Summary

Table of Content

North America Microbrewery Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Microbrewery Equipment Market Size

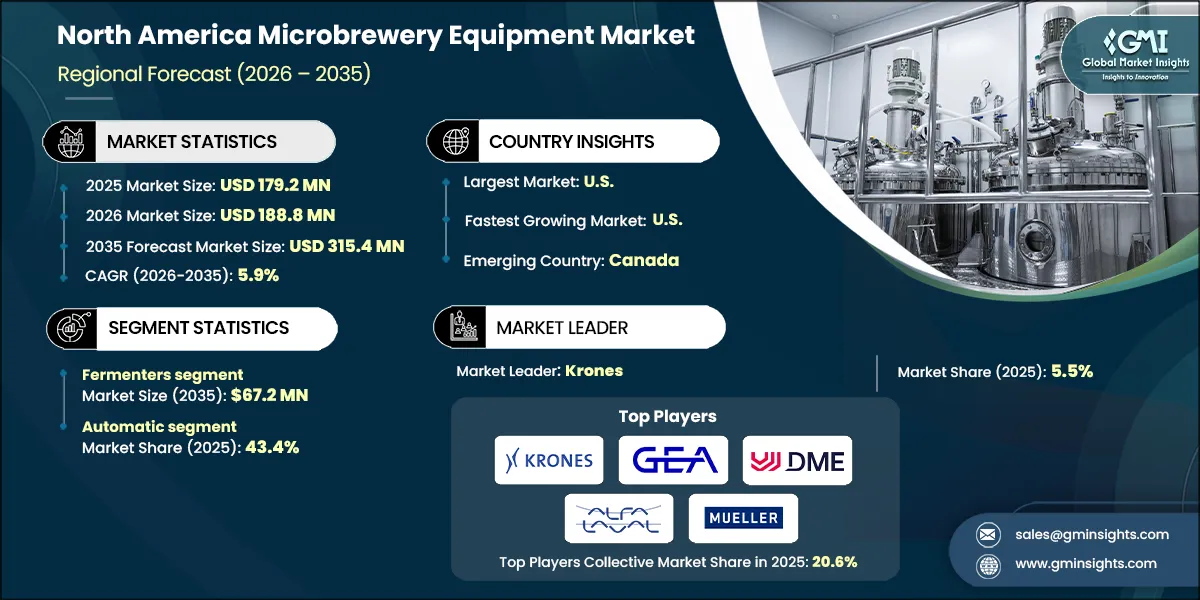

The North America microbrewery equipment market was valued at USD 179.2 million in 2025. The market is expected to grow from USD 188.8 million in 2026 to USD 315.4 million in 2035, at a CAGR of 5.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

The North American microbrewery equipment market is expanding due to increased interest in craft beer among consumers and growing numbers of microbreweries. Consumers in North America now want craft beverages produced locally and with unique flavours, which leads them to purchase new technology including fermenters, brewing kettles and mash tuns. By using this technology, craft brewers hope to improve their production processes and provide consistent high-quality products.

Based on data released by the Brewers Association in 2022, there are about 9,552 operating craft breweries in the US as of December 31, 2022; this includes approximately 2,035 microbreweries, and 3,418 brewpubs. The industry continues to grow substantially; the total number of craft breweries has increased from 9,384 in 2021 to 9,709 towards the end of 2022, largely due to increased consumer demand for craft beer and the implementation of new technologies being developed to address the many different types of consumer preferences.

The US government is also supporting the growth of the Microbrewery Equipment market through legislation. The Craft Beverage Modernization and Tax Reform Act is legislation enacted in 2018 that lowered the excise tax rate on small breweries, allowing them to use the money saved on taxes to buy new, state-of-the-art equipment to support continued growth within their businesses. By encouraging microbreweries to operate more efficiently, this law is also contributing to the increased availability of specialized equipment in North America.

Rapid technological change is transforming the business aspect of brewing beer in developing a more efficient and lean way to brew beer and decreasing the amount of manual labor required and the quality of the product. For example, AI technology is being used to determine the best time to ferment for maximum efficiency and provide enhanced production capabilities.

