Summary

Table of Content

MEA Feminine Hygiene Wash Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Feminine Hygiene Wash Market Size

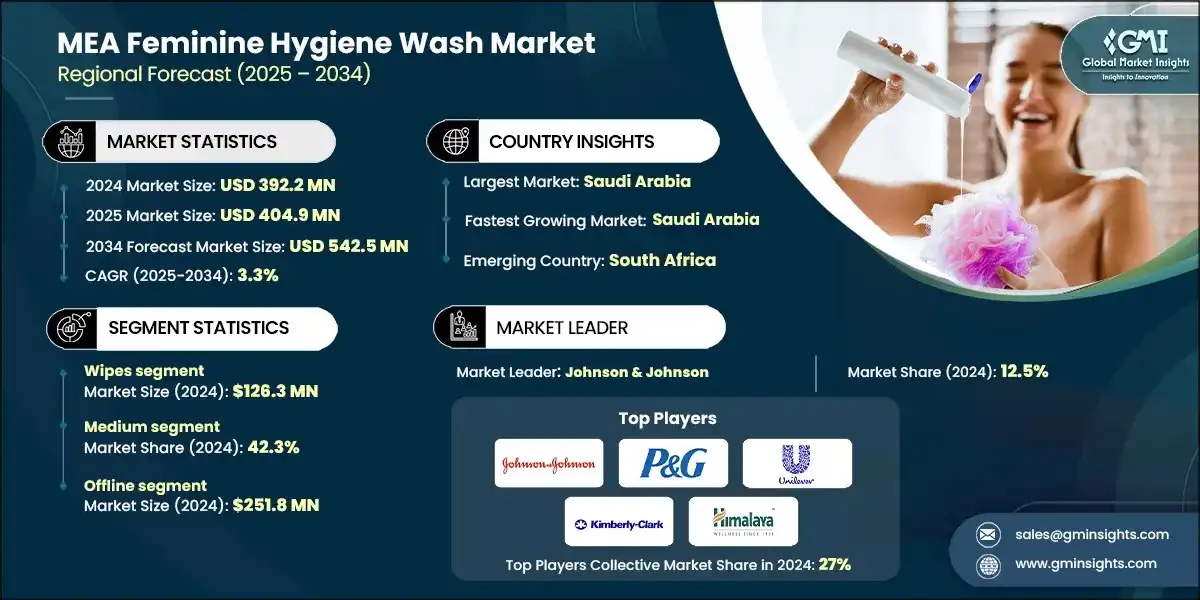

The MEA feminine hygiene wash market was estimated at USD 392.2 million in 2024. The market is expected to grow from USD 404.9 million in 2025 to USD 542.5 million in 2034, at a CAGR of 3.3% according to latest report published by Global Market Insights Inc.

To get key market trends

In the MEA Region, there is a growing shift in the way consumers view feminine hygiene products due to increasing awareness campaigns and education initiatives. Governments, non-governmental organizations (NGOs), and Healthcare providers are also working hard to promote intimate hygiene as a key element of women's overall health and wellbeing. These initiatives have helped break down many taboo barriers and allowed for open conversations around personal care. With increased education and information on the risk of infections and the importance of pH-Balance as a measure of health, feminine hygiene washes are shifting from being considered discretionary to necessary items for most women and creating a strong developmental base for future continued market growth, especially within urban and semi-urban environments.

Manufacturers are also playing a pivotal role in this market evolution, Unilever launched specific products that cater to the unique needs of women, further boosting market penetration. These developments underscore the growing demand for feminine hygiene products in the region. Moreover, government-backed initiatives, such as the Menstrual Hygiene Management (MHM) program in countries like Kenya and South Africa, have significantly contributed to raising awareness.

These programs aim to educate women and girls about the importance of maintaining proper hygiene during menstruation, thereby normalizing conversations around feminine hygiene. Such initiatives, coupled with increasing disposable incomes and improved access to products in semi-urban and rural areas, are expected to drive the market's growth during the forecast period.

