Summary

Table of Content

MEA Bulk Material Handling Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Bulk Material Handling Equipment Market Size

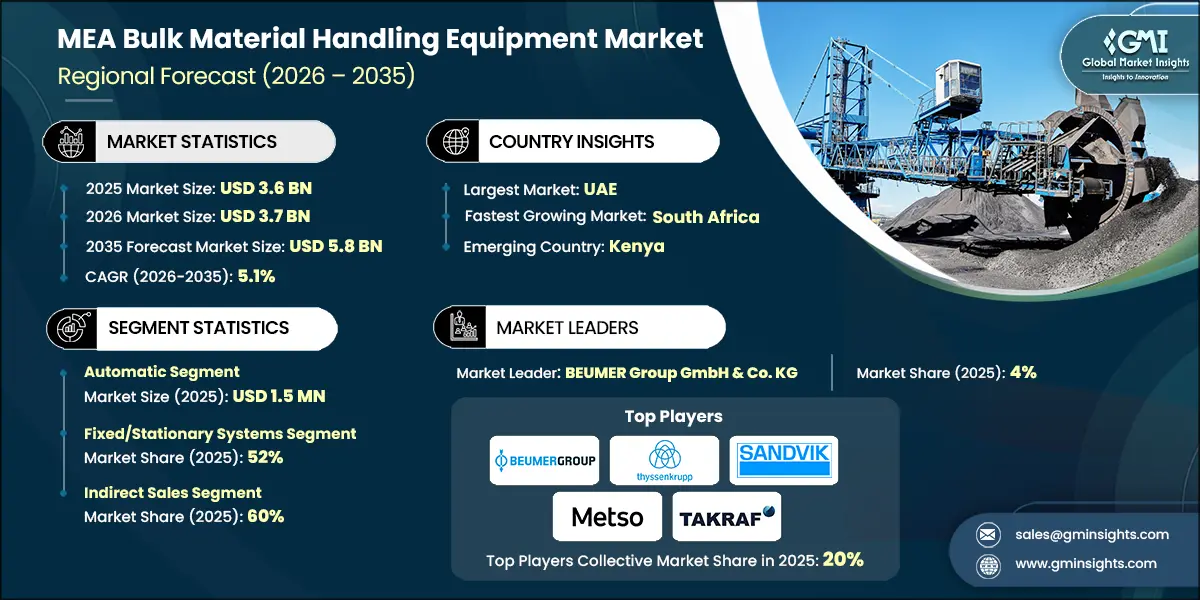

The MEA bulk material handling equipment market is estimated at USD 3.6 billion in 2025. The market is expected to grow from USD 3.7 billion in 2026 to USD 5.8 billion in 2035, at a CAGR of 5.1% according to latest report published by Global Market Insights Inc.

To get key market trends

An increase in the global need for minerals such as platinum, manganese and rare earth minerals is driving the continued growth of mining in Southern Africa. As a result of this growth, rapid growth in investing in systems to move quickly and efficiently to handle very high volumes of bulk materials and minimize downtime follows from this, as do advances in conveyor systems, stackers and reclaimers. Stricter environmental laws are making it necessary for mining companies to invest in more advanced systems for dust suppression and to reduce energy consumption. Many new projects will not only increase demand for mining equipment, but they will also increase technological advancements in Southern Africa that will create a major concentration of bulk handling equipment solutions for the MEA market.

According to the Minerals Council South Africa, the mining industry contributed approximately USD 24 billion to the country's GDP in 2022, highlighting its economic significance. This surge in mining activities has led to substantial investments in bulk material handling systems, which are essential for managing the extraction and transportation of high-volume ores efficiently.

MEA Bulk Material Handling Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.6 Billion |

| Market Size in 2026 | USD 3.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.1% |

| Market Size in 2035 | USD 5.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid expansion of mining operations in Southern Africa | This trend significantly boosts demand for high-capacity conveyors, stackers, and reclaimers. Mining projects require durable, automated systems to handle large volumes efficiently, creating strong growth opportunities for equipment manufacturers. |

| Port infrastructure modernization in GCC Countries | Modernization initiatives drive adoption of advanced ship loaders, unloaders, and automated handling systems. These upgrades improve cargo throughput and operational efficiency, positioning GCC ports as global trade hubs. |

| Growth in cement manufacturing Sector | Rising infrastructure development fuels cement production, increasing demand for crushers, feeders, and conveyor systems. Efficient material handling ensures continuous plant operations and supports large-scale construction projects. |