In addition, Canadian microbreweries have flourished- the government support at all levels and the entrepreneurial spirit of many Canadian brewers are creating an ever-expanding craft beer community, which will continue to provide new opportunities for small breweries in developing the North American market.

North America Microbrewery Equipment Market Report Attributes

| Key Takeaway | Details | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Market Size & Growth | |||||||||||

| Base Year | 2025 | ||||||||||

| Market Size in 2025 | USD 179.2 Million | ||||||||||

| Market Size in 2026 | USD 188.8 Million | ||||||||||

| Forecast Period 2026-2035 CAGR | 5.9% | ||||||||||

| Market Size in 2035 | USD 315.4 Million | ||||||||||

| Key Market Trends | |||||||||||

| Drivers | Impact | ||||||||||

| Growing popularity of craft beer | The rising consumer preference for unique, locally brewed craft beers is fueling demand for advanced brewing equipment in North America. This trend supports small-scale brewers and drives innovation in brewing technology. | ||||||||||

| Expansion of microbreweries | The increasing number of microbreweries across the U.S. and Canada is creating strong demand for scalable and efficient brewing systems. This expansion is also encouraging equipment suppliers to offer customized solutions | ||||||||||

| Technological advancements | Automation and IoT-enabled brewing systems are improving efficiency and consistency in beer production. These innovations reduce labor costs and enhance quality control, making them attractive to microbreweries. | ||||||||||

| Pitfalls & Challenges | Impact | ||||||||||

| Market saturation in developed regions | High density of microbreweries in North America is leading to intense competition and slower growth opportunities. Saturation pressures smaller players to differentiate through quality and branding. | ||||||||||

| High initial investment | Setting up a microbrewery requires significant capital for equipment and infrastructure, which can deter new entrants. Financing challenges often limit expansion plans for small-scale brewers. | ||||||||||

| Opportunities: | Impact | ||||||||||

| E-commerce and direct-to-consumer sales | Online platforms and DTC models allow breweries to reach wider audiences and boost profitability. This trend is driving demand for packaging and distribution equipment tailored for small batches. | ||||||||||

| Growing homebrewing market | The surge in homebrewing enthusiasts is creating opportunities for compact, affordable brewing systems. Manufacturers are tapping into this niche with user-friendly equipment and starter kits. | ||||||||||

| Market Leaders (2025) | Market Leader |

5.5% market share | |||||||||

| Top Players |

The collective market share in 2025 is 20.6 % | ||||||||||

| Competitive Edge |

| ||||||||||

What are the growth opportunities in this market?

North America Microbrewery Equipment Market Trends

Changing innovation and technology transformation are important for the growth of the market.

- Automation and smart brewing technology are a growing trend in the North America microbrewery equipment marketplace. Improving accuracy, consistency and efficiency of production, particularly among small-scale brewers, improves the overall quality of their products and makes them more profitable. US based microbreweries are increasingly implementing automated systems to streamline production and improve the consistency of their end products.

- IoT sensors and data analytics are fundamentally changing how microbreweries operate in North America. With the use of IoT enabled equipment and digital controls, brewers can monitor and optimize their operations in real-time with less need for manual intervention, reducing errors and increasing overall operational efficiencies. Canadian microbreweries, among others, are starting to incorporate these technologies into their operations to improve operational efficiencies and to lower their operational costs.

- The growing environmental awareness and government regulation is causing more microbrewers in North America to adopt energy efficient and sustainable breweries. Equipment such as heat recovery units and eco-friendly cleaning tools are becoming increasingly common among North America based microbreweries looking for ways to reduce water and energy consumption.

- Increasingly, the craft beer culture in North America is stimulating the need for specialized brewing vessels, fermenters, and filtration systems tailored to the small batch setting. Microbreweries, such as those in California and Colorado, have invested heavily in state-of-the-art equipment to target niche markets within their respective states.

- The convergence of technology such as data analytics, AI-based solutions with microbrewing in North America is creating opportunities for microbrewers to improve their product quality and streamline their operations. The growing interest in home brewing and small-scale commercial brewing is driving demand for cost-effective and user-friendly solutions, creating space for the different types of manufacturers that provide customized solutions.

