Summary

Table of Content

Leather Chemicals Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Leather Chemicals Market Size

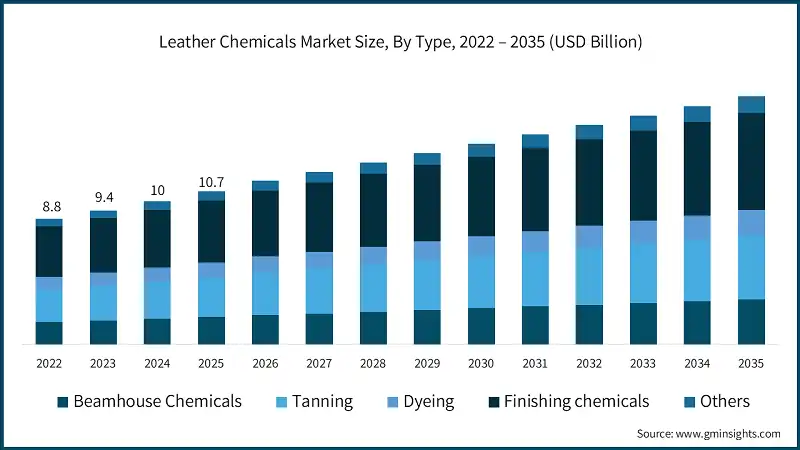

The global leather chemicals market was valued at USD 10.7 billion in 2025. The market is expected to grow from USD 11.4 billion in 2026 to USD 17.3 billion in 2035, at a CAGR of 4.7% according to latest report published by Global Market Insights Inc.

To get key market trends

- The premium automotive, high-end fashion and luxury furniture industries have driven demand for leather, creating an opportunity for chemical manufacturers to develop chemical formulations that are durable and aesthetically appealing, while offering improved texture via upstream processing.

- The automobile industry is one of the largest contributors to growth in the demand for lightweight luxury materials to be used in automotive interiors. As global automobile production is estimated to exceed 95 million units by 2026, the demand for high-performance leather chemicals, especially chrome-free tanning and polyurethane based finishing products, are soaring.

- OEMs are demanding high-quality carpet and upholstery leather, and manufacturers are having to continue to develop new chemical formulations that meet the rigorous performance requirements.

- Environmental regulation is changing industry in ways that have not been experienced in the past. The global trend for the change of tanning methods from traditional chrome tanning to chrome-free or plant-based tanning methods has been growing rapidly, especially in Europe and North America.

- Regulatory requirements such as the EU's REACH and ZDHC are forcing chemical companies to reform their products. As a result, there has been an increase in the use of biodegradable surfactants; there is also a greater use of low impact dye and enzyme-based chemicals in the beamhouse phase of leather manufacturing, resulting in more environmentally friendly leather production techniques.

- Several new technologies are now available, including enzyme based bating, waterless dyeing technologies, and synthetic fat liquors. All these technologies have the potential to conserve water and reduce the amount of wastewater produced, along with improving yield and softness of leather. Global companies such as Stahl and TFL have increased R&D expenditure to support Eco-friendly lines of products to ensure compliance with sustainability targets and global ESG standards.

- The concept of value chain integration is also becoming more important. Chemical suppliers are increasingly partnering with tanneries to provide customized solutions based on their customers' unique application needs. For example, chemical suppliers are providing customized products for niche markets, such as Automotive Interior and Athletic Footwear. The use of custom chemical solutions that meet specified physical performance characteristics, such as flexing, tensile strength, and colorfastness, is becoming more prevalent.

Leather Chemicals Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 10.7 Billion |

| Market Size in 2026 | USD 11.4 Billion |

| Forecast Period 2026-2035 CAGR | 4.7% |

| Market Size in 2035 | USD 17.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of Leather Production in Emerging Markets | Boosts consumption of leather chemicals, especially in Asia-Pacific. |

| Rising Demand in Automotive and Luxury Furniture Segments | Promotes adoption of high-performance chemicals for premium applications. |

| Stringent Environmental Laws in Developed Countries | Accelerates innovation and transition towards sustainable leather processing. |

| Pitfalls & Challenges | Impact |

| Fluctuating Raw Material Costs | Affects pricing strategies and profit margins for chemical manufacturers. |

| Environmental Concerns and Wastewater Management Regulations | Increases compliance costs and pressures on traditional chrome tanning processes. |

| Opportunities: | Impact |

| Technological Advancements in Smart and Functional Leather | Enables development of specialty chemicals for temperature regulation and durability. |

| Collaborations with Tanneries and OEMs for Custom Solutions | Enhances customer retention through tailored chemical applications. |

| Market Leaders (2025) | |

| Market Leaders |

Approximate Market Share of 8% in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Latin America |

| Emerging Country | Brazil, Argentina |

| Future Outlook |

|

What are the growth opportunities in this market?

