Summary

Table of Content

Pet Therapeutic Diet Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Therapeutic Diet Market Size

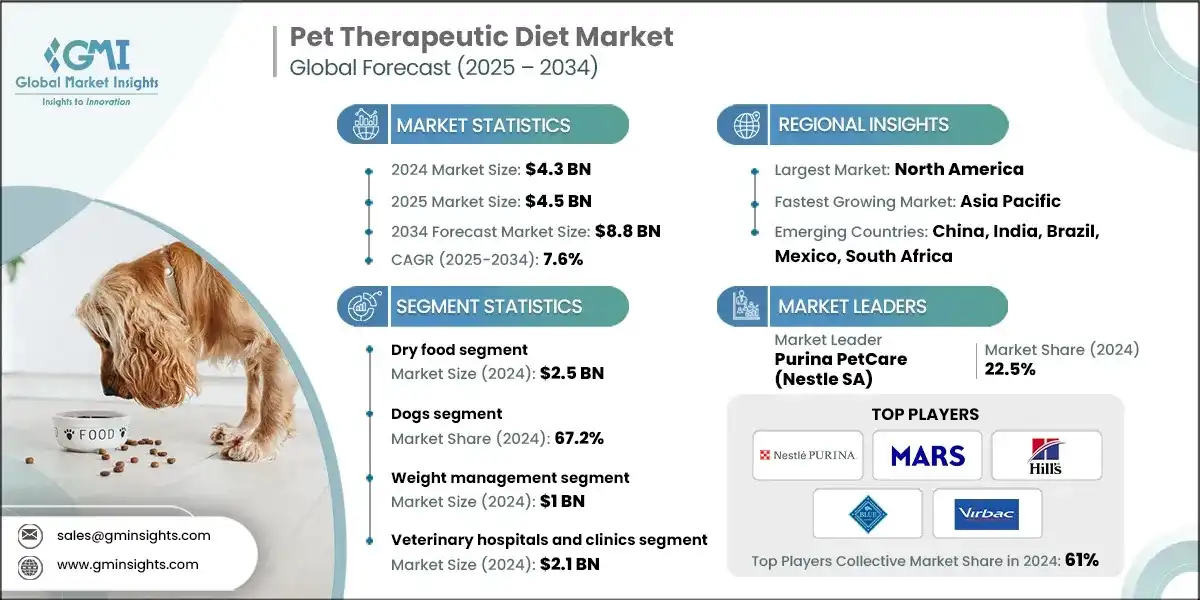

The global pet therapeutic diet market was valued at USD 4.3 billion in 2024 and is projected to grow from USD 4.5 billion in 2025 to USD 8.8 billion by 2034, registering a CAGR of 7.6%, according to Global Market Insights Inc

To get key market trends

The increasing prevalence of chronic health conditions in pets, such as kidney disorders, diabetes, obesity, and gastrointestinal issues, is stimulating demand for pet therapeutic dietary solutions. For example, rising pet obesity is a significant driver. The 2022 U.S. Pet Obesity Prevalence Survey found that a staggering 61% of cats and 59% of dogs are overweight or have obesity, indicating a widespread problem with pet health.

Moreover, the rising elderly population of pets, especially dogs and cats, further stimulates market growth. In terms of the current age distribution of pets in the U.S., MRI-Simmons data shows a long-term increase in the share of dog-owning households with senior dogs (age 7+), rising from 42% in 2012 to 52% as of summer 2022. This means that a total of 26.5 million households own senior dogs. Thus, growing pet ownership and increased spending on pet care are expanding market growth.

A pet therapeutic diet is a specially prepared form of pet food intended to aid in the control of specific health disorders such as kidney disease, obesity, gastrointestinal disease, diabetes, skin allergies, and joint disease. They differ from ordinary pet food in that they are formulated with specific nutrient profiles and are mostly prescribed or suggested by vets for enhancing pets' life quality and supporting medical therapy. Key players such as Purina PetCare (Nestle SA), Mars, Hill's Pet Nutrition (Colgate Palmolive), Blue Buffalo, and Virbac lead the market with their wide product portfolio and robust R&D. Collectively, these players drive innovation, grow veterinary partnerships, and increase awareness, positioning therapeutic diets as a rapidly expanding category in the pet nutrition market.

