Summary

Table of Content

Omega-3 Fatty Acids Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Omega-3 Fatty Acids Market Size

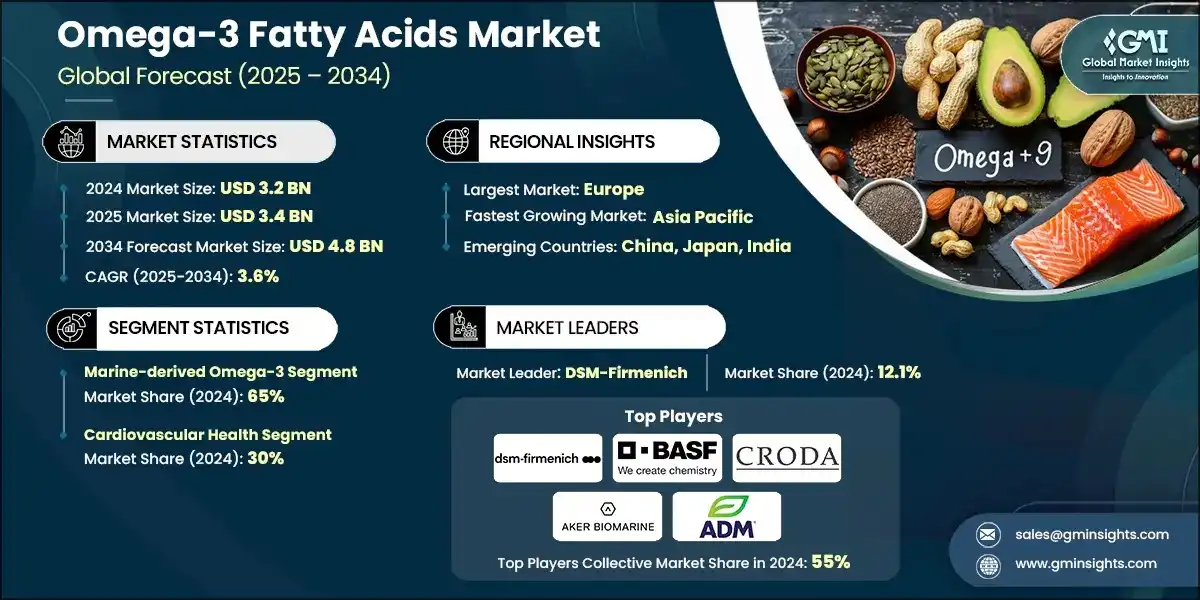

The global omega-3 fatty acids market was estimated at USD 3.2 billion in 2024. The market is expected to grow from USD 3.4 billion in 2025 to USD 4.8 billion in 2034, at a CAGR of 3.6% according to latest report published by Global Market Insights Inc.

To get key market trends

- Research supporting the health advantages of omega-3 propels the market; there are over 40,000 peer-reviewed articles on EPA and DHA, of which more than 4,000 human clinical trials report benefits for cardiovascular, brain, and eye health. In the REDUCE-IT trial involving over 8,000 high-risk patients, it has been shown that supplementation with highly purified EPA could significantly reduce the incidence of major cardiovascular events.

- As consumers become increasingly educated about the health benefits, their interest in Omega-3 supplements, particularly those purporting to support cardiovascular and brain health, grows exponentially. There are many clinical studies validating purported claims against EPA and DHA with regards to the prevention of heart diseases; supporting evidence comes from around 40,000 published studies assessing the effectiveness of these claims.

- The commercial landscape of vegetarian and vegan formulations is changing the landscape of demand for plant-based Omega-3 sources. Algal-derived oils are thus the fastest-growing segment at a CAGR of 13.36%, courtesy of consumers' predilection toward plant alternatives, in addition to the sustainability considerations.

- Rising general interest in fortified foods and beverages with Omega-3 ingredients takes the market applications well beyond standard supplementation. Food manufacturers sought to include omega-3 fatty acids in juices, breads, packaged meats, and dairy.

