Summary

Table of Content

Platelet and Plasma Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Platelet and Plasma Market Size

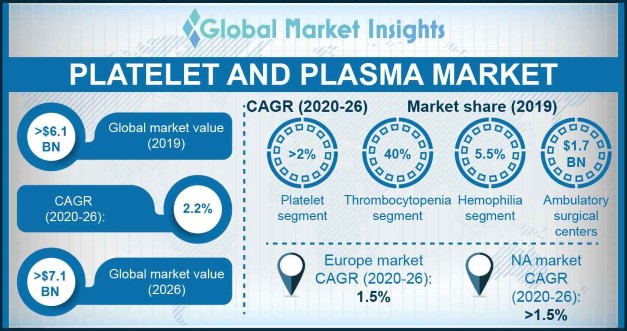

Platelet and Plasma Market size was more than USD 6.1 billion in 2019 and will witness 2.2% CAGR during 2020 to 2026. Platelet and plasma are critical parts of the treatment for several serious health problems. Platelets are tiny cell components of blood that helps in formation of blood clot to stop bleeding while plasma is a liquid component of blood that takes hormones, nutrients, and proteins to the different parts of body.

To get key market trends

To get key market trends

Increasing demand of platelet and plasma for the treatment of life-threatening diseases and deficiencies such as hemophilia, thrombocytopenia, coagulation factor deficiencies, liver disease along with other blood disorders will upsurge the industry growth. Favourable reimbursement policies in developed countries will further boost market demand over the projected timeline.

Platelet and Plasma Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 6,132.4 Million |

| Forecast Period 2020 to 2026 CAGR | 2.2% |

| Market Size in 2026 | USD 7,176.0 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Platelet and Plasma Market Analysis

Increasing demand for blood transfusion procedures in Europe will propel the market growth over the forecast period. Recent years have seen an upsurge in number of blood banks in European countries to full fill the growing demand for platelet and plasma that stimulates the market growth. Blood transfusion in these countries is often a part of specialized healthcare system. For instance, in Norwegian hospitals there are currently more than 60 blood banks that provide all blood components including platelet and plasma. Numerous blood donations occur at accredited and certified blood banks. This will drive the market growth over the projected timeline.

Also, according to the World Health Organization (WHO), every year more than 115 million units of donated blood are collected worldwide and around 42% of these are collected in high-income nations of America and Europe. Increasing number of blood donation camps will significantly propel the market demand over forecast period.

Learn more about the key segments shaping this market

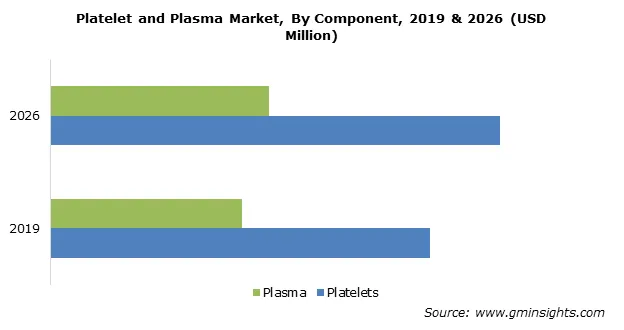

The platelet market accounted for nearly USD 4.1 billion value in 2019, owing to the growing number of trauma cases and road accidents. Platelets play a critical role during surgeries and help in formation of blood clots to prevent excess bleeding.

Use of platelets and its derivatives for quick healing in various surgical procedures such as cardiothoracic surgery, maxillofacial diseases, and other musculoskeletal diseases is increasing globally. They are also used prominently in various orthopedic treatments such as total knee arthroplasty, osteoarthritis of shoulder, bone and ligament regeneration as well as soft tissue healing. This is anticipated to drive the segmental growth.

Hemophilia segment accounted for around 5.5% market share in 2019 and will witness significant market growth over the forecast period. The growth is attributed to increasing number of traumatic injuries leading to hemorrhage and imbalance of body hemostatic mechanism. Such factors will increase demand for blood transfusion leading to segmental growth. Hemophilia is more prevalent in patients with history of easy bleeding and bruising followed by surgery and is genetically transferred from one generation to another that will further augment the market growth.

