Summary

Table of Content

Rigid Endoscopes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Rigid Endoscopes Market Size

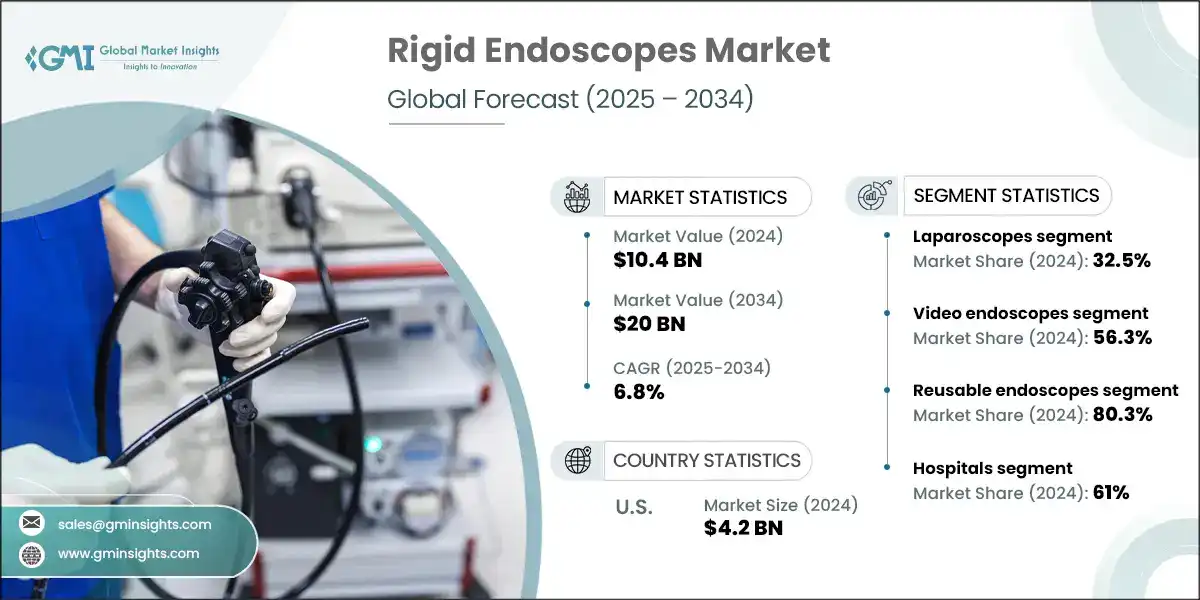

The global rigid endoscopes market was estimated at USD 10.4 billion in 2024. The market is expected to grow from USD 11 billion in 2025 to USD 20 billion in 2034, growing at a CAGR of 6.8%. The growing prevalence of chronic ailments coupled with the rising geriatric population is one of the key variables driving industry growth. Endoscopy procedures that utilize rigid endoscopes are crucial in the management or treatment of multiple health conditions, including digestive tract-related infections, chronic obstructive pulmonary disease (COPD), and common ENT problems among others.

To get key market trends

Rigid endoscopes are smart medical devices with a straight, inflexible tube used to visually examine internal organs and perform minimally invasive surgeries. They provide high-resolution imaging and are mostly used in procedures involving the bladder, joints, abdominal cavity and uterus. The market growth is strongly attributed to the rising demand for minimally invasive surgical procedures, which offer faster recovery times and reduced complications. Major players in the industry include Ambu, B. Braun, Boston Scientific, Cook, Fujifilm, and Olympus.

