Summary

Table of Content

Point of Care Testing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Point of Care Testing Market Size

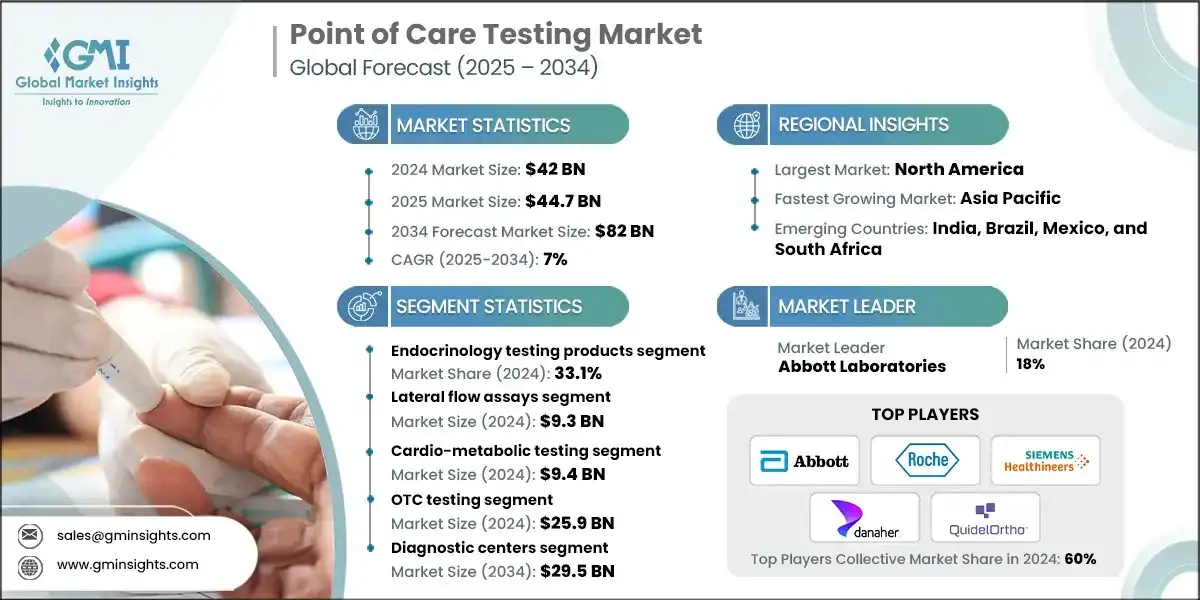

The global point of care testing market size was estimated at USD 42 billion in 2024. The market is expected to grow from USD 44.7 billion in 2025 to USD 82 billion in 2034, growing at a CAGR of 7%, according to the latest report published by Global Market Insights Inc. The growth of the global market is largely influenced by the upward trend in disease prevalence among developing countries, surging number of pathology labs and services equipped with advanced diagnostic equipment in North America, technological advancements, and increasing research and development investment.

