Summary

Table of Content

North America Sugarcane Tableware Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Sugarcane Tableware Market Size

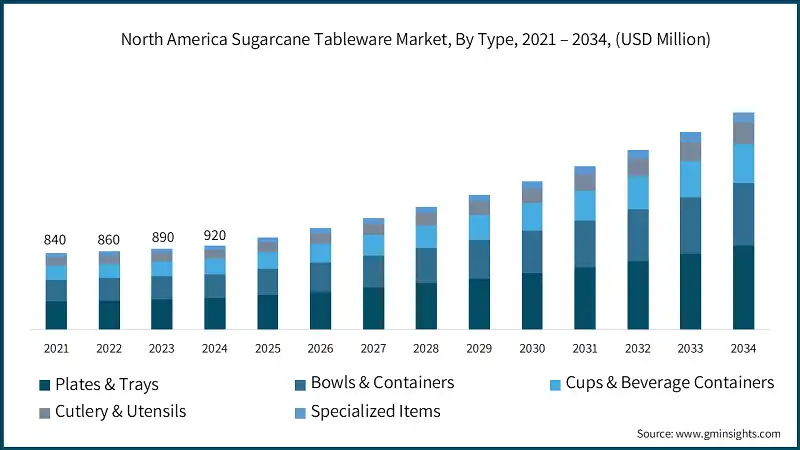

The North America sugarcane tableware market was estimated at USD 920 million in 2024. The market is expected to grow from USD 1.01 billion in 2025 to USD 2.4 billion in 2034, at a CAGR of 10% according to latest report published by Global Market Insights Inc.

To get key market trends

The FDA’s February 2024 announcement eliminating PFAS-based grease-proofing agents from U.S. food packaging has triggered a rapid shift in material sourcing across the foodservice industry. This regulatory milestone, reinforced by state-level PFAS bans, has created a significant market opportunity for biodegradable alternatives. Sugarcane bagasse tableware is emerging as a preferred solution due to its natural grease resistance, compostability, and alignment with sustainability goals.

As restaurants, QSRs, and packaging suppliers seek PFAS-free options, sugarcane products offer a compliant and eco-friendly substitute. The market is further propelled by consumer demand for safer, plastic-free dining experiences and corporate ESG commitments. With technological improvements enhancing durability and performance, sugarcane tableware is well-positioned to capture growing demand in North America. This transformation marks a pivotal moment for bio-based disposables, turning regulatory pressure into a catalyst for innovation and market expansion.

The awareness of consumers regarding environmental challenges has increased, which has had a ripple effect on purchasing behavior in North America. Today's consumers prefer brands and organizations that take environmental responsibility seriously, thus creating demand for biodegradable and compostable tableware. Sugarcane tableware presents a powerful story of the transition of waste to value and is in line with eco-conscious buyers. This phenomenon is particularly relevant in food service and hospitality where sustainability is now an element of customer loyalty. A growing focus on green credentials has assisted sugarcane tableware transition from a niche product to a mainstream product which helps sustain further and continued adoption.

According to the U.S. Environmental Protection Agency (EPA), over 35 million tons of plastic waste were generated in 2021, with less than 10% being recycled. This alarming statistic underscores the urgency for sustainable alternatives, positioning sugarcane tableware as a viable and scalable solution. The regulatory push is a structural driver that embeds sustainability into procurement strategies, ensuring long-term market growth.

The rapid growth of quick-service restaurants, cloud kitchens, and food delivery service has increased the demand for disposable but sustainable ware. Products made from sugarcane provide durability, heat resistance, and appearance like traditional plasticware. In addition, enhancements in manufacturing technology have improved product quality and decreased production costs, increasing competitive advantage against traditional materials.

The U.S. leads the North American sugarcane tableware market due to strong regulatory frameworks, high consumer awareness, and a mature foodservice industry. Its large-scale adoption of sustainable practices amplifies demand for eco-friendly disposables. Simultaneously, the plates and trays segment dominates because of their widespread use in restaurants, catering, and takeout services. These products offer durability and versatility, making them essential for quick-service and delivery models. Together, U.S. leadership and segment dominance create a synergistic effect, accelerating market expansion through high-volume consumption and innovation in product design, reinforcing sustainability as a core purchasing criterion.