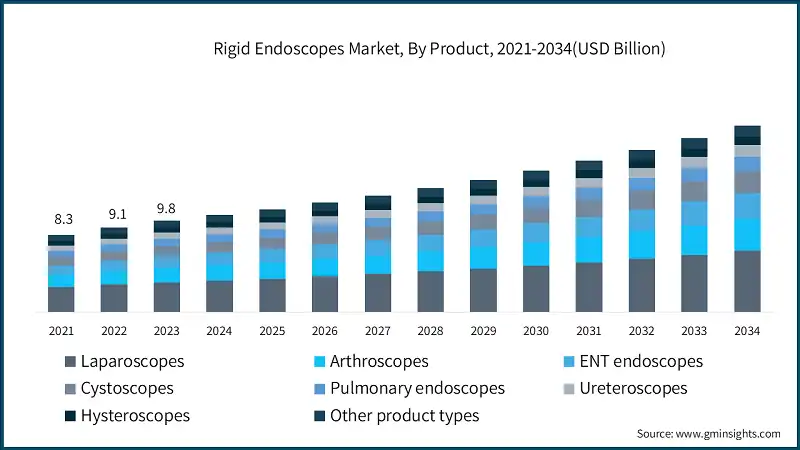

The market saw growth from USD 8.3 billion in 2021 to USD 9.8 billion in 2023, registering a positive CAGR of 8.9% during this period. The rising prevalence of chronic diseases like autoimmune disorders, diabetes, and cancer where patients prefer self-administration over hospital visits, is a major contributing factor to the market growth. The rigid endoscopes market is being driven by a combination of increasing surgical volumes, rising prevalence of chronic diseases, and advances in minimally invasive technologies. The rising global cancer burden is one of the main contributors, according to Cancer Tomorrow, there were about 13.3 million cancer cases in 2020, and by 2040, that number is predicted to more than double to 30.3 million.

One of the key contributors is the growing global cancer burden according to Cancer Tomorrow, cancer cases were around 13.3 million in 2020 and are expected to more than double to 30.3 million by 2040. This surge in cancer incidence is anticipated to increase demand for surgical interventions and biopsy, where rigid endoscopes play a vital role in treatment and diagnosis.

Additionally, women’s health issues are enhancing market demand. WHO reported in 2021 that approximately 190 million women suffer from endometriosis, a condition often requiring laparoscopic intervention using rigid scopes. Similarly, a 2022 study revealed that the likelihood of uterine fibroids (UFs) ranges between 20-77%, particularly affecting women health under 35 (40-60%) and over 50 (up to 80%), with Black women in the U.S. having a 59% occurrence rate. These conditions often require endoscopic treatment. Post-pandemic trends also indicate a sharp rebound in elective surgeries, further fueling adoption. Coupled with advancements in HD and 4K imaging and the expansion of ambulatory surgical centers, these factors are creating robust momentum for the rigid endoscopes market.

Rigid endoscopes are medical devices that provide sharp, high-resolution images while viewing and operating inside the body through tiny incisions. They are perfect for procedures in places like the abdomen, joints, or reproductive organs during minimally invasive surgeries because, in unlike flexible scopes, they have a solid, straight design that offers stability and precision.

Rigid Endoscopes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 10.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 6.8% |

| Market Size in 2034 | USD 20 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing prevalence of chronic conditions | Increasing disease burden drives demand for diagnostic and surgical procedures, boosting rigid endoscope utilization globally. |

| Technological advancements | Improved imaging, miniaturization, and digital integration enhance procedural outcomes, expanding clinical adoption of rigid endoscopes. |

| Rising adoption of minimally invasive surgeries | Preference for less invasive procedures increases demand for rigid endoscopes in laparoscopic, urological, and orthopedic applications. |

| Increasing health awareness and demand for early-stage diagnosis | Patients seeking early intervention are accelerating diagnostic endoscopy use, positively impacting rigid endoscope demand. |

| Pitfalls & Challenges | Impact |

| High cost related to product | Significant capital investment and maintenance costs deter adoption, especially in low-resource and budget-constrained healthcare settings. |

| Risk of patient discomfort and procedural limitations | Limited flexibility may reduce use in anatomically complex regions, prompting preference for flexible or alternative endoscopy solutions. |

| Opportunities: | Impact |

| Expansion of outpatient and ambulatory surgical centers (ASCs) | ASCs demand compact, efficient tools, creating future growth potential for affordable, portable rigid endoscope systems. |

| Emerging markets with improving healthcare infrastructure | Healthcare modernization in developing regions opens new sales channels and long-term growth prospects for rigid endoscope manufacturers. |

| Market Leaders (2024) | |

| Market Leaders |

15.1% market share in 2024 |

| Top Players |

Collective market share in 2024 is 26.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Rigid Endoscopes Market Trends

