Summary

Table of Content

North America Insulin Delivery Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Insulin Delivery Devices Market Size

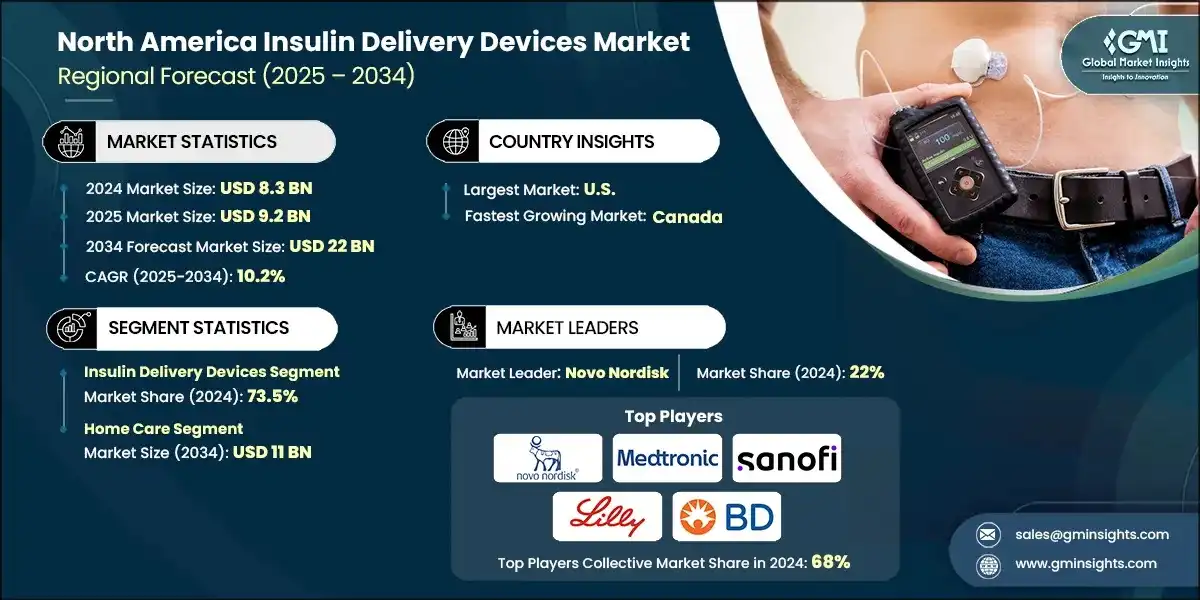

The North America insulin delivery devices market size was valued at USD 8.3 billion in 2024. The market is expected to grow from USD 9.2 billion in 2025 to USD 22 billion in 2034, at a CAGR of 10.2% during the forecast period, according to the latest report published by Global Market Insights Inc. The market for insulin delivery devices is growing strongly due to the increasing incidence of diabetes, ongoing technological advancements, and growing awareness about self-care for the condition. The market for easy-to-use, mobile, and accurate insulin delivery devices such as insulin pens, pumps, and patch devices is growing very fast because patients are looking for more convenient and effective means of controlling their blood sugar levels.

To get key market trends

This market plays a critical role in enhancing treatment adherence and enabling personalized diabetes care across diverse patient populations. Leading companies such as Novo Nordisk, Medtronic plc, Eli Lilly, Becton, Dickinson and Company and Sanofi at the forefront of this industry. These players maintain their competitive edge through continuous innovation in device technology, strategic partnerships, and strong distribution networks, all aimed at improving patient outcomes and simplifying diabetes management.

North America insulin delivery devices market is growing aggressively, increasing from USD 6.3 billion in 2021 to USD 7.6 billion in 2023. The market's growth is directly associated with the increasing rate of diabetes across the region. According to the Centers for Disease Control and Prevention (CDC) report released in 2024, 38.4 million individuals of all ages or 11.6% of the U.S. population had diabetes in 2021. Growing burden has weighed heavily in accelerating the need for simple-to-use and effective insulin delivery devices. The rapid growth in diabetes incidence is fueling innovation and uptake of sophisticated insulin pens, pumps, and wearable devices, making it easier and more effective for millions in North America to manage diabetes.

