Summary

Table of Content

MEA Barge Transportation Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

MEA Barge Transportation Market Size

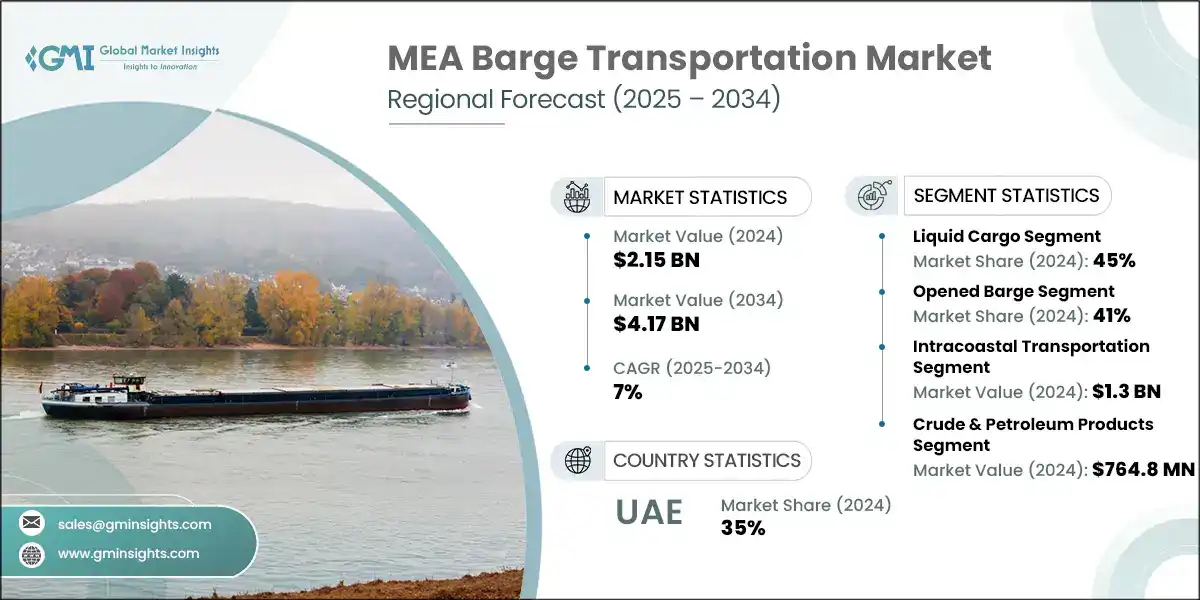

The MEA barge transportation market was valued at USD 2.15 billion in 2024. The market is expected to grow from USD 2.26 billion in 2025 to USD 4.17 billion in 2034, at a CAGR of 7%, according to the latest report published by Global Market Insights Inc.

To get key market trends

- The Middle East and Africa (MEA) barge transportation market is driven by increasing intra-regional trade, port expansions, and demand for cost-effective bulk logistics. According to the International Energy Agency (IEA), the Middle East accounts for 30% of global oil supply, and 18% of natural gas supply, as well as almost 25% of global LNG deliveries, and approximately one third of global urea exports, which warrant the use of specialist tank barges.

- The African Continental Free Trade Area (AfCFTA) is also contributing to inland waterway freight transport growth, and the United Nations Economic Commission for Africa (UNECA) estimates that intra-Africa freight volume is likely to grow by 22% by 2030.

- Overall, market remains fragmented with state-owned interests, such as ADNOC and Qatar Gas, in a dominant position in the Gulf, whereas smaller private interests operate in the fragmented marketplace across Africa. Market fundamentals have a major impact on factors impacting the sea barge transport such as fuel prices, efficiency of port operations, and regulatory changes.

- The World Bank’s Logistics Performance Index (LPI) notes that delays at ports in Africa incur significant data operational costs to barges, particularly when compared with the much more efficient ports of the GCC. The National Transport and Logistics Strategy (NTLS) of the Kingdom of Saudi Arabia, initially published in 2021 and updated in 2025, estimates over USD 265bn in investment required by 2030 for a multi-modal logistics hub that would establish Saudi Arabia as an international logistics hub of world class excellence.

