Summary

Table of Content

North America Pots and Planters Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Pots and Planters Market Size

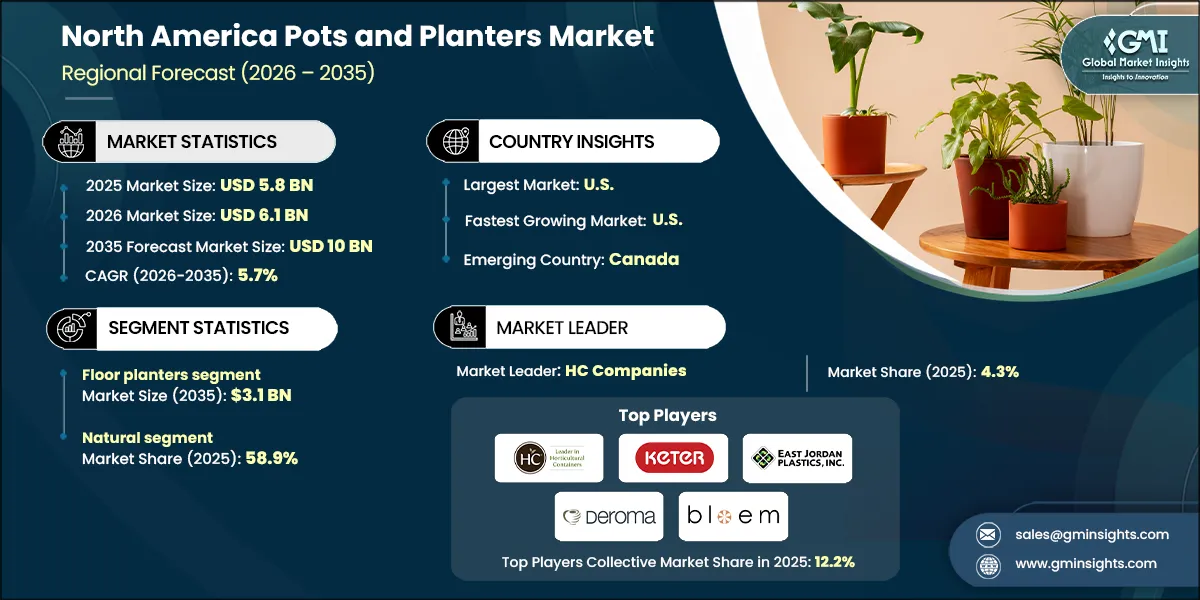

The North America pots and planters market was valued at USD 5.8 billion in 2025. The market is expected to grow from USD 6.1 billion in 2026 to USD 10 billion in 2035, at a CAGR of 5.7%, according to latest report published by Global Market Insights Inc.

To get key market trends

The North American market for pots and planters is experiencing tremendous growth due to the increased popularity of urban gardens and home decoration. This change in preference has resulted in a growing demand for functional and clearly designed indoor planters. According to the United States Department of Agriculture (USDA), there has been an ongoing increase in urban gardening programs, helping to fuel the continued growth of this area of the economy.

The increasing popularity of environmentally friendly products is also driving growth in this market. An increasing number of consumers are seeking plans made from sustainable materials such as bamboo, recycled plastic, and terracotta and are willing to pay extra for these types of products. The Sustainable Furnishings Council (SFC) indicates that there has been a 25% increase in demand for sustainable furnishings within the last two years, which supports the global objective of sustainability.

Companies like The Sill and Bloomscape are taking advantage of this by selling more indoor planters than ever before. In addition to these two companies, a number of government agencies are creating programs to promote urban gardening, which will help further support the growth of this market. According to The National Gardening Association (NGA), by the year 2026, more than 30 percent of the urban populace of the U.S.A. will have engaged in indoor horticulture, demonstrating the ongoing appeal of this type of horticulture.

The rise in urbanization along with a focus on sustainable development, will grow demand & growth within the industry therefore allowing for increased competition & better options for customers over the past decade as more consumers become interested in low-maintenance gardening solutions. Through the use of product developments such as self-watering planters introduced by Lechuza as well as eco-friendly options introduced by Elho, it will provide customers with additional access to products that meet their specific needs.

