Summary

Table of Content

North America Commercial Boiler Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Commercial Boiler Market Size

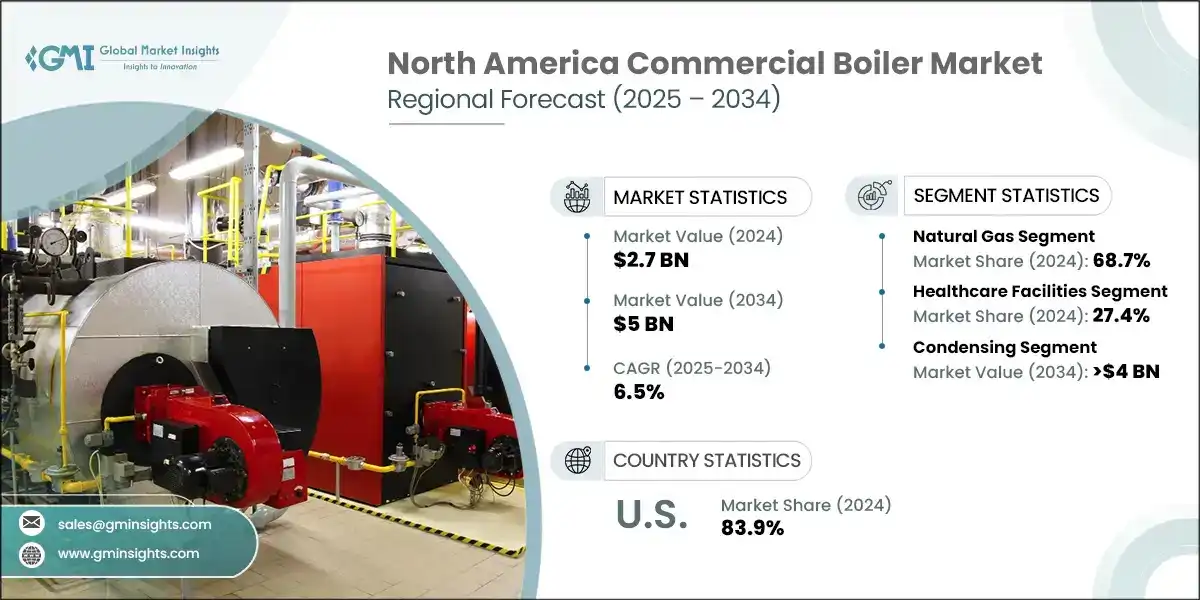

The North America commercial boiler market was estimated at USD 2.7 billion in 2024. The market is expected to grow from USD 2.8 billion in 2025 to USD 5 billion in 2034, at a CAGR of 6.5%.

To get key market trends

- Rising adoption of low-carbon heating systems including condensing gas, electric, and hybrid boiler solutions owing to decarbonization policies will spur business prospective. Municipal and institutional districts in major cities across the region are expanding centralized heating networks as part of district energy retrofits and new infrastructure will escalate North America commercial boiler market outlook.

- Commercial boilers are large-capacity heating systems designed to generate steam or hot water for space heating, water heating, or industrial processes in commercial buildings including hospitals, schools, offices, and manufacturing facilities. These units operate on various fuels and are engineered for high efficiency, durability & continuous operation under varying loads.

- For reference, in July 2025, AstraZeneca announced a landmark USD 50 billion investment in the U.S. by 2030, aimed at expanding its manufacturing and R&D footprint. The initiative includes the development of a state-of-the-art pharmaceutical manufacturing facility in Virginia, its largest single investment to date as well as the expansion of research and cell therapy production capabilities across key sites in Maryland, California, Massachusetts, Texas, and Indiana.

- Supportive government subsidies and utility programs to support electric boiler integration as part of the grid-interactive efficient buildings particularly in decarbonized electricity grids will influence product demand. Continuous integration of smart building codes to improve operational efficiency, remote diagnostics, and predictive maintenance are propelling North America commercial boiler market scenario.

