Summary

Table of Content

Prenatal and Newborn Genetic Testing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Prenatal and Newborn Genetic Testing Market Size

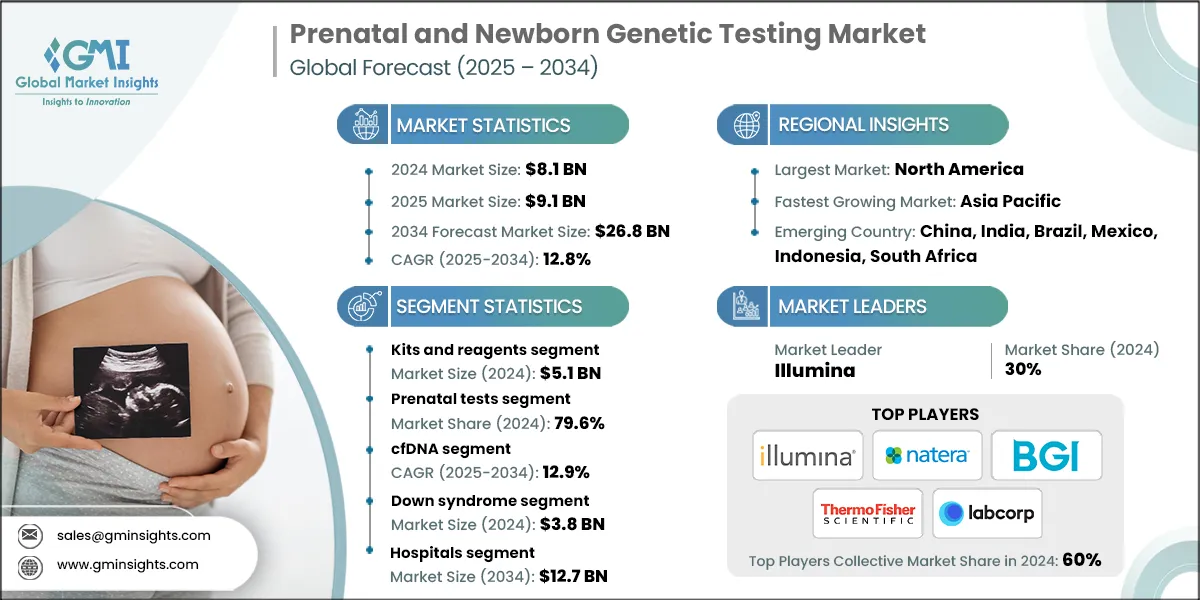

The global prenatal and newborn genetic testing market size was valued at USD 8.1 billion in 2024. The market is anticipated to grow from USD 9.1 billion in 2025 to USD 26.8 billion in 2034, growing at a CAGR of 12.8% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The significant growth in the market is largely fueled by rising maternal age, increased risk of genetic disorders, and advancements in testing technologies. The worldwide trend of delayed pregnancies, especially in developed and urban areas, heightens the risk of chromosomal anomalies such as trisomy 21 (Down syndrome), trisomy 18 (Edwards syndrome), or single-gene defects like cystic fibrosis (CF), hemochromatosis, and sickle cell anemia. This demographic shift urges the need for early genetic screening as part of routine prenatal diagnosis and newborn screening procedures. Thus, the growing adoption and awareness of early diagnosis and screening foster the market demand.