Omega-3 Fatty Acids Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.2 Billion |

| Market Size in 2025 | USD 3.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 3.6% |

| Market Size in 2034 | USD 4.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing awareness of omega-3s health benefits | Increasing awareness of omega-3s health benefits, particularly for heart health and brain development. |

| Rising consumer demand for natural and dietary supplements | Rising consumer demand for natural and dietary supplements to improve overall wellness. |

| Growing prevalence of cardiovascular diseases | Growing prevalence of cardiovascular diseases and mental health issues driving supplement consumption. |

| Pitfalls & Challenges | Impact |

| High costs of sourcing | High costs of sourcing and producing high-quality omega-3 fatty acids can limit market growth. |

| Opportunities: | Impact |

| Expansion into emerging markets | Expansion into emerging markets with increasing health consciousness and rising disposable incomes. |

| Market Leaders (2024) | |

| Market Leaders |

12.1% market share |

| Top Players |

Collective market share is 55% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, Japan, India |

| Future Outlook |

|

What are the growth opportunities in this market?

Omega-3 Fatty Acids Market Trends

- Source Diversification on Sustained Terms- This major trend redirects dependence away from traditional marine sources and toward sustainable or alternative sources, in particular-algal-derived omega-3. DSM-Firmenich, which is the front-runner in the market, has divested all marine lipids businesses while strengthening its algal omega lifestyle. Such moves indicate the overall trend transformation in businesses. Algal omega-3 production provides many benefits, such as reduced pressure on wild fisheries because of controlled cultivation environments and shorter supply chains with 25-day production cycles, compared with over 24 months for fish oil. It has been found that 64% of supplement customers around the world would switch to plant-based omega-3 if it were available, mostly because of sustainability concerns and trends in plant-based diets. The intended change in preference supports the predicted CIM for algal omega-3 at 13.36% through 2030, much higher than the trend for traditional marine sources. The growth profile of the algal fraction depicts environmental awareness and technological improvements in microalgae cultivation and extraction processes.

- Precision Nutrition and High-Concentration Formulations- The evolution of markets into precision nutrition brings about the need for highly concentrated omega-3 formulations with improved bioavailability and specific therapeutic applications. More and more evidence suggests that EPA should be used by itself over the traditional combinations of EPA+DHA, and meta-analysis of 38 randomized controlled trials indicates that purified EPA gives better cardiovascular outcomes. Because of this, a scientific separation is being created between generic fish oil supplements and concentrated pharmaceutical-grade formulations.

- Functional Food Integration and Application Expansion- Omega in functional foods is among the swelling trends, as it is brought by manufacturers into various categories of foods other than the usual dietary supplements. Consumers look for convenient nutrition, hence the promising growth for functional foods that market everyday foods as nutrient delivery systems alongside supplements. That includes fortified beverages, dairy products, baked goods, and plant-based protein alternatives.

Omega-3 Fatty Acids Market Analysis

Learn more about the key segments shaping this market

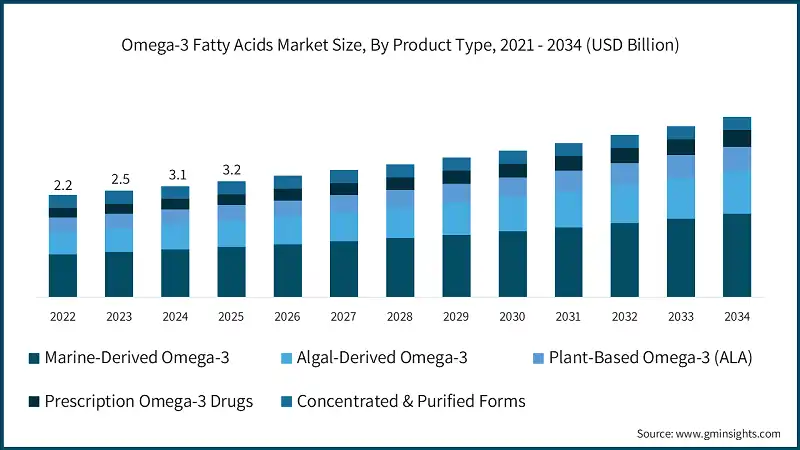

Marine-derived omega-3 product type dominated about 65% market share in 2024, through established supply chains and cost advantages already tested through large-scale clinical validation for cardiovascular and cognitive health applications. In addition, traditional sources of fish oil from salmon, mackerel, and sardines contain EPA and DHA from 0.26g to 1.83g per 3 ounces of serving size, which would suit many formulation needs.