North America Microbrewery Equipment Market Analysis

Learn more about the key segments shaping this market

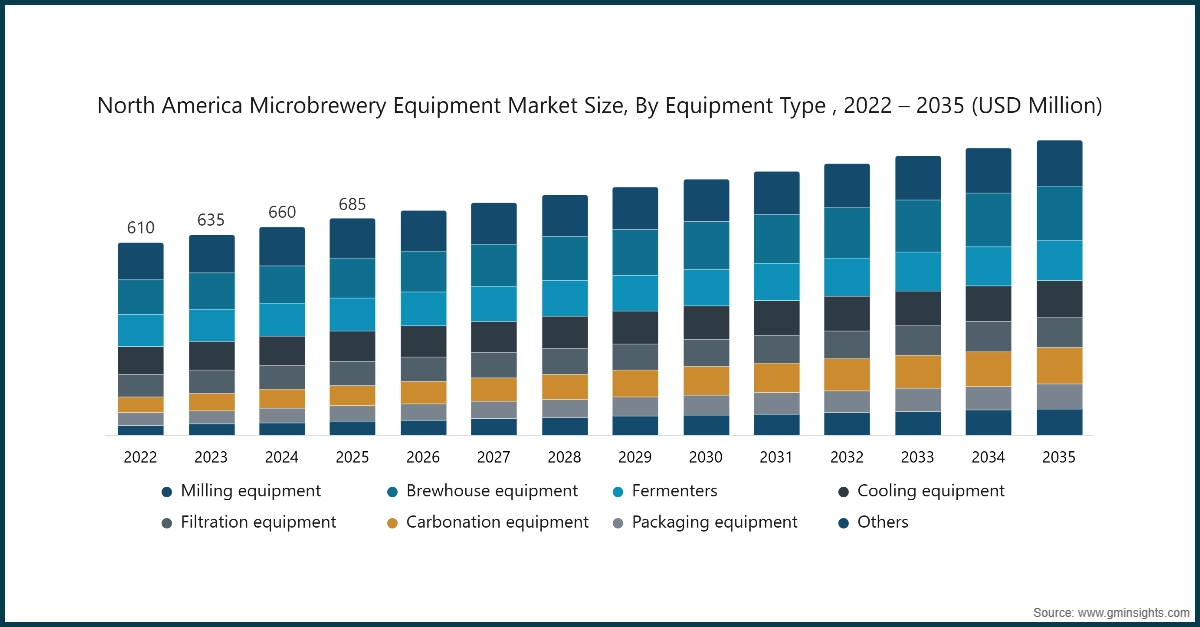

Based on equipment type, the North America microbrewery equipment industry is segmented into milling equipment, brewhouse equipment, fermenters, cooling equipment, filtration equipment, carbonation equipment, packaging equipment, and others. The fermenters segment accounts for revenue of around USD 37.8 million in the year 2025 and is expected to reach USD 67.2 million by 2035.

- Fermenters are an integral component of the brewing process; they allow for the transformation of yeast into alcohol. Because fermenters represent a key element of the beer production process, they are essential for both commercial and micro-craft breweries. Additionally, as the popularity of craft beers increases, so too does the value of fermenters.

- Breweries can customize their own fermentation tanks based on size, shape, and technology. As a result of this steady increase in craft breweries across North America, there has been an unparalleled demand for fermentation tanks. The government reported that in 2023, there were over 1,200 licensed breweries operating in Canada; therefore, the demand for specialized brewing equipment continues to climb.

- Due to the advent of new technology, fermenters have become dominant in the marketplace and provide numerous advantages to breweries. Automated temperature control, pressure control and real-time monitoring have improved both productivity and product quality, leading to widespread adoption of fermenters by many breweries seeking to improve their operations with the best possible process equipment.

- In addition to technological advances, there has also been a good deal of government support for the craft beer industry, which has positively impacted the fermenters market; for instance, in Canada, when small breweries receive tax benefits and grants from the government, it incentivizes breweries to invest more in high-quality brewing equipment

- As the craft beer industry continues to grow globally, the fermenters segment will maintain its position as an industry leader. Fermenters will continue to play an important role in the overall production of beer, and with the growth of new breweries, ongoing technological advances, and supportive government policies, the fermenters segment will achieve continued growth through the forecast period of interest.

