Summary

Table of Content

North America Urology Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Urology Devices Market Size

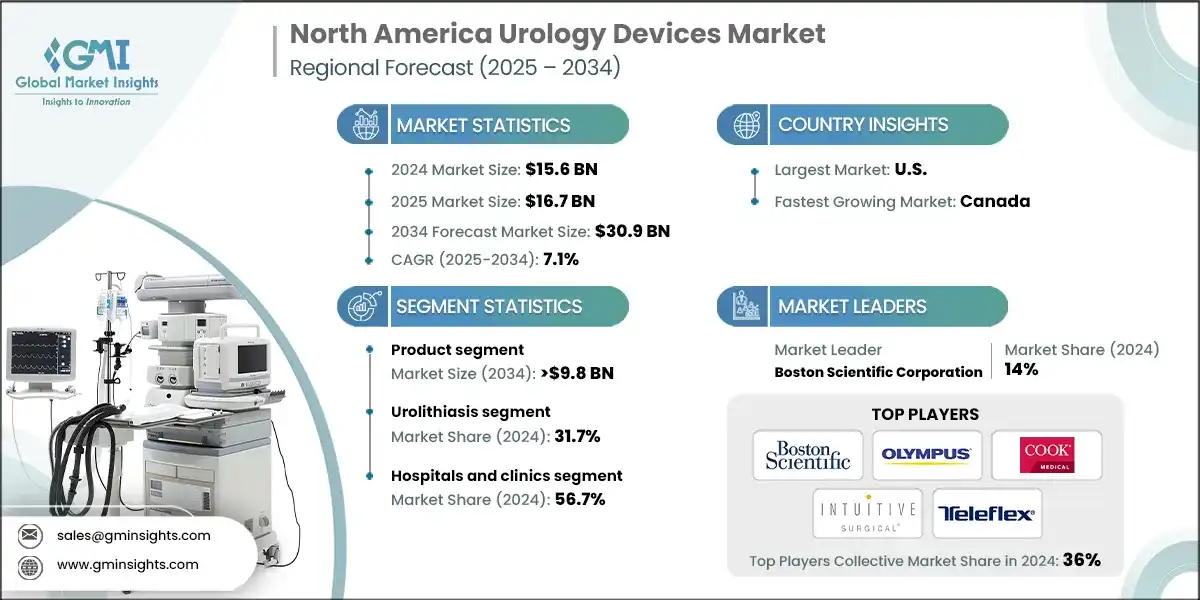

The North America urology devices market was estimated at USD 15.6 billion in 2024. The market is expected to grow from USD 16.7 billion in 2025 to USD 30.9 billion in 2034, growing at a CAGR of 7.1%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The high growth is driven by a number of factors such as the increasing incidence of urological conditions such as urinary incontinence, BPH, and kidney stones among key drivers. Demand for minimally invasive procedures and home-based urological treatment is also fueling the market growth. In addition to this, the development of urology-specific technology as well as intelligent diagnostic equipment is having a beneficial effect on the use of advanced urology devices.

A urology device refers to a medical device used for diagnostic, treatment, or management purposes of urinary tract and male reproductive system. This comprises equipment for procedures such as stone removal, prostate treatment, urinary incontinence control, and bladder surveillance. Major players in the industry include Boston Scientific Corporation, Olympus Corporation, Cook Medical, Intuitive Surgical, and Teleflex.

The North America urology devices market grew from USD 12.9 billion in 2021 to USD 14.6 billion in 2023. The growth has been largely influenced by a growing incidence of urological disorders, an aging population in the region, and technological advancements in diagnostic and surgical urology platforms. Increasing awareness in North America about the minimally invasive procedures and high demand for home-based urological therapy have also influenced the market growth.

Among the essential market changes is the increased use of minimally invasive and robot-assisted urological procedures, notably for conditions such as benign prostatic hyperplasia (BHP), urolithiasis, and prostate cancer. Robotic technologies have revolutionized the profile of urological products by improving accuracy, limiting recovery time, and enhancing patient outcomes. Devices such as Medtronic's Hugo RAS have gained broad acceptance in record time, notably in prostatectomy procedures.

