Summary

Table of Content

Medical Adhesive Tapes Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Adhesive Tapes Market Size

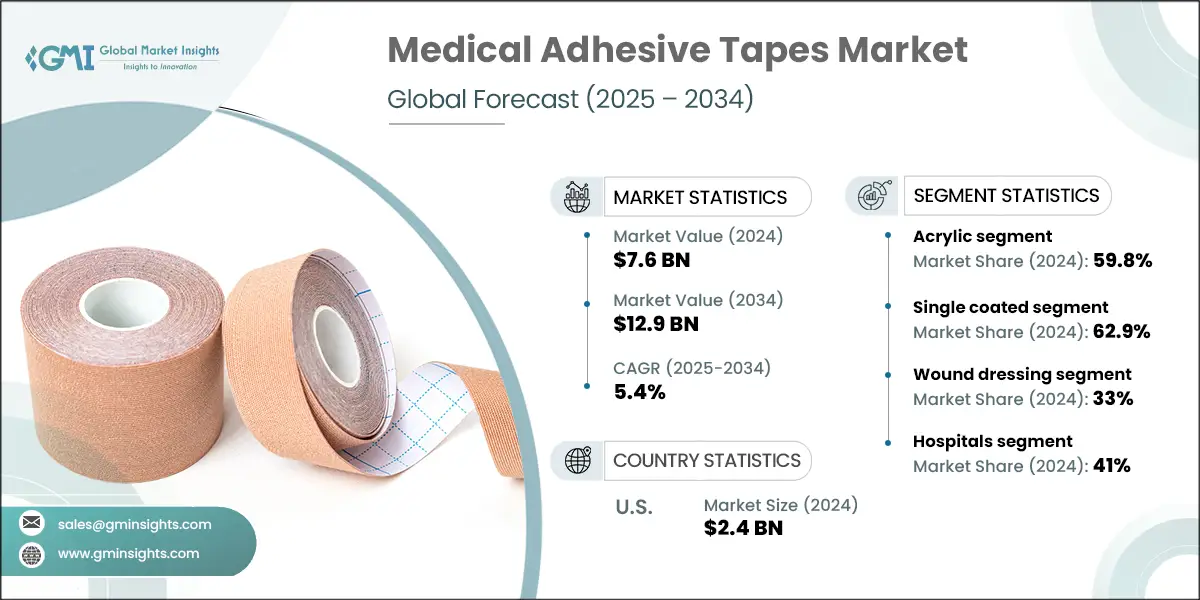

The global medical adhesive tapes market was valued at USD 7.6 billion in 2024 and is projected to grow from USD 8 billion in 2025 to USD 12.9 billion by 2034, expanding at a CAGR of 5.4%. The market has been steadily growing, driven by the rising prevalence of chronic disorders, an increasing number of surgical procedures, and a surge in road accidents, and other traumatic incidents.

To get key market trends

Medical adhesive tapes are specialized tapes used by clinicians to secure dressings, bandages, and medical devices to the skin. Medical adhesive tapes are necessary for securing dressings, IV lines dressing, medical devices and also in emergency cases such as road accidents where high number of injuries happen and require prompt wound care and surgical intervention. Major players in the medical adhesive tapes industry include Cardinal Health, Solventum, Avery Dennison Corporation, and Lintec Corporation. The market primarily focuses on developing skin-friendly, durable, and hypoallergenic adhesive solutions that ensure secure fixation while minimizing skin irritation, especially for sensitive or compromised skin conditions.

