Summary

Table of Content

Poultry Farming Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Poultry Farming Equipment Market Size

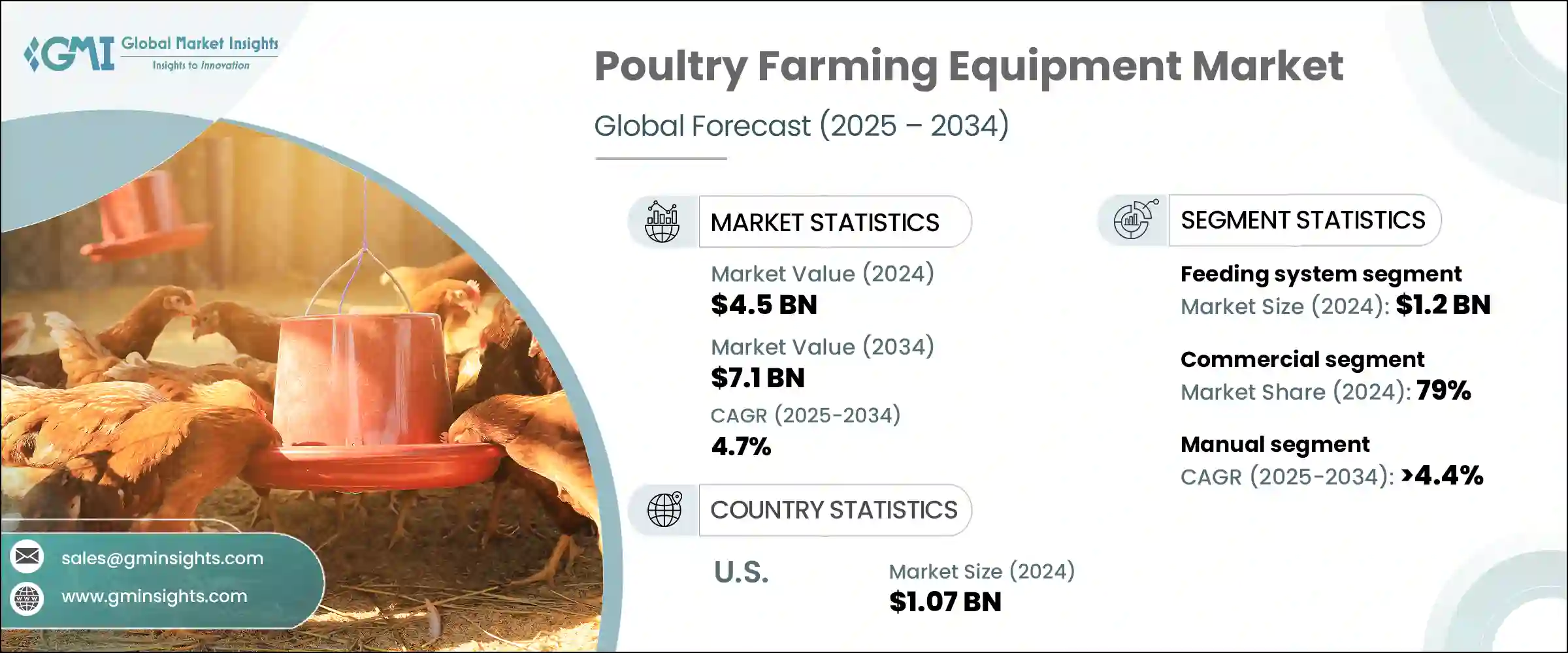

The poultry farming equipment market was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 4.7% between 2025 and 2034. The market for poultry farming equipment is expanding due to the growing demand for poultry products, such as meat and eggs.

To get key market trends

With changing consumer tastes towards protein-based diets, poultry has become an affordable and universally accepted source of protein. This trend is especially evident in the developing economies, where improved disposable incomes and urbanization are driving poultry product consumption. The U.S. Department of Agriculture (USDA) pegged per capita chicken consumption at around 100 pounds in 2023. In comparison, beef per capita consumption was approximately 57 pounds, and per capita turkey consumption came in at close to 15 pounds.