Additionally, the U.S. FDA has cleared the next-generation urology devices that enhance procedure efficiency and also patient comfort. For instance, in 2022, Teleflex's UroLift System gained FDA clearance with a small delivery profile for enhanced prostatic urethra navigation.

Urology devices are specialized medical tools used to diagnose and treat disorders of the urinary tract and male reproductive system. These devices assist in managing conditions such as kidney stones, urinary incontinence, prostate enlargement, and bladder or prostate cancer. It is commonly used in hospitals, surgical centers, and urology clinics.

North America Urology Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 15.6 Billion |

| Market Size in 2025 | USD 16.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.1% |

| Market Size in 2034 | USD 30.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of urological disorders | The growing patient base affected by conditions such as benign prostatic hyperplasia (BPH), nephrolithiasis, and urinary incontinence is fueling demand for advanced diagnostic and therapeutic solutions across North America. |

| Increasing awareness and early diagnosis | More patients are undergoing screening and initial treatment, leading to higher utilization of urology devices in both hospital and outpatient settings. |

| Technological advancements in therapeutic devices | Breakthroughs in minimally invasive technologies including laser-based stone fragmentation, robotic-assisted procedures, and next-gen catheter systems are improving clinical outcomes and streamlining procedural workflows. |

| Shift toward decentralized and home-based care | The growing preference for outpatient and home dialysis options is driving uptake of compact, user-friendly devices designed for remote monitoring and self-administration, particularly in the U.S. and Canada. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory hurdles | Navigating the stringent approval frameworks of agencies such as the FDA presents significant hurdles for new entrants and increases time-to-market and operational costs for established players. |

| Limited access in rural areas | Limited infrastructure and workforce shortages in remote regions continue to restrict access to advanced urological care, creating gaps in service delivery and device utilization. |

| Opportunities: | Impact |

| Expansion of ambulatory and minimally invasive procedures | The rising demand for same-day interventions is encouraging innovation in compact, high-efficiency devices tailored for outpatient settings, reducing reliance on inpatient care models. |

| Increased demand for diagnostic tools | The push for precision medicine is accelerating the development of AI-enabled imaging tools and non-invasive diagnostic platforms, supporting early detection and personalized treatment strategies. |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 36% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Canada |

| Future outlook |

|

What are the growth opportunities in this market?

North America Urology Devices Market Trends

- North America urology devices industry experiences dynamic transformation driven by both macro and micro-level trends. On the macro level, the rising global burden of urological disorders such as kidney disease, bladder cancer, and other disorders is accelerating the demand for innovative, minimally invasive diagnostic, and therapeutic devices.

- Chronic kidney disease (CKD) is a significant public health issue in the U.S., with more than 35.5 million adults, or about 1 in 7 Americans, impacted. Increasing numbers of patients are fueling demand for timely diagnosis and adequate treatment, in large part through the application of newer urology equipment such as ureteroscopes, cystoscopes, and ureteral stents, which was valued at around USD 470.6 million in 2023.

- Hospitals across North America are moving towards outpatient, ambulatory, and home care models of healthcare. This shift is driving the adoption of smaller, disposable, and user-friendly devices that enable decentralized care and minimize hospital reliance.

- On the product level, the North America urology devices market is experiencing expedited innovation. Manufacturers are bringing next-generation devices that improve safety, minimize infection risk, and enhance procedural efficiency. Boston Scientific's LithoVue Elite, brought to market in 2023, is one such example of a single-use digital ureteroscope with real-time intrarenal pressure monitoring to minimize the risk of kidney injury during procedures.

- Robot-assisted procedures are also picking up great momentum in North America, especially for surgeries such as prostatectomy and nephrectomy. Platforms such as Intuitive Surgical's da Vinci system are making it possible to perform more accurate, minimally invasive procedures, with benefits such as increased dexterity, 3D visualization, and quicker recovery.