The market is experiencing robust momentum, shaped by a complex interplay of macroeconomic forces, evolving healthcare infrastructure, micro-level provider behaviors, and rapid technological breakthroughs. At the macro level, the sustained global increase in surgical volumes driven by demographic shifts like aging populations, growing prevalence of chronic diseases, and rebound of elective procedures post-pandemic is a major catalyst.

- Governments around the world are also making significant investments to improve the capabilities of minimally invasive surgery (MIS) to decrease hospitalization expenses, recovery times, and surgical complications. This will create favorable funding and reimbursement conditions for the procurement of rigid endoscopes.

- On the micro level, surgical preferences are evolving. Surgeons are increasingly adopting rigid endoscopes due to their exceptional image clarity, structural stability, and ease of use during procedures such as laparoscopy, arthroscopy, and urology. Hospital administrators are seeing these tools as long-term assets that offer cost-effective performance and reduced maintenance versus their flexible counterparts. The proliferation of ambulatory surgical centers (ASCs), especially in regions like North America and Europe, adds another mid-level driver, the need for affordable, reliable endoscopic systems in outpatient settings.

- Technological advancements continue to redefine what’s possible. High-definition (HD) and ultra-high-definition 4K imaging systems are now integrated into many rigid endoscope platforms, delivering unmatched visual resolution, better lighting, and improved intraoperative decision-making. Digital amalgamation including, cloud-based image archiving and ergonomic, AI-assisted diagnostics, modular designs advances surgical precision and workflow efficiency. Manufacturers are also pushing their limits with miniaturized scopes tailored specifically for ophthalmic, neurosurgical, and pediatric applications, strengthening rigid endoscope use beyond old-style domains.

- At a wider systemic level, rising awareness and screening for diseases like gastrointestinal disorders, cancer, and joint ailments are driving increased diagnostic and therapeutic procedures. Consumer demand for faster recovery experiences and the outpatient model reinforces the MIS trend. These cultural and systemic shifts are prompting hospitals to prioritize investments in advanced endoscopic suites.

Rigid Endoscopes Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 8.3 billion in 2021. The market size reached USD 9.8 billion in 2023, from USD 9.1 billion in 2022.

Based on the device type, the market is segmented into laparoscopes, arthroscopes, ENT endoscopes, cystoscopes, pulmonary endoscopes, ureteroscopes, hysteroscopes, and other product types. The laparoscopes segment accounted for 32.5% of the market in 2024 due to the rising preference for minimally invasive surgeries that offer faster recovery, reduced hospital stays, and lower post-operative complications.

The segment is expected to exceed USD 6.6 billion by 2034, growing at a CAGR of 6.9% during the forecast period. On the other hand, arthroscopes segment is expected to grow with a CAGR of 7.9%. The growth of this segment can be attributed to the rising incidence of sports injuries and joint disorders, coupled with growing demand for minimally invasive orthopedic procedures.

- The laparoscopes segment is undergoing strong growth within the rigid endoscopes market, mainly driven by the growing adoption of minimally invasive surgeries for procedures such as hernia repair, gallbladder removal, and gynecological interventions. Growing awareness among patients about faster recovery, reduced postoperative pain, and shorter hospital stays is fueling demand.

- Furthermore, the global surge in obesity-associated conditions and gastrointestinal conditions has led to a higher volume of laparoscopic bariatric and diagnostic procedures. Technological developments such as 4K imaging and improved lighting systems further improve surgical precision, encouraging healthcare facilities to invest in advanced laparoscopic tools to advance clinical outcomes and patient satisfaction.