- The Covid-19 pandemic caused disruption to waterborne and barge transport activities in the Middle East and Africa. Early in the pandemic, a decline in sea freight volume occurred due to restrictions and the slowing down of economies to control the spread of the pandemic, this was followed by a significant increase in consumer product demand, which caused unprecedented rates for containerized freight. While rates have since begun to normalize following record highs in 2022, shipping companies have reported record profits during this period.

- The Middle East is the major player in the MEA barge transport market due to its significance in global energy trade and strong regional maritime infrastructure. The barge market is very much driven by oil and gas logistics, and large-scale operations typically transport crude, refined products or LNG across the Gulf region and beyond.

- Qatar and Oman continue to develop their local barge sectors, port expansion projects in many of the Gulf States, and in particular UAE and Saudi Arabia, are adding to barge connectivity for intraregional trade and transshipment to Africa and Asia. For example, in June 2025, The National Shipping Company of Saudi Arabia (Bahri) commenced the commercial operations of its first three floating desalination barges.

- East Africa is the fastest growing market for barge transportation driven by increased trade volumes, port modernization, and demand for more efficient use of inland waterway as a transport modality. Major ports like Mombasa and Dar es Salaam are the key gateway ports for landlocked countries in the region (e.g. Uganda, Rwanda, Burundi) and this demand for barge services is coming to increase cargo movement and ease road congestion.

- Recently, in April 2025, Kenya lifted a seven-year suspension on container cargo stripping at Mombasa port in advance of dhow and barge movement to Zanzibar and Pemba. It is anticipated that this policy change by the Kenyan government will substantially increase transshipment volumes through Mombasa and, by them, accelerate development in the regional barge transportation market.

MEA Barge Transportation Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.15 Billion |

| Forecast Period 2025 – 2034 CAGR | 7% |

| Market Size in 2034 | USD 4.17 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of oil & gas exploration and production activities | The surge in offshore and onshore oil & gas projects across the Gulf Cooperation Council (GCC) region |

| Rising mineral and agricultural commodity exports | Commodity exports Growing exports of coal, iron ore, phosphates, and grain from MEA nations such as South Africa, Morocco, and Egypt |

| Government investment in port and inland waterway infrastructure | Significant public and private investment in modernizing ports, dredging rivers, and improving intermodal connectivity |

| Increasing demand for low-carbon freight solutions | Rising environmental regulations and sustainability commitments |

| Pitfalls & Challenges | Impact |

| Limited navigable inland waterways in arid regions | The geographical scarcity of perennial rivers in much of the MEA limits the scope of barge operations |

| Vulnerability to climate change and water level fluctuations | Seasonal variations, droughts, and flooding events can disrupt barge schedules and reduce operational days |

| Opportunities: | Impact |

| Expansion of cross-border trade corridors | The development of regional trade agreements and cross-border logistics corridors |

| Adoption of technologically advanced, automated barges | The integration of automation, GPS tracking, and fuel-efficient propulsion systems improve operational efficiency |

| Market Leaders (2024) | |

| Market Leaders |

9% market share |

| Top Players |

Collective market share in 2024 is 36% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Middle East |

| Fastest Growing Market | East Africa |

| Emerging Countries | Egypt, Nigeria, Iraq, Sudan, Kenya |

| Future outlook |

|

What are the growth opportunities in this market?

MEA Barge Transportation Market Trends

- The governments in the MEA region are investing more in updating inland waterways, ports and terminals to limit reliance on increasing congestion of road and rail networks. Priority projects along the Nile in Egypt, Niger River in Nigeria and Lake Victoria in East Africa, to name a few, focus on decreasing emissions and lowering transport costs for freight transportation which continues to be an increasingly popular area of logistics development.

- There is a strong need to improve connectivity specifically for bulk commodities, as part of the objective is to decrease logistics costs and otherwise develop multimodal nodes to accommodate trade flows from industrial and agricultural areas and regions. Take for example, February 2025, Premier Marine Engineering Services together with ADNOC Logistics and Services did complete ahead of schedule their first locally built cargo barge within the United Arab Emirates, adding to the UAE's shipping capabilities.

- Barge transport operators are still at the initial stage of adopting digital tracking and automated scheduling and fleet management platforms to improve overall efficiency and transparency. However, real-time cargo monitoring with route optimization tools have helped provide predictability in delivery schedules for domestic and cross-border trade.