- Stringent emission regulations and mandates driving the innovation of low-NOx and ultra-clean heating technologies are set to accelerate product adoption across the industry. Ongoing retrofit of aging commercial infrastructure is creating demand for modern, energy-efficient boiler systems to replace outdated, oversized, and inefficient systems, which in turn will escalate North America commercial boiler market dynamics.

- For citation, the government of Canada has announced a strategic investment of USD 1.3 billion in federal research funding. This funding is being distributed through key programs managed by Canada’s three federal research granting agencies.

- The surge in urban revitalization initiatives and the expansion of university campuses are increasingly incorporating centralized boiler systems into district heating networks, creating promising growth opportunities for the industry. The introduction of enhanced boiler efficiency mandating higher minimum AFUE or thermal efficiency, further encouraging adoption of condensing technologies.

- The North America commercial boiler market was valued at USD 2.2 billion in 2019 and grew at a CAGR of over 6.5% through 2024. The accelerated growth of hyperscale and enterprise data centers is driving the integration of heat recovery boiler systems, engineered to capture and repurpose thermal waste for HVAC applications and district energy grids.

- For citation, in February 2025, Loblaw Companies Limited (L.TO) announced plans to allocate approximately USD 1.6 billion in capital expenditures this year, aimed at modernizing its existing retail footprint, expanding its store network, and supporting the creation of roughly 8,000 new jobs across Canada.

- Regional climate directives are accelerating the deployment of low-carbon and electric boiler technologies, particularly within public sector infrastructure. Government initiatives are actively promoting ENERGY STAR certification among key boiler manufacturers, reinforcing energy efficiency standards and enhancing the sector’s growth trajectory.

North America Commercial Boiler Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.5% |

| Market Size in 2034 | USD 5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising need for space heating in commercial buildings | Drives sustained demand for high-efficiency boilers across office complexes, healthcare facilities, and educational institutional, especially in cold climate zones. |

| Implementation of stringent government regulations | Accelerates the replacement of legacy systems with low-emission and high-efficiency boilers to comply with environmental and energy performance mandates. |

| Positive outlook toward healthcare sector | The sectors deploy boilers for space heating, autoclaves equipment sterilization and water heating purposes. |

| Pitfalls & Challenges | Impact |

| High initial investment | Acts as a deterrent for small-to-medium commercial establishments, delaying boiler upgrades or limiting adoption of advanced or low-carbon technologies. |

| Opportunities: | Impact |

| Electrification of commercial heating systems | Enables market expansion for electric and hybrid boilers, especially in regions with decarbonized grids and strong utility incentives. |

| Integration with building automation systems | Increased demand for smart, IoT-enabled boilers that support energy optimization and compliance with evolving building codes. |

| Growth in green building certifications | Encourages adoption of ultra-efficient boiler systems to meet sustainability targets and gain competitive advantages in real estate. |

| Expansion of public infrastructure and government retrofits | Opens large-scale procurement opportunities for modern boiler systems in schools, municipalities, buildings, and healthcare facilities backed by federal and provincial funding. |

| Market Leaders (2024) | |

| Market Leaders |

9.5% market share |

| Top Players |

Collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Canada |

| Emerging Country | |

| Future Outlook |

|

What are the growth opportunities in this market?

North America Commercial Boiler Market Trends

- The rising demand for space heating in commercial buildings is fueled by a combination of climatic, infrastructural, and regulatory factors. The region is experiencing prolonged cold seasons, especially in northern states and Canada along with rising demand for reliable heating solutions which maintains comfortable indoor environments will energize industry potential.

- The expansion of commercial real estate propelled by urban development, population growth, and the rise of mixed-use buildings is intensifying the need for scalable heating solutions. Modern commercial buildings are increasingly designed with integrated HVAC systems, where boilers play a central role in space heating, which in turn will fuel North America commercial boiler market landscape.

- Moreover, the shift toward energy-efficient infrastructure is prompting building owners to replace outdated heating systems with advanced boilers that offer better thermal performance and lower emissions. The surge in healthcare infrastructure expansion is further fueling the demand for boiler systems with low NOx performance and high reliability.