Algal-derived omega-3 is expected to grow with a CAGR of 3.9% through 2034. Growing interest among consumers of sustainable plant-based alternatives and advances in microalgae cultivation technology greatly spur this segment. One portfolio of algal oil products by DSM-Firmenich, branded as OMEGA, has potency that is about twice as much as that of standard fish oil at >500 mg/g total EPA+DHA, compared to an average of 270 mg/g in fish oil. Much smaller dosage forms are possible because of this concentration advantage. It addresses consumer issues regarding the fishy taste and odor associated with traditional marine sources.

Plant-based omega-3 (ALA) from flaxseed, chia, and walnut sources holds 12% of market share in 2024 serving vegetarian and vegan consumers. However, there is clinical evidence for low efficiency in conversion from ALA to EPA and DHA (usually <5%), putting plant-based ALA as an adjunct rather than as a substitute to marine or algal sources.

Learn more about the key segments shaping this market

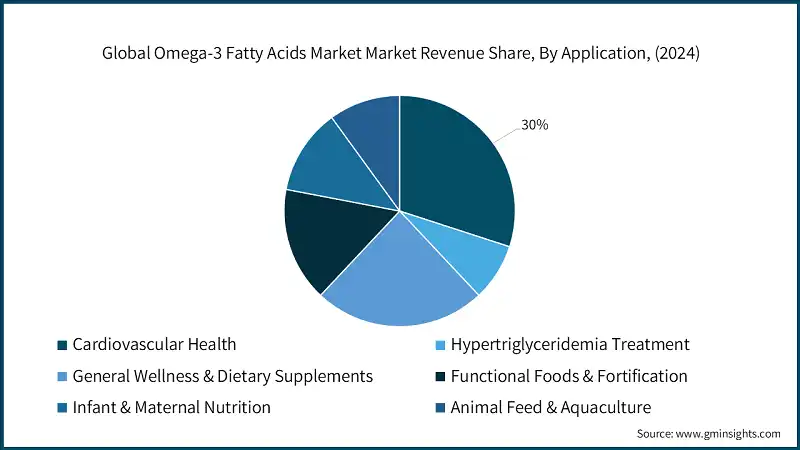

There are huge market demands for applications related to cardiovascular health holding 30% revenue share in 2024. REDUCE-IT trial findings, which showed 25% fewer major cardiovascular events with high-dose EPA supplementations. American Heart Association's recommendation for two servings or more of fatty fish weekly consumption, and evidence-based intake ranges of 0.5-1.8g daily EPA+DHA, cardiology applications will continue to grow in consumption. Hypertriglyceridemia treatment holds a small portion of 8% with record prescription-grade omega-3 formulations related to significantly decreased triglycerides as per clinical studies.

General wellness and dietary supplements make up a large application portion at about 24% market share in 2024, typically representing the general acceptance by consumers for omega-3 for preventive health and wellness. These two consumer health awareness trends go along with accessibility via retail channels, but clinical evidence between generic supplements considerably varies. Functional foods and fortification captured 16% of the market due to manufacturer innovations joining omega-3s as ingredients across the beverage, dairy, and baked goods categories.

Infant and maternal nutrition stands at 12% market share in 2024 and has strong growth potential based on clinical growth that substantiates DHA's benefit for brain and eye development during pregnancy and early childhood. Animal feed and aquaculture applications account for moderate market shares, supporting sustainable aquaculture practices and pet nutrition markets. They are being built with an ever-growing number of omega-3 benefits for animal health and development.

Looking for region specific data?