| Pitfalls & Challenges | Impact |

| High initial capital investment requirements | Bulk handling systems involve substantial upfront costs, which can deter smaller operators and delay project execution, impacting overall market penetration. |

| Lack of skilled labor & technical expertise | Advanced systems require trained personnel for installation and maintenance. Skill shortages can lead to operational inefficiencies and higher downtime. |

| Opportunities: | Impact |

| Renewable energy projects (solar, wind) require handling systems | Large-scale renewable projects need bulk handling for raw materials like aggregates and metals, creating new demand beyond traditional sectors. |

| Railway infrastructure expansion | Rail projects in MEA require integrated bulk handling solutions for loading and unloading materials, opening avenues for specialized equipment suppliers. |

| Market Leaders (2025) | |

| Market Leaders |

4% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | UAE |

| Fastest growing market | South Africa |

| Emerging countries | Kenya |

| Future outlook |

|

What are the growth opportunities in this market?

Environmental sustainability is also becoming a key focus area for mining companies in the region. Stricter environmental regulations, such as those outlined by South Africa's National Environmental Management Act (NEMA), are compelling companies to adopt advanced dust suppression technologies and energy-efficient equipment. For example, water mist systems and chemical dust suppressants are being integrated into bulk handling processes to mitigate environmental impacts. Furthermore, energy-efficient electric drive systems and renewable energy-powered equipment are gaining traction, aligning with global sustainability goals.

GCC nations are investing heavily in port modernization to strengthen their role as global trade gateways. Projects in Saudi Arabia, UAE, and Oman focus on expanding bulk cargo terminals and integrating automated handling systems. These upgrades aim to accommodate growing imports of raw materials and exports of industrial products, particularly in energy and construction sectors.

For instance, Saudi Arabia’s National Transport and Logistics Strategy aims to position the country among the top 10 global logistics hubs by 2030. The strategy includes the development of over 59 logistics zones and the expansion of port capacities to handle more than 40 million TEUs (twenty-foot equivalent units) annually. Similarly, the UAE’s Khalifa Port is undergoing a USD 1.1 billion expansion to increase its container handling capacity to 15 million TEUs by 2030, while Oman’s Port of Duqm is being developed as a major industrial and logistics hub with a focus on bulk cargo handling.

Advanced bulk handling equipment, such as high-capacity ship loaders, unloaders, and conveyor systems, plays a pivotal role in these modernization efforts. These technologies are instrumental in reducing vessel turnaround times, minimizing operational costs, and enhancing overall supply chain efficiency. According to industry reports, automated handling systems can improve port productivity by up to 30%, significantly boosting the competitiveness of GCC ports on a global scale.

MEA Bulk Material Handling Equipment Market Trends

The MEA bulk material handling equipment industry is currently experiencing rapid growth due largely to technological advances. Automation, electrification, and sustainability initiatives are changing project requirements, while the increasing need for capacity due to more investment in mines and ports creates new technical requirements for suppliers/vendors. There are several areas where suppliers can differentiate based on their use of digital technologies, providing lifecycle services that address risk and provide lower costs and quicker turnaround times.

- Automation is progressing from single-use pilot programs to being implemented across very large companies within mines, shipping ports, and cement production facilities. Enhanced throughput/safety has been developed with the development of integrated PLC/SCADA architectures, sensor rich conveyor systems, and autonomous stacker-reclaimers. With IoT telemetry, businesses can monitor equipment health conditionally and predictively and have completed remote diagnostic testing to help reduce unwanted downtime and spare parts' inventories. As labor becomes more limited and safety requirements become more rigorous, companies will need to build a business case for implementing automation's effectiveness via optimum data-driven energy use per tonne handled. Successful implementations of automation should include phased retrofits of existing equipment, robust cybersecurity measures, as well as operator training in embedding digital workflows into the company's operations to minimize disruption to production.

- Energy costs increasingly determine the overall cost of ownership, which has resulted in increased interest in high-efficiency drives for operational use as well as variable frequency control and regenerative braking technology on conveyor systems and ship loaders. Electrification of fixed assets, i.e., replaced diesel with electric power produces significant reduction in both emissions and maintenance complexity. Performance contracting allows for organizations to invest in upgrades through financing through future savings on their energy costs - allowing them to overcome upfront capital costs that prevent them from making the necessary improvements to their operations. Operators utilize kWh per tonne moved benchmarks to identify what are considered standardized components to facilitate spare part stocking and harmonization of control systems. Careful load profiling; utilizing soft-start strategies; and performing continuous power quality measurements further keep operations stable particularly in variable grid situations while allowing for achievement of decarbonization targets and ESG reporting requirements.

