Summary

Table of Content

Oil and Gas Vapor Recovery Units Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Oil & Gas Vapor Recovery Units Market Size

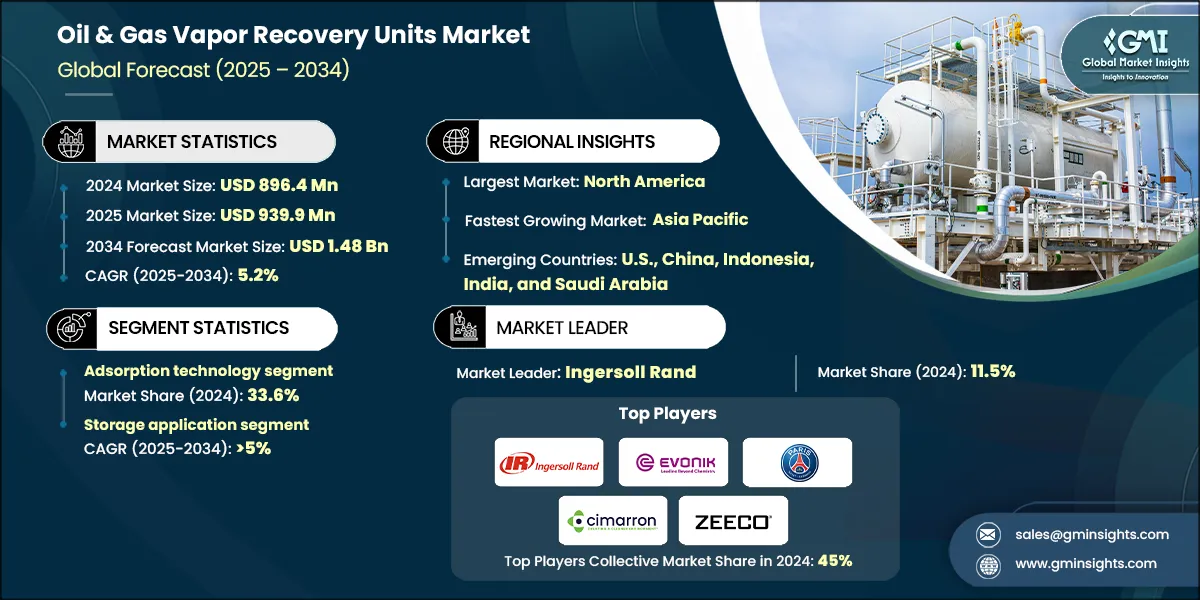

According to a recent study by Global Market Insights Inc., the oil & gas vapor recovery units market was estimated at USD 896.4 million in 2024. The market is expected to grow from USD 939.9 million in 2025 to USD 1.48 billion in 2034, at a CAGR of 5.2%.

To get key market trends

Stringent environmental regulations across major oil-producing regions are compelling upstream and downstream operators to deploy vapor recovery units (VRUs) to mitigate emissions of volatile organic compounds (VOCs), thereby accelerating market growth.

- VRUs are engineered systems used in oil & gas operations to capture and recover hydrocarbon vapors released during the storage, transfer, and processing of volatile liquids such as crude oil, gasoline, and petrochemical products.

- The increasing adoption of VRUs in oil refineries, crude oil terminals, and gasoline storage facilities is driven by their efficiency in reducing emissions and recycling valuable hydrocarbons, making them prefer clean technology. Rapid expansion of crude oil and gasoline storage infrastructure, especially in emerging economies, is boosting the installation of these units across tank farms and bulk liquid handling terminals.

- For instance, in May 2025, ADNOC has expanded its energy partnerships with U.S. companies through strategic agreements announced during the UAE-U.S. business dialogue. These deals could unlock USD 60 billion in U.S. investments into ADNOC’s oil and gas projects in Abu Dhabi.