To get key market trends

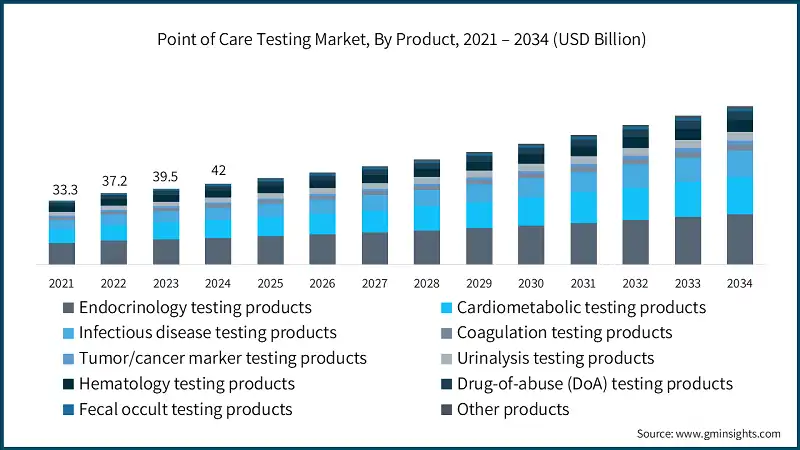

The market increased from USD 33.3 billion in 2021 to USD 39.5 billion in 2023. This growth was driven by the rising burden of chronic and infectious diseases in developing countries. Communicable diseases such as HIV/AIDS, tuberculosis (TB), malaria, viral hepatitis, sexually transmitted infections, and neglected tropical diseases (NTDs) remain leading causes of death and disability in low-income populations. HIV has claimed over 36.3 million lives, while TB causes around 1.5 million deaths annually, making it the second deadliest infectious disease after COVID-19. In 2020, children under 5 years accounted for 77% (487,000) of all malaria deaths worldwide. The COVID-19 pandemic has further reversed progress in combating these diseases, increasing the need for strong healthcare systems. This increased burden of chronic diseases highlight need for point of care testing solutions stimulating the market growth.

The increasing focus on research and development in point-of-care (POC) testing is a major factor driving market expansion. With rising demand for rapid diagnostics in emergency and remote settings, governments and health organizations are actively investing in innovative solutions. For instance, U.S. National Institutes of Health (NIH) allocated over USD 1.5 billion toward diagnostic technologies, including POC testing. This funding continues to grow annually, reflecting the urgency to develop accessible tools for managing infectious diseases, diabetes, and cardiovascular conditions. These investments not only accelerate innovation but also ensure that diagnostic solutions are tailored to real-world healthcare challenges. As a result, sustained research and development support is essential for advancing POC testing, making diagnostics faster, more accurate, and widely available especially in underserved regions.

The Point-of-Care Testing includes diagnostic tools designed to deliver fast, reliable, and lab-grade results directly at or near the patient’s location. These systems support quick clinical decisions, minimizing reliance on centralized laboratories. Leveraging technologies such as lateral flow assays, microfluidic platforms, and immunoassay techniques, point of care testing devices test biological samples like blood, urine, or saliva, producing results within minutes.

Point of Care Testing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 42 Billion |

| Market Size in 2025 | USD 44.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 7% |

| Market Size in 2034 | USD 82 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Upward trend in disease prevalence among developing countries | Drives increased demand for accessible and rapid diagnostic solutions. |

| Surging number of pathology labs and services equipped with advanced diagnostic equipment | Enhances adoption of point of care testing through improved infrastructure and clinical integration. |

| Technological advancements in point of care tests | Enable development of more accurate, portable, and user-friendly point of care testing. |

| Increasing research and development investment | Accelerates innovation and expansion of point of care testing applications across healthcare settings. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory framework | Slows down product approvals and market entry, limiting innovation and expansion. |

| High cost of product development | Restricts participation of smaller players and raises barriers to technological advancement. |

| Opportunities: | Impact |

| Growing demand in remote and rural areas | Expands market reach by addressing unmet diagnostic needs in underserved regions. |

| Integration with digital health platforms | Enhances real-time data access and clinical decision-making, boosting point of care testing adoption. |

| Market Leaders (2024) | |

| Market Leaders |

18% market share |

| Top Players |

Collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, Mexico, and South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Point of Care Testing Market Trends

- Technological advancement has enabled the miniaturization of complex laboratory equipment into compact, portable point of care testing devices. Innovations in microfluidics and lab-on-a-chip systems allow for precise handling of minute biological samples, such as blood or saliva, within a small cartridge. These integrated systems combine sample preparation, reaction, and detection in one unit, drastically reducing the time and space needed for diagnostics.

- Modern point of care testing increasingly incorporates advanced biosensors and artificial intelligence (AI) algorithms to improve diagnostic accuracy and reliability. Biosensors based on nanomaterials or electrochemical detection can identify biomarkers at extremely low concentrations, enhancing sensitivity. AI-driven interpretation of results helps reduce human error and supports clinical decision-making.