- Increasingly Procurement departments assess the total lifecycle cost and impacts of the products they purchase as much as they do the actual purchase price or the performance characteristics. For example, Buyers specify low-dust chutes, enclosed conveyors, and advanced filtering systems to reduce fugitive emissions from industrial operations into both surrounding communities and the environment. Within the Materials Selection process of the lifecycle assessment there is also a movement to recycle alloys and extended-wear liners to minimize maintenance frequency and replacement cycles. Environmental audits require a supplier's baseline documentation of noise, dust, and energy for the entire lifecycle of their products, and suppliers can provide documentation outlining their verified product footprint and circular service offerings, i.e. repair, refurbish, remanufacture. By embedding sustainability practices into product design, the supplier significantly reduces the compliance risk, unlocks concessional financing opportunities for customers, and increases stakeholder trust in their business, particularly with projects near urban centres or ecologically sensitive areas.

- Digital twins of stockyards, conveyors, and loading arms enabling virtual commissioning and scenario planning. By simulating flow rates, belt tensions, and surge conditions, teams optimize layouts before site work, reducing change orders and claims. Once live, twins ingest sensor data to validate performance, refine control logic, and anticipate bottlenecks under variable feed characteristics. Integration with inventory systems improves blend quality and reconciles book-to-physical variances. The tangible outcomes shorter ramp-up, better OEE, and safer interventions—justify investment when paired with disciplined data governance and KPI alignment.

- Project owners increasingly favor suppliers with regional teams, parts depots, and certified service partners. Local assembly and modular kits shorten lead times, ease customs risks, and adapt designs to site conditions. Outcome-based service contracts (availability guarantees, throughput commitments) align incentives and stabilize operating budgets. Training academies, mobile repair units, and remote support close skills gaps and standardize maintenance practices. This “glocal” approach—global engineering with local execution improves asset reliability, accelerates permitting and compliance, and builds resilience against supply-chain disruptions and currency volatility.

MEA Bulk Material Handling Equipment Market Analysis

Learn more about the key segments shaping this market

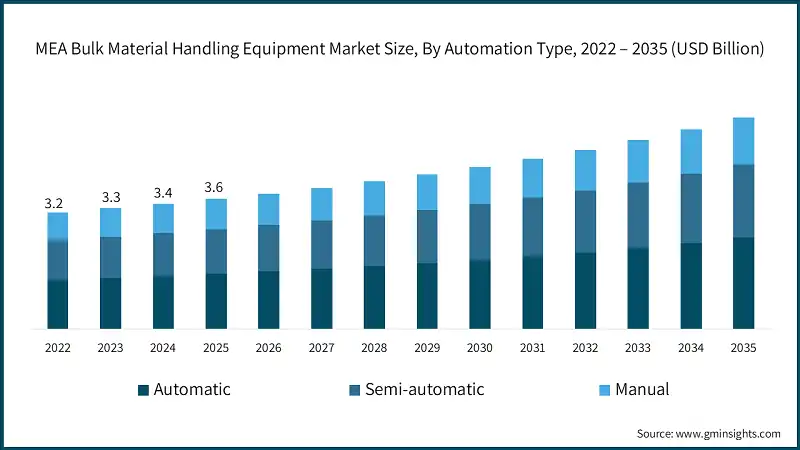

Based on automation type, the MEA bulk material handling equipment is divided into manual, semi-automatic, and automatic. In 2025, automatic held the major market share, generating a revenue of USD 1.5 million.

- The automatic segment has emerged as the dominant automation type in the MEA bulk material handling equipment industry, primarily due to the region’s growing emphasis on operational efficiency and cost optimization. Industries such as mining, cement, and port logistics are increasingly adopting automated systems to handle large volumes of materials with minimal human intervention. Automation reduces downtime, enhances safety, and ensures consistent throughput, which is critical for high-capacity operations. Furthermore, the integration of advanced technologies like IoT-enabled sensors and predictive maintenance tools is driving demand for fully automated solutions. This trend reflects a strategic shift toward productivity and sustainability, positioning automation as a cornerstone of future growth in MEA’s industrial landscape.