- Global efforts to reduce methane emissions are driving increased deployment of vapor recovery units at oil well pads and compressor stations, enabling effective capture of hydrocarbon vapors and supporting regulatory compliance. The integration of advanced VRUs with distributed control systems (DCS) and centralized SCADA platforms is improving operational transparency through remote diagnostics, automated performance tracking, and real-time monitoring capabilities.

- Oil and gas ports and terminals are increasingly adopting marine vapor recovery systems to manage hydrocarbon emissions during tanker loading and unloading operations, supporting stricter environmental compliance. Growing demand for systems certified under ATEX and IECEx standards for hazardous environments is reinforcing market momentum and driving innovation in vapor recovery technologies.

- For reference, in February 2025, Honeywell International revealed that Taiyo Oil had selected its proprietary UOP Ethanol-to-Jet technology to support sustainable aviation fuel (SAF) production at its Okinawa facility in Japan. This strategic collaboration reinforces Honeywell’s position as a leader in clean energy solutions and reflects its alignment with global decarbonization objectives within the aviation sector.

- The growing preference for compact, skid-mounted vapor recovery units in oil and gas operations is driven by the need for space-saving solutions in constrained environments and mobile setups. Integration of advanced components such as high-efficiency condensers, corrosion-resistant materials, self-cleaning systems, and upgraded filtration technologies is boosting product performance and expanding market opportunities.

- Consistent demand for vapor recovery units in oil and gas operations is being fueled by the economic benefits of reclaiming fuel for resale, alongside the need to meet evolving environmental regulations and reduce manual intervention. Ongoing tightening of air quality standards across upstream, midstream, and downstream segments is expected to further drive product deployment.

- The oil & gas vapor recovery units market was valued at USD 793.2 million in 2021 and grew at a CAGR of over 4% through 2024. The increasing focus on reducing methane and VOC emissions across oil and gas operations to meet global climate targets is driving positive business scenario.

- The increasing adoption of net-zero and sustainability goals by oil and gas companies propelled by investors and stakeholder expectations, is accelerating the deployment of these units. Expanding applications of VRUs across fuel terminals and petrochemical complexes are further enhancing business growth.

Oil and Gas Vapor Recovery Units Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 896.4 Million |

| Market Size in 2025 | USD 39.5 Million |

| Forecast Period 2025-2034 CAGR | 5.2% |

| Market Size in 2034 | USD 1.48 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising focus on methane mitigation | Increasing global climate initiatives and stricter regulations are driving demand for VRUs to capture and reduce methane emissions. |

| Expansion of oil & gas infrastructure | Growth in upstream and midstream activities is boosting VRU installations to recover hydrocarbons and minimize environmental impact. |

| Increasing demand for emission control technologies | Rising awareness and compliance requirements are accelerating adoption of VRUs as part of broader emission reduction strategies. |

| Pitfalls & Challenges | Impact |

| High initial investment | Significant upfront costs for equipment and installation can deter small and mid-sized operators from adopting VRU systems. |

| Opportunities: | Impact |

| Adoption of low-carbon technologies | Growing interest in decarbonization is creating demand for VRUs as part of sustainable oil & gas operations. |

| Government incentives and funding | Supportive policies and financial incentives for emission reduction technologies are encouraging VRU deployment. |

| Technological advancements in VRUs | Innovations in automation and efficiency are making VRUs more attractive and cost-effective for operators. |

| Emerging markets expansion | Increasing oil & gas activities in developing regions offer new growth avenues for VRU installations. |

| Market Leaders (2024) | |

| Market Leader |

11.5% market share |

| Top 5 Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | U.S., China, Indonesia, India, and Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Oil & Gas Vapor Recovery Units Market Trends

- The intensifying global emphasis on methane mitigation fueled by climate change imperatives, is set to accelerate industry growth. Regulatory bodies across both developed and emerging economies are enforcing stricter methane emission norms, directly increasing the demand for vapor recovery units as essential compliance tools within oil and gas operations.