- For instance, Abbott offers the i-STAT hs-TnI (high-sensitivity Troponin I) cartridge, which is designed to rapidly aid in the diagnosis of myocardial infarction (heart attack) at the point of care. This cartridge is part of the i-STAT system, a handheld blood analyzer that delivers lab-quality results in approximately 15 minutes, allowing clinicians to make faster treatment decisions in emergency settings.

- Many point of care testing devices now come with Bluetooth or Wi-Fi, allowing them to sync with electronic health records or send results directly to doctors. This is especially useful in remote or rural areas where access to specialists is limited.

Point of Care Testing Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 33.3 billion in 2021. The market size reached USD 39.5 billion in 2023, from USD 37.2 billion in 2022.

Based on the Product, the market is segmented into endocrinology testing products, cardiometabolic testing products, infectious disease testing products, coagulation testing products, tumor/cancer marker testing products, urinalysis testing products, hematology testing products, drug-of-abuse testing products, fecal occult testing products, other products. The Endocrinology testing products segment held a significant market share of 33.1% in 2024.

- The endocrinology testing segment is expected to grow steadily. This growth is largely due to the rising incidence of endocrine disorders such as diabetes, thyroid issues, and adrenal dysfunctions, which require fast and reliable diagnostic solutions at the point of care.

- For instance, according to IDF in 2024, diabetes was responsible for 3.4 million deaths, equating to one death every 9 seconds, underscoring its global impact. Currently, 589 million adults aged 20-79 (1 in 9) are living with diabetes, and this number is projected to rise to 853 million by 2050. These alarming figures highlight the urgent need for accessible, real-time diagnostic and management tools, especially in underserved regions. Point-of-care testing solutions like glucose meters and HbA1c analyzers are becoming increasingly vital in addressing this growing health crisis.

- Technological advancements in biosensors, microfluidics, and immunoassay platforms have significantly improved the accuracy and efficiency of these tests. Glucose meters and HbA1c analyzers dominate the market, evolving into smart devices integrated with mobile apps for data tracking and telemedicine.

- As a result, advancements and increasing incidence of endocrine disorders are collectively propelling the growth of the market, addressing critical diagnostic needs across diverse healthcare settings.

Based on technology, the point of care testing market is segmented into lateral flow assays, dipsticks, microfluidics, molecular diagnostics, immunoassays, agglutination assays, flow-through methods, solid-phase techniques, and biosensors. The lateral flow assays segment was worth USD 9.3 billion in 2024.

- Lateral flow assays (LFAs) are simple, paper-based diagnostic devices used to detect the presence of a target substance in a liquid sample, typically using antibodies. They are widely known for their rapid results and ease of use, making them ideal for point-of-care testing.

- The rising prevalence of infectious diseases like COVID-19, Zika, dengue, and HIV/AIDS has significantly boosted the demand for LFAs in point of care testing. These tests enable quick screening and diagnosis, allowing healthcare providers to make immediate treatment decisions, which is crucial for controlling outbreaks and improving patient outcomes.

- Beyond infectious diseases, LFAs are used in various applications such as pregnancy testing, cancer biomarker detection, cardiac markers, drug screening, and food safety. Their versatility and ability to detect multiple analytes make them a cornerstone of modern point of care testing.

- Therefore, market is witnessing strong growth, due to the rising burden of chronic and infectious diseases and the continuous advancement of diagnostic technologies.

Based on application, the point of care testing market is segmented into cardio-metabolic testing, infectious disease testing, nephrology testing, drug-of-abuse testing, blood glucose testing, pregnancy testing, cancer biomarker testing, and other applications. The cardio-metabolic testing segment was worth USD 9.4 billion in 2024.

- Cardiometabolic testing assays are diagnostic tools used to evaluate biomarkers related to cardiovascular and metabolic health, such as cholesterol levels, glucose, and HbA1c. These tests help in identifying risks and managing conditions like heart disease, diabetes, and dyslipidaemia.

