Summary

Table of Content

Nanocellulose Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nanocellulose Market Size

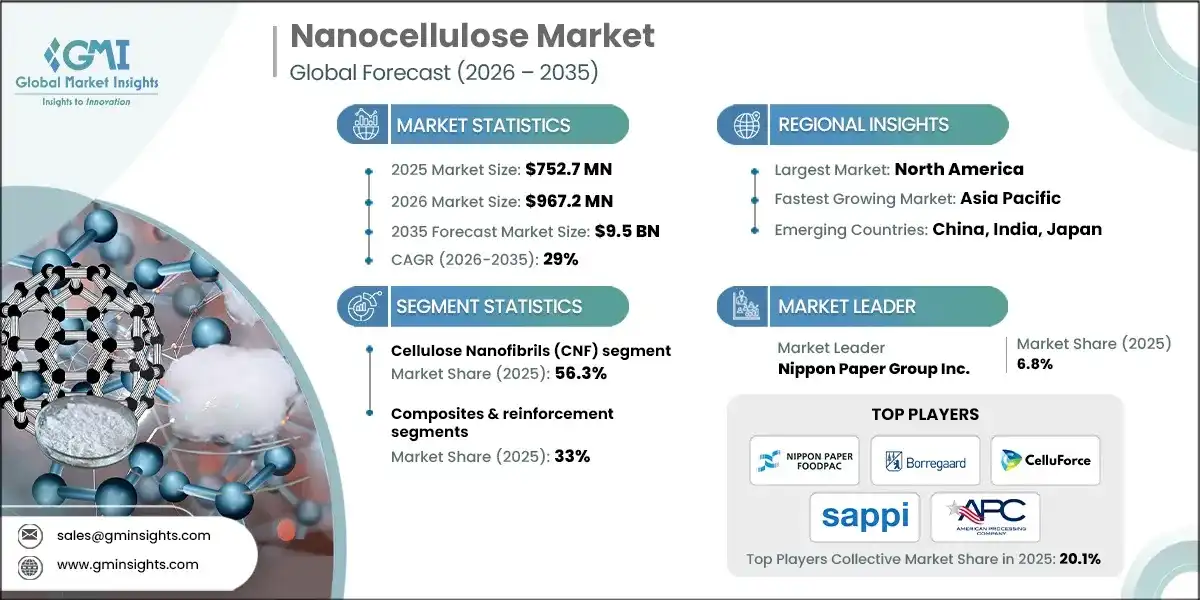

The global nanocellulose market size was valued at USD 752.7 million in 2025 and is poised to expand from USD 967.2 million in 2026 to USD 9.5 billion by 2035, reflecting a 29% CAGR from 2026 to 2035, according to the latest report published by Global Market Insights Inc.

To get key market trends

- Nanocellulose is a class of bio-based nanomaterials derived from cellulose, the planet’s most abundant biopolymer, and offers exceptional stiffness-to-weight, high specific surface area, and tunable surface chemistry. At the materials level, tensile strength can approach ~10 GPa and Young’s modulus 140–150 GPa for cellulose nanocrystals, positioning the nanocellulose market to substitute petroleum-based additives in demanding uses. Three primary types—cellulose nanocrystals (CNC), cellulose nanofibrils (CNF), and bacterial nanocellulose (BNC)—anchor current commercial activity, each with distinct morphologies and processing routes that map to different industry needs.

- Sustainable packaging adoption is accelerating as brands look for barrier films and coatings that deliver oxygen transmission rates rivaling synthetics while maintaining compostability, which keeps the market firmly on the radar of global CPGs

- Biomedical innovation is moving from concept to clinic, with BNC dressings and CNF/CNC hydrogels supporting wound care, scaffolds, and controlled delivery—broadening the nanocellulose market’s premium segments.