- For illustration, in December 2022, the Federal Energy Management Program (FEMP) issued updated acquisition guidelines that directives specifically apply to natural gas boilers with input ratings below 300,000 Btu/h, while explicitly excluding higher-capacity commercial units, thereby streamlining procurement practices and reinforcing federal energy efficiency benchmarks.

- The implementation of stringent government regulations is shaping both product innovation and adoption strategies. In addition, regulatory bodies across the region are enforcing aggressive decarbonization targets, compelling commercial facilities toward adoption of high-efficiency and low-emission heating systems, thereby fostering North America commercial boiler market growth.

- Regulatory frameworks including energy codes and green building certifications are also encouraging the deployment of energy-efficient boilers. Compliance including ASME Section IV and CSA B51/B149 is a critical buying criterion among institutions to reduce liability, ensure code compliance, and streamline inspection is boosting industry trend.

- Supportive government programs including U.S. Rural Energy for America Program and Canada’s Clean Energy for Rural and Remote Communities are encouraging the use of wood chips and pellets boiler in commercial buildings, which in turn will escalate North America commercial boiler market landscape.

- For illustration, Natural Resources Canada, through its Federal Energy Efficiency Regulations, establishes Minimum Equipment Performance Standards (MEPS) that directly influence the types of heating and cooling systems permitted for sale in Canada.

- Effective January 1, 2025, all newly manufactured commercial gas boilers with input ratings between 300,000 BTU/h and 10,000,000 BTU/h must meet a minimum thermal efficiency of 90%, up from the previous standard of 83%.

North America Commercial Boiler Market Analysis

Learn more about the key segments shaping this market

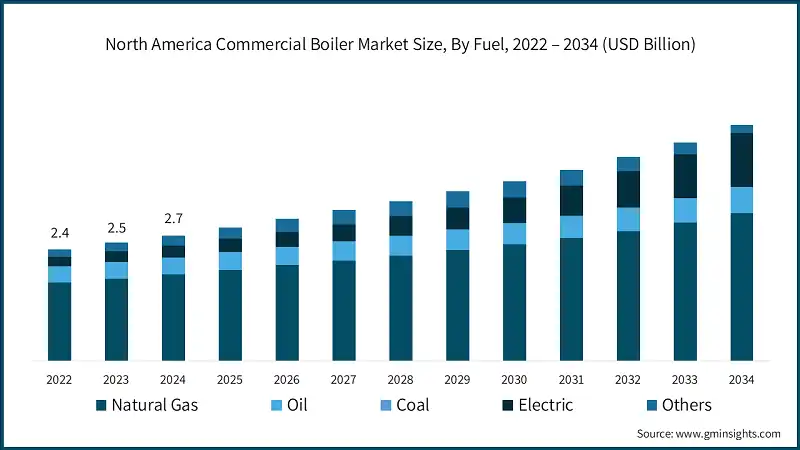

- Based on fuel, the industry is segmented into natural gas, oil, coal, electric, and others. The natural gas boiler holds a market share of 68.7% in 2024 and is projected to grow at a CAGR of over 5.5% through 2034. Widespread gas infrastructure across the region supports continued dominance of these boilers in commercial settings.

- High thermal efficiency and lower operating costs make natural gas systems a preferred choice in retrofits and new constructions, especially in regions with deregulated gas markets. Utility rebate programs and energy efficiency incentives are actively promoting high efficiency condensing gas boilers, which will propel business perspective.

- For reference, in March 2025, Natural Resources Canada reinforced its commitment to energy efficiency by promoting ENERGY STAR-certified boilers as part of its broader sustainability initiatives. According to the agency, ENERGY STAR-certified gas boilers consume approximately 10% less energy, while oil-fired models use about 4% less compared to conventional units contributing to reduced carbon emissions and enhanced home energy performance.

- The oil boiler market is anticipated to reach over USD 500 million by 2034. These boilers are increasingly limited to off-grid or remote locations with no access to natural gas infrastructure. Ongoing regulatory pressure on sulfur content in heating oil is driving technology upgrades and cleaner combustion systems will energize product demand.

- For instance, in 2023, U.S. foreign direct investment (FDI) in Canada reached USD 452 billion, while Canadian FDI in the United States totalled USD 672 billion. Notably, nearly 50% of Canada’s outbound investment was directed toward the U.S., playing a significant role in supporting local economic development and job creation across key sectors.