- As global shipping enterprises enter inland barge services, digital solutions are becoming a competitive advantage in a contractor's ability to innovate to meet increasing customer service expectations for timely logistics. For example, Maritime logistics software company OpenTug, Seattle, secured a strategic investment of USD 2.2 million to grow their products that are critical to barge operations, BargeOS and LinerOS. OpenTug's software suite provides automation, real-time visibility, and optimized coordination of the inland and coastal commercial barge industry.

- The MEA barge transportation sector growth is heavily linked to the increase in trade of oil, gas, minerals, and agricultural commodities. Crude oil and refined products movements will continue to dominate for many countries such as Nigeria and Iraq that mainly rely on inland waterways for transporting these commodities while countries like Sudan and Egypt are exploring barge transport as a more efficient way to discharge grains and fertilizers.

- This need to ensure secure and low-cost transport of these fundamental goods is translating into increased demand for barge operations, thereby strengthening inland energy and agricultural trade corridors as glaring market growth strategies. For instance, May 2025, the Austrian oil conglomerate OMV will divest their interest in sour gas development offshore United Arab Emirates (UAE) as agreed with Lukoil Gulf Upstream, a subsidiary of Russia's Lukoil.

MEA Barge Transportation Market Analysis

Learn more about the key segments shaping this market

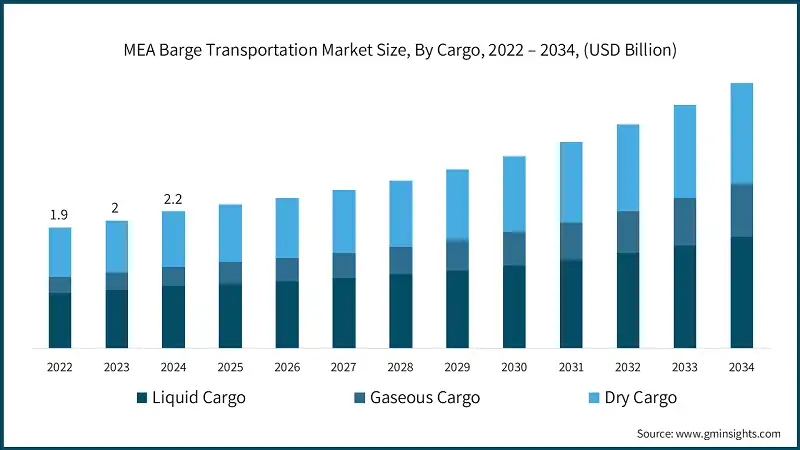

Based on cargo, the market is divided into liquid, gaseous, and dry cargo. The liquid cargo segment dominated the market accounting for around 45% in 2024 and is expected to grow at a CAGR of over 6% through 2025-2034.

- In the MEA barge transportation market, liquid cargo makes up the largest segment, and the region is heavily reliant on petroleum products, chemicals, and refined oil by barge. Inland waterways and coastal barge routes are utilized to facilitate the movements of crude oil, diesel, and gasoline in countries like Nigeria, Iraq, and Egypt.

- The barge for liquid bulk is not only efficient but also significantly lower in cost and safer to move which is important in meeting the demands of industrial operations and continuously providing supplies for export and energy. Barge transportation of liquid cargo is an essential part of the fluidity and legacy of the energy supply chain in the region.

- Also, the higher demand for transactional reliance of petroleum, chemicals, and petrochemical industry fueled demand for liquid cargo barges that have an advanced level of safety and enhanced storage. Companies are investing more in investments and seconds of expansion in refinery, storage terminals, and inland depots contribute to sustained buoyancy of liquid goods which continue to consolidate this share of the market underwater. Advancements of international shipping players entering the MEA market, and local operators upgrading their fleet, liquid cargo continues to sure foundation that sustains overall revenue for barge transportation across the board.

- Gaseous cargo, with liquefied natural gas (LNG) and liquefied petroleum gas (LPG) leading the pack, is developing into the area’s fastest-growing segment due to the region's movement towards cleaner fuels and energy diversification. Nations including Egypt and Nigeria are expanding their LNG infrastructure and using barges for short-range transport to terminals and regional hubs. Members of the Barge Operators Association of Nigeria (BOAN) transport atleast one million TEUs of containers and roughly 500,000 metric tons of general cargo from the ports in Lagos annually.