- Integration into energy storage is gathering pace as CNF-based electrodes and separators improve safety, flexibility, and cycle life—linking the market to wearables and next-gen batteries

Nanocellulose Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 752.7 Million |

| Market Size in 2026 | USD 967.2 Million |

| Forecast Period 2026-2035 CAGR | 29% |

| Market Size in 2035 | USD 9.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Demand for Eco-Friendly Materials | Eco-material push boosts adoption in packaging and consumer goods |

| High Mechanical Strength and Barrier Properties | Strength/barrier performance enables substitution and premium pricing |

| Supportive R&D and Funding | Public–private R&D accelerates tech transfer and application readiness |

| Pitfalls & Challenges | Impact |

| High Production Costs | High capex/opex slows entry into price-sensitive segments |

| Limited Large-Scale Commercialization | Limited large-scale capacity and standardization delay mass adoption |

| Opportunities: | Impact |

| Functionalized Grades | Functionalized grades unlock nonpolar matrices and smart surfaces |

| Market Leaders (2025) | |

| Market Leaders |

6.8 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | Asia Pacific |

| Future outlook |

|

What are the growth opportunities in this market?

Nanocellulose Market Trends

- The packaging industry is undergoing a fundamental transformation driven by environmental imperatives and regulatory pressures to reduce plastic waste. Global plastic waste generation reached approximately 359 million metric tonnes annually, with packaging representing a significant portion of this burden. Nanocellulose-based packaging materials offer a compelling sustainable alternative, combining biodegradability, renewable sourcing, and high-performance barrier properties that rival conventional petroleum-based films.

- Cellulose nanocrystals and nanofibrils demonstrate exceptional oxygen barrier performance when incorporated into biodegradable polymer matrices or applied as coatings on paper and paperboard substrates. At low to medium relative humidity conditions (below 50% RH), nanocellulose films achieve oxygen permeability values as low as 0.06 cm³·24h ¹·m ²·bar ¹, comparable to ethylene vinyl alcohol (EVOH) copolymers used in conventional food packaging. This performance is attributed to the dense hydrogen-bonded network structure and high crystallinity of nanocellulose, which creates tortuous diffusion pathways for gas molecules.

- Commercial adoption is accelerating in food packaging applications. Nippon Paper Group's carboxymethylated CNF product, Cellenpia®, has been incorporated into food products including dorayaki (Japanese confection) to extend shelf life by improving moisture retention and shape stability. The company reports current sales of approximately 70 tons per year with a target of 100 tons per year by 2035, reflecting growing market acceptance. In Europe, Borregaard's Exilva microfibrillated cellulose is being evaluated for barrier coatings on corrugated board and paperboard packaging, enabling recyclable alternatives to plastic-laminated materials.

- The trend extends beyond barrier performance to active and intelligent packaging functionalities. Nanocellulose serves as a carrier matrix for antimicrobial agents, antioxidants, and freshness indicators, enabling extended shelf life and food safety monitoring. Research demonstrates that CNF-based films loaded with silver nanoparticles, zinc oxide, or essential oils provide sustained antimicrobial activity against foodborne pathogens including E. coli, Salmonella, and Listeria. Intelligent packaging incorporating nanocellulose with pH-sensitive dyes or anthocyanins enables visual monitoring of food freshness, addressing consumer demand for transparency and waste reduction.