Medical Adhesive Tapes Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 7.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.4% |

| Market Size in 2034 | USD 12.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Surge in road accidents and other traumatic incidents | Drives demand high-adhesion tapes for emergency wound dressing, IV line securing, and device fixation. |

| Increasing prevalence of chronic disorders | Drives long-term usage of tapes for wound care, catheter fixation, and frequent dressing changes, especially in diabetic and cardiovascular patients. |

| Rising number of surgical procedures | Boosts demand for post-operative tapes that are skin-friendly, breathable, and provide secure fixation without causing trauma. |

| Growing healthcare sector in emerging economies | Expanded market reach due to increased procurement of medical consumables, supported by rising disposable incomes and government healthcare investments. |

| Pitfalls & Challenges | Impact |

| High cost of raw materials | Limits adoption in smaller clinics and price-sensitive regions |

| Stringent regulatory scenario | Delay product launches and increase R&D expenses |

| Opportunities: | Impact |

| Rising technological innovations in medical tapes | Enables development of customized, high-performance tapes for surgical, chronic care, and wearable device applications, enhancing product differentiation and market competitiveness. |

| Market Leaders (2024) | |

| Market Leaders |

8.5% market share |

| Top Players |

Collective Market Share in 2024 is 16% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

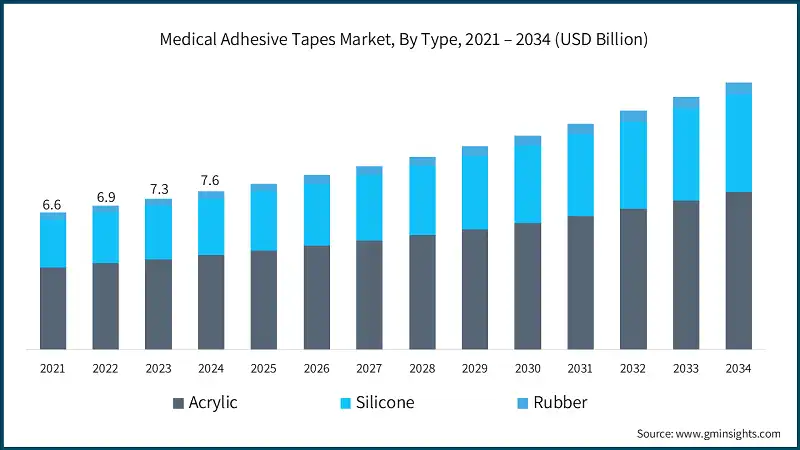

The market increased from USD 6.6 billion in 2021 to USD 7.3 billion in 2023. This growth is largely due to the increasing number of surgical procedures and the rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and ulcers, which often require surgical intervention and long-term wound care. Additionally, the healthcare system is shifting towards patient-centric treatment, where the choice of medical adhesive tapes is increasingly tailored to individual patient needs. Factors such as skin sensitivity, mobility, and wound location are key considerations in selecting the right tape. Innovations such as silicone-based adhesives and biocompatible materials are gaining popularity for their ability to reduce skin trauma and improve healing outcomes.

The increasing number of road accidents and traumatic incidents is playing a major role in driving market growth. For example, the Ministry of Road Transport and Highways (MoRTH), Government of India, reported 461,312 road accidents in 2022. These accidents resulted in 168,491 fatalities and left 443,366 people injured. This marks an 11.9% rise in accidents compared to 2021. These figures clearly show the growing need for accessible trauma care infrastructure and effective wound management solutions, such as adhesive tapes for dressing fixation and protection.

Additionally, the rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, and ulcers are significantly boosting the medical adhesive tapes market. For instance, the International Diabetes Federation predicts that the global diabetic population will grow from 463 million in 2019 to 578 million by 2030, eventually reaching 700 million by 2045. Additionally, the global annual incidence of diabetic foot ulcers ranges from 9.1 to 26.1 million, with over 2 million cases reported each year in the U.S. alone. Further, more than 50% of these cases result in mortality within five years, and 5% lead to amputations. These statistics underline the urgent need for wound care solutions includes medical adhesive tapes, which offer secure fixation, skin-friendliness, and moisture control. Moreover, the demand for pressure-sensitive and hypoallergenic tapes is expected to rise, as they cater to the unique needs of diabetic patients with sensitive skin and long-term dressing requirements.