Learn more about the key segments shaping this market

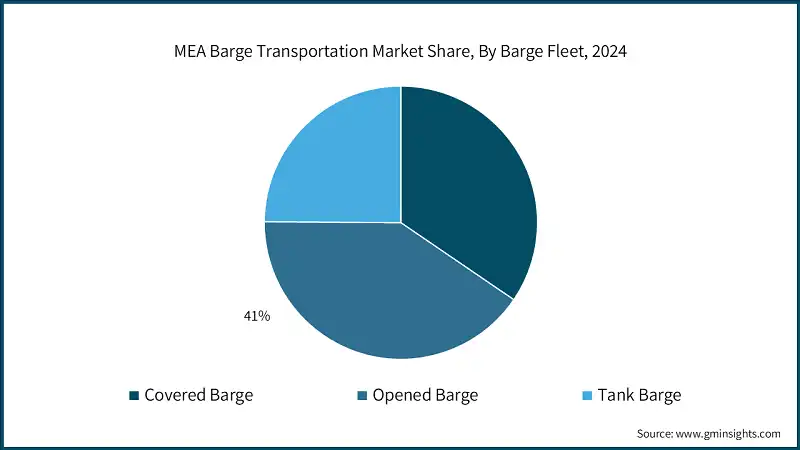

Based on barge fleet, the market is categorized into covered barge, opened, and tank. The opened barge segment dominates the market with 41% share in 2024, and the segment is expected to grow at a CAGR of over 8% from 2025-2034.

- Opened barges represent the largest segment in the MEA barge transportation market due to their versatility in carrying bulk commodities such as coal, iron ore, grains, construction materials, and containers. Their open-top design makes it easy to load and unload heavy and oversized cargo efficiently, and they are typically the cheapest option for transporting goods by water, whether inland or coastal.

- For example, the Nile and Niger rivers have the most significant trade corridors for bulk commodities, where open barges have a large volume share of the business. Open barges provide significant infrastructure assistance in the region, support agriculture exports, and are used for shipping raw materials.

- For example, in August 2025, Prism Logistics put into service its first opened barge built to 250-class specifications, in Abu Dhabi. This added a strong marine transportation capability for its network of logistics in the Gulf Cooperation Council (GCC) region. This vessel was designed to transport heavy loads and cargo on international sea routes. The addition of this vessel represents a significant milestone in the company’s offshore logistics strategy in an era of increasing demand for companies looking for large-scale cargo solutions.

- Covered barges are the fastest growing segment of transport in the MEA barges transportation sector and is the fastest growing segment due to a clear need to protect sensitive/valuable cargoes like grains, fertilizers, chemicals, manufactured goods and the like from the elements, contamination, and even animal intrusions. With the rise of food security agenda and agricultural exports in the likes of Egypt, Sudan and Kenya, demand is building for covered barges to safely and hygienically circulate goods.

- Due to their capability to safely and effectively provide a secure, weatherproof, transport, covered barges are perfect for high valued and perishable commodities and the reason why they are the fastest growing vessel type in the MEA barges transportation market. For example, in April 2025, UAE based Gulf Marine Services (GMS), an operator and provider of self-propelled, self-elevating support vessels for the offshore energy sector, secured a contract for one of its Jackup covered barges in the Gulf Cooperation Council (GCC).

Based on barging activity, the market is divided into intracoastal transportation and inland water transport. The intracoastal transportation segment dominates the market and was valued at USD 1.3 billion in 2024.

- Intracoastal transportation is the largest segment of the MEA barge transportation market because it provides a means for moving bulk commodities, energy products, and containers along a coastal route and between major ports. Intracoastal transportation, utilizing established coastlines, will develop port infrastructure in the UAE, Saudi Arabia, and Egypt in locations where viable and enables transport without extensive inland waterway improvements in the indicative MEA region. It is an essential mode of transport for energy-producing states that depend on intracoastal barge transportation to connect offshore oil and gas production facilities with refineries and export terminals. Intracoastal transport is the dominant coastal mode, utilizing vessels that handle large shipments more cheaply than road and railway transport.

- Inland water transport is the fastest-growing segment driven by a growing focus on using rivers and lakes to develop domestic logistic effectiveness. Decongesting traditional road and rail systems, various projects are being undertaken to improve inland water transport on rivers such as the Nile in Egypt, the Niger River in Nigeria, and the Great Lakes region of East Africa with cheap freight alternatives.