- Additionally, new technologies in laser lithotripsy, artificial intelligence, and disposable optics are revolutionizing the urological care landscape. These technologies are allowing for more precise stone fragmentation, real-time diagnosis, and sterile, single-use procedures further elevating the quality and availability of care throughout the region.

North America Urology Devices Market Analysis

Learn more about the key segments shaping this market

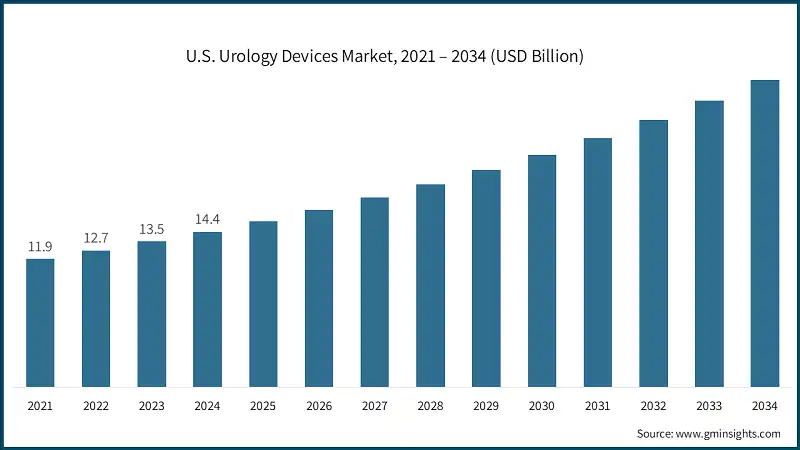

The North America urology devices market was valued at USD 12.9 billion in 2021. The market size reached USD 14.6 billion in 2023, from USD 13.7 billion in 2022.

Based on the product type, the urology devices market is segmented into products and accessories. The product segment is further subdivided into endoscopes, laser and lithotripsy devices, dialysis devices, and other products. The product segment accounted for 30.7% of the market in 2024 due to their high imaging precision, customizable configurations, and ability to support complex diagnostic and therapeutic procedures. The segment is expected to exceed USD 9.8 billion by 2034, growing at a CAGR of 7.4% during the forecast period. On the other hand, the accessories segment is poised to grow at CAGR of 7%. The growth of this segment can be attributed to the increasing demand for disposable components, rising procedural volumes, and the need for cost-effective and infection-resistant solutions that enhance the safety and efficiency of urological interventions.

- The endoscope sub-segment in the product segment maintains the largest share in the urology devices market, majorly because of its vital function in both diagnostic and therapeutic urological procedures. The devices allow direct intervention and visualization inside the urinary tract, such as the urethra, bladder, ureters, and kidneys, thus being vital for the treatment of diseases such as kidney stones, bladder tumors, among others.

- Common examples are cystoscopes and ureteroscopes, which are commonly employed in operations such as transurethral resection and ureteroscopy. This area is growing because of a rise in demand for magnetic-guided and minimally invasive procedures, which provide quicker recovery and shorter hospitalizations. Increasing prevalence of urological diseases, coupled with advances in endoscopic visualization, has made endoscopes the backbone in current practice.

- Technological innovations such as high-definition imaging, digital integration, and disposable scopes have further driven the segment's growth. Solutions such as Olympus's URF-V3 and Karl Storz's Flex-Xc are excellent examples of endoscopic technology innovation enhancing procedural efficiency and patient safety. This trend towards digital and disposable endoscopes also addresses infection control issues.

- Endoscopes are becoming increasingly prominent in healthcare for their potential to enable personalized and low-cost therapy. Improved ergonomics, reduced weight, and ease of use with digital platforms are making them more available in high-volume surgery centers and outpatient facilities.

Based on the application, the North America urology devices market is segmented into urolithiasis, urethral malignancies, bladder disorders, kidney diseases, erectile dysfunction, and other applications. The urolithiasis segment accounted for the highest market share of 31.7% in 2024, owing to the rising incidence of kidney stones, increasing adoption of minimally invasive stone removal techniques, and growing preference for outpatient lithotripsy procedures.