Medical adhesive tapes are an essential part of modern health systems, especially used in wound care, surgical procedures, and fixation of medical devices. These tapes are designed to be breathable, flexible, and hypoallergenic to provide maximum comfort when used for long periods.

Medical Adhesive Tapes Market Trends

- The growing need for wound care solutions in surgical treatments is driving the widespread use of medical adhesive tapes. These tapes are crucial for keeping surgical dressings, IV lines, and post-operative wound sites secure.

- For example, the American Academy of Orthopaedic Surgeons (AAOS) reports that with the rising demand for surgeries, orthopaedic surgeons in the U.S. will either need to double their total joint arthroplasty (TJA) caseload or increase the number of surgeons by 10% every five years to meet the demand by 2050. This highlights the increasing importance of dependable adhesive tapes in orthopaedic and joint procedures.

- In addition, the rising emergency surgeries and elective procedures, such as trauma cases, accidents, and acute medical conditions, necessitate the demand for immediate surgical interventions, increasing the demand for advanced adhesive tapes that offer secure fixation, breathability, and low skin irritation.

- For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS) Global Survey 2022, the U.S. led globally in aesthetic procedures, performing over 7.4 million procedures accounting for 22% of the global total followed by Brazil (8.9%), which topped in surgical procedures, and Japan (7.3%). Notably, 47.4% of surgical procedures worldwide were conducted in hospitals, while 31.1% occurred in office-based facilities, emphasizing the broad healthcare settings where surgical care is delivered.

- Thus, this high surgical volume contributes to the growing demand for medical adhesive tapes, which are essential for wound closure, dressing fixation, post-operative recovery, and maintaining sterility in both hospital and outpatient environments.

Medical Adhesive Tapes Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 6.6 billion in 2021. The market size reached USD 7.3 billion in 2023, from USD 6.9 billion in 2022.

Based on the type, the medical adhesive tapes market is segmented into acrylic, silicone, and rubber. The acrylic segment accounted for 59.8% of the market in 2024, due to its skin-friendliness, breathability, and resistance to moisture and temperature, making it ideal for both short- and long-term medical applications such as surgical dressings, IV securement, and wound care. The segment is expected to exceed USD 7.6 billion by 2034, growing at a CAGR of 5.3% during the forecast period. On the other hand, the silicone segment is expected to grow with a CAGR of 5.8% from 2025 to 2034. The growth of this segment can be attributed to its superior skin adhesion with minimal trauma upon removal, making it ideal for sensitive skin and long-term applications.

- Acrylic adhesives are fundamental in the formulation of medical adhesive tapes and are widely used for applications including wound care, surgical drapes, IV fixation, and wearable medical devices, which is estimated to reach USD 543.9 billion by 2034.

- In addition, acrylic adhesives can be formulated to allow moisture vapor transmission, enhancing breathability and supporting a healthier healing environment. This breathability helps to maintain skin integrity by preventing excessive moisture buildup beneath the tape, which can lead to maceration.

- For example, Solventum Micropore Surgical Tape, which uses an acrylate-based adhesive specifically designed to permit moisture vapor transmission. This allows for adequate airflow to the skin, reducing the risk of skin damage and promoting comfort during extended wear.

- Further, innovations in acrylic adhesive formulations and tape backing materials have significantly enhanced the performance and patient comfort of medical tapes. Advanced acrylics provide balanced adhesion that minimizes skin trauma during removal while maintaining secure fixation, especially for patients with sensitive or fragile skin. Thus, these factors are propelling the growth of the market.

Based on the adhesive, the medical adhesive tapes market is segmented into single coated and double coated. The single coated segment accounted for the highest market share of 62.9% in 2024.

- Single-coated tapes are extensively used for securing dressings, tubing, and medical devices due to their ease of application and reliable adhesion across a variety of surfaces.

- For instance, Cardinal Health’s Kendall Paper Tape, a lightweight, breathable, and hypoallergenic tape widely used in both hospital and outpatient settings.