Rapid urbanization across Middle East and Africa has transformed consumer lifestyles, leading to higher female workforce participation and increased mobility. One of the most notable changes has been the increase in the participation of women in the workforce and an increase in their mobility. Women who live in urban areas must often use public facilities, including shared restrooms. The increased use of these facilities creates a heightened concern for sanitation among women. Feminine hygiene washes provide women with an easy way to keep themselves clean and comfortable throughout the day.

The increase in disposable income has allowed many women to regularly use premium and mid-range feminine hygiene products, rather than just using them on occasion. This change illustrates a greater trend towards convenience-focused purchasing habits and therefore shows that feminine hygiene washes will become essential products in the modern world.

According to the World Bank, the urban population in the MEA region has grown from 58% in 2010 to over 63% in 2023, reflecting rapid urbanization trends. This demographic shift has driven demand for hygiene products tailored to the needs of urban consumers. Feminine hygiene washes have gained traction due to their ability to address specific hygiene concerns, such as maintaining pH balance and preventing infections. These products are often enriched with natural ingredients like tea tree oil, aloe vera, and lactic acid, which provide additional benefits such as soothing irritation and promoting overall vaginal health.

The dominance of Saudi Arabia in the Middle East and Africa (MEA) feminine hygiene wash market, and the leadership position of Saudi Arabia in the wipes segment is facilitating rapid growth across the entire MEA market segments of Feminine Hygiene. The combination of these factors includes the level of disposable income, availability of modern retailing infrastructure, and a cultural shift in Saudi Arabian society towards personal care products all contribute to the high demand for products that provide premium quality and that are convenient to use.

At the same time, Wipes meet the needs for evolving lifestyles by providing portability and convenience, making them particularly attractive to urban and working women. As a result, these factors are driving an increase in penetration and innovation within products, as brands have begun to create Eco-friendly products as well as dermatologically tested Wipes that are specifically designed for the needs of Saudi consumers. The synergy between the leadership of geographic region with a strong preference for product types will drive the growth of the category in the future.

MEA Feminine Hygiene Wash Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 392.2 Million |

| Market Size in 2025 | USD 404.9 Million |

| Forecast Period 2025 - 2034 CAGR | 3.3% |

| Market Size in 2034 | USD 542.5 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising Awareness and Education on Intimate Hygiene | The MEA region is witnessing a significant shift in consumer perception toward feminine hygiene, driven by increased awareness campaigns and educational initiatives. |

| Urbanization and Lifestyle Changes | Rapid urbanization across MEA has transformed consumer lifestyles, leading to higher female workforce participation and increased mobility. |

| Preference for Natural and Sustainable Products | Consumer preferences in MEA are increasingly aligned with global trends favoring natural and eco-friendly products. Health-conscious buyers seek formulations with herbal ingredients and minimal chemical additives to reduce irritation risks. |

| Pitfalls & Challenges | Impact |

| Cultural and Social Taboos | Despite growing awareness, cultural sensitivities and social stigma around intimate hygiene remain significant barriers in many MEA countries. |

| High Price Sensitivity and Limited Accessibility | Feminine hygiene washes are often perceived as premium products, making them less affordable for low-income consumers. |

| Opportunities: | Impact |

| Expansion into Untapped Rural Markets | While urban areas dominate current sales, rural regions in MEA present significant growth potential. Rising penetration of smartphones and internet connectivity is improving access to health education, creating awareness about intimate hygiene. |

| Product Diversification and Innovation | The market is ripe for innovation beyond traditional liquid washes. Introducing variants such as wipes, foam-based cleansers, and travel-friendly sachets can attract consumers seeking convenience and portability. |

| Market Leaders (2024) | |

| Market Leaders |

12.5% market share |

| Top Players |

The collective market share in 2024 is 27% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Saudi Arabia |

| Fastest Growing Market | Saudi Arabia |

| Emerging Country | South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

MEA Feminine Hygiene Wash Market Trends

The market is evolving rapidly, driven by changing consumer preferences, technological advancements, and socio-economic shifts. Emerging trends highlight a strong focus on health, sustainability, and convenience, shaping product innovation and marketing strategies. These developments are redefining competitive dynamics and influencing long-term growth trajectories across the region.