Learn more about the key segments shaping this market

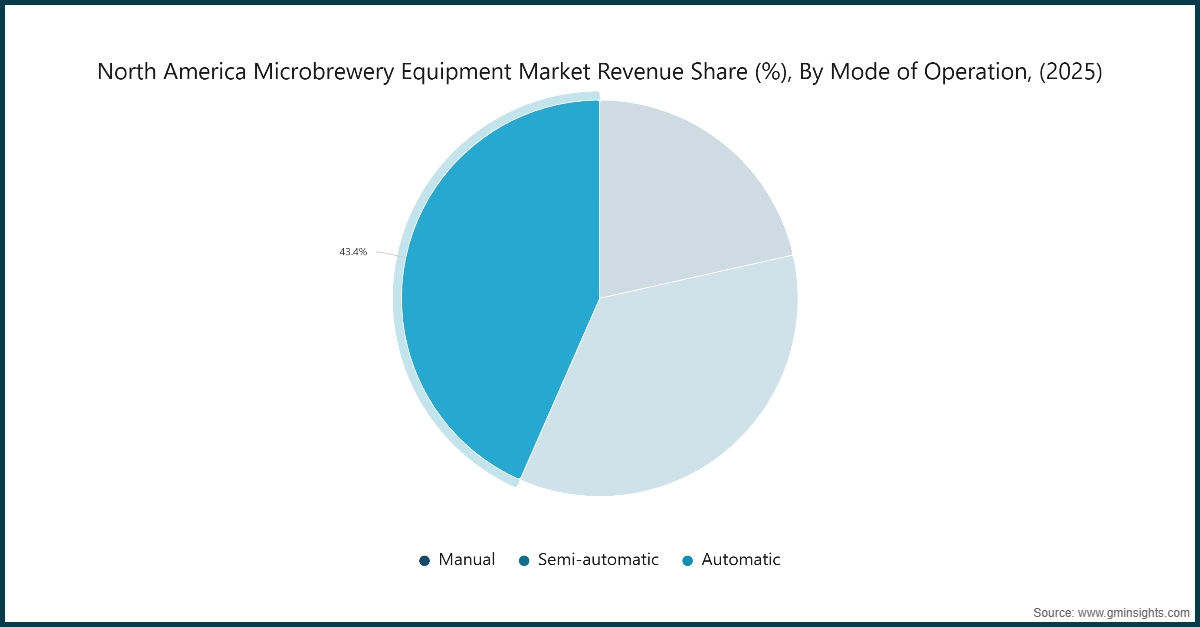

Based on operation, the North America microbrewery equipment market is bifurcated into manual, semi-automatic, and automatic. The automatic segments held the largest share, accounting for 43.4% of the global market in 2025.

- The use of automatic brewing systems provides the brewer with more accurate control over several important brewing parameters including temperature, pressure, flow rate and fermentation time. This type of precision helps to ensure that all products produced by the microbrewery have a consistent level of quality, which is vital if the microbrewery wants to maintain its competitive position in an increasingly expanding craft beer market.

- According to the Brewers Association 2024- there were over 10,000 craft breweries in the Nation; thus the demand for efficient ways to automate the craft beer brewing process will continue to grow. Breweries that implement an automated brewing system are able to streamline their brewing operations while simultaneously increasing the speed of their process.

- Automated brewing systems require very minimal human supervision and can be fully operated 24 hours a day. As a result, microbreweries will have an increased output levels while also reducing their labor costs. Small-scale breweries are especially benefiting from the opportunity to increase production levels without significant increases to their operational costs. In addition to providing the advantages of increased efficiency and decreased reliance on manual labor, many automated brewing systems have built-in sensor technology and sophisticated software that help provide the brewery with real-time feedback models.

- As government support of the craft brewing sector has influenced the growth of automated equipment utilization, many small businesses across America have also been encouraged to move toward automation because of support at both state and federal levels via initiatives that stimulate the development of small business and technology.