Leather Chemicals Market Trends

- In recent years, a dramatic shift has occurred throughout the leathergoods manufacturing industry as companies make the transition away from the use of traditional chromium salts in favor of chrome-free sustainable alternatives such as vegetable tanning, aldehyde tanning and synthetic agents (Syntans). As the use of chrome salts has been popular due to their cost-effectiveness and efficiency, they have raised serious concerns regarding their environmental and health impact resulting from the potential production of toxic Cr(VI).

- In addition to the emergence of chrome-free and sustainable tanning chemicals, there has been an exponential growth in investment in enzyme and bio-based leather processing chemicals, due to the increased emphasis placed by both tanneries and original equipment manufacturers (OEM) on sustainable sourcing of chemical ingredients. The introduction of enzyme-assisted tannery chemical processes during the beamhouse phase of the production process (soaking, bating, unhairing) can dramatically improve the depollution of wastewater by up to 30-40 per cent, reduce COD/BOD levels and decrease processing time.

- The incorporation of artificial intelligence and the Internet of Things (IoT) into chemical dosing systems can help reduce waste and consistency variability that exist in traditional systems. This reduction in waste and variability is critical for the automotive and high-end leather sectors, as the unique functional characteristics of each type of leather are the greatest contributors to brand equity.

- In many developing countries that produce leather products, such as Bangladesh, India and Ethiopia, the governments of these nations have developed supportive policies that allow leather producers to receive financial assistance, both domestically and internationally, to improve their competitiveness against both, producing countries and each other.

- One example is the central leather research institute in India that works with chemical suppliers to enhance both the quality of production processes and environmental compliance by their customers, as well as the savar tannery park in Bangladesh that has created a centralized waste treatment facility financed in part by loans from international development assistance. These shifts in government policy allow major global companies to invest directly in the local facilities and processes supporting production and application, which increases the need for higher-quality chemicals.

Leather Chemicals Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into beamhouse chemicals, tanning, dyeing, finishing chemicals, and others. Finishing chemicals dominated the market with an approximate market share of 40.2% in 2025 and is expected to grow with a CAGR of 4.4% by 2035.

- Finishing chemicals are the leading segment in the leather chemicals industry globally because they are critical to improving the aesthetics, performance, and the perceived value of the finished leather products. One of the reasons that finishing chemicals have such a large market share is their high value addition.

- Finishing chemicals are added to the final stage of production to improve the surface characteristics including feel, brightness, gloss, wear resistance and weatherability etc. Finishing chemicals include acrylic emulsions, polyurethane-based coatings and silicone finishes. Finishing chemicals are a means for manufacturers to fulfil the aesthetic and functional requirements of Original Equipment Manufacturers (OEMs) and end-users.

- Historically, water-based and low VOC finishing chemicals have driven a significant increase in this market. As chemical companies respond to the growing number of regulations restricting the use of solvent-based products e.g. REACH in Europe, the emergence of eco-friendly finishing solutions is growing in importance. By being compliant with current regulations and earning certifications such as ZDHC and LWG, finishing chemicals are positioned to be key components in the transition to eco-friendly (green) manufacturing.

- Furthermore, from a performance aspect, manufacturers now can create customized finishing agents to achieve highly specific performance characteristics including UV resistance, heat resistance, anti-yellowing and anti-scratch characteristics. These performance characteristics are essential for the luxury fashion and automotive interior markets.

