Summary

Table of Content

Polymer Filaments for Construction-Scale 3D Printing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Polymer Filaments for Construction-Scale 3D Printing Market Size

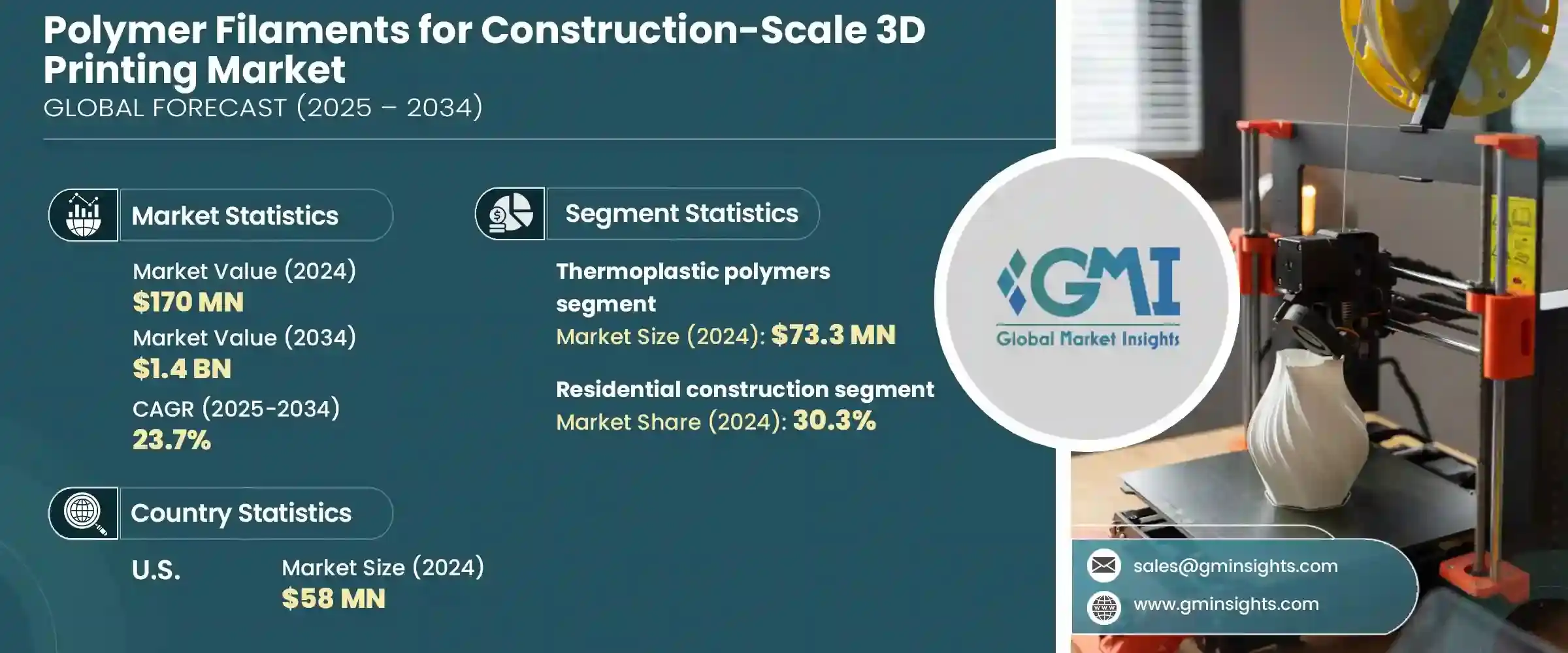

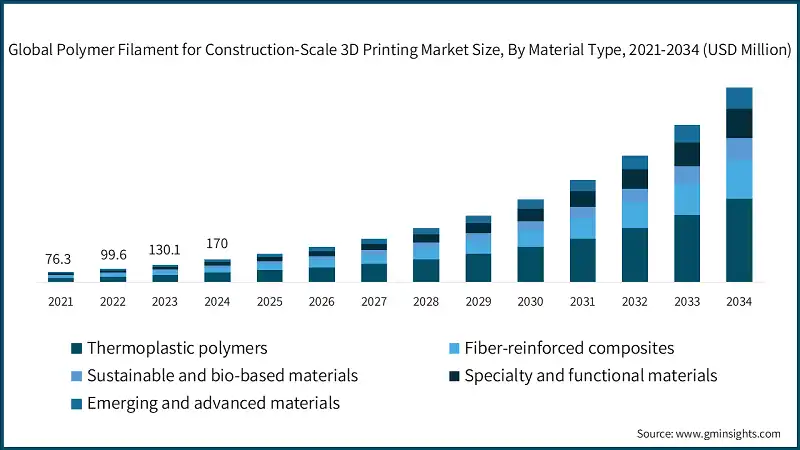

The global polymer filaments for construction-scale 3D printing market was valued at USD 170 million in 2024. The market is expected to grow from 210 million in 2025 to 1.4 billion in 2034, at a CAGR of 23.7%.

To get key market trends

- Polymer filaments for construction-scale 3D printing refers mainly to engineered thermoplastic materials such as PLA (polylactic acid), ABS (acrylonitrile butadiene styrene), and PET (polyethylene terephthalate) that have been optimized for large-format additive manufacturing in the production of structural components, tools, and even whole buildings.

- This technological niche serves to align with some of the major drivers for growth reforming the construction industry. According to a report released by the U.S. Department of Energy in 2019, additive manufacturing can reduce energy use in manufacturing by 50% and waste and material costs by about 90% in contrast to conventional manufacturing.

- The freedom of design provided by 3D printing enables architects to construct geometrically sophisticated and lightweight structures that cannot be achieved with traditional methods, thus incentivizing innovation. Such possibilities generated a demand for high-performance polymer filaments, which are now being pursued by governments placing emphasis on resilience in infrastructure.

- NIST emphasizes in its 2023 framework that integration of 3D printing can bridge skills gap by automating repetitive processes with less material use and waste generation compared to traditional manufacturing, for a further push in filament adoption.

- North America currently dominates the market, owing to the increasing uptake of 3D printing within the construction industry, enabling government policies, and the inclination toward environmentally friendly building materials. A significant increase has been recorded in investment for the future innovative construction technologies with polymer filaments in the region.