Nanocellulose Market Analysis

Learn more about the key segments shaping this market

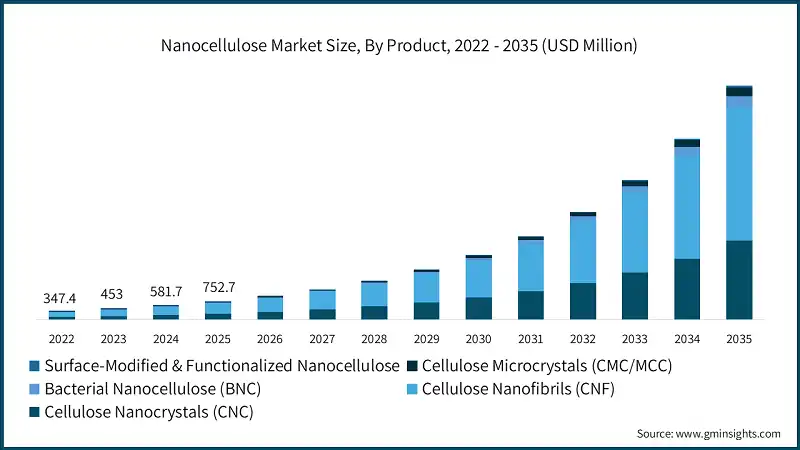

Based on Product, the market is segmented as cellulose nanocrystals (CNC), cellulose nanofibrils (CNF), bacterial nanocellulose (BNC), cellulose microcrystals (CMC/MCC), surface-modified & functionalized nanocellulose.

- Cellulose Nanofibrils (CNF) captured roughly 56.3% of the nanocellulose market share in 2025, based on versatility in rheology modification, coatings, and reinforcement, aided by commercial scale production at players like Borregaard. CNF’s leadership is supported by established industrial capacity in Norway and Japan and by use cases ranging from construction admixtures to waterborne coatings. CNC’s production via acid hydrolysis yields rod like crystals with high crystallinity and oxygen barrier potential that suit advanced films and composites.

- BNC’s biosynthetic routes enable ultrapure networks ideal for wound care and implants, where clinical evidence supports reduced pain and improved healing. MCC’s regulatory familiarity (e.g., GRAS in food) and supply base enable broad use in texture and binding, while surface modified nanocellulose unlocks antimicrobial, barrier, and stimuli responsive functions in specialty applications.

Learn more about the key segments shaping this market

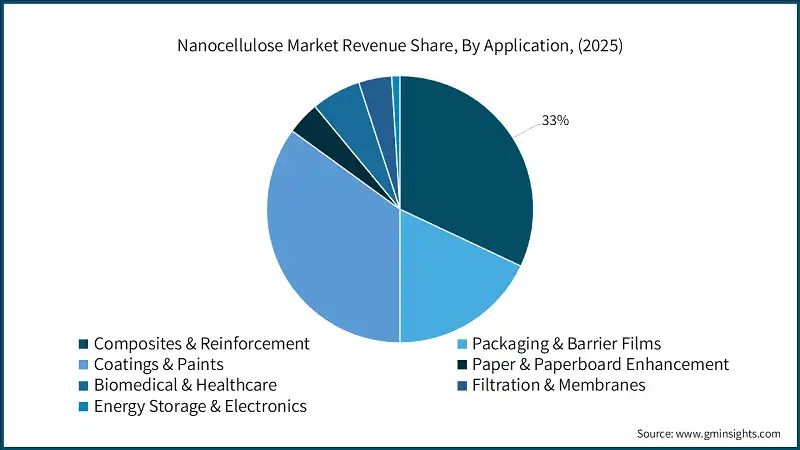

Based on application the market is segmented as composites & reinforcement, packaging & barrier films, coatings & paints, paper & paperboard enhancement, biomedical & healthcare, filtration & membranes, energy storage & electronics, rheology modifiers & additives, agricultural applications, and construction materials.

- Composites & reinforcement represented about 33% of the nanocellulose market in 2025, as automakers and Tier 1s evaluate CNF reinforced engineering plastics for weight reduction while maintaining strength and wear properties in gears and housings. Paper and paperboard enhancement follows, leveraging CNF to boost tensile strength and improve surface while reducing fiber usage in specialty grades. Packaging and barrier films continue to expand, particularly for food contact applications where oxygen barriers and compostability improve shelf life and sustainability credentials.

- Biomedical and healthcare contribute a premium niche, from BNC wound dressings already used in clinics to CNF/CNC hydrogels for scaffolds and drug delivery with favorable biocompatibility profile. Energy storage and electronics are the fastest growing emerging outlets, where CNF based electrodes, separators, and gel electrolytes offer high cycle stability and safer operation for wearables and flexible devices. The numbers tell us end markets value multi functionality—reinforcement, barrier, and sustainability—driving the market deeper into performance critical specs.