- Surge in e-commerce and digital engagement: The emergence of e-commerce platforms and social media marketing is being used to change how products are accessed and how consumers interact. With the use of e-commerce channels, younger consumers have access to a convenience factor, more options and the ability to purchase in a discreet manner that is consistent with their lifestyle. To provide information and create trust with consumers, brands are utilizing influencer marketing and targeted marketing campaigns.

- In addition, this digital shift provides consumers with real-time feedback on their purchases, as well as personalized product recommendations, all of which enhance their experience as customers. As smartphones become more prevalent and continue to be used to shop online, the online sales of feminine hygiene products are projected to continue to grow, which will provide opportunities for both global and local companies to grow their presence and foster customer loyalty.

- Growing demand for natural and herbal formulations: Consumers in MEA are increasingly prioritizing safety and wellness, driving demand for feminine hygiene washes with natural and herbal ingredients. This trend stems from heightened awareness of chemical-related health risks and a preference for gentle, skin-friendly solutions. Brands are responding by introducing products enriched with plant extracts, probiotics, and essential oils. These formulations not only reduce irritation but also align with sustainability goals, appealing to eco-conscious buyers. The herbal segment is gaining traction among premium and mid-range consumers, positioning natural products as a key differentiator in competitive markets. This shift underscores a broader movement toward holistic personal care.

- Premiumization and product innovation: Premiumization is emerging as a significant trend, fueled by rising disposable incomes and lifestyle changes in urban MEA markets. Consumers are seeking advanced solutions that offer added benefits such as pH balance, anti-bacterial properties, and soothing extracts. Brands are innovating with foam-based cleansers, wipes, and travel-friendly formats to cater to convenience-driven buyers. Premium products are marketed as part of a comprehensive self-care routine, reinforcing their aspirational appeal. This trend not only enhances profitability for manufacturers but also elevates consumer expectations, pushing continuous innovation. As competition intensifies, premiumization will remain a critical strategy for differentiation and market leadership.

MEA Feminine Hygiene Wash Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into creams, wipes, spray, bar, gel, and others. In 2024, wipes segment held the major market share, generating a revenue of USD 126.3 million.

- The wipes segment has emerged as the dominant product type in the MEA feminine hygiene wash market, primarily due to its convenience and portability. Modern lifestyles, characterized by increased mobility and time constraints, have driven demand for on-the-go hygiene solutions. Wipes offer a discreet and practical alternative to liquid washes, making them highly suitable for travel, workplace use, and situations where water access is limited.

- Additionally, the segment benefits from strong consumer preference for single-use, hygienic formats that minimize contamination risks. Brands are innovating with biodegradable materials and infused formulations featuring soothing and antibacterial properties, aligning with sustainability and health trends. The affordability of wipes compared to premium liquid washes further enhances their appeal among price-sensitive consumers. As urbanization and female workforce participation continue to rise, wipes are expected to maintain their leadership position, supported by aggressive marketing and expanding distribution through retail and e-commerce channels.