Between 2021-2023, the market was significantly influenced by increasing pet humanization, with owners increasingly looking for customized nutrition to cure chronic diseases like obesity, kidney disease, and gastrointestinal issues. The pet therapeutic diet market witnessed steady growth, growing from USD 3.4 billion in 2021 to USD 4.1 billion in 2023. A high inclination towards online marketing and direct-to-consumer schemes made prescription as well as condition-specific diets easily available and helped in increasing awareness among pet parents. Regionally, North America led the way through strong pet ownership and veterinary involvement, with Asia-Pacific as an emerging, rapid growth market fueled by increasing incomes and wider retail channels.

Pet therapeutic diets, also known as veterinary diets, are pet foods designed to be fed to pets with specific diseases or medical conditions. They act as complementary to medications or drugs, and they are therefore used to treat or prevent disease in pets. These diets require veterinary oversight or a prescription and target issues like obesity, renal disease, gastrointestinal disorders, joint health, skin disorders, and other health conditions such as dental health, liver care and diabetes control.

Pet Therapeutic Diet Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.6% |

| Market Size in 2034 | USD 8.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing aging pet population | As pets live longer, they are more prone to conditions like kidney disease, arthritis, and obesity, which require specialized nutrition. This is boosting demand for therapeutic diets tailored to senior pet health needs. |

| Rising pet ownership and pet humanization | Increasing numbers of pet owners now view pets as family members, leading to higher willingness to spend on premium healthcare and nutrition. This emotional bond drives adoption of prescription and condition-specific diets. |

| Growing prevalence of chronic disease in companion animals | Rising cases of obesity, diabetes, gastrointestinal disorders, and skin allergies are creating a larger need for therapeutic solutions. Specialized diets are being prescribed more frequently by veterinarians to manage these conditions. |

| Product innovation and customization | Companies are developing diets with tailored nutrient profiles, natural ingredients, and breed- or condition-specific formulations. Such innovation enhances consumer trust and expands the appeal of therapeutic diets globally. |

| Pitfalls & Challenges | Impact |

| Regulatory challenges and reliability concerns | Strict regulatory requirements for approval and labeling of therapeutic diets often slow down product launches and increase costs. Additionally, concerns over the clinical reliability and consistency of such diets may reduce veterinarian and consumer confidence. |

| Limited awareness and education | Many pet owners remain unaware of the availability and benefits of therapeutic diets, relying instead on regular pet food. A lack of education among owners and limited promotion outside veterinary channels restrict wider adoption in the market. |

| Opportunities: | Impact |

| Rising pet ownership and urbanization in developing regions | The combination of rapid urbanization and rising pet ownership in developing regions will open substantial opportunities for the pet therapeutic diet market. As populations in Asia-Pacific, Latin America, and parts of Africa migrate to urban centers, pets are increasingly regarded as integral family members, driving demand for high-quality nutrition. |

| Growing demand for clean-label, organic and plant-based therapeutic diets | A surge in demand for clean-label, organic, and plant-based formulations will reshape the pet therapeutic diet market. As pet owners grow more ingredient-conscious, they increasingly seek products that balance clinical efficacy with ethical, sustainable, and environmentally responsible attributes. This shift is driving innovation in diets that manage conditions such as obesity, kidney disease, and food sensitivities while utilizing plant-based proteins, non-GMO crops, and recyclable or biodegradable packaging. |

| Market Leaders (2024) | |

| Market Leaders |

22.5% market share. |

| Top Players |

Collective Market Share in 2024 is 61% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Pet Therapeutic Diet Market Trends

- The pet therapeutic diet industry is experiencing a positive shift stimulated by the rising prevalence of chronic diseases in pets, growing pet humanization, and evolving nutritional science, which determines specialized pet nutrition.

- Another important trend stimulating the market is the increasing demand for condition-specific diets for chronic diseases such as kidney disease, diabetes, gastrointestinal disorders, and allergies in companion animals. This results in the development of targeted nutritional formulas by manufacturers that provide functional benefits with veterinary treatment plans.

