Summary

Table of Content

Pharmaceutical Robots Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pharmaceutical Robots Market Size

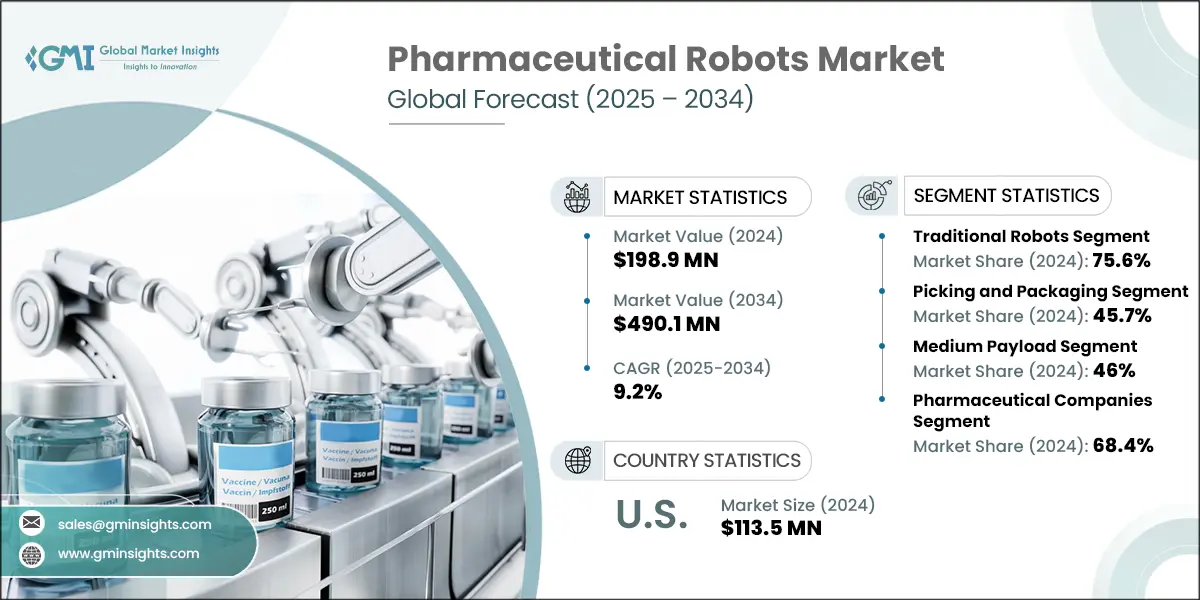

The global pharmaceutical robots market was estimated at USD 198.9 million in 2024. The market is expected to grow from USD 221.3 million in 2025 to USD 490.1 million in 2034, growing at a CAGR of 9.2%. This high growth is attributed to several factors including increasing pharmaceutical research and development investments, growing demand for automation in pharmaceutical manufacturing, and surging adoption of collaborative robots in pharma manufacturing facilities.

To get key market trends

Pharmaceutical robots are automated machines used across the pharma industry for range of applications including involvement in manufacturing, drug discovery and testing, cleanroom applications, etc. Major players operating in the industry includes ABB, YASKAWA, KUKA, FANUC, and STAUBLI among other key companies. The demand for collaborative robots is projected to record significant growth owing to the enhanced safety offered by these machines, to curb labor shortages and increasing application in more complex pharma process such as sterile compounding, among others.

Pharmaceutical Robots Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 198.9 Million |

| Forecast Period 2025 - 2034 CAGR | 9.2% |

| Market Size in 2034 | USD 490.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for automation in pharmaceutical manufacturing | Automation is being widely adopted in large pharma firms to enhance productivity and reduce human error. |

| Increasing pharmaceutical research and development investments and production volumes | High research and development spending is fueling demand for robotic systems in lab automation and personalized drug development. |

| Technological advancements in robotic systems | Improvements in precision controls, compact designs and better payload handling are enabling diverse pharma applications. |

| Surging adoption of collaborative robots in pharma manufacturing facilities | Cobots are being increasingly used in labs and cleanrooms for low-risk and repetitive tasks. |

| Pitfalls & Challenges | Impact |

| High initial investment and maintenance | High costs limit adoption in price-sensitive markets and smaller pharmaceutical firms. |

| Lack of skilled personnel to work in automated units | Limited availability of trained operators and technicians is impacting effective utilization of robotic systems. |

| Opportunities: | Impact |

| Integration of AI and machine learning in robotics | Widespread use of AI in pharma robots will enable intelligent decision-making, autonomous process optimization. |

| Expansion in emerging markets | Rising pharma manufacturing hubs and favorable government initiatives will push the industry growth. |

| Market Leaders (2024) | |

| Market Leaders |

14.1% market share |

| Top Players |

Collective Market Share in 2024 is 58% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Mexico, Vietnam, Thailand |

| Future outlook |

|

What are the growth opportunities in this market?