- Inland water transport is a key industry because of investment by governments and private operators in dredging, terminals, and modern barge fleets. Increased use of inland waterways is a viable option for transporting agricultural products, industrial raw materials, and fuel products.

Based on end use, the market is divided into coal, crude & petroleum products, liquid chemicals, food pulp & other liquid, agricultural products, metal ores and fabricated metal products, pharmaceuticals, dry & gaseous chemicals, LPG, CNG, and other gaseous products, electronics & digital equipment, and others. The crude & petroleum products segment dominates the market and was valued at USD 764.8 million in 2024.

- Crude oil and petroleum products comprise the bulk of the MEA barge transport sector, a relatable representation to the regions position as a global energy hub., such as Nigeria, Iraq, Egypt use barges widely as an economical bulk transport means, easily moving crude oil, refined fuel and petrochemical feedstock in bulk volumes from inland production sites, refineries and across loading docks.

- Barges provide a reliable and affordable alternative for groups that want an efficient way to transport crude oil and natural resources because they do not have the capacity of pipeline or rail systems, and their ability to move incredible quantities of liquid product witlessly and reliably represents the base function of the MEA barge transportation market.

- The established reliability and usability of barges as transport means in this sector is enhanced with continuing refinery expansion, ongoing oilfield discovery and development, alongside the ongoing consumption of fuels in the region. In addition to capital requirements for storage and related facilities development, countries in MEA are craving substantial transport systems supporting their primary revenue sources with energy exports.

- LPG, CNG, and other gaseous products are the fastest-growing segment of barge transportation, driven by the region's gradual transition to cleaner fuels and gas energy solutions. Countries such as Egypt and Nigeria are developing their natural gas and LPG infrastructure, and barges are increasingly utilized as a method of short-haul and regional distribution to terminals, heavy industrial sites, and power plants.

- Increased acceptance of natural gas to produce electricity, for industrial purposes, and residential use is creating a demand for secure and cryogenic barge solutions to safely transport gaseous products. Investments in natural gas liquefaction, storage options, and distribution are expanding, and expect this segment of the market to grow rapidly, outpacing traditional cargo segments of the market.

Looking for region specific data?

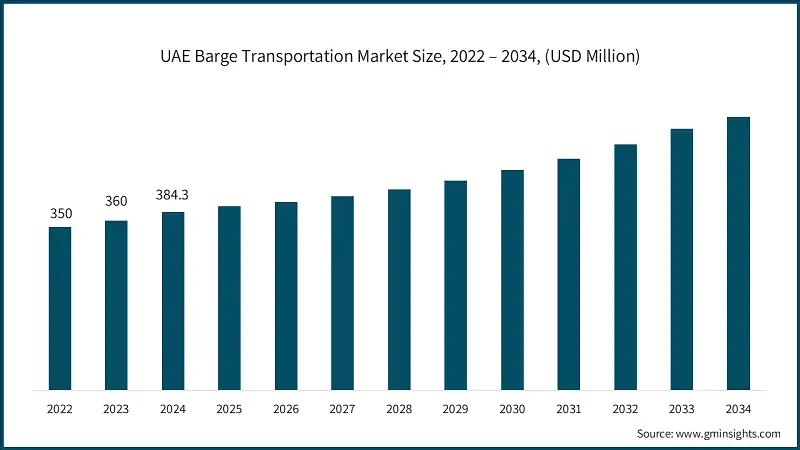

The UAE dominated the Middle East Africa barge transportation market with around 35% market share and revenue of USD 384.3 million in 2024.

- The largest market for barge transportation in the Middle East is in the UAE. This is due to its favorable location along some of the world’s largest shipping lanes, as well as with important ports such as Jebel Ali, Abu Dhabi Khalifa, and Fujairah operating as regional hubs for bulk cargo (notably crude oil, petroleum products and containers).

- As barges are a lower-cost option for intra-port and coastal logistics, and with the extensive infrastructure, modern port facilities and the presence of global shipping companies, the UAE remains the largest regional market for barge transport. Also, the large scale of different types of industrial activity and the construction sector in the UAE creates a lot of demand for the movement of bulk materials which helps to make the UAE the largest barge transport market.