North America Pots and Planters Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Size in 2026 | USD 6.1 Billion |

| Forecast Period 2026-2035 CAGR | 5.7% |

| Market Size in 2035 | USD 10 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Urbanization and small-space gardening trends | Growing urban density in North America is increasing demand for compact, modular, and balcony friendly planters that maximize limited living spaces. |

| Rising demand for sustainable and eco-friendly products | Consumers are increasingly choosing pots and planters made from recycled plastics, bio composites, and other low impact materials. |

| Increase in DIY gardening and landscaping projects | The surge in home improvement and DIY gardening habits is strengthening demand for easy to assemble, self-watering, and beginner-friendly planter solutions. |

| Pitfalls & Challenges | Impact |

| Changing consumer preferences and trends | Intense market competition limits pricing flexibility, pushing brands to differentiate through design and value-added features. Margins remain under pressure. |

| Counterfeit and imitation products | Sales peak during spring and summer, creating revenue fluctuations and inventory challenges. Off-season demand remains relatively weak. |

| Opportunities: | Impact |

| Growth in sustainable and eco-friendly socks | Eco-conscious consumers present a major opportunity for brands offering certified green products. Marketing sustainability can drive premium positioning. |

| Expansion of smart and functional socks | Smart and self-watering planters cater to urban lifestyles and commercial spaces, reducing maintenance needs. This segment offers strong innovation-led growth. |

| Market Leaders (2025) | |

| Market Leader |

4.3% market share |

| Top Players |

Collective market share in 2025 is 12.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest growing market | U.S. |

| Emerging countries | Canada |

| Future outlook |

|

What are the growth opportunities in this market?

North America Pots and Planters Market Trends

Changing innovation and technology transformation are important for the growth of the North America pots and planters market.

- Urban dwellers have become interested in vertical gardening in an effort to adapt to their small living environments; this trend is causing the development of more integrated and compact planter designs by the manufacturers. Integrated and compact designs will allow people who wish to take advantage of their limited garden space to do so efficiently.

- New environmentally friendly materials, including bamboo and recycled plastics, have become a strong selling point for consumers and are driving the trend of using sustainable products. The U.S. EPA has developed several initiatives to encourage people to make use of recycled materials, which coincides with consumers' interest in having more environmentally responsible gardening options.

- As a result of the environmental and consumer trends described above, many leading brands in the industry have identified an opportunity to create new, innovative products. One example is EcoForms, which produces compostable planters. Remarkably, Bloem also produces planters from recycled items. The introduction of innovative products like these will shape the future of the industry based on satisfying environmental and consumer demands.

- The rise of online marketplaces have shaped current trends in North America. According to the National Gardening Association, online marketing and social media advertisements have played a critical role in improving consumer awareness of sustainable gardening practices. Through social platforms such as Instagram and Pinterest, consumers have been introduced to many new and/or innovative eco-friendly planter designs that match consumer preferences and sustainability objectives.

- In addition, Government-sponsored initiatives in North America are helping support the growth of the market as well- These programs, along with the growing demand from consumers for space-efficient and environmentally friendly products, will create growth opportunities for the market during the forecast period.