Moreover, increasing initiatives by national health organizations and government bodies are contributing significantly to the growth of the insulin delivery devices market in North America. The Centers for Disease Control and Prevention (CDC) and the American Diabetes Association launched the National Diabetes Prevention Program (National DPP) in 2010 to combat the rising burden of prediabetes and type 2 diabetes in the U.S. This nationwide initiative fosters partnerships between public and private organizations to deliver evidence-based, cost-effective interventions aimed at preventing type 2 diabetes. The program is built on a proven curriculum that helps delay or prevent the onset of diabetes in high-risk adults. These efforts, combined with growing public awareness and regulatory support, are accelerating the adoption of insulin delivery devices across the region.

Insulin delivery devices are medical tools designed to administer insulin to individuals with diabetes in a safe, accurate, and convenient manner. These devices play a critical role in diabetes management by helping patients maintain optimal blood glucose levels, especially when the body is unable to produce sufficient insulin naturally.

North America Insulin Delivery Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.3 Billion |

| Market Size in 2025 | USD 9.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 10.2% |

| Market Size in 2034 | USD 22 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of diabetes | The U.S. alone had 38.4 million people with diabetes in 2021, accounting for 11.6% of the population. This high prevalence is driving strong demand for insulin delivery solutions across North America. |

| Technological advancements in insulin delivery devices | North America is leading in the adoption of smart insulin pens, tubeless patch pumps, and Bluetooth-enabled devices, which are improving dosing accuracy and integrating with digital health platforms. |

| Increasing diabetes care expenditure | High healthcare spending in the U.S. and Canada is enabling broader access to modern insulin delivery technologies, with a growing preference for devices that support self-management and reduce complications. |

| Favourable device insurance and reimbursement policies | Supportive reimbursement frameworks, especially in the U.S., are making advanced insulin delivery devices more accessible, encouraging adoption among both newly diagnosed and long-term patients. |

| Adoption of facilitative initiatives | Programs such as the National Diabetes Prevention Program (National DPP) are promoting diabetes awareness, education, and preventive care, accelerating the uptake of insulin delivery devices in high-risk populations. |

| Pitfalls & Challenges | Impact |

| High cost of insulin delivery devices | Despite insurance coverage, the premium pricing of insulin pumps and smart pens can still be a barrier for uninsured or underinsured populations in North America. |

| Stringent government regulations | Regulatory scrutiny from agencies such as the FDA can delay product approvals and increase compliance costs, affecting market agility for manufacturers. |

| Opportunities: | Impact |

| Integration with digital health platforms | Strong digital infrastructure and high smartphone penetration in North America allow insulin delivery devices to sync with apps and cloud-based platforms, enhancing real-time monitoring and remote care. |

| Development of smart and wearable devices | High demand from tech-savvy and younger populations is driving innovation in wearable insulin delivery systems, with North America leading in adoption and commercialization. |

| Market Leaders (2024) | |

| Market Leaders |

22% market share |

| Top Players |

Collective market share in 2024 is 68% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Canada |

| Emerging Country | |

| Future Outlook |

|

What are the growth opportunities in this market?

North America Insulin Delivery Devices Market Trends

- The insulin delivery device market in North America is undergoing a transformative evolution, driven by the region’s high diabetes burden and growing demand for convenient, accurate, and patient-friendly solutions. As more individuals in the U.S. and Canada transition toward self-management of diabetes, devices such as insulin pens, pumps, and patch systems are becoming preferred alternatives to traditional syringes due to their ease of use and improved dosing precision.