- The arthroscopes segment holds a market share of 15.6%, fueled by the rising prevalence of arthritis, sports injuries, and joint conditions. The change toward minimally invasive orthopedic surgical procedure and growing adoption of arthroscopic procedures in outpatient settings are significantly contributive to the segment’s strong growth momentum.

- The ENT endoscopes segment holds 12.9% market share, driven by growing prevalence of chronic sinusitis, increasing demand for minimally invasive ENT procedures, and technological developments in visualization. Increasing geriatric population and outpatient adoption further fuel its increasing clinical and diagnostic applications.

Based on technology, the rigid endoscopes market is segmented into video endoscopes, conventional endoscopes, and fiber-optic endoscopes. The video endoscopes segment accounted for the highest market share of 56.3% in 2024 due to its superior image clarity, real-time visualization, and enhanced documentation capabilities, which significantly improve diagnostic accuracy and surgical precision.

- The video endoscopes segment in the market is gaining traction due to its ability to distribute high-resolution, real-time imaging that improves diagnostic accuracy and surgical precision. Surgeons prefer video endoscopes for their ergonomic assistance, ease of documentation, and facility to share visuals with the surgical team during procedures.

- Technological progressions like digital zoom, AI-assisted imagining and 4K imaging are further enhancing adoption. Additionally, rising demand for minimally invasive surgeries across specialties is accelerating the shift toward video-enabled rigid systems.

- The conventional endoscopes segment is expected to grow at a CAGR of 7.4% in the market, driven by their widespread clinical adoption, cost efficiency, and ease of usage in routine diagnostic and surgical procedures. Their durability and minimal maintenance needs make them especially appealing in resource-limited settings and outpatient surgical centers, boosting overall demand.

Based on usability, the rigid endoscopes market is bifurcated into reusable endoscopes, and disposable endoscopes. The reusable endoscopes segment accounted for the highest market share of 80.3% in 2024, driven by their cost-effectiveness, durability, and widespread adoption across hospitals and surgical centers for repeated procedures.

- The segment dominates the market due to its cost-effectiveness, durability, and long-term value. These devices are designed for repeated use, making them highly economical for hospitals and surgical centers that perform high volumes of minimally invasive procedures. Their robust construction ensures consistent performance over time, while advanced sterilization techniques have addressed infection control concerns.

- Additionally, their compatibility with high-definition imaging systems and integration into existing surgical infrastructure further supports their widespread adoption, particularly in well-equipped healthcare facilities seeking efficient, long-lasting tools.

- The next-largest segment, disposable endoscopes, held a market share of 19.8% in 2024, is gaining traction due to growing concerns over cross-contamination and hospital-acquired infections. These single-use devices eliminate the need for complex sterilization, reducing turnaround time and improving workflow efficiency, particularly in high-volume settings. Increased adoption is also driven by cost-effectiveness in avoiding reprocessing-related damages and repair costs.

- Furthermore, rising procedural volumes in outpatient and emergency settings, along with favorable regulatory approvals and technological advancements in image quality, are supporting the rapid growth of this segment.