North America Pots and Planters Market Analysis

Learn more about the key segments shaping this market

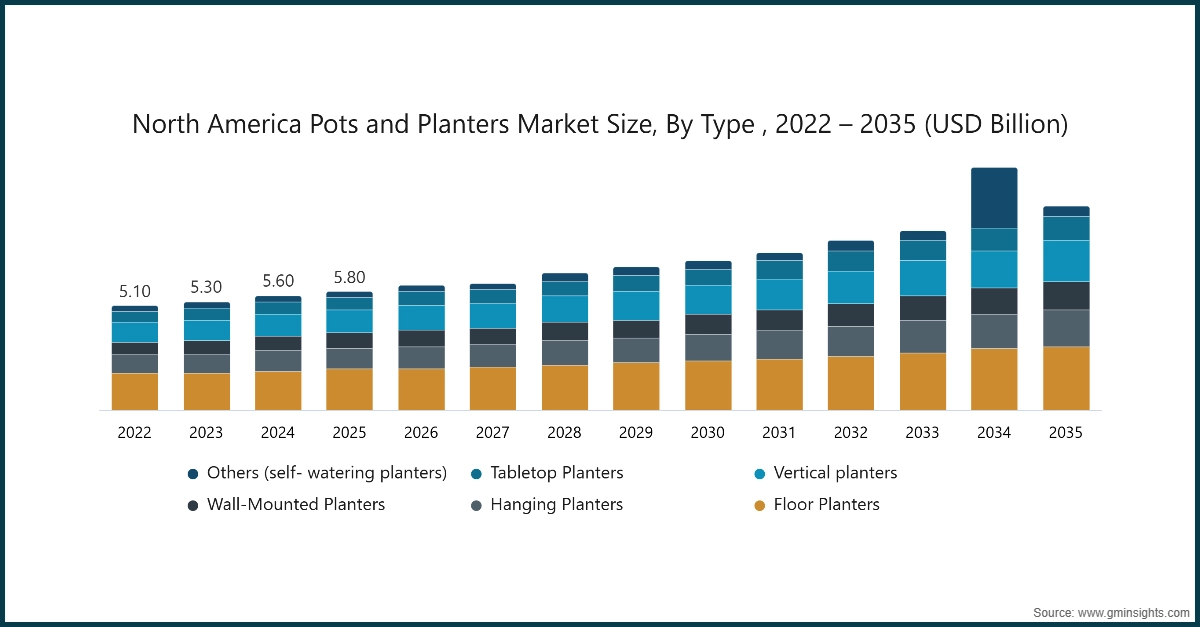

Based on type, the pots and planters industry is segmented into floor planters, hanging planters, wall-mounted planters, tabletop planters, vertical planters and others (self-watering plants, etc.). The floor planters segment accounts for revenue of around USD 2 billion in the year 2025 and is expected to reach USD 3.1 billion by 2035.

- North America's floor planter market is experiencing rapid growth due to the versatility and professional nature of these products. Government programs and associations have also promoted the use of floor planters to increase the visibility of the benefits of this product range. For example, the U.S. Environmental Protection Agency's (EPA) Indoor Air Quality (IAQ) Program has been promoting indoor plants in order to improve indoor air quality.

- The EPA IAQ Program estimates that indoor air pollution levels can be 2-5 times higher than those found outdoors, whereas the placement of vegetation within the home can dramatically improve indoor air quality. Floor planters are meeting the increasing demand for plant containers in North America. Manufacturers such as Lechuza and Crescent Garden are responding to the increased demand for indoor plants with innovative products.

- The Green Infrastructure Program (GIP)a Canada government program worth USD 9.2 billion, is focused on urban greening and sustainability and encourages the use of planters in cities, as a means of providing additional green space. Lechuza has recently developed self-watering floor planters which provide a low-maintenance maintenance product for their customers. Further Crescent Garden is gaining popularity with their lightweight weatherproof planters because of their combination of elegance and utility.

- The growing trend toward customization among consumers regarding their choices for floor planters is creating significant new interest among North American consumers to be able to purchase floor planters in a variety of different materials such as ceramics, metals, plastics, in many different shapes and sizes and in many different colours. This ability to select floor planters that fit seamlessly with various design styles is critical to meeting the diverse and growing preferences of the consumer base in the region.

- Through continued support from the government and a growing demand from consumers for functional and innovative products, we anticipate that the floor planters segment will retain its dominant market position in the North America pots and planters market throughout the duration of the forecast.