- Technological innovation is a key catalyst for market growth in North America. Companies are continuously enhancing device design to improve comfort, safety, and usability. Features such as ergonomic grips, prefilled cartridges, and automated dosing mechanisms are helping reduce user error and improve treatment adherence. The integration of digital diabetes management technologies including Bluetooth connectivity and mobile app integration is offering patients and healthcare providers real-time access to insulin therapy data, enabling more personalized and efficient care.

- For instance, Insulet Corporation’s Omnipod DASH Insulin Management System, approved by the U.S. FDA, exemplifies this trend. It features Bluetooth-enabled connectivity and a personal diabetes manager, allowing seamless access to therapy information via smartphone apps such as Omnipod Display and Omnipod View. These innovations are reshaping how patients in North America interact with their treatment regimens.

- Moreover, North America remains at the forefront of innovation and adoption. Strong healthcare infrastructure, favorable reimbursement policies, and active public-private initiatives such as the National Diabetes Prevention Program are reinforcing the region’s leadership in modern diabetes care and driving continued growth in the insulin delivery devices market.

North America Insulin Delivery Devices Market Analysis

Learn more about the key segments shaping this market

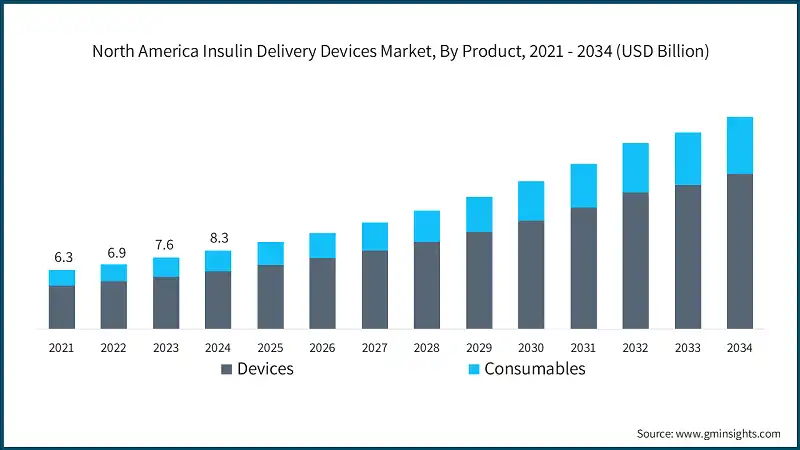

In 2021, the North America market was valued at USD 6.3 billion. The following year, it saw a slight increase to USD 6.9 billion, and by 2022, the market further climbed to USD 7.6 billion in 2023.

Based on product, the North America market is divided into insulin delivery devices and consumables. The insulin delivery devices segment accounted for 73.5% of the market in 2024 primarily due to their widespread adoption among patients seeking convenient, accurate, and user-friendly alternatives to traditional insulin administration methods. The segment is expected to reach USD 16.1 billion by 2034, growing with a CAGR of 10.2% during the forecast period. On the other hand, consumables segment is expected to grow with slightly higher CAGR of 10.3%. The growth of this segment is primarily driven by the recurring demand for essential components such as insulin cartridges, infusion sets, reservoirs, and needles.

- The insulin delivery device segment is the dominant segment of the North America insulin delivery device market with a commanding share due to its superior technology, durability over a long period, and high patient affinity. It comprises of insulin pens, pumps, and others each of which is specifically designed to make insulin delivery more accurate, convenient, and easy to use.

- They are preferred because they are user-friendly, transportable, and most of the time link to digital health platforms, making them suitable for patients and clinicians alike. They allow individuals to take control of their diabetes more, minimize errors in dosing, and enhance overall treatment outcomes.

- Innovation is the main driver of growth for this segment. Firms are placing emphasis on developments such as automated dosing, Bluetooth pairing, and ergonomic designs to simplify and enhance the delivery of insulin. For instance, Novo Nordisk's NoVo Pen 6 and NoVo Pen Echo Plus are intelligent insulin pens that record doses automatically and communicate with diabetes apps, allowing patients and physicians to monitor treatment more conveniently.