- While urolithiasis continues to dominate due to its acute and recurrent nature, the kidney diseases segment is also witnessing substantial growth. This is largely attributed to the increasing burden of chronic kidney conditions across North America. In Canada alone, approximately 1 in 10 individuals i.e. around 4 million people are affected by kidney disease, as reported in 2023. The number of people living with end-stage kidney disease (ESKD) has surged by 29% since 2012, with over 53,000 Canadians currently undergoing treatment. Alarmingly, kidney disease ranked as the 11th leading cause of death in Canada in 2020, and 76% of the 4,043 Canadians on the organ transplant waiting list are waiting for a kidney.

- This growing prevalence of kidney-related conditions is significantly amplifying the demand for urology devices. Chronic kidney diseases often require repeat diagnostics, follow-up imaging, and secondary interventions, which in turn sustain long-term utilization of ureteroscopes, stone retrieval baskets, and high-powered laser systems across both hospital and ambulatory care settings.

- Moreover, the increasing incidence of kidney failure among younger populations is further accelerating the need for advanced and minimally invasive urology solutions. In Canada, 45% of new ESKD patients are under the age of 65, highlighting the urgency for innovative technologies that can support early intervention and long-term management.

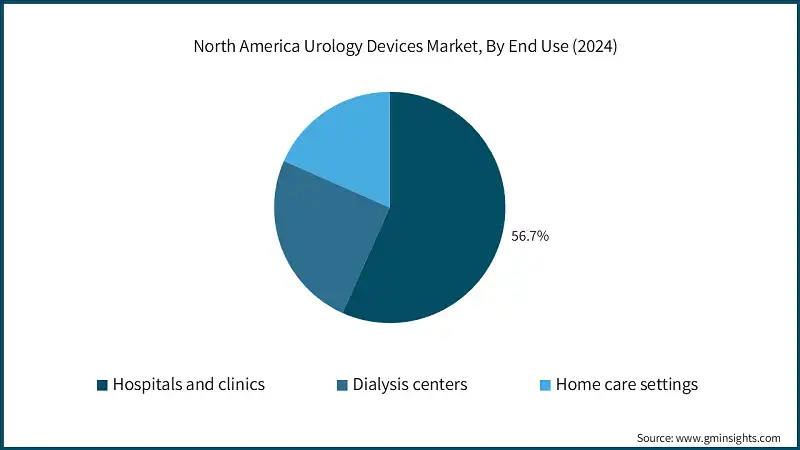

Learn more about the key segments shaping this market

Based on the end use, the North America urology devices market is segmented into hospitals and clinics, dialysis centers, and home care settings. The hospitals and clinics segment accounted for 56.7% market share in 2024, driven by the high volume of urological procedures performed in clinical settings, availability of advanced infrastructure, and growing preference for specialized care and minimally invasive treatments.

- In North America, hospitals and specialty clinics continue to lead the urology devices market, serving as the central hubs for both complex surgical procedures and the management of urologic malignancies. Their integrated infrastructure and advanced diagnostic capabilities position them as the preferred choice for both urgent interventions and scheduled treatments.

- These facilities maintain a competitive edge due to their capacity to handle large patient volumes, perform technologically advanced minimally invasive surgeries, and provide comprehensive post-operative care. Their readiness to adopt next-generation urology technologies further reinforces their dominance in the market.

- Moreover, the availability of highly trained medical personnel, including urologists, anesthesiologists, and specialized nursing teams, ensures the effective deployment of sophisticated equipment and adherence to best-practice clinical protocols. This skilled workforce plays a critical role in optimizing patient outcomes and enhancing procedural efficiency.

Looking for region specific data?

The U.S. dominated the North America urology devices market with the highest market share of 92.5% in 2024.

- The U.S. urology devices market was valued at USD 11.9 billion and USD 12.7 billion in 2021 and 2022, respectively. In 2024, the market size increased to USD 14.4 billion from USD 13.5 billion in 2023. This growth is primarily attributed to the increased demand for minimally invasive procedures, technological advancements in urological diagnostics and therapeutics.