Learn more about the key segments shaping this market

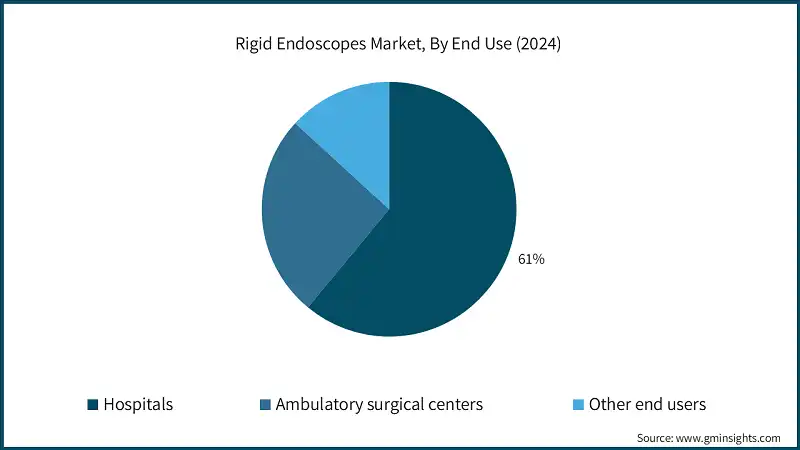

Based on the end use, the rigid endoscopes market is segmented into hospitals, ambulatory surgical centers, and other end users. The hospitals segment accounted for the highest market share of 61% in 2024 driven by high surgical volumes, advanced infrastructure, and greater adoption of minimally invasive procedures requiring rigid endoscopes.

- The top two end use segments represent 86.8% of total market value. The hospital segment is driven by the rising cancer burden and increasing need for precise diagnostic and surgical tools. Hospitals are adopting rigid endoscopes for procedures involving oncology, gynecology, and urology due to their high imaging clarity and reliability.

- Additionally, the surge in biologic therapies and demand for minimally invasive surgeries within institutional settings has made hospitals the primary hub for advanced endoscopic interventions, supporting continued investment in rigid endoscopy systems.

- The next largest segment, ambulatory surgical centers, held a market share of 25.8% in 2024. The hospital segment is driven by the high volume of complex and emergency procedures, access to advanced imaging infrastructure, and availability of skilled surgeons. Hospitals often serve as primary centers for cancer, orthopedic, and gynecological surgeries, making them key adopters of rigid endoscopes for accurate diagnostics and minimally invasive interventions.

Looking for region specific data?

North America dominated the global rigid endoscopes market with the highest market share of 42% in 2024.

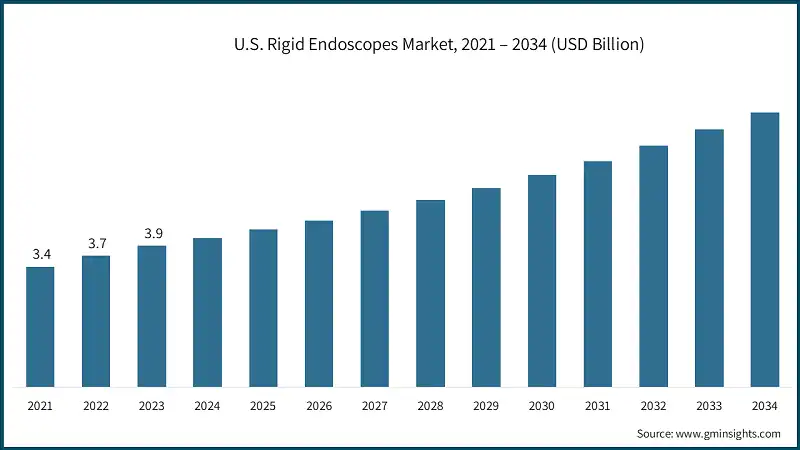

- The U.S. market was valued at USD 3.4 billion and USD 3.7 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 4.2 billion from USD 3.9 billion in 2023. The region was driven by its advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and strong presence of leading medical device manufacturers. Favorable reimbursement policies and widespread awareness of early disease detection further fuel regional growth.

- Within North America, the U.S. continues to lead, with the market growing at a CAGR of 6.4%. This growth is supported by an aging population, increasing surgical volumes, and rising incidences of chronic conditions such as cancer and gastrointestinal disorders.

- Additionally, the U.S. is at the forefront of technological innovations in imaging and endoscopic tools, with significant investments in outpatient surgical centers and precision-driven diagnostics.

Europe rigid endoscopes market accounted for USD 2.2 billion in 2024.

- The market is driven by the region’s well-established healthcare infrastructure, growing preference for minimally invasive surgeries, and rising aging population. Europe's proactive approach to early disease diagnosis, especially for gastrointestinal, gynecological, and urological disorders, is fueling the adoption of advanced endoscopic technologies. Government-backed investments in surgical innovations and favorable reimbursement policies further support market growth.