- For instance, Cardiovascular diseases (CVDs) remain the leading cause of death worldwide, claiming an estimated 17.9 million lives each year. These include a range of heart and blood vessel disorders such as coronary heart disease, cerebrovascular disease, and rheumatic heart disease. Alarmingly, over 80% of CVD-related deaths result from heart attacks and strokes, with one-third occurring prematurely in individuals under the age of 70. This highlights the urgent need for early detection and effective management strategies, where point-of-care testing plays a vital role in improving outcomes.

- Additionally, one of point of care testing’s key advantages is its ability to deliver real-time data during consultations, allowing healthcare providers to adjust treatment plans immediately. For example, lipid panel point of care testing has shown promise in streamlining cardiovascular risk management. Devices like Dario Health Smart Glucose Meter and PTS Diagnostics CardioChek empower patients to monitor their health frequently, enhancing engagement and adherence.

Based on prescription, the point of care testing market is segmented into OTC testing, prescription-based testing. The OTC testing segment was worth USD 25.9 billion in 2024.

- Over the counter (OTC) testing refers to diagnostic tests that individuals can purchase and perform at home without needing a prescription or visiting a healthcare facility.

- OTC tests are designed to be simple and user-friendly, requiring minimal technical knowledge. Whether it's checking glucose levels, confirming pregnancy, or detecting infections, these tests empower users to take control of their health.

- For instance, Abbott offers several OTC point of care testing products, including the BinaxNOW COVID-19 Antigen Self-Test, which became widely used during the pandemic. It provides results in 15 minutes and is FDA-approved for home use.

- The ease of use encourages regular testing, which is crucial for managing chronic conditions and catching early signs of illness.

- OTC point of care testing delivers fast results, enabling timely decisions and reducing delays associated with lab testing. In conclusion, the growing adoption of OTC diagnostics reflects a shift toward patient-centered care, which helps individuals manage their health proactively and conveniently.

Learn more about the key segments shaping this market

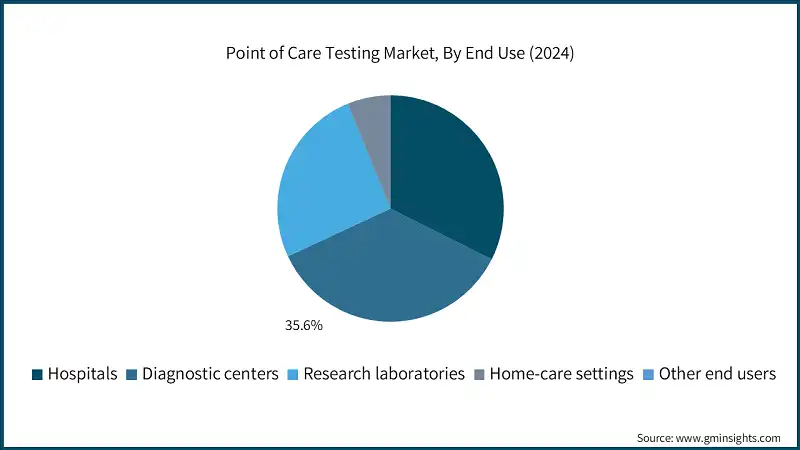

Based on end use, the point of care testing market is categorized into hospitals, diagnostic centers, research laboratories, home-care settings, other end users. Among these, diagnostic centers segment dominated the market in 2024, accounting for 35.6% of the total market share. This dominance is projected to continue, with the segment expected to reach USD 29.5 billion by 2034.

- Specialized diagnostic centers are important in point-of-care testing, offering a broad spectrum of rapid diagnostic services across medical disciplines. These facilities range from independent labs to focused clinics, providing on-site testing for both acute and chronic conditions, which enhances accessibility and efficiency in patient care.

- Equipped with advanced point of care testing technologies and skilled personnel, these centers provide accurate, real-time results for tests such as infectious disease screening, glucose monitoring, and cardiac biomarker analysis. Their ability to produce immediate results supports faster clinical decisions and improves patient outcomes.

- Additionally, major advantage of these centers is their convenience and expertise. Patients benefit from quick access to diagnostic services without needing hospital admission, while healthcare providers gain timely data for treatment planning. These centers often collaborate with hospitals and specialists to ensure seamless care coordination.

