Summary

Table of Content

Medical Device Distribution Services Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Device Distribution Services Market Size

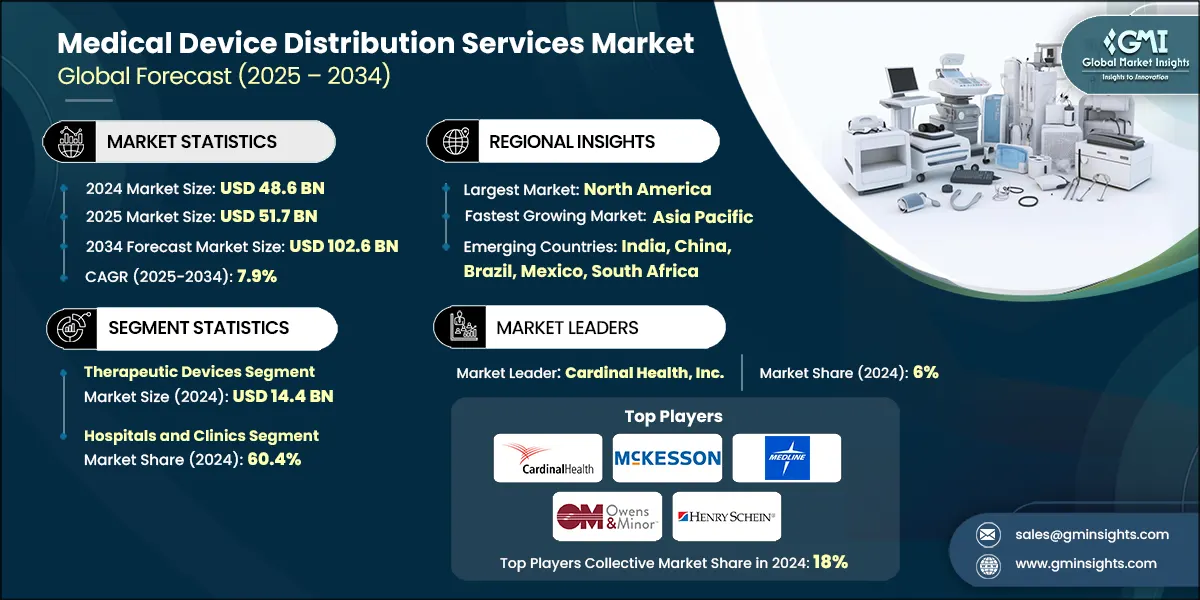

The global medical device distribution services market was valued at USD 48.6 billion in 2024 and is projected to grow from USD 51.7 billion in 2025 to USD 102.6 billion by 2034, expanding at a CAGR of 7.9%, according to the latest report published by Global Market Insights Inc. This steady growth is driven by the growing prevalence of chronic diseases, surge in investments for research and growth in medical device approvals, rising demand for home healthcare and remote monitoring, and advancements in medical device technology.

To get key market trends

Major companies in the industry include Cardinal Health, Inc., McKesson Corporation, Medline Inc., Owens & Minor, and Henry Schein. These industry leaders are investing in advanced logistics technologies, data-driven inventory management systems, and integrated supply chain solutions to ensure timely and efficient distribution of critical medical devices. By leveraging strategic partnerships with healthcare providers, manufacturers, and digital health platforms, they are expanding their reach and improving service quality.

Medical Device Distribution Services Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 48.6 Billion |

| Market Size in 2025 | USD 51.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.9% |

| Market Size in 2034 | USD 102.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing prevalence of chronic diseases | Drives increased demand for timely distribution of diagnostic, monitoring, and therapeutic devices across hospitals, clinics, and homecare settings. |

| Surge in investments for research purpose and growth in medical device approvals | Accelerates the need for agile distribution networks to ensure rapid market entry and availability of newly approved devices. |

| Rising demand for home healthcare and remote monitoring | Promotes expansion of direct-to-patient delivery models and specialized logistics for connected and portable medical devices. |

| Advancements in medical device technology | Necessitates sophisticated handling, cold-chain logistics, and inventory systems to manage high-value and tech-integrated devices. |