Learn more about the key segments shaping this market

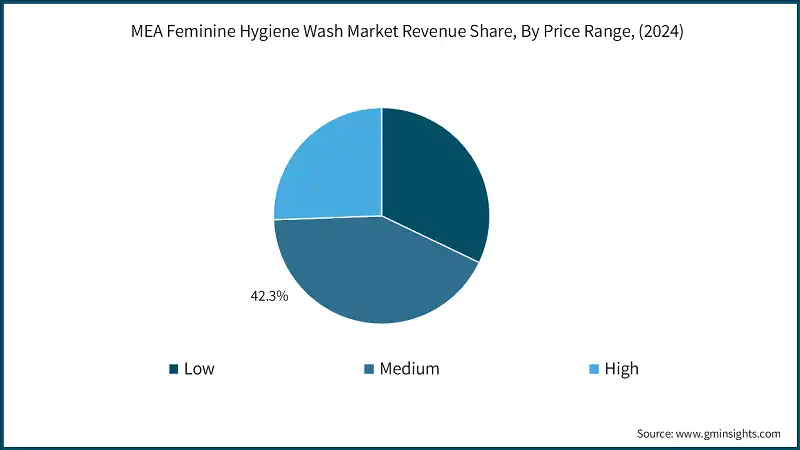

Based on price range, the MEA feminine hygiene wash market is segmented into low, medium, and high. The medium segment held the largest share, accounting for 42.3% of the market in 2024.

- The medium price range segment holds a dominant position in the market due to its balance between affordability and quality. Consumers in the region are highly price-sensitive, yet increasingly aware of the importance of intimate hygiene, creating strong demand for products that deliver value without compromising safety. Medium-priced offerings typically feature essential benefits such as pH balance and dermatological testing, making them accessible to a broad demographic, including middle-income households.

- These products appeal to both urban and semi-urban consumers who seek reliable solutions at reasonable costs. Additionally, brands in this segment often leverage attractive packaging and moderate premium features to differentiate from low-cost alternatives while remaining affordable. As disposable incomes rise and awareness spreads, the medium price range is expected to sustain its leadership, supported by strategic marketing and wide distribution through retail and e-commerce channels.

Based on distribution channel, the MEA feminine hygiene wash market is segmented into online and offline. In 2024, offline held a major market share, generating a revenue of USD 251.8 million.

- The offline channel continues to dominate the MEA feminine hygiene wash market, primarily due to strong consumer reliance on physical retail for personal care products. Pharmacies, supermarkets, and specialty stores remain trusted points of purchase, offering immediate product availability and the assurance of authenticity. Cultural preferences in many MEA countries favor in-person shopping, where consumers can seek advice from pharmacists or store representatives before buying intimate hygiene products.

- Additionally, offline channels provide opportunities for promotional displays and sampling, which are critical for educating first-time buyers. Despite the growth of e-commerce, limited internet penetration in rural areas and concerns about privacy in online transactions reinforce the importance of brick-and-mortar outlets. As awareness campaigns and product visibility increase in retail spaces, offline distribution is expected to maintain its leadership, supported by strong brand partnerships and localized marketing strategies tailored to regional consumer behavior.

Looking for region specific data?

Saudi Arabia Feminine Hygiene Wash Market

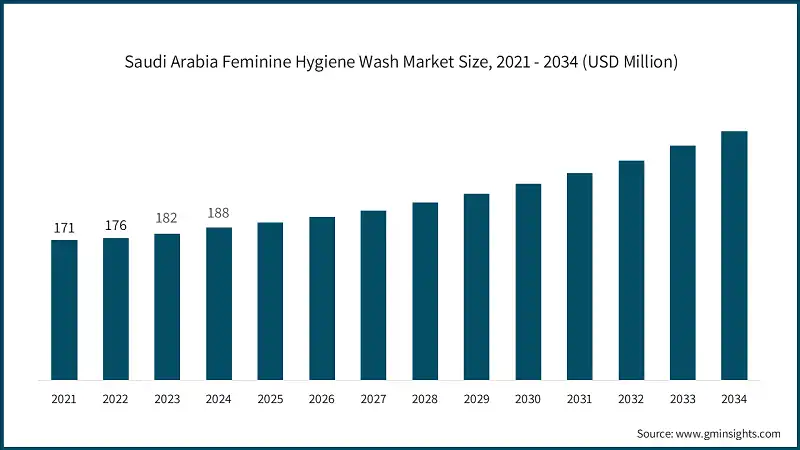

In 2024, the Saudi Arabia dominated the market, accounting for more than 40% and generating around USD 188 million revenue in the same year.