- Such advancements are particularly beneficial in home and clinical environments where usability and dependability are critical. Devices are also being designed for patient groups including children, elderly, and people with restricted hand movement, making it more user-friendly to a greater group of individuals.

Learn more about the key segments shaping this market

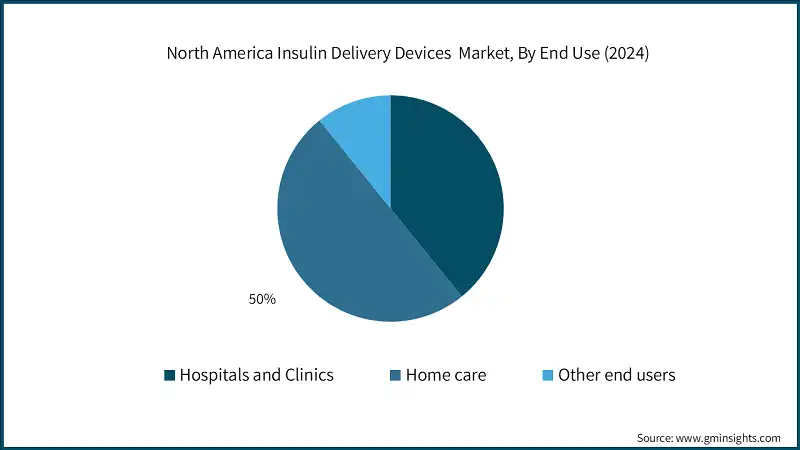

Based on end use, North America insulin delivery devices market is classified into hospitals and clinics, home care, and other end users. The home care segment dominated the market in 2024 and is expected to reach USD 11 billion by 2034.

- Home care is becoming an important growth segment in the market for insulin delivery devices due to growing patient demand for the management of diabetes in home, friendly environments. This trend finds support in the presence of easy-to-use devices, increased awareness of self-management, and supportive policies launched by public health agencies.

- Patients are increasingly turning to portable and user-friendly insulin infusion devices that make daily administration easy and minimize the frequency of hospital visits. Disposable insulin pens and wearable pumps are especially well-liked in-home environments because of their convenience, low training need, and consistent performance.

- Public initiatives are dominating this trend. For instance, the American Diabetes Association's Diabetes Self-Management Support (DSMS) program and the Diabetes Support Initiative seek to inform and empower patients to self-manage their condition.

- Consequently, demand for home-use insulin delivery devices is increasing consistently. Not only do these devices enhance treatment compliance, but they also fit into wider healthcare objectives of cost savings, empowering patients, and decentralized delivery of care. Manufacturers are reacting to this by creating products that are user-friendly, hygienic, and compatible with digital monitoring equipment, rendering them suitable for diabetes care at home.

Looking for region specific data?