North America Sugarcane Tableware Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 920 Million |

| Market Size in 2025 | USD 1.01 Billion |

| Forecast Period 2025 - 2034 CAGR | 10% |

| Market Size in 2034 | USD 2.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| PFAS-Free Regulation Spurs Demand for Sustainable Tableware | The FDAs February 2024 announcement eliminating PFAS-based grease-proofing agents from U.S. food packaging has triggered a rapid shift in material sourcing across the foodservice industry. |

| Rising consumer preference for eco-friendly products | Consumer awareness of environmental issues has surged, influencing purchasing behavior across North America. Modern consumers increasingly favor brands and establishments that demonstrate environmental responsibility, creating a demand pull for biodegradable and compostable tableware. |

| Expansion of foodservice industry and technological advancements | The rapid growth of quick-service restaurants, cloud kitchens, and food delivery platforms has amplified the need for disposable yet sustainable tableware. Sugarcane products meet this demand by offering durability, heat resistance, and aesthetic appeal comparable to traditional plastics. |

| Pitfalls & Challenges | Impact |

| High production costs compared to conventional alternatives | Sugarcane tableware manufacturing involves specialized processes to convert bagasse into durable, food-grade products. These steps require advanced machinery and quality control measures, which increase operational expenses compared to traditional plastic or paper alternatives. |

| Limited consumer awareness and adoption in certain segments | Despite growing environmental consciousness, consumer awareness of sugarcane-based tableware remains uneven across North America. Many end-users are unfamiliar with its benefits, such as biodegradability and compostability, leading to slower adoption outside urban and eco-conscious regions. |

| Opportunities: | Impact |

| Growing retail penetration of eco-friendly products | Smart packaging equipment offers traceability, freshness control and consumer interaction. These value-added features pertain to premium agricultural products, as well as traceability/compliance with export markets. |

| Strategic partnerships with foodservice giants | Sustainability-compliant packaging lines provide manufacturers competitive advantages by aligning with global sustainability requirements and offering compliance benefits for years to come. |

| Market Leaders (2024) | |

| Market Leaders |

26% market share |

| Top Players |

The collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | U.S. |

| Emerging Country | Canada |

| Future Outlook |

|

What are the growth opportunities in this market?

North America Sugarcane Tableware Market Trends

The North America sugarcane tableware industry is evolving rapidly, driven by sustainability imperatives and changing consumer preferences. Businesses are adopting eco-friendly solutions to comply with regulations and enhance brand reputation. Key trends highlight technological innovation, retail expansion, and the growing influence of foodservice channels, shaping the industry’s future trajectory.

- Surge in sustainable packaging adoption: sustainability has become a core business priority, influencing procurement decisions across foodservice and hospitality sectors. Sugarcane tableware, made from bagasse, offers a biodegradable alternative to plastics, aligning with environmental mandates and corporate ESG goals. This trend is reinforced by government regulations and consumer demand for eco-friendly products, positioning sugarcane tableware as a mainstream solution rather than a niche offering.

- Technological advancements in manufacturing: manufacturers are investing in advanced molding techniques and material engineering to improve product durability, heat resistance, and moisture control. These innovations address performance concerns and make sugarcane tableware suitable for diverse applications, including hot meals and liquids. Automation and optimized supply chains are reducing costs, enhancing scalability, and narrowing the price gap with conventional plastics.

- Expansion of food delivery and quick-service channels: the rapid growth of food delivery platforms and quick-service restaurants is fueling demand for disposable yet sustainable tableware. Sugarcane plates, trays, and clamshell containers are increasingly preferred for their strength and compostability. As urbanization and lifestyle changes drive QSR proliferation, sugarcane tableware emerges as a strategic enabler for businesses balancing convenience with sustainability.

North America Sugarcane Tableware Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is divided into plates & trays, bowls & containers, cups & beverage containers, cutlery & utensils, and specialized items. In 2024, plates & trays held the major market share, generating a revenue of USD 340 million.