| Pitfalls & Challenges | Impact |

| Requirement for high initial capital expenditure | Limits entry of smaller distributors and delays infrastructure upgrades, impacting scalability and service efficiency. |

| Presence of stringent regulatory compliance | Increases operational complexity and costs for distributors, requiring investment in compliance systems and staff training. |

| Opportunities: | Impact |

| Growth in online distribution services and digital ordering system | Enables faster, more transparent procurement processes and supports expansion into homecare and ambulatory markets. |

| Increasing public private partnership to strengthen supply chain | Facilitates infrastructure development and resilience, improving last-mile delivery and emergency preparedness. |

| Market Leaders (2024) | |

| Market Leaders |

6% market share |

| Top Players |

Collective market share in 2024 is 18% |

| Competitive Edge |

|

| Regional Insights | |

| India, China, Brazil, Mexico, South Africa | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, China, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

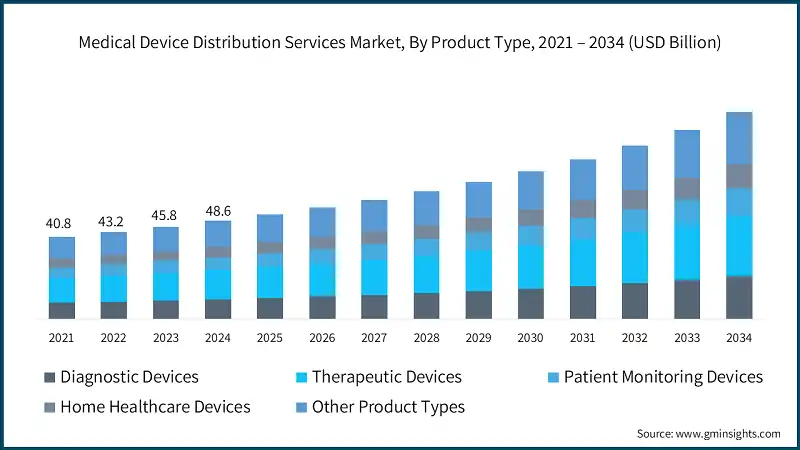

The market increased from USD 40.8 billion in 2021 to USD 45.8 billion in 2023. The growing prevalence of chronic diseases is significantly propelling the growth of the medical device distribution services market. The rising burden of chronic diseases, including diabetes, cardiovascular conditions, and respiratory disorders, is a major driver of market growth. According to the World Health Organization, noncommunicable diseases (NCDs) resulted in mortality of about 43 million people in 2021, which estimates to about 75% of non-pandemic-related deaths worldwide. This trend is increasing the demand for advanced medical devices such as surgical devices, continuous glucose monitoring systems, insulin delivery devices, electrocardiograms, electroencephalograms, drug delivery devices, and other essential medical technologies. Additionally, the growing prevalence of cardiovascular and respiratory diseases has intensified the need for advanced patient monitoring and diagnostic devices, supporting early intervention and disease management.

The medical device distribution services market is experiencing accelerated growth, driven by significant investments in research and development and a steady increase in global medical device approvals. Governments, private investors, and multinational corporations are channeling substantial resources into innovation, aiming to enhance device performance, safety, and accessibility across diverse healthcare settings. According to the WHO Global Observatory on Health research and development, global expenditure on health-related research and development has consistently risen, with major economies allocating billions annually to medical technology innovation. For example, the U.S. National Institute of Health (NIH) invested approximately USD 33 billion into biomedical research during 2022. Therefore, the continuing increase in financial commitment to research and development is driving the growth of the medical device distribution services sector and reinforcing its importance in providing timely access to innovative medical technologies.