- Rapid urbanization and infrastructure development initiatives by governments in the Asia-Pacific region boost it to the fastest growth region among others globally in adopting 3D printing technology in construction. Countries like China, India, and Japan are spending a lot on smart construction technologies which are favoured by extensive usage of durable, high-performance polymer filaments.

Polymer Filaments for Construction-Scale 3D Printing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 170 million |

| Forecast Period 2025 - 2034 CAGR | 23.7% |

| Market Size in 2034 | USD 1.4 billion |

| Key Market Trends | |

| Drivers | Impact |

| Construction industry efficiency and cost reduction needs | Driving demand for innovative, cost-effective materials like polymer filaments to streamline construction processes and reduce overall project expenses. |

| Design freedom and architectural innovation opportunities | Encouraging adoption of polymer filament-based 3D printing to enable complex, customized, and innovative architectural designs that were previously difficult or costly to achieve. |

| Labor shortage and automation trends | Accelerating the integration of automated 3D printing solutions with polymer filaments to address labor shortages and improve construction speed and precision. |

| Pitfalls & Challenges | Impact |

| Building code and regulatory approval complexities | Delayed adoption of polymer filament 3D printing due to lengthy and stringent approval processes for new construction methods. |

| Material cost and performance trade-offs | High material costs and uncertainties around long-term performance hinder widespread market acceptance and adoption. |

| Opportunities: | Impact |

| Growing demand for sustainable and eco-friendly materials | Increased adoption of biodegradable polymers reduces environmental footprint. |

| Expansion into large-scale construction projects using durable, high-strength filaments | Facilitates the development of cost-effective, rapid, and precise construction methods. |

| Market Leaders (2024) | |

| Market Leader |

|

| Top Players |

Collective market share in 2024 is 44.2% |

| Competitive Edge | |

| Regional Insights | |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Indonesia, Vietnam |

| Future Outlook |

|

What are the growth opportunities in this market?