- The coal based boiler market was valued at USD 14.3 million in 2024. These heating systems are in significant decline across the region owing to aggressive decarbonization mandates and public health policies. The EPA’s tightening of MACT standards has accelerated the retirement of smaller-scale coal heating systems in schools and government buildings.

- The electric boiler market will witness a growth rate of over 16.5% through 2034. Rapid electrification or commercial buildings is driving strong interest in electric boilers, particularly in jurisdictions with clean or renewable electricity grids. These units are seeing increased uptake in schools, hospitals, and office complexes seeking to meet net-zero building mandates.

- For reference, in July 2025, SaskEnergy's Commercial Boiler Rebate Program is a strategic initiative aimed at encouraging investment in high-efficiency, appropriately sized commercial boilers. The program supports both new construction and retrofits projects, helping SaskEnergy commercial customers reduce natural gas consumption and lower operational costs.

- Based on technology, the North America commercial boiler market is segmented into condensing and non-condensing. The condensing segment will exceed USD 4 billion by 2034. These condensing units are gaining strong traction on account of their ability to achieve thermal efficiencies above 90% by recovering latent heat from exhaust gases.

- Widespread utilization in retrofit projects where facilities aim to reduce energy costs and carbon emissions without replacing the full heating infrastructure will foster business outlook. Modern units paired with remote diagnostics, BACnet/Modbus connectivity, and sequencing controls to enhance operational visibility are accelerating industry growth.

- For reference, in January 2025, Walmart Canada has unveiled a strategic investment plan totalling USD 6.5 billion over the next five years, aimed at accelerating its growth and strengthening its market position nationwide.

- The non-condensing commercial boiler market was valued at USD 902.7 million in 2024. These boilers remain in demand for high-temperature applications where return water temperatures exceed condensing thresholds. These heating systems are preferred in settings where initial capital cost is a primary concern, and these units are typically less expensive to purchase and install.

Learn more about the key segments shaping this market

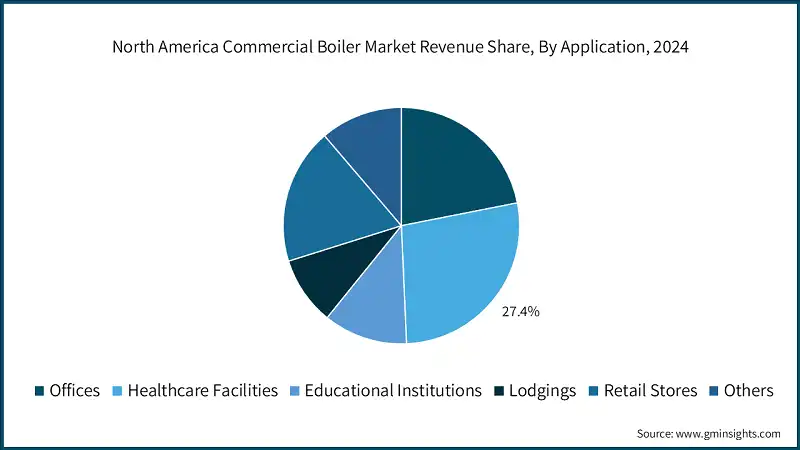

- Based on application, the North America commercial boiler market is segmented into healthcare facilities, offices, educational institutions, retail stores, lodgings, and others. The healthcare facilities segment holds a share of 27.4% in 2024 and is set to exceed USD 1 billion by 2034.

- These units play a mission-critical role in hospitals, supporting heating, sterilization, laundry, and hot water demands 24/7. In addition, these heating systems in healthcare environments are integrated with emergency backup generators to ensure thermal continuity during grid outages, thereby propelling the product demand.

- For illustration, in May 2025, Siemens Healthineers is committing USD 150 million toward strategic expansion initiatives in the U.S. This investment aims to scale production capacity, generate employment opportunities, and enhance customer service capabilities across key operations.