Additionally, the medical device distribution services market is increasingly shaped by the growing preference for home-based healthcare and remote patient monitoring (RPM) solutions. According to a national analysis of Medicare data (2019–2023), utilization of remote-monitoring services including RPM and remote therapeutic monitoring (RTM) has surged dramatically. Over this period, 13.5 million remote-monitoring services were delivered, corresponding to USD 664.5 million in reimbursements. RPM services alone increased by about 33 times, from 160,595 services in 2019 to 5.5 million in 2023, while payments rose by about 29 times, reflecting strong adoption across clinical specialties. The growing demand for connected devices, wearable sensors, and portable diagnostic equipment requires robust distribution networks capable of handling last-mile delivery, device installation, and digital support services further propelling growth of this market.

The medical device distribution services market comprises third-party logistics and hybrid distributors that manage the storage, handling, and delivery of medical devices from manufacturers to healthcare providers and end-users (home care service providers, self-managed patients). This market focuses on service revenues, which include distributor margins and value-added services, excluding the cost of medical devices at manufacturer level.

Medical Device Distribution Services Market Trends

- The medical device distribution services industry is experiencing significant growth, propelled by rapid technological advancements that are transforming healthcare delivery.

- Innovations in artificial intelligence (AI), robotics, Internet of Things (IoT), and sensor-based digital health technologies are enabling devices to become smarter, more connected, and increasingly patient-centric. These breakthroughs are not only improving diagnostic accuracy and therapeutic outcomes but also reshaping distribution strategies to meet evolving healthcare demands.

- According to the World Health Organization, there are over 2 million types of medical devices globally, categorized into more than 7,000 generic groups, ranging from basic instruments to advanced AI-enabled systems. Emerging technologies such as AI-powered imaging systems, robotic-assisted surgical platforms, and IoT-enabled monitoring devices are driving a paradigm shift toward precision medicine and minimally invasive care.

- Wearable sensor devices such as patches, wearables, and smartwatches are starting to be used in hospitals to allow for continuous monitoring of critical signs outside of the hospital environment and to provide remote care and chronic disease management capabilities to patients. These devices reduce hospital burden and improve patient engagement.

- Advances made in medical device technology will continue to fuel the growth of the medical distribution services market. As the healthcare landscape continues to evolve through technological breakthroughs and regulatory changes, distributors have the opportunity to grow from being suppliers of logistics supporting providers to strategic partners supporting the transformation of the healthcare industry.

Medical Device Distribution Services Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into diagnostic devices, therapeutic devices, patient monitoring devices, home healthcare devices, and other product types. The therapeutic devices segment was valued at USD 14.4 billion in 2024 and held a significant market share of 29.7%.

- Therapeutic devices represent the largest segment due to the ongoing and high demand for therapeutic devices used to treat chronic illnesses and perform surgical procedures. Some examples of therapeutic devices include drug delivery systems, infusion pumps, respiratory devices, cardiovascular stents, prosthetics, and dialysis machines.

- The increase in surgical procedures, particularly in developing countries, drives the growth of the therapeutic device market segment. The Global Surgery 2030 report from The Lancet indicated that low- and middle-income countries will require an additional 143 million annual surgical procedures to save lives and reduce the incidence of disability. Because of this high demand for surgery, the need to distribute therapeutic devices has also increased significantly.

- Therapeutic devices often require specialized handling, training, and post-sale support, strengthening the role of distributors as critical intermediaries. Distributors not only ensure timely delivery but also provide technical assistance and compliance guidance, fostering long-term partnerships with healthcare providers.

- The segment’s strong position is further reinforced by the growing prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders, which necessitate a continuous supply of therapeutic devices for both hospital-based and home-care settings.

- Collectively, these factors make therapeutic devices the cornerstone of the medical device distribution services market, driving revenue growth and shaping strategic priorities for logistics providers worldwide.