Polymer Filaments for Construction-Scale 3D Printing Market Trends

- This trend revolves around making 3D printing possible on a construction scale using recycled plastics (such as rPET, rPE) and bio-based polymers. This relates to some extent to the global goals of sustainability and reducing the construction footprint on the environment.

- To address increasingly specialized applications within construction, the emphasis, therefore, varies in developing specialized filaments capable of high performance, such as filaments with improved fire resistance, enhanced UV stability, and better mechanical strengths fit for load-bearing elements. The state supports within national programs such as those in Germany via the Federal Ministry of Education and Research (BMBF) to encourage such research into advanced materials for additive manufacturing, which may also include construction-related ones.

- In construction, polymer 3D printing is increasingly being integrated with Building Information Modelling (BIM) and digital twin technologies, creating seamless design-to-print workflows with real-time monitoring and simulation for better accuracy and efficiency. A large number of BIM-consistent advertisements and promotion have been carried out by the National Institute of Standards and Technology (NIST) in the United States, which has generated research about BIM adoption for construction industry purpose.

- An ongoing trend is the development of multimaterial printing techniques that will enable the deposition of several polymer composites at the same time using a single printer. Using these techniques it is possible to create highly complex functional building components with desirable properties-such as strength, flexibility, insulation, fire-resistance, and so on-for special structural or aesthetic requirements. The integration of different materials in one process enables the production of customized architectural elements from much more sophisticated designs and functions without needing extensive assembly into various constituent parts.

- At present, ongoing developments in the world of 3D printing hardware are actually being achieved, especially in terms of active robotic extrusion systems and mobile printing units that are designed specifically for applications in construction. Such machines can go directly to sites and print such structural elements as walls, beams, and even entire building sections. Improvements in speed, precision and reliability make all the difference in construction productivity and can also help simplify the construction-making process. It speeds up rapid prototyping and allows customized designs, especially useful in complex and bespoke architectural designs.

Polymer Filaments for Construction-Scale 3D Printing Market Analysis

Learn more about the key segments shaping this market

- Thermoplastic polymers dominates due to their known ease of processing, availability, and proven mechanical properties which contribute to the suitability of building components. They can be melted and extruded simply and yet reliably, which is why they are preferred for present-day printings on large scale.

- The polymers are economical in terms of performance and provide a quick solution for demanding needs associated with structural elements or functional parts in constructions.

- Fiber-reinforced composites are also fastest growing material and expected to growth at a CAGR of 23.9%. This expansion is attributed to new fiber technologies that provide increased fabrication strength and load-bearing abilities in these composites.

- Sustainable and bio-based materials are also increasing driven by the eco-conscious methods and innovations in bio-composites.

Learn more about the key segments shaping this market

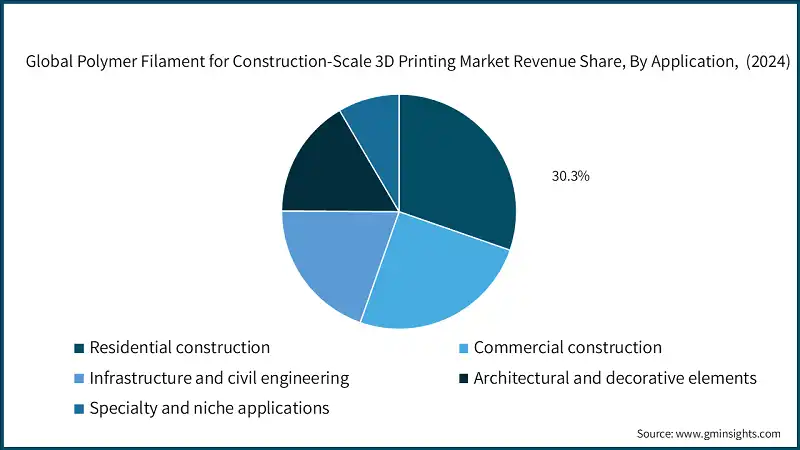

Based on application, the polymer filaments for construction-scale 3D printing market is segmented into residential construction, commercial construction, infrastructure and civil engineering, architectural and decorative elements and specialty and niche applications. Residential construction made up 30.3% of the market in 2024.