- Further, single coated tapes can be applied quickly and easily, while providing skin-friendly adhesion, breathable backing, and moisture resistance.

- Moreover, the growing demand for versatile and cost-effective single-coated medical adhesive tapes highlights their importance, particularly in healthcare environments where quick and efficient application is critical. Their simplicity and dependable performance make them indispensable in a variety of clinical settings, including hospitals, outpatient clinics, and home care settings.

Based on the application, the medical adhesive tapes market is segmented into surgery, wound dressing, device fixation, and other applications. The wound dressing segment accounted for the highest market share of 33% in 2024.

- The increasing number of chronic and acute wounds is driving a higher demand for medical adhesive tapes, which are essential in wound care management.

- For instance, according to data from the National Institutes of Health, chronic wounds affect approximately 1–2% of the population in developed countries, with the incidence notably increasing among aging populations. This trend underscores the growing need for effective wound care solutions to minimize complications such as infection and delayed healing.

- Medical adhesive tapes are essential in wound dressing applications, as they securely fasten dressings over wounds. This secure placement protects the wound from external contaminants, maintaining a stable and hygienic environment that promotes faster healing and reduces the risk of infection.

- Additionally, managing complex wounds, such as diabetic foot ulcers, requires advanced dressing techniques. In these cases, medical adhesive tapes are critical for holding sophisticated dressings in place, ensuring they remain effective over time. This capability is vital for creating a protective barrier and supporting optimal healing conditions, further driving the growth of the medical adhesive tape market.

- Medical adhesive tapes play a vital role in wound dressing applications, primarily by securely fastening dressings over wounds. This secure placement helps to protect the wound from external contaminants, thereby maintaining a stable and hygienic environment that promotes faster healing and reduces the risk of infection.

Learn more about the key segments shaping this market

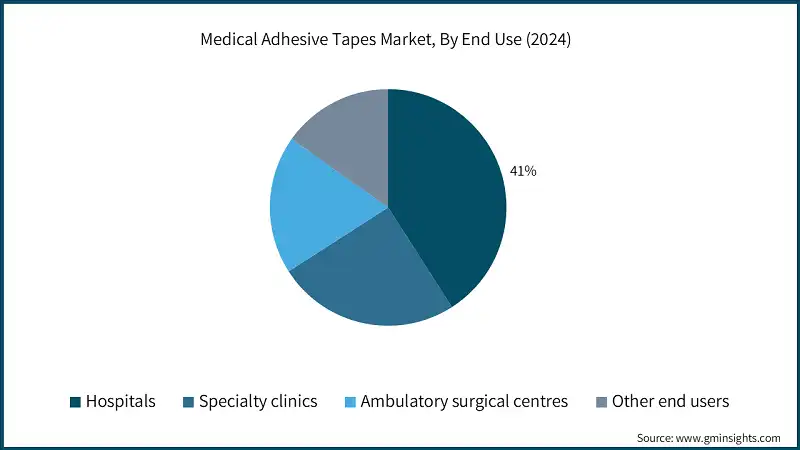

Based on end use, the medical adhesive tapes market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and other end users. The hospitals segment accounted for the highest market share of 41% in 2024.

- Medical adhesive tapes are easily available and can be stocked in large amounts in hospitals. Additionally, hospitals ensures constant care for patients, even during emergencies or high patients inflows, by maintaining the adequate supplies of these essential products.

- In emergency cases where time and speed is crucial, medical adhesive tapes products offer quick and effective solutions for securing dressings and managing wounds.

- Furthermore, hospitals serve as primary centers for acute care, trauma management, and post-operative recovery, making them key consumers of medical adhesive tapes. These tapes are widely used for securing IV lines, catheters, dressings, and surgical drapes, requiring high-performance materials that ensure durability, skin safety, and patient comfort.