Learn more about the key segments shaping this market

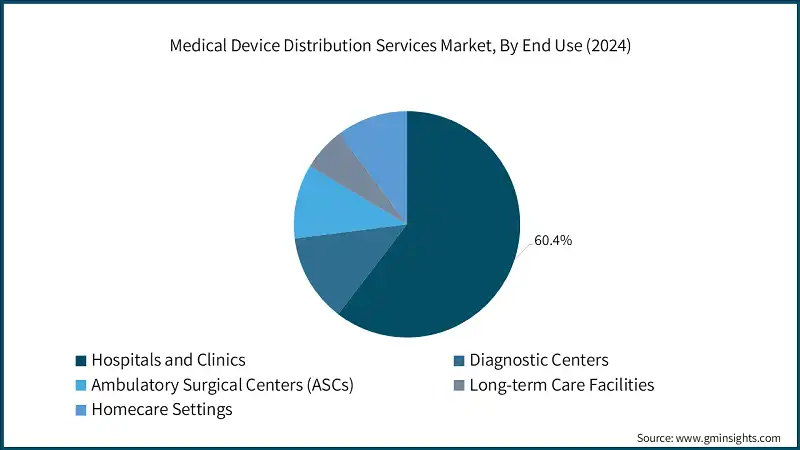

Based on end use, the medical device distribution services market is segmented into hospitals and clinics, diagnostic centers, ambulatory surgical centers (ASCs), long-term care facilities, and homecare settings. The hospitals and clinics segment held a significant market share of 60.4% in 2024.

- Hospitals and clinics represent the largest end-use segment in the medical device distribution services market, owing to their comprehensive healthcare delivery models that encompass chronic disease management, emergency surgeries, and advanced therapeutic interventions. This results in a consistently high patient volume and a sustained demand for diverse medical devices.

- To ensure uninterrupted availability of critical devices and avoid shortages, hospitals typically procure in bulk and maintain substantial inventories. Their procurement departments are equipped to negotiate large-scale contracts with suppliers and Group Purchasing Organizations (GPOs), leveraging economies of scale to optimize costs.

- Hospitals and clinics also possess advanced storage and servicing capabilities, which align with the requirements of high-value and complex devices such as cardiovascular stents, infusion pumps, and surgical implants. These capabilities make them key partners for distributors offering specialized handling and compliance-driven logistics.

- Collectively, these factors position hospitals and clinics as the cornerstone of medical device distribution services, shaping procurement strategies and influencing the adoption of advanced logistics technologies across the healthcare ecosystem.

Looking for region specific data?

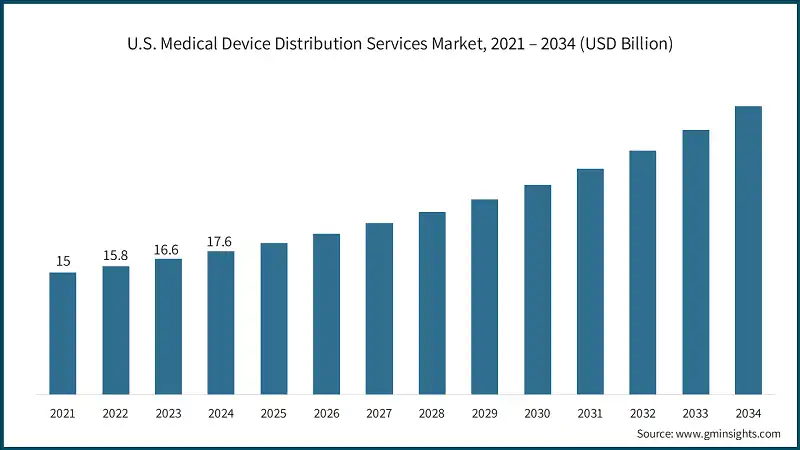

The North America region accounted for 39.2% of the global medical device distribution services market share in 2024, driven by the region’s advanced healthcare infrastructure, high procedural volumes, and strong regulatory oversight.

- Chronic disease prevalence is a major driver of device demand in North America. According to the Centers for Disease Control and Prevention (CDC), in 2023, 76.4% of U.S. adults representing approximately 194 million people had at least one chronic condition, while 51.4% (about 130 million) live with multiple chronic conditions. Among adults aged sixty-five and older, 93% have at least one chronic condition, and 78.8% have MCC. Even among younger adults (18–34), 59.5% report at least one chronic condition. These trends significantly impact demand for diagnostic, monitoring, and therapeutic devices across care settings.