- As more pets are diagnosed with complex health conditions, therapeutic diets are being preferred over standard pet foods.

- In addition, vet recommendations are a major growth driver in this market. Because therapeutic diets are usually recommended to address health issues like renal disease, gastrointestinal disorders, or weight management, veterinarians' recommendations are highly influential. With growing veterinary practices and increased accessibility, the influence of professional guidance on product adoption continues to strengthen.

- Rapid growth in e-commerce is also influencing the pet therapeutic diet market. Online shopping has facilitated easy access to niche diets for pet owners, with the convenience of subscription plans and doorstep delivery. This increased digital visibility has not only enhanced availability but also brought repeat purchases and loyalty among consumers.

- Furthermore, an increasing shift towards personalized nutrition and life stage-specific formulations is influencing market growth. Startups and major pet food brands are investing in AI-driven platforms and digital health ecosystems that offer personalized diet suggestions and subscription-based delivery models.

- Lastly, the integration of holistic practices that include combining dietary therapy with physiotherapy, mental stimulation, and alternative remedies has gained focus among veterinary care providers and pet wellness centers, which has further contributed to the growing adoption of pet therapeutic diets in recent years.

Pet Therapeutic Diet Market Analysis

Learn more about the key segments shaping this market

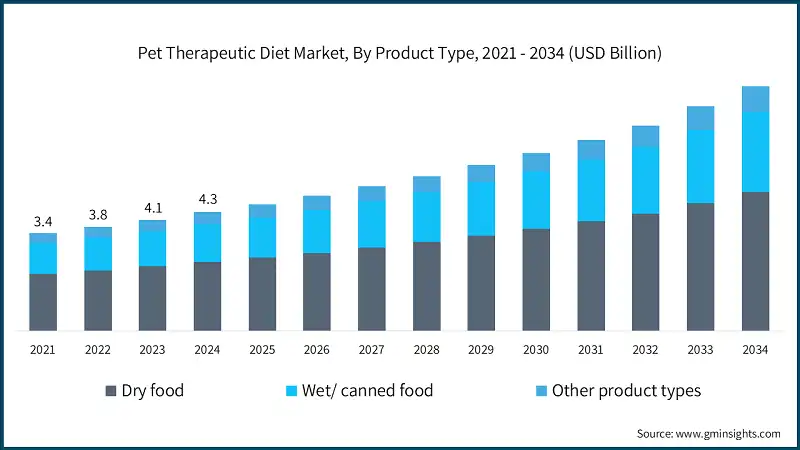

The global market was valued at USD 3.4 billion and USD 3.8 billion in 2021 and 2022, respectively. In 2024, the market size reached USD 4.3 billion, growing from USD 4.1 billion in 2023.

Based on the product type, the global pet therapeutic diet market is classified into dry food, wet/canned food, and other product types. The dry food segment dominated the market in 2024 and was valued at USD 2.5 billion. The wet/canned food segment accounted for a share of 28.7% in 2024 and is poised to witness growth over the coming years. Favored for its high moisture content, palatability, and ease of consumption, it is particularly suited for pets with dental issues, reduced appetite, or chronic conditions such as kidney disease and urinary tract disorders. Moisture-rich diets are especially important for hydration, a critical factor in managing renal and urinary health.

- Increasing prevalence of chronic health conditions in pets, such as kidney disease, diabetes, gastrointestinal disorders, and obesity, stimulates the demand for dry food.

- The convenience, extended shelf life, ease of storage, and cost-effectiveness of dry food make it an ideal choice for pet owners and veterinary professionals.

- For instance, as per a study published by the NIH, 37.7% of pet owners prefer dry food for their pets rather than wet food, which is preferred by 14% of people. Consistent portion control and easy integration into daily routines can be achieved by dry food, especially for pets with chronic illnesses that require dietary supplements, which increases their adoption rates.

- The wider availability of dry therapeutic diets in the market further strengthens their market share.