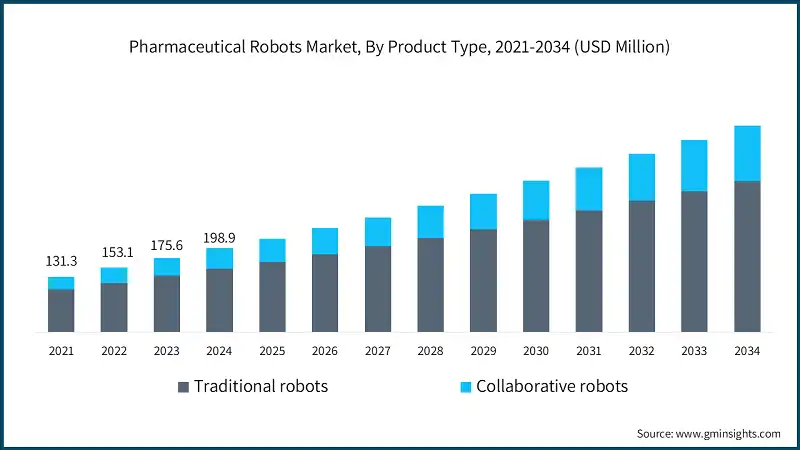

The market witnessed healthy growth from USD 131.3 million in 2021 to USD 175.6 million in 2023. This growth was primarily driven by increased demand for several drugs, medicines, and large scale vaccination programs around the world. Due to this sudden rise in demand for various new drugs and medicines, pharma companies invested substantially in improving their supply chain, increase productivity, thus increasing their dependence on automated machines and robotics. This can be better highlighted by the statistics released by International Federation of Robotics in its 2024 World Robotics report. The report stated that the total number of operational industrial robots across the world crossed 4 million installations mark for the first time in 2023. Thus, such growing number of robotic installations is projected to further fuel the industry growth.

Additionally, there is a consistent rise in the research and development spending by pharma companies for improved and novel drug developments. Along with the significant development in advance therapies including gene editing, antibodies, etc. the players have a significant focus on automating the tasks in their firms. This is expected to boost the adoption of pharmaceutical robots including the collaborative devices that offers user a better safety profile and efficiency. For example, the time taken and cost of new drug development is consistently rising and it stands around USD 2.2 billion per asset currently. Adoption of robotics may assist the firms in reducing the time taken to develop a new drug, thereby increasing their overall productivity.

Further, the growing demand for automation in the pharmaceutical industry is a key factor propelling the adoption of robotics in the market. The ongoing developments and strategies adopted by industry players along with favorable supportive policies from governments is shaping the product trajectory in the upward direction. For instance, in 2021, NuTec Tooling Systems, a custom automation solutions provider, has employed SCARA Robots by EPSON for its newly built syringe coating machine. This development enables the company to offer cost-effective and precise automation in the syringe manufacturing process.

Pharmaceutical robots are automated machines used across the pharma industry for range of applications including involvement in manufacturing, drug discovery services and testing, cleanroom applications, etc. They play a key role in enhancing the overall productivity of these firms.

Pharmaceutical Robots Market Trends

The key trends impacting the market include integration of robots with AI and machine learning, focus on sustainability, expansion of robotics in new applications, as well as expansion in emerging markets among others.

- As healthcare landscape evolves, personalized medicine is becoming increasingly important, owing to new scientific discoveries, technological advances and the minimal side effects associated with them. Robots are making it possible to scale up personalized medicine production by quickly adapting to different medicine formulations, forms, and individual patient needs.

- Additionally, the integration of robotics in pharmaceutical processes helps develop a more sustainable future by addressing important environmental concerns. Automation helps reduce energy usage, create less waste, and contributes to saving water resources. Pharmaceutical manufacturing units are focusing on adopting such robotic systems, as they offer less contamination while enhancing the process efficiency. For example, Azzurra FAB, a fully modular, and robotic drug filling platform by Pharma Integration is an automated, gloveless device that can contribute to reducing contamination risks.