- The plates and trays segment holds a dominant position in the North America sugarcane tableware market due to its extensive application across foodservice channels, catering, and takeout services. These products offer superior functionality, including strength, heat resistance, and compostability, making them ideal for quick-service restaurants and delivery platforms.

- Their versatility in serving both solid and liquid meals enhances operational efficiency for businesses seeking sustainable solutions. Additionally, consumer preference for eco-friendly disposables in everyday dining and large-scale events further amplifies demand. This dominance is expected to persist as sustainability regulations tighten, and foodservice operators prioritize environmentally responsible packaging alternatives.

Learn more about the key segments shaping this market

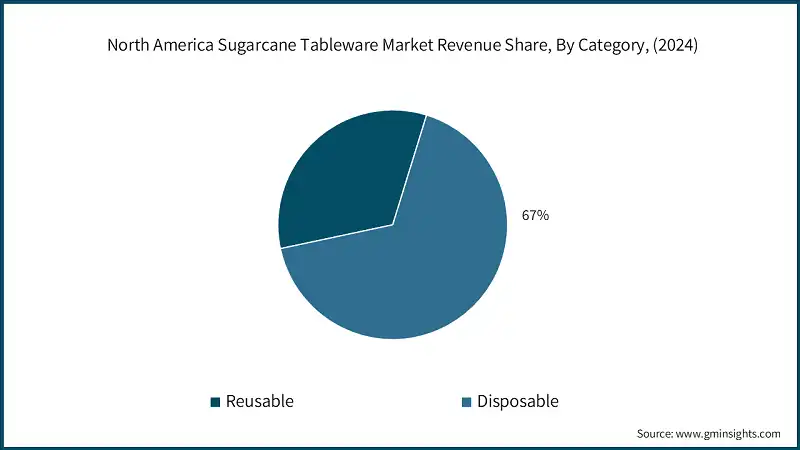

Based on category, the North America sugarcane tableware market is segmented into reusable and disposable. The disposable segment held the largest share, accounting for 67% of the market in 2024.

- The disposable segment leads the North America sugarcane tableware industry primarily due to its convenience and alignment with sustainability goals. Foodservice operators, catering businesses, and quick-service restaurants increasingly prefer disposable sugarcane products to meet hygiene standards and reduce operational complexities.

- These products offer a practical solution for single-use applications while ensuring environmental compliance, as they are biodegradable and compostable. Rising consumer demand for eco-friendly disposables in takeout and delivery services further strengthens this segment’s position. With growing regulatory pressure against plastics and heightened awareness of green alternatives, the disposable category is expected to maintain its dominance and drive overall market growth.

Based on distribution channel, the North America sugarcane tableware market is segmented online and offline. In 2024, offline held a major market share, accounting for more than 60% of the market in 2024.

- The offline distribution channel dominates the North America sugarcane tableware market due to strong penetration in traditional retail and wholesale networks. Restaurants, catering services, and institutional buyers prefer offline purchasing for bulk orders, immediate availability, and quality assurance. Physical stores and distributors offer personalized service, enabling businesses to evaluate product durability and compliance before procurement.

- Additionally, offline channels facilitate better negotiation on pricing and logistics, which is critical for large-scale operations. Despite the rise in e-commerce, offline networks remain the preferred choice for foodservice operators seeking reliability and quick turnaround, reinforcing their leadership in market share.

Looking for region specific data?