Looking for region specific data?

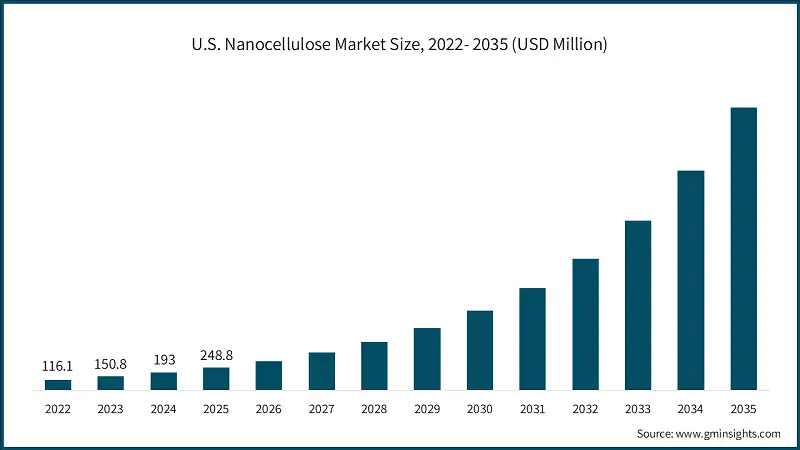

The U.S. nanocellulose market valued at USD 248.8 million in 2025 and estimated to grow to almost USD 3 billion by 2035. North America holds around 39.3% of the market share in 2025.

- The North America market leads on share and depth, supported by extensive research infrastructure including the USDA Forest Products Laboratory pilot plant and strong industry-academia collaboration. The USDA Forest Service's 2024 outreach initiative for nanocellulose research partnerships and FPInnovations' successful Nanocellulose Challenges Program demonstrate ecosystem support for commercialization.

- American Process Inc. and CelluForce Inc. operate pilot and demonstration facilities in the region, with CelluForce's Windsor, Quebec plant representing the world's first NCC demonstration facility inaugurated in 2012. Key growth drivers include automotive lightweighting initiatives, sustainable packaging demand from major food and beverage companies, and biomedical innovation clusters. The region benefits from abundant forest resources, established pulp and paper industry infrastructure, and favorable regulatory environment for bio-based materials.

- The Europe nanocellulose market is shaped by forestry integration and policy signals. Norway’s Borregaard operates the world’s first commercial CNF facility at Sarpsborg, offering paste and suspension grades and deep technical support for customers. Germany, the UK, France, Spain, and Italy see activity clustered around coatings, paper, and composites, helped by circular-economy directives that reward recyclable, fiber based barriers. A region where sustainability policy and advanced biorefinery know how keep the market on a clear upward trajectory.

- Asia Pacific’s nanocellulose market posts the fastest growth as Japan leads commercialization, China scales manufacturing, and India accelerates research. The China market is building capacity to serve packaging and electronics, while the India market benefits from public research driving yields and energy efficiency in CNF production.

Nanocellulose Market Share

The nanocellulose industry is moderately concentrated, with the top five players holding 20.1% combined share in 2025 and a long tail of specialized producers, research spin outs, and regional entrants. Nippon Paper Group leads with 6.8% on the strength of its Cellenpia portfolio, process integration with pulp assets, and dual site production at Ishinomaki and Gotsu—an advantage in supply reliability for Japanese OEMs and global partners.

Borregaard’s 1,000 t/y CNF plant and deep application support give it a strong European position across coatings, construction, personal care, and batteries, which keeps it central to many qualification pipelines in the nanocellulose market. CelluForce remains a key CNC source from its Windsor demonstration facility, supplying trials in paints, films, textiles, and composites while expanding collaboration agreements across regions.

- Nippon Paper Group Inc.