- U.S. benefits from a robust healthcare ecosystem, characterized by advanced clinical infrastructure, favorable reimbursement policies, and the presence of leading MedTech innovators such as Boston Scientific, Olympus, and Cook Medical. These companies continue to invest heavily in R&D, driving the development of next-generation urology devices and expanding their clinical applications.

- A key market driver is the high prevalence of chronic kidney disease (CKD), which affects more than 1 in 7 U.S. adults, an estimated 35.5 million Americans. Despite its widespread impact, nearly 90% of individuals with CKD remain undiagnosed, highlighting a critical gap in early detection and preventive care. This has led to increased demand for advanced diagnostic tools, screening programs, and integrated care models that support early intervention.

- Furthermore, the U.S. market is supported by a growing emphasis on value-based care, which encourages the adoption of cost-effective, patient-centric technologies. The integration of digital health platforms, remote monitoring systems, and AI-assisted diagnostics is transforming urology practices, improving access to care and enhancing clinical outcomes.

The Canada urology devices market accounted for USD 1.2 billion in 2024.

- In Canada, the rising prevalence of urological disorders, particularly chronic kidney conditions, is a key factor driving market expansion. According to the national health data, more than 53,000 Canadians are currently receiving treatment for kidney failure, reflecting a growing demand for advanced diagnostic and therapeutic urology devices. This burden is further intensified by the increasing incidence of end-stage kidney disease and the high proportion of patients awaiting kidney transplants.

- Canada’s healthcare system supports this growth through publicly funded initiatives aimed at improving access to minimally invasive surgical technologies and robotic-assisted procedures. These reforms are enhancing the adoption of next-generation urology devices across hospitals and specialty clinics.

- Additionally, Canada's regulatory environment, governed by Health Canada, emphasizes patient safety and clinical efficacy, fostering confidence among healthcare providers and accelerating the approval of innovative medical technologies. The combination of a strong public health infrastructure, targeted funding, and a rising clinical need positions Canada as a promising market for urology device manufacturers.

North America Urology Devices Market Share

- In North America, the urology devices market is shaped by a mix of established leaders and emerging innovators. Boston Scientific Corporation, Olympus Corporation, Cook Medical, Intuitive Surgical, and Teleflex collectively account for approximately 36% of the regional market share, reflecting a moderately consolidated landscape. These companies maintain their competitive positions through a combination of advanced product offerings, strategic partnerships, and sustained investment in minimally invasive and robotic technologies.

- Boston Scientific continues to lead with its LithoVue single-use digital ureteroscope, widely adopted for kidney stone procedures. Its emphasis on disposable solutions supports hospital infection control protocols and cost-effective care delivery.

- New entrants are gaining traction with single-use cystoscopes, designed for infection control and cost-efficiency in ambulatory settings. Their solutions are particularly suited for high-volume clinical environments.

- Other notable players such as Coloplast, NIPRO, Richard Wolf, and Siemens Healthineers contribute to the market with specialized offerings in continence care, endoscopy, and diagnostic imaging, further diversifying the competitive landscape.

North America Urology Devices Market Companies

A few of the prominent players operating in the North America urology devices industry include:

- Ambu

- B. Braun

- Boston Scientific Corporation

- Coloplast

- Cook Medical

- Intuitive Surgical

- Laborie Medical Technologies

- NIPRO

- Olympus Corporation

- Richard Wolf

- Siemens Healthineers

- Teleflex

- Olympus Corporation

Olympus plays a pivotal role in the North American urology space through its VISERA ELITE III visualization platform, which supports a broad range of procedures including lithotripsy, BPH interventions, and soft tissue surgeries. The company’s regional strategy emphasizes high-definition imaging, advanced energy systems, and infection control. Olympus continues to strengthen its footprint in hospitals and ambulatory surgical centers by offering integrated diagnostic and therapeutic solutions. Its renewed focus on sustainability and clinical innovation underpins its long-term growth objectives in urology.