North America Sugarcane Tableware Market

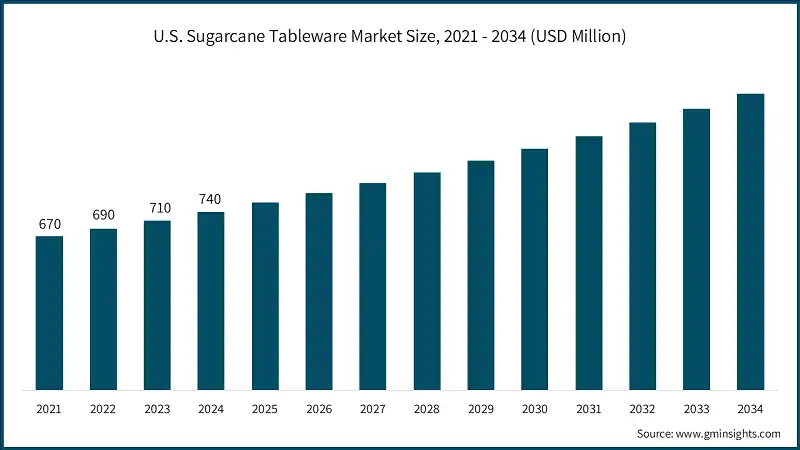

In 2024, the U.S. dominated the market, accounting for around 80% and generating around USD 740 million revenue in the same year.

- The U.S. holds a dominant share in the North America sugarcane tableware market, driven by stringent environmental regulations and strong consumer demand for sustainable products. Federal and state-level bans on single-use plastics have accelerated the adoption of biodegradable alternatives, positioning sugarcane tableware as a preferred choice.

- Additionally, the U.S. foodservice industry, which includes quick-service restaurants, catering businesses, and large-scale institutional buyers, has embraced eco-friendly disposables to align with corporate sustainability goals. High purchasing power and advanced distribution networks further support market penetration. This leadership is expected to continue as sustainability becomes integral to business strategies and consumer expectations.

North America Sugarcane Tableware Market Share

Huhtamaki Group are leading with 26% market share. Huhtamaki Group, Eco-Products (Novolex), Sabert Corporation, World Centric, and Pactiv Evergreen collectively hold around 60%, indicating moderately fragmented market concentration.

Huhtamaki has established a strong foothold through its extensive range of molded fiber products, including plates and trays made from bagasse. Its commitment to innovation and sustainability aligns with regulatory trends, reinforcing its leadership in eco-friendly packaging. In 2024, Huhtamaki reported stable net sales with a slight volume increase and achieved a 6% rise in adjusted EBIT, supported by cost-saving initiatives and strategic investments in innovation. This financial resilience, combined with its global presence and focus on circular economy principles, positions Huhtamaki as a dominant player in the North American market.

Eco-Products, a Novolex brand, differentiates itself through a comprehensive portfolio of compostable molded fiber dinnerware and take-out containers. Its Vanguard and Veridian collections cater to grease-resistant and regulatory-compliant needs, making it a preferred choice for foodservice operators. As a Certified B Corporation, Eco-Products emphasizes social and environmental impact, which strengthens its brand equity. The company’s consistent growth in sustainable packaging and its proactive approach to contamination mitigation programs further enhance its market positioning, ensuring strong performance in the expanding eco-friendly segment.

Sabert leverages over four decades of expertise in food packaging innovation, offering a diverse range of compostable products under its Green Collection. Its proprietary Packaging Value Model ensures high standards of safety, performance, and sustainability. With annual revenues exceeding $900 million and a workforce of over 2,000 employees, Sabert demonstrates robust financial strength. Strategic acquisitions, such as LBP Manufacturing LLC, and continuous product innovation like EcoSnap™ containers underscore its commitment to sustainability and market leadership, making it a key driver in the sugarcane tableware segment.

World Centric focuses exclusively on compostable products, including plates, bowls, and trays made from bagasse. Its strong positioning stems from a mission-driven approach, allocating a portion of profits to social and environmental causes, which resonates with eco-conscious consumers and businesses. The company’s emphasis on design innovation and partnerships with foodservice providers has enabled steady growth. By aligning its product offerings with zero-waste goals and regulatory compliance, World Centric continues to strengthen its presence in North America’s sustainable tableware market.

North America Sugarcane Tableware Market Companies

Major players operating in the North America sugarcane tableware industry are:

- Be Green Packaging

- BioandChic

- BioMass Packaging

- Dart Container Corporation

- EccoCane

- Genpak

- Green Wave International

- Huhtamaki North America

- Inno-Pak/Stalk Market

- Mika International/MikaPak

- Pactiv Evergreen

- Sonoco Products Company

- Tellus Products LLC

- Vitaveg Eco Packaging

- WestRock/Smurfit WestRock

- World Centric

Pactiv Evergreen commands a significant share of the North American foodservice packaging market, supported by its extensive distribution network and diversified product portfolio. The company reported $5.5 billion in revenue in 2023, with adjusted EBITDA of $840 million, reflecting operational efficiency and strategic cost management. Its focus on plant-based materials, including bagasse, positions it well to capitalize on the growing demand for biodegradable tableware. Investments in production systems and sustainability initiatives further reinforce their competitive advantage in the sugarcane tableware segment.