- The region’s diagnostic infrastructure is supported by over 317,000 CLIA-certified laboratories, including independent diagnostic centers, hospital-based labs, and physician office labs. These facilities perform billions of tests annually, driving consistent demand for in vitro diagnostic (IVD) kits, analysers, reagents, and integrated data systems. The region’s emphasis on decentralized care, digital health integration, and outcome-based reimbursement continues to drive innovation and growth in medical devices distribution services market.

Europe medical device distribution services market accounted for USD 14.2 billion in 2024 and is anticipated to show lucrative growth over the forecast period, supported by strong regulatory frameworks, national health system investments, and a growing emphasis on decentralized care delivery.

- Europe’s medical device sector is highly diversified, with over 500,000 types of medical devices and in vitro diagnostics (IVDs) available across the EU market. These include everything from basic consumables to advanced imaging systems, surgical tools, and remote monitoring platforms. The sector is characterized by a high concentration of small and medium-sized enterprises (SMEs) and is governed by the EU Medical Device Regulation which ensures safety, performance, and market transparency. The region’s commitment to innovation, equitable access, and public health resilience continues to shape device distribution strategies across clinical and non-clinical settings. The growing adoption of decentralized care models, including homecare and telehealth, further drives demand for robust distribution networks capable of delivering devices directly to patients and community health centers.

Germany's medical device distribution services market is projected to experience steady growth between 2025 and 2034, driven by the rising prevalence of chronic diseases and the increasing need for advanced healthcare solutions. According to the European Health Interview Survey (EHIS-3), conducted in 2019–2020, diabetes affected 8.1% of the population, chronic respiratory diseases 11.2%, and cardiovascular diseases 6.6%, all higher than the EU-28 average. This growing disease burden is creating sustained demand for diagnostic tools, monitoring devices, and therapeutic equipment, positioning distribution networks as a critical link in ensuring timely access to these technologies across hospitals, clinics, and home-care settings.

- Germany is witnessing a surge in demand for home healthcare and remote monitoring solutions, driven by an aging population and a shift toward decentralized care delivery. Patients with chronic conditions increasingly prefer home-based management supported by connected devices, telehealth platforms, and wearable monitors. This evolution is propelling distributors to expand their portfolios with smart medical devices and strengthen logistics capabilities to meet rising expectations for speed, reliability, and compliance.

The Asia Pacific medical device distribution services market was valued at USD 11 billion in 2024 and is projected to show a lucrative growth of about 8.6% during the forecast period, driven by rising healthcare investments, demographic shifts, and national policy initiatives.

- Demographic trends are reshaping healthcare demand. By 2050, one in four people in Asia Pacific will be aged sixty or older, with the elderly population projected to more than double to 1.3 billion. In China alone, the population aged sixty and above is expected to reach 402 million by 2040, representing 28% of the total population, up from 254 million in 2019. This aging trend is driving demand for diagnostic imaging systems, patient monitoring devices, and homecare solutions to manage chronic conditions and geriatric care. As the need for advanced medical devices rises, distribution services become critical for ensuring timely availability across hospitals, clinics, and homecare settings.

Japan medical device distribution services market is poised to witness lucrative growth between 2025 to 2034, driven by the country’s growing geriatric population and the rising demand for home healthcare solutions. With nearly 30% of Japan’s population aged 65 and above, the healthcare system faces increasing pressure to manage age-related conditions such as cardiovascular diseases, diabetes, and respiratory disorders.

- This demographic trend is fueling demand for advanced medical devices, including diagnostic tools, mobility aids, and therapeutic equipment, creating significant opportunities for distributors to ensure timely and efficient delivery across hospitals, clinics, and home-care settings.

Brazil is experiencing significant growth in the medical device distribution services market, supported by improved diagnostic infrastructure, rising prevalence of chronic disorders, and growing elderly populations. NCDs remain a critical challenge in Latin America, particularly in Brazil, where 76% of all deaths in 2019 were attributed to NCDs, and 66.1% occurred prematurely (ages 30–69). Despite the Strategic Action Plan for Tackling NCDs (2011, revised 2022) and alignment with WHO’s Global Action Plan, Brazil faces difficulties in meeting its 2030 target of reducing NCD mortality by one-third. These trends underscore the need for scalable diagnostic and monitoring devices across hospitals, ASCs, LTCFs, and homecare settings.