Prenatal and Newborn Genetic Testing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.1 Billion |

| Market Size in 2025 | USD 9.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.8% |

| Market Size in 2034 | USD 26.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of chronic and lifestyle diseases | Advanced maternal age raises genetic risks, prompting increased demand for early, accurate prenatal screening solutions. |

| Increasing demand for NIPT testing | NIPT offers safe, early detection of chromosomal abnormalities, with a high success rate, driving widespread adoption among healthcare providers and parents. |

| Rising incidence of genetic disorders | Growing prevalence of inherited conditions fuels the need for early diagnosis through advanced genetic testing technologies. |

| Growing parental awareness and demand for early diagnosis | Parents are increasingly informed about genetic risks, leading to proactive screening and early intervention during pregnancy. |

| Expanding advancements in technologies for accuracy and accessibility | Innovations in sequencing and bioinformatics enhance test precision, affordability, and accessibility across diverse healthcare settings. |

| Pitfalls & Challenges | Impact |

| High cost of advanced tests | Expensive genetic tests limit access in low-income regions, decelerating market growth despite technological progress. |

| Data privacy and security | Concerns over handling sensitive genetic data hinder adoption and raise ethical and regulatory challenges. |

| Opportunities: | Impact |

| Growing demand for personalized medicine in prenatal care | Tailored genetic insights enable personalized pregnancy management, opening new avenues for targeted diagnostics and therapies. |

| Increasing penetration in emerging markets | Rising healthcare investment and awareness in developing regions create significant growth potential for genetic testing services. |

| Expanding public-private initiatives | Collaborations between governments and companies promote infrastructure, education, and access to prenatal screening programs. |

| Market Leaders (2024) | |

| Market Leaders |

30% market share |

| Top Players |

Collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Prenatal and newborn genetic testing involves medical intervention conducted during pregnancy and shortly after birth to determine the possibility of a genetic condition, chromosomal anomalies, or birth defect in the fetus or newborn. This test includes both screening and diagnostic tests. The leading players in the market include Illumina, Natera, BGI Group, Thermo Fisher Scientific, and Labcorp. These companies offer advanced prenatal and newborn genetic screening and diagnostic solutions. They utilize technologies like next-generation sequencing (NGS) and polymerase chain reaction (PCR), and provide integrated platforms, cloud-based analysis, and customized tests, further shaping the market growth.

The shift towards non-invasive testing has significantly boosted market growth. Non-invasive prenatal testing (NIPT) examines cell-free fetal DNA (cfDNA) from the mother's blood to identify chromosomal defects with high sensitivity and low risk. The test has offered over 99% success for trisomy 21 detection, with ease of detection as early as 10 weeks of pregnancy has driven it towards increased application in the clinical setting. This has led the way for market players to broaden their NIPT offerings and investments in expanding NIPT panels to include microdeletions and sex chromosome disorders. With growing awareness and broader insurance coverage, NIPT is poised to be a major driver of the prenatal and newborn genetic testing market.

Government initiative programs, such as mandatory newborn screenings, enable early screening and diagnostics, stimulating the growth of the market. Supportive public health policies, insurance coverage, and funding improve access to testing, driving its adoption. Additionally, substantial investments in genomics and proteomics research have led to technological advancements, enhancing the accuracy and scope of prenatal and newborn genetic testing. These factors collectively foster a favorable environment for market expansion, improve health outcomes, and support early intervention strategies.

Prenatal genetic testing is performed during pregnancy to detect potential genetic disorders or birth defects such as Down syndrome, CF, and Tay-Sachs disease. After birth, newborn genetic testing screens for inherited conditions like phenylketonuria (PKU), spinal muscular atrophy (SMA), and congenital heart disease. These tests are crucial for early diagnosis, guiding treatment decisions, and improving health outcomes. Collectively, they support reducing infant mortality and providing improved long-term care by enabling timely medical interventions and informed parental choices.

Prenatal and Newborn Genetic Testing Market Trends

- The growing adoption of prenatal and newborn screening, driven by the rising prevalence of genetic disorders and chromosomal abnormalities, has significantly boosted its demand.

- The global rise in genetic disorders and chromosomal abnormalities has significantly increased the demand for prenatal and newborn genetic testing. According to the World Health Organization (WHO), the most common severe congenital disorders are heart defects, neural tube defects, and Down syndrome. Nine of ten children born with a serious congenital disorder are in low and middle-income countries. This growing severity contributes to long-term disability, which takes a significant toll on individuals, families, health care systems, and societies.