- The alignment of corporate decarbonization strategies with investor-led ESG frameworks is reinforcing product adoption. The growing relevance of carbon credit systems linked to methane reduction is enhancing business dynamics. Additionally, the deployment of advanced emissions monitoring and reporting technologies is strengthening transparency and regulatory trust, further supporting the installation of these units.

- For reference, in October 2025, ExxonMobil has entered into an agreement with the Government of Gabon to explore offshore oil and gas reserves in the Central African nation. The collaboration will focus on deepwater and ultra-deepwater blocks, reinforcing ExxonMobil’s strategic expansion in West Africa’s energy sector.

- The ongoing expansion of oil & gas infrastructure supported by increasing investments across upstream, midstream, and downstream segments, is set to enhance industry prospects. The rising deployment of crude oil storage tanks, transmission pipelines, and refining units in developing regions will significantly boost demand for these systems.

- The emergence of new petrochemical complexes and LNG export terminals requiring integrated vapor control systems is propelling the need for sustainable emission solutions. The widespread integration of VRUs as standard equipment in tank farms and distribution terminals is anticipated to further strengthen industry growth.

- For citation, in September 2023, Universal Biofuels completed the expansion of its biodiesel production facility in India. The upgrade increased the plant’s annual capacity to 60 million gallons, achieving this milestone more than a year ahead of schedule. This development strengthened company’s position in the renewable fuels sector and supports India’s clean energy goals.

- The rising demand for emission control technologies propelled by the rapid expansion of fuel retail networks and urban fueling stations, is enhancing business outlook. Increasing consumer reliance on gasoline and diesel distribution infrastructure in developing regions is expected to fuel the adoption of vapor recovery units.

- The heightened requirement for hydrocarbon vapor management at fuel terminals and retail depots is strengthening product demand. The development of compact VRUs designed for small-scale fueling setups, along with the integration of modular systems suitable for retrofitting existing stations, is set to amplify industry growth.

Oil & Gas Vapor Recovery Units Market Analysis

Learn more about the key segments shaping this market

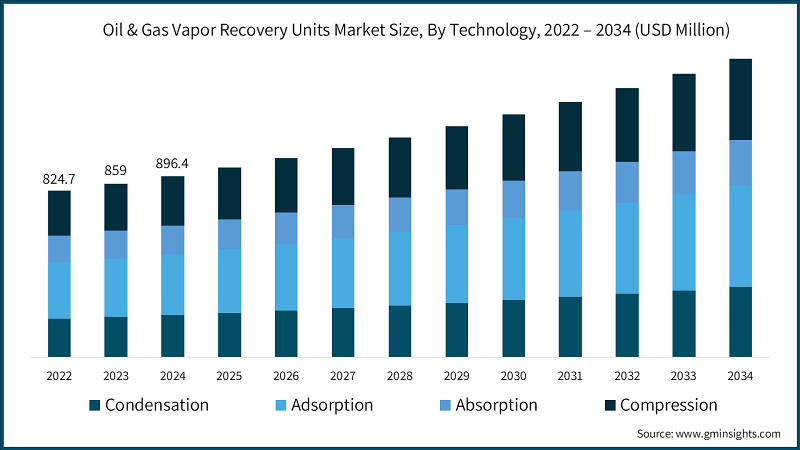

- Based on technology, the industry is segmented into absorption, adsorption, condensation, and compression. The adsorption technology holds a share of 33.6% in 2024 and is expected to grow at a CAGR of over 5% through 2034. The use of advanced adsorbent materials such as carbon nanotubes and silica aerogels is enhancing vapor capture efficiency, especially under humid oilfield conditions.

- Increasing focus on low-maintenance and regenerative adsorption systems is also driving adoption in upstream and midstream operations, where continuous vapor recovery is critical for emission control and operational safety.