- In conclusion, diagnostic centers specializing in point of care testing are vital to modern healthcare delivery. Their rapid testing capabilities, accessibility, and integration with broader care networks make them essential for improving diagnostic speed, patient experience, and overall health outcomes.

Looking for region specific data?

North America Point of Care Testing Market

The North America market dominated the global point of care testing industrywith a market share of 33.4% in 2024.

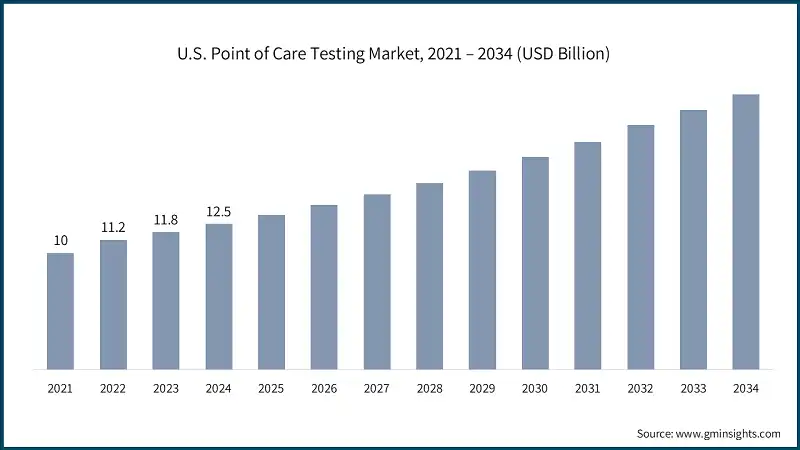

The U.S. market was valued at USD 10 billion and USD 11.2 billion in 2021 and 2022, respectively. The market size reached USD 12.5 billion in 2024, growing from USD 11.8 billion in 2023.

- The U.S. point-of-care testing market is witnessing notable growth, largely due to the upward trend in disease prevalence, such as diabetes.

- According to the CDC, approximately 38.4 million people of all ages in the U.S. (11.6% of the total population) were living with diabetes. Among adults aged 18 and older, 38.1 million individuals, or 14.7% of all U.S. adults, had diabetes. These figures highlight the scale of the challenge and the growing need for point-of-care testing devices for diabetic patients, particularly in hospital, outpatient, and homecare settings.

- As the prevalence of diabetes continues to rise across the U.S., the demand for fast, reliable, and technology-driven diagnostic tools is increasing.

Europe point of care testing market

Europe market accounted for USD 12.1 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The European point-of-care testing market is steadily expanding, largely driven by the increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders. These health challenges have heightened the demand for rapid, accessible diagnostic tools that support early detection.

- For instance, according to International Diabetes Federation (IDF) data on diabetes, the number of adults aged 20 to 79 with diabetes has nearly tripled over the past two decades from 22.4 million in 2000 to 65.6 million in 2024. Projections suggest this figure will reach 72.4 million by 2050. These estimates are based on data from 60 countries and territories, with 71 data sources from 41 countries meeting inclusion criteria, underscoring the reliability and scale of the trend.

- Point of care testing technologies in Europe are being widely adopted across hospitals, clinics, and home care settings due to their ability to deliver real-time results. This enables healthcare providers to make faster clinical decisions and improves patient outcomes, especially in time-sensitive situations.

Germany point of care testing market is anticipated to witness considerable growth over the analysis period.

- The German point-of-care testing market is experiencing steady growth, largely driven by the rising incidence of infectious diseases across the country. As public health challenges such as tuberculosis, influenza, and emerging viral infections persist, the demand for rapid and reliable diagnostic tools has intensified.

- For example, the European Centre for Disease Prevention and Control (ECDC) reported 4,076 tuberculosis cases in Germany in 2022, underscoring the need for accessible and efficient diagnostic tools. Point of care testing technologies help address such challenges by enabling rapid testing and reducing delays in clinical decision-making.