Learn more about the key segments shaping this market

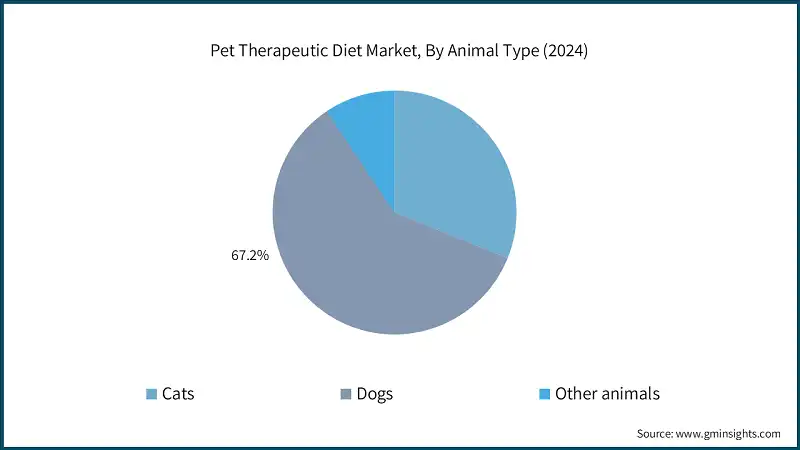

Based on animal type, the global pet therapeutic diet market is segmented into cats, dogs, and other animals. In 2024, the dogs segment accounted for the largest share of 67.2% in the global pet therapeutic diet market. On the other hand, the cats segment accounted for USD 1.3 billion and is anticipated to grow at a CAGR of 8% during the forecast period, supported by increasing feline ownership and awareness of specialized nutritional needs.

- The rising number of pet dogs globally increases the demand for therapeutic diets for dogs. For example, according to the World Animal Foundation, in 2025, the global pet dog population is estimated to be around 471 million, while the global pet cat population is estimated to be around 373 million.

- Additionally, dogs are more susceptible to chronic conditions such as obesity, arthritis, diabetes, kidney disease, and food allergies, many of which require long-term dietary management. Moreover, increasing obesity and unhealthy diets in dogs, due to high intake of commercial foods rich in fats and artificial additives, further contribute to the need for pet therapeutic diets.

- Furthermore, veterinary spending on dogs is higher compared to other pets, with therapeutic nutrition playing an important role in preventive and chronic disease care. According to the American Pet Products Association (APPA), annual spending on dog food averaged USD 287 per dog.

- Lastly, dogs mostly have structured feeding routines and higher caloric intake needs than smaller animals, which further strengthens their dominant market position.

Based on the health condition, the global pet therapeutic diet market is categorized into renal health, gastrointestinal health, skin and coat health, cardiovascular health, weight management, joint care, and other health conditions. The weight management segment dominated the market in 2024 with a revenue of USD 1 billion.

- The weight management segment is gaining significant traction due to the rising prevalence of obesity among companion animals. For instance, a European study found that 32% of dogs were overweight or obese based on BMI, and 56% based on Body Fat Index (BFI). This growing health concern is pushing demand for obesity management products, as pet owners seek to improve their pets' quality of life and longevity.

- Therapeutic weight management diets are formulated to provide balanced nutrition with reduced calories, often featuring high protein, low fat, added fiber for satiety, and functional ingredients like L-carnitine for fat metabolism, which help pet owners effectively manage obesity issues in their pets.

- On the other hand, the gastrointestinal health segment was valued at USD 868.5 million in 2024 and is anticipated to grow at 7.6% CAGR over the analysis period.

- The rising prevalence of gastrointestinal health issues, such as animal gastroesophageal reflux disease, is the major factor stimulating the market for gastrointestinal therapeutic diets. For instance, in January 2023, the Journal of Small Animal Practice mentioned in a study that 50% of dogs had evidence of gastroesophageal reflux.

- In addition, digestive disorders such as chronic diarrhea, inflammatory bowel disease, pancreatitis, and food sensitivities are common in pets, especially as they age. Therapeutic diets for gastrointestinal care feature easily digestible ingredients, controlled fat levels, and functional additives like prebiotics and probiotics to stabilize gut microbiota.