- Residential construction is a front-runner in the application segment on account of its direct addressal of critical housing demands and affordability challenges. Additionally, one of the great selling points for the application of polymer 3D printing to support increased housing availability is that it can produce housing parts rapidly and in turn reduce construction time and labor cost. Both new construction and renovation of existing homes have solutions through this method; hence it answers a large and very basic demand.

- Commercial construction ranks second, already being driven by an increased number of infrastructure projects as well as innovative building techniques.

- Microstructural and civil applications augmented by demand for ruggedness, weather resistance, and longevity in bridges, tunnels, and public infrastructure works.

- The booming market for architectural and decorative features, driven by customized and complex designs requirements as well as sustainability aesthetics in the building. Specialty and niche applications, still show steady growth as they focus on high-performance materials for unique construction requirements.

Based on technology, the polymer filaments for construction-scale 3D printing market is segmented into large-scale fused deposition modelling (FDM), robotic construction systems, continuous manufacturing technologies and emerging and advanced technologies. Large-scale fused deposition modelling (FDM) leads the market in 2024.

- Large-scale fused deposition modelling (FDM) leads the technology segment due to its relative simplicity, lower initial investment compared to other systems, and proven track record in handling polymer filaments. Technology’s scalability allows it to be adapted for various construction scales, from components to entire buildings, using widely available extrusion equipment principles.

- Robotic construction technologies in conjunction with FDM are changing the industry by enabling high precision automation as well as reducing labor costs and increasing safety. Thus, robotic construction is opening new avenues of architectural possibilities for an ever-demanding industry. These continuous manufacturing technologies do play a vital role in ensuring a constant supply of consistent high-quality filaments for large-infrastructure projects.

- In the meantime, other advanced technologies, including hybrid printing methods, novel composite materials, and smart self-healing filaments, are to push the limits of material strength and durability with sustainability. All these synergistic technological innovations propel the market forward, providing even more resource-efficient, sustainable, and innovative construction solutions, which positively fulfill the emerging needs of an ever-evolving industry.

Based on end use, the polymer filaments for construction-scale 3D printing market is segmented into construction companies and general contractors, architects and design professionals, real estate developers and building owners, research and educational institutions and government and public sector. Construction companies and general contractors leads the market in 2024.

- Construction companies and general contractors are the major end users since there is a direct need for it as a tool in building projects to increase construction speed, lower labor costs, and provide flexibility with intricate designs. They exist in terms of adoption into working project scenarios and are looking for the advantages of waste, on-site mechanisms, etc. Their practical approach and emphasis on project delivery make this segment a key adopter.

- Architects and design professionals also play an important part, because they integrate new printing technologies into the design workflow, thus allowing the creativity and precision of architecture to go beyond traditional limits. Real estate developers and owners of properties are now interested in investing in 3D printing technologies to reduce the time of their projects, personalize building features, and make them sustainable thereby benefiting property value and tenant attraction.

- Research and educational institutions contribute much to technological advancement via development, pioneering studies, and training experts for the next generation that creates industry innovation. Meanwhile, the government and public sectors are primary stakeholders in establishing regulations, funding large pilot projects, and encouraging sustainable urban development.

Based on equipment scale, the polymer filaments for construction-scale 3D printing market is segmented into large-scale industrial systems, medium- scale industrial systems, compact and portable systems and hybrid and multi-technology systems. Large-scale industrial systems lead the market in 2024.

- Large-scale industrial systems dominate the market as they are specifically designed to handle the massive volume and dimensions required for constructing entire buildings or substantial components. Their high build volumes and robust construction enable the production of load-bearing walls, structural elements, and large facades, directly addressing the core application of construction-scale 3D printing.