- The office boiler market was valued at USD 581.2 million in 2024. Rising demand for high-efficiency boilers in office buildings paired with modernized HVAC systems to meet local energy ordinances and ESG target will amplify industry potential. Urban office complexes integrating condensing boilers with building automation systems for better energy control and tenant comfort are driving business growth.

- The educational institutional segment will project at a CAGR of over 6.5% till 2034. Schools, colleges, and universities are prioritizing high-efficiency boilers to reduce operating costs and meet sustainability goals under energy performance contracts. Older institutions are replacing outdated with right-sized condensing units that aligned with current heating loads are driving industry momentum.

- For illustration, Canada’s building and industrial sectors are major energy consumers and emitters. Regulatory amendments targeting product energy use are projected to deliver USD 51 billion in net profits by 2050, with a benefit-to-cost ratio exceeding 9:1. Total estimated benefits: USD 57 billion; costs: USD 6.2 billion. These measures support Canada’s net-zero emissions goal by 2050.

- The lodgings boiler market was valued at USD 247.9 million in 2024. Hotels rely on commercial boilers for domestic hot water, spa operations, HVAC, and laundry systems, driving year-round heating demand. Increasing preference for compact, wall-hung, or floor-standing boilers in retrofit projects will positively sway business outlook.

- The retail store segment is set to reach over USD 900 million by 2034. Surging adoption of these boilers in mid and large retail stores for space heating, often in rooftop or mechanical setups will bolster industry scenario. Increasing use of modular gas or electric boilers in shopping centers, department stores, and enclosed malls for energy zoning flexibility are fortifying product portfolio.

Looking for region specific data?

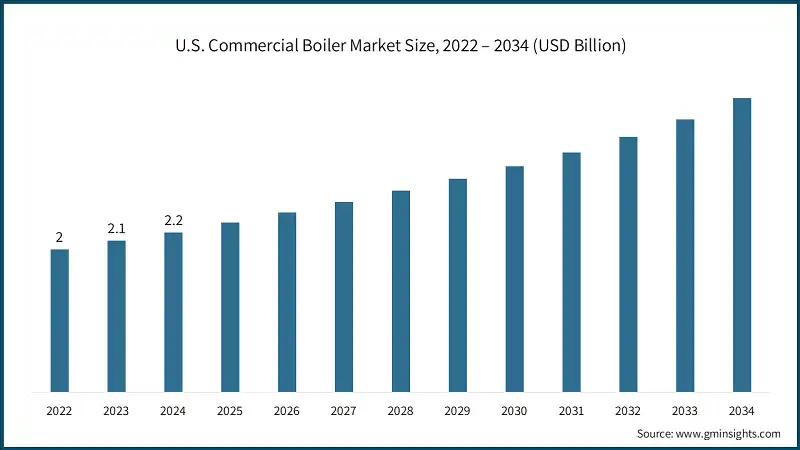

- The U.S. dominated the commercial boiler market in North America with 83.9% share in 2024 and generated USD 2.2 billion in revenue. Commercial buildings are increasingly using condensing boilers integrated with building automation systems for peak energy performance are influencing industry dynamics.

- Aging infrastructure in public buildings, especially schools and courthouses, is driving federal and state-funded retrofit programs that include boiler replacements, thereby energizing product demand. Growing adoption of electric boilers in urban areas with decarbonization mandates, particularly in states pursuing building electrification policies will boost industry potential.

- For citation, FY 2025, the U.S. Department of Housing and Urban Development (HUD) allocated USD 35.2 billion representing over 11% of its total USD 296.2 billion budget—toward key priorities including affordable housing, community revitalization, and urban development. This allocation reflects HUD’s continued strategic commitment to advancing its mission through targeted investment in core operational programs.

- The Canada commercial boiler market is expected to reach over USD 550 million by 2034. Stringent national building codes and provincial climate policies are accelerating adoption of high-efficiency and low-emission commercial boilers. Extreme winter conditions in central and eastern provinces maintain strong demand for reliable hot water and steam-based heating systems are fueling industry growth.

- The Mexico commercial boiler market will witness a CAGR of over 7% through 2034. The country is experiencing significant growth propelled by expanding gas grid access and favorable cost compared to LPG or electricity. Energy efficiency initiatives under Mexico’s Energy Transition Law are leading to increased interest in modern, high-efficiency commercial boilers.