- Thus, the growing prevalence of chronic health conditions in pets and increasing awareness among pet owners will positively drive market growth.

Based on the distribution channel, the global pet therapeutic diet market is categorized into veterinary hospitals and clinics, e-commerce, retail pharmacies, and other distribution channels. The veterinary hospitals and clinics segment dominated the market in 2024 and was valued at USD 2.1 billion.

- Veterinary clinics and hospitals are the prime channel of distribution for pet therapeutic diets since they are the first line of diagnosis and treatment of companion animals.

- Therapeutic diets need to be prescribed or recommended by a veterinarian for most conditions, especially chronic ones like kidney disease, obesity, and gastrointestinal diseases. This direct association with diagnosis and prescription of diet consequently makes clinics and hospitals the most prominent outlets for these products.

- Moreover, the increasing number of veterinary clinics and hospitals globally, coupled with the growing adoption of advanced therapeutic nutrition in pets, is positively driving market growth.

Looking for region specific data?

The North America market dominated the global pet therapeutic diet market with a market share of 47.3% in 2024. The market is driven by rising pet ownership and increased spending on animal healthcare.

The U.S. market was valued at USD 1.49 billion and USD 1.66 billion in 2021 and 2022, respectively. The market size reached USD 1.84 billion in 2024, growing from USD 1.76 billion in 2023.

- Increasing pet ownership in the U.S. is stimulating the market for pet therapeutic diets.

- According to the American Pet Products Association (APPA), in 2023, 66% of households in the U.S. owned at least one pet. This widespread ownership, coupled with the growing trend of pet humanization, has driven demand for specialized nutrition, including therapeutic diets.

- Pet owners are increasingly treating pets as family members, prioritizing preventive care, chronic condition management, and veterinary-recommended diets. In 2024, U.S. pet expenditure reached USD 151.9 billion, with USD 65.8 billion spent on pet food and treats, highlighting the market's premium positioning.

- Thus, the growing pet population and the high willingness of pet owners to spend on veterinary care are driving market growth.

The Europe pet therapeutic diet market was valued at USD 1 billion in 2024 and is projected to reach USD 2.1 billion by 2034.

- Growth is supported by high pet ownership, a well-established veterinary network, and harmonized regulations promoting innovation and safety.

- According to the European Pet Food Industry Federation (FEDIAF), pet ownership reached 90 million households in 2023, up from 88 million in 2021.

- Major markets such as Germany (10.7M dogs, 15.7M cats), France (9.9M dogs, 16.6M cats), and the UK (13.5M dogs, 12.5M cats) provide a large consumer base for therapeutic nutrition products.

Germany dominates the European pet therapeutic diet market, showcasing strong growth potential.

- The country has a well-developed veterinary infrastructure, which supports the recommendation and adoption of therapeutic diets for conditions such as renal disorders, obesity, and gastrointestinal issues.

- In addition, Germany's robust retail network, including veterinary clinics, specialty pet stores, and e-commerce platforms, ensures wide availability and accessibility of these products.

The Asia Pacific region is expected to witness high growth in the pet therapeutic diet market, growing at a CAGR of 8.2%, driven by rising pet ownership, urbanization, and greater awareness of pet health across both emerging and mature economies.

- Key markets include China, India, Japan, South Korea, and Australia, where pets are increasingly regarded as family members, fueling demand for specialized nutrition solutions.

- Growing awareness campaigns by veterinarians, NGOs, pet influencers, and pet food brands are educating consumers about disease prevention through nutrition and conditions that require dietary interventions, such as obesity, allergies, and renal issues.

- Lastly, increasing growth in the number of veterinary clinics, pet hospitals, and pet wellness centers, especially in urban cities across China, India, and Southeast Asia, drives the growth of the market.

China's pet therapeutic diet market held the largest share in the Asia Pacific diet market.

- China has the highest market share in the region, due to the increasing prevalence of diseases in animals, increasing pet ownership, and increasing demand for preventive care.