- Due to the ability of automated microbrewery equipment to provide an even flow of products of high quality while meeting strict compliance with federal regulatory requirements, automatic microbrewery equipment has become the most popular segment of the North American microbrewery equipment industry.

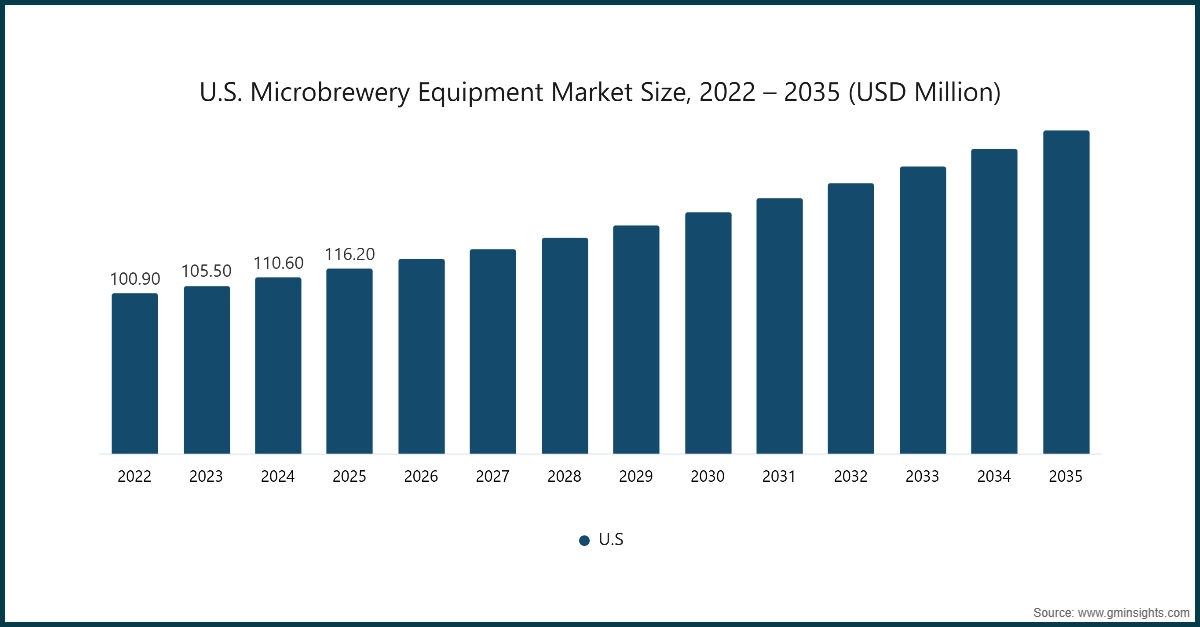

U.S. Microbrewery Equipment Market

Looking for region specific data?

In 2025, the U.S. dominated the North America microbrewery equipment market growth in North America, accounting for 64.8% of the share in the region.

- Federal energy-efficiency and industrial decarbonization incentives have lowered operating costs for small manufacturers, including breweries adopting efficient brewhouse, chilling, and packaging systems. DOE’s Better Buildings/Better Plants reports nearly USD 22 billion in cumulative savings since 2011, while Infrastructure Law and IRA programs expand rebates and financing that craft facilities can tap for process upgrades and electrification.

- At the resource and compliance level, federal guidance is pushing water reuse and wastewater improvements inside beverage plants, encouraging investments in treatment skids, membranes, and CIP systems.

Canada Microbrewery Equipment Market

Canada microbrewery equipment market is expected to grow at 6% during the forecast period. Government-backed funding programs like the Sustainable Canadian Agricultural Partnership are driving modernization in breweries. These incentives support investments in advanced brewhouse and packaging equipment. Combined with beer’s status as Canada’s top alcoholic beverage, this creates strong demand for microbrewery equipment.

North America Microbrewery Equipment Market Share

The top companies in the market Krones, GEA Group, DME Process Systems, Alfa Laval and Paul Mueller Company and collectively hold a share of 20.6% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Krones provides complete brewing and packaging solutions for microbreweries, including brewhouse systems, fermentation tanks, and automated filling lines. They focus on turnkey installations and lifecycle services tailored for craft breweries in North America.