Learn more about the key segments shaping this market

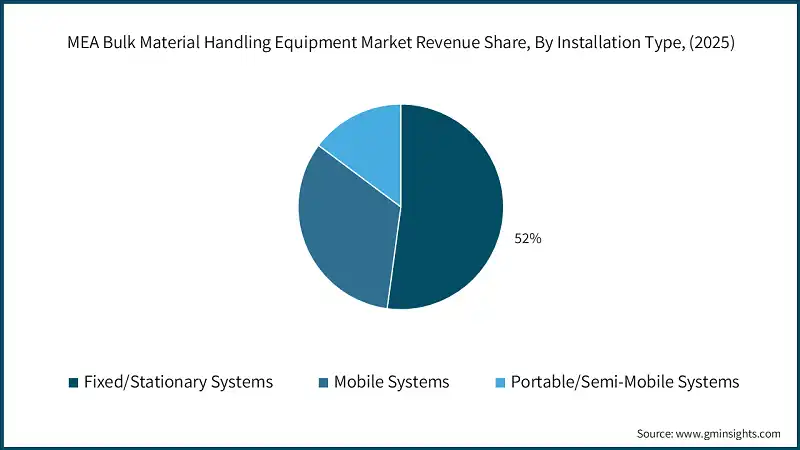

Based on installation type, the MEA bulk material handling equipment is segmented into fixed/stationary systems, mobile systems, and portable/semi-mobile systems. The fixed/stationary systems segment accounted for over 52% of the MEA bulk material handling equipment market share in 2025.

- Fixed or stationary systems hold a dominant position in the MEA bulk material handling equipment industry due to their reliability and suitability for large-scale, continuous operations. Industries such as mining, cement, and port terminals prefer stationary installations for handling high volumes of bulk materials efficiently over extended periods. These systems offer superior durability, lower maintenance costs, and enhanced capacity compared to mobile alternatives, making them ideal for permanent facilities. Additionally, the region’s significant investments in infrastructure and industrial plants reinforce demand for fixed systems, as they provide long-term operational stability and integration with automated processes. This dominance reflects a strategic focus on scalability and cost efficiency in MEA’s industrial landscape.

Based on distribution channel, the MEA bulk material handling equipment market is segmented direct sales and indirect sales. In 2025, indirect sales segment accounted for over 60% market share in 2025.

- Indirect sales have emerged as the leading distribution channel in the MEA bulk material handling equipment industry due to their ability to provide localized support and cost-effective solutions. Distributors and dealers play a critical role in bridging the gap between global manufacturers and regional customers, offering faster delivery, installation assistance, and after-sales service.

- This model is particularly effective in markets with complex regulatory environments and logistical challenges, where local expertise ensures compliance and operational continuity. Additionally, indirect channels enable manufacturers to expand market reach without significant capital investment in regional infrastructure. However, reliance on intermediaries can limit direct customer engagement and customization, making strategic partnerships and training programs essential to maintain brand integrity and technical standards.

Looking for region specific data?

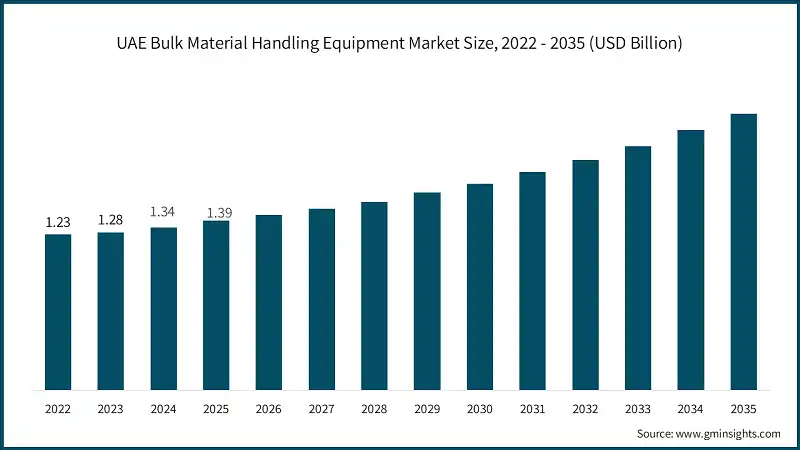

The UAE bulk material handling equipment market dominated around 39% market share with USD 1.39 billion revenue in 2025.