- Additionally, the specialty clinics segment accounts for 25% of the market share in 2024, driven by the expansion of outpatient surgical centers, dermatology clinics, and wound care facilities. These clinics focus on targeted diagnostic and therapeutic services, favoring compact, easy-to-use, and biocompatible adhesive tape formats.

- Most specialty clinics prefer single-use, skin-safe tapes that allow for easy application and removal, making them ideal for short-duration procedures and minor interventions. The emphasis on cost-effectiveness, simplicity, and patient comfort drives the adoption of tapes designed to minimize skin trauma and allergic reactions, further propelling market demand.

Looking for region specific data?

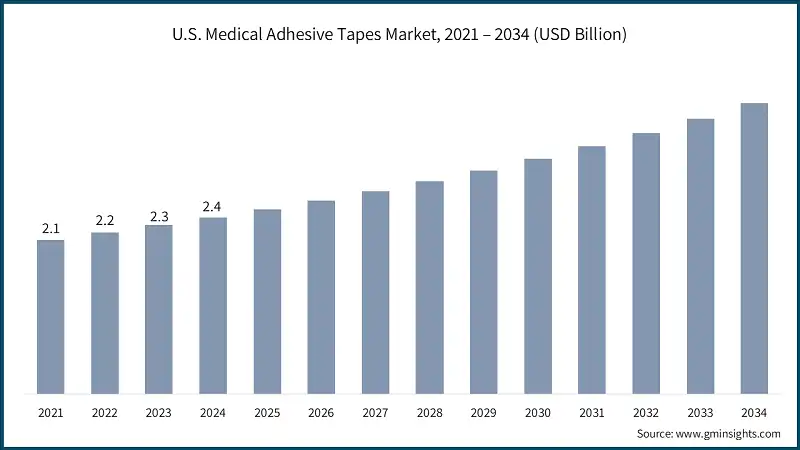

North America dominated the global medical adhesive tapes market with the highest market share of 34.4% in 2024. The region has advanced healthcare infrastructure, and the rate of adoption of innovative medical technologies is also high. Further, there is an increasing prevalence of chronic diseases in the U.S. and Canada, thus propelling the growth of this market.

- The U.S. medical adhesive tapes market was valued at 2.1 billion and USD 2.2 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 2.4 billion from USD 2.3 billion in 2023.

- The increasing incidence of chronic wounds is driving the demand for medical adhesive tape products in the U.S. According to the American Academy of Home Care Medicine, chronic wounds affect an estimated 6.5 million people annually in the U.S., which is approximately 1 in every 38 adults. This condition costs between USD 28.1 billion and USD 96.8 billion each year. As a result, the demand for efficient wound care products, such as medical adhesive tapes, is rising in the U.S.

- Additionally, the U.S. has one of the most advanced healthcare infrastructures in the world, with a strong network of hospitals, clinics, and specialized care centers.

- Moreover, the growing aging population and the rising prevalence of diabetes is driving high demand for medical adhesive tape solutions in the U.S. For instance, the Centers for Disease Control and Prevention reports that about 11.6% of the U.S. population has diabetes.

Europe medical adhesive tapes market accounted for USD 2.2 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The rising prevalence of chronic diseases in the region, coupled with increasing government initiatives to enhance healthcare infrastructure, is expected to drive market growth.

- Furthermore, the presence of key market players in the region strengthens Europe’s position in the market. These companies are actively innovating and developing advanced solutions, which aids market growth.

Germany medical adhesive tapes market is projected to experience steady growth between 2025 and 2034.

- In Germany, the rising number of road accidents and traumatic incidents is significantly contributing to the growing demand for medical adhesive tapes. These tapes are essential in emergency medical care, where quick and effective wound management is critical.

- For example, according to the German Federal Statistical Office, approximately 21,600 people were injured in road traffic accidents in February 2023 alone. Additionally, the number of fatalities increased to 167, marking a rise compared to February 2020. These alarming statistics highlight the urgent need for efficient trauma care solutions, including medical adhesive tapes, which are vital for securing dressings, stabilizing wounds, and preventing infections in emergency settings.