- As burden of infectious diseases in Germany is rising, so does demand of Point of care testing.

Asia Pacific point of care testing market

The Asia Pacific market is anticipated to grow at the CAGR of 7.8% during the analysis timeframe.

- The Asia-Pacific point-of-care testing market is experiencing strong growth, primarily driven by the rising prevalence of infectious diseases such as tuberculosis, dengue, influenza, and hepatitis. These public health challenges have increased the demand for rapid and accessible diagnostic tools that can support early detection and timely treatment.

- For instance, according to the International Diabetes Federation, in western pacific region the number of adults aged 20-79 years with diabetes in this region surged from 44.1 million in 2000 to 131.9 million in 2011, and further to 215.4 million in 2024. Projections estimate this number will reach 253.8 million by 2050, underscoring the urgent need for point of care testing solutions.

Japan point of care testing market is predicted to grow significantly over the forecast period.

- The Japan market is experiencing steady growth, largely driven by rapid advancements in diagnostic technologies. Innovations in biosensors, microfluidics, and portable analyzers are transforming traditional diagnostic practices by enabling faster, more accurate, and decentralized testing.

- These technologies support real-time monitoring and personalized diagnostics, allowing healthcare providers to make immediate decisions during patient consultations. This is particularly valuable in managing infectious diseases and chronic conditions, where timely intervention can significantly improve outcomes.

- Japan’s strong focus on healthcare innovation is contributing to the increased adoption of point of care testing across hospitals, clinics, and home care settings. The integration of digital health tools and mobile connectivity further enhances the accessibility and efficiency of these solutions.

Latin America Point of Care Testing Market

Brazil is experiencing significant growth in the Latin America market due to the high burden of chronic diseases.

- The point-of-care testing market in Brazil is witnessing significant growth, due to the increasing demand for rapid diagnostics and decentralized healthcare solutions. Factors such as a technological advancement, rising prevalence of chronic diseases like diabetes and cardiovascular conditions, and the need for timely clinical decisions are contributing to the expansion of point of care testing adoption across the country. These devices enable faster diagnosis and treatment initiation, especially in remote and underserved areas, thereby improving patient outcomes.

- Healthcare providers across Brazil are increasingly integrating point of care testing technologies into their clinical workflows to enhance diagnostic efficiency, reduce the burden on centralized laboratories, and support early intervention strategies.

- For instance, according to the International Diabetes Federation (IDF), Brazil had over 16.6 million adults living with diabetes in 2024, representing a 10.6% prevalence among its 155 million adult population. Brazil is part of the IDF South and Central America (SACA) region, which currently has 35 million people with diabetes, projected to rise to 52 million by 2050. This surge in diabetes cases creates need for point of care testing devices such as blood glucose monitors, HbA1c analyzers, and urine test kits. The growing diabetic population is placing pressure on the healthcare system, accelerating the need for accessible, accurate, and cost-effective diagnostic tools that can be deployed at the point of care.

Middle East and Africa Point of Care Testing Market

Saudi Arabia market is poised to witness substantial growth in the Middle East and Africa market during the forecast period.

- The point-of-care testing market in Saudi Arabia is expanding rapidly, driven by the increasing prevalence of infectious diseases and the need for timely, decentralized diagnostic solutions. The country’s healthcare system is prioritizing early detection and rapid response to infectious threats. point of care testing devices offer a critical advantage by enabling immediate testing at or near the site of patient care, which is essential for controlling the spread of infections and improving public health outcomes.

- Infectious diseases such as influenza, HIV, hepatitis C, and sexually transmitted diseases (STDs) continue to pose significant public health challenges in Saudi Arabia. point of care testing technologies are increasingly being adopted to support healthcare workers, reduce diagnostic delays, and improve patient outcomes through faster clinical decision-making.

- The growing demand for efficient infectious disease management is accelerating the integration of point of care testing devices across hospitals, clinics, and community health programs.