- Sustained investments in ports, logistics corridors, and industrial parks support the growth of the bulk material handling equipment sector in the UAE. Modernization of major terminals combined with the creation of free zones creates a demand for high-throughput automated stacker reclaimers, automated corpse loaders/unloaders, and enclosed conveyor systems that reduce dust and improve energy efficiency. Aggregate and cement flows to support infrastructure and real estate development continue to drive the requirements for durable, low-maintenance systems with the capability for predictive monitoring and the ability to provide fast access to spare parts.

- As industrial diversification occurs in the downstream metals, recycling, and food logistics industries, equipment mixes are evolving towards screening and separation technologies and storage systems with traceability and hygiene properties. Equipment purchasers are increasingly concerned about operational costs over the life of the equipment, guarantees for maximum up time, and environmental compliance; consequently, equipment suppliers are increasingly selling modular types, providing local service centres, and offering performance-based contracts. While the issue of extreme sensitivity to capital expenditures and shortages of qualified workers will continue to exist, the processes of electrification, the use of digital twins, and IoT upgrades are improving equipment reliability and throughput. The UAE is becoming a regional model for highly efficient and sustainable operations in the bulk material handling equipment space.

MEA Bulk Material Handling Equipment Market Share

BEUMER Group GmbH & Co. KG, ThyssenKrupp AG, Sandvik AB, Metso Outotec Corporation, and TAKRAF GmbH collectively hold around 20%, indicating fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

BEUMER Group GmbH & Co. KG focuses on innovation and sustainability, investing heavily in automated conveyor systems and IoT-enabled solutions for predictive maintenance. Its strategy emphasizes customized engineering, lifecycle services, and energy-efficient designs to meet ESG goals. Regional service hubs and digital retrofits enhance customer proximity and operational reliability.

Thyssenkrupp leverages integrated engineering capabilities and large-scale project execution expertise. Its strategy centers on turnkey solutions for mining and port operations, supported by advanced automation and material flow optimization. The company prioritizes strategic partnerships and modular designs to reduce installation time and improve cost efficiency.

Sandvik adopts a technology-driven approach, focusing on smart material handling systems integrated with real-time monitoring and analytics. Its strategy includes digitalization and sustainability, offering energy-efficient equipment and predictive maintenance tools. Continuous R&D investment ensures differentiation in high-capacity mining and mineral processing applications.

MEA Bulk Material Handling Equipment Market Companies

Major players operating in the MEA bulk material handling equipment are:

- AUMUND Group

- BEUMER Group

- Caterpillar

- CITIC Heavy Industries

- Continental

- KOCH Solutions

- Komatsu

- Liebherr Group

- Metso Outotec

- Sandvik

- Siwertell

- TAKRAF

- Tenova

- ThyssenKrupp

- Vigan Engineering

Metso Outotec emphasizes process integration and environmental compliance, delivering solutions that combine bulk handling with mineral processing. Its strategy includes eco-friendly designs, electrification, and automation to reduce emissions and improve throughput. Strong aftermarket services and global footprint reinforce customer loyalty and operational continuity.

TAKRAF’s strategy revolves around customized solutions for large-scale mining projects, leveraging expertise in high-capacity conveyors and bucket-wheel excavators. It focuses on engineering excellence and digital upgrades, offering advanced control systems and predictive maintenance features. Regional partnerships and modular systems support scalability and cost optimization.

MEA Bulk Material Handling Equipment Market News

- In July 2025, TAKRAF Group won a contract to supply four advanced compact spreaders for a large-scale phosphate operation in North Africa. Each unit features a 37.5-meter boom and a 13-meter dump height, designed to optimize material distribution and operational efficiency. This order underscores TAKRAF’s strategic positioning in the MEA mining sector, reflecting growing regional investment in high-capacity bulk handling solutions to support fertilizer and mineral production.

- In June 2025, Sandvik introduced a new generation of upgraded jaw crushers that deliver enhanced safety, productivity, and sustainability. Key features include hydraulic wedge setting and synchronized retraction for safer operation, an improved power pack, upgraded guarding, and the advanced ACS-j monitoring and control system. These crushers are engineered for seamless integration, a smaller footprint, and come with a three-year standard warranty demonstrating Sandvik’s commitment to operational efficiency and longevity.

- In December 2025, Metso Outotec opened a new engineering hub in Pittsburgh to bolster its bulk material handling and port solutions services. Though focused on North America, their global conveyor solutions include overland conveyors capable of up to 20,000 t/h—are pertinent to MEA markets as well.