- Further, more pharmaceutical companies now embrace automation, as robots are making drug manufacturing, packaging, quality checks, and research more efficient. The combination of artificial intelligence and robotics, along with robotic process automation, is helping discover new drugs faster, run better clinical trials, and meet regulatory requirements more effectively.

Pharmaceutical Robots Market Analysis

Learn more about the key segments shaping this market

The global market witnessed growth from USD 131.3 million in 2021 to USD 175.6 million in 2023 and is expected to record a growth with a CAGR of 9.2% over the forecast period.

Based on product type, the pharmaceutical robots market is segmented into traditional robots and collaborative robots. The traditional robots segment accounted for 75.6% of the market in 2024 due to their precise and high-speed operational capabilities, adoption in complex and high-end manufacturing units, and improved efficiency. The segment is expected to exceed USD 357.8 million by 2034, growing at a CAGR of 8.9% during the forecast period. On the other hand, collaborative robots segment is expected to grow with a CAGR of 10.3%. The growth of this segment can be attributed to their enhanced safety-level, growing adoption in pharma industry for diverse applications and improved productivity.

- Articulated robots have a majority share in the traditional robots segment because of the wide application range they serve across different industries. These robots are used in material handling, packaging, and they also offer a wide range of payload options for the users to choose from. Key players operating in the industry are focusing on further improving their scope of applications in the pharmaceuticals domain.

- In addition, these robots are preferred in pharmaceutical manufacturing as they are multi-jointed robots provide flexibility in movement and can reach various locations within a production facility. For example, the ABB's IRB 120 robot helps pharmaceutical manufacturers achieve precise handling and dosing of small volumes, ensuring the accurate production of highly potent medications where precision plays a vital role.

- Further, the collaborative robots segment was valued at USD 48.5 million in 2024 and is projected to record robust growth over the projected period. This growth is attributed to the cost-effectiveness and versatility offered by these robotic machines.

Based on application, the pharmaceutical robots market is segmented into picking and packaging, pharmaceutical drugs inspection, laboratory applications and other applications. The picking and packaging segment accounted for the highest market share of 45.7% in 2024 due to increase in adoption of these robots, especially for packaging purpose across majority of the pharmaceutical manufacturing facilities.

- The pick and place robotic systems allow better conservation of floor space available in the facility thereby leading to optimum utilization of workspace. The pharmaceutical companies are collaborating with players offering custom solutions for efficient operations. For instance, during the pandemic, a COVID-19 test kits manufacturing firm was supplied with three Model VC30 systems to automate its packaging of test kits. These systems were integrated with automation solutions from ESS technology incorporating FANUC robots, that resulted in improved efficiency and time during the crucial period.

- Additionally, packaging and palletizing can be repetitive and time-consuming process for workers in a pharmaceutical facility. Picking and packaging robots work like extra hands in a warehouse, using their robotic arms to carefully package products and neatly arrange them on pallets for shipping. This makes the whole process smoother and helps save on labor costs.

- On the other hand, pharmaceutical drugs inspection segment held the second-largest share of around 23.3% in 2024. The significant market share was owing to the ability of these systems to provide precise results to better ensure the quality and safety of drugs in the pharma units. Equipped with high-quality sensors and vision systems they are designed to offer enhanced visual inspection through an automated device.

Based on payload, the pharmaceutical robots market is segmented into low (upto 5 kg), medium (6-15 kg), and high (more than 15 kg). The medium payload segment accounted for the highest market share of 46% in 2024 due to their widespread use in a range of applications such as packaging, palletizing and several other tasks where moderate payload is necessary.

- The medium payload (6-15 kg) segment leads the pharmaceutical robots market by providing the right mix of strength and precision that manufacturers look for in a machine. These robots play a vital role in pharmaceutical manufacturing operations, taking care of essential tasks such as material handling, packaging, palletizing, and quality inspection. They are suitable for both routine tasks and sensitive operations because they can work quickly while maintaining accuracy.

- Manufacturers mainly use the articulated and SCARA robots in this segment because they work well within automated production lines. As pharmaceutical companies look for better ways to automate their processes while saving space, this segment continues to grow stronger in the market.

- Further, the high payload segment was valued at USD 33.2 million in 2024. These robots take on heavy lifting in pharmaceutical facilities. For example, the M-410iC/185 robot by FANUC is among a popular robot with a payload capacity of 185 kg and a reach of 3143 mm. The specifications make it a preferred choice for high-speed palletizing and transferring products around the facility.