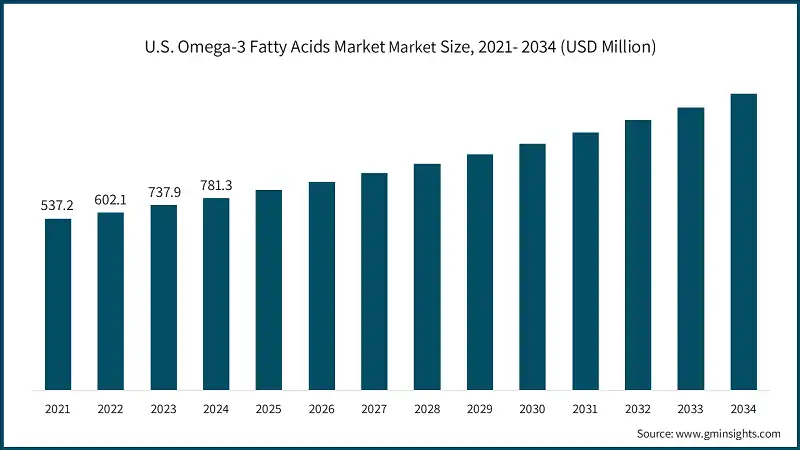

- The omega 3 fatty acids market in the U.S. was valued at USD 781.3 million in 2024 and will reach about USD 1.1 billion by 2034. In general, North America reflects rather mature market conditions with well-cultured supplement consumption along with high-awareness consumerism toward health matters, holding a 30% market share in 2024 of the global omega-3 market in demand and supply. U.S. enjoys an upper hand with 83% of the North American market out of regional consumption mostly supported by retail distribution, direct-to-consumer marketing, and recommendations via healthcare providers. In regulatory terms, the market is stabilized and fortified in terms of consumer confidence by virtue of FDA scrutiny and GRAS (Generally Recognized As Safe) status for omega-3 ingredient lists. Growth potential, however, is presently lesser as compared to the emerging regions about the mature market.

- Asia Pacific omega-3 fatty acids market is the fastest-growing regional market holding around 28% of the revenue share in 2024, on account of increasing middle-class population, rising disposable income, and growing health consciousness in China, India, and Japan. With a large consumer base along with some manufacturing capabilities, China leads the regional consumption, while India exhibits the fastest growth within the Asia Pacific, buoyed by a large vegetarian population generating demand for algal-based omega-3 alternatives. With an established health food culture, Japan offers omega-3 innovations with premium positioning into a regulatory framework allowing functional food claims.

- Europe omega 3 fatty acids market is accounted for over 27% share in 2024 and has a highly sophisticated regulatory environment with EFSA health claim approvals and a strong consumer niche for sustainably sourced traceable ingredients. Germany presents the largest consumption of omega-3 in Europe with a 19% market share in 2024 of the regional market, while Italy shows high growth attractiveness with a projected 12% CAGR by forecasted period. The dynamics of the European marketplace favor tapping into algal and sustainable omega-3 sources toward environmental consciousness paired with regulatory emphasis on sustainability claims. Latin America and the Middle East & Africa represent emerging markets, respectively, providing opportunities for long-term growth through economic developments and health awareness.

Omega-3 Fatty Acids Market Share

The global omega-3 fatty acids industry exhibits moderate concentration, with the top five DSM-Firmenich, BASF SE, Croda International, Aker BioMarine, Archer Daniels Midland players commanding a combined 55% market share in 2024. The situation denotes competitive dynamics whereby established multinational companies go into competition with smaller companies focusing on omega-3 products. Leadership in the market mirrors strategic advantages in terms of vertical integration, technological innovation, regulatory competencies, and global distribution capabilities across various end-user industries.

Market leader DSM-Firmenich has a market share of 12.1% in 2024, favorably positioned to execute its strategic transformation from marine to algal-derived omega-3 solutions through its life's OMEGA portfolio. The market position of the firm captures the advantageous outcome of the merger between the DSM and Firmenich capacities, leading to the creation of synergies in nutritional ingredients and flavor technologies. The competitive advantage enjoyed by DSM-Firmenich stems from proprietary algal cultivation technology, end-to-end supply chain control, and firm customer relationships across the pharmaceutical, nutraceutical, and food industries. Divestment of the marine lipids operations while increasing algal capacity shows a strategic tilt towards segments of sustainable, high growth for omega-3.

BASF SE has a strong market presence due to a diversified portfolio of nutritional ingredients, capitalizing on chemical industry prowess in purification, concentration, and formulation technologies. The company's omega-3 strategy revolves around high-concentration products and pharmaceutical-grade formulations which both support premium pricing and specialized applications. Croda International concentrates on specialty omega-3 ingredients that emphasize bioavailability and novel delivery systems, serving the pharmaceutical and premium nutraceutical markets through technological differentiation.