The Asia Pacific region is projected to be valued at USD 1.9 billion in 2025 and is expected to reach USD 3.3 billion by 2034.

- The medical adhesive tapes market in the Asia Pacific region is expanding rapidly due to the growing burden of chronic diseases, a surge in road accidents and other traumatic incidents, and continuous advancements in medical adhesive tapes.

- Countries such as China, India, and Japan are adopting advanced technology, driven by the increasing demand for medical adhesive tapes and expanding access to healthcare services.

- Additionally, the rapid growth in the number of hospitals and specialty clinics, along with government policies aimed at improving diagnostic capabilities, is further contributing to the market's growth in the region.

China medical adhesive tapes market is poised to witness lucrative growth between 2025 – 2034.

- The country has one of the fastest aging populations, which necessitates frequent medical care.

- For instance, according to estimates from the World Health Organization in 2019, approximately 254 million people aged 65 and above were residing in the country. This number is projected to rise significantly, with 402 million people expected to be over the age of 60 by 2040.

- This aging population is more susceptible to chronic health conditions such as diabetes and cardiovascular diseases, which often require regular wound care, surgical procedures, and diagnostic interventions. As a result, medical adhesive tapes are essential for securing dressings, IV lines, and post-operative bandages, especially for elderly patients with delicate and sensitive skin.

Brazil is experiencing significant growth in the medical adhesive tapes market, driven by rising number of chronic diseases.

- The rising prevalence of chronic diseases, such as cardiovascular diseases, is driving the growth of the market in the country.

- For instance, according to the Brazilian National Health Survey in 2019, approximately 12.95 million individuals were diagnosed with cardiovascular disease (CVD) in Brazil, with 51% of the affected population being male.

- Additionally, demographic shifts, particularly the country’s aging population, are further increasing the demand for medical adhesive tapes. Age-related conditions, such as chronic wounds, fragile skin, and mobility-related injuries, are becoming more common.

The medical adhesive tapes market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- The increasing demand for surgical interventions, both critical and non-critical, in Saudi Arabia has boosted the demand for medical adhesive tape products in the country. According to the Ministry of Health of the Saudi Arabian government, about 290,000 surgeries were performed in 2022 across different regions in Saudi Arabia.

- Furthermore, the government of Saudi Arabia is significantly investing in healthcare infrastructure to incorporate advanced medical care supplies, such as medical adhesive tapes, within hospital settings. This initiative aims to provide the utmost care for individuals suffering from chronic conditions in the country.

Medical Adhesive Tapes Market Share

- The top 5 players, such as Solventum, Avery Dennison Corporation, Lintec Corporation, Cardinal Health, and Berry Global Group collectively held 16% of the total market share. These businesses keep their dominance by combining strong product lines, business alliances, legal clearances, and continuous innovation.

- Solventum leads the medical adhesive tapes segment with its advanced, skin-friendly securement solutions designed to improve patient outcomes and clinical efficiency. Their latest innovations include multi-layered adhesives, gentle removal technologies, and securement systems that help reduce the risk of Medical Adhesive-Related Skin Injury (MARSI). These features enhance patient comfort while improving workflow efficiency in high-volume care environments.

- Manufacturers in the medical adhesive tapes space are focusing on value-based strategies to penetrate cost-sensitive markets, particularly in Asia-Pacific and Latin America. They introduce compact, single-use tape formats made with biocompatible materials, ergonomic dispensers, and skin-safe adhesives. These products are tailored for outpatient clinics, mobile health units, and home care settings, extending wound care and securement solutions to underserved and semi-urban populations.

- The medical adhesive tapes market is evolving with trends such as skin injury prevention protocols and infection control-focused designs. These advancements are driven by the growing need for chronic disease management, post-operative care, and elderly patient support, along with a global shift toward personalized, non-invasive, and cost-effective healthcare delivery.