- Within Europe, Germany stands out as a key contributor, owing to its high surgical volumes, strong presence of medical device manufacturers, and widespread integration of HD and 4K imaging systems in hospitals. The country’s aging demographic and high incidence of colorectal and gynecological conditions also spur demand for rigid endoscopes.

- Moreover, Germany's emphasis on outpatient care and advanced surgical training programs is accelerating the uptake of precision instruments, cementing its leadership in the regional endoscopic device market.

The Asia Pacific rigid endoscopes market is anticipated to witness high growth over the analysis timeframe.

- The Asia Pacific market is poised for substantial growth, fueled by rising healthcare investments, expanding surgical infrastructure, and growing awareness of minimally invasive procedures. Rapid urbanization, an aging population, and increasing cases of chronic conditions such as cancer, gastrointestinal disorders, and orthopedic ailments are pushing the demand for advanced diagnostic and surgical tools.

- Additionally, government-led healthcare reforms and public-private partnerships are improving access to surgical technologies across emerging economies like India, Indonesia, and Vietnam.

- In China specifically, the market is being driven by a strong push toward domestic medical innovation, rising surgical volumes, and favorable government initiatives under programs such as Healthy China 2030. The country’s expanding middle class, rising demand for quality healthcare, and hospital upgrades, particularly in tier II and tier III cities, are encouraging the adoption of high-precision tools like rigid endoscopes, further accelerating growth in the region.

The Latin America rigid endoscopes market is anticipated to witness high growth over the analysis timeframe.

- The Latin America market is poised for significant growth, driven by expanding access to healthcare services, rising surgical volumes, and increasing investments in minimally invasive technologies. Governments across the region are actively working to modernize healthcare infrastructure, particularly in public hospitals, which is fueling demand for advanced surgical tools like rigid endoscopes.

- Additionally, growing awareness around early disease diagnosis, especially for conditions like cancer and gynecological disorders, is leading to higher adoption of endoscopic procedures.

- In Brazil, which dominates the Latin American market, the surge is further supported by a growing medical tourism sector and a robust network of private hospitals. Brazil has also witnessed a rise in chronic conditions such as uterine fibroids and gastrointestinal diseases, pushing demand for laparoscopic and urologic interventions.

- Moreover, partnerships between local distributors and global medtech firms are improving technology access, making Brazil a key contributor to regional market growth.

Rigid Endoscopes Market Share

Leading companies like Olympus Corporation, Karl Storz, Stryker together hold between 25% - 30% of the market share in the moderately consolidated global market. These players maintain their competitive edge through continuous innovation, global distribution networks, and deep clinical expertise across multiple surgical specialties. Olympus, for example, has remained a dominant force in both gastrointestinal and laparoscopic endoscopy through the integration of high-definition and 4K imaging systems, offering enhanced visibility during complex surgeries.

Karl Storz continues to strengthen its foothold through specialized product portfolios in urology, gynecology, and arthroscopy, while also leveraging modular system design to appeal to ambulatory surgical centers and outpatient clinics.

Stryker, on the other hand, has gained prominence through its focus on ergonomic endoscopic platforms and advanced visualization systems, which are widely adopted in orthopedic and ENT procedures.

Aside from these leaders, other notable players such as Richard Wolf, Boston Scientific, PENTAX Medical, ConMed, Smith & Nephew, B. Braun and others are increasing their market share through regional expansion and targeted innovations. The market also sees growing activity from emerging Asian manufacturers offering cost-competitive solutions, especially in price-sensitive regions like Latin America, Southeast Asia, and parts of Eastern Europe.

As of 2023, the market is projected over the next several years, indicating ample opportunities for both established and emerging players. Strategic mergers, acquisitions, and research and development investments continue to shape the competitive landscape, making innovation and localization key pillars of sustained market presence.