- For illustration, according to the Mexico’s Secretariat of Economy, foreign direct investment (FDI) totalled USD 36.1 billion in 2023, representing a 2.3% year-over-year increase from USD 35.2 billion in 2022. This upward trend highlights continued investor confidence in Mexico’s economic landscape.

North America Commercial Boiler Market Share

- The top 5 companies in the North America commercial boiler industry are A. O. Smith, Ariston Holding, Burnham Commercial Boilers, Lennox International, and Rinnai America contributing around 35% of the market in 2024. The market is moderately consolidated, characterized by the presence of both established multinational manufacturers and regional players.

- Competition is driven by innovation in condensing technology, smart controls, and compliance with energy efficiency standards including ENERGY STAR, AHRI ratings, and regional emission regulations. Companies also compete by offering modular systems for ease of scalability and by addressing the growing electrification trend in states with decarbonization goals.

- The local manufacturers & niche firms maintain competitiveness by focusing on customized solutions, service responsiveness, and cost-effective designs for mid-sized commercials spaces. Market participants are increasingly investing in training, certification programs, and digital support platforms to enhance installer loyalty.

- A.O. Smith competes in the market as a technologically driven and efficient-focused manufacturer, leveraging its strong reputation for water heating and expanding its footprint on space heating applications. Its competitive edge lies in robust R&D capabilities, energy-efficient product design, and a strong distribution network across the region.

- Bradford White Corporation operates in the market with a strong focus on reliability, American made products, and service-focused solutions. The company, through its subsidiary Laars Heating Systems, is a recognized player in the hydronic heating segment, offering both condensing and non-condensing commercial boilers.

- Over the past 3 years, the market has seen a gradual shift toward higher market concentration, driven by technological advancements, regulatory compliance requirements, and strategic consolidation. This evolving dynamic has increased entry barriers for smaller or regional players, who often lack the capital and technical expertise to compete on efficiency, emissions compliances, or smart control integration.

North America Commercial Boiler Market Companies

- In the first quarter of 2025, Babcock & Wilcox Enterprises reported revenue from continuing operations of USD 181.2 million, marking a 10% year-over-year from USD 164.3 million in Q1 2024. This was primarily fueled by USD 8.5 million from a natural gas project and a USD 10 million rise in parts sales.

- In the fourth quarter of 2024, Lennox reported strong financial performance, posting a revenue of USD 1.3 billion and operating income of USD 245 million. Core revenue grew 22% year-over-year to USD 1.3 billion, while the adjusted segment profit growth surged by 41% to USD 248 million. Segment margin expanded by 250 basis points, reaching an all-time high of 18.4%.

- For the full year 2024, Ariston Holding reported net revenue of USD 3.1 billion, representing a 12.7% Y-o-Y decline on an organic basis. Fourth-quarter revenue totalled USD 849.7 million, down 6.8% compared to the same period in the previous year, though showing sequential improvement. Adjusted EBIT for the year came in at USD 1.16 million, reflecting a 48% decrease from 2023.

Major players operating in the North America commercial boiler industry are:

- A.O. Smith

- AERCO

- Ariston Holding

- Babcock & Wilcox Enterprises

- Bosch Thermotechnology

- Bradford White Corporation

- Burnham Commercial Boilers

- Clayton Industries

- Cleaver-Brooks

- Columbia Heating Products

- Daikin Industries

- Energy Kinetics

- Fulton

- HTP

- Hurst Boiler & Welding

- Lennox International

- Lochinvar

- Miura America

- Navien

- NTI Boilers

- P.M. Lattner Manufacturing

- Parker Boiler

- PB Heat

- Precision Boilers

- Rentech Boiler Systems

- Rinnai America

- Thermal Solutions

- U.S. Boiler Company

- Viessmann

- WM Technologies

North America Commercial Boiler Industry News

- In January 2025, Bosch Home Comfort launched the Buderus SSB Gen 2 Boiler, introducing a range of advanced enhancements over its predecessor. With output capacities spanning from 798 to 8,192 MBH, the Gen 2 model is engineered to deliver superior performance, reliability, and adaptability making it an ideal solution for a wide spectrum of commercial applications.