Medical Adhesive Tapes Market Companies

Few of the prominent players operating in the medical adhesive tapes industry include:

- Avery Dennison Corporation

- Berry Global Group

- Cardinal Health

- DermaMed Coatings Company

- Dermarite Industries

- Flexcon Company

- Johnson & Johnson

- Lintec Corporation

- Lohmann GmbH

- McKesson Corporation

- Medline Industries

- Medtronic

- Nichiban

- Nitto Denko Corporation

- Paul Hartmann

- Smith & Nephew

- Solventum

- Solventum

Solventum has diversified product portfolio in medical adhesive tapes. Its product portfolio includes the Medical Foam Tape 1774T, 3M Medical Silicone Tape 2480, Soft, are conformable silicone adhesive ideal for sensitive or fragile skin and repositionable without loss of adhesion.

- Cardinal Health

Cardinal Health has a robust geographical presence, which enables it to enhance its market reach. Cardinal Health operates in nearly 60 countries, embracing a strong distribution network.

- Avery Dennison Corporation

Avery Dennison Corporation holds a significant share in the medical adhesive tapes market through its comprehensive product portfolio. Avery Dennison emphasizes R&D and product development focusing on skin-friendly adhesives, gentle removal technologies, and custom formulations that support long-term wear, and moisture management.

Medical Adhesive Tapes Industry News

- In July 2024, Avery Dennison Medical launched the Medical Wearable Adhesives Learning Center, an educational platform focused on advancing skin-friendly adhesive technologies for wearable medical devices. This initiative supports healthcare professionals and designers with resources to enhance device performance and patient comfort, reinforcing the company’s commitment to innovation and user-centered solutions in the growing wearable healthcare market.

- In May 2023, Nitto Denko Corporation launched PlanetFlags, a bio-based double-sided adhesive tape made with recycled film. Designed for component fixation, the tape reduces lifecycle CO2 emissions by 45%, promoting sustainability and resource recycling reflecting Nitto’s commitment to environmentally responsible innovation in the market.

The medical adhesive tapes market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in Units and from 2021 – 2034 for the following segments:

Market, By Type

- Acrylic

- Silicon

- Rubber

Market, By Adhesive

- Single coated

- Double coated

Market, By Adhesive

- Surgery

- Wound dressing

- Device fixation

- Other applications

Market, By End Use

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the medical adhesive tapes market?

Key players include Solventum, Avery Dennison Corporation, Cardinal Health, Lintec Corporation, and Berry Global Group.

What are the upcoming trends in the medical adhesive tapes industry?

Key trends include development of hypoallergenic and breathable adhesives, eco-friendly biodegradable tapes, and solutions tailored for wearable medical devices.

How much share did the wound dressing application segment hold in 2024?

Wound dressing applications accounted for 33% market share in 2024.

Which end-use segment led the medical adhesive tapes market in 2024?

Hospitals dominated with 41% market share in 2024, supported by large-scale usage during surgeries, trauma care, and emergency procedures.

Which region leads the medical adhesive tapes market?

North America held 34.4% market share in 2024, supported by advanced healthcare infrastructure and high chronic wound incidence.

How much revenue did the acrylic segment generate in 2024?

The acrylic segment accounted for 59.8% of the market in 2024.

What is the growth outlook for the silicone adhesive segment from 2025 to 2034?

Silicone adhesives are projected to grow at a CAGR of 5.8% due to their gentle removal and suitability for sensitive skin and long-term use.

What is the market size of the medical adhesive tapes in 2024?

The market size was USD 7.6 billion in 2024, with a CAGR of 5.4% expected through 2034 driven by the growing healthcare sector in emerging economies.

What is the projected value of the medical adhesive tapes market by 2034?

The market is expected to reach USD 12.9 billion by 2034, driven by rising surgical procedures, trauma cases, and innovations in skin-friendly adhesives.

Medical Adhesive Tapes Market Scope

Related Reports