North America Sugarcane Tableware Industry News

- In November 2025, Eco-Products expanded its Vanguard line of PFAS-free molded fiber products, addressing regulatory concerns and boosting its leadership in compostable tableware solutions for foodservice operators.

- In August 2025, Sabert introduced new bagasse-based plates and trays under its Green Collection, focusing on durability and compostability. This product expansion strengthens its competitive edge in sustainable packaging.

- In July 2025, World Centric announced collaborations with major quick-service restaurants to supply compostable sugarcane tableware, accelerating adoption of eco-friendly disposables across high-volume foodservice channels.

- In June 2023, Tellus Products announced that its entire Florida-made sugarcane tableware line has received BPI certification. This certification underscores the company's commitment to sustainable manufacturing practices and environmentally responsible products. Achieving BPI standards enhances market credibility, appeals to eco-conscious consumers, and aligns with global sustainability trends. The certification positions Tellus Products as a leader in eco-friendly tableware solutions within the competitive sustainable packaging industry.

The North America sugarcane tableware market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Type

- Plates & trays

- Round plates

- Square & rectangular plates

- Compartment plates

- Serving trays

- Bowls & containers

- Soup bowls

- Salad bowls

- Takeout containers

- Clamshell containers

- Cups & beverage containers

- Hot beverage cups

- Cold beverage cups

- Lids & accessories

- Beverage carriers

- Cutlery & utensils

- Forks

- Knives

- Spoons

- Serving utensils

- Specialized items

- Portion cups

- Condiment containers

- Food trays

- Custom applications

Market, By Category

- Reusable

- Disposable

Market, By End Use

- Residential

- Commercial

- Foodservice industry

- Catering & events

- Entertainment & recreation

- Others

Market, By Pricing

- Low

- Medium

- High

Market, By Distribution Channel

- Online

- E-commerce

- Company website

- Offline

- Hypermarkets/supermarkets

- Specialty stores

- Other retail stores

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

What is the market size of the North America sugarcane tableware industry in 2024?

The market size was USD 920 million in 2024, with a 10% CAGR projected for 2025–2034 driven by increasing demand for sustainable and PFAS-free foodservice packaging solutions.

What is the current North America sugarcane tableware market size in 2025?

The market size is projected to reach USD 1.01 billion in 2025.

What is the projected value of the North America sugarcane tableware market by 2034?

The market is expected to reach USD 2.4 billion by 2034, supported by strong regulatory pressure against plastics and rapid adoption of biodegradable tableware across foodservice operations.

How much revenue did the plates & trays segment generate in 2024?

The plates & trays segment generated USD 340 million in 2024, leading the market due to extensive use across restaurants, catering, and takeout formats.

What was the valuation of the disposable category in 2024?

The disposable category held 67% market share in 2024, reflecting rising demand for convenient, compostable products aligned with hygiene and sustainability requirements.

Which region leads the North America sugarcane tableware market?

The U.S. led the regional industry with around 80% share, generating approximately USD 740 million in 2024. Growth is supported by stringent environmental regulations, strong QSR penetration, and high consumer awareness of sustainable alternatives.

What are the upcoming trends in the North America sugarcane tableware industry?

Key trends include rising adoption of PFAS-free packaging, technological advancements improving durability and performance, and growing penetration of sustainable tableware in food delivery and quick-service channels.

Who are the key players in the North America sugarcane tableware market?

Major players include Huhtamaki Group, Eco-Products (Novolex), Sabert Corporation, World Centric, Pactiv Evergreen, Be Green Packaging, Genpak, EccoCane, BioMass Packaging, Tellus Products LLC, and WestRock/Smurfit WestRock.

North America Sugarcane Tableware Market Scope

Related Reports