- The condensation based technology in oil & gas vapor recovery units market was evaluated at USD 207.7 million in 2024. Integration with closed-loop cooling systems is gaining momentum as oil & gas operators aim to reduce water usage and support environmentally responsible practices.

- Additionally, the rising deployment of cryogenic condensation units in LNG terminals and gas processing plants is improving recovery rates for light hydrocarbons, making this technology increasingly viable for high-throughput applications.

- For illustration, in September 2025, BP entered a MoU with the Egyptian government to explore the viability of a five-well drilling initiative in the Mediterranean Sea, targeting depths between 300 and 1,500 meters. This strategic move reflects a broader industry trend toward maximizing domestic gas production by capitalizing on existing infrastructure, particularly in the West Nile Delta region.

- The absorption based technology is set to reach over USD 200 million by 2034. These systems are increasingly adopted in refining and petrochemical operations where recovered vapors can be reprocessed into existing liquid streams.

- The trend toward using environmentally friendly absorbents and hybrid systems combining absorption with membrane separation is enhancing performance and reducing operational costs, especially in facilities with fluctuating vapor compositions.

- The compression segment will witness a CAGR of over 5% through 2034. Growing utilization in upstream oil & gas activities, particularly at well sites and pipeline stations, is driving demand where recovered vapors are reinjected or reused within production cycles.

- The increasing preference for skid-mounted and modular compression units is supporting rapid deployment in remote locations, while advancements in variable-speed compressors are improving energy efficiency and vapor recovery rates.

Learn more about the key segments shaping this market

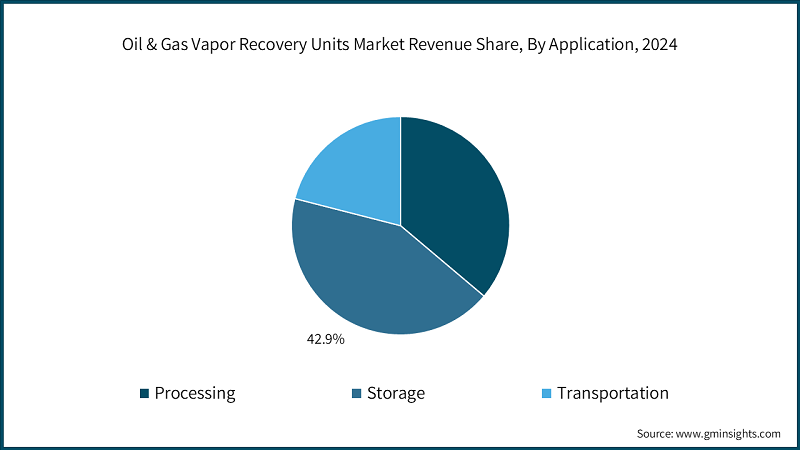

- Based on application, the market is segmented into processing, storage, and transportation. The storage application in oil & gas vapor recovery units market will witness a growth rate of over 5% from 2025 to 2034. Increasing regulatory pressure on benzene and VOC emissions from tank breathing and working losses is driving the deployment of vapor recovery units at oil & gas storage facilities.

- Additionally, the trend toward integrating dual-stage VRUs in large tank farms is improving recovery efficiency and helping operators meet evolving environmental standards.

- The processing segment market is set to reach over USD 500 million by 2034. Adoption of variable-speed and low-pressure compression technologies enabling efficient recovery of high-value vapor gases for on-site fuel use, supporting operational efficiency across oil & gas plants.

- The growing focus on energy optimization and flare minimization in gas processing units is further boosting the demand for VRUs, especially in facilities with high vapor throughput.

- For instance, in August 2025, ONEOK, Enbridge, MPLX LP, and WhiteWater through their Matterhorn joint venture, announced the development of the Eiger Express Pipeline to support rising natural gas output from the Permian Basin.

- In addition, spanning approximately 450 miles with a 42-inch diameter, the pipeline will transport up to 2.5 Bcf/d of natural gas from West Texas to the Katy area near Houston, with reserved capacity for Corpus Christi deliveries.

