB, Heroal, Sanwa Holdings Corporation, and Somfy S.A. collectively hold around 35%, indicating a moderately fragmented market concentration with a strong tier of dominant global players. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions, and collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- ASSA ABLOY completed the acquisition of Senior Architectural Systems, a leading UK supplier of innovative aluminum door and thermally efficient fenestration systems. This strategic move significantly expanded ASSA ABLOY’s footprint in the European commercial construction sector. The acquisition allowed ASSA ABLOY to integrate advanced energy-saving aluminum technologies, reinforcing its commitment to performance, durability, and high-security access solutions. Nico Delvaux, CEO of ASSA ABLOY, emphasized that the deal provides a broader range of future-oriented solutions to help customers meet evolving energy regulations.

- Hörmann Group unveiled an array of new digital monitoring attachments for its industrial roller shutters and sectional doors at the BAU Trade Fair. The additions included the smart control system, a cloud-based monitoring tool capable of measuring door cycles and motor health in real-time. This technology features smart sensors for improved visibility into shutter performance and robust durability for harsh industrial environments. A senior product manager highlighted the company's commitment to enhancing facility performance by providing operators with a comprehensive set of digital tools for predictive maintenance and reducing downtime.

Roller Shutter Market Companies

Major players operating in the roller shutter industry are:

- Alukon KG

- Alulux GmbH

- Aluprof S.A.

- ASSA ABLOY AB

- Bunka Shutter Co., Ltd.

- C&S Roller Shutters

- Gandhi Automations Pvt Ltd

- Heroal

- Hörmann KG Verkaufsgesellschaft mbH

- Hunter Douglas N.V.

- Novoferm GmbH

- Rollac Shutters

- Sanwa Holdings Corporation

- Somfy S.A.

- StellaGroup

Somfy expanded its range of smart motorized platforms with the introduction of the Zigbee Rev B motor line, a system fully compatible with high-speed automated facility management. Engineered for optimal productivity and precise control, this bidirectional system offers faster operation and real-time positional feedback compared to older mechanical limit designs. Unveiled at major industry expos, its modular integration and mobile-app programming improved control for diverse commercial entry points. The design's advantage lies in providing better thermal control and eliminating the need for constant manual adjustments during peak operational hours.

Roller Shutter Market News

- In April 2025, Sanwa Holdings (Overhead Door Corporation) announced the acquisition of Pasco Doors in the USA, a specialist in custom high-performance door solutions. This move was designed for high-capacity industrial work, utilizing specialized drive systems to eliminate mechanical slippage in heavy-duty environments while simplifying maintenance on its medium-load platforms.

- In July 2025, Aluprof S.A. launched the SkyFlow Bulk Shutter series, a self-propelled motorized unit equipped with a high-efficiency motor and a proprietary energy-management control system. This system automatically adjusts the opening speed based on facility traffic density, maximizing energy efficiency; the unit also boasts a narrow frame for easy integration into tight brownfield facility access points.

- In 2025, Hansa Systems (Access Division) continued to offer their specialized, high-performance modular attachments for assembly line partitions. This focuses on high mobility and lower overhead for smaller manufacturing firms that require rapid reconfiguration of their production floors and quick-deploy safety barriers.

- In September 2024, Bunka Shutter introduced the redesigned Air-Keep Sorter Shutter, tailored for cold-storage and retail logistics specialists. This new iteration boasted robust performance in thermal insulation and airtightness. Powered by a high-efficiency electric drive, it featured a Series III reinforced slat design, aggressive wind-locks for diverse weather conditions, and various durability enhancements. Operating at a quiet decibel level, the new model addressed the needs of professionals aiming to broaden their capacity for fulfillment in the e-commerce industry.

- In 2024, Rayco Industrial continued to emphasize its powerful heavy-duty models, such as the TR-Series Security Shutter, which uses a high-performance drive engine and incorporates their "Command Flow" automatic speed control to enhance performance on large-scale warehouse openings. This focuses on meeting high-security standards without the need for complex secondary locking mechanisms.

The roller shutter market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

By Product Type

- Built on roller shutter

- Built in roller shutter

- Integrated roller shutter

- Roller shutter with tilted laths

By Material

- Wood

- Aluminum

- Metal

- Glass

By Operating System

- Manual

- Automated

By Fixation Type

- Door

- Window

By End Use

- Commercial

- HoReCa

- Hospitals

- Offices

- Malls

- Others (institutions, banquets, etc.)

- Residential

- Industrial

- Warehouses

- Factories

By Distribution Channel

- Online channels

- E-commerce

- Company websites

- Offline channels

- Distributors

- Retailers

- Specialty stores

- Others (departmental stores, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the emerging trends in the roller shutter industry?

Key trends include the integration of IoT-enabled remote monitoring and wireless control systems, advancements in electric drive motors for energy efficiency, and the development of high-tensile slats and reinforced guide rails for enhanced durability and structural integrity.

Who are the key players in the roller shutter market?

Major players include Alukon KG, Alulux GmbH, Aluprof S.A., ASSA ABLOY AB, Bunka Shutter Co., Ltd., C&S Roller Shutters, Gandhi Automations Pvt Ltd, Heroal, Hörmann KG Verkaufsgesellschaft mbH, Hunter Douglas N.V., and Novoferm GmbH.

Which region dominated the roller shutter market in 2025?

North America was a key regional market, valued at USD 14.9 billion in 2025, with a projected growth rate of 5.5% through 2035. The region's growth is driven by robust construction activities and increasing adoption of advanced roller shutter systems.

What was the valuation of the manual operating system segment in 2025?

The manual operating system segment held a 62.3% market share and generated USD 39 billion in 2025.

Which distribution channel led the roller shutter market in 2025?

Offline sales led the market with a 51.4% share in 2025, reflecting the industry's reliance on physical specialty stores and professional installers.

What was the revenue generated by the built-on roller shutter segment in 2025?

The built-on roller shutter segment generated USD 23.1 billion in 2025, accounting for 36.9% of the global market share.

What is the projected value of the roller shutter market by 2035?

The market is expected to reach USD 107.4 billion by 2035, fueled by automation integration, lightweight material innovations, and growing demand for advanced roller shutter systems.

What is the projected size of the roller shutter market in 2026?

The market is expected to reach USD 65.9 billion in 2026.

What was the market size of the roller shutter market in 2025?

The market size was USD 62.6 billion in 2025, with a CAGR of 5.6% projected through 2035, driven by technological advancements, increased warehouse construction, and the adoption of smart home solutions.

Roller Shutter Market Scope

Related Reports