Omega-3 Fatty Acids Market Companies

Major players operating in the omega-3 fatty acids industry are:

- DSM-Firmenich

- BASF SE

- Croda International

- Aker BioMarine

- Archer Daniels Midland

- Cargill

- Corbion

- Omega Protein Corporation

- Epax

- KD Pharma Group

- DSM-Firmenich

- The company's models integrate proprietary technologies for cultivating microalgae with global distribution capabilities with access into segments of pharma, nutraceutical, and food production. Recent innovation includes product launch of life's OMEGA O3020, the first algal-based lipid with high EPA content available in Europe and USA, showing innovation in algal omega-3 concentration and formulation. The company has been well positioned as a sustainable brand, particularly in providing 100% vegan, algae-derived omega-3s completely independent of any fisheries-a direct response to the environmental conscience of consumers and regulatory requirements of sustainability.

- The company's models integrate proprietary technologies for cultivating microalgae with global distribution capabilities with access into segments of pharma, nutraceutical, and food production. Recent innovation includes product launch of life's OMEGA O3020, the first algal-based lipid with high EPA content available in Europe and USA, showing innovation in algal omega-3 concentration and formulation. The company has been well positioned as a sustainable brand, particularly in providing 100% vegan, algae-derived omega-3s completely independent of any fisheries-a direct response to the environmental conscience of consumers and regulatory requirements of sustainability.

- BASF SE

- An integrated chemical firm with skills in omega-3 purification, concentration, and formulation technologies would manufacture pharmaceutical-grade high-concentration products. They depend on technology to devise a differentiating strategy via in-house extraction and purification techniques, achieving ultra-high concentration formulations with therapeutic applications and exceeding 85% purity. BASF allows expansion into several markets located in various countries and types of end-user applications through a global network for manufacturing and regulatory know-how.

- An integrated chemical firm with skills in omega-3 purification, concentration, and formulation technologies would manufacture pharmaceutical-grade high-concentration products. They depend on technology to devise a differentiating strategy via in-house extraction and purification techniques, achieving ultra-high concentration formulations with therapeutic applications and exceeding 85% purity. BASF allows expansion into several markets located in various countries and types of end-user applications through a global network for manufacturing and regulatory know-how.

- Croda International

- Croda International specializes in developing bioavailability-enhanced, high-performance omega-3 ingredients and their novel delivery systems. Besides improving omega-3 stability and absorption using expertise in surface chemistry, the company focuses on specialty applications: pharmaceutical excipients, cosmetic ingredients, and premium nutraceutical formulations. Croda's approach is more to innovate and gain a premium rather than focusing on commodity volume production.

- Croda International specializes in developing bioavailability-enhanced, high-performance omega-3 ingredients and their novel delivery systems. Besides improving omega-3 stability and absorption using expertise in surface chemistry, the company focuses on specialty applications: pharmaceutical excipients, cosmetic ingredients, and premium nutraceutical formulations. Croda's approach is more to innovate and gain a premium rather than focusing on commodity volume production.

- Aker BioMarine

- Aker BioMarine dominates the krill oil segment by harvesting Antarctic krill, which contain phospholipid-bound omega-3 with enhanced bioavailability and unique astaxanthin content. The company's sustainable harvesting practices and Marine Stewardship Council certification appeal to environmentally conscious consumers and premium market segments. Other strategic initiatives include entering supply agreements for pharmaceutical applications and geographic expansion through distribution partnerships.

- Aker BioMarine dominates the krill oil segment by harvesting Antarctic krill, which contain phospholipid-bound omega-3 with enhanced bioavailability and unique astaxanthin content. The company's sustainable harvesting practices and Marine Stewardship Council certification appeal to environmentally conscious consumers and premium market segments. Other strategic initiatives include entering supply agreements for pharmaceutical applications and geographic expansion through distribution partnerships.

- Archer Daniels Midland

- Archer Daniels Midland (ADM) applies agricultural processing expertise and global distribution network to omega-3 markets, emphasizing cost-effective solutions for food and feed applications. The company's strategy focuses on large-volume, commodity-grade omega-3 ingredients for functional food fortification and animal nutrition, leveraging existing customer relationships and manufacturing infrastructure.