GEA offers modular brewing systems, separators, filtration units, and dealcoholizing technology for craft breweries. Their solutions emphasize energy efficiency, automation, and scalability for small to mid-sized brewhouses in North America.

DME designs and manufactures brewhouses, fermenters, and cellar tanks for microbreweries, with custom engineering and project management support. They serve North American breweries with complete brewing systems and installation services.

North America Microbrewery Equipment Market Companies

Major players operating in the North America microbrewery equipment industry are:

- ABE Equipment

- Alfa Laval

- Blichmann Engineering

- Crawford Brewing

- Deutsche Beverage

- DME Process Systems

- GEA Group

- Krones

- Newlands Systems

- Paul Mueller Company

- Portland Kettle Works

- Premier Stainless Systems

- ProBrew Systems

- Speidel

- SS Brewtech

Alfa Laval supplies brewery centrifuges, heat exchangers, and membrane systems for beer clarification, pasteurization, and dealcoholization. Their equipment helps microbreweries improve quality and sustainability through efficient processing.

Paul Mueller provides brewing tanks, fermenters, keg washers, and turnkey brewhouse packages for microbreweries. Their U.S.-based manufacturing ensures quick delivery and support for craft breweries across North America.

North America Microbrewery Equipment Industry News

- In September 2025, GEA launched its QBOIL wort-boiling system, delivering up to 35% energy savings compared to conventional setups. This innovation supports sustainability and cost reduction for craft and microbreweries in North America.

- In May 2025, Krones reported continued growth and announced plans to expand its capacity to meet rising demand for brewery projects. The company emphasized strengthening its North American operations to support future installations and service capabilities.

- In April 2025, Paul Mueller expanded its Springfield, Missouri manufacturing facility to increase brewing equipment output. The move strengthens domestic supply and supports faster delivery for North American microbreweries.

- In March 2025, GEA installed its AromaPlus membrane system at Edelweißbrauerei FARNY to produce alcohol-free beer while preserving flavor. This reflects growing North American interest in low-alcohol brewing solutions.

- In January 2025, Blichmann refreshed its Pro systems portfolio and updated RipTide Pump documentation, featuring modular kettles and advanced heating technology. These upgrades cater to nano and pilot breweries expanding in North America.

The North America microbrewery equipment market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Equipment Type

- Milling equipment

- Brewhouse equipment

- Fermenters

- Cooling equipment

- Filtration equipment

- Carbonation equipment

- Packaging equipment

- Others

Market, By Mode of Operation

- Manual

- Semi-automatic

- Automatic

Market, By Application

- Commercial microbreweries

- Brewpubs

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

Who are the key players in the North America microbrewery equipment market?

Key players include ABE Equipment, Alfa Laval, Blichmann Engineering, Crawford Brewing, Deutsche Beverage, DME Process Systems, and GEA Group.

What are the upcoming trends in the North America microbrewery equipment industry?

Key trends include the adoption of automation and smart brewing technologies, the integration of IoT sensors and data analytics for real-time monitoring, and efforts to enhance operational efficiency and reduce costs.

Which country dominated the North America microbrewery equipment market in 2025?

The United States dominated the market, accounting for 64.8% of the regional share in 2025, driven by the widespread adoption of advanced brewing technologies.

How much revenue did the fermenters segment generate?

The fermenters segment generated approximately USD 37.8 million in 2025 and is projected to reach USD 67.2 million by 2035.

What was the market share of the automatic segment in 2025?

The automatic segment held the largest share, accounting for 43.4% of the global market in 2025.

What is the projected size of the North America microbrewery equipment market in 2026?

The market is expected to grow to USD 188.8 million in 2026.

What was the market size of the North America microbrewery equipment market in 2025?

The market size was valued at USD 179.2 million in 2025, with a CAGR of 5.9% expected through 2035, driven by technological advancements and increasing adoption of automation in microbreweries.

What is the projected value of the North America microbrewery equipment market by 2035?

The market is expected to reach USD 315.4 million by 2035, fueled by the integration of IoT-enabled equipment and growing demand for operational efficiency.

North America Microbrewery Equipment Market Scope

Related Reports