- Saudi Arabia leads the MEA feminine hygiene wash market, driven by its strong economic base, high disposable incomes, and rapid urbanization. The country’s growing female workforce and increasing health awareness have significantly boosted demand for intimate hygiene products. Cultural shifts toward modern lifestyles, coupled with government initiatives promoting women’s health, have further accelerated adoption. Saudi consumers exhibit a preference for premium and branded products, supported by robust retail infrastructure and expanding e-commerce platforms.

- International players dominate the market, but local brands are gaining traction by offering herbal and affordable alternatives. Aggressive marketing campaigns and influencer-driven promotions on social media have enhanced product visibility and acceptance. With rising internet penetration and a young, tech-savvy population, Saudi Arabia is expected to remain the largest contributor to regional revenue, setting benchmarks for innovation and premiumization in the feminine hygiene segment.

MEA Feminine Hygiene Wash Market Share

Johnson & Johnson is leading with 12.5% market share. Johnson & Johnson, Procter & Gamble, Unilever, Kimberly-Clark, and Himalaya Wellness collectively hold around 27%.

Johnson & Johnson focuses on brand trust and healthcare credibility to strengthen its position. The company leverages its established reputation in personal care and pharmaceuticals to promote feminine hygiene products as medically safe and clinically tested. It invests heavily in educational campaigns and partnerships with healthcare professionals to build consumer confidence. Additionally, J&J emphasizes premium product positioning, targeting urban consumers who prioritize quality and safety. Its strategy includes expanding distribution through pharmacies and modern retail channels, ensuring strong visibility and accessibility.

Procter & Gamble (P&G) adopts a consumer-centric innovation strategy, introducing products that combine convenience with advanced hygiene benefits. The company invests in digital marketing and influencer collaborations to engage younger demographics and normalizes discussions around intimate care. P&G also focuses on affordable premiumization, offering mid-range products with added features to appeal to price-sensitive yet quality-conscious consumers. Its strong retail partnerships and e-commerce presence further enhance market penetration.

Unilever’s strategy revolves around sustainability and inclusivity. The company promotes eco-friendly formulations and packaging, aligning with global trends toward ethical consumption. It leverages its extensive distribution network to ensure availability across urban and semi-urban markets. Unilever also invests in localized marketing campaigns, addressing cultural sensitivities while educating consumers about hygiene. This approach strengthens brand relevance and trust in diverse MEA markets.

Kimberly-Clark focuses on premiumization and product differentiation. The company introduces innovative formats such as wipes and foam cleansers, catering to convenience-driven consumers. Its marketing emphasizes comfort, safety, and dermatological testing, positioning products as part of a holistic self-care routine. Kimberly-Clark also invests in strategic retail partnerships and promotional activities to enhance visibility in offline channels, which dominate the region.

MEA Feminine Hygiene Wash Market Companies

Major players operating in the MEA feminine hygiene wash industry are:

- Beiersdorf

- Cottrell Pharmaceuticals

- FemFresh (A brand under Levlad)

- Himalaya Herbal Healthcare

- Himalaya Wellness

- Johnson & Johnson

- Kimberly-Clark

- Lactacyd (Part of Lactalis)

- New Avon

- Pigeon

- Procter & Gamble

- Sebapharma

- The Body Shop

- Unilever

- VWash Plus (VWash)

P&G maintains a dominant position through brand diversification and innovation. Its feminine care portfolio includes globally recognized brands like Always and Whisper, which are marketed as reliable and premium solutions. P&G’s strategy emphasizes affordable premiumization, combining quality with competitive pricing to appeal to middle-income consumers. Strong e-commerce penetration and influencer-led campaigns further enhance its reach in MEA, making P&G a benchmark for scale and consumer trust.