- Demographic shifts amplify device demand. Brazil’s elderly population (65+) grew by 57% from 14.1 million in 2010 to 22.2 million in 2022, now representing 11% of the population, with an additional 10 million aged 60–65. This aging trend, combined with declining fertility rates, is driving demand for homecare solutions, mobility aids, and chronic disease management technologies further propelling growth of this market.

- Saudi Arabia’s medical device distribution services market is gaining momentum, propelled by rapid advancements in medical device technology and the country’s commitment to modernizing healthcare infrastructure. Cutting-edge innovations such as AI-powered diagnostic tools, minimally invasive surgical systems, and smart monitoring devices are transforming patient care and driving demand for efficient distribution networks.

- These technological breakthroughs, coupled with government initiatives under Vision 2030 to enhance healthcare accessibility and quality, are creating significant opportunities for distributors to deliver high-performance devices across hospitals, clinics, and home-care settings, positioning Saudi Arabia as a growing hub for advanced medical solutions.

Medical Device Distribution Services Market Share

- The top 5 players, such as Cardinal Health, Inc., McKesson Corporation, Medline Inc., Owens & Minor, and Henry Schein, collectively held 18% of the total market share.

- Leading companies are driving innovation and operational excellence to enhance healthcare delivery across global markets. These industry leaders are investing in advanced logistics technologies, data-driven inventory management systems, and integrated supply chain solutions to ensure timely and efficient distribution of critical medical devices.

- Through acquisitions and global expansion strategies, these companies are reinforcing their leadership in the medical device distribution ecosystem and supporting the evolving needs of modern healthcare systems. For instance, in May 2023, Cardinal Health Canada announced plans to open a new 163,000 square-foot distribution center in the Greater Toronto Area. This facility became operational in early 2024 and integrates state-of-the-art robotic technologies to enhance operational efficiencies and accuracy. This expansion is expected to increase Cardinal Health Canada's national distribution footprint to over 1.1 million square-foot, bolstering its capacity to meet the medical and surgical product demands of the Canadian healthcare system.

- By leveraging strategic partnerships with healthcare providers, manufacturers, and digital health platforms, they are expanding their reach and improving service quality. Their focus on automation, real-time tracking, and regulatory compliance will significantly shape future of medical device distribution services.

Medical Device Distribution Services Market Companies

Few of the prominent players operating in the medical device distribution services industry include:

- Alfresa Holdings Corporation

- Avantor, Inc.

- Bunzl plc

- CAN-med Healthcare

- Cardinal Health, Inc.

- Henry Schein, Inc.

- KEBOMED Europe AG

- McKesson Corporation

- Meditek Systems Pvt. Ltd.

- Medline Industries, LP.

- Owens & Minor, Inc.

- Patterson Companies, Inc.

- Soquelec Ltd.

- Southmedic Inc.

- The Stevens Company Limited

Cardinal Health offers comprehensive medical supply distribution solutions for hospitals, ambulatory surgery centers, and physician offices. Their services include inventory management, supply chain optimization, and third-party logistics (3PL) capabilities. Cardinal Health emphasizes flexibility with scalable models, reliability backed by 50 years of experience, and visibility through advanced tools for order tracking and optimization. Cardinal Health stands out for its ValueLink system, which streamlines supply delivery by using logical units of measure, reducing inventory costs by up to 30%, and improving operational efficiency through Lean Six Sigma practices.

McKesson provides one of the most robust healthcare distribution networks in the U.S., delivering pharmaceuticals, medical-surgical supplies, and equipment to hospitals, physician offices, and long-term care facilities. Their services include same-day and next-day delivery, cold chain logistics, inventory management, and compliance support. McKesson operates over 50 distribution centers and offers more than 300,000 products, including private-label options. McKesson’s strength lies in its scale and accuracy, with 99.8% order accuracy and next-day delivery to 95% of U.S. locations. Their advanced technology, such as the SupplyManager platform, ensures streamlined ordering and inventory control, making them a trusted partner for efficiency and reliability.