- Properties of medium-scale engineering are actual features to satisfy varying requirements between portability, mobility, and capacity during mid-scale commercial production or special needs construction jobs requiring flexibility in throughput. Small portable systems are specific to particular markets, such as on-site repairs, customized architectural elements, or remote construction sites.

- The hybrid and multi-technology approaches consist of various methods, such as incorporating FDM with other types of additive systems, thus enhancing versatility, compatibility with different materials, and functional opportunities, and attracting innovative constructors and research institutions that seek to solve technological problems.

Looking for region specific data?

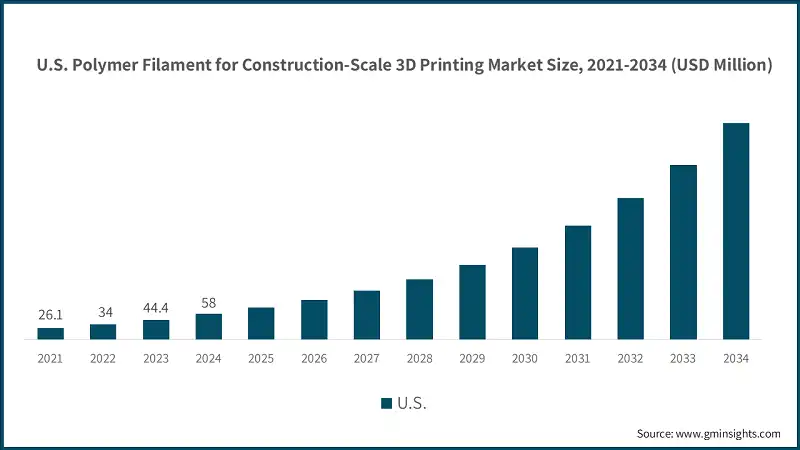

U.S. polymer filaments for construction-scale 3D printing market accounted for USD 58 million in 2024.

- As a region, North America could be entirely described for polymer filaments in the 3D construction printing industry by the U.S., which highly dominates the region, having a very advanced infrastructure in technology usage and a subsequent high adoption rate of these technologies plus huge investments in innovation construction.

- The U.S. also boasts of a strong presence of key players in the industry, budding innovators, and extensive R&D activities-fueling the development and adoption of high-performance filament materials appropriate for large construction projects. These efforts are complemented by the country's demand for environment-friendly and cost-effective solutions for buildings, which even increase the demand for specialized polymer filaments to hold up further complex constructions.

- Canada, although a relatively smaller market in size, is receiving rapid growth due to the increasing government initiatives encouraging sustainable construction practices along with technological advancements. The adoption of the 3D construction printing method by Canadian constructors is done mainly to reduce project time and costs, especially for construction at remote and environmentally sensitive sites. The positive aspect of adopting eco-friendly and durable filament materials starts to gain importance with government incentives as well as partnerships with industry.

The market in Germany is expected to experience significant and promising growth from 2025 to 2034.

- 3D printing technologies for construction are quickly gaining application in Europe, with Germany and the UK at the helm. Sustainability and innovation play a dominant role in German policies, directing ostensible government-related research and sector involvement into recycled and bio-based polymers for large-scale 3D printing.

- In the UK, digital twin and BIM are convincing constructors to adopt smart and efficient practices. Europe retains a cutting edge over the others in developing specialized materials such as fire-resistant and UV-stable filaments; given the area's stress on regulatory standards and sustainability, it is a market leader. Among all contenders in Europe, Germany is experiencing massive growth as a consequence of vigorous R&D investment and industrial engagement.

The polymer filaments for construction-scale 3D printing market in China is expected to experience significant and promising growth from 2025 to 2034.

- In the region, polymer 3D printing for construction is fastly moving with jumps from China and India. Heavy investments from the government in smart infrastructure and sustainable building solutions make China the fastest-growing market in APAC. With regard to urban development and affordable housing projects, advances in the country on large-scale extrusion systems and multi-material printing provide an edge.

- India is also attempting to catch up with increasing government support for innovative construction methods to address housing shortages and infrastructure needs. Cost-effectiveness, population base, and rapid growth in the construction sector make APAC a region of interest, with China now leading in terms of technological adoption and market expansion.