Point of Care Testing Market Share

- Top players like Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Danaher Corporation, and QuidelOrtho Corporation, are expanding their global footprint through strategic initiatives such as mergers, acquisitions, and innovation-driven partnerships to strengthen their competitiveness in the evolving point of care testing landscape. These top 5 players are contributing 60% of the market share.

- These companies are actively integrating advanced diagnostic technologies including molecular point of care testing, biosensors, and smartphone-enabled testing into their portfolios. By embedding connectivity features and cloud-based data sharing, they enhance diagnostic speed, accuracy, and remote patient monitoring capabilities.

- Collaborations with healthcare providers, digital health platforms, and regulatory bodies are central to their strategy, ensuring point of care testing solutions meet clinical standards, data privacy regulations, and patient safety benchmarks. Additionally, efforts to improve access in underserved and aging populations are making decentralized diagnostics more inclusive and impactful.

- Through technology-driven innovation, these market leaders are transforming point-of-care diagnostics by enabling faster clinical decisions, reducing hospital visits, and improving patient outcomes. Their focus on patient-centric, evidence-based testing is reshaping care delivery models and contributing to more efficient and sustainable healthcare systems worldwide.

Point of Care Testing Market Companies

Some of the eminent market participants operating in the point of care testing solutions industry include:

- Abbott Laboratories

- Acon Laboratories

- Becton, Dickinson, and Company

- BioMerieux SA

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Dexcom, Inc

- Drägerwerk AG & Co. KGaA

- F. Hoffmann-La Roche Ltd.

- LifeScan IP Holdings, LLC

- Medtronic Plc

- Meridian Bioscience, Inc.

- Nova Biomedical

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Danaher Corporation

Danaher Corporation is a major player in the market through its subsidiaries. The company focuses on molecular diagnostics and rapid testing platforms for infectious diseases. Its point of care testing solutions are widely used in clinical labs and emergency settings, offering high sensitivity and fast turnaround times. Danaher’s strength lies in its innovation-driven portfolio and strategic acquisitions that enhance its presence in decentralized diagnostics.

QuidelOrtho Corporation specializes in rapid diagnostic testing, particularly for infectious diseases such as influenza, COVID-19, and strep. Known for its lateral flow and molecular point of care testing platforms, the company serves hospitals, clinics, and retail health providers. QuidelOrtho’s merger with Ortho Clinical Diagnostics has expanded its capabilities, making it a strong contender in both acute and chronic disease testing at the point of care.

Bio-Rad Laboratories, Inc. is a notable contributor to the point-of-care testing (point of care testing) market, especially in infectious disease diagnostics. The company supports decentralized healthcare through rapid antibody and antigen detection solutions. Its focus on quality control and assay reliability makes Bio-Rad a trusted partner for clinical laboratories and healthcare providers seeking accurate, near-patient testing capabilities.

Point of Care Testing Industry News

- In December 2023, Roche strengthened its position in the point-of-care testing (point of care testing) market by acquiring LumiraDx’s diagnostic platform. This strategic move enhanced Roche’s capabilities in rapid testing, allowing it to deliver faster and more reliable results across various infectious diseases.

- In February 2024, Danaher subsidiary HemoCue partnered with Novo Nordisk to improve point-of-care diagnostic testing for children with type 1 diabetes in underserved regions. The collaboration focuses on enhancing early detection and disease management in low- and middle-income countries.

The point of care testing market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2021 - 2034 for the following segments:

Market, By Product

- Endocrinology testing products

- Glucose monitoring

- Strips

- Meters

- Lancets

- Cholesterol testing products

- Pregnancy testing products

- Fertility testing products

- Thyroid function tests

- Glucose monitoring

- Cardiometabolic testing products

- Cardiac marker testing products

- hsTnI (High-Sensitivity Troponin I)

- BNP (B-Type Natriuretic Peptide)

- D-dimer

- CK-MB (Creatine Kinase-MB)

- Myoglobin

- Other cardiac marker testing

- Cardiac marker testing products

- Blood gas (Lung function)