- Saudi Arabia is the fastest-growing barge transport market in the Middle East. This is a result of the kingdom's significant investments in the development of their energy and petrochemicals sector and their large-scale infrastructure development. The kingdom is developing its inland waterways, including ports, on the Red Sea and Arabian Gulf to improve logistics while reducing their dependency on the road and rail networks.

- Demand for barge transport has been driven by both increases in exports of crude oil and refined petroleum, but also larger-scale industrial and construction projects have increased significantly in the country. Strategic initiatives under Vision 2030, including port modernization and economic diversification, are expected to accelerate market growth, positioning Saudi Arabia as the fastest-expanding regional hub for barge operations.

Morocco barge transportation market will grow tremendously from period 2025 to 2034.

- Morocco is the largest market in North Africa, largely due to its geographic advantages on the Atlantic and Mediterranean. Ports like Casablanca, Tangier Med, and Agadir are key terminals for bulk, containerized, and energy products and allow for coastal and intracoastal movement of barges effectively. The port infrastructure is supportive of this developing sector with a burgeoning reliance on industrial exports and agricultural moving towards Morocco's key focus, which is to use barges for long-distance and bulk transport. In addition, Morocco's networks of established trade relations and a strong logistics system provide a solid base for where Morocco has development as the largest market in North Africa.

- Egypt is the fastest emerging barge transportation market in North Africa, driven by the growth of the Nile River transport market and the upgrade of the inland waterways. The substantial investment into ports dredging and multimodal terminal building continues to drive efficiencies in bulk commodities increased use of barge transport (grains, fertilizer, petroleum). The industry will further support more barges moving through Egypt and the regionalization of the Suez Canal corridor is contributing to rapid demand growth for moving into the barge. Therefore, Egypt is experiencing the highest growth in barge market volume in North Africa and a burgeoning hub.

The barge transportation market in Nigeria will experience prosperous growth during 2025-2034.

- In the market, Nigeria accounts for more than 49% of the total market share, being identified as the fastest growth area at a projected CAGR of 9.9%. Nigeria is the largest market in West Africa, with driving sectors including crude oil, petroleum products, agricultural products, and industrial goods. There are also vast inland waterways, such as the Niger–Benue River system, that support high-volume barge transportation operations that, when combined with the modernization of key ports in Lagos, Port Harcourt, and Warri, make for access to mass cargo transportation.

- Additionally, the government is focused on reducing government road-driven congestion while pushing for an internal push towards inland water transport, which is aiding the rapid growth by attracting investment. The barge transportation market in Ghana has also experienced growth; however, with a more moderate CAGR, primarily driven by cocoa and exports of minerals and other bulk marketed commodities.

- Ghana has vast inland water transport options available, for example, the state-owned Volta River Authority provides barge services along the Volta River, which offers coastal logistical support to farming and industrial goods movement as well and the Tema and Takoradi ports, which are both directly connected to the sea and can service coastal barge shipments. Growth potential for the Barge Transportation market in Ghana has also received national effort driven by H.E. Nana Addo Danquah Akufo-Addo, the government had introduced several policies to reduce road congestion and improve the usage of inland waterways.

- Similarly, in Guinea the barge segment in Guinea is also in its infancy, dentitionally remaining focused on bauxite exports, iron ore, and other mineral exports. Guinea does without adequate ports or developed inland waterways for sizeable and widespread usage, however in a similar trend to the Bar Wrapping we've observed in Nigeria, begun to see minimal investment taken to dredge rivers and re-imagine logistics as an alternative for resource moves and bulk commodities.

The barge transportation market in South Africa is expected to experience magnificent growth between 2025-2034.

- South Africa has a well-established barge transportation marketplace, with large scale coastal barge operations serving to carry bulk cargoes including coal, minerals, agricultural products and containers along its extensive and compelling coastline. Ports along the coast of South Africa such as Durban, Cape Town, and Richards Bay, serve as the hubs for most coastal and intracoastal operational barge activity. The advanced port infrastructure, diversity of industrial demand, and connectivity with logistics networks allows South Africa to be the largest barge transportation market in Southern Africa.