- In addition, an estimated 240,000 newborns die globally within 28 days of birth each year due to congenital disorders. This highlights the urgent need for awareness of newborn screening, mandatory screening programs, and improved access to early diagnostic services as essential components of preventive healthcare and public health policy.

- For instance, the NHS implemented the mandatory newborn screening procedure in England. According to the plans, every newborn in England will undergo an assessment of their DNA mapping to identify the risk of disease. The screening for rare diseases will involve sequencing their complete DNA using blood samples from their umbilical cord, taken shortly after birth. This breakthrough initiative aims to revolutionize the global efforts in managing genetic disease by enabling timely interventions and reducing the long-term disease burden.

- Moreover, the market is further driven by the declining cost of genetic sequencing, aided by wide market accessibility. For example, the cost of whole genome sequencing (WGS) has decreased from about USD 100,000 in 2001 to less than USD 1,000. The significant decrease resulted from rapid advancement in NGS technologies and the growing competition between diagnostic service providers.

- Additionally, growing investment from the government and private sector industry players in genetic test infrastructure is reshaping the market dynamics. These efforts collectively drive innovation and expand access to early diagnostic solutions, reinforcing market growth.

Prenatal and Newborn Genetic Testing Market Analysis

Learn more about the key segments shaping this market

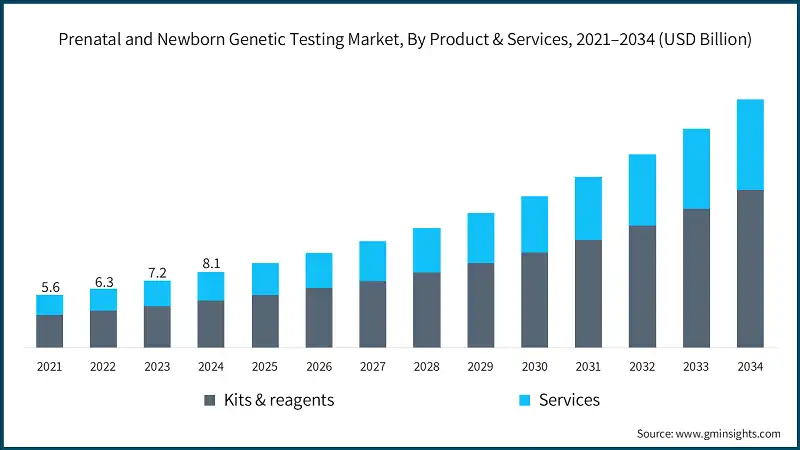

Based on product and services, the market is segmented into kits and reagents and services. The kits and reagents segment held a dominant position in the market, valuing USD 5.1 billion in 2024.

- The widespread adoption of advanced testing kits, such as NIPT kits and cfDNA test kits that offer high accuracy and early detection, has underscored its demand in the market.

- These kits are essential for both clinical diagnostics and research applications, and their growing availability has significantly boosted market penetration.

- The presence of several companies offering specialized kits and reagents further supports this segment's leadership.

