Summary

Table of Content

LNG Bunkering Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

LNG Bunkering Market Size

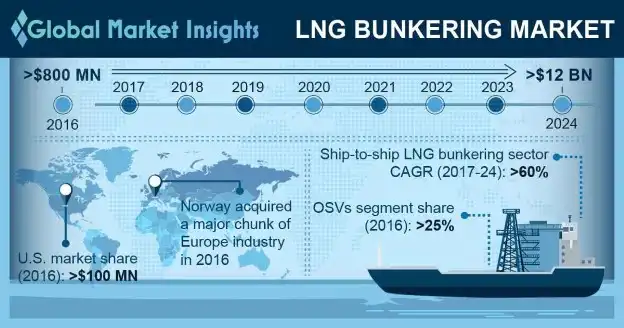

LNG Bunkering Market size for 2016 was valued over USD 800 Million and the capacity is set to exceed 18,500 kilotons by 2024.

To get key market trends

Shifting trends towards clean energy coupled with stringent government regulations to minimize airborne emissions including sulfur and nitrous oxide will drive the global LNG bunkering market size. Ability to reduce carbon emission by 20% to 25% will make its adoption preferable over other available counterparts. In 2015, IMO and MARPOL introduced strict norms to reduce the sulfur and nitrous content with an aim to reduce the marine pollution. Technological advancement in vessel designs to reduce maintenance, enhance fuel efficiency and improve performance, reliability and safety are some of the key parameters which will stimulate the product demand. Strong orderbook for LNG-propelled vessels subject to the implementation of IMO Tier III norms will further complement the industry growth.

Shifting trend towards sustainable fuel coupled with increasing shale production will foster the LNG bunkering market. In the U.S. shale gas production reached from 13,447 bcf in 2015 to 15,213 bcf in 2016. Growing demand for reliable, eco-friendly and low-cost marine fuel will further complement the business landscape. Vancouver bunker prices for LNGe-380 were USD 255/ mt when compared to IFO 380 floating of USD 284 in May 2017.

LNG Bunkering Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 800 Million (USD) |

| Market Size in 2024 | 12 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

LNG Bunkering Market Analysis

Ship-to-ship LNG bunkering market is predicted to witness growth over 60% by 2024 owing to its high capacity and quick transfer operations. Ability to allow the movement of cargo and bunkering operation to occur simultaneously will further complement the industry landscape. In 2017, Belgium received the delivery of world’s first purpose built LNG bunker vessel Engie Zeebrugge with a capacity of 5000 cu. meters.

Availability of pipeline on ports along with larger hose to increase the bunkering rate will positively impact port-to-ship market size. Low cost and quick transfer operation will encourage the adoption of truck to ship operations.

RO-Pax LNG bunkering market is set to witness strong growth pertaining to its high fuel consumption. RO-Pax consists of cruise-ships, ferries and Roll-On Roll-Off car carriers. Positive outlook towards international maritime trade along with stringent environmental regulations will drive bulk carriers and container vessels LNG bunkering market. Heavy vessel traffic especially in Asia Pacific region will further boost the product demand.

Offshore Support Vessels (OSVs) in 2016, accounted for over 25% of global market share. Increasing hydrocarbon exploration and production in offshore fields coupled with strict emissions regulation will fuel the industry growth. Rising investments toward FLNG projects including FPSO and FSRU will further complement the industry size. In 2012, Shell announced to invest USD 12.6 billion in FLNG project in Australia which is expected to commence its operation in 2018.

U.S. LNG bunkering market size was valued over USD 100 million in 2016. Ongoing shale production with strict emission norms will augment the business growth. In 2015, the U.S. Environment Protection Agency implemented the TIER III norms under MARPOL annexure VI governed by IMO with an aim to reduce sulfur and NOx emissions from marine vessels across Emission Control Areas (ECAs). The U.S. Coast Guard regulations regarding ship building with gas fueled engines will further augment the business.

Norway LNG bunkering market dominates the European region with over 18000 bunkering operations. Increasing focus to maintain fossil fuel sustainability along with rising concern to minimize environmental impact will drive the business growth. Growing investments towards the upgradation and rebuilding of LNG infrastructure will further complement the industry outlook. In 2014, EU announced to invest USD 85.44 million to build GATE terminal in Rotterdam to facilitate rapid access to gas for foreign ships.

Increasing demand for gas fueled vessel owing to rising environmental concerns along with government initiatives towards adoption of clean fuel will drive the Singapore market share. In 2017, Ministry of Port Authority (MPA) of Singapore announced to provide USD 1.45 million funding for vessels under pilot program.

LNG Bunkering Market Share

Key players in LNG bunkering market are

- Skangas

- Gasum

- Royal Dutch Shell

- Korea Gas Corporation

- Evol

- Harvey Gulf

- Crowley Maritime

- Engie

- Bomin Linde

- Polskie

- Swedegas

- ENN Energy

- Prima LNG

- Enagas

- Fjord Line

The industry is moderately fragmented and as a part of its strategy has undergone various acquisitions of liquefaction plants to improve the availability of liquefied natural gas at price competitive to marine fuel oil. In December 2014, Skangas acquired Risavika plant in Norway to avail LNG for bunkering operations.

LNG Bunkering Industry Background

Bunkering is a process to refuel the marine vessels. The operation is carried out through pipelines connected to a terminal or direct transfer from trucks or ships. Effortless transportation and storage of liquefied natural gas makes its adoption viable. Converting natural gas into liquid state at -1610 Celsius is beneficial for easy transport and shipping. Higher heating value coupled with lower density results in the reduction of emissions of harmful greenhouse gas. Truck-to-ship, port-to-ship and ship-to-ship are the major products varying in terms of capacity from 20 - 60 tons, 700 - 4000 tons and 700 - 7500 tons respectively.

Frequently Asked Question(FAQ) :

How much valuation is the lng bunkering market predicted to record in the year 2024?

The forecast worth of lng bunkering market is predicted to exceed USD 12 bn by 2024.

What was the global lng bunkering market share valuation in the year 2016?

lng bunkering market recorded a valuation of USD 800 mn in 2016.

LNG Bunkering Market Scope

Related Reports