- Additionally, the government is investing in infrastructure and logistics to increase the efficiency and capacity of the supply chain within the country. For instance, in March 2024, China launched Pet Sourcing China, a new global supply chain platform exclusively for pet industry supply chain management.

- Moreover, expanding veterinary services and greater awareness of preventive pet healthcare are also supporting market growth.

The Latin America pet therapeutic diet market was valued at USD 337.8 million in 2024.

- Growth is fueled by rising pet ownership, urbanization, and increasing awareness of specialized nutrition for managing pet health conditions, especially in Brazil, Mexico, and Argentina.

- Brazil stands out as one of the largest pet markets globally, with over 160 million pets in 2023, including 62 million dogs and 42.8 million birds. Pet ownership in urban households increased from 58% in 2021 to 65% in 2023, underscoring the link between pet companionship, modern living, and social status.

- These factors, combined with pet humanization trends, provide a strong foundation for therapeutic diet uptake in the region.

The Middle East and Africa pet therapeutic diet market is experiencing stable growth, driven by the growing trend of pet ownership among urban populations and the slow transition toward premium and specialist nutrition.

- Growing health awareness among pet owners and the contribution of diet in controlling common diseases like kidney disease, obesity, and skin allergies is fueling demand for therapeutic diets.

- While still in a developing phase relative to the advanced regions, the Middle East and Africa region shows strong growth potential as rapid economic growth, lifestyle transformation, and increased investments in pet care infrastructure favor the wide adoption of therapeutic diets.

Pet Therapeutic Diet Market Share

The global market is characterized by intense competition, with participation from multinational companies, specialized pet nutrition companies, and emerging niche brands. Top 5 players such as Purina PetCare (Nestle SA), Mars, Incorporated, Hill's Pet Nutrition (Colgate Palmolive), Blue Buffalo (General Mills), and Virbac account for ~58 - 63% of the market share. These players focus on various strategies such as business expansion, mergers and acquisitions, collaborations, and novel product launches to consolidate their market presence. For instance, in January 2024, Hill's Pet Nutrition launched a series of new products in its prescription diet range, for common pet health issues such as weight management and gastrointestinal health.

Additionally, companies such as Virbac, Ziwi Pets, Husse, and Eden Holistic Pet Foods focus on natural, functional formulations and premium ingredients, catering to the rising demand for holistic and condition-specific pet nutrition. Meanwhile, emerging and specialty brands such as Open Farm, Stella & Chewy's, Drools Pet Food, JustFoodForDogs, and Diamond Pet Foods are differentiating through transparency in sourcing, customized nutrition plans, and sustainability-driven approaches. This dynamic competitive landscape is shaped by innovation, veterinary partnerships, and growing consumer preference for health-focused diets that enhance pets' health.

Pet Therapeutic Diet Market Companies

Few of the prominent players operating in the pet therapeutic diet industry include:

- Blue Buffalo (General Mills)

- Diamond Pet Foods (Schell & Kampeter, Inc.)

- Drools Pet Food

- Eden Holistic Pet Foods

- EmerAid

- Hill's Pet Nutrition (Colgate Palmolive)

- Husse

- JustFoodForDogs

- Mars, Incorporated

- Open Farm

- Purina PetCare (Nestle SA)

- Stella and Chewy’s

- Virbac

- VNG

- Ziwi Pets

- Purina PetCare (Nestle SA)

Purina PetCare, a division of Nestle, is a major force in the pet therapeutic diet market, offering a comprehensive range of science-backed nutritional products under its Purina Pro Plan Veterinary Diets brand. These formulations address critical health concerns such as urinary tract health, hepatic support, diabetes management, and joint mobility. Purina leverages its strong R&D infrastructure, veterinary partnerships, and consumer trust to deliver diets that combine high therapeutic efficacy with optimal taste and digestibility.

- Mars, Incorporated

Mars, Incorporated holds a prominent position in the global pet therapeutic diet market, driven by its leadership in nutritional research, veterinary services, and targeted dietary innovation. Through its renowned brands, including Royal Canin, the company offers clinically formulated nutritional solutions designed to address a wide range of health conditions such as renal disorders, gastrointestinal sensitivities, dermatological issues, and weight management.