Learn more about the key segments shaping this market

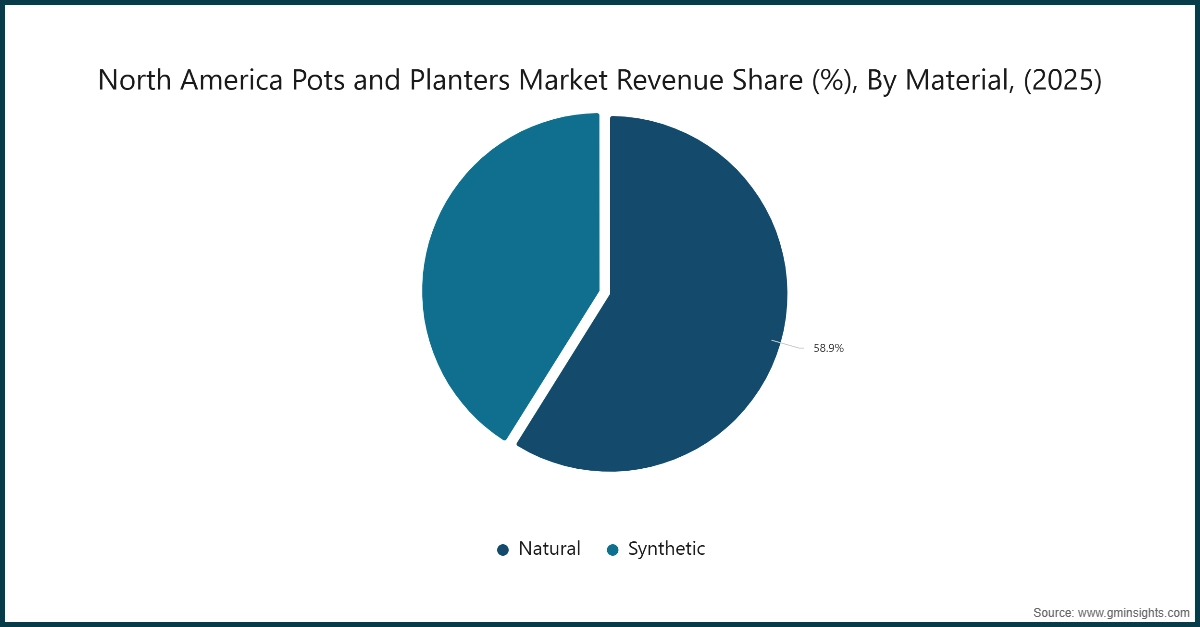

Based on the materials, the North America pots and planters' market is bifurcated into natural and synthetic. The natural segments held the largest share, accounting for 58.9% of the North America pots and planters market in 2025.

- There has been an increase in the segment of pots & planters produced using natural materials within the material category of pots & planters. This is due, in part, to the increase of consumer interest in eco-friendly and sustainable products and government initiatives and/ or acts designed to assist consumer choice. An example of this is the United States Department of Agriculture (USDA) BioPreferred Program, which lists over 16,000 certified bio-based products.

- Furthe, Canada’s Zero Plastic Waste Initiative, which is part of Ocean Plastics Charter that aims to eliminate plastic waste completely by 2030. This initiative promotes the use of biodegradable and natural materials and therefore has helped to boost demand for planters produced using sustainable materials.

- Manufacturers across North America are developing innovative products to meet this consumer demand. For example, EcoForms produces a line of biodegradable planters made from renewable plant by-products. Their planters have become very popular with consumers who are environmentally conscious. Similarly, Root Pouch produces planters made from recycled natural fiber, which combines sustainability with durability and functionality.

- The Environmental Protection Agency (EPA) estimated that in 2022, about 292.4 million tons of municipal solid waste were generated by Americans. Of that total, approximately 12.2% of that waste is made up of plastics. Increased awareness of how synthetic materials affect the environment has resulted in consumers wanting to make better purchases and use more natural products.

- The natural materials segment of the pots and planters industry in North America will continue to lead the market through the forecast period due to strong government support programs such as the USDA’s BioPreferred program and Canada’s zero plastic waste program as well as increasing consumer awareness about sustainability.

Looking for region specific data?