- In July 2024, Bradford White Corporation completed the strategic acquisition of FloLogic, a North Carolina-based innovator in advanced plumbing leak detection and automatic shut-off technologies for light commercial markets. This acquisition underscores Bradford White’s commitment to driving innovation and delivering high-performance solutions, while significantly enhancing its portfolio of smart water management technologies.

- In May 2024, Daikin Industries entered a strategic partnership with Miura, following approval from both companies’ boards. This agreement stated that Daikin will acquire a 4.67% equity stakes in Miura, while Miura will assume 49% ownership in Daikin Applied Systems, a wholly owned subsidiary of Daikin. This collaboration is designed to leverage the complementary strengths of both organizations spanning products, technologies, and service networks—to deliver integrated and comprehensive energy solutions.

- In January 2024, AERCO launched the CFR, the first stainless steel condensing boiler designed for installation in a Category I Vent system. This innovation delivers up to 87.6% thermal efficiency, setting a new benchmark for performance in Category I boilers. This boiler is available in 1,500 MBH and 3,000 MBH models along with if further offers a cost-effective upgrade path for facilities looking to replace aging non-condensing boiler systems.

The North America commercial boiler market research reports include in-depth coverage of the industry with estimates & forecast in terms of volume (Units), capacity (MMBTU/hr) & revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Fuel

- Natural gas

- Oil

- Coal

- Electric

- Others

Market, By Capacity

- ≤ 0.3 – 2.5 MMBTU/hr

- > 2.5 - 10 MMBTU/hr

- > 10 - 50 MMBTU/hr

- > 50 - 100 MMBTU/hr

- > 100 - 250 MMBTU/hr

Market, By Technology

- Condensing

- Non-condensing

Market, By Product

- Hot water

- Steam

Market, By Application

- Offices

- Healthcare facilities

- Educational institutions

- Lodgings

- Retail stores

- Others

The above information has been provided for the following countries:

- U.S.

- Canada

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the North America commercial boiler market?

Major key players are A.O. Smith, AERCO, Ariston Holding, Babcock & Wilcox Enterprises, Bosch Thermotechnology, Bradford White Corporation, Burnham Commercial Boilers, Clayton Industries, Cleaver-Brooks, Columbia Heating Products, Daikin Industries, Energy Kinetics, Fulton, HTP, Hurst Boiler & Welding.

What is the growth outlook for electric boilers from 2025 to 2034?

Electric boilers are projected to grow at over 16.5% CAGR through 2034, driven by rapid electrification of commercial buildings and clean electricity grids supporting net-zero building mandates.

Which application segment leads the commercial boiler market?

The healthcare facilities hold 27.4% market share in 2024 and are set to exceed USD 1 billion by 2034, as boilers play mission-critical roles supporting heating, sterilization, and hot water demands 24/7.

What are the key trends driving the North America commercial boiler market?

Key trends include adoption of low-carbon heating technologies, stringent emission regulations, integration with smart building automation systems, and expansion of district heating networks in urban areas.

What was the valuation of the condensing technology segment in the market?

The condensing segment will exceed USD 4 billion by 2034, gaining strong traction due to their ability to achieve thermal efficiencies above 90% by recovering latent heat from exhaust gases.

What is the size of North America commercial boiler market in 2024?

The market size was USD 2.7 billion in 2024, with a CAGR of 6.5% expected through 2034 due to rising adoption of low-carbon heating systems including condensing gas, electric, and hybrid boiler solutions.

Which fuel segment dominates the commercial boiler market and what is its share?

Natural gas boilers dominated 68.7% market share in 2024 and are projected to grow at a CAGR of over 5.5% through 2034, supported by widespread gas infrastructure and high thermal efficiency.

What is the projected value of the North America commercial boiler market by 2034?

The North America commercial boiler industry is expected to reach USD 5 billion by 2034, propelled by decarbonization policies, energy efficiency mandates, and infrastructure modernization.

North America Commercial Boiler Market Scope

Related Reports