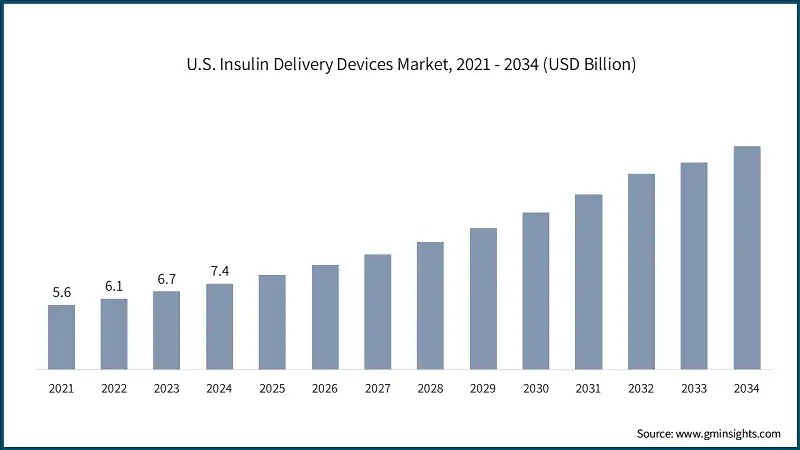

U.S. Insulin Delivery Devices Market

- The U.S. stands at the forefront of the North America market, propelled by a high diabetes burden, advanced healthcare infrastructure, and strong regulatory support. In 2021, 2 million Americans were living with type 1 diabetes, including approximately 304,000 children and adolescents, according to the American Diabetes Association. This substantial and diverse patient base drives consistent demand for insulin delivery solutions across all age groups.

- As diabetes management increasingly shifts toward self-care, patients are opting for convenient and precise devices such as insulin pens, pumps, and patch systems over traditional syringes.

- These devices offer improved dosing accuracy and ease of use, aligning with the U.S. healthcare system’s emphasis on precision, safety, and patient comfort. Their widespread availability through hospital pharmacies, retail chains, and e-commerce platforms, coupled with insurance coverage and formulary inclusion, has significantly boosted adoption.

- Moreover, the U.S.-based companies are enhancing device design with features such as ergonomic grips, prefilled cartridges, and automated dosing mechanisms, which reduce user error and improve treatment adherence. The integration of digital health technologies, including bluetooth connectivity and mobile app integration, is transforming diabetes care by enabling real-time monitoring and personalized therapy.

- A prime example of this innovation is Insulet Corporation’s Omnipod DASH Insulin Management System, approved by the U.S. FDA. It features bluetooth-enabled connectivity and a personal diabetes manager, allowing patients to access therapy data via smartphone apps such as Omnipod display and Omnipod view. These advancements are reshaping how patients interact with their treatment regimens, making insulin therapy more intuitive and data driven.

Canada Insulin Delivery Devices Market

Canada market accounted for USD 909.2 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Canada is emerging as a significant region in the insulin delivery devices market, supported by its universal healthcare system and rising diabetes burden. According to national data from 2023, type 1 diabetes accounts for 5-10% of cases, type 2 diabetes for 90-95%, and gestational diabetes affects 10% of women who give birth. These figures reflect a diverse patient population requiring consistent access to effective insulin delivery solutions.

- The growing prevalence of diabetes across all age groups highlights the need for scalable, accurate, and user-friendly insulin administration tools. As more Canadians manage their condition through self-care, the demand for insulin pens, pumps, and patch systems continues to rise, driven by their convenience and dosing precision.

- Canada’s healthcare system supports the adoption of modern insulin delivery technologies, aligning with broader national efforts to improve chronic disease management and patient outcomes. These trends reinforce Canada’s role as a key market for innovation and growth in the insulin delivery devices sector.

North America Insulin Delivery Devices Market Share

The North America market is defined by a mix of dominant companies and regionally focused innovators, creating a moderately consolidated yet highly competitive landscape. Novo Nordisk leads the market with the largest share, followed by Eli Lilly, Sanofi, Medtronic, and Becton, Dickinson and Company (BD). These top 5 players hold around 68% of the market share in the consolidated North America market.

To strengthen their market positions, these companies are adopting multi-pronged strategies such as partnerships, acquisitions, and competitive pricing. These efforts aim to improve the accessibility and affordability of insulin pens and pumps, while addressing evolving patient needs across diverse healthcare settings. The increasing integration of digital health features, including bluetooth connectivity and mobile app support, is further accelerating adoption in the region.

Overall, the North American market is experiencing intensified competition and rapid technological advancement, as both established and emerging companies continue to evolve their offerings to meet the rising demand for effective diabetes management tools.

North America Insulin Delivery Devices Market Companies

Prominent players operating in the North America market are as mentioned below:

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Eli Lilly & Company

- F. Hoffmann-La Roche Ltd.