Poultry Farming Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.7% |

| Market Size in 2034 | USD 7.1 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Total Egg Production in India for 2022-23 is estimated at 138.38 billion, commercial poultry egg production at 118.16 billion and 20.20 billion for backyard poultry. Total meat production for countries for 2022-23 is estimated at 9.77 MMT, Poultry meat is 4.995 MMT, i.e. 51.13%. Despite growing domestic chicken meat production, the import supplies are still expected to increase by 3% up to 930, 000 tons.

Growth in the quick-service restaurant (QSR) business and increasing popularity of ready-to-consume poultry products are increasing demand for poultry farm equipment. The QSR segment is dependent on a reliable supply of high-quality poultry items, which is making farmers opt for advanced equipment to ensure these needs. Growing penetration by online platforms is also making distribution of poultry products easier, driving the demand for efficient farm equipment indirectly.

Poultry Farming Equipment Market Trends

- Multifloor is a revolutionary technology that integrates the advantages of slated floor and cage equipment. The birds have the freedom to move within the slated floor poultry house section, while maximum automation and mechanization of feeding, drinking and litter-removal operations facilitate their living conditions.

- Each bird house is on a unique floor of the multilevel structure with a shared microclimate and ventilation network. Utilities positioned within the building allow centralized operation of life support processes, such as but not limited to, removal of litter, temperature maintenance, adjustment of humidity and lighting.

- Texha launched its breeder and poultry farming equipment. Such poultry machinery for breeder reproduction is continuously increasing market demand as anticipated. This is partly because of the fresh amendments of the Russian law on local content as well as international poultry industry trends.

Poultry Farming Equipment Market Analysis

Learn more about the key segments shaping this market

Based on the equipment type, the market is divided into a feeding system, watering system, cage system, climate control system, incubation equipment, egg handling equipment and others. In 2024, the feeding system dominated the market generating revenue of USD 1.2 billion and projected to grow at a CAGR of 4.7% during the forecast period.

- Automatic feeding systems are gaining popularity among the Poultry farmers as these systems cut labor bills. Precision hoppers and timed rations are standard, pushing demand even higher. Technological advancements such as precision feeding are encouraging expansion in this segment.

- The trend towards advanced cage systems, driven by animal welfare regulation and consumer interest in ethically produced poultry, is a growth driver for this segment. The demand to provide optimum environmental conditions to promote poultry health and production is leading to the production of high-performance climate control systems.

- Evolution in the technology employed in incubation equipment is also driving market growth. Increased egg production and the need for economic handling, grading, and packaging solutions are driving demand for egg handling equipment. Automation and integration with other systems are key trends in this segment.

Learn more about the key segments shaping this market

Based on end users, the poultry farming equipment market is segmented into household and commercial. In 2024, the commercial segment dominates the market with 79% market share and the segment is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- The commercial segment acquired most of the market share driven by the increasing demand for poultry products like meat and eggs in large quantities. The use of advanced and automated poultry farming machinery is on the rise among commercial poultry farms to improve efficiency, lower labor costs, and keep up with the increasing global demand for poultry products.

- According to Food and Agriculture Organization Corporate Statistical Database (FAOSTAT) production data, India ranks 3rd in Egg Production and 8th in meat production in the world. In 2022, India's total poultry feed production reached 27 million metric tons per year. The poultry sector in India has shown impressive growth, with poultry meat production increasing at an average annual rate of 8%, and egg production rising by 7.45% between 2014-15 and 2021-22.

- The household segment is growing because of the surging in backyard poultry farming, fueled by the popularity of organic and locally produced poultry products. Consumers are increasingly turning to small-scale poultry farming equipment to maintain better management and productivity in their backyard operations.

Based on the mode of operation, the poultry farming equipment market is segmented into manual, semi-automatic and fully automatic. In 2024, the manual segment dominates the market and is projected to grow at a CAGR of over 4.4% from 2025 to 2034.

- The manual poultry equipment segment acquired most of the market share driven by the increasing demand for low-cost equipment and poor access to advanced technology. Demand is being propelled by small-scale poultry farmers who place high value on low-cost solutions rather than automation.