Himalaya Wellness capitalizes on the herbal and natural segment, differentiating itself through plant-based formulations and chemical-free products. This position appeals to health-conscious and eco-aware consumers in MEA. The company’s annual performance reflects steady growth, supported by its strong presence in pharmacies and expanding online channels. Himalaya’s strategy includes affordable pricing and regional outreach, making it accessible to middle-income buyers while maintaining a premium perception through its natural ingredient focus. This approach secures its niche leadership in the herbal feminine hygiene category.

MEA Feminine Hygiene Wash Market News

- In October 2025, Kimberly-Clark announced a USD 28.7 million investment to expand menstrual and maternal health programs across Latin America and Asia over the next three years. The initiative aims to reach 24 million women and girls, addressing gaps in menstrual hygiene, maternal care, and reproductive education. This strategic move reinforces Kimberly-Clark’s commitment to gender health equity and positions the company as a leader in social impact-driven growth.

- In November 2025, Kimberly-Clark announced a $40 billion acquisition of Kenvue, marking a strategic shift into health and wellness. The deal combines Kimberly-Clark’s hygiene brands with Kenvue’s consumer health portfolio, including Tylenol and Neutrogena, creating a global leader with projected annual revenue of $32 billion. This move strengthens Kimberly-Clark’s diversification strategy and positions it for long-term growth in high-margin healthcare categories.

- In September 2024, Procter & Gamble reported that penetration of feminine care products remains below 40% in rural India, compared to about 60% in urban areas, despite the category growing 100 times over 30 years to RS 3,400 crore. The company sees significant untapped potential in rural markets and expects double-digit growth over the next three years, driven by innovation and distribution expansion.

- In March 2020, Glenmark announced the transfer of its VWash brand to Hindustan Unilever, marking a strategic move to strengthen HUL’s presence in the feminine hygiene segment. The acquisition enables HUL to leverage its extensive distribution network and marketing capabilities to scale VWash across India. This deal reflects growing demand for intimate hygiene products and positions HUL to capture significant market share in a fast-expanding category.

The MEA feminine hygiene wash market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Creams

- Wipes

- Spray

- Bar

- Gel

- Others

Market, By Price

- Low

- Medium

- High

Market, By End Use

- Female teenager

- Female adult

Market, By Distribution Channel

- Online

- E-commerce website

- Company website

- Offline

- Hypermarket & supermarket

- Specialty stores

- Others

The above information is provided for the following countries:

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the MEA feminine hygiene wash market?

Key players include Beiersdorf, Cottrell Pharmaceuticals, FemFresh (A Levlad brand), Himalaya Herbal Healthcare, Himalaya Wellness, Johnson & Johnson, Kimberly-Clark, Lactacyd (Under Lactalis), New Avon, Pigeon, Procter & Gamble, and Sebapharma.

What are the upcoming trends in the MEA feminine hygiene wash industry?

Key trends include the rise of e-commerce and digital engagement, increased use of influencer marketing, and growing demand for personalized product recommendations and discreet purchasing options.

Which country leads the MEA feminine hygiene wash market?

Saudi Arabia led the market in 2024, accounting for over 40% of the market share and generating approximately USD 188 million in revenue.

Which distribution channel leads the MEA feminine hygiene wash market?

The offline distribution channel dominated the market in 2024, generating USD 251.8 million in revenue.

What was the valuation of the medium price range segment?

The medium price range segment held 42.3% of the market share and generated significant revenue in 2024.

How much revenue did the wipes segment generate?

The wipes segment generated USD 126.3 million in 2024, leading the market by product type.

What is the projected size of the MEA feminine hygiene wash market in 2025?

The market is expected to reach USD 404.9 million in 2025.

What is the market size of the MEA feminine hygiene wash market in 2024?

The market size was USD 392.2 million in 2024, with a CAGR of 3.3% expected through 2034, driven by changing consumer preferences, technological advancements, and socio-economic shifts.

What is the projected value of the MEA feminine hygiene wash market by 2034?

The market is expected to reach USD 542.5 million by 2034, supported by trends such as health awareness, sustainability, and convenience-focused product innovations.

MEA Feminine Hygiene Wash Market Scope

Related Reports