Rigid Endoscopes Market Companies

Few of the prominent players operating in the rigid endoscopes industry include:

- Ambu A/S

- Arthrex

- B. Braun

- Boston Scientific

- ConMed

- Cook Medical

- Fujifilm

- Henke-Sass, Wolf

- Karl Storz

- Olympus Corporation

- PENTAX Medical

- Richard Wolf

- Schölly Fiberoptic

- Smith & Nephew

- Stryker

- XION GmbH

- Ambu A/S

Ambu A/S stands out with its focus on single-use endoscopy solutions that reduce infection risks and eliminate reprocessing costs. Its innovation in sterile, portable endoscopic technology supports high-volume clinical settings, especially in emergency care and outpatient environments, positioning Ambu as a disruptor in conventional rigid endoscope applications.

- B. Braun

B. Braun leverages its expertise in surgical instrumentation to offer robust and ergonomic rigid endoscopes, particularly in laparoscopic and urological procedures. Its systems integrate seamlessly with OR setups, emphasizing safety, hygiene, and precision. The company’s focus on training, service, and integrated solutions enhances its value in hospital partnerships.

- Boston Scientific

Boston Scientific differentiates itself through a strong focus on minimally invasive therapies, including urology and gynecology. While more active in flexible endoscopy, its rigid systems benefit from the company’s innovation in optics and surgical access tools. Its global footprint and clinician-focused research and development strengthen its appeal in hospital procurement decisions.

- Stryker

Stryker is known for its high-performance rigid endoscope platforms with advanced 4K imaging and ergonomic designs tailored for precision and surgeon comfort. Its integration with digital OR solutions and navigation systems enhances workflow efficiency. Stryker’s strong brand presence and innovation pipeline make it a top choice in orthopedic and ENT surgeries.

Rigid Endoscopes Industry News:

- In April 2022, SurgEase collaborated with Wellness The Clinic to introduce the LumenEye X1, a digital rigid rectoscope developed to support endoscopic.

- In January 2022, Pristine Surgical secured USFDA clearance for its innovative 4K single-use surgical arthroscope. Designed to enhance arthroscopic procedures, this device aims to offer surgeons improved visualization and procedural efficiency.

The rigid endoscopes market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product Type

- Laparoscopes

- Arthroscopes

- ENT endoscopes

- Cystoscopes

- Pulmonary endoscopes

- Ureteroscopes

- Hysteroscopes

- Other product types

Market, By Technology

- Video endoscopes

- Conventional endoscopes

- Fiber-optic endoscopes

Market, By Usability

- Reusable endoscopes

- Disposable endoscopes

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the projected size of the rigid endoscopes market in 2025?

The market is expected to reach USD 11 billion in 2025.

What was the market share of the video endoscopes segment in 2024?

The video endoscopes segment accounted for 56.3% of the market in 2024.

What was the market share of the reusable endoscopes segment in 2024?

The reusable endoscopes segment held an 80.3% market share in 2024.

Which region leads the rigid endoscopes market?

The U.S. led the market with a valuation of USD 4.2 billion in 2024, driven by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and favorable reimbursement policies.

Who are the key players in the rigid endoscopes market?

Key players include Ambu A/S, Arthrex, B. Braun, Boston Scientific, ConMed, Cook Medical, Fujifilm, Henke‑Sass, Wolf, Karl Storz, Olympus Corporation, and PENTAX Medical.

What are the upcoming trends in the rigid endoscopes industry?

Key trends include increasing investments in minimally invasive surgery (MIS), advancements in endoscopic technologies, and growing awareness of early disease detection.

What is the projected value of the rigid endoscopes market by 2034?

The market is expected to reach USD 20 billion by 2034, supported by advancements in minimally invasive surgery (MIS) and increasing surgical volumes globally.

What is the market size of the rigid endoscopes in 2024?

The market size was USD 10.4 billion in 2024, with a CAGR of 6.8% expected through 2034, driven by the rising prevalence of chronic diseases and an aging population.

Rigid Endoscopes Market Scope

Related Reports