Learn more about the key segments shaping this market

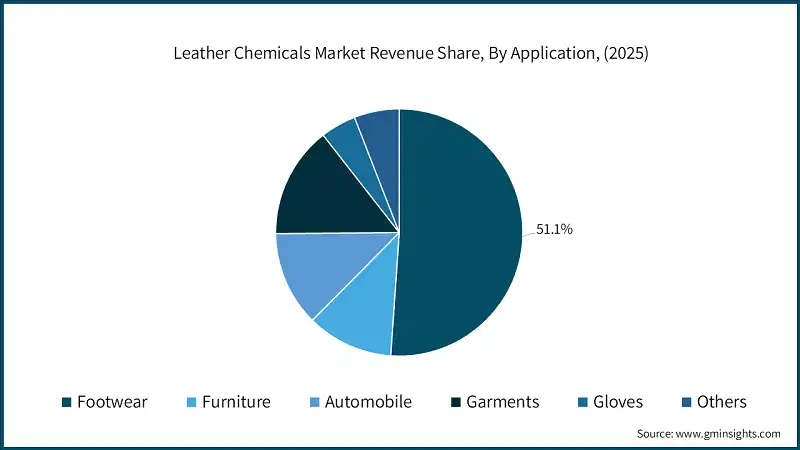

Based on application, the leather chemicals market is segmented into footwear, furniture, automobile, garments, gloves, and others. Footwear held the largest market share of 51.1% in 2025 and is expected to grow at a CAGR of 4.7% during 2026-2035.

- Footwear is the largest application market due to the amount of leather footwear manufactured globally and due to footwear’s requirement for processed leather that meets very specific and grandiose physical, aesthetic & performance specifications.

- The growth of the market in this area has resulted from an increased use of premium, high-end, durable, stylish footwear, which has been enhanced by demand for high-end leather finishes, specially designed tanning agents and performance-enhancing chemicals, with most of the growth stemming from regions like Asia-Pacific, Latin America and Parts of Europe. According to the World Footwear Yearbook, in 2024 over 13 billion pairs of shoes were manufactured globally with the majority of these being leather shoes at the premium and mid-range segments.

- Typical Footwear manufacturers prefer chemicals that deliver flex-crack resistance, softness, colour-fastness, and sweat-resistance due to the frequency of use and, as such, they consume very-high volumes of retanning agents/water-proof fat-liquors/polyurethane finishing chemicals thus, resulting in the footwear segment being extremely chemical intensive.

- Many of the established leading manufacturers of Leather Chemicals have formulated a wide variety of custom products specifically for athletic, leather casual, and safety footwear due to the enormous growth in these segments. One segment that is driving growth is the growing trend of chrome-free tanned leather used in footwear due to international companies' push for achieving exacting and more stringent sustainable operating targets.

Looking for region specific data?

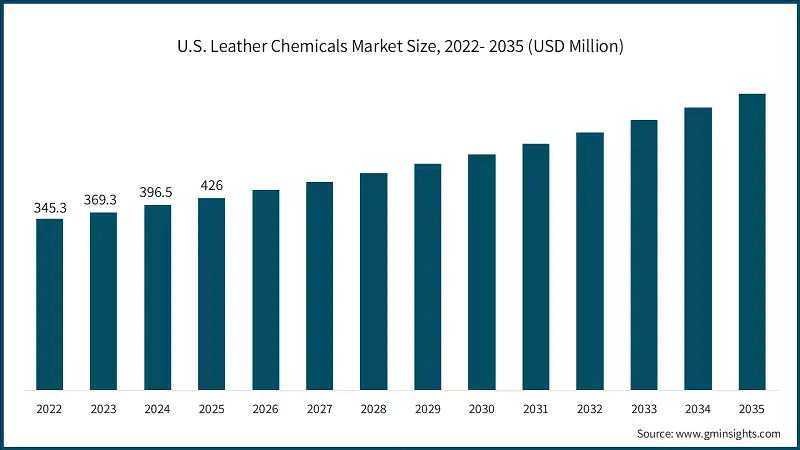

The North America leather chemicals market is growing rapidly on a global level with a market share of 5% in 2025.

- Leather chemicals consumption within North America is driven largely by the North American automotive supply chain. The market within the United States is evolving due to changing preferences within the automotive, upholstery, and premium footwear markets. Canada has a smaller leather manufacturing output compared to Mexico; however, it produces high-quality leather products and has strict regulations in place for imports of sustainable manufactured leathers, which has created strong demand for non-chrome tanned leathers and water-soluble finishing chemicals.

U.S. dominates the North America leather chemicals market, showcasing strong growth potential.

- The recent changes in legislation and an increased emphasis on environmentally friendly products by both EPA and consumers have resulted in a growing trend towards biodegradable, low-VOC leather finishing chemicals being offered by both tanneries and chemical companies.

Europe market leads the industry with revenue of USD 2.8 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe is Geroville's leading location for leather due to the influence of its environmental regulations, as well as highly skilled manufacturers and their associations in Europe (tanneries). Europe's influence on fashion and automotive industries also drives trends globally. Countries such as Italy, Spain and Germany are continuing to export large volumes of leather because of their high-quality production.