Medline is the largest privately held manufacturer and distributor of medical supplies in the U.S., offering over 335,000 products across acute care, surgery centers, long-term care, and home health settings. Their distribution network includes 50+ centers and 2,000 MedTrans trucks, ensuring next-day delivery to 95% of U.S. customers. Medline also provides customized solutions like surgical procedure trays, crisis supply management, and data-driven formulary guidance. Medline differentiates itself through its integrated approach combining clinical expertise with supply chain solutions, enabling healthcare providers to improve both operational efficiency and patient outcomes. Their ability to scale and adapt quickly makes them a leader in supply chain resiliency.

Medical Device Distribution Services Market News:

- In October 2021, Medline Canada officially inaugurated its advanced distribution center in Terrebonne, Quebec, enhancing the efficient delivery of essential medical supplies and equipment to residents of the province. Medline has the largest inventory and storage capacity in Quebec to help ensure the availability of supplies and medical equipment to a wide range of hospitals, clinics, seniors' residences, pharmacies and retail stores.

- In April 2021, Soquelec Ltd. entered into a strategic partnership with JEOL to become the official sales representative for JEOL’s electron microscope product line across Canada. This collaboration enhances Soquelec’s portfolio of advanced scientific instruments, strengthening its position in the microscopy market.

- In June 2021, Obex Medical became part of Bunzl plc, enhancing Bunzl’s healthcare capabilities across the Asia Pacific region. Obex distributes a wide range of healthcare equipment and devices to hospitals and healthcare providers, focusing on minimally invasive, consumable, and implantable solutions. This strategic move enhanced Bunzl’s ability to deliver essential medical devices and consumables to hospitals and healthcare providers through its global service-led distribution model.

The medical device distribution services market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Product Type

- Diagnostic devices

- Therapeutic devices

- Patient monitoring devices

- Home healthcare devices

- Other product types

Market, By End Use

- Hospitals and clinics

- Diagnostic centers

- Ambulatory surgical centers (ASCs)

- Long-term care facilities

- Homecare settings

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the medical device distribution services market?

Key trends include adoption of AI-powered diagnostic tools, IoT-enabled monitoring devices, automated warehouses with blockchain traceability, and expansion of direct-to-patient delivery models for home healthcare

Which region leads the medical device distribution services market?

North America held 39.2% share with a strong presence in 2024. Advanced healthcare infrastructure, high chronic disease prevalence, and over 317,000 CLIA-certified laboratories fuel the region's dominance.

Who are the key players in the medical device distribution services market?

Key players include Cardinal Health Inc., McKesson Corporation, Medline Inc., Owens & Minor, Henry Schein Inc., Alfresa Holdings Corporation, Avantor Inc., Bunzl plc, Patterson Companies Inc., and The Stevens Company Limited.

What was the valuation of hospitals and clinics segment in 2024?

Hospitals and clinics held 60.4% market share in 2024, fueled by comprehensive healthcare delivery models and high patient volumes requiring diverse medical devices.

What is the growth outlook for Asia Pacific medical device distribution services market from 2025 to 2034?

Asia Pacific is projected to grow at approximately 8.6% CAGR till 2034, due to rising healthcare investments, demographic shifts, and an aging population expected to reach 1.3 billion by 2050.

What is the current medical device distribution services market size in 2025?

The market size is projected to reach USD 51.7 billion in 2025.

How much revenue did the therapeutic devices segment generate in 2024?

Therapeutic devices generated USD 14.4 billion in 2024, leading the market with 29.7% share.

What is the market size of the medical device distribution services in 2024?

The market size was USD 48.6 billion in 2024, with a CAGR of 7.9% expected through 2034 driven by rising chronic diseases, increased R&D investments, growing home healthcare demand, and advancements in device technology.

What is the projected value of the medical device distribution services market by 2034?

The medical device distribution services market is expected to reach USD 102.6 billion by 2034, propelled by technological advancements, aging populations, and expansion of remote patient monitoring solutions.

Medical Device Distribution Services Market Scope

Related Reports