- The semi-automatic segment is experiencing growth owing to both price and efficiency. The mode is widely accepted in emerging markets where farmers desire to increase productivity without paying exorbitant amounts for fully automated systems. The fully automatic segment is undergoing remarkable expansion, driven by research and development in technology and the increased demand for large-scale poultry farm operations. Automation decreases labor dependence, increases operational effectiveness, and delivers superior monitoring and control and, therefore, is a choice of preference in developed economies.

Looking for region specific data?

In terms of country, the United States led the poultry farming equipment market with 80% of the North American market share and estimated USD 1.07 billion in revenue during 2024.

- The expansion of the U.S. market is primarily driven by growing demand for poultry products, such as meat and eggs.

- The combined value of production from broilers, eggs, turkeys, and the value of sales from chickens in 2024 was $70.2 billion, up 4 percent from $67.4 billion in 2023. Of the combined total, 65 percent was from broilers, 30 percent from eggs, 5 percent from turkeys, and less than 1 percent from chickens.

- The value of broilers produced during 2024 was $45.4 billion, up 6 percent from 2023. The total number of broilers produced in 2024 was 9.33 billion, up 1 percent from 2023. The total amount of live weight broilers produced in 2024 was 61.1 billion pounds, up 1 percent from 2023.

- The value of turkeys produced during 2024 was $3.69 billion, down 44 percent from $6.57 billion the previous year. The total number of turkeys raised in 2024 was 200 million, down 8 percent from 2023. Turkey production in 2024 totaled 6.58 billion pounds, down 6 percent from the 6.99 billion pounds produced in 2023.

The Europe poultry farming equipment market was valued at USD 0.8 billion in 2024 and is projected to grow at a CAGR of 4.2% between 2025 and 2034.

- The growth of commercial poultry farms throughout the Europe region is propelling the need for large-capacity and robust machinery that can sustain large-scale farming. Additionally, government policies and subsidies to implement modern agriculture are also fostering a conducive atmosphere for the growth of the market. Such programs are motivating farmers to invest in sophisticated machinery to enhance productivity and fulfill the growing demand from consumers. In 2025, Poland will remain the largest EU chicken meat producer, accounting for more than 22 percent of total EU production.

The Asia Pacific poultry farming equipment market was valued at USD 2 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034.

- The market in Asia-Pacific is growing rapidly due to rising demand for poultry products and improvement in farm technologies. Improving disposable income and shifting consumer preferences towards a high intake of poultry meat and eggs in countries such as China, India, and Japan are driving poultry product consumption, boosting the demand for advanced farming equipment. The regional governments are further providing support for the poultry sector in terms of subsidies and efforts for the modernization of agricultural practices, further driving market growth.

- According to Food and Agriculture Organization Corporate Statistical Database (FAOSTAT) production data, India ranks 3rd in Egg Production and 8th in meat production in the world. In 2022, India's total poultry feed production reached 27 million metric tons per year. The poultry sector in India has shown impressive growth, with poultry meat production increasing at an average annual rate of 8%, and egg production rising by 7.45% between 2014-15 and 2021-22.

The Middle East and Africa poultry farming equipment market was valued at USD 0.2 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034.

- Saudi Arabia's poultry industry has attained 100% self-sufficiency in table eggs, providing a respectable surplus that supports the country's food security, the Ministry of Environment, Water, and Agriculture has stated.

- As stated by the ministry, Saudi Arabia produced about 8 billion eggs in 2024. Eggs form the centerpiece of a meal and are extensively utilized in the production of necessary foods including pastries, pies, and other foodstuffs. The ministry further pointed to the efforts made in the improvement of food quality, meeting safety standards, and stabilizing food supply within the market. These initiatives support Saudi Vision 2030's objectives of locally manufacturing more and encouraging locally manufactured products.

Poultry Farming Equipment Market Share

- The top five companies in the market are Big Dutchman, Roxell, SKA, Tecno Poultry Equipment, Texhaand they collectively hold a share of 8%-12% in the market.

- These companies continue to acquire and merge with others, expand facilities, and make various collaborations to increase their product offerings, access customer bases, and secure their market positions.