- The transportation segment market was valued at USD 188.2 million in 2024. Vapor recovery units are becoming critical in oil & gas logistics, especially during loading and unloading at truck, railcar, and marine terminals, where vapor displacement events are common.

- Furthermore, the global implementation of Stage 1 and Stage 2 vapor recovery mandates is accelerating system installations at bulk fuel terminals and dispensing stations, as operators aim to meet compliance targets and reduce environmental footprint.

Looking for region specific data?

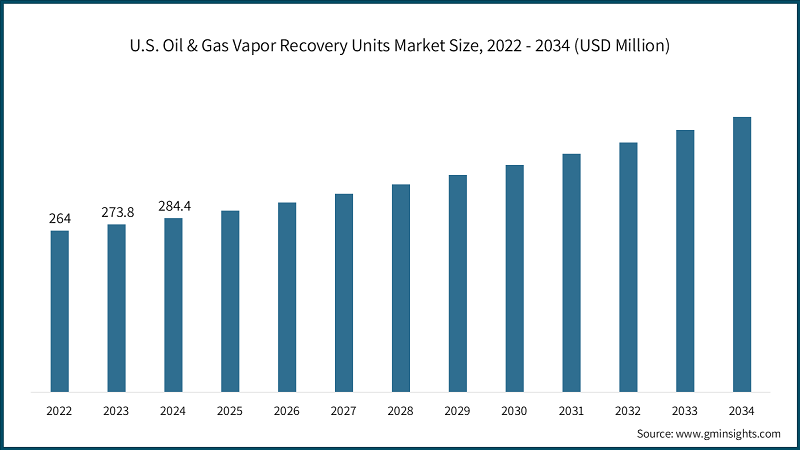

- The U.S. dominated the oil & gas vapor recovery units market in North America with USD 284.4 million in 2024. Rapid deployment of VRUs across shale basins is helping reduce emissions from tank batteries, supporting both regulatory compliance and industry growth.

- In addition, increasing demand for these systems in gasoline terminals is being fueled by stricter air quality regulations under the Clean Air Act, fostering a favorable environment for advanced VRU technologies.

- The North America oil & gas vapor recovery units market will project at a CAGR of over 4.5% through 2034. Midstream operators are increasingly integrating VRUs to capture vapors from condensate stabilization and gas processing, improving operational efficiency and environmental performance.

- Additionally, the push for methane mitigation under federal climate initiatives is encouraging upstream operators to adopt VRUs as part of broader emission reduction strategies. The rise of ESG-focused investments is also accelerating technology upgrades across the region.

- For instance, in March 2025, Enbridge announced a USD 2 billion investment to modernize its Mainline pipeline network, a key component of North America’s energy infrastructure. The upgrade, scheduled for completion by 2028, will focus on enhancing system reliability, improving operational efficiency, and implementing advanced safety protocols.

- The Asia Pacific oil & gas vapor recovery units market holds a share of 23% in 2024. Rapid urbanization and evolving environmental regulations in emerging economies are driving VRU adoption across fuel distribution networks. Government mandates targeting vapor recovery at fuel stations are expanding the small-scale VRU segment, especially in urban and semi-urban areas, supporting emission control efforts and industry growth.

- For reference, in October 2025, Baker Hughes has entered into a strategic partnership with Tamboran Resources, committing a USD 10 million investment and agreeing to deliver oilfield services for Tamboran’s initial shale gas development in Australia’s onshore Beetaloo Basin.

- The Europe oil & gas vapor recovery units market was valued at USD 248.4 million in 2024. Strong regulatory support is driving widespread VRU installations across storage terminals, refineries, and ports. Seaport operators are investing in dual-stage systems for ship-loading operations, boosting business potential.