The UAE polymer filaments for construction-scale 3D printing market is expected to experience significant and promising growth from 2025 to 2034.

- 3D printing technologies are rapidly gaining acceptance for construction in the Middle East, especially in Saudi Arabia and the UAE, because of lofty visions of smart cities and sustainable development. The UAE may be considered a vanguard in 3D printing integration with digital twin and BIM technologies to bring down costs and time for construction work.

- Saudi Arabia has put this on its emerging market list due to government initiatives toward diversification of its economy, along with substantial investments in innovative building methods. The two governments are inclined to utilize recyclable materials and bio-based polymers as part of their sustainability agenda. At present, the UAE has entered hypergrowth as a country in the region, taking the lead on myriad large-scale projects and construction technology.

The polymer filaments for construction-scale 3D printing market in Brazil is expected to experience significant and promising growth from 2025 to 2034.

- Latin America is somewhat progressing into 3D printing-related architecture-building and Brazil has entered the scene as a regional leader owing to sustainable and affordable housing projects. The government initiatives toward acceptance of recycled plastics and bio-based polymers are congruent with the environmental aspirations of the country.

- Argentina is gradually advancing, from pilot projects and research collaborations towards a new technology. Latin American growth is rather modest and animated by the economy and infrastructure needs, with Brazil being the most promising and fastest growing in the region.

Polymer Filaments for Construction-Scale 3D Printing Market Share

- Polymer Filaments for Construction Scale 3D Printing markets is moderately consolidated with players like Arkema, BASF SE, Covestro, Sika AG and Skanska AB holding 44.2% market share.

- Leading companies in the construction-scale 3D printing filament market secure their dominance through long-term dedicated R&D activities. They continue the consistent development of innovative sustainable high-performance polymer formulations that match stringent regulatory norms and industry standards.

- Companies are developing multifunctional filaments with improved properties like UV stability, higher durability, and eco-friendliness, key factors for large-scale construction. The strategic alliances they form with construction firms, developers, and infrastructure agencies enable them to secure a wider market, especially for the large urban development and affordable housing projects.

- Programs for rapid regional expansion into Asia-Pacific, North American, and European markets allow these companies to innovate, create new industry standards, and shape the future of construction-scale 3D printing with polymer filaments.

Polymer Filaments for Construction-Scale 3D Printing Market Companies

Major players operating in the polymer filaments for construction-scale 3D printing industry are:

- Arkema

- BASF SE

- Coex 3D

- Covestro

- Manlon Polymers

- Mighty Buildings

- MudBots

- Sika AG

- Skanska AB

- Tvasta Manufacturing Solutions

Arkema is engaged in developing high-performance polymer solutions for construction-scale 3D printing and uses its expertise in specialty chemicals to formulate innovative filaments that meet the stringent requirements for construction at larger scales. Their interest revolves around procuring materials combining durability, stability, and precision to create complex architectural structures with enhanced strength and longevity.

BASF SE is a contributor to development of advanced polymer filaments especially suited to construction 3D printing. The strategy focuses on tailoring material properties in respect to flexibility, toughness, and environmental resistance.

Covestro applies its know-how in polycarbonate and polyurethane technology to develop polymer filaments characterized by impact resistance, thermal stability, and precision. These three properties are vital in the design and manufacture of complex and high-performance architectural elements. Focused on materials which allow for complex design, ensures that 3D printed components fulfil the aesthetic and structural requirements stipulated within construction.

Sika AG is already a household name when it comes to construction chemistry, since it offers polymer filaments that provide compatibility and adhesion with traditional building materials, including concrete, steel, and wood.

Collectively, these companies illustrate a collaborative approach in innovating and refining polymer solutions such that the widespread adoption of 3D printing in construction can be made possible to address the issues related to material performance, compatibility, and scalability.

Polymer Filaments for Construction-Scale 3D Printing Industry News

- February 2025 – Putzmeister Group launched the INSTATIQ brand for construction 3D printing. The German company rebranded its large-scale, industrial-grade solution previously known as KARLOS. This move aimed to make 3D concrete printing more accessible to the mass market.