- Moreover, Mozambique's barge segment has also been expanding primarily due to coal, gas and agricultural exports. Furthermore, the increasing popularity of inland waterways and coastal routes, especially the Zambezi River and Beira corridor, offer low maintenance and cost-effective alternatives for transporting bulk commodities by barge. In addition to inland waterway and coastal growth, continued expansion of port facilities and development of gas infrastructure has produced an increasingly attractive barge landscape, most notably for transporting LNG and minerals.

- Angola's barge transportation market is primarily driven by crude oil and products, petroleum products and mineral exports. Operationally, coastal and riverine barge transportation along the Congo river and coastal routes connects offshore production and inland locations with ports, such as Luanda and Lobito. Angola's investment in port modernization and dredging projects are enhancing capacity and reliability for energy - and bulk commodity circulation along the coast.

Barge Transportation Market Share

The top 7 companies in the market are Gulf Agency Company, ADNOC Logistics & Services, ARTCo Barge & Stevedoring, Astro Offshore, African Marine Solutions, CMA CGM, and A.P. Moller - Maersk. These companies hold around 36% of the market share in 2024.

- ADNOC Logistics & Services is the predominant player in the UAE and the greater MEA region. ADNOC L&S operates a large fleet of 31 jack-up barges and over 100 offshore support vessels. This places the company as a leading logistics operator in the region. Recently, the company has made additional expansion efforts, purchasing eight new jack-up barges. This commitment to expansion shows ADNOC L&S is enhancing its offshore capabilities.

- Similarly, Gulf Agency Company (GAC) is an established operator with a greatly diverse range of marine services. They perform tug and barge operations in the MEA region and additionally provide offshore support and logistics services. Within the MEA region, Gulf Agency Company (GAC) has a regional network supporting various marine and logistics operations.

- ARTCo Barge & Stevedoring is a more specialized operator in relation to the U.S. inland waterways. They have several Gottwald/Terex cranes; this enables the efficient transloading of distributions of break-bulk and bulk cargo. ARTCo Barge and Stevedoring service primarily the U.S. inland waterways and does not have any direct engagement in the MEA barge transportation market.

- Astro Offshore is an emerging operator with strong focus now serving the offshore support services. They own and operate more than 25 offshore vessels that include barges in the offshore oil and gas and renewables markets. The company prides itself on being nimble and forward thinking to quickly capitalizing on new opportunities in the offshore sector.

MEA Barge Transportation Market Companies

Major players operating in the MEA barge transportation industry include:

- ARTCo Barge & Stevedoring

- Astro Offshore

- GAC Marine

- Gulf Agency Company

- Kirby Corporation

- Liwa Marine Services

- Marine Core & Charter

- Marquette Transportation Company,

- Global shipping companies CMA CGM Group and A.P. Moller - Maersk use their large international networks and integrated logistics services to increase inland and coastal barge services throughout the MEA region. With limited direct influence in the MEA market, ARTCo Barge & Stevedoring operates mainly in the U.S. The market is composed of mainly a mixture of dominant local and regional operators; emerging local specialists; and prevalent global shipping brands. ADNOC L&S is the largest fleet operator and most significant regional player.

- African Marine Solutions (AMS) is a regional operator focused mainly on marine services in Southern Africa. The company offers offshore support South Africa, tug, and barge services relating to the oil and gas industry, mainly in the Southern African region. AMS focuses largely on a wider range of offshore logistics, barge, and port support services.

- CMA CGM Group, a global leader in container shipping and shipping services with a growing presence in the MEA barge transport market. The CMA CGM Group operates a fleet of over 650 vessels (including barges), and more than 420 ports globally, focusing on expanding inland and coastal barge services to complement its traditional global container shipping operations.

- A.P. Moller is global shipping giant with a significant presence in the MEA region. Also, the company provides integrated logistics solutions, including barge transportation, across the MEA region. It continued investment in regional infrastructure and services to strengthen its market position.

MEA Barge Transportation Industry News

- In August 2025, Onitsha Port in Anambra State, Nigeria received its first barge of the year, MV ZUPITOR/MV RB ALASKA. It has rekindled interest among local traders and logistics operators, but more importantly, it has re-emphasized the potential of inland waterways, which could serve as a cheaper and efficient transport option. With the restart of barge services, road congestion relief as well as transport cost reductions could provide a more economically favorable opportunity for growth in the region.