The Asia Pacific leather chemicals market is anticipated to grow at a CAGR of 4.7% during the analysis timeframe.

- Asia Pacific is the most developed and fastest-growing leather chemical market worldwide because it is the main manufacturing location for many leather goods. Countries such as China, India, Bangladesh, and Vietnam have made substantial investments in leather manufacturing infrastructure. For example, the Indian Government has introduced several initiatives under the Indian Footwear and Leather Development Programme (IFLDP) designed to support investments in effluent treatment and technology upgrades for footwear and leather chemical producers.

Latin America leather chemicals accounted for 19.7% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Brazil and Argentina dominate the leather chemical industry in this region because they have strong livestock operations and footwear markets. In Brazil, there is one of the largest leather producers and exporters in the world specializing in the automotive and furniture industries. Export connections with Europe and governmental support for environmentally-friendly tanning technology have created a growing market for environmentally sound retanning and finishing agents.

Middle East & Africa leather chemicals accounted for 6.7% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East & Africa is in the early stages of developing a market; Ethiopia, Egypt and South Africa are currently facilitating the growth of leather related parks and tanneries through increased investments. Ethiopia, in addition to having a significant amount of livestock, has also become a center of excellence for exporting leather to maximize their preferential trading relationship with the U.S. and EU.

Leather Chemicals Market Share

The global leather chemicals industry is reasonably consolidated with the top five players comprising around 25% of overall market share in 2025. Strong distribution networks, advanced R&D capability, and global manufacturing footprint are leveraged by these key market players to maintain dominance. They Stahl Holdings, BASF SE, TFL Ledertechnik GmbH, TEXAPEL, and Elementis plc.

Stahl Holdings has maintained its industry leadership through the extensive range of products it offers in the finishing chemicals areas, in addition to investing heavily in sustainable tanning options. Stahl has also continued to innovate and find ways to differentiate its products with biodegradable and low VOC technologies and through collaboration with prominent fashion brands that are compliant with the ZDHC guidelines.

Finally, mergers and acquisitions, joint ventures, and partnerships continue to create opportunities to establish strong market presence. Partnerships between chemical manufacturers and regional tanneries improve supply chain strength, develop application capabilities and provide better access to the quickly growing leather manufacturing markets in Asia-Pacific and Latin-America, where many manufacturers are growing rapidly.

- Stahl Holdings B.V.: Stahl is the world leader in leather chemicals and has the broadest range of leather finishing, coating and polymer solutions available. Sustainability and innovation play an important role in all that they do; offering products that include environmentally friendly water-based, low VOC and bio-based technologies. Stahl works closely with both Leather Manufacturers and Fashion Brands to develop custom chemical products that meet the requirements of the ZDHC and LWG Compliance to create a safe and responsible leather product.

- TFL Ledertechnik GmbH: After acquiring Lanxess’s Organic Leather Chemicals business, TFL is in a better position than it was prior to the acquisition. The combination of these two companies now provides a full range of chemical solutions from the Beamhouse to Finishing with particular emphasis on Chrome-Free Tanning Agents, Retanning Agents and Fatliquors. The company's emphasis is on providing technical support and efficiency throughout the manufacturing processes providing leather solutions for Automotive Footwear and Garment Segments.

- BASF SE: BASF's Leather Chemicals Division is part of its Performance Chemicals Business Unit. BASF produces sustainable syntans, retanning polymers, and dispersions. The division focuses on digitalization within leather processing, as well as EHS compliance and innovation-oriented R&D for eco-conscious manufacturers.

- Clariant International Ltd.: The Clariant Leather Division provides wet-end and finishing chemicals. This division focuses heavily on selling modular chemical systems that are tailored to each type of leather. Clariant has global manufacturing facilities and utilizes localized application laboratories for fast product development and specific technical support for its regions.

- Elementis plc: Elementis PLC manufactures specialty chemicals in the Leather Chemical segment as part of its Specialties Division, with a range of performance-enhancing additives and solutions for all stages of leather production (wet-end and finishing). They are a recognized leader in this field, particularly for their range of rheology modifiers, dispersants and functional additives that improve the feel, softness and durability of leather products.

Leather Chemicals Market Companies

Major players operating in the leather chemicals industry include:

- ATC Tannery Chemicals

- Balmer Lawrie & Co. Ltd.

- BASF SE

- Clariant International Ltd.

- DyStar Group

- Elementis plc

- FGL International S.p.A.

- Industrias Químicas Iris, S.A.