- In December 2025, BEUMER Group opened a 2 billion state-of-the-art plant in Jhajjar, Haryana, aimed at producing high-tech conveyor systems, cement handling solutions, and airport logistics equipment. This strategic investment enhances BEUMER’s regional manufacturing capabilities, reduces lead times, and strengthens its global supply chain. The facility underscores BEUMER’s commitment to innovation and lifecycle services, positioning the company to meet rising demand for efficient bulk material handling solutions across emerging markets.

The MEA bulk material handling equipment research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Equipment Type

- Conveyor systems

- Belt conveyor systems

- Pipe conveyor systems

- Drag chain conveyor systems

- Screw conveyor systems

- Stacker-reclaimer systems (stockyard machines)

- Circular stacker-reclaimers

- Linear stacker-reclaimers

- Combined stacker-reclaimers

- Shiploader & shipunloader systems

- Continuous shiploaders

- Grab-type shipunloaders

- Pneumatic shipunloaders

- Wagon tippler & marshaling equipment

- Bucket wheel excavators

- Lignite mining end uses

- Iron ore end uses

- Overburden removal end uses

- Feeders & feeding equipment

- Vibratory feeders

- Belt feeders

- Apron feeders

- Crushers & size reduction equipment

- Jaw crushers

- Cone crushers

- Impact crushers

- Hammer mills

- Screening & separation equipment

- Vibrating screens

- Classifiers & separators

- Storage systems

- Hoppers & bins

- Silos & storage facilities

- Auxiliary & support equipment

- Belt cleaners & scrapers

- Take-up systems

- Transfer equipment & chutes

- Dust collection systems

- Magnetic separators

Market, By Capacity

- Small capacity systems (under 1,000 tph)

- Medium capacity systems (1,000-5,000 tph)

- High-capacity systems (5,000-8,000 tph)

- Ultra-high-capacity systems (8,000+ tph)

Market, By Installation Type

- Fixed/stationary systems

- Mobile systems

- Portable/semi-mobile systems

Market, By Automation Type

- Manual

- Semi-automatic

- Automatic

Market, By Commodity Type

- Iron ore

- Coal

- Copper

- Fertilizers & chemicals

- Multi-commodity systems

- Other bulk commodities

Market, By End Use

- Mining operations

- Port & terminal operations

- Power generation

- Cement manufacturing

- Steel & metals processing

- Agriculture & food processing

- Construction & aggregates

- Logistics & distribution centers

- Other end-use industries

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following countries:

- UAE

- Saudi Arabia

- Qatar

- Egypt

- Algeria

- South Africa

- Namibia

- Kenya

- Nigeria

Frequently Asked Question(FAQ) :

Who are the key players in the MEA bulk material handling equipment market?

Key players include AUMUND Group, BEUMER Group, Caterpillar, CITIC Heavy Industries, Continental, KOCH Solutions, Komatsu, Liebherr Group, Metso Outotec, Sandvik, Siwertell, TAKRAF, Tenova, ThyssenKrupp, Vigan Engineering

What are the upcoming trends in the MEA bulk material handling equipment market?

Key trends include automation with IoT and predictive maintenance, energy-efficient electrification, dust suppression for sustainability, and digital twins for optimization.

Which region leads the MEA bulk material handling equipment market?

UAE held 39% share with USD 1.39 billion in 2025. Investments in ports and logistics corridors fuel the region's dominance.

What was the market share of fixed/stationary installation segment in 2025?

Fixed/stationary systems held over 52% market share in 2025.

What is the market size projection for the MEA bulk material handling equipment market in 2026?

The market size is projected to reach USD 3.7 billion in 2026.

What was the revenue of the automatic segment in 2025?

Automatic systems generated USD 1.5 million in 2025, leading as the major automation type due to emphasis on efficiency and IoT integration.

What is the market size of the MEA bulk material handling equipment market in 2025?

The market size was USD 3.6 billion in 2025, with a CAGR of 5.1% expected from 2026 to 2035 driven by rising mining activity in Southern Africa and port modernization in GCC countries.

What is the projected value of the MEA bulk material handling equipment market by 2035?

The MEA bulk material handling equipment market is expected to reach USD 5.8 billion by 2035, propelled by infrastructure investments, automation adoption, and demand for efficient mineral handling.

MEA Bulk Material Handling Equipment Market Scope

Related Reports