- Big Dutchman adopts a strategy focused on technological innovation and sustainability to meet increasing demand for sophisticated poultry machinery. Big Dutchman has a diverse portfolio of products that increase productivity while reducing environmental footprint. By implementing the latest technology, Big Dutchman makes its solutions efficient and easy to use. Big Dutchman also emphasizes energy-efficient systems to reach global sustainability initiatives. In addition, Big Dutchman invests in its global reach through strategic partnerships and alliances. Its focus on quality and innovation has made it a global leader in poultry equipment.

- Officine Facco uses its engineering skills to offer innovative and sustainable poultry farming solutions. Sustainability is the direction in which the company positions its offerings, aligning them with international environment-oriented goals. In addition, Officine Facco also focuses on customer satisfaction through the provision of guaranteed after-sales assistance and tailor-made solutions. The strategy helps the company to sustain its competitive advantage and strengthen its position in the international market.

Poultry Farming Equipment Market Companies

Major players operating in the poultry farming equipment industry are:

- AGICO

- Big Dutchman

- Hellmann Poultry

- Hightop

- Officine Facco

- PEP Poultry Equipment Plus

- Potters Poultry

- Qingdao Huabo

- Roxell

- SKA

- Tavsan

- Tecno Poultry Equipment

- Texha

- Valco Industries

- Zucami Poultry Equipment

To improve the product and market share key players are constantly investing in technological activities and are also entering into partnerships to provide improved and better solutions for the customers. These investments are benefiting both companies and customers as they help develop and offer solutions as per the changing technological trends and thus the customer requirements.

Officine Facco publishes a joint venture with Mr. Wang in China, a renowned entrepreneur in the poultry and agricultural world. The outcome is Facco Technology Hebei, which has complete control from Officine Facco, and will specialize in the production of turnkey poultry systems for the Asian market, though not limited to it. A strategic investment for the Italian group, for a significant financial and, above all, organizational and human resources commitment, with a tough growth plan.

Poultry Farming Equipment Market Industry News

- In December 2024, Tecno Poultry Equipment is set for future growth and ready to support customers in the evolving egg industry. As part of the new Grain and Protein Technologies Group Tecno is positioned to execute a focused growth strategy.

- In November 2023, SKA completed the first acquisition of a company active in the Poultry sector. The new company, ISA is specialized in the design and production of poultry and animal houses and owns ISA Montaggi, which is responsible for the installation and assembly of the houses. The ISA group focuses on the entire production process for farming systems, from design to development, through to manufacturing and installation, offering a broad range of services to ensure the end client can rely on a well-tailored product.

- In October 2023, Officine Facco announces the acquisition of Sperotto. New opportunities will arise in international markets for the future of both companies. The objective of this acquisition is to enhance the internal production of carpentry and prefabricated steel constructions, currently Sperotto's core business which produces sheds not only for poultry, but also for industry in general.

- In October 2022, Roxell launches the Fortena chain feeding system for broiler breeders in the production period. Roxell thus completes its total range for feeding, which contains a solution for every type of poultry farmer. These feeding systems are a component of Roxell’s 360° range for farm equipment with innovative drinking systems, nests, heating, ventilation and controllers.

The poultry farming equipment market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, by Equipment Type

- Feeding system

- Watering system

- Cage system

- Layer cage

- Broiler cage

- Breeder cage

- Climate control system

- Ventilation system

- Heating system

- Cooling system

- Incubation equipment

- Egg handling equipment

- Others (lighting system etc.)

Market, by Mode of Operation

- Manual

- Semi-automatic

- Fully automatic

Market, by Poultry Type

- Chicken

- Duck

- Turkey

- Others (geese, rabbit etc.)

Market, by End Use

- Household

- Commercial

Market, by Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the poultry farming equipment industry?

Key players in the sector include AGICO, Big Dutchman, Hellmann Poultry, Hightop, and Officine Facco.

How big is the poultry farming equipment market?

The poultry farming equipment industry was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

Why is the commercial segment dominating the market?

The commercial segment held a 79% market share in 2024 and is expected to grow at a CAGR of 4.9% through 2034.

What is the size of the United States poultry farming equipment industry?

The United States led the North American poultry farming equipment market with an 80% share and an estimated revenue of USD 1.07 billion in 2024.

Poultry Farming Equipment Market Scope

Related Reports