- June 2023 – Braskem completed the acquisition of taulman3D, expanding its additive manufacturing material portfolio. The deal added nylon and recycled PE filaments, strengthening Braskem's market position. taulman3D's globally distributed materials complemented Braskem's offerings, enhancing its presence in the 3D printing industry.

- June 2020 – DSM finalized the acquisition of a portion of Clariant’s 3D printing materials portfolio. Clariant transferred select filament and pellet materials along with part of its 3D printing team to DSM. This move allowed DSM to broaden its additive manufacturing capabilities and better serve customer needs.

The polymer filaments for construction-scale 3D printing market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of Units from 2021–2034 for the following segments:

Market, By Material Type

- Thermoplastic polymers

- PLA (polylactic acid) and bio-based thermoplastics

- ABS (acrylonitrile butadiene styrene) and engineering plastics

- PETG (polyethylene terephthalate glycol) and specialty polymers

- High-performance engineering plastics (PEEK, PEI, PEKK)

- Fiber-reinforced composites

- Carbon fiber reinforced polymers (CFRP)

- Glass fiber reinforced polymers (GFRP)

- Natural fiber reinforced composites

- Continuous fiber reinforcement systems

- Sustainable and bio-based materials

- Bio-based polymer formulations

- Recycled content and post-consumer materials

- Biodegradable and compostable polymers

- Waste-derived and circular economy materials

- Specialty and functional materials

- Fire-resistant and flame-retardant polymers

- Thermal insulation and energy-efficient materials

- Conductive and smart material systems

- Multi-functional and hybrid material solutions

- Emerging and advanced materials

- Nanocomposite and enhanced performance materials

- Shape memory and responsive polymer systems

- Self-healing and adaptive material technologies

- Biomimetic and nature-inspired material solution

Market, By Application

- Residential construction

- Commercial construction

- Infrastructure and civil engineering

- Architectural and decorative elements

- Specialty and niche applications

Market, By Technology

- Large-scale fused deposition modelling (FDM)

- Robotic construction systems

- Continuous manufacturing technologies

- Emerging and advanced technologies

Market, By End Use

- Construction companies and general contractors

- Architects and design professionals

- Real estate developers and building owners

- Research and educational institutions

- Government and public sector

Market, By Equipment Scale

- Large-scale industrial systems

- Medium- scale industrial systems

- Compact and portable systems

- Hybrid and multi-technology system

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the polymer filaments for construction-scale 3D printing industry?

Key trends include development of bio-based and recycled filaments, integration with BIM and digital twin systems, and rise of robotic and multimaterial printing for complex structures.

Who are the key players in the polymer filaments for construction-scale 3D printing market?

Key players include Arkema, BASF SE, Covestro, Sika AG, Skanska AB, Coex 3D, MudBots, Mighty Buildings, Tvasta Manufacturing Solutions, and Manlon Polymers.

What is the growth outlook for fiber-reinforced composites from 2025 to 2034?

Fiber-reinforced composites are projected to grow at a 23.9% CAGR till 2034.

What was the valuation of residential construction application segment in 2024?

Residential construction held 30.3% market share and was the leading application segment in 2024.

Which region leads the polymer filaments for construction-scale 3D printing market?

U.S. held the largest share with USD 58 million in 2024. Market growth is fueled by advanced R&D, strong industry presence, and sustainable construction initiatives.

What is the market size of the polymer filaments for construction-scale 3D printing in 2024?

The market size was USD 170 million in 2024, with a CAGR of 23.7% expected through 2034 driven by design freedom and architectural innovation in construction.

What is the projected value of the polymer filaments for construction-scale 3D printing market by 2034?

The market is expected to reach USD 1.4 billion by 2034, due to sustainable construction demand, automation, and advancements in large-scale 3D printing.

How much revenue did the thermoplastic polymers segment generate in 2024?

Thermoplastic polymers generated USD 73.3 million in 2024.

Polymer Filaments for Construction-Scale 3D Printing Market Scope

Related Reports