Learn more about the key segments shaping this market

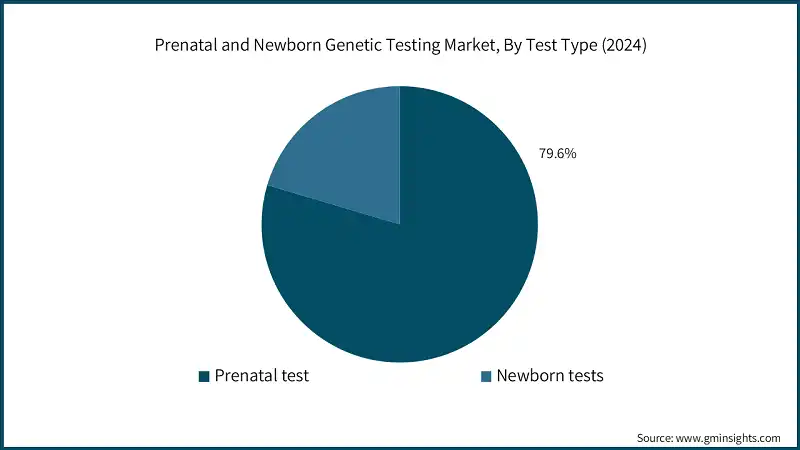

Based on test type, the market is segmented into prenatal tests and newborn tests. The prenatal tests segment held a dominant position in 2024 with a share of 79.6%. The prenatal tests are further categorized into non-invasive prenatal testing (NIPT), carrier screening, serum screening, nuchal translucency ultrasound, chorionic villus sampling (CVS), and amniocentesis.

- The high market share was primarily driven due to the widespread awareness among parents of inherited congenital anomalies, emphasizing the need for early screening.

- Pregnancy after the age of 35 increases the risk of birth defects, particularly chromosomal defects such as Down syndrome, Turner syndrome, preterm birth, gestational diabetes, and other anomalies. For instance, as reported in several studies, the likelihood of having Down syndrome in a child rises from 1 in 100 for a woman conceiving at the age of 40.

- Additionally, Beth Israel Deaconess Medical Center highlights that 3-5% of babies are born with several genetic conditions. These statistics underscore the vital role of prenatal genetic testing in minimizing risks and supporting early detection.

- Moreover, the growing technological advancements, such as NIPT and cfDNA testing, have further accelerated the adoption by offering safer, faster, and more accurate screening options.

- For instance, in February 2025, Yourgene Health, a part of the Novacyt group, launched IONA Care+, a comprehensive service for genetic conditions in the UK. The service utilizes the IONA Nx NIPT workflow to deliver safe, fast, and accurate NIPT results. This breakthrough service aimed to offer high-quality and safe screening for pregnant women during their pregnancies.

- Thus, the aforementioned factors are expected to augment industry growth over the forecast period.

Based on technology, the market is segmented as next-generation sequencing (NGS), cell-free DNA (cfDNA), array-comparative genomic hybridization (aCGH), fluorescence in-situ hybridization (FISH), spectrometry, whole exome sequencing (WES), and other technologies. The cfDNA segment held a dominant position in the market and is poised to grow at a CAGR of 12.9% till 2034.

- The cfDNA technology is primarily used in NIPT, has gained widespread adoption due to its high accuracy, safety, and ability to detect chromosomal abnormalities early in pregnancy.

- This has fueled its demand, as cfDNA testing is increasingly favored by healthcare providers and expectant parents due to its minimal risk and reliable results.

- Additionally, the growing awareness of genetic disorders, coupled with advancements in screening technologies, has further strengthened the adoption of cfDNA-based tests, making it the leading segment in the market.

Based on application, the market is segmented into Down syndrome, phenylketonuria (PKU), cystic fibrosis (CF), sickle cell anemia, congenital hypothyroidism, Pendred syndrome, and other applications. The Down syndrome segment accounted for around 46.5% of market share with the total revenue of USD 3.8 billion in 2024.

- Down syndrome is one of the most prevalent chromosomal anomalies related to multiple congenital defects and leads to intellectual disability, causing severe health-related complications.

- According to the WHO, Down syndrome is observed in 1 out of 1,000 to 1,100 live births globally. Similarly, the Centers for Disease Control and Prevention (CDC) reported a 30% rise in the condition over recent years in the U.S. Thus, these rising cases elevated the prominence of the segments surging for early screening and diagnosis, thereby facilitating market growth.

Based on end use, the market is segmented as hospitals, diagnostic laboratories, maternity and specialty clinics, and other end users. The hospitals segment held a significant share in 2024 and is projected to be valued at USD 12.7 billion in 2034.