- Nippon Paper Group Inc. maintains market leadership through its Cellenpia® brand cellulose nanofiber products and established mass-production infrastructure. The company operates production facilities at Ishinomaki Mill (500 metric tons per year CNF capacity) and Gotsu Mill (30 metric tons per year carboxymethylated CNF for food applications), with the Gotsu facility operating at full day-shift capacity reflecting strong demand. Nippon Paper's competitive advantages include vertical integration with pulp production, diverse product portfolio spanning food-grade, industrial-grade, and specialty CNF variants, and strong domestic market position in Japan supported by government initiatives promoting CNF commercialization.

- Nippon Paper Group Inc. maintains market leadership through its Cellenpia® brand cellulose nanofiber products and established mass-production infrastructure. The company operates production facilities at Ishinomaki Mill (500 metric tons per year CNF capacity) and Gotsu Mill (30 metric tons per year carboxymethylated CNF for food applications), with the Gotsu facility operating at full day-shift capacity reflecting strong demand. Nippon Paper's competitive advantages include vertical integration with pulp production, diverse product portfolio spanning food-grade, industrial-grade, and specialty CNF variants, and strong domestic market position in Japan supported by government initiatives promoting CNF commercialization.

- Borregaard ASA

- Borregaard ASA holds a strong competitive position as the operator of the world's first commercial-scale microfibrillated cellulose production facility, with annual capacity of 1,000 metric tons (dry basis) at its Sarpsborg, Norway site. The company's Exilva product line serves diverse markets including agriculture, batteries, construction, coatings, cleaners, paints, paper & packaging, personal care, and adhesives, demonstrating broad application versatility.

- Borregaard ASA holds a strong competitive position as the operator of the world's first commercial-scale microfibrillated cellulose production facility, with annual capacity of 1,000 metric tons (dry basis) at its Sarpsborg, Norway site. The company's Exilva product line serves diverse markets including agriculture, batteries, construction, coatings, cleaners, paints, paper & packaging, personal care, and adhesives, demonstrating broad application versatility.

- CelluForce Inc

- CelluForce Inc. operates as a joint venture focused on cellulose nanocrystal production and commercialization, with a demonstration facility at Domtar's Windsor, Quebec mill targeting 1,000 kg/day capacity. The facility, inaugurated in 2012 as the world's first NCC demonstration plant with USD 36 million investment and government support totaling USD 33.4 million, positions CelluForce as a leading CNC supplier for industrial trials and early commercial applications.

- CelluForce Inc. operates as a joint venture focused on cellulose nanocrystal production and commercialization, with a demonstration facility at Domtar's Windsor, Quebec mill targeting 1,000 kg/day capacity. The facility, inaugurated in 2012 as the world's first NCC demonstration plant with USD 36 million investment and government support totaling USD 33.4 million, positions CelluForce as a leading CNC supplier for industrial trials and early commercial applications.

Nanocellulose Market Companies

Major players operating in the nanocellulose industry are:

- Sappi Limited

- Borregaard ASA

- CelluForce Inc.

- FPInnovations

- American Process Inc. (API)

- Kruger Inc.

- Daicel Corporation

- Nippon Paper Group Inc.

- Melodea Ltd.

- J. Rettenmaier & Söhne GmbH + Co. KG

- CelluComp Ltd.

- Asahi Kasei Corporation

- Oji Holdings Corporation

- Stora Enso

- Holmen AB

- Anomera

Nanocellulose Industry News

- In July 2025, Harvest Nano initiated operations at Michigan’s first cotton textile waste-to-nanocellulose plant in collaboration with Goodwill Industries of West Michigan. This facility processes non saleable textile waste into micro- and nanocellulose for use in industries such as packaging, automotive, aerospace, and 3D printing

- In April 2025, Helogen, a space-biology firm, entered a partnership with AgResearch (NZ Crown Institute) to produce bacterial nanocellulose (BNC) aboard Helogen’s autonomous orbital laboratories. The goal is to exploit microgravity to enhance BNC properties and enable novel applications in healthcare, electronics, and advanced materials. Helogen holds commercial rights to all materials produced through this collaboration.