- The Middle East & Africa oil & gas vapor recovery units market will exceed USD 130 million by 2034. Rising environmental oversight and flaring reduction mandates are accelerating VRU integration at upstream production sites. Increasing oil production activities in countries including Saudi Arabia and the UAE, coupled with sustainability goals, are driving demand for high-capacity VRUs in both onshore and offshore facilities.

- For illustration, in October 2025, Shell has received endorsement from President Bola Ahmed Tinubu following its USD 2 billion Final Investment Decision (FID) for a new gas development in Nigeria’s shallow offshore HI Field, located in OML 144. The Non-Associated Gas (NAG) project is expected to deliver approximately 350 million standard cubic feet per day (mmscf/d) by 2028, supporting domestic energy supply.

- The Latin America vapor recovery units market is projected to grow at a CAGR of over 4.5% through 2034. Growing integration of advanced vapor-phase capture systems for high-throughput fuel transfer is driving business growth. Government-led initiatives to implement VRUs at fuel stations and municipal depots are reinforcing regional infrastructure and accelerating industry momentum.

Oil & Gas Vapor Recovery Units Market Share

- The top 5 companies in the oil & gas vapor recovery units industry are EVONIK, PSG, Ingersoll Rand, ZEECO, and Cimarron Energy contributing around 45% of the market in 2024. The competitive environment remains intense, shaped by tightening environmental regulations and rising demand for advanced emission control technologies across oil and gas operations.

- Ingersoll Rand maintains a strong position in the VRU market, leveraging its engineering expertise and global presence in compressor systems. The company’s oil-free reciprocating compressors are a core component of its vapor recovery solutions, offering high reliability, low maintenance, and optimized recovery performance.

- Evonik’s differentiates itself through its advanced material science capabilities, particularly in membrane and adsorption technologies. Its proprietary polymer-based membranes deliver high selectivity and durability, even in demanding industrial environments.

- PSG Dover offers specialized oil-free reciprocating gas compressors engineered for vapor recovery applications. These units are designed for high performance with minimal vibration and maintenance, making them well-suited for use in oilfield storage and distribution terminals. PSG’s focus on reliability and efficiency continues to strengthen its market presence.

- Cimarron Energy is recognized for its integrated emissions control solutions, combining compression and carbon-based recovery technologies. Its VRUs are widely deployed in upstream oil and gas operations, offering high recovery rates and turnkey service capabilities from design and fabrication to field installation.

- ZEECO’s competitive strength lies in its high efficiency activated carbon systems, capable of recovering up to 99% of hydrocarbon vapors. These systems are designed for versatility, accommodating vapor compositions across trucks, rail, and marine terminals.

Oil & Gas Vapor Recovery Units Market Companies

- In 2024, Dover Corporation, the parent entity of PSG, reported robust financial results with total revenue reaching USD 7.7 billion and earnings from continuing operations amounting to USD 1.4 billion. Demonstrating its commitment to shareholder value, the company distributed USD 283 million in dividends during the year.

- Ingersoll Rand demonstrated resilience in 2024, with total order intake reaching USD 7.1 billion, marking a 4% year-over-year growth amid steady industrial demand. Revenue climbed 5% to USD 7.2 billion, reflecting strong momentum across its diversified portfolio.

- Kilburn Industries recorded operational revenue of USD 39 million in 2024. The company posted a profit before tax of USD 8.5 million, while net earnings stood at USD 6.4 million, indicating consistent financial growth and effective cost management.

Major players operating in the oil & gas vapor recovery units market are:

- ALMA Group

- BORSIG

- Cimarron Energy

- Cool Sorption

- Evonik

- Flogistix

- Ingersoll Rand

- KAPPA GI

- Kilburn Engineering

- Koch Engineered Solutions

- LeROI

- PETROGAS

- PSG

- Reynold India

- S&S Technical

- SCS Technologies

- SYMEX Technologies

- Tecam

- VOCZero

- Zeeco

Oil & Gas Vapor Recovery Units Industry News

- In July 2025, Flogistix, is making a significant impact in New Mexico’s oil and gas sector by helping operators slash methane emissions through its advanced vapor recovery units (VRUs). Operating in the state’s major basins, Flogistix’s VRUs capture and process vapors that would otherwise be flared or vented, converting them into valuable products like propane and butane.