- Gan & Lee Pharmaceuticals

- Haselmeier

- Insulet Corporation

- Medtronic plc

- MicroPort

- Nipro Corporation

- Novo Nordisk

- Owen Mumford

- Sanofi

- Terumo Corporation

- Wockhardt Ltd.

- Sanofi

Sanofi plays an important role in the North America market, particularly through its widely used insulin pens (global market was valued at USD 9.6 billion in 2024). The company focuses on long-acting insulin formulations and device simplicity, making its products suitable for a broad range of patients. Sanofi’s integration with healthcare systems and emphasis on accessibility support its continued growth across the U.S. and Canada.

Medtronic is a prominent player in the North America market, known for its expertise in diabetes care and medical technology. The company’s strong presence in the region, commitment to innovation, and focus on integrated care solutions have positioned it as a leader in delivering reliable insulin pump systems. Medtronic continues to expand access and improve patient outcomes through strategic collaborations and technology-driven approaches.

Owen Mumford contributes to the North America market through its ergonomic and patient-friendly injection solutions. The company is recognized for its focus on comfort, usability, and environmental responsibility. With growing adoption in clinical and home care settings, Owen Mumford supports broader access to insulin therapies and enhances the overall patient experience in the region.

North America Insulin Delivery Devices Industry News

- In March 2023, Sanofi announced a major pricing reform for its insulin products in the U.S. The company committed to reducing the list price of Lantus, its most widely prescribed insulin, by 78%, and capping out-of-pocket costs at USD 35 for patients with commercial insurance. This move aligns with broader efforts to improve insulin affordability and access across the U.S. healthcare system. Sanofi’s decision reflects its commitment to supporting patients with diabetes and addressing long-standing concerns around insulin pricing in North America.

The North America insulin delivery devices market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product

- Insulin delivery devices

- Insulin pumps

- Tubed pumps

- Tubeless pumps

- Pens

- Reusable

- Disposable

- Other insulin delivery devices

- Insulin pumps

- Consumables

- Testing strips

- Pen needles

- Standard

- Safety

- Syringes

- Insulin pumps consumables

Market, By End Use

- Hospitals and clinics

- Home care

- Other end use

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

How much revenue did the consumables segment generate in 2024?

The consumables segment accounted for the remaining 26.5% share, valued at around USD 2.2 billion in 2024, with consistent demand for insulin cartridges, pen needles, and infusion sets.

Who are the leading companies in the North America insulin delivery devices market?

Major players include Novo Nordisk, Medtronic plc, Sanofi, Eli Lilly & Company, and Becton, Dickinson and Company, which collectively held about 68% of the market share in 2024. Other key players include Insulet Corporation, Owen Mumford, Terumo Corporation, and F. Hoffmann-La Roche Ltd.

Which end-use segment led the market in 2024?

The home care segment dominated the market in 2024 and is projected to reach USD 11 billion by 2034, reflecting growing patient preference for at-home diabetes management and self-administration convenience.

What is the market size of the North America insulin delivery devices market in 2024?

The market size was USD 8.3 billion in 2024, driven by the rising prevalence of diabetes, growing adoption of insulin pens and pumps, and increasing focus on self-care management across the region.

Which product segment dominated the market in 2024?

The insulin delivery devices segment held a 73.5% share in 2024, generating approximately USD 6.1 billion, driven by widespread adoption of insulin pens, pumps, and patch devices that provide convenience and accuracy in insulin administration.

What is the projected value of the North America insulin delivery devices market by 2034?

The market is projected to reach USD 22 billion by 2034, growing at a CAGR of 10.2% from 2025 to 2034, fueled by increasing demand for smart and wearable insulin delivery systems.

What is the estimated market value for 2025?

The North America insulin delivery devices industry is expected to reach USD 9.2 billion in 2025, supported by higher diabetes care expenditure and favorable reimbursement policies in the U.S. and Canada.

North America Insulin Delivery Devices Market Scope

Related Reports