Summary

Table of Content

Medical Styrenic Polymers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Styrenic Polymers Market Size

Medical Styrenic Polymers Market size was valued at around USD 3.2 billion in 2019 and will exhibit a growth rate of over 5.7% CAGR from the period of 2020 to 2026. The demand for styrenic polymers is mainly driven by its rising preference over traditional polymers and metals, owing to growing concerns over environmental threats.

Poly vinyl chloride (PVC) is among the most popular thermoplastic used across medical industry. Moreover, another factor driving the medical styrenic polymers market is the drastic shift from traditionally used metallic devices to polymer based medical devices, owing to its wide advantages over metallic devices. Polymer based medical highly desirable in medical applications mainly due to its design versatility, easy disposability. light weight, cost effectiveness and better aesthetics. This shift in preference is anticipated to positively contribute to the overall market size during the forecast period.

To get key market trends

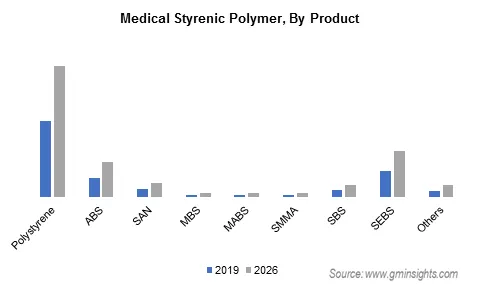

A variety of styrenic polymers such as, SMMA, ABS, SAN, MABS, SBCs, MBS, etc. is employed in medical applications. Polystyrene is among the most common polymer types of styrenic copolymer and constitute a major chunk of the overall medical styrenic polymers market mainly due to several excellent properties such as aesthetics, color stability and melt flow consistency among others. The other most commonly used styrenic polymers are SEBS and ABS.

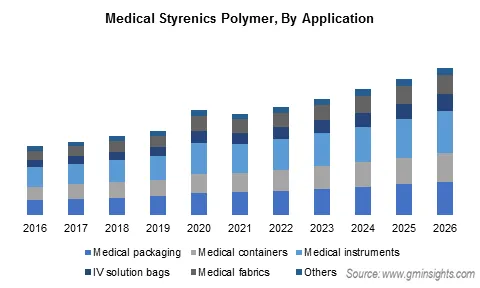

Styrenic polymers are widely used in containers, IV solution bags, packaging, fabrics and other applications such as tubing’s, multiflow devices etc. Medical packaging constitutes a major chunk which accounts for approximately 20% of the total medical styrenic polymers in 2019. Medical packaging includes packaging for pharmaceutical capsules, tablets, liquids, ointments, powders and creams, as well as for overwrapping medical devices via material made up of ABS, polystyrene, SBS, MBS, SEBS, etc. These growing applications of styrenic polymers in medical devices will positively impact the medical styrenic polymers market share throughout the forecast period. However, the high price of styrenic polymers is projected to be a major factor retraining the overall market during the assessment period.

Medical Styrenic Polymers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 3.4 Billion |

| Forecast Period 2020 to 2026 CAGR | 5.7% |

| Market Size in 2026 | USD 5.9 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Medical Styrenic Polymers Market Analysis

Learn more about the key segments shaping this market

Polystyrene will constitute approximately 50% of the total industry share in 2026. It is the most widely applicable styrenic polymer in the medical industry. It provides several desirable attributes such as excellent flow consistency and color stability, good resistance to ethylene oxide sterilization process, UV light sterilization process as well as to gamma and electron beams.

ABS and SEBS are other major segments in the overall market. Acrylonitrile butadiene styrene held a market share of over 12% in terms of revenue in 2019 and is projected to grow at a CAGR of over 6% during the review period. The other medical styrenic polymers market segment include Acrylonitrile Styrene Acrylate (ASA), Styrene Isoprene Butadiene Styrene (SIBS), Unsaturated Polyester Resin (UPR), etc. ASA exhibits similar properties to ABS such as high gloss, good chemical and heat resistance and high impact strength at low temperatures hence are widely used in medical devices across the globe.

Learn more about the key segments shaping this market

Medical instrument was the largest segment in 2019 and is projected to exhibit a CARG of 6.8% throughout the forecast period. Medical instruments segment includes medical drip chambers, dry powder inhaler, diagnostic instruments, disposable laboratory ware, petri dishes, tissue culture components, flasks, pipettes, etc. The growing demand for styrenic polymers in these applications shall substantially contribute to the growth of the medical styrenic polymers market segment during the assessment period.