- In February 2025, Zeeco launched an advanced research complex at its Global Technology Center in Oklahoma. The ARC is a cutting-edge addition to the GTC, which already houses the world’s largest industrial-scale combustion research and test facility. It offers multiple fully equipped pad sites to support heavy industries in designing, developing, and testing new combustion and pollution-control technologies.

- In July 2024, Dover Corporation advanced its clean energy strategy by acquiring Demaco Holland B.V., now integrated into OPW’s Clean Energy Solutions division under the Clean Energy & Fueling segment. Demaco enhances Dover’s portfolio with cryogenic flow control technologies, including vacuum-jacketed piping, sub-coolers, separators, valves, couplings, loading arms, and level sensors. These innovations support hydrogen and industrial gas applications, aligning with broader market trends favoring sustainable infrastructure and low-emission energy solutions.

- In April 2023, Evonik announced that the company will develop a vapor recovery system at its Reserve, Louisiana facility, specifically targeting emissions from truck loading operations. This system will capture air pollutants and hydrocarbon vapors currently released into the atmosphere and redirect them to newly installed advanced control technologies, a thermal oxidizer and a permanent flare. These devices are designed to significantly reduce hazardous air pollutants (HAPs), ensuring compliance with environmental standards.

The oil & gas vapor recovery units market research reports include in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Technology

- Condensation

- Adsorption

- Absorption

- Compression

Market, By Application

- Processing

- Storage

- Transportation

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Norway

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- Egypt

- Oman

- South Africa

- Nigeria

- Latin America

- Brazil

- Mexico

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the oil & gas vapor recovery units market?

Key players include ALMA Group, BORSIG, Cimarron Energy, Cool Sorption, Evonik, Flogistix, Ingersoll Rand, KAPPA GI, Kilburn Engineering, Koch Engineered Solutions, LeROI, PETROGAS, PSG, Reynold India, S&S Technical, SCS Technologies, SYMEX Technologies, Tecam, VOCZero, and Zeeco.

What are the upcoming trends in the oil & gas vapor recovery units market?

Key trends include integration with SCADA platforms for remote monitoring, adoption of compact skid-mounted units, use of advanced adsorbent materials, and deployment of cryogenic condensation systems in LNG terminals.

Which region leads the oil & gas vapor recovery units market?

North America dominates the market, with the U.S. generating USD 284.4 million in 2024. Strict Clean Air Act regulations and shale basin operations fuel the region's leadership.

What is the growth outlook for the storage application segment from 2025 to 2034?

The storage application segment is projected to witness a growth rate of over 5% from 2025 to 2034, led by regulatory pressure on benzene and VOC emissions from tank operations.

What is the current oil & gas vapor recovery units market size in 2025?

The market size is projected to reach USD 939.9 million in 2025.

How much revenue did the adsorption technology segment generate in 2024?

Adsorption technology held 33.6% market share in 2024 and is expected to grow at over 5% CAGR through 2034.

What is the projected value of the processing segment by 2034?

The processing segment is set to reach over USD 500 million by 2034, driven by adoption of variable-speed compression technologies and focus on flare minimization.

What is the market size of the oil & gas vapor recovery units in 2024?

The market size was USD 896.4 million in 2024, with a CAGR of 5.2% expected through 2034 driven by stringent environmental regulations and increasing focus on VOC emission control.

What is the projected value of the oil & gas vapor recovery units market by 2034?

The oil & gas vapor recovery units market is expected to reach USD 1.48 billion by 2034, propelled by methane mitigation efforts, infrastructure expansion, and adoption of emission control technologies.

Oil and Gas Vapor Recovery Units Market Scope

Related Reports