- Metabolite testing products

- Electrolytes testing

- Liver function

- Bilirubin

- Alanine transaminase (ALT)

- Kidney function

- Creatinine

- Urea

- Uric Acid

- HBA1C testing products

- Infectious disease testing products

- Influenza testing products

- HIV testing products

- Hepatitis C testing products

- Sexually transmitted disease (STD) testing products

- Healthcare-associated infection (HAI) testing products

- Respiratory infection testing products

- Tropical disease testing products

- Other infectious disease testing products

- Coagulation testing products

- PT/INR testing products

- Activated clotting time (ACT/APTT) testing products

- Tumor/cancer marker testing products

- Urinalysis testing products

- Hematology testing products

- Drug-of-abuse (DoA) testing products

- Fecal occult testing products

- Other products

Market, By Technology

- Lateral flow assays

- Dipsticks

- Microfluidics

- Molecular diagnostics

- Immunoassays

- Agglutination assays

- Flow-through

- Solid phase

- Biosensors

- Electrochemical

- Optical

- Thermal

- Mass-sensitive

- Other biosensors

Market, By Prescription

- OTC testing

- Prescription-based testing

Market, By Application

- Cardio metabolic testing

- Infectious disease testing

- Nephrology testing

- Drug-of-abuse (DoA) testing

- Blood glucose testing

- Pregnancy testing

- Cancer biomarker testing

- Other applications

Market, By End Use

- Hospitals

- Diagnostic centers

- Research laboratories

- Home-care settings

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the global point of care testing market?

Key players include Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Danaher Corporation, QuidelOrtho Corporation, Bio-Rad Laboratories Inc., Medtronic Plc, Sysmex Corporation, ACON Laboratories, and BioMérieux SA.

Which end-use segment dominated the global market in 2024?

The diagnostic centers segment led the market with 35.6% share, projected to reach USD 29.5 billion by 2034, owing to the availability of advanced POC technologies and specialized rapid diagnostic services.

Which region leads the global market?

North America led the market with 33.4% share in 2024, driven by high disease prevalence, strong healthcare infrastructure, and ongoing investments in diagnostic innovation.

Which region is expected to be the fastest growing in the global market?

The Asia Pacific region is expected to grow at a CAGR of 7.8% through 2034, fueled by the increasing burden of infectious diseases, rising healthcare awareness, and rapid expansion of diagnostic networks.

Which prescription type led the global point of care testing market in 2024?

The over-the-counter (OTC) testing segment dominated with USD 25.9 billion revenue, supported by increasing consumer preference for self-testing kits for glucose, pregnancy, and infectious diseases.

Which application segment generated the highest revenue in 2024?

The cardiometabolic testing segment accounted for USD 9.4 billion in 2024, driven by the growing prevalence of cardiovascular and metabolic disorders and the increasing use of POC devices for early risk detection.

What is the market size of the global point of care testing market in 2024?

The market size was USD 42 billion in 2024, driven by the rising prevalence of chronic and infectious diseases, the expansion of diagnostic infrastructure, and technological advancements in portable and rapid testing solutions.

What is the projected market value of the global point of care testing industry by 2034?

The market is expected to reach USD 82 billion by 2034, growing at a CAGR of 7%, fueled by increasing healthcare investments, integration of digital health platforms, and growing demand for decentralized diagnostics.

What is the estimated market size of the global market in 2025?

The market is projected to reach USD 44.7 billion in 2025, supported by the adoption of real-time diagnostic solutions and the growing need for immediate clinical decision-making in both developed and emerging economies.

Which product segment dominated the global point of care testing market in 2024?

The endocrinology testing products segment held the leading position with 33.1% market share, driven by the rising incidence of diabetes and thyroid disorders that require rapid and reliable testing at the point of care.

Which technology segment held the largest share in 2024?

The lateral flow assays segment was valued at USD 9.3 billion in 2024, dominating the market due to its simplicity, affordability, and widespread use in infectious disease diagnostics, pregnancy tests, and drug screening.

Point of Care Testing Market Scope

Related Reports