Moreover, the ongoing pandemic across the globe has further propelled the demand for medical instruments in turn boosting the demand for medical styrenic polymers. The aforementioned trends along with stringent regulations against using harmful polymer materials has triggered demand for styrene-based polymers in medical instruments which shall further generate substantial gain for the medical styrenic polymers market.

Medical packaging was another major segment in 2019 and held a market share of over 22% in terms of revenue. Stringent regulations imposed by regional regulatory bodies to reduce impact of harmful and toxic materials release in the environment is a key factor which is replacing conventional polymers such as polycarbonate, polyvinyl chloride, etc. with styrene-based polymers as packaging material in the medical industry. Styrenic polymers are plasticizer free and impose no or minimum harm on the environment. For instance, polystyrene which is the most common styrenic polymer as packaging materials owing to its excellent environmental qualities.

The other application segment held a market share of over 5% in 2019. The other application segment for medical styrenic polymer market includes hemodialyzer housing, medical tubing, IV connectors, valves, multi flow devices, etc. which are formed from ABS, SAN, MBS, Polystyrene, etc.

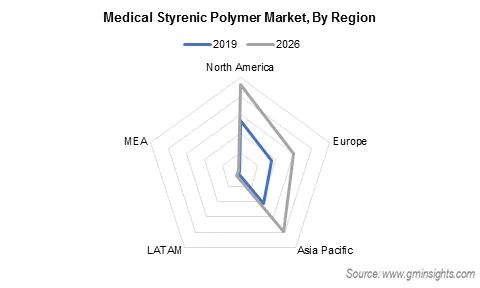

Looking for region specific data?

North America held the largest share of over 38% of the total market size in 2019. This can be attributed to growing healthcare spending in the North American region. Moreover, the presence of strict healthcare standards and regulations has resulted in the substitution of conventional metallic devices to thermoplastic elastomer owing to their easy processability and their compliance with the environmental regulations. North American market was closely followed by the European market and shall exhibit similar growth trends throughout the giver period 2020-2026

Medical Styrenic Polymers Market Share

Capacity expansion is one of the commonly witnessed strategies in the global market. The major companies in the medical styrenic polymers industry are seen to expand their manufacturing capacity to cater to a larger target market. Some of the key product producing companies include:

- Styrolution group GmbH

- BASF

- Trinseo

- SABIC

- Chi Mei

- Kraton

- Chevron Phillips Chemical

- Bayer MaterialScience

- Nova Chemical

- LG Chem

- ELIX Polymers

- Mitsubishi Chemical Holding

- Ovation Polymers

- Grupo Dynasol

- Formosa Chemical & Fibre Corporation

Medical styrenic polymers market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in million square meters & revenue in USD million from 2015 to 2026, for the following segments:

By Product

- Polystyrene

- ABS

- SAN

- MBS

- MABS

- SMMA

- SBS

- SEBS

- Others

By Application

- Medical packaging

- Medical containers

- Medical instruments

- IV solution bags

- Medical fabrics

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Australia

- Japan

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Where are medical styrenic polymer products expected to gain massive traction?

Medical styrenic polymers will gain heavy traction in North America owing to rising healthcare expenditure and stringent medical care norms. North America held the biggest revenue share of over 38% in 2019.

How will the demand for medical instruments augment medical styrenic polymer industry outlook?

High demand for medical instruments such as dry powder inhaler, disposable laboratory ware, medical drip chambers, etc., that use styrenic polymers, will push segment growth, poised to register 6.8% CAGR through 2026.

Why are polystyrene products anticipated to propel the industry demand?

Polystyrene has excellent characteristic such as good resistance to UV light sterilization process & ethylene oxide sterilization process, high flow consistency, etc., owing to which the segment may hold around 50% of the medical styrenic polymer market share by 2026.

How will medical packaging applications prove lucrative for the market growth?

Medical packaging applications held more than 20% of the overall market share in 2019 and will depict appreciable growth ahead, driven by product adoption in packaging for liquids, creams, powders, pharmaceutical capsules, and tablets.

What is the main factor responsible for increasing the demand for medical styrenic polymers?

Increasing preference for styrenic polymers as opposed to conventional polymers and metal on account of increasing environmental concerns will push the product demand.

What was the estimated global medical styrenic polymer market size in 2019?

medical styrenic polymer market

How much growth is the medical styrenic polymer industry projected to record over the forecast spell?

The medical styrenic polymer market is likely to register a crcr of 5.7% over the forecast period.

Medical Styrenic Polymers Market Scope

Related Reports