- Archer Daniels Midland (ADM) applies agricultural processing expertise and global distribution network to omega-3 markets, emphasizing cost-effective solutions for food and feed applications. The company's strategy focuses on large-volume, commodity-grade omega-3 ingredients for functional food fortification and animal nutrition, leveraging existing customer relationships and manufacturing infrastructure.

Omega-3 Fatty Acids Industry News

- In March 2025, Innovaoleo by Natac, Natac’s omega-3 division launched Omega 3 Star. This product stands out in the market for its neutrality in terms of smell, taste, colour and provides multiple benefits for human and animal health.

- In November 2024, Polaris Nutritional Lipids announced the commercial launch of Omegavie DHA 800, containing not less than 800 mg/g DHA through high-efficiency molecular distillation technology. Such an extremely concentrated product is dedicated to the pharmaceutical and premium supplement markets requiring extreme potency products.

- In September 2024, KD Pharma Group completed taking over DSM-Firmenich's marine lipids business-unit operations, bringing together its capabilities as a manufacturer of pharmaceutical-grade omega-3s. The deal mirrors consolidation trends across industry and highlights strategic intent focused on highly specialized, high-value applications for omega-3.

The omega-3 fatty acids market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Product Type

- Marine-derived omega-3

- Fish oil

- Concentrated fish oil

- Krill oil & phospholipid forms

- Others

- Algal-derived omega-3

- Microalgae oil

- Fermentation-derived EPA & DHA

- Plant-based omega-3 (ala)

- Flaxseed oil

- Chia seed oil

- Others

- Prescription omega-3 drugs

- Concentrated & purified forms

Market, By Application

- Cardiovascular health

- Primary prevention products

- Secondary prevention formulations

- Blood pressure management

- Arrhythmia prevention

- Hypertriglyceridemia treatment

- Severe hypertriglyceridemia

- Moderate hypertriglyceridemia

- General wellness & dietary supplements

- Daily nutrition

- Brain health & cognitive function

- Eye health & vision support

- Joint health & inflammation

- Functional foods & fortification

- Dairy product

- Bakery & confectionery

- Beverage fortification

- Meat & poultry

- Infant & maternal nutrition

- Infant formula applications

- Prenatal & postnatal supplements

- Pediatric nutrition products

- Animal feed & aquaculture

- Aquaculture feed

- Pet food

- Livestock feed

Market, By End Use Industry

- Pharmaceutical industry

- Nutraceutical & dietary supplement industry

- Food & beverage industry

- Animal feed industry

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the omega-3 fatty acids market?

Key players include DSM-Firmenich, BASF SE, Croda International, Aker BioMarine, Archer Daniels Midland, Cargill, Corbion, Omega Protein Corporation, Epax, KD Pharma Group, Polaris Nutritional Lipids, Solutex, Veramaris, Yield10 Bioscience, AlgaeCytes, Fermentalg, and Qualitas Health.

What is the current omega-3 fatty acids market size in 2025?

The market size is projected to reach USD 3.4 billion in 2025.

How much revenue did the marine-derived omega-3 segment generate in 2024?

Marine-derived omega-3 dominated the market with approximately 65% share in 2024, fueled by established supply chains and clinical validation for cardiovascular and cognitive health applications.

What is the growth outlook for algal-derived omega-3 from 2025 to 2034?

Algal-derived omega-3 is projected to grow at a CAGR of 3.9% through 2034, supported by consumer demand for sustainable plant-based alternatives and advances in microalgae cultivation technology.

Which region leads the omega-3 fatty acids market?

The U.S. market generated USD 781.3 million in 2024 and is expected to reach about USD 1.1 billion by 2034.

What is the market size of the omega-3 fatty acids in 2024?

The market size was USD 3.2 billion in 2024, with a CAGR of 3.6% expected through 2034 driven by rising demand for natural dietary supplements promoting wellness and increasing awareness of health benefits.

What are the upcoming trends in the omega-3 fatty acids market?

Key trends include source diversification toward sustainable algal-derived omega-3, precision nutrition with high-concentration formulations, functional food integration, and expansion into emerging markets with rising health consciousness.

What is the projected value of the omega-3 fatty acids market by 2034?

The omega-3 fatty acids market is expected to reach USD 4.8 billion by 2034, propelled by growing health consciousness, clinical research validation, and expansion of functional foods fortification.

Omega-3 Fatty Acids Market Scope

Related Reports