U.S. Pots and Planters Market

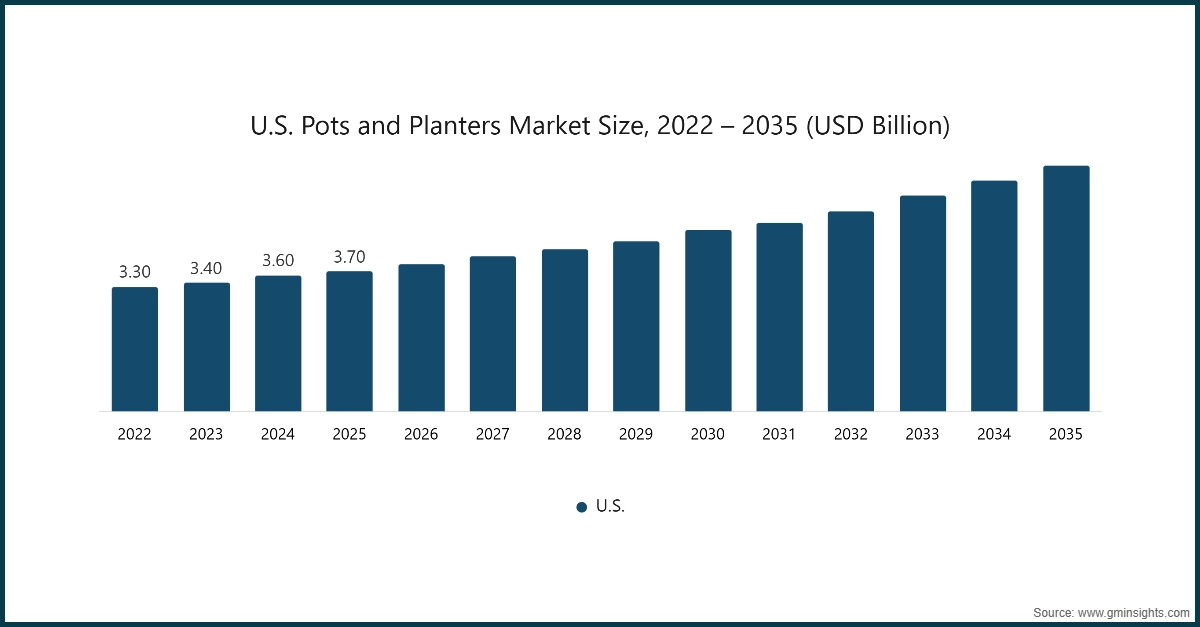

In 2025, the U.S. dominated the pots and planters market growth in North America, accounting for 64.4% of the share in the region.

- The U.S. dominates the North America pots and planters market due to strong demand from residential landscaping and urban gardening trends. Rising home improvement spending and popularity of indoor plants have boosted sales significantly. Government initiatives promoting sustainable landscaping and water-efficient gardening also support market expansion. Additionally, the presence of major retailers and e-commerce platforms ensures easy product accessibility.

- According to the U.S. Census Bureau, residential construction spending reached over USD 980 billion in 2025, reflecting a surge in home improvement projects that often include garden and patio enhancements. This trend directly drives demand for decorative and functional pots and planters.

Canada Pots and Planters Market

Canada pots and planters market is expected to grow at 5.6% during the forecast period.

- Canada’s pots and planters market is growing largely due to rising home gardening and urban lifestyle trends, especially as consumers prioritize indoor plants and balcony gardens for wellness and décor. Demand is further fueled by increasing adoption of lightweight, durable, and weather‑resistant resin and recycled‑material planters. Retail expansion through home improvement chains and e‑commerce is making stylish, functional planters more accessible nationwide.

North America Pots and Planters Market Shares

The top companies in the North America pots and planters market include HC Companies, Keter, East Jordan Plastics, Deroma and Bloem Living and collectively hold a share of 12.2% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Keter Group is a leading producer of resin-based planters, including self-watering and wood-look outdoor containers, widely available through major retailers like Amazon and Walmart. The brand emphasizes durable, weather-resistant materials and modular designs that appeal to both home and commercial gardeners. By combining functional innovation with accessible distribution, Keter secures a strong market foothold in the self-watering planter segment.

- The HC Companies specialize in horticultural containers for greenhouse, nursery, and consumer markets across North America. Their product offerings include round and square planters, trays, and self-watering pots, distributed widely through a robust network of distributors and retailers like Lowe’s, Walmart, Amazon, Target, and Wayfair. HC Companies emphasize smart growing solutions tailored to professional growers and home gardeners alike.

- East Jordan Plastics is a leading U.S. manufacturer of horticultural containers, producing grower pots, hanging baskets, planters, bowls, and plug trays for greenhouse and nursery markets. Their "Shuttle" line includes durable injection‑molded and thermoformed containers made from up to 100% recycled materials.

North America Pots and Planters Market Companies

Major players operating in the North America pots and planters industry are:

- Anderson Pots

- Belden Plastics

- Bloem Living

- Campania International

- Deroma

- East Jordan Plastics

- HC Companies

- Jay Scotts Collection

- Keter

- Novelty Manufacturing

- NYP Corporation

- Poppelmann

- TerraCast Products

- Tusco Products

- Urban Pot

Deroma is a Italian planter company active in the North America market with a wide assortment of terracotta, ceramic, and recycled‑plastic planters. Their products focus on high‑design indoor/outdoor pots, self‑watering planters, bowls, and decorative containers inspired by Italian craftsmanship. Deroma’s assortment includes recycled plastic Jacinto planters and traditional clay pots sold via major retailers. Their emphasis is on style, durability, and plant‑friendly materials.