- Kolon Industries, Inc.

- PIOVAN Leather Chemicals

- Schill + Seilacher GmbH

- Sisecam Chemicals

- Stahl Holdings

- Syntans & Colloids

- Texal

- Texapel

- TFL Ledertechnik GmbH

- Trumpler GmbH & Co. KG

- Zschimmer & Schwarz GmbH & Co KG

Leather Chemicals Industry News

- In November 2025, Stahl introduced its innovative Stahl Neo Bio coating system, made with 70% sustainable materials and intended for high-end footwear and automotive leather use.

- In October 2025, TFL increased its production capabilities at its new facility in Gujarat, India, which will be dedicated exclusively to organic fatliquors and chrome-free retanning agents for the South Asian market.

- In September 2025, BASF launched the new digital formulation platform that incorporates artificial intelligence into the customisation of chemical formulations for leather, allowing customers to develop new chemical formulations more quickly and easily than ever before.

- In July 2025, Clariant opened an Application Lab in Brazil for leather manufacturers throughout Latin America. This lab will provide leather manufacturers in that region with local support and expertise in developing sustainable dyeing and finishing technology.

- In May 2025, The Zschimmer & Schwarz group, through its collaboration with a European automotive component manufacturer, announced the development of the new leather finishing products that are 'odour-neutral' and meet high standards for emissions.

This leather chemicals market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Type

- Beamhouse Chemicals

- Soaking

- Liming

- Deliming and Bating

- Tanning

- Chrome

- Non-Chrome

- Dyeing

- Water Soluble

- Non-water Soluble

- Finishing Chemicals

- Polyurethane

- Acrylic

- Silicone

- Others

- Others

Market, By Application

- Footwear

- Casual and Fashion Shoes

- Sports Shoes

- Safety/Industrial Footwear

- Boots

- Furniture

- Residential Upholstery

- Office Furniture

- Hospitality Furniture

- Luxury Leather Seating

- Automobile

- Car Seats & Upholstery

- Steering Wheel & Gear Covers

- Door Panels

- Motorcycle Seats

- Garments

- Leather Jackets

- Trousers & Skirts

- Belts

- Coats & Outerwear

- Gloves

- Industrial/Safety Gloves

- Fashion Gloves

- Sports Gloves

- Tactical/Military Gloves

- Others

- Bags & Luggage

- Wallets & Small Accessories

- Saddlery

- Sporting Goods

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the key trends in the leather chemicals market?

Major leather chemicals industrya trends include a shift toward chrome-free tanning, increased use of bio-based and enzyme-based chemicals, and adoption of water-based, low-VOC finishing solutions to meet global sustainability standards.

What is the growth outlook for the leather chemicals market from 2026 to 2035?

The leather chemicals industry is projected to grow at a CAGR of 4.7% from 2026 to 2035, supported by rising investments in sustainable leather processing and increasing OEM demand for high-quality leather.

What is the market share of North America in the leather chemicals industry in 2025?

North America accounted for around 5% share of the global market in 2025. Growth is supported by steady demand from the automotive upholstery, premium footwear, and furniture industries.

Who are the key players in the leather chemicals market?

Key leather chemicals industry players include Stahl Holdings, BASF SE, TFL Ledertechnik GmbH, TEXAPEL, Elementis plc, Clariant International Ltd., DyStar Group, and Zschimmer & Schwarz GmbH & Co KG.

What was the market share of the footwear application segment in 2025?

The footwear segment held a dominant 51.1% share of the market in 2025, driven by high global leather footwear production and demand for performance-enhancing chemical formulations.

How much revenue did the finishing chemicals segment generate in 2025?

Finishing chemicals accounted for around 40.2% market share in 2025, making it the leading segment in the industry due to high value addition and demand for enhanced aesthetics and performance.

What is the projected value of the leather chemicals industry by 2035?

The market is expected to reach USD 17.3 billion by 2035, expanding at a CAGR of 4.7% due to sustainability regulations, growth in premium leather goods, and technological advancements in leather processing.

What is the current leather chemicals market size in 2026?

The market is projected to reach USD 11.4 billion in 2026, supported by increasing adoption of eco-friendly tanning and finishing solutions across the leather industry.

What is the market size of the leather chemicals industry in 2025?

The market size was valued at USD 10.7 billion in 2025 and is expected to grow at a CAGR of 4.7% through 2035, driven by expansion of leather production in emerging economies and rising demand from automotive and footwear industries.

Leather Chemicals Market Scope

Related Reports