Learn more about the key segments shaping this market

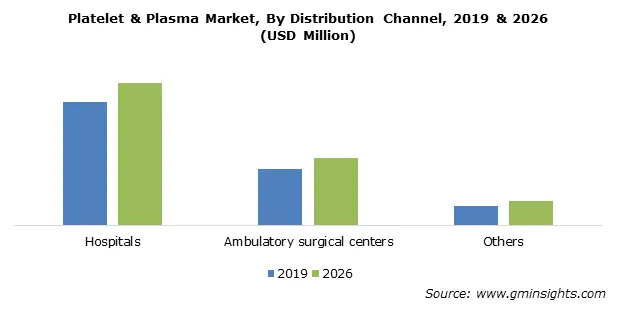

Hospitals accounted for around 62% market share in 2019 and is estimated to grow significantly over the coming years. The growth of this segment is attributed to the higher availability of blood components such as platelet and plasma in hospitals, thus boosting the segmental growth.

The growth of the segment is also attributed to the growing number of surgeries that require blood transfusion. These procedures are mostly performed in hospital settings, thereby fostering the segment growth. Additionally, increasing number of well-established hospitals coupled with rising healthcare coverage is a positive impact rendering factor for the market growth.

North America platelet and plasma market is anticipated to hold a significant market share in 2019 and will witness over 1.5% CAGR during the analysis period. Regional growth is primarily attributed to favorable regulations pertaining to use of platelet and plasma derived products. Also, increasing number of patients suffering from obesity, cancer, cardiothoracic disorders as well as growing incidences of neurological conditions will increase the demand for platelet and plasma, thereby propelling the regional market growth.

Moreover, rising healthcare expenditure and various initiatives by organizations such as setting-up blood donation campaigns will further boost the regional market growth.

Platelet and Plasma Market Share

Some of the eminent industry participants operating in the platelet & plasma market share include:

- America’s Blood Centers

- American Association of Blood Banks

- Blood Centers of America

- Indian Red Cross

- European Blood Alliance

- Japanese Red Cross

- Italian Red Cross

- OneBlood

- South African Red Cross Society

- American Red Cross.

The notable market participants are strategically implementing several business strategies to increase the awareness among people pertaining to blood donation in order to meet the demand for platelet and plasma.

Some of the recent industry developments: The platelet and plasma industry research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2026, for the following segments:

By Component, 2015 – 2026 (USD Million)

- Platelets

- Plasma

By Application, 2015 – 2026 (USD Million)

- Hemophilia

- Thrombocytopenia

- Perioperative indications

- Platelet function disorders

- Other platelet applications

- Coagulation factor deficiencies

- Thrombotic thrombocytopenic purpura

- Hemorrhage

- Liver disease

- Other plasma applications

By Distribution Channel, 2015 – 2026 (USD Million)

- Hospitals

- Ambulatory surgical centers

- Others

The above information is provided for the following geographies:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- Latin America

- Brazil

- Mexico

- Middle East

- South Africa

- Saudi Arabia

Frequently Asked Question(FAQ) :

What was the market valuation of platelet segment in 2019?

The platelet segment accounted for nearly USD 4.1 billion market value in 2019.

What is the growth rate of the North America market?

North America platelet & plasma market will witness over 1.5% CAGR during 2020-2026.

How much share of platelet and plasma market was held by hemophilia segment in 2019?

Hemophilia segment accounted for around 5.5% market share in 2019.

How much growth will the platelet and plasma industry share witness during the forecast timeframe?

The industry share of platelet and plasma is projected to expand at 2.2% CAGR during up to 2026.

How much did the global platelet and plasma market size account for in 2019?

The market size of platelet and plasma valued over USD 6.1 billion in 2019.

Platelet and Plasma Market Scope

Related Reports