Bloem Living is a U.S.‑based designer and manufacturer of resin planters, self‑watering pots, window boxes, hanging planters, and decorative containers. Their collection focuses on lightweight, UV‑resistant, all‑weather plastic planters made in the USA with growing emphasis on recycled materials. Bloem markets trend‑driven designs, color palettes, and retailer‑friendly merchandising solutions.

Pots and Planters Industry News

- In October 2025, Keter introduced an enhanced plendor Raised Garden Bed- with an upgraded self‑watering system featuring an improved water‑gauge design and advanced moisture‑control reservoir. The update was highlighted as a key innovation, offering better protection against root decay and over‑watering—making it especially appealing to busy and first‑time gardeners

- In June 2025, Keter and Tetra Pak introduced Cube Planters made from up to 98% recycled polyAl derived from used beverage cartons. Costco began stocking these eco‑friendly planters in UK stores after successful launches in Spain and Portugal. Each unit uses material from about 166 recycled cartons, advancing circular‑economy practices. The collaboration marks a sustainability milestone for the planters segment.

- In April 2025, The HC Companies and Classic Home & Garden announced their merger to launch Growscape, a unified brand serving growers, retailers, and distributors. The integration brings together U.S. manufacturing and global sourcing strengths for planters and décor. Leadership highlighted a focus on innovation, sustainability, and operational efficiency.

- In early 2025, HC Companies introduced a Low‑Profile Tray, an innovative, pre‑assembled horticultural tray using recycled polypropylene. The new design reduces labor, cuts material usage, and improves greenhouse handling efficiency. Its sustainability features align with growing industry demand for recyclable growing systems. This launch expands HC’s eco‑focused planter and tray portfolio for growers.

- In July 2024, East Jordan Plastics announced it had earned Post‑Consumer Recycled (PCR) Plastic Certification. The company strengthened its closed‑loop recycling program, which reprocesses millions of pounds of horticultural plastic annually. This milestone supports rising demand for recycled-content planters in North America. It reinforces

The North America pots and planters market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) volume (Million Units) (from 2022 to 2035), for the following segments:

Market, By Type

- Floor planters

- Hanging planters

- Wall-mounted planters

- Tabletop planters

- Vertical planters

- Others (self-watering planters)

Market, By Material

- Natural

- Terracotta

- Ceramic

- Clay

- Stone

- Wood

- Concrete

- Synthetic

- Plastic

- Fiberglass

- Others (recycled materials, etc.)

Market, By Price

- Low

- Medium

- High

Market, By Installation

- Interior space

- Exterior space

Market, By Category

- Smart

- Conventional

Market, By End Use

- Residential

- Commercial

- Institutes

- HoReCa

- Retail

- Healthcare

- Corporates

- Others (spa centers, airports and transportation hubs, etc.)

Market, By Distribution Channel

- Online

- E-Commerce

- Company website

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others (Individual stores, Departmental stores, etc.)

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

What was the market size of the North America pots and planters market in 2025?

The market size was valued at USD 5.8 billion in 2025, driven by increasing urban gardening trends and the adoption of sustainable materials.

What is the projected value of the North America pots and planters industry by 2035?

The market is expected to reach USD 10 billion by 2035, growing at a CAGR of 5.7%, fueled by innovations in compact planter designs and eco-friendly materials.

What is the projected size of the North America pots and planters market in 2026?

The market is expected to grow to USD 6.1 billion in 2026.

What was the market share of the floor planters segment in 2025?

The floor planters segment accounted for approximately USD 2 billion in revenue in 2025 and is projected to reach USD 3.1 billion by 2035.

Which country dominated the North America pots and planters market in 2025?

The United States led the market in 2025, holding a significant 64.4% share of the regional market.

What are the upcoming trends in the North America pots and planters industry?

Key trends include the rise of vertical gardening, the use of sustainable materials like bamboo and recycled plastics, and the development of innovative products such as compostable and recycled-material planters.

Who are the key players in the North America pots and planters market?

Major players include Anderson Pots, Belden Plastics, Bloem Living, Campania International, Deroma, East Jordan Plastics, HC Companies, Jay Scotts Collection, Keter, and Novelty Manufacturing.

North America Pots and Planters Market Scope

Related Reports