- The hospitals segment dominance was driven by its wide accessibility to advanced diagnostics technology, skilled professionals, and comprehensive prenatal care services.

- These healthcare settings also benefit from favorable reimbursement policies and higher patient confidence, making them the preferred choice for routine and high-risk screening.

- Additionally, their integrated infrastructure supports both screening and diagnostic procedures, contributing significantly to market growth.

Looking for region specific data?

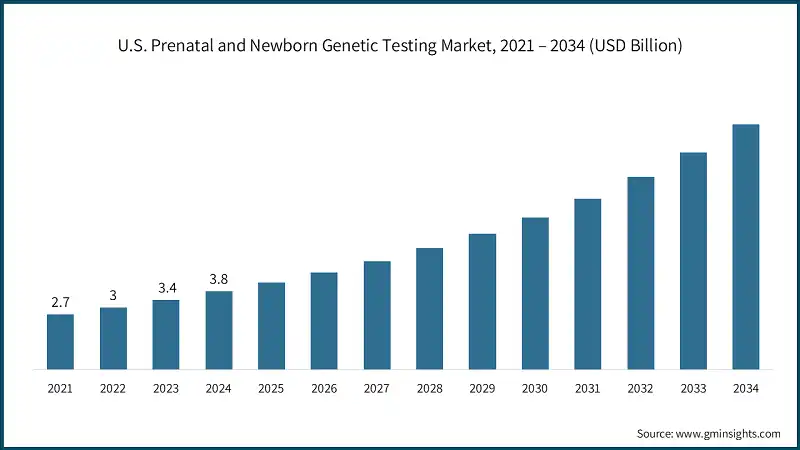

North America Prenatal and Newborn Genetic Testing Market North America accounted for 52.3% market share in the prenatal and newborn genetic testing industry in 2024 and is anticipated to witness high growth during the forecast timeframe. The U.S. prenatal and newborn genetic testing market was valued at USD 2.7 billion and USD 3 billion in 2021 and 2022, respectively. The market size reached USD 3.8 billion in 2024, growing from USD 3.4 billion in 2023. The European prenatal and newborn genetic testing industry held a revenue of USD 2.1 billion in 2024 and is anticipated to exhibit lucrative growth over the forecast period. Germany dominates the European prenatal and newborn genetic testing market, showcasing strong growth potential. The Asia Pacific prenatal and newborn genetic testing industry is anticipated to witness significant growth over the analysis timeframe. China is anticipated to grow significantly within the Asia Pacific prenatal and newborn genetic testing market. Latin America is experiencing significant growth in the prenatal and newborn genetic testing industry. Saudi Arabia is poised to witness substantial growth in the Middle East and Africa prenatal and newborn genetic testing industry during the forecast period. The top 5 leading players in the prenatal and newborn genetic testing industry, including Illumina, Natera, BGI Group, Thermo Fisher Scientific, and LabCorp, collectively accounted for over 55-60% of the market share. These companies leverage advanced technologies, an extensive portfolio, strong research capabilities, and robust distribution networks. Strategic collaborations between public health systems and private diagnostics firms are enhancing market penetration. Additionally, startups are entering the space with AI-driven platforms and non-invasive testing innovations, intensifying competition and accelerating market growth. A few of the prominent players operating in the prenatal and newborn genetic testing industry include: Illumina leads the prenatal and newborn genetic testing market with a share of 30-35% in 2024. Illumina offers industry-leading sequencing platforms and bioinformatics tools that deliver unmatched accuracy and scalability. Its strong focus on innovation and global reach enables comprehensive genetic testing solutions for both clinical and research applications, setting a high standard in the market. Natera’s proprietary SNP-based technology powers its non-invasive prenatal tests, offering superior sensitivity and specificity. Its Panorama test is widely trusted for early detection of chromosomal abnormalities, making Natera a leader in personalized, data-driven reproductive health diagnostics. Thermo Fisher provides a broad range of genetic testing instruments, reagents, and software solutions. Its global distribution network and strong customer support make it a preferred partner for laboratories seeking reliable, high-throughput testing capabilities across diverse clinical settings. BGI Genomics combines affordability with advanced sequencing technologies, making genetic testing accessible in emerging markets. Its large-scale data processing and international collaborations support rapid diagnostics, positioning it as a key player in expanding global healthcare equity.Europe Prenatal and Newborn Genetic Testing Market