- Hill's Pet Nutrition (Colgate Palmolive)

Hill's Pet Nutrition is known for its Prescription Diet range that targets conditions such as renal health, weight management, digestive care, and joint support. The company works closely with veterinarians globally, integrating its solutions into professional practice. The company's commitment to nutritional precision is supported by collaboration with academic research institutions and pet health networks, enabling the continuous refinement of therapeutic formulations.

Pet Therapeutic Diet Industry News:

- In June 2025, General Mills announced two new product launches in its North America Pet segment, featuring innovations from Blue Buffalo and Edgard & Cooper. These initiatives are tailored to meet the changing preferences of modern pet parents and are strategically designed to drive growth in the pet nutrition category. By aligning with consumer trends, General Mills strengthened its market position and expanded its revenue potential in the thriving pet food industry.

- In May 2025, Nestlé acquired a minority stake in Drools Pet Food Private Limited, citing the move as a financial investment. According to Nestlé's statement, Drools will continue to operate independently, both strategically and operationally. The investment provided Drools with access to additional capital and global expertise, supporting its expansion and innovation in India's growing pet food market.

- In April 2025, Hill's Pet Nutrition introduced an enhancement of its Science Diet adult and senior dry food range by introducing ActivBiome+ Multi-Benefit—a blend of prebiotic fibers and antioxidants that supports digestive, immune, and organ health. This innovation strengthened its competitive edge in the premium pet nutrition market.

- In August 2024, Blue Buffalo became the official pet food and treats partner of Best Friends Animal Society (BFAS), a renowned animal welfare organization and leader in pet adoption. This partnership reflects a shared commitment to improving pet lives through quality nutrition and compassionate care. By aligning with BFAS, Blue Buffalo boosted brand visibility and reinforced its reputation as a trusted advocate for pet wellness.

The pet therapeutic diet market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product Type

- Dry food

- Wet/ canned food

- Other product types

Market, By Animal Type

- Cats

- Dogs

- Other animals

Market, By Health Condition

- Renal health

- Gastrointestinal health

- Skin and coat health

- Cardiovascular health

- Weight management

- Joint care

- Other health conditions

Market, By Distribution Channel

- Veterinary hospitals and clinics

- E-commerce

- Retail pharmacies

- Other distribution channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the pet therapeutic diet market?

North America leads the market with a 47.3% share in 2024, driven by rising pet ownership and increased spending on animal healthcare.

What are the upcoming trends in the pet therapeutic diet market?

Trends include the development of condition-specific diets for chronic diseases, advancements in targeted nutritional formulas, and increasing awareness of pet health and wellness.

Who are the key players in the pet therapeutic diet industry?

Key players include Blue Buffalo (General Mills), Diamond Pet Foods (Schell & Kampeter, Inc.), Drools Pet Food, Eden Holistic Pet Foods, EmerAid, Hill's Pet Nutrition (Colgate Palmolive), Husse, JustFoodForDogs, Mars, Incorporated, Open Farm, and Purina PetCare (Nestle SA).

What is the growth outlook for the cat segment during the forecast period?

The cat segment, valued at USD 1.3 billion in 2024, is anticipated to grow at a CAGR of 8% during the forecast period, supported by increasing feline ownership and awareness of specialized nutritional needs.

What was the market share of the wet/canned food segment in 2024?

The wet/canned food segment accounted for 28.7% of the market in 2024, driven by its high moisture content, palatability, and suitability for pets with dental issues or chronic conditions.

How much revenue did the dry food segment generate in 2024?

The dry food segment generated approximately USD 2.5 billion in 2024, dominating the market due to its convenience and widespread adoption.

What is the market size of the pet therapeutic diet in 2024?

The market size was valued at USD 4.3 billion in 2024, with a CAGR of 7.6% expected through 2034.

What is the projected value of the pet therapeutic diet market by 2034?

The market is projected to reach USD 8.8 billion by 2034, fueled by the growing demand for condition-specific diets and targeted nutritional formulas for companion animals.

Pet Therapeutic Diet Market Scope

Related Reports