Intuitive Surgical leads the robotic-assisted urology segment in North America with its Da Vinci Surgical System, widely adopted for prostate, kidney, and bladder procedures. The company’s value proposition lies in its end-to-end ecosystem combining robotic platforms, real-time analytics, and surgeon education programs. Its ongoing enhancements in precision, ergonomics, and workflow integration have made it a preferred choice for minimally invasive urologic surgeries across major health systems.

Coloplast has established a strong presence in the North American market through its specialized offerings in continence care and catheter-based solutions. Its flagship SpeediCath product line is recognized for user-friendly design, patient comfort, and reduced infection risk. The company’s focus on long-term urological care particularly for individuals with neurogenic bladder, spinal cord injuries, and chronic conditions positions it as a leader in home and outpatient care segments. Coloplast’s patient-centric model and clinical support programs continue to drive adoption across the region.

North America Urology Devices Industry News

- In April 2022, Baxter International Inc. received U.S. FDA clearance for its ST Set, designed for use in continuous renal replacement therapy (CRRT). This regulatory milestone reinforces Baxter’s commitment to advancing acute kidney care solutions in critical care settings. The ST Set is engineered to streamline therapy delivery and enhance patient safety, supporting clinicians in managing acute kidney injury with greater efficiency. The clearance strengthened Baxter’s renal portfolio and aligned with its broader strategy to expand access to life-sustaining therapies across U.S. hospitals.

The North America urology devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Product Type

- Product

- Accessories

- Endoscopes

- Cystoscopes

- Disposable

- Reusable

- Ureteroscopes

- Disposable

- Reusable

- Cystoscopes

- Laser and lithotripsy devices

- Dialysis devices

- Other products

- Endoscopes

- Accessories

- Catheters

- Stents

- Lubricants and gels

- Other accessories

Market, By Application

- Urolithiasis

- Urethral malignancies

- Bladder disorders

- Kidney diseases

- Erectile dysfunction

- Other applications

Market, By End Use

- Hospitals and clinics

- Dialysis centers

- Home care settings

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Who are the key players in the North America urology devices market?

Key players include Boston Scientific Corporation, Olympus Corporation, Cook Medical, Intuitive Surgical, Teleflex, Coloplast, B. Braun, Laborie Medical Technologies, NIPRO, Richard Wolf, Siemens Healthineers, and Ambu.

Which country leads the North America urology devices market?

The U.S. dominated the market with a 92.5% share, valued at USD 14.4 billion in 2024. Growth is fueled by a high burden of chronic kidney disease, robust healthcare infrastructure, and strong presence of leading MedTech innovators.

What are the upcoming trends in the North America urology devices industry?

Key trends include increasing adoption of robotic-assisted surgeries, AI-based diagnostic imaging, disposable single-use scopes for infection control, and rising demand for outpatient & home-based urology solutions.

What was the valuation of hospitals & clinics end-use segment in 2024?

Hospitals and clinics held 56.7% market share in 2024. Their dominance stems from high patient volumes, advanced infrastructure, and increasing preference for minimally invasive treatments.

What is the growth outlook for accessories from 2025 to 2034?

The accessories segment is projected to grow at a CAGR of 7% till 2034.

How much revenue did the product segment generate in 2024?

The product segment generated 30.7% market share in 2024, driven by high adoption of endoscopes, lithotripsy systems, and dialysis devices.

What is the projected value of the North America urology devices industry by 2034?

The North America urology devices market is expected to reach USD 30.9 billion by 2034, supported by technological advancements in robotic-assisted surgeries, AI-enabled diagnostics, and the shift toward outpatient and home-based care.

What is the current North America urology devices market size in 2025?

The market size is projected to reach USD 16.7 billion in 2025.

What is the market size of the North America urology devices market in 2024?

The market size was USD 15.6 billion in 2024, with a CAGR of 7.1% expected through 2034 driven by the rising prevalence of urological disorders and increasing adoption of minimally invasive procedures.

North America Urology Devices Market Scope

Related Reports