Asia Pacific Prenatal and Newborn Genetic Testing Market

Latin America Prenatal and Newborn Genetic Testing Market

Middle East and Africa Prenatal and Newborn Genetic Testing Market

Prenatal and Newborn Genetic Testing Market Share

Prenatal and Newborn Genetic Testing Market Companies

Prenatal and Newborn Genetic Testing Industry News

The prenatal and newborn genetic testing market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product and Services

- Kits and reagents

- Services

Market, By Test Type

- Prenatal test

- Screening tests

- Non-invasive prenatal testing (NIPT)

- Carrier screening

- Serum screening

- Nuchal translucency ultrasound

- Diagnostic

- Chorionic villus sampling (CVS)

- Amniocentesis

- Screening tests

- Newborn screening

- Heel prick test

- Hearing screening

- Critical congenital heart defect (CCHD)

- Other newborn screening tests

Market, By Technology

- Next-generation sequencing (NGS)

- Cell-free DNA (cfDNA)

- Array-comparative genomic hybridization (aCGH)

- Fluorescence in-situ hybridization (FISH)

- Spectrometry

- Whole exome sequencing (WES)

- Other technologies

Market, By Application

- Down syndrome

- Phenylketonuria (PKU)

- Cystic fibrosis (CF)

- Sickle cell anemia

- Congenital hypothyroidism

- Pendred syndrome

- Other applications

Market, By End Use

- Hospitals

- Diagnostic laboratories

- Maternity and specialty clinics

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the prenatal and newborn genetic testing industry?

Key players include Aetna, Agilent, BGI Group, BillionToOne, CENTOGENE, Eurofins, Fulgent Genetics, Genelab (Clevergene), Genes2me, Illumina, LabCorp, LaCAR, Myriad Genetics, Natera, and Retrogen.

What is the growth outlook for the cfDNA segment through 2034?

The cfDNA segment is anticipated to expand at a CAGR of 12.9% through 2034.

Which region leads the prenatal and newborn genetic testing sector?

North America leads the market with a 52.3% share in 2024. The market growth is supported by advanced healthcare infrastructure, greater awareness among expectant parents in the U.S. and Canada.

What are the upcoming trends in the prenatal and newborn genetic testing market?

Trends include mandatory newborn screening, NGS advancements, lower sequencing costs, and rising investments in genetic testing infrastructure.

How much revenue did the kits and reagents segment generate in 2024?

The kits and reagents segment generated approximately USD 5.1 billion in 2024, led by the adoption of advanced testing kits like NIPT and cfDNA test kits.

What is the market size of the prenatal and newborn genetic testing in 2024?

The market size was USD 8.1 billion in 2024, with a CAGR of 12.8% expected through 2034. The growth is driven by rising maternal age, increased risk of genetic disorders.

What was the market share of the prenatal tests segment in 2024?

The prenatal tests segment held a dominant market share of 79.6% in 2024, primarily due to increased awareness among parents about inherited congenital anomalies.

What is the expected size of the prenatal and newborn genetic testing market in 2025?

The market size is projected to reach USD 9.1 billion in 2025.

What is the projected value of the prenatal and newborn genetic testing market by 2034?

The market is poised to reach USD 26.8 billion by 2034, fueled by technological advancements, increased awareness of early diagnosis, and declining costs of genetic sequencing.

Prenatal and Newborn Genetic Testing Market Scope

Related Reports