- In August 2023, Nippon Paper Group achieved world-first mass-production adoption of CNF-reinforced thermoplastics (Cellenpia®PLAS) in transportation equipment through selection for an engine component of a personal watercraft by Yamaha Motor. The company is conducting demonstrations at Fuji Mill and pursuing commercialization in mobility and industrial applications with over 20 companies engaged in discussions.

The nanocellulose market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product

- Cellulose Nanocrystals (CNC)

- Sulfated CNC

- Carboxylated CNC

- Other chemically modified CNC

- Cellulose Nanofibrils (CNF)

- Enzymatically treated CNF

- TEMPO-Mediated Oxidation

- Carboxymethylation

- Bacterial Nanocellulose (BNC)

- Cellulose Microcrystals (CMC/MCC)

- Surface-Modified & Functionalized Nanocellulose

Market, By Application

- Composites & Reinforcement

- Polymer Matrix Types

- Thermoplastic Composites

- Thermoset Composites

- Bio-Based Polymer Composites

- Polymer Matrix Types

- Packaging & Barrier Films

- Food Contact Applications

- Oxygen Barrier Films

- Moisture Barrier Coatings

- Grease-Resistant Packaging

- Active & Intelligent Packaging

- Biodegradable Packaging Solutions

- Food Contact Applications

- Coatings & Paints

- Rheology Modification

- Barrier & Protective Coatings

- Anti-Corrosion Applications

- Paper & Paperboard Enhancement

- Biomedical & Healthcare

- Filtration & Membranes

- Water Treatment Applications

- Air Filtration

- Oil-Water Separation

- Heavy Metal Removal

- Energy Storage & Electronics

- Battery Separators

- Supercapacitor Electrodes

- Flexible Electronics Substrates

- Sensors & Actuators

- Rheology Modifiers & Additives

- Agricultural Applications

- Construction Materials

- Cement & Concrete Additives

- Adhesives & Sealants

- Wood Composites & Engineered Wood

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What is the expected size of the nanocellulose industry in 2026?

The market size is projected to reach USD 967.2 million in 2026, reflecting steady growth in adoption across industries.

What was the market share of Cellulose Nanofibrils (CNF) in 2025?

Cellulose Nanofibrils (CNF) captured approximately 56.3% of the market share in 2025, owing to its versatility in rheology modification, coatings, and reinforcement applications.

What is the market size of the nanocellulose in 2025?

The market size was valued at USD 752.7 million in 2025, growing at a CAGR of 29% from 2026 to 2035, driven by its application in sustainable materials and high-performance properties.

What is the projected value of the nanocellulose market by 2035?

The market is poised to reach USD 9.5 billion by 2035, fueled by demand in packaging, composites, and biomedical applications.

What was the valuation of the composites and reinforcement segment in 2025?

The composites and reinforcement segment accounted for about 33% of the market in 2025, led by its use in automotive engineering plastics and paperboard enhancement.

Which region leads the nanocellulose sector?

The U.S. market, valued at USD 248.8 million in 2025, is expected to grow to nearly USD 3 billion by 2035, supported by advancements in packaging and composites.

What are the upcoming trends in the nanocellulose market?

Key trends include growing use of nanocellulose in biodegradable and intelligent packaging, antimicrobial films, and advanced composites for automotive and biomedical applications.

Who are the key players in the nanocellulose industry?

Key players include Sappi Limited, Borregaard ASA, CelluForce Inc., FPInnovations, American Process Inc. (API), Kruger Inc., Daicel Corporation, Nippon Paper Group Inc., Melodea Ltd., J. Rettenmaier & Söhne GmbH + Co. KG, Stora Enso, Holmen AB, and Anomera.

Nanocellulose Market Scope

Related Reports