- In of June 2025, Maersk has resumed accepting import cargo at Haifa Port, Israel. Vessels to Haifa Port will proceed with their regularly scheduled port calls beginning June 30. The decision to accept cargo once again comes after a cease-fire agreement has been reached which has brought de-escalation to the conflict allowing for continued maritime operations in the region.

- In of June 2025, Saudi Arabia's National Shipping Company (Bahri) began commercial operation of its three abandoned commercial barges, each floating desalination barge can generate 50,000 cubic meters of water per day, for a combined 150,000 cubic meters of water per day. The rest of the project addresses the scarcity of water in the region while demonstrating the growing importance of barges in facilitating infrastructure development beyond traditional cargo transport.

- In May 2025, Vitol Bunkers commenced supplying marine fuels via barge in the West African region, starting with deliveries of Very Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO). This initiative aims to enhance fuel supply flexibility and efficiency, particularly in locations like Dakar and offshore Lomé. The move is expected to streamline operations for vessels operating in these regions, contributing to the growth of the maritime industry in West Africa.

The MEA barge transportation market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume (USD Mn & Units) from 2021-2034, for the following segments:

Market, By Cargo

- Liquid cargo

- Gaseous cargo

- Dry cargo

Market, By Barge Fleet

- Covered barge

- Opened barge

- Tank barge

Market, By Size

- 140ft to 180ft

- 195ft to 250ft

- 260ft to 300ft

- 300ft and above

Market, By Barging Activity

- Intracoastal transportation

- Inland water transport

Market, By Application

- Coal

- Crude & petroleum products

- Liquid chemicals

- Food pulp & other liquid

- Agricultural products

- Metal ores and fabricated metal products

- Pharmaceuticals

- Dry & gaseous chemicals

- LPG, CNG, and other gaseous products

- Electronics & digital equipment

- Others

The above information is provided for the following regions and countries:

- Middle East

- Bahrain

- Kuwait

- Oman

- Qatar

- Saudi Arabia

- UAE

- North Africa

- Algeria

- Egypt

- Libya

- Morocco

- Tunisia

- West Africa

- Ghana

- Guinea

- Liberia

- Nigeria

- Senegal

- Togo

- East Africa

- Somalia

- Kenya

- Somalia

- Tanzania

- Djibouti

- Southern Africa

- Angola

- Mozambique

- South Africa

- Namibia

- Madagascar

Frequently Asked Question(FAQ) :

Who are the key players in the MEA barge transportation industry?

Key players include ARTCo Barge & Stevedoring, Astro Offshore, GAC Marine, Gulf Agency Company, Kirby Corporation, Liwa Marine Services, Marine Core & Charter, and Marquette Transportation Company.

Which country leads the barge transportation market?

The UAE leads the Middle East Africa market with a 35% share, generating USD 384.3 million in revenue in 2024. Its strategic location along major shipping lanes and key ports like Jebel Ali, Abu Dhabi Khalifa, and Fujairah contribute to its dominance.

What are the upcoming trends in the MEA barge transportation market?

Trends include modernization of inland waterways, digital fleet tracking, real-time cargo monitoring, multimodal integration, and digital solutions for efficiency and customer satisfaction.

What was the market share of the opened barge segment in 2024?

The opened barge segment held a 41% market share in 2024 and is set to expand at a CAGR of over 8% up to 2034.

What is the market size of the MEA barge transportation in 2024?

The market size was valued at USD 2.15 billion in 2024, with a CAGR of 7% expected through 2034. Increasing intra-regional trade, port expansions, and demand for cost-effective bulk logistics are driving market growth.

What is the growth outlook for the intracoastal transportation segment?

The intracoastal transportation segment, valued at USD 1.3 billion in 2024, due to its role in moving bulk commodities, energy products.

How much revenue did the liquid cargo segment generate in 2024?

The liquid cargo segment accounted for approximately 45% of the market in 2024 and is expected to witness over 6% CAGR till 2034.

What is the expected size of the MEA barge transportation industry in 2025?

The market is expected to reach USD 2.26 billion in 2025.

What is the projected value of the MEA barge transportation market by 2034?

The market is poised to reach USD 4.17 billion by 2034, driven by rising trade of oil, gas, minerals, and agricultural commodities, as well as advancements in inland waterway infrastructure.

MEA Barge Transportation Market Scope

Related Reports