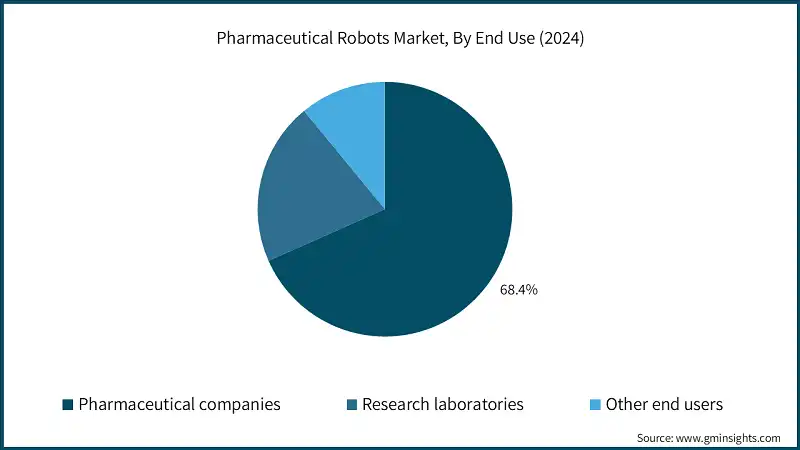

Learn more about the key segments shaping this market

Based on end use, the pharmaceutical robots market is segmented into pharmaceutical companies, research laboratories, and other end users. The pharmaceutical companies segment accounted for the highest market share of 68.4% in 2024 owing to high growth observed by top pharmaceutical companies due to increased product volumes, demand for development of novel drugs and significant investment by local and multi-national pharma companies in expanding and upgrading their infrastructure.

- The pharmaceutical industry is witnessing significant growth owing to factors such as rise in number of patients suffering from chronic diseases, growing per capita healthcare spending, and a greater need for consistent medication supply from regions and countries around the world.

- Investments by leading pharma players, collaboration with key industry participants and growing research and development activities are among the key parameters expected to fuel the product demand, for instance, in May 2024, Astellas Pharma Inc. signed an memorandum of understanding (MoU) with YASKAWA Electric to plan for the development of an innovative cell therapy ecosystem that will be based on a reliable integration of robotics and pharmaceutical technologies. This partnership may allow the involved entities to design a platform covering stages from research phase to commercialization.

- Moreover, as these companies need to maintain rigorous quality standards, they employ robotic systems that are equipped with advanced sensors and vision systems capable of maintaining high-quality standards in pharmaceutical production.

Looking for region specific data?

North America dominated the global pharmaceutical robots market with the highest market share of 61.4% in 2024.

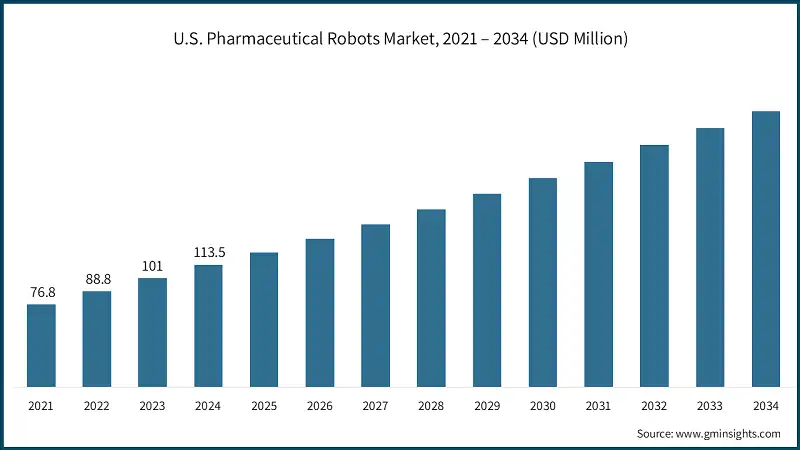

- The U.S. pharmaceutical robots market was valued at 76.8 million and USD 88.8 million in 2021 and 2022, respectively. In 2024 the market size reached USD 113.5 million from USD 101 million in 2023. Presence of leading global pharmaceutical companies such as Johnson & Johnson, Pfizer, AbbVie and Bristol Myers Squibb among various other companies is one of the key variables in driving the demand for pharmaceutical robots in the U.S.

- The players operating in the U.S. have been investing consistently in improving and upgrading their supply-chain to track, digitize, and make the process more transparent to boost the overall operation efficiency as well as save on additional expenses in millions. For example, Johnson & Johnson has integrated the YuMi - collaborative robots into its supply chain to better its floor management in factory and also integrated Internet of Things (IoT) sensors that provide real-time data inputs to the monitoring authority which can be further analyzed and used to improve and scaleup the process.

- Similarly, AbbVie has accelerated its drug discovery and optimization of drug design through the use of AI and machine algorithms in its research laboratories. Use of artificial intelligence in drug discovery considerably minimizes the required time, making the process simpler by innovatively analyzing huge datasets generated during the process among others benefits.

- Hence, consistent rise in healthcare spending, availability of patients suffering from multiple chronic diseases is resulting in increased demand for medicines and drugs, which in turn is anticipated to push the industry growth.

Europe pharmaceutical robots market accounted for USD 39.7 million in 2024.

- Rigorous quality standards set by regional regulatory authority promotes the pharmaceutical companies operating in Europe to opt for automation including robots that can significantly reduce the repetitive mistakes by factor workers which hampers the manufacturing process and overall output of the company.

- The regional players are investing highly in developing next-generation infrastructure solutions in their manufacturing facilities. For example, as per a recent survey conducted on behalf of Hexagon, a robotics company, between Dec 2024 and Jan 2025, highlighted that around 65 percent of the respondents from leading pharma companies, agreed to have plans of investing in predictive maintenance through AI.

- Similarly, more than 60 percent of the respondents said their firm is planning for physical automation in next 12 months. Other aspects such as cybersecurity and IoT are also under implementation to keep the AI integrated factory hardware in a better control.

- Further, increase in research and development expenditure by research laboratories and other industry stakeholders is expected to push the adoption of pharmaceutical robots in Europe.

Asia Pacific pharmaceutical robots market is anticipated to witness high growth with a CAGR of 12.5% over the analysis timeframe.

- Countries with significant pharmaceutical capabilities in the region such as Japan, South Korea and China are investing considerably in improving and upgrading their manufacturing process. The evolving workforce landscape, characterized by a scarcity of qualified labor in some of the developed regional countries, necessitates innovative solutions. Robotic automation plays a key role in fulfilling these requirements, thereby supporting the adoption of robots in pharma units.

- Robotic systems are expected to optimize the pharmaceutical industry processes by overcoming traditional challenges faced in drug discovery to advancements in personalized medicine, by improving efficiency and quality aspects simultaneously.

- Further, Pharma 4.0 is the integration of digital technologies, including robotics, into the entire pharmaceutical value chain. Well-established pharma companies, especially from East Asia region, with a significant focus on digitization and automation in their facilities are among the front runners for incorporating such advancements in their facilities, thereby spurring the market growth.

Latin America pharmaceutical robots market is expected to witness high growth over the forecast period.

- The pharmaceutical robot market in Latin America continues to grow as manufacturers expand their production capacity and seek better efficiency through automation. Countries such as Brazil, Mexico, and Argentina are investing more in pharmaceutical facilities, which opens up new possibilities for adopting robots in packaging, quality control, and laboratory related tasks among others.

- In addition, as regulatory standards become more demanding, pharmaceutical companies are turning to robotic solutions to ensure their products remain sterile and consistent.

- Further, companies are particularly interested in collaborative and medium-payload robots because they work well in tight spaces and can handle high-volume production. Local governments are actively supporting domestic drug manufacturing, which helps increase the need for pharmaceutical robots throughout the region.

Pharmaceutical Robots Market Share

Leading companies such as ABB, YASKAWA, KUKA, FANUC, STAUBLI together hold around 58% of the market share in the moderately consolidated global market. These players keep their dominance in the industry by combining strong product lines, business alliances with major pharma giants globally, worldwide expansion, and consistent innovation.

Companies in the pharmaceutical robots market are growing their presence by taking different approaches, particularly by investing in research and development. They focus on resolving important challenges in the industry such as precise drug handling and maintaining sterile manufacturing conditions to build a stronger position in the market. By working together with pharmaceutical companies and research institutions, they develop solutions that meet specific needs. These carefully planned efforts help companies stand out and grow their presence in the market.

In addition, companies are actively developing compact, high-precision robots that work effectively in sterile environments and cleanroom operations. They are focusing their efforts on expanding collaborative robot offerings, integrating AI and vision systems, and providing specialized automation solutions for the pharmaceutical industry.

Lastly, by partnering with pharmaceutical manufacturers and system integrators, these companies deliver comprehensive solutions that improve production efficiency, quality assurance, and regulatory compliance in markets worldwide.

Pharmaceutical Robots Market Companies

Few of the prominent players operating in the pharmaceutical robots industry include:

- ABB

- DENSO WAVE

- EPSON

- FANUC

- KAWASAKI Robotics

- KUKA

- MITSUBISHI ELECTRIC

- OMRON AUTOMATION

- STAUBLI

- UNIVERSAL ROBOTS

- YASKAWA

- ABB

ABB focuses on pharmaceutical automation solutions using collaborative robots and modular systems. The company builds systems including digital twin technology and AI-enabled robotics to ensure sterile manufacturing processes. By working closely with pharmaceutical companies, it is able to provide complete automation solutions while developing robotic systems for cleanroom operations.

- YASKAWA

YASKAWA builds high-speed, precision robotics for pharmaceutical packaging and handling. The company blends motion control technology with SCARA and articulated robots to enhance cleanroom operations. YASKAWA grows its presence in Asia while offering easy-to-use programming tools for mid-sized pharmaceutical companies.

- MITSUBISHI ELECTRIC

Mitsubishi Electric connects its robotics with PLCs, sensors, and SCADA systems in pharmaceutical facilities. The company grows its collaborative robot offerings, enhances robot programming interfaces, and builds pharmaceutical automation systems by working with OEMs and system integrators.

- STAUBLI

Staubli makes robots for sensitive, sterile pharmaceutical applications, with expertise in cleanroom-certified robots (ISO 5/6). The company offers its TX2 and Stericlean series for aseptic operations while meeting GMP standards. Staubli helps biotech laboratories with compact, high-precision robotic systems.

Pharmaceutical Robots Industry News:

- In June 2025, Seiko Epson Corporation is working on a collaborative robot solution that will be used as a Cleanroom Robot to Advance Laboratory Automation in Life Sciences and Pharmaceuticals. The product launch is planned for 2025. As stated by company, initial product sales are planned for Japan and Europe region, followed by other regions. This development will further improve company's business prospect in the coming years.

- In May 2024, Astellas Pharma Inc. signed a memorandum of understanding with YASKAWA Electric Corporation to plan for the development of an innovative cell therapy ecosystem that will be based on a reliable integration of robotics and pharmaceutical technologies. This partnership may allow the involved companies to design a platform covering stages from early-stage research phase to commercialization.

- In December 2023, ABB Robotics and XtalPi announced that they entered into a strategic partnership to produce a range of automated laboratory workstations in China. This development, which includes the newly developed automated laboratories, will boost the productivity of research and development processes in biopharmaceuticals, and new energy materials.

The pharmaceutical robots market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product Type

- Traditional robots

- Articulated robots

- SCARA robots

- Delta/Parallel robots

- Cartesian robots

- Dual-arm robots

- Collaborative robots

Market, By Application

- Picking and packaging

- Pharmaceutical drugs inspection

- Laboratory applications

- Other applications

Market, By Payload

- Low (Upto 5 kg)

- Medium (6-15 kg)

- High (more than 15 kg)

Market, By End Use

- Pharmaceutical companies

- Research laboratories

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the pharmaceutical robots in 2024?

The market size was USD 198.9 million in 2024, with a CAGR of 9.2% expected through 2034, driven by increasing pharmaceutical R&D investments, rising demand for automation in manufacturing, and the adoption of collaborative robots.

What is the projected value of the pharmaceutical robots market by 2034?

The market is expected to reach USD 490.1 million by 2034, fueled by advancements in robotics technology, integration with AI, and expansion into emerging markets.

What is the projected size of the pharmaceutical robots market in 2025?

The market is expected to reach USD 221.3 million in 2025.

How much revenue did the traditional robots segment generate?

The traditional robots segment accounted for 75.6% of the market in 2024 due to their precise and high-speed operational capabilities, adoption in complex and high-end manufacturing units, and improved efficiency.

What was the valuation of the picking and packaging segment?

The picking and packaging segment accounted for 45.7% of the market share, primarily due to its extensive use in pharmaceutical manufacturing plants.

How much was the Europe pharmaceutical robots market worth in 2024?

The Europe pharmaceutical robots industry was valued at USD 39.7 million in 2024.

What are the upcoming trends in the pharmaceutical robots industry?

Key trends include the integration of robotics with AI and machine learning, a focus on sustainability, the expansion of robotics into new applications, and growth in emerging markets.

Who are the key players in the pharmaceutical robots market?

Key players include ABB, DENSO WAVE, EPSON, FANUC, KAWASAKI Robotics, KUKA, MITSUBISHI ELECTRIC, OMRON AUTOMATION, and STAUBLI